Automatic Checkweigher Market to grow with the introduction of precision weight measurement solutions across industries over the next decade Automatic check weighers quality control background automatic check weighers are an essential part of the quality control process in producing a consistent weight of a product, reducing waste and improving efficiency. The increasing emphasis on compliance to regulatory standards would continue to propel sales of automated check weighing systems, particularly in the food and pharmaceutical verticals.

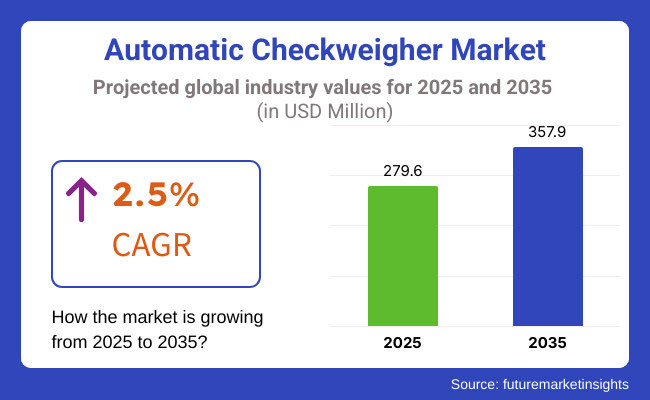

The market is expected to grow USD 279.6 million by 2025 end and USD 357.9 million by 2035 end, at a CAGR of 2.5% during 2025 to 2035. Market: Process automation, AI-based inspection devices, and an integrated view (smart manufacturing systems) are driving demand in the market. Now fast forward to today with companies striving to reduce product giveaway and increase throughput of high-speed production lines, automatic check weighers are a must-have component on all modern manufacturing and packaging lines.

North America dominates the Automatic Checkweigher Market, with the United States and Canada at the forefront in the sectors of food processing, pharmaceuticals, and logistics. FDA’s strict weight verification regulations on food and drug packaging are encouraging manufacturer for sophisticated checkweighing systems. The region is also experiencing the fast adoption of AI-based hardware checkweighers that can easily integrate into IoT and cloud-based monitoring solutions for better accuracy and efficiency.

The European region owns a major part of the market owing to the EU’s weight compliance regulations for packaged goods, both in Germany, the UK, and France that is driving adoption! In Germany, this is reflected in a very high demand from the food and beverage sector for automated checkweighing solutions that can help with precision packaging targets and sustainability initiatives. With advancements in technology, European manufacturers are investing in high-speed checkweighers with multi-sensor capabilities and the use of artificial intelligence (AI)/ machine learning to detect errors made during production, which is at the forefront for reducing wastage of finished products and improving production efficiency.

The region across Asia Pacific is anticipated to develop at the highest rate in the Automatic Checkweigher Market on account of China, Japan, South Korea and India. One of the key contributors to the market expansion is ongoing growth of the region's food processing, pharmaceutical and e-commerce businesses. In China, the government’s emphasis on food safety regulation and intelligence in manufacturing is driving enterprises to integrate real-time weight inspection system in production line. Moreover, the aptitude of Japan for advanced automation industry is driving the demand for high-precision checkweigher with better machine vision and AI in them.

Challenge

High Initial Investment and Integration Complexity

On the downside, automatic checkweighers require high capital investment which can be a challenge for small and mid-size manufacturers to adopt this technology. The cost of implementation can raise due to technical challenges and potential system integration with the already existing production lines. In addition, the need for frequent calibration and maintenance incurs operational costs. Companies are responding to these challenges by developing affordable, modular checkweighing systems, providing ease of integration and little maintenance.

Opportunity

Advancements in AI and Real-Time Data Analytics

The growing adoption of AI-based systems for checkweighing is anticipated to provide a significant opportunity for the growth of the market. With AI-powered algorithms, checkweighers can be trained to analyse weight and identify patterns in the data, allowing real-time adjustments to equipment and processes, predictive maintenance, and reducing the need for expensive interventions to reach the final product. Moreover, the cloud-based monitoring systems enable the manufacturers to analyse the production performances from a remote location and maximise the efficiency. To stay ahead in a market environment that utilizes IoT connectivity, machine learning proficiency, and improved automation, corporates investing in smart checkweighing technology will be equipped with a leading edge with superior solutions.

2020 to 2024: Rising Demand for Automation and Quality Control

The automatic checkweigher market has grown significantly from 2020 to 2024, attributed to the high demand for automation in quality control, increased production efficiency, and regulatory compliance in food & beverage, pharmaceuticals, logistics, manufacturing, and other sectors.

The food & beverage segment held the largest market share, attributed to the growing usage of high-speed checkweighing systems for package weight verification to mitigate product giveaway and ensure compliance with weight regulations. Over the years as worldwide food safety standards became more stringent, firms began pairing checkweighers with metal detectors, and more recently with X-ray inspection systems to help detect contaminants and maintain compliance to quality control procedures.

The strict requirements of the pharmaceutical industry Good Manufacturing Practices (GMP) and FDA regulations mandated rigorous verification of dosage. The automatic checkweighers ensured consistency in drug production because they were pivotal for tablet and capsule weight check, vial verification, and ampoule inspection.

Market expansion gains also came from the logistics and e-commerce industries as companies automated parcel sorting and shipment verification to improve order accuracy and increase operational efficiency. Checkweighers played a critical role in reducing shipment mistakes, ensuring containers were being packed with weight spread evenly and enhancing throughput in warehouses.

Even this market's hopeful path was obstructed by lofty upfront costs of investment, the idiosyncratic nature of where to calibrate forms of utilization, and levers of integration for existing legacy systems. The rise of IoT-based real-time monitoring and predictive maintenance was also a game-changer for businesses, enabling them to overcome some of those barriers and reduce the inefficiencies and operational costs associated with checkweighers.

2025 to 2035: AI-Powered Optimization, Smart Weighing, and Sustainability Initiatives

2025 to 2035 - The automatic checkweigher market is set to undergo its most significant transformation yet, due to the advent of artificial intelligence (AI)-powered smart weighing systems, Internet of Things (IoT) enabled connectivity, and rising environmental sustainability trends.

Change the production game automatically set each weight threshold, identify errors, analyse patterns, and automatically adjust the production line. Leveraging machine learning, algorithms will analyse historical weight data, anticipate deviations from sample weights, and mitigate false rejections, increasing performance and efficiency.

Through cloud-based monitoring and IoT integration, manufacturers will be able to execute remote diagnostics, predictive maintenance, and real-time performance tracking. This will reduce idle time, increase operational efficiency, and prolong the life of machinery.

Within food & beverage, next-gen checkweighers will harness non-contact laser weighing and hyperspectral imaging to deliver the detection of ingredients at variance, foreign contaminants and packaging compliance. These advancements will improve product safety and compliance, and reduce waste.

This technology will help the pharmaceutical industry build real-time dosage control systems, serialization tracking systems, and anti-counterfeiting systems for all the products. By integrating block chain technology in the supply chains, not only can they ensure transparency but also can remain compliant with necessary regulations.

Reducing energy consumption, integrating recyclable materials, and implementing systems and solutions that minimize waste along the supply chain will also again take centre stage. Keen to minimize excess packaging and carbon footprint, organizations will also leverage AI powered automation to further improve material utilization.

AI-enabled parcel checkweighers with automated dimensioning, weight verification and RFID tracking will pervade the e-commerce and logistics sectors, streamlining warehouse automation and last-mile delivery. Such progression will greatly enhance operational productivity, reduce shipping errors, and help reduce costs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technology Evolution | Adoption of high-speed checkweighers with integrated reject mechanisms. |

| Food & Beverage Industry | Focus on packaging accuracy, weight compliance, and food safety. |

| Pharmaceutical Applications | Compliance-driven adoption for dosage weight verification. |

| E-commerce & Logistics | Implementation of parcel checkweighing for shipment accuracy. |

| IoT & Connectivity | Introduction of cloud-based data logging and predictive maintenance. |

| Sustainability Focus | Early adoption of energy-efficient checkweighers. |

| Regulatory Compliance | Increasing need for FDA, GMP, and food safety adherence. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology Evolution | Growth of AI-powered, smart weighing, and adaptive learning checkweighers. |

| Food & Beverage Industry | Expansion of laser-based, non-contact, and AI-driven product verification. |

| Pharmaceutical Applications | Integration of vision-based AI checkweighing, serialization tracking, and block chain security. |

| E-commerce & Logistics | Growth of RFID-enabled, AI-enhanced, and dimensioning-based checkweighers. |

| IoT & Connectivity | Widespread adoption of real-time IoT monitoring, remote diagnostics, and machine learning optimization. |

| Sustainability Focus | Expansion of low-energy consumption, waste-reducing, and eco-friendly weighing solutions. |

| Regulatory Compliance | AI-driven compliance monitoring, automated audit reporting, and block chain-enabled tracking. |

Due to rising demand for accurate and efficient weight verification systems in various sectors, such as food & beverage, pharmaceuticals, and logistics, the United States has maintained a good position in the automatic checkweigher market. FDA and USDA regulatory compliance standards, specifically when it comes to product quality and consistency, are driving manufacturers to turn to high-accuracy checkweighing solutions. The rising trend of automation in packaging and production lines is also supporting the growth of advanced checkweighers equipped with AI and real-time monitoring features.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.4% |

Due to rising demand for accurate and efficient weight verification systems in various sectors, such as food & beverage, pharmaceuticals, and logistics, the United States has maintained a good position in the automatic checkweigher market. FDA and USDA regulatory compliance standards, specifically when it comes to product quality and consistency, are driving manufacturers to turn to high-accuracy checkweighing solutions. The rising trend of automation in packaging and production lines is also supporting the growth of advanced checkweighers equipped with AI and real-time monitoring features.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.2% |

The automatic checkweigher market in the European Union is driven by Germany, France, and Italy. Demand for high-precision checkweighers is largely driven by strict EU standards in terms of accuracy in the weight of packaged products and quality control in food and pharmaceutical sectors. Manufacturers are also being further compelled to adopt automated weight-checking solutions due to a growing focus on food waste reduction and enhancing packaging efficiency. Moreover, with the growth in smart manufacturing and proliferation of Industry 4.0 initiatives, the integration of IoT enabled checkweighing systems for production monitoring is complementing the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.4% |

The automatic checkweigher market in Japan is relatively matured and a growth-oriented market, owing to country focused on automation with a high level of accuracy in manufacture. Major adopters include the food and pharmaceutical industries, which need to guarantee that their packaged products meet high quality and weight specifications. Further, the market is driven by advanced technological innovations, including the AI-driven weight monitoring and real-time data analytics. The growing trend of smart factories and automated quality control processes are likely to drive demand for high-accuracy check-weighers in the ensuing years.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 1.9% |

The automatic checkweigher market in South Korea is growing at a moderate rate, supported by the country’s flourishing food processing, pharmaceutical, and logistics industries. Automated quality control systems are increasingly obtained to reduce errors and increase employee’s production. The rising number of global packaging and logistics companies in the region also drives the need for real-time monitoring and high-speed weight measurement checkweighers. Growing adoption of smart manufacturing practices is further projected to propel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.5% |

These machines are used as part of quality control and packaging operations to make sure the weight of the product remains within prescribed limits. They enable businesses to create less material waste, lower giveaway costs, follow industry regulations, and increase operational efficiency.

Automatic checkweighers are emerging as a vital component of modern production lines with increasing adoption of these machines in food & beverage, pharmaceuticals, logistics, and manufacturing. To optimize throughput and ensure consistency in product packaging, businesses require sophisticated high-speed checkweighing solutions.

Standalone Systems Offer Cost-Effective and Flexible Solutions

Standalone automatic checkweighers are used in production lines and do not require integration with any other inspection systems for them to check product weight. Most commonly found in smaller to mid-sized production facilities, these machines are typically used where flexibility and affordable price point are critical.

Standalone checkweighers are often a preferred choice for industries like confectionery, pharmaceuticals, and cosmetics as they facilitate accurate weight measurement without interrupting production flow. These machines enable companies to efficiently detect and reject non-compliant products before they are shipped, avoiding costly rejections and non-compliance with regulations.

Systems that combine checkweighing with metal detection, X-ray inspection or vision inspection. These systems enable a holistic quality control by allowing for the detection of weight deviations, contaminants, and packaging defects to take place in parallel.

Combination systems are preferred in industries like food processing, dairy and pharmaceuticals that are under strict safety and compliance mandates. These machines enable manufacturers to run operations more efficiently while reducing false rejects and enhancing overall product quality. Because of their multifunctional properties, combination systems are becoming increasingly prominent in the field of smart as well as automated production lines.

Strain Gauge Technology Remains the Industry Standard

The most common checkweighers work based on a strain gauge which is reliable, cost-effective, and easily integrated. When a load is applied, they detect slight changes in resistance of strain gauge load cells, which they use to calculate weight.

Businesses involved in food packaging, logistics, and manufacturing of consumer goods, rely on strain gauge technology due to its proven accuracy and reliability. These systems excel in high-throughput settings, and as such are a popular choice for applications where real-time, accurate weighing is needed.

Electromagnetic Force Restoration (EMFR) design checkweighers provide high accuracy and fast response time; making them most suitable for pharmaceutical, electronics and fine chemical industry. EMFR technology is based on electromagnetic force compensation and offers a minimum microgram resolution, avoiding the strain gauge systems measurement limitations.

EMFR-based checkweighers provide the highest level of precision for checkweighing in lightweight applications or cases, including medicine, electronic components, and luxury goods, precisely ensuring compliance with weight specifications. While EMFR checkweighers do have a higher purchase price compared to strain gauge systems, they produce enhanced accuracy and stability over their lifespan, ensuring this technology is well worth investing in for premium product ranges.

This eventual growth of the automatic checkweigher market is imposed as industries advance toward better accuracy, efficiency, and implementation of international weight regulations. AI-supported weight control, real-time data monitoring, and IoT-enabled automation are integrated by companies to improve the precision and productivity of their products. In food & beverage, pharmaceuticals, logistics, and manufacturing sectors, the market benefits from high-speed weighing for cost efficiency and quality control.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| METTLER TOLEDO | 20-24% |

| Ishida Co., Ltd | 15-19% |

| Anritsu Corporation | 12-16% |

| Bizerba | 10-14% |

| A&D Company, Limited | 7-11% |

| Yamato Scale | 6-10% |

| WIPOTEC-OCS | 5-9% |

| Thermo Fisher Scientific Inc. | 4-8% |

| Bosch Packaging Technology | 3-7% |

| Minebea Intec | 3-6% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| METTLER TOLEDO | Develops high-precision, automated checkweighers with AI-based weight monitoring and adaptive rejection systems. |

| Ishida Co., Ltd | Manufactures high-speed multi-lane checkweighers for food, pharma, and logistics applications, integrating IoT connectivity. |

| Anritsu Corporation | Provides X-ray-integrated checkweighers for enhanced contamination detection and weight compliance monitoring. |

| Bizerba | Innovates smart weighing technology with automated belt speed adjustments and cloud-based data analytics. |

| A&D Company, Limited | Specializes in compact checkweighers with precision load cell technology for food and industrial applications. |

| Yamato Scale | Develops flexible and customizable checkweighers, ensuring compliance with global weight regulations. |

| WIPOTEC-OCS | Offers high-accuracy dynamic checkweighers, integrating RFID tracking and predictive maintenance features. |

| Thermo Fisher Scientific Inc. | Provides automated weighing solutions with AI-driven fault detection and real-time performance monitoring. |

| Bosch Packaging Technology | Focuses on integrated checkweighing within automated packaging lines, ensuring high-speed, error-free operations. |

| Minebea Intec | Designs hygienic, high-speed checkweighers with real-time weight deviation analysis for food and pharma industries. |

METTLER TOLEDO (20-24%)

METTLER TOLEDO leads the market by delivering AI-powered precision weighing solutions, ensuring automated compliance and seamless production line integration.

Ishida Co., Ltd (15-19%)

Ishida pioneers multi-lane checkweighing technology, integrating IoT connectivity and smart automation for food and pharma industries.

Anritsu Corporation (12-16%)

Anritsu enhances food safety with X-ray-integrated checkweighers, ensuring contaminant detection and precise weight control.

Bizerba (10-14%)

Bizerba develops cloud-connected checkweighers, optimizing smart weight monitoring and belt speed adjustments for various industries.

A&D Company, Limited (7-11%)

A&D produces compact, precision checkweighers, ensuring accurate load cell measurements for high-speed industrial processes.

Yamato Scale (6-10%)

Yamato offers customizable checkweighers, catering to global compliance regulations and food industry applications.

WIPOTEC-OCS (5-9%)

WIPOTEC integrates RFID tracking and predictive maintenance, ensuring high-accuracy dynamic checkweighing solutions.

Thermo Fisher Scientific Inc. (4-8%)

Thermo Fisher advances AI-powered fault detection systems, optimizing real-time weight control and efficiency monitoring.

Bosch Packaging Technology (3-7%)

Bosch automates high-speed checkweighing within packaging lines, ensuring error-free operations in mass production.

Minebea Intec (3-6%)

Minebea Intec specializes in hygienic, high-speed checkweighing solutions, ensuring compliance with global food and pharma standards.

Other Key Players (25-35% Combined)

Emerging players focus on AI-powered checkweighing innovations, eco-friendly material integration, and smart factory automation. Notable players include:

The overall market size for the Automatic Checkweigher Market was USD 279.6 million in 2025.

The Automatic Checkweigher Market is expected to reach USD 357.9 million in 2035.

The demand is driven by increasing automation in packaging, stringent regulatory requirements for product weight accuracy, rising demand in the food & beverage and pharmaceutical industries, and the need for high-speed, high-precision weighing solutions.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

Standalone and Combination Systems Drive Market Growth.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Unit) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Unit) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Unit) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 8: Global Market Volume (Unit) Forecast by Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Unit) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Unit) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: North America Market Volume (Unit) Forecast by Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Unit) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Unit) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 24: Latin America Market Volume (Unit) Forecast by Industry, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Unit) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Europe Market Volume (Unit) Forecast by Technology, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 32: Europe Market Volume (Unit) Forecast by Industry, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Unit) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Asia Pacific Market Volume (Unit) Forecast by Technology, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 40: Asia Pacific Market Volume (Unit) Forecast by Industry, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Unit) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Unit) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: MEA Market Volume (Unit) Forecast by Technology, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 48: MEA Market Volume (Unit) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Unit) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Unit) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Unit) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 18: Global Market Volume (Unit) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Unit) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Unit) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 42: North America Market Volume (Unit) Analysis by Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Unit) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Unit) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Unit) Analysis by Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Unit) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Europe Market Volume (Unit) Analysis by Technology, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 90: Europe Market Volume (Unit) Analysis by Industry, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Unit) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Unit) Analysis by Technology, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Unit) Analysis by Industry, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Unit) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Unit) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: MEA Market Volume (Unit) Analysis by Technology, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 138: MEA Market Volume (Unit) Analysis by Industry, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 143: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Automatic Checkweigher in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Checkweigher in USA Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA