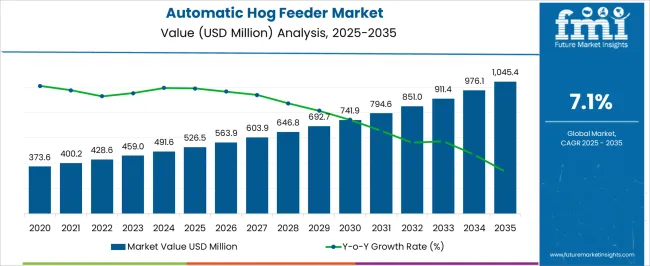

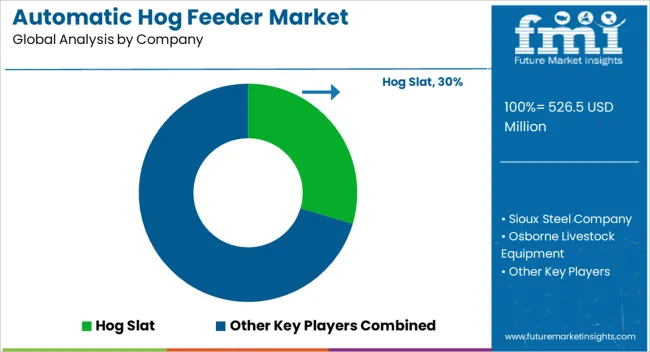

The Automatic Hog Feeder Market is estimated to be valued at USD 526.5 million in 2025 and is projected to reach USD 1045.4 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Automatic Hog Feeder Market Estimated Value in (2025 E) | USD 526.5 million |

| Automatic Hog Feeder Market Forecast Value in (2035 F) | USD 1045.4 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

The automatic hog feeder market is gaining momentum due to the rising need for efficient livestock management, feed optimization, and labor cost reduction in the swine industry. Increasing focus on precision feeding and the demand for equipment that minimizes waste while ensuring consistent nutrition delivery are driving adoption across farms.

Stainless steel designs and automated monitoring systems have enhanced feeder durability and hygiene, supporting long term operational performance. Furthermore, advancements in smart feeding technologies that integrate sensors and data analytics are improving feed conversion ratios, making them attractive for both small and large scale operations.

Growing commercial swine production in emerging economies and heightened awareness of biosecurity measures are further accelerating adoption. The market outlook remains strong as producers prioritize sustainability, productivity, and profitability in modern hog farming practices.

The market is segmented by Type, Material, Application, and Sales Channel and region. By Type, the market is divided into Infant Feeders and Adult Feeders. In terms of Material, the market is classified into Stainless Steel, Mild Steel, and Others. Based on Application, the market is segmented into Hunting and Domestic Farm. By Sales Channel, the market is divided into Direct Sales and Agro Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

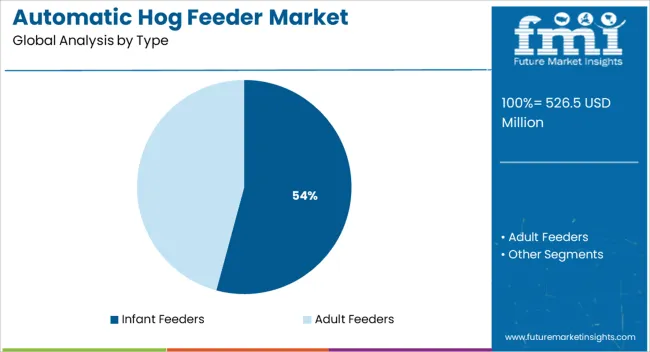

The infant feeders segment is projected to hold 54.20% of total revenue by 2025 within the type category, making it the leading segment. Growth is being supported by the increasing requirement for specialized feeding systems designed to improve the survival and growth rates of piglets.

Automated infant feeders provide consistent access to nutrition, reduce manual labor, and improve animal welfare by minimizing stress during feeding. Their contribution to reducing mortality and enhancing uniform growth across litters has made them a preferred choice for commercial farms.

Continuous technological refinement and the adoption of precision feeding solutions have further strengthened the dominance of this segment in the overall market.

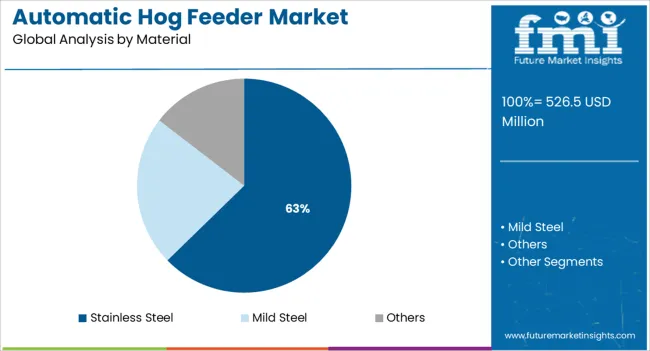

The stainless steel segment is expected to account for 62.70% of total market revenue by 2025 under the material category, positioning it as the leading material choice. This dominance is driven by the material’s durability, resistance to corrosion, and ability to maintain hygiene in feeding operations.

Stainless steel feeders require lower maintenance and have longer lifespans, offering better cost efficiency compared to alternatives. The ability to withstand high pressure cleaning and harsh farm environments has further enhanced their appeal.

Their adoption has been reinforced by growing awareness of biosecurity and the need for robust infrastructure in commercial hog farming, establishing stainless steel as the dominant material in the market.

When compared to the 6.4% CAGR recorded between 2020 and 2025, the automatic hog feeder industry is predicted to expand at a 7.1% CAGR between 2025 and 2035. The average growth of the market is expected to be around 1.07x between 2025 and 2025.

| Market Statistics | Details |

|---|---|

| Market Share (2020) | USD 296.1 million |

| Market Share (2024) | USD 403.0 million |

| Market Share (2025) | USD 428.6 million |

Short-term Growth (2025 to 2029): the industry is anticipated to gain in the short term from technological advances, such as better sensors that enable more precise and effective feeding.

Medium-term Growth (2035 to 2035): precision livestock farming is a growing trend that is predicted to increase demand for an automated hog feeder.

Long-term Growth (2035 to 2035): the growing demand for automated hog feeders could be attributed to the rising popularity of substitute proteins like plant-based proteins.

Recent innovations like automatic weighing and biometrics affect global market growth. Hog management software's use of biometric sensors makes it possible to monitor more animals with fewer staff members. It gives accurate and unbiased information on their health and welfare.

Over the forecast period, the infant automatic hog feeder segment is expected to dominate the market. Growth is credited to the companies' investments in research and development to create new technology for infant hog feeders that are effective and nutritionally superior.

The need for young hog feeders is also being driven by governmental laws and customer preferences for ethical animal treatment. However, the adult automatic hog feeder segment is anticipated to experience considerable expansion.

During the forecast period, stainless steel automatic hog feeders are anticipated to lead the market share in terms of volume and value. Stainless steel is frequently used to produce hog feeders due to its improved corrosion-resistant qualities, longer product life, and simplicity of maintenance.

Stainless steel is a very ductile substance that can be used to create intricate components for automatic hog feeders. The segment's appeal is also owed to the fact that it is resistant to oxidation and abrasion and is renowned for its exceptional strength and durability.

Due to its low price, mild steel automatic hog feeders are anticipated to grow at a moderate rate throughout the projection period. Additionally, mild steel automatic hog feeders are simple to install and have a low material weight. As they can survive high temperatures and are resistant to wear and strain, the demand is expected to increase significantly.

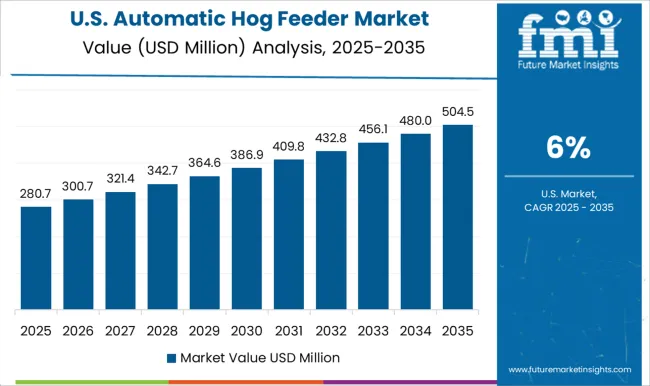

The USA dominated the automatic hog feeder market with a share of 30.1%, and worth USD 526.5 million in 2025. The market is expanding due to the rising costs of human labor and rising consumer desire for automation and convenience.

Another factor boosting demand for automatic hog feeders is growing consumer concern over animal welfare and the value of providing hogs with a healthy diet.

The growing trend toward large-scale farming operations necessitates the use of automated systems to save time, money, and labor. As a result, the market in the USA is projected to witness significant growth during the forecast period.

| Attributes | Statistics |

|---|---|

| United Kingdom Market Value 2025 | USD 38.9 million |

| United Kingdom Market Value 2035 | USD 81.1 million |

| United Kingdom Market Share (2025 to 2035) | 9.1% |

| United Kingdom Market CAGR (2025 to 2035) | 7.6% |

The rising desire for automated technologies to assist farmers in managing their animals is fueling this expansion. In the United Kingdom, intelligent automated feeders are becoming common, as they provide better control over feed quantity, nutrition, and timing.

The project calls for the construction of an automatic feeding system that provides the pig's food at regular intervals and is able to keep track of their well-being. Other initiatives include installing automatic feeders in the pig unit of the National Pig Association and installing a monitoring system for the well-being of the pigs in the pig unit of the University of Warwick.

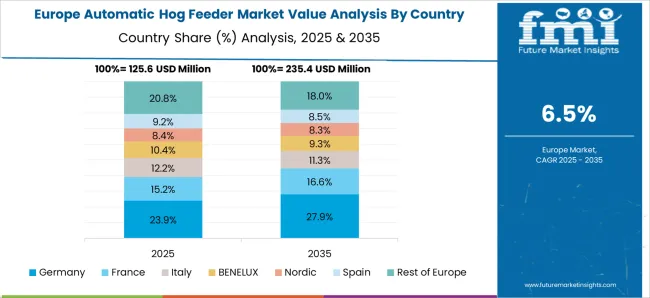

Germany dominated the Europe automatic hog feeder sector with a share of 19.9%, and worth USD 85.2 million in 2025. This is attributed to the constant efforts by key players in Germany.

| Country | China |

|---|---|

| Market Share (2025) | 10.1% |

| CAGR (2025 to 2035) | 5.7% |

| Market Value (2025) | USD 43.29 million |

| Market Value (2035) | USD 75.3 million |

| Country | India |

|---|---|

| Market Share (2025) | 8.3% |

| CAGR (2025 to 2035) | 3.9% |

| Market Value (2025) | USD 16.6 million |

| Market Value (2035) | USD 37 million |

Some of the related projects in China that raise the automatic hog feeder adoption rates:

The automatic hog feeder business in India is expected to witness significant growth during the forecast period. It is fueled by the growing need for automated animal husbandry solutions.

The market in India is anticipated to increase in response to the growing demand from the agriculture industry for better farming techniques. Government programs to support animal husbandry and the implementation of various animal welfare laws are adding up to the market value.

The rise in small-scale hog farms and the need to cut labor costs are the main factors driving the market. The market was worth USD 18.8 million in 2025, with a share of 4.4%. and is expected to grow further in the coming years. The major players in the market include Hasegawa, Takasaka, and Ushio.

These companies manufacture a wide range of automatic hog feeders, ranging from simple models to advanced ones with features such as automatic cleaning systems.

Many of these businesses have also created mobile apps that let farmers check on the performance of the feeder from a distance. The government's initiatives to encourage the adoption of innovative technology in the agriculture industry are anticipated to help the market.

The reason for successful start-ups in the industry is that a large amount of demand is not particularly hard to find. In low-bandwidth environments and areas with low cost through distribution, start-ups arose from companies that were able to sell to consumers directly or through resellers.

The growth required was driven by an existing need. In contrast, companies that are trying to enter markets where there is already competition encounter a problem:

Both problems need adequate attention to make a stronghold in the market. For instance, a Pune-based business called Prima Agrotech has created an automatic hog feeder that can be set to release food at predetermined intervals. A mobile app can be used to remotely monitor the feeder as well.

Due to the presence of established players worldwide, the market is very competitive. In order to produce new technologies that are used to improve the performance of their current products, players are heavily spending on research and development.

Key players are also investing heavily in marketing and promotional activities to gain a competitive edge over their competitors. Moreover, these players are also focusing on strategic collaborations and partnerships to expand their product portfolio and capture a large market share.

Recent Developments

The global automatic hog feeder market is estimated to be valued at USD 526.5 million in 2025.

The market size for the automatic hog feeder market is projected to reach USD 1,045.4 million by 2035.

The automatic hog feeder market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in automatic hog feeder market are infant feeders and adult feeders.

In terms of material, stainless steel segment to command 62.7% share in the automatic hog feeder market in 2025.

The global automatic hog feeder market is estimated to be valued at USD 526.5 million in 2025.

The market size for the automatic hog feeder market is projected to reach USD 1,045.4 million by 2035.

The automatic hog feeder market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in automatic hog feeder market are infant feeders and adult feeders.

In terms of material, stainless steel segment to command 62.7% share in the automatic hog feeder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA