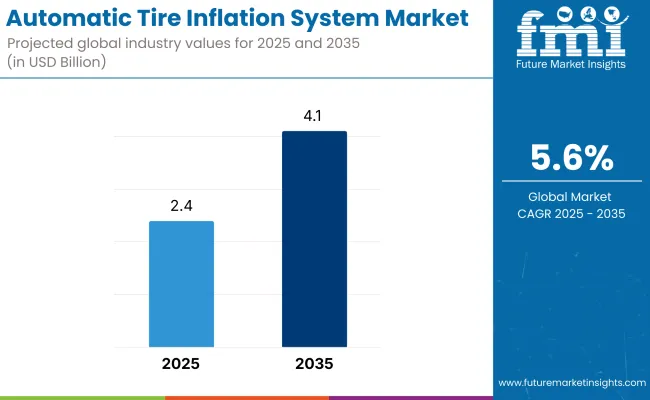

The global automatic tire inflation system (ATIS) sales were recorded at USD 1.8 billion in 2020. This figure is estimated to rise to USD 2.4 billion by 2025. Over the forecast period through 2035, the market is projected to reach USD 4.1 billion, exhibiting a compound annual growth rate (CAGR) of 5.6%.

Growth in the ATIS market is being driven by multiple converging trends across both commercial and specialty vehicle segments. The development of expansive highway corridors, rising demand for off-road vehicles, and the increasing integration of autonomous driving systems have collectively heightened the need for advanced vehicle safety mechanisms. In this context, ATIS has emerged as a critical component-improving tire longevity, maintaining pressure consistency, and reducing the risk of blowouts, particularly in long-haul and high-load applications.

Freudenberg Sealing Technologies has been at the forefront of enhancing the performance of central tire inflation systems (CTIS) by offering next-generation sealing solutions. Jens Wolfman, Head of Global Segment Special Sealing Products at Freudenberg Sealing Technologies, stated, “Our sealing solutions for CTIS are designed to meet the highest standards of performance and reliability, ensuring optimal tire pressure management across various operating conditions.”

In support of these advancements, Wolfram further noted, “The North American heavy-duty vehicle market in particular has been seeking solutions to system aging caused by high speeds and temperatures in heavy-duty applications.”

Automotive OEMs are also integrating ATIS technologies into electric and next-gen mobility platforms. In February 2022, Tesla received a patent for an automatic tire inflation system tailored for the Tesla Semi electric truck. The patented system allows real-time tire pressure adjustments to improve energy efficiency and vehicle control during varying load and road conditions, a feature particularly critical for long-distance electric freight transport.

As EV adoption accelerates, fleet operators are prioritizing technologies that minimize energy losses and extend operational range. Automatic tire inflation systems (ATIS), once viewed as maintenance tools, are now being positioned as critical components in range optimization strategies. The ability to maintain consistent tire pressure reduces rolling resistance, directly impacting battery efficiency in electric trucks. This trend is further reinforced by the convergence of ATIS with telematics, allowing real-time pressure diagnostics and predictive maintenance.

These developments highlight the growing relevance of ATIS in improving road safety, reducing fuel consumption, and supporting the reliability of autonomous and electric vehicle fleets. With regulatory focus intensifying on safety compliance and operational uptime, the ATIS market is expected to remain on a robust upward trajectory through 2035.

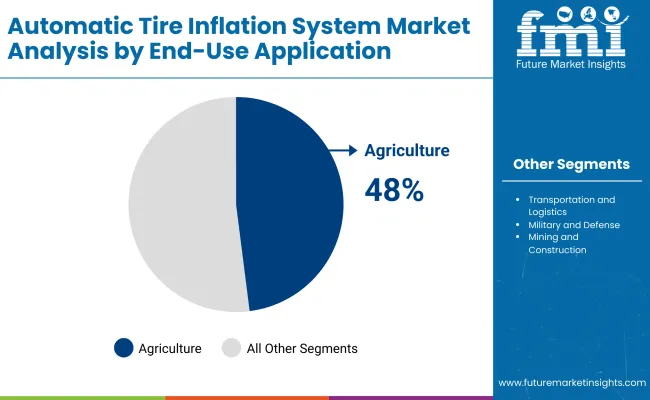

Agriculture segment is projected to account for nearly 48% of total automatic tire inflation system (ATIS) installations by 2025, making them the leading vehicle type in this market segment. This is further expected to grow at CAGR of 5.3% over the assessment period. This dominance has been attributed to increasing reliance on tractors in both agricultural and construction applications, where optimal tire pressure directly impacts performance, fuel efficiency, and terrain adaptability.

In the agricultural sector, the need to minimize soil compaction and improve traction has encouraged the adoption of inflation systems that adjust tire pressure in real time. As precision farming gains ground, ATIS is being increasingly deployed to support machine longevity and consistent field performance. In the construction industry, tractors and earth-moving equipment are frequently exposed to varying load conditions and rugged environments, making pressure stability critical to safety and uptime.

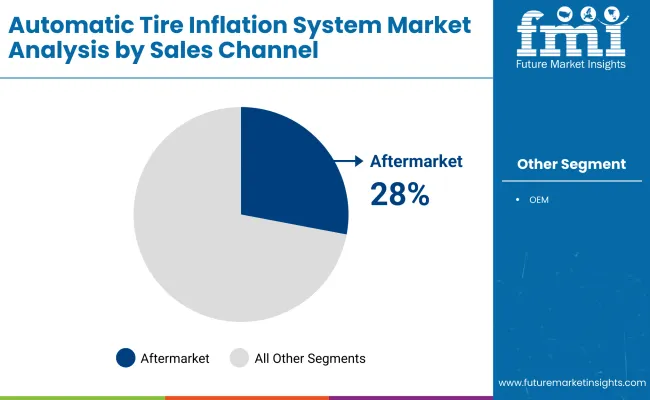

Aftermarket fitments of automatic tire inflation systems (ATIS) are projected to account for approximately 28% of total market share by 2025. This segment is anticipated to expand at a CAGR of 5.7% over the forecast period from 2025 to 2035. Growth has been largely supported by increasing demand for retrofitting solutions across aging commercial vehicle fleets, particularly in North America, Latin America, and parts of Asia Pacific.

Fleet operators are prioritizing ATIS retrofits to extend the service life of vehicles while improving fuel efficiency and safety. With pressure management becoming critical for regulatory compliance and operating cost reduction, aftermarket fitments are offering a flexible, cost-effective alternative to full system replacements. Independent service providers and authorized dealers have expanded product availability, helping bridge gaps in older vehicle categories that lack factory-installed systems.

The highest holder of the market for Advanced Traffic and Intelligent Systems (ATIS) in North America is based on the intermingling of tough tire pressure regulations; high market demand, and a solid logistics system.

The region is relatively orientated, for example, the USA Federal Motor Carrier Safety Administration requires the use of a tire pressure monitoring system, which in turn increases the need for smart solutions. The key leaders dominating the market are the automotive and technology industries that push forward innovation and integration of ATIS systems.

Furthermore, the logistics sector expansion that has particularly taken place in the e-commerce sector has added substantially to this demand pertaining active fleet management, the real-time tracking, and automated traffic management systems. These factors combined are evidently qualifying North America as the leading area in the ATIS market.

Europe is considered to be a major Advanced Traffic and Intelligent Systems (ATIS) market, which is prompted by involvement in vehicle safety, environmental care, and the regulatory support. The region is historically proven for managing emissions and ensuring road safety improvement, for example, Germany, France, and the United Kingdom are ahead in using smart technologies for the vehicles of these sectors.

European regulatory policies that prescribe safety standards by the EU along with the green programs are the bread and butter for the services connected with the application of ATIS solutions. The automotive industry in Europe is also a pioneer of innovations, hence it is a very attractive place for the development of applications such as vehicle and traffic management.

The Asia-Pacific region is showing the fastest growth in Advanced Traffic and Intelligent Systems (ATIS), thanks to the development of cities, new roads, and increased fleet sizes. The demand for ATIS solutions is surging in countries like China and India, which are both adopting these technologies in areas like fleet management, traffic monitoring, and vehicle safety.

Government programs that focus on advancing vehicle technologies, reducing emissions, and enhancing transportation systems are some of the major reasons for the uptake of smart technologies. The outlays for smart infrastructure, initially in terms of intelligent transportation, and for the electric and autonomous vehicle markets are promoting ATIS as well as creating new opportunities in Asia-Pacific, making the region a hub for development.

Challenges

High Initial Investment Costs

Among the prohibitive problems hindering mass ATIS adoption is the high start-up investment needed for both infrastructure and technology. Using state-of-the-art facilities such as the real-time traffic management, vehicle-to-infrastructure communication, and smart sensors incur huge upfront costs.

Fleet operators, who are predominantly small and medium-sized enterprises, find it extremely challenging to incur such expenditure upfront which consequently delays the general implementation of ATIS solutions. The return of income in terms of efficacy and safety over time is unquestionable, but overcoming the initial funding issue continues to be a considerable bottleneck for the deployment in various sectors.

Integration Complexities

Besides, one of the important challenges is the difficulty of the integration of ATIS technologies with existing infrastructure and vehicles. The majority of the transportation network operators and fleet units` use the old systems, which can be the biggest hindrance to incorporating new technologies, thus, the process might be very hard and consume a lot of time.

These costs may involve the extensive retrofitting of vehicles or the considerable upgrading of infrastructure, causing the sidelining of no normal operations. Costly integration solutions are then required to streamline deployment and ensure compatibility across various systems.

Opportunities

Advancements in IoT-Enabled Monitoring

The rapid growth of IoT (Internet of Things) based applications brings to the ATIS market a great potential. These IoT connections that the vehicles will have will allow us to track with real-time data tire health, traffic flow, and also vehicle performance. This shift towards data-driven solutions is aimed to be more efficient, thus minimizing downtime and enabling predictive maintenance.

The fleet operators will get vital tips with shared tire pressure, wear, and driving conditions, the prevention of accidents will be improved, and the maintenance cost will be reduced, holes in tire risk will be eliminated and the road use will be optimized. As IoT technologies develop, the transport systems become even more intelligent, creating space for the innovation driver.

Electric and Autonomous Vehicle Adoption

The ongoing trend of integrating electric and autonomous vehicles into society offers one of the biggest opportunities for the ATIS market. With the increasing popularity of electric vehicles (EVs), the need arises for systems to optimize energy consumption, monitor battery conditions, and improve the overall vehicle performance.

Autonomous vehicles are equipped with state-of-the-art sensor technologies and work with the data-driven algorithm; thus, they provide additional channels for the connection of the ATIS solutions. All the vehicles need correlated networks of direct visibility of the environment to operate safely and efficiently, therefore, the ATIS ecosystem gets new products and services, which are high changes in the Automatic Tire Inflation System (ATIS).

The market for the Automatic Tire Inflation System (ATIS) has seen considerable growth from 2020 to 2024. The growth has been attributed to increased attention towards fuel mileage, tire longevity, and vehicle safety issues. The rising regulatory tire pressure monitoring mandates, in amalgamation with technological advancements like telematics and IoT connectivity, have activated the diffusion of ATIS onboard commercial and heavy-duty trucks.

The fleet operators have lately grasped the fact that besides the safety cars the most. adopted treatment for problems with tires pressure is repetitive repair, thus, the first-ending, pressure monitoring ATIS not only aids in preventing accidents and tire wear but also lowers fleet operating costs has actuated the market further.

In the following years, the ATIS market is projected to be subject to significant structural changes from the initial state to that of the emergent technologies including AI-based tire analytics, automated fleet management systems, and eco-sustainability innovations.

The transition to electric and autonomous vehicles will be the main determinant of the ATIS market in the future, thus spotlighting the issues of energy consumption and equipment that maintains itself.

New discoveries, industrial energy resources, and intelligent transport systems are the driving forces for the commendable performance of the ATIS sector.

The AI-inflated, ATIS will provide not only predictive but also insightful analytics for the vehicle's performance which will ensure safety and lower the risks. Also, taking on the powerful theme of sustainability, the producers are going to increase the use of recyclable materials and will innovate low-energy inflation techniques to be in line with the carbon reduction efforts across the globe.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased government mandates for tire pressure monitoring systems (TPMS). |

| Technological Advancements | Integration of IoT and telematics for remote tire monitoring. |

| Industry-Specific Demand | Adoption in trucking, agriculture, and military vehicles. |

| Sustainability & Circular Economy | Focus on fuel savings and tire waste reduction. |

| Market Growth Drivers | Cost savings, safety regulations, and fleet operational efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter compliance standards for smart tire technology and sustainability goals. |

| Technological Advancements | AI-driven predictive maintenance and automated tire pressure optimization. |

| Industry-Specific Demand | Expansion into electric and autonomous vehicle fleets, last-mile delivery, and off-road applications. |

| Sustainability & Circular Economy | Development of eco-friendly materials and energy-efficient inflation mechanisms. |

| Market Growth Drivers | Rising demand for automated mobility solutions, green transportation initiatives, and smart city integration. |

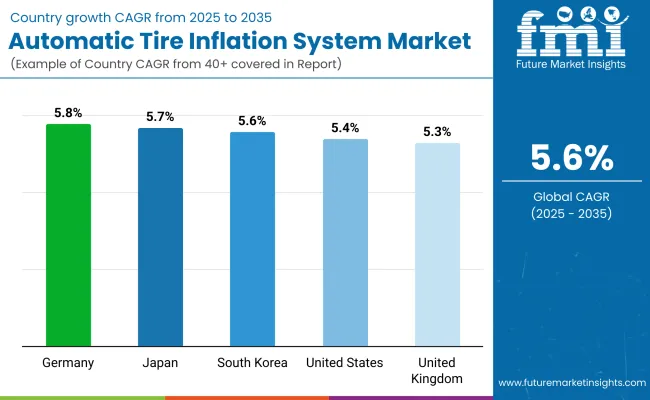

The USA ATIS market is flourishing, due to the implementation of rigorous safety regulations, the urgent need for rising fleet management efficiency, and more and more companies are realizing the benefits of smart tire technology.

The governmental policies that promote vehicle automation and sustainability are essential to the growth of this market. The trucking and logistics industries are the first to embrace ATIS, thus improving efficiency and decreasing tire-related failures. Technological progresses like integrating IoT into ATIS solutions, also lead to a faster implementation of these systems in various sectors. The rise in electric and autonomous vehicle adoption is also contributing to the TS market.

Also, fleet operators are making use of ATIS as it enables them to save on both maintenance costs and ensure they meet the regulations. The agricultural domain is experiencing a notable demand surge for ATIS due to their capability to enhance tire performance and productivity of heavy-duty vehicles, which have to work in extreme conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

The UK government is working towards reducing carbon emissions and improving vehicle efficiency, leading to an expansion of the ATIS market. The use of ATIS in commercial fleets and public transport is the primary factor behind the increase in fuel economy and decrease in maintenance costs.

Smart mobility initiatives are also important to the ATIS development as they, in turn, support logistics and agriculture by increasing vehicle performance and minimizing downtime. Thanks to the rise in investments in autonomous and electric transportation, ATIS technology has become an integral element of vehicle health and performance improvement.

Furthermore, partnerships between the fleet operators and the tech companies are what make progress in the matter assured. The agricultural sector is not left behind as it is also turning to ATIS that guarantees the appropriate tire pressure, which consequently leads to higher market yield and less fuel consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The ATIS market in Germany is mainly propelled by the developed automobile industry, the rigid car safety measures, and the considerable emphasis on the smart mobility solutions. To date, the increasing application of ATIS in commercial trucks, military vehicles, and agricultural machinery has been the strongest encouragement for the market operations.

Strict road safety and emission regulations of the EU serve as the positives that will bring the ATIS technology to the forefront, thus, conserving fuel and cutting down on available expenses. Investments in the logistics of automation and the mobility of artificial intelligence are the main stimulants that take the lead in the ATIS installation.

The rapid development of the defense sector in Germany is accompanied by the employment of ATIS in military vehicles to increase their effectiveness and resilience in conflict areas. The country’s endeavors in environmentally-friendly transportation and the intelligent fleet management solutions are other important factors for the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

The constantly changing ATIS market in Japan is heavily driven by cutting-edge technologies in the fields of automation, smart transportation, and vehicle safety. The auto sector has been the most focus driver of the ATIS with ATIS installed in the electric and commercial vehicles of the future.

The vigorous government regulations governing the utilization of lightened transportation and ecofriendly mode of transport serves as a catalyst in the ATIS deployment procurement across crop cultivation and transportation. The strong concentration of Japan in the area of AI vehicular technology and self-driving solutions has also a positive impact on the autonomy fleets for ATIS.

The well-established tire manufacturing industry in the land of the rising sun is also the one that has always been applying different techniques in order to get better the ATIS performance. Also, the rising investments in zero-emission transportation and connected vehicle ecosystems lead to the expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The ATIS market in South Korea is gaining momentum largely due to the automotive industry's rapid growth, investment in self-driving vehicles, and the focus on climate-friendly transportation.

The ATIS logistics and defense sectors are also engaging in the integration of ATIS for the reason of vehicle efficiency and cost reduction. Furthermore, increasing customer knowledge regarding road security and the optimization of tire maintenance is the other major factor contributing to the growth of the market.

In addition, the strong research and development ecosystem in Korea results in innovations in the ATIS technology, and the technology is thus used in many different industries. The support of the government for the connected vehicles and smart infrastructure projects being rolled out has prompted the acceleration of ATIS deployment in the commercial fleet and public transport.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

he ATIS market is now booming as more and more sectors of the industry are focusing on vehicle efficiency, fuel saving, and tire life. Tire pressure automatic solutions, which are the ones that keep the tires inflated with the suitable air pressure without any intervention from the driver, are replacing the manual ones in a considerable range of areas like the commercial trucking, trailers, military vehicles, and parts of agricultural equipment.

The technology not only helps to increase the vehicle performance but also helps to reduce fuel and costs as well as increase the tires' lifetime by the avoidance of under-inflation, which is a problem that many other vehicles face and that in turn increases operational costs and safety risks.

The advent of the strict regulatory framework on tire pressure monitoring along with the fleet efficiency is expected to ensure the continued growth in the market for intelligent and automated tire management systems.

The shifts mentioned earlier besides the emphasis on environmental sustainability and safety will push the ATIS market even further thereby creating more avenues for technologies and the next generation of tire management solutions.

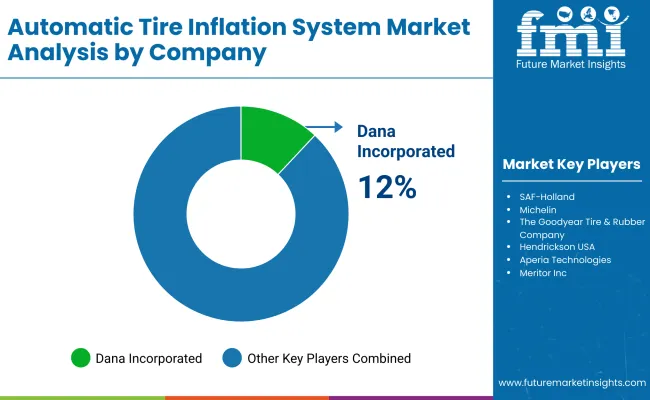

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dana Incorporated | 12-18% |

| SAF-Holland | 10-15% |

| Michelin | 9-13% |

| The Goodyear Tire & Rubber Company | 7-12% |

| Hendrickson USA | 5-9% |

| Other Companies | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dana Incorporated | Offers advanced ATIS solutions integrating real-time monitoring and telematics. |

| SAF-Holland | Specializes in tire inflation systems for trailers and commercial fleets. |

| Michelin | Provides smart tire inflation systems with AI-driven analytics. |

| Goodyear Tire & Rubber | Focuses on fleet management solutions integrated with ATIS. |

| Hendrickson USA | Develops automatic inflation systems for off-road and heavy-duty applications. |

Key Company Insights

Dana Incorporated

Dana Incorporated is the forerunner in ATIS technology, providing imaginative solutions that are exclusively for the augmentation of fuel efficiency and tire performance. The company blends telematics and tire pressure monitoring to achieve a more efficient fleet management.

The ATIS products from Dana are designated to commercial vehicles, military applications, and agricultural machinery. The corporate establishment allocates financial resources to R&D for discovering better features for automation and predictive maintenance in tire inflation systems. Thanks to a global footprint and strategic partnerships, Dana keeps on its expansion phase in various markets.

SAF-Holland

SAF-Holland, being a main player in the ATIS sector, offers specialized solutions for trailers and commercial fleets. The company’s focuses vehicle safety, reducing maintenance costs, and thus improving overall operational efficiency.

The ATIS solutions from the company are appreciated for their reliability and the possibility of easily being integrated with the current fleet management systems. The company is actively expanding its product line through acquisitions and technological advancements, thus strengthening its position in the industry.

Michelin

Michelin introduced the most recent ATIS solutions, which include AI-driven analytics and IoT-based monitoring. The firm’s smart tire technology optimizes air pressure adjustments in order to enhance fuel economy and extend tire life. The ATIS solutions going to be implemented by Michelin are primarily in commercial trucking and agricultural sectors.

The company is constantly innovating and is determinant on sustainability projects, therefore, it is a leader in the area of tire management systems that are smart, environmentally friendly, and economical.

Goodyear Tire & Rubber Company

Goodyear is a strong contender in the ATIS market, providing integrated tire inflation and fleet management solutions. The firm’s advanced ATIS technology helps fleets to achieve reduced downtime, improved fuel efficiency, and enhanced safety.

Goodyear has been investing in AI-based tire analytics that prognosticate maintenance and offer real-time monitoring. These solutions have a vast acceptance in North America and Europe and are continuously penetrating the new markets.

Hendrickson USA

Hendrickson USA's specialty is in self-tire inflation systems that are for heavy-duty and off-road applications. The firm’s ATIS technology is designed to bear the brunt of extreme conditions, making it the best fit for military, mining, and construction vehicles.

Hendrickson's constant commitment to durability and innovation has supported its market presence. The company cooperates with OEMs and fleet operators in order to provide customized ATIS solutions for better vehicle performance and safety.

In terms of Vehicle Type: the industry is divided into Passenger Vehicles, Commercial Vehicles, Off-Road Vehicles, Electric Vehicles (EVs)

In terms of Technology, the industry is divided into Central Tire Inflation Systems (CTIS), Automatic Tire Pressure Monitoring Systems (TPMS), Direct Inflation Systems, Indirect Inflation Systems

In terms of Component, the industry is divided into Compressor Units, Control Units, Sensors and Valves, Pneumatic Lines and Connectors

In terms of End-Use Application, the industry is divided into Transportation and Logistics, Mining and Construction, Agriculture, Military and Defense

In terms of Sales Channel, the industry is divided into OEM (Original Equipment Manufacturer), Aftermarket

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Automatic Tire Inflation System Market is projected to reach USD 2.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.6% over the assessment period.

By 2035, the Automatic Tire Inflation System Market is expected to reach USD 4.1 billion.

The commercial vehicle segment holds the largest share in the Automatic Tire Inflation System (ATIS) market. This segment includes trucks, trailers, and buses, where tire maintenance is critical for safety, operational efficiency, and cost management.

Major companies operating in the Automatic Tire Inflation System Market include Pressure Systems International (PSI), Aperia Technologies, Meritor Inc., Haltec Corporation, Airgo Systems, Stemco, Parker Hannifin.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Component, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Component, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Component, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Component, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 21: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Component, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 45: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Component, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA