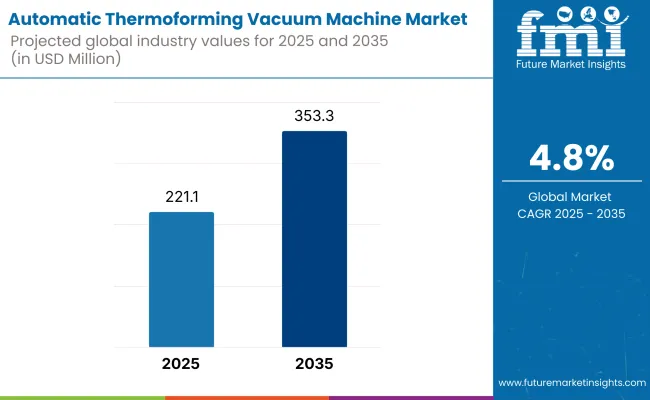

The automatic thermoforming vacuum machine market is set to expand steadily at a 4.8% CAGR from 2025 to 2035, with total market value projected to reach from USD 221.1 million in 2025 to USD 353.3 million by the end of the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 221.1 million |

| Industry Value (2035F) | USD 353.3 million |

| CAGR (2025 to 2035) | 4.8% |

This growth is driven by rising demand for efficient, hygienic, and sustainable packaging solutions across food, pharmaceutical, and personal care sectors. Advancements in technologies such as servo-driven motion control, AI-powered inspection systems, and IoT-enabled sensors are key contributors to market expansion. Additionally, the increasing need for recyclable packaging materials and tool-less machine changeovers further supports market growth.

Government sustainability mandates and energy-efficiency incentives are facilitating equipment upgrades across manufacturing lines. Recent innovations in automatic thermoforming vacuum machines include the integration of servo-driven plug assist systems, which enhance material distribution and reduce scrap rates. Advanced HMI interfaces now allow real-time process monitoring, ensuring consistent product quality and faster cycle adjustments.

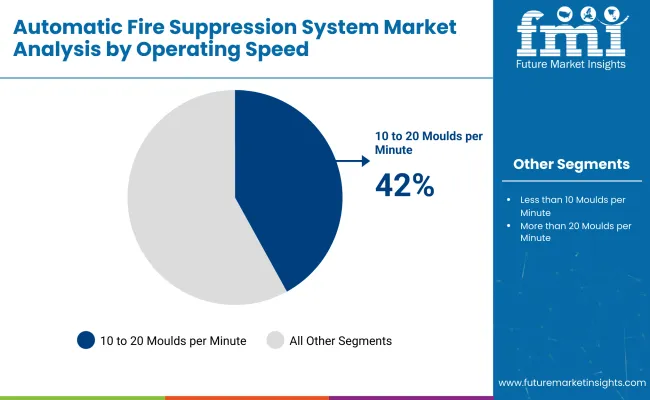

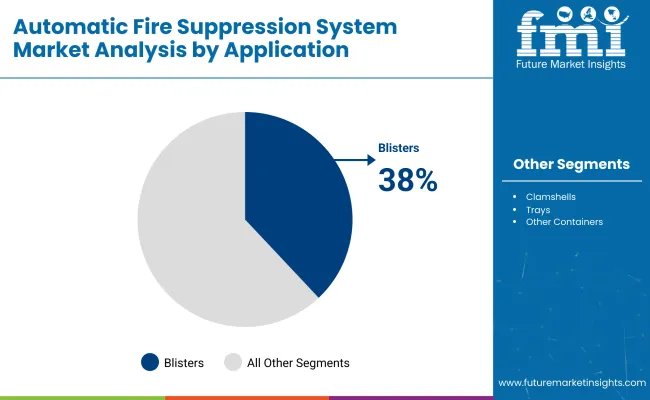

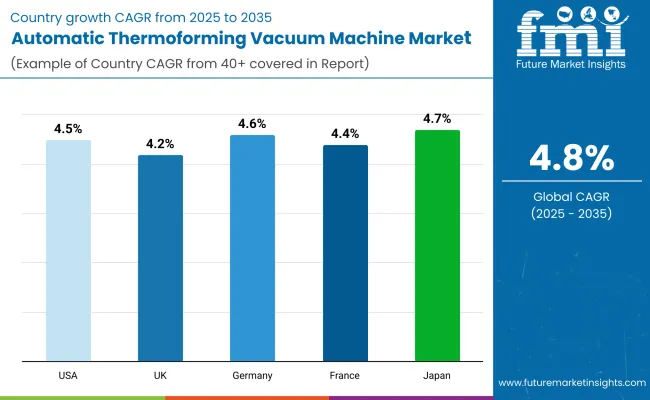

The automatic thermoforming vacuum machine market offers strong growth prospects across key segments and regions. Machines with 10 to 20 moulds per minute are expected to dominate the operating speed segment, capturing 42% of the market share by 2025. Blister packaging will lead the application segment, accounting for 38% of global demand. The USA market is forecasted to grow at a CAGR of 4.5%, while Japan and Germany will expand steadily at 4.7% and 4.6% CAGR, respectively.

The automatic thermoforming vacuum machine market is segmented based on operating speed, application, end use, and region. By operating speed, the market includes machines with less than 10 moulds per minute, from 10 to 20 moulds per minute, and with more than 20 moulds per minute.

By application, it is categorized into blisters, clamshells, trays, cups, and other containers (lids, bowls, medical packs, and food tubs). In terms of end use, the market serves industries such as food, pharmaceuticals, personal care & cosmetics, home care, and other industries (electronics, automotive, industrial packaging, and consumer goods). Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Machines operating at 10 to 20 moulds per minute are projected to lead the operating speed segment, accounting for 42% of the global market share by 2025. These machines offer an ideal balance between throughput, precision, and cost-effectiveness, making them highly preferred by mid-sized packaging manufacturers across the food, pharmaceutical, and consumer goods sectors.

Blister packaging is projected to command the application segment, accounting for 38% of the global market share in 2025. Its widespread use in pharmaceuticals, consumer electronics, and personal care products drives strong demand due to its protective, tamper-proof, and unit-dose features.

The end use segment is expected to be led by the food industry, capturing 40% of the global market share in 2025, driven by increasing demand for hygienic, durable, and tamper-evident packaging solutions across fresh, frozen, and ready-to-eat products.

The automatic thermoforming vacuum machine market is experiencing steady growth, fueled by rising demand for high-efficiency packaging solutions, sustainability-focused manufacturing, and advancements in automation technologies.

Recent Trends in This Market

Challenges

The USA automatic thermoforming vacuum machine market is forecasted to grow at a CAGR of 4.5% from 2025 to 2035, driven by rising demand for advanced packaging in food, healthcare, and consumer goods. Regulatory emphasis on hygienic and sustainable packaging formats is prompting manufacturers to adopt high-precision and eco-compliant machinery.

The UK automatic thermoforming vacuum machine market is projected to expand at a CAGR of 4.2% during 2025-2035, supported by sustainability mandates, demand for recyclable materials, and investments in automation across food and healthcare sectors. Post-Brexit manufacturing shifts are also driving local production capacity and machine procurement.

Germany’s automatic thermoforming vacuum machine market is expected to witness a CAGR of 4.6% from 2025 to 2035, owing to its leadership in precision engineering and sustainable industrial practices. The country’s strong manufacturing base and commitment to recyclable packaging technologies support steady demand for thermoforming vacuum machines.

The French automatic thermoforming vacuum machine market is anticipated to grow at a CAGR of 4.4% through 2035, driven by innovations in food processing, healthcare packaging, and regulatory-driven demand for low-waste packaging systems.

Japan’s automatic thermoforming vacuum machine market demand is forecasted to grow at a CAGR of 4.7% between 2025 and 2035, supported by its advanced electronics and medical packaging industries. The country prioritizes compact, energy-efficient machinery, aligning with sustainability goals and limited factory space.

The automatic thermoforming vacuum machine market is moderately consolidated, with a few prominent tier-one players and several niche-level competitors. Leading companies such as ILLIG Packaging Solutions GmbH, MULTIVAC Sepp Haggenmüller SE & Co. KG, and KIEFEL GmbH compete through relentless product innovation, pricing strategies, strategic partnerships, and global expansion. Their focus spans sustainability, modular design, automation, and Industry 4.0 integration, strengthening their offerings and market presence.

Tier-one firms continuously upgrade their portfolios with AI-powered quality control, IoT-enabled monitoring, and eco-conscious systems. In contrast, tier-two players like Formech Inc., Ridat, and Rajoo Engineers Ltd. serve smaller manufacturers with compact, cost-effective, and customizable machines.

Recent Automatic Thermoforming Vacuum Machine Industry News

In 2023, Asano Laboratories Co. Ltd. introduced a large-scale, high-speed pressure and vacuum thermoforming system equipped with a camera-based defect detection module.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 221.1 million |

| Projected Market Size (2035) | USD 353.3 million |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020-2024 |

| Projections Period | 2025-2035 |

| Report Parameters | Revenue in USD million |

| By Operating Speed Analyzed | With less than 10 Moulds per Minute, From 10 to 20 Moulds per Minute, and With more than 20 Moulds per Minute |

| By Application Analyzed | Blisters, Clamshells, Trays, Cups, and Other Containers (Lids, Bowls, Medical Packs, and Food Tubs) |

| By End Use Analyzed | Food, Pharmaceuticals, Personal Care & Cosmetics, Home Care, and Other Industries (Electronics, Automotive, Industrial Packaging, and Consumer Goods) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Asano Laboratories Co. Ltd., FRIMO Group GmbH, Gabler Thermoform GmbH & Co. KG, Brown Machine Group Holdings LLC, Algus Packaging Inc, Webomatic Maschinenfabrik GmbH, GEISS AG, Rajoo Engineers Ltd, COMI S.p.A, GN Thermoforming Equipment, and Other Major Players |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis. |

In terms of Operating Speed, the industry is divided into With less than 10 Moulds per Minute, From 10 to 20 Moulds per Minute, With more than 20 Moulds per Minute

In terms of Application, the industry is divided into Blisters, Clamshells, Trays, Cups, Other Containers

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The market is projected to reach USD 221.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.8% during the forecast period.

Machines with 10 to 20 moulds per minute are expected to lead with a 42% share in 2025.

Top players in the automatic thermoforming vacuum machine market include ILLIG, MULTIVAC, KIEFEL, Formech, Ridat, Rajoo Engineers, and Asano Laboratories.

Japan is projected to be the fastest-growing region with a CAGR of 4.7%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Vacuum Sealing Machine Providers

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filling Machine Market Analysis - Size, Growth, and Forecast 2025 to 2035

Automatic Capping Machine Market - Size, Share, and Forecast 2025 to 2035

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Automatic Ducting Machine Market Growth - Trends & Forecast 2025 to 2035

Automatic Grilling Machine Market

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Case Erecting Machine Market Size, Trend & Forecast 2024-2034

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Powder Filling Machines Market

Automatic Liquid Filling Machines Market

Vacuum Chamber Packaging Machines Market

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Clay Brick Making Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA