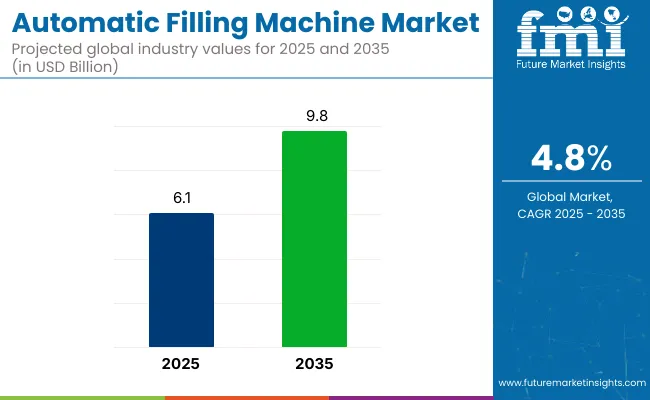

The global automatic filling machine market is valued at USD 6.1 billion in 2025 and is anticipated to reach USD 9.8 billion by 2035, reflecting a CAGR of 4.8%. This growth is being driven by increasing demand for automated, high-precision packaging in food, beverages, pharmaceuticals, and personal care products.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 6.1 billion |

| Projected Value (2035) | USD 9.8 billion |

| CAGR (2025 to 2035) | 4.8% |

The rising need to reduce contamination risks and improve production efficiency has elevated the adoption of automated filling technologies, especially liquid-based systems. Additionally, sectors emphasizing hygiene and regulatory compliance, such as pharma and food processing, are accelerating investments in automated machinery with IoT and AI integration.

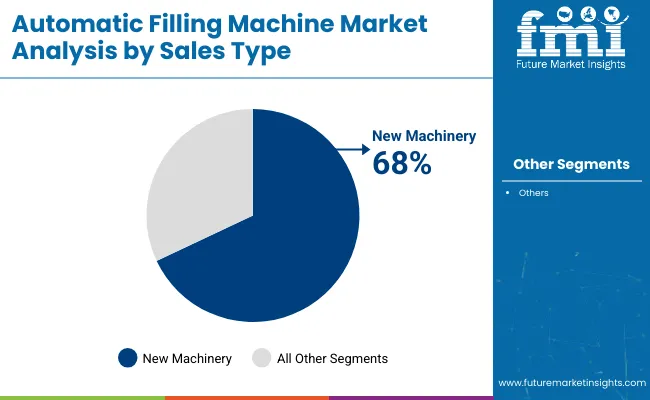

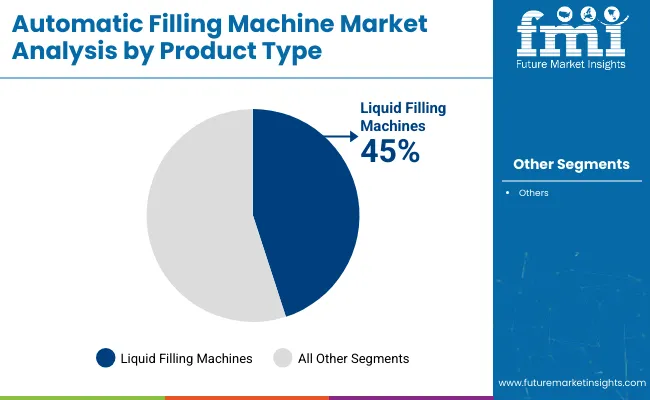

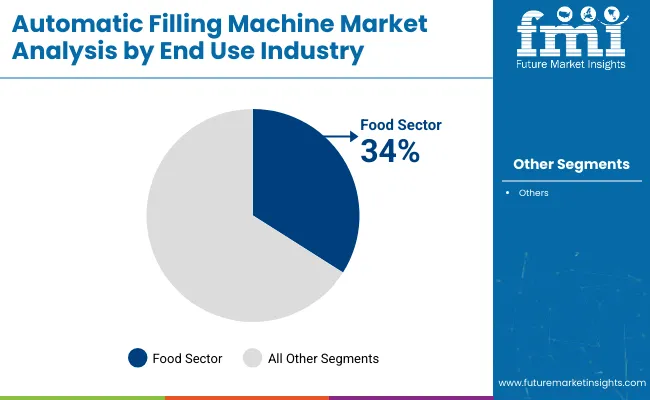

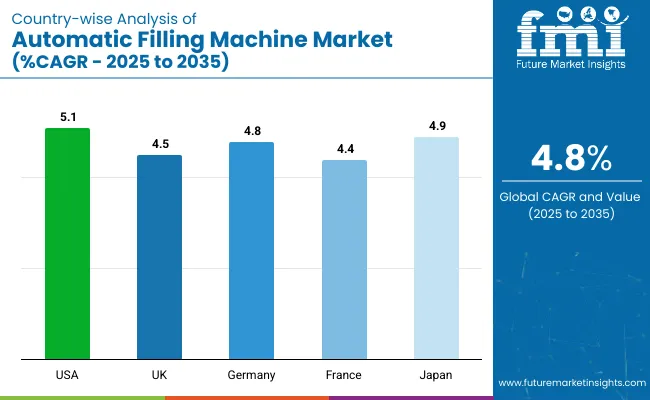

North America is expected to maintain the largest revenue share, led by stringent FDA and USDA regulations in the food and pharma sectors. Meanwhile, Japan is anticipated to register growth at a CAGR of 4.9%, driven by its excellence in robotics and compact machinery innovation. Liquid filling machines are projected to retain over 45% share through 2035. In terms of sales type, new machinery segment holds a prominent share of 68%. By end use industry, the food segment accounts for 34% share.

Significant profitability is expected to be witnessed by Tetra Pak and Coesia S.p.A due to investments made in sustainable, energy-efficient systems compatible with recyclable materials. Meanwhile, SMEs may face challenges in emerging economies due to the high initial investment and limited availability of a skilled workforce required to operate automated systems. Slow transitions could be experienced by countries in Africa and Latin America due to struggles with limited technical expertise and capital for advanced automation setups.

The global automatic filling machine market is segmented by sales type (new machinery, spare parts), by product type (solid, semi-solid, liquid), by end use industry (food, beverage, pharmaceutical, personal care, chemical, others including nutraceuticals, industrial lubricants, and agrochemicals), and by region (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa).

The new machinery segment is expected to dominate the automatic filling machine market, driven by the rising adoption of Industry 4.0 technologies and smart automation systems. Manufacturers across food, pharma, and beverage sectors are investing in advanced, AI-enabled machines to enhance throughput and reduce labor dependency. In 2025, this segment holds around 68% of the total market share, with growth further fueled by global expansion of production facilities and a push for operational modernization.

Liquid filling machines are projected to remain the leading product category due to their versatility and hygiene standards, especially in pharmaceutical and beverage applications. Syrups, soft drinks, and lotions are widely filled using these machines, requiring high-speed, contamination-free processing. In 2025, they account for more than 45% market share, and this dominance is likely to continue as demand for packaged liquids and sterile filling systems rises across developed and emerging markets.

The food industry holds the highest market share, contributing approximately 34% of global revenue in 2025, owing to increasing demand for ready-to-eat meals, sauces, grains, and dairy products. Hygiene, speed, and consistency in food packaging are ensured by automatic filling machines. Rapid urbanization, growth in cold-chain logistics, and consumer preference for packaged products are pushing food processors to invest heavily in automated, multi-format filling systems, especially in Asia-Pacific and North America.

Recent Trends in the Automatic Filling Machine Market

Key Challenges

The automatic filling machine market in the USA is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by strong industrial automation, rising demand for packaged food, and stringent FDA regulations in pharmaceutical manufacturing. Manufacturers are focusing on the integration of IoT-enabled systems and smart factory initiatives to boost production efficiency. Moreover, the push for sustainable packaging is prompting rapid upgrades in legacy filling equipment across sectors.

The automatic filling machine market in the UK is projected to expand at a CAGR of 4.5% between 2025 and 2035, led by the rise in packaged food consumption and evolving personal care trends. Regulatory authorities like the MHRA and the FSA are enforcing automation upgrades for enhanced hygiene and safety. Additionally, sustainability initiatives are prompting the use of recyclable-compatible filling technologies, especially among small and mid-sized manufacturers aiming for carbon neutrality.

The sales in the automatic filling machine market in Germany are anticipated to witness a CAGR of 4.8% from 2025 to 2035, fueled by its leadership in industrial engineering and machine automation. As a major manufacturing hub in Europe, the country is home to numerous packaging equipment producers. A strong focus on precision engineering, environmental sustainability, and Industry 4.0 practices is accelerating the uptake of smart, energy-efficient filling systems.

The automatic filling machine industry in France is forecasted to grow at a CAGR of 4.4% over the forecast period, supported by government incentives for sustainable production and digital transformation in the food and pharmaceutical sectors. Compact, flexible filling solutions are being prioritized by French manufacturers to serve diverse product lines. Additionally, the cosmetics sector is expanding rapidly, necessitating advanced precision fillers to maintain product integrity.

The automatic filling machine industry in Japan is set to register a CAGR of 4.9% from 2025 to 2035, driven by its excellence in robotics and compact machinery innovation. The aging population has led to a spike in pharmaceutical demand, pushing for more sterile and efficient filling solutions. AI-driven systems that are space-efficient are being adopted by Japanese manufacturers and aligned with global regulatory standards for pharma, food, and personal care packaging.

The automatic filling machine market is moderately consolidated, with several leading suppliers, such as KHS GmbH, Serac Group, Barry‑Wehmiller, IMA Group, Syntegon, Sidel, Aseptic Technologies, Marchesini, Ronchi Mario, and Filamatic, together accounting for a significant share of global revenues.

These companies compete intensely through pricing strategies, continuous innovation, automation-enabled solutions, strategic partnerships, and international expansions to serve diverse industry needs and regulatory standards. Partnerships with packaging lines, sustainability upgrades, and digital services have become common strategic moves.

Leading firms are focusing on cost-effective, energy-efficient systems and digital transformation. KHS, Syntegon, and IMA are introducing modular, AI-integrated platforms; Serac and Sidel emphasize partnering with beverage giants; and Barry-Wehmiller and Aseptic Technologies invest in aseptic innovations. Filamatic, Ronchi Mario, and Marchesini cater to niche pharma and personal care sectors with compact, hygienic solutions.

Recent Automatic Filling Machine Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.1 billion |

| Projected Market Size (2035) | USD 9.8 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in Units Sold |

| By Sales Type | New Machinery, Spare Parts |

| By Product Type | Solid, Semi-solid, Liquid |

| By End Use Industry | Food, Beverage, Pharmaceutical, Personal Care, Chemical, Others (includes nutraceuticals, industrial lubricants, agrochemicals) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | KHS GmbH, Serac Group, Barry-Wehmiller Companies, IMA Group, Syntegon Technology, Sidel Group, Aseptic Technologies, Marchesini Group, Ronchi Mario S.p.A., Filamatic |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

In terms of Product Type, the industry is divided into Solid, Semi-solid, Liquid

In terms of End Use Industry, the industry is divided into Food, Beverage, Pharmaceutical, Personal Care, Chemical, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global automatic filling machine market is valued at USD 6.1 billion in 2025.

By 2035, the market is expected to reach USD 9.8 billion.

The market is projected to grow at a CAGR of 4.8% from 2025 to 2035.

Liquid filling machines lead the market with over 45% share due to high demand in pharma and beverages.

The USA is expected to register the fastest growth, with a CAGR of 5.1% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Powder Filling Machines Market

Automatic Liquid Filling Machines Market

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dicing Saw Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA