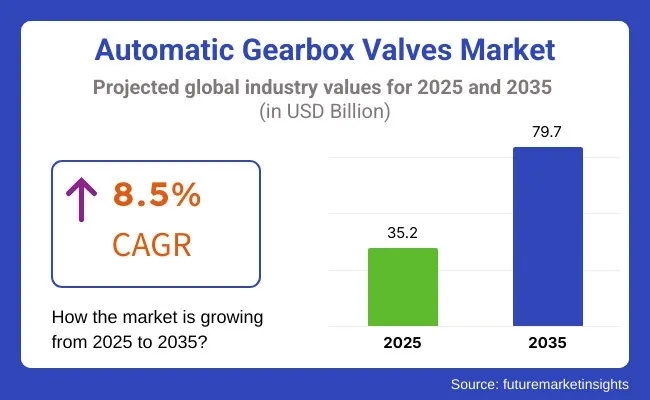

The global automatic gearbox valves market is estimated to reach USD 35.2 billion in 2025 and is projected to grow to USD 79.7 billion by 2035, reflecting a CAGR of 8.5% over the forecast period. This rise is being driven by advanced transmission architectures, increased adoption of dual-clutch and automatic gearboxes, and the shift toward electrified drivetrain systems requiring precise hydraulic control.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 35.2 Billion |

| Market Value (2035F) | USD 79.7 Billion |

| CAGR (2025 to 2035) | 8.5% |

In late 2024, HUSCO Automotive confirmed growth in its transmission control valve output. A Waukesha facility expansion was reported to increase production of electro-hydraulic solenoid valves to support “shift-by-wire and start-stop” systems. Production was stated to include low hysteresis valve designs with repeatable performance across high-volume applications in both China and Europe via a Shanghai facility addition.

In mid-2024, Sonnax launched an oversized cooler lube flow control valve kit for automatic transmissions, designed for trucks and off-road applications. The kit reportedly addressed common overheating issues in heavy-duty drivetrains by increasing cooler flow by 30% without reducing hydraulic pressure.

Design trends have emphasized system efficiency and thermal management. Variable flow control valves have been engineered to adapt oil flow based on load, RPM, and temperature. Leak-tight spool and seat designs have been specified to meet high-pressure, high-temperature demands in dual-clutch transmissions.

Materials science advancements have been observed through the adoption of corrosion-resistant stainless steel valve bodies, reduced-slop machined spools, and coated valve surfaces to prevent solenoid wear and contamination issues. Modular valve block formats have been introduced for compact hydraulic circuits.

In both OEM and aftermarket segments, drop-in valve kits with integrated solenoids and pressure sensors have been supplied to facilitate repair and upgrade cycles. These kits were characterized by standard sealing interfaces and plug-and-play electrical connectors.

Regional demand has been driven by transmission electrification in Asia-Pacific, powertrain efficiency mandates in North America, and heavy-duty commercial vehicle growth in Europe. In 2025, vehicle programs in hybrid and dual-clutch powertrain segments were reported to have specified high precision valve systems to meet shift quality and emission standards.

Solenoid valves are estimated to account for approximately 38% of the global automotive gearbox valves market share in 2025 and are projected to grow at a CAGR of 8.7% through 2035. These valves play a critical role in regulating hydraulic pressure, controlling gear shifts, and modulating clutch engagement in automatic, DCT, and CVT systems.

In 2025, automakers increasingly integrate solenoid valves into transmission control modules (TCMs) for real-time responsiveness, shift smoothness, and torque management. The trend toward electronically controlled drivetrains-especially in hybrid and performance vehicles-further strengthens demand. Suppliers are focusing on developing compact, energy-efficient, and fast-response solenoids with extended life cycles, suitable for integration in mechatronic gearbox architectures.

Automatic transmission systems are projected to hold nearly 61% of the global gearbox valves market share in 2025 and are expected to grow at a CAGR of 8.6% through 2035. Their dominance is driven by increasing consumer preference for driving comfort and rising integration of torque converters and multi-speed AT systems across passenger cars and light commercial vehicles. In 2025, automatic transmissions remain standard in North America, China, and GCC countries, with strong penetration in mid-size sedans, SUVs, and crossover segments.

Gearbox valve requirements in AT systems span solenoid control for shift actuation, pressure regulation, and accumulator management. As manufacturers continue to refine gear shift logic for fuel efficiency, NVH, and drivability, automatic transmissions will remain the largest consumer of advanced valve technologies in the drivetrain ecosystem.

High Costs and Complex Integration

It is anticipated that the high cost of precision-engineered transmission components, which ultimately raises the total expenses associated with the manufacturing of vehicles, will act as one of the major challenges for Automatic Gearbox Valves Market. Advanced manufacturing processes and large research and development investments makes it hard for small to medium-sized automotive suppliers to enter the market for hydraulic and electronic valve control unit integration.

The increasing competition from EVs, which utilize simpler transmission systems than traditional ICE vehicles, also has long term repercussions for the automatic gearbox valve market. Production and market dynamics are also influenced by supply chain disruptions, semiconductor shortages, and the rising and falling prices of raw materials.

AI-Enhanced Gearbox Control and Sustainable Valve Materials

The report also highlights potential opportunities and challenges in the Automatic Gearbox Valves market. AI-based predictive maintenance and self-learning transmission control algorithms are beginning to be used in automatic transmissions that improve efficiency by enabling adaptive shift strategies according to real-time assessments of driving conditions.

The development of sustainable and low mass materials, including carbon-fiber-reinforced composites and corrosion-resistant alloys, is enhancing the durability and thermal properties of gearbox valves. Moreover, it is generally expected that more devices would come with Electromechanical Valve Actuation technologies in place of Hydraulic solenoid valves that allows for faster reaction time and better energy efficiency.

The growing adoption of automatic transmissions in affordable cars and increasing requirement for high-performance gearbox valves in luxury and sports vehicle are further contributing to market growth. This strong growth in autonomous and connected vehicles is also driving a need for intelligent transmission control systems with AI-integrated valve actuators.

Demand for automatic transmission and growing automobile industry specifically in the emerging economies are also expected to contribute significantly to the growth of automatic gearbox valves market in the projected time frame automatic gearbox valves in United States. Strict fuel economy and emission rules set forth by the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA) are incentivizing automakers to build automatic gearboxes with greater efficiency via more effective valve designs.

The increasing penetration of hybrid and electric vehicles (EVs) is also acting as a growth multiplier for the global automobile electronically controlled gearbox valves market as OEMs integrate next-generation electronically controlled gearbox valves into their vehicle designs to amplify performance. Major automobile manufacturers, including Ford, General Motors, and Tesla, are pouring funds into smart transmission systems with smart valve actuation technologies powered by AI.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.8% |

The UK Automatic Gearbox Valves Market is driven by the rising consumer preference for automatic and semi-automatic transmission vehicles, increasing demand for fuel-efficient drivetrains increases the demand for Automatic Gearbox Valves, and government initiatives promoting hybrid and electric vehicle adoption.

The UK government, for instance, has banned new petrol and diesel cars by 2035, which is accelerating the move toward hybrid and EV powertrains, driving a demand for high-precision gearbox valves that maximise transmission performance. The evolution of adaptive gearbox valve control systems for DCTs and CVTs is also being presented in 31 papers, showcasing recent improvements in performance and efficiency in both concepts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.3% |

The Automatic Gearbox Valves Market in the European Union is considerably driven up by strict regulations on emissions and growing use of cutting-edge automatic transmittal systems as well as swift electrification of the transportation business. The European Automobile Manufacturers Association (ACEA) is promoting low-emission and high-efficiency vehicle parts such as electronically controlled gearbox valves.

It accounts for major markets such as Germany, France and Italy, as automotive manufacturers including Volkswagen, BMW and Renault are focusing highly on such high-performance automatic transmission systems which incorporates intelligent hydraulic and solenoids vales in order to achieve better gear shifting and fuel efficiency. The rapid growth in the adoption of autonomous vehicles coupled with AI-based predictive maintenance systems is significantly contributing to the demand for self-adjusting gearbox valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.5% |

Japan’s position as a leader in the development of transmission technology, the increasing demand for hybrid vehicles, and the surging investment in next-gen automotive components are driving the Automatic Gearbox Valves Market in the country. For example, Japanese car manufacturers (Toyota, Honda, and Nissan) lead the development of CVT and hybrid transmissions, focusing on the integration of high-efficiency gearbox valves to improve performance and fuel economy.

The Japanese government through the Ministry of Economy, Trade and Industry (METI) promotes smart mobility solutions and targets low weight and efficient gearbox valves to further boost energy efficiency of automatic transmissions. Moreover, the fortified robotics and AI-based automation technological platforms of the country is pushing the efficient as well as accurate operation of valve control mechanisms in modern transmission architecture.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.7% |

The South Korean Automatic Gearbox Valves Market is growing rapidly owing to the modifiers of technology alley in automotive systems, fast growing production of electric and hybrid vehicles, smart investment in smart transmission systems and factors driving the growth of this market during the forecast period. Advancements in next-generation gearbox technology with government support from South Korea's MOTIE (Ministry of Trade, Industry, and Energy) would spur demand for high-performance solenoid and hydraulic valves.

Major South Korean automakers like Hyundai, Kia are integrating AI-based transmission management systems, which use adaptive gearbox valves to improve fuel efficiency, torque management, and driving comfort. The growing deployment of autonomous vehicle technologies along with connected vehicle ecosystems is additionally propelling the growth of electronically controlled automatic gearbox valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

Rising adoption of automatic transmissions in passenger and commercial vehicles, technological advancements in transmission control technologies, increasing demand for fuel-efficient and smooth driving experiences, and the increasing vehicular proliferation within rapidly growing economies are primarily driving the growth of the Automatic Gearbox Valves Market. Market Dynamics, Electronic shift-by-wire systems, digital transmission control through AI, and increased adoption of electric and hybrid vehicles are some of the major market drivers.

Leading companies are focused on developing high precision solenoid valves, electronically controlled transmission valves, and adaptive hydraulic valve technology to improve gear shifting, fuel economy, and vehicle performance. Major players in the marketplace consist of automotive component manufacturers, transmission system experts, and electronic control unit (ECU) suppliers, all of which are playing a role in innovations for next-gen transmission valve bodies and shift actuators.

Several automotive component manufacturers and transmission system suppliers contribute to advancements in solenoid valves, electronic shift actuators, and adaptive gearbox control technologies. These include:

The overall market size for the Automatic Gearbox Valves Market was USD 35.2 Billion in 2025.

The Automatic Gearbox Valves Market is expected to reach USD 79.7 Billion in 2035.

Increasing adoption of automatic transmission vehicles, advancements in gearbox technology, and rising demand for fuel-efficient and smooth-driving systems will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Pressure control valves are expected to dominate due to their essential role in precise transmission fluid control and performance optimization.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA