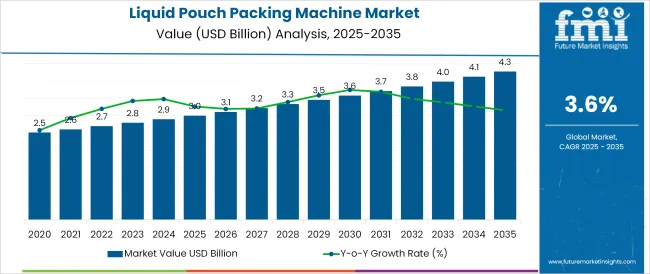

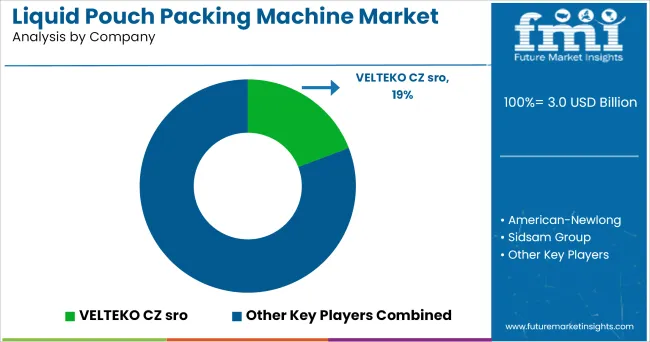

The Liquid Pouch Packing Machine Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The liquid pouch packing machine market is undergoing dynamic growth, shaped by the rising consumption of packaged liquids, advancements in packaging automation, and growing hygiene and efficiency standards in production environments. The shift from rigid containers to flexible pouch formats, motivated by lower logistics costs and improved shelf visibility, is reinforcing the adoption of high-performance pouch filling systems.

Governmental emphasis on food safety compliance, sustainability in packaging, and automation of manufacturing operations has positioned liquid pouch machinery as a critical asset in modern production lines. Technological innovations in sealing precision, leak detection, and viscosity management are enabling broader application of these machines across food, beverage, pharmaceutical, and chemical industries.

In the coming years, further growth is anticipated from increased penetration in developing regions, where small-to-mid-size enterprises are embracing automation to enhance product consistency and reduce operational downtime. The integration of smart controls, clean-in-place (CIP) systems, and modular upgrades will further accelerate deployment and life-cycle value.

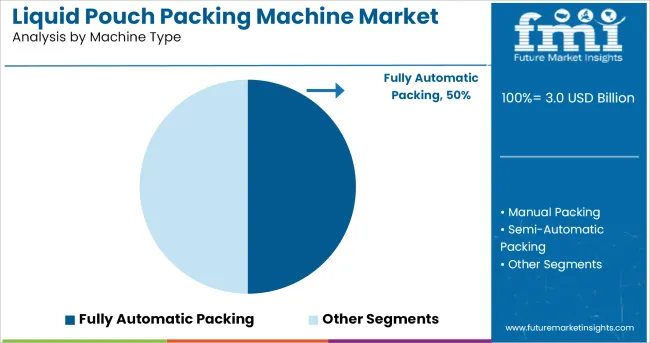

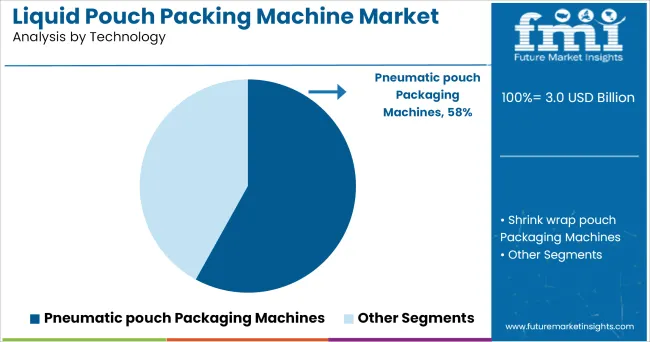

The market is segmented by Machine Type, Technology, and End-User and region. By Machine Type, the market is divided into Fully Automatic Packing, Manual Packing, and Semi-Automatic Packing. In terms of Technology, the market is classified into Pneumatic pouch Packaging Machines and Shrink wrap pouch Packaging Machines.

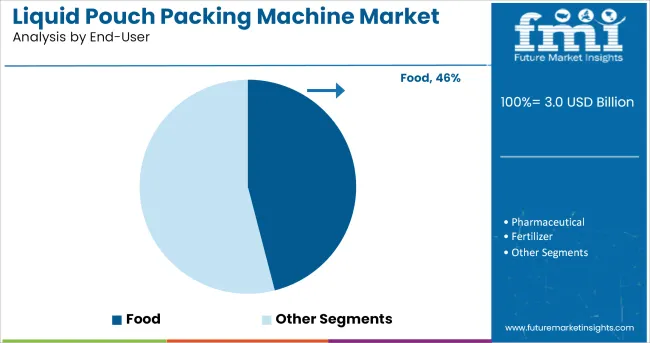

Based on End-User, the market is segmented into Food, Pharmaceutical, Fertilizer, Cosmetic, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By machine type, fully automatic liquid pouch packing machines are projected to contribute 50% of market revenue in 2025, establishing them as the leading segment. This dominance is being driven by the ability of fully automatic systems to deliver high-speed, low-error packaging with minimal human intervention, significantly improving productivity in high-demand environments.

The use of programmable logic controls, servo systems, and integrated sensor arrays enables real-time monitoring and adjustment, resulting in consistent pouch filling, reduced wastage, and extended equipment uptime. These systems have become essential in industries where contamination control, output precision, and production scalability are non-negotiable.

Their compact footprint, combined with energy-efficient motors and automated material handling, supports lean manufacturing objectives while enhancing operator safety. As labor costs rise and regulatory oversight intensifies, fully automatic machines are increasingly viewed as strategic investments that ensure regulatory compliance, enhance throughput, and deliver measurable operational efficiencies across large and mid-scale enterprises.

From a technology standpoint, pneumatic pouch packaging machines are expected to capture 58% of market revenue in 2025, driven by their reliability, cost efficiency, and low maintenance requirements. Pneumatic systems offer precise control over filling and sealing operations, especially in environments handling varying viscosities and temperature-sensitive liquids.

The simplicity of pneumatic actuation reduces the risk of mechanical failure, while maintaining high cycle speeds and clean operation, making them ideal for sterile and semi-sterile packaging settings. The absence of complex electrical systems lowers downtime, and their adaptability to different pouch types has broadened use cases across small-to-medium enterprises.

Pneumatic systems are particularly effective in regulated industries, as they meet stringent hygiene and cleaning protocols. With enhanced compatibility for integration into semi- and fully-automated production lines, their use is being supported by an increasing number of OEMs offering modular platforms. The scalability, durability, and ease of integration of pneumatic technologies are key contributors to their continued market leadership.

By end-user, the food industry is projected to hold a leading 46% share of the liquid pouch packing machine market in 2025, reflecting its deep reliance on precise, sanitary, and high-throughput packaging solutions. This dominance is underpinned by increasing demand for single-serve, ready-to-eat, and extended shelf-life liquid products such as sauces, dairy, soups, and health beverages.

Food producers are prioritizing machinery that ensures product integrity, prevents microbial contamination, and supports a variety of pouch materials suitable for cold-chain and ambient storage. The ability of liquid pouch packing machines to accommodate flexible fill volumes and offer hermetic sealing has enabled compliance with food safety regulations while optimizing line efficiency.

Additionally, growing consumption in urban centers, combined with rising expectations for packaging convenience and portion control, has accelerated the adoption of advanced pouch solutions. As sustainability goals reshape packaging strategies, the food sector is increasingly turning to high-speed, precision-driven machines that can deliver performance, flexibility, and compliance in one integrated system.

There is an increase in demand for minimizing human errors and increasing efficiency in different industries with the help of computers. This is one of the major factors fueling the growth of liquid pouch packing machines. There are industries such as food, beverage, and pharmaceutical, they want them free from any contamination.

They are continuously working on automatic filling machine to make sure that there is no human touch. This will also fuel the growth of liquid pouch packing machines in upcoming years.

Due to drastic changes in consumers' buying habits with new technology and trends, this too will contribute to the market growth. The packing machine is becoming a cost-effective solution for both manufacturers and consumers.

As customers are getting health conscious day by day, they look for healthy packing pouches. In such a scenario, healthy liquid packing pouches are fulfilling their needs and this need is creating many opportunities for market growth. The pouches are small, easy to carry, easy to use, and convenient to dispose of. This is further helping the market of liquid pouch packing machines to grow globally.

There is a rise in the rapid rate of the pharmaceutical industry with new research and developments. There is a huge investment from pharmaceutical drug manufacturers to develop drugs to broaden the variety of products in their product offerings, this will drive the growth for liquid pouch packing machines.

As there are many R & D projects are going on in medical sciences for advanced machinery for bulk drug production, processing, and packaging, this too is generating huge opportunities for the liquid pouch packing machine market globally.

For an instance in 2020, Cambrex Corporation, a Canada-based company announced that it will double its capacity of the liquid packaging and weekly output at its Mirabel site in Canada. The company will also add a new filler on the existing packaging line and a CGMP (Current Good Manufacturing Practice) packaging line. Such trends are driving the growth of liquid pouch packing machines globally.

South Asia is becoming one of the advanced regions for manufacturing liquid pouch packing machines for many key vendors with the help of advanced technology as the labor is cheap. The government is also supporting the development of new industries, working in this area of the solution.

It has been found that South Asia people are strongly supporting environment-friendly packing and also demanding skincare and particularly luxury products. Such penetration will create many opportunities for liquid pouch packing machines in coming years in this region.

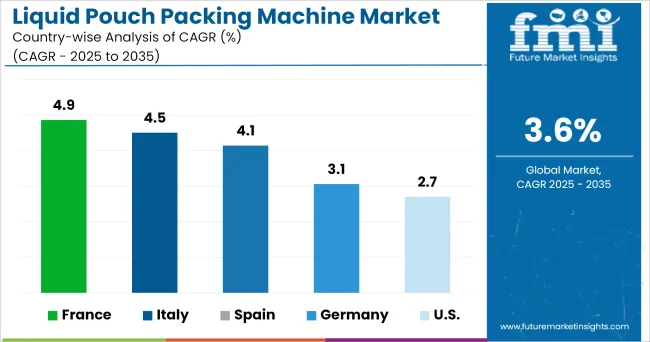

The European region is going to hold a significant share of the liquid pouch packing machine market from 2024 to 2035. The reason behind this the presence of major solution providers in the region.

Europe region is having the largest market for pouch packaging machines in the food and beverage industries. Hence, due to extended boundaries of flexible packaging in food, beverage, and medical applications, the demand for liquid pouch packing machines continues to grow in this region.

Some of the leading vendors of liquid pouch packing machines include

Some of the key players in the liquid pouch packing machine market and they are actively involved in offering liquid pouch packing machine solutions for different applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global liquid pouch packing machine market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the liquid pouch packing machine market is projected to reach USD 4.3 billion by 2035.

The liquid pouch packing machine market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in liquid pouch packing machine market are fully automatic packing, manual packing and semi-automatic packing.

In terms of technology, pneumatic pouch packaging machines segment to command 58.0% share in the liquid pouch packing machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Liquid Pouch Packing Machine Companies

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA