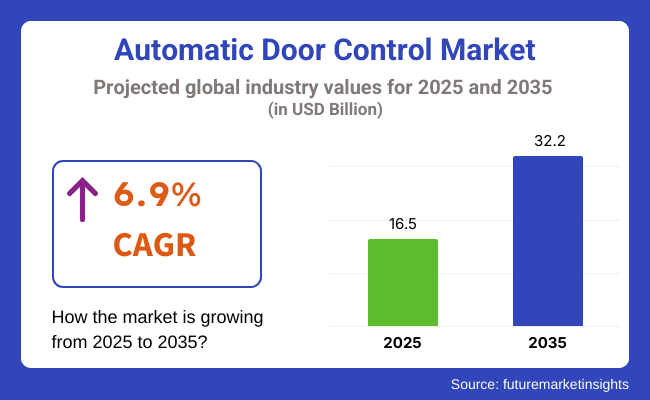

The automatic door control market is projected to grow from USD 16.5 billion in 2025 to USD 32.2 billion by 2035. The market is poised to expand at a CAGR of 6.9% during the forecast period.

This substantial expansion underscores the accelerating replacement of traditional manual doors with automated systems across residential, commercial, industrial, and public infrastructure projects worldwide. As urbanization intensifies and building codes evolve to mandate improved accessibility and energy performance, automated portal management solutions have moved from luxury additions to essential components of modern architectural design.

The market encompasses a diverse array of systems, ranging from sensor‐activated sliding and revolving doors to swing, folding, and high‐speed options, that enable seamless, hands‐free entry and exit. These technologies are increasingly integrated into building management platforms, leveraging advanced sensors, embedded microprocessors, and connectivity modules to offer real-time diagnostics, remote monitoring, and customizable access profiles.

In high-traffic environments such as airports, hospitals, shopping centers, and office complexes, automated doors not only facilitate smoother pedestrian flow but also help maintain indoor climate control by minimizing air exchange, thereby reducing HVAC loads. Beyond efficiency gains, these systems enhance user experience through adaptive speed control, noise-dampening motors, and aesthetically customizable frames and glazing options that blend with architectural motifs.

Several forces are driving demand for automatic door controls. First, heightened emphasis on hygiene, accelerated by recent global health concerns, has spurred adoption of touchless entry mechanisms, which rely on infrared or microwave motion detection, pressure mats, or even voice and biometric authentication to eliminate shared contact points.

Second, the push toward smart, connected buildings has led facility managers to prioritize solutions that integrate with IoT ecosystems, enabling predictive maintenance and energy optimization through data analytics. Third, regulatory pressures around accessibility and sustainable construction are compelling developers to install doors that comply with standards for barrier-free design and thermal performance.

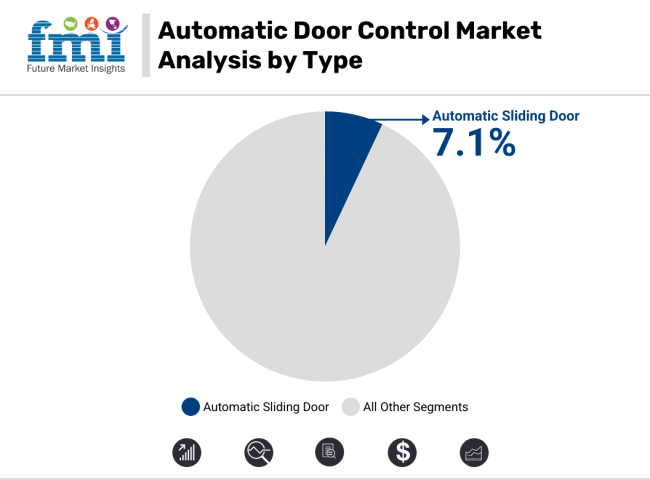

The automatic door control market is segmented based on type, end-user, and region. By type, the market is divided into automatic sliding door, automatic revolving door, and others (automatic swing, folding, high-speed, hermetically sealed, and balanced doors).

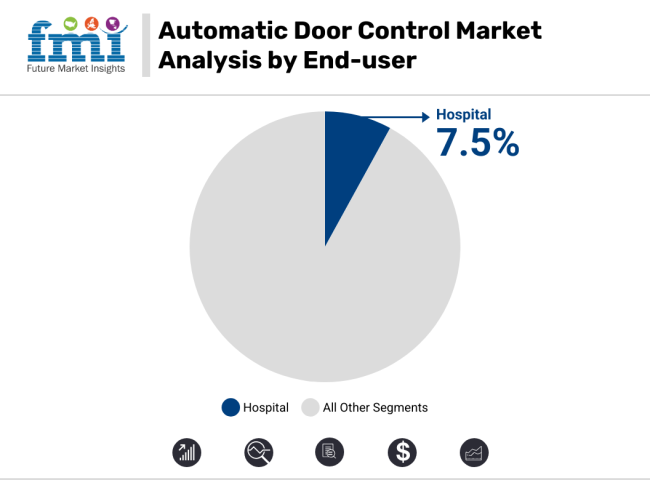

By end-user, it is categorized into hospital, airport, retail store, hotel, office building, government institution, and others (educational institutions, shopping malls, warehouses, industrial plants, and transportation hubs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Advanced sensor integration combined with AI-enhanced motion detection is propelling the automatic sliding door segment to lead the market with a robust 7.1% CAGR projected through 2035. These systems utilize dual-technology sensors that merge infrared and microwave sensing, significantly cutting down false activations in busy environments while enhancing user safety. Such reliability and efficiency have positioned automatic sliding doors as the preferred option for high-traffic areas like hospitals, airports, and retail stores.

Additionally, the integration of predictive maintenance platforms powered by IoT analytics enables continuous real-time monitoring of mechanical health. Facility managers receive automatic alerts for any signs of component wear, which helps reduce unexpected downtime and extends the operational lifespan of these doors, especially in environments that experience heavy use.

The automatic revolving door segment is driven primarily by its energy-saving features. Innovations such as low-power motors and thermal-break glazing are instrumental in minimizing HVAC energy consumption, making revolving doors especially attractive for green-certified office buildings and hotels. Meanwhile, the “others” segment, which includes folding, swing, and high-speed industrial doors, is adapting to specialized architectural demands by offering frameless glass panels, powder-coated finishes, and rapid-cycle operations.

These features cater well to luxury retail spaces, cultural institutions, and industrial manufacturing plants. Across all door categories, tightening accessibility and fire-safety regulations are accelerating innovation in safety edges, obstacle-detection technologies, and emergency-release mechanisms.

The fastest-growing end-user segment in the automatic door control market is hospitals. This segment is projected to expand at a CAGR of 7.5% from 2025 to 2035, and is primarily driven by stringent hygiene protocols, the rising volume of patient inflow, and increased investments in healthcare infrastructure globally.

The widespread adoption of contactless entry systems in ICUs, surgical suites, and emergency wards, especially in the post-pandemic era, has propelled demand for automatic sliding and swing doors in hospitals. Integration with access control and security systems further enhances operational efficiency and infection control in medical environments.

Other significant end users include airports, retail stores, and office buildings. Airports are prioritizing automated doors to streamline passenger flow and improve security, particularly in high-traffic terminals. Retail stores leverage automatic doors to enhance customer experience and energy efficiency, while office buildings focus on smart entry systems integrated with workplace access management. Hotels adopt aesthetically designed doors to create welcoming, barrier-free entrances. Government institutions prefer durable, high-security door systems.

The “others” segment, covering schools, universities, warehouses, and industrial facilities, is growing steadily as automation expands into institutional and logistics infrastructures. All these segments benefit from ongoing regulatory pushes for accessibility, safety, and energy efficiency across global building standards.

Challenge

High Initial Costs and Integration Complexity in Automated Door Systems

The growth of the automatic door control market. Automatic door systems are a critical part of businesses and public infrastructure that enables enhanced security, access and energy efficiency, but integrating these technologies means increased installation costs and an associated poor integration with already implemented building management systems. Moreover, in particular, safety standards that change from year to year and regional compliance needs when it comes to deployment, further add layers of complexity.

To overcome these issues, manufacturers should prioritize modular and affordable door control systems that offer user-friendly interfaces, compatibility with smart building solutions, and high energy efficiency. Predictive maintenance functionality and IoT-enabled diagnostics will also help to reduce operational costs and downtime.

Opportunity

Expansion of Smart Building Infrastructure and Contactless Technologies

Rapid global uptake of smart and energy-efficient solutions, along with a growing inclination towards contactless technologies, is providing an impetus to the automatic door control Market.

Businesses and healthcare facilities are also important users of automatic door systems, as they need to operate on the right foot, and to cure the spread of germs, companies and service providers are integrating such automatic door systems in their spaces. Artificial intelligence-powered door control, biometric authentication, and voice-activated entry solutions are changing how buildings implement access control.

Furthermore, Sustainability initiatives are improving, and manufacturers are producing energy-efficient and solar automatic doors to minimize the environmental impact. Fortunes will then favour those companies that will invest in advanced sensor technology, advanced cloud-based monitoring, AI-powered security integration.

The United States automatic door control market has steadily grown due to increasing demands for intelligent building solutions, the construction of more commercial areas, and stricter accessibility rules. Both the Americans with Disabilities Act and construction safety codes are driving widespread use of self-operating sliding and swinging doors in public structures, hospitals, and shopping complexes.

The hospitality and transportation industries have become major customers of contactless and sensor-based entrance control systems, needing touchless access in airports, hotels, and shopping malls. Moreover, the rising preference for smart homes and internet-connected security setups is fuelling requirements for automated access to residential properties.

Advances in AI-guided permission management and heightened investments in high-security automated entrance arrangements mean the USA automatic door control market is anticipated to considerably expand its scope and impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The United Kingdom automatic door control market has steadily expanded in recent years due to rising investments channelled towards commercial real estate ventures and an increasing societal adoption of intelligent security solutions along with stricter governmental regulations aimed at enhancing building accessibility.

Under the UK's Disability Discrimination Act and Construction Design and Management directives, the implementation of automatic entranceways has been strongly encouraged in hospitals, government offices, and other commercial complexes to foster a more inclusive architecture.

Meanwhile, key sectors such as retail and hospitality, which includes everything from multinational hotel chains to bustling shopping centres and corner restaurants, have wholeheartedly embraced the entrance-facilitating practicalities and energy-preserving perks of automated doors integrated with sensor-based triggering systems. Furthermore, a growing conscientiousness surrounding the development of sustainable and energy-efficient building technologies has driven increased utilization of low-energy automated entryways.

With smart building investments continuing to rise across the nation and automated doorways further expanding into applications within high-security compounds, the UK automatic door control market is positioned for steady maturation in the coming years according to various analyses.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.7% |

The rapidly advancing European Union mechanized entryway governance sector has undergone robust expansion in recent years, propelled by rigorous structural protection benchmarks, intensifying urbanization, and expanding investments in brilliant infrastructure initiatives. Nations like Germany, France, Italy, and others have emerged as pioneering implementers of mechanized entryway platforms in both commercial and industrial verticals.

The EU's fixation on energy-proficient edifices, in accordance with the European Green Deal and Energy Performance of Buildings Directive, has exponentially accelerated the adoption of automated doorway mechanisms that better insulate and reduce consumed energy.

In addition, the proliferating necessity for contactless access remedies in healthcare and public structures is further fuelling market growth. The debut of more intelligent automated security entrance systems has enabled edifices to ensure safety while minimizing human contact amid the ongoing pandemic.

With continuous investments in brilliant metropolitan projects and high-security architectural digitization, experts anticipate that the EU automated doorway management market will steadily continue evolving in the coming years. Presently, the EU is working to develop standardized guidelines for automated doors to harmonize prerequisites and ensure reliable functionality, accessibility, and security across borders as freedom of movement increases post-pandemic.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.8% |

The evolving Japanese automatic door control market is being reshaped by increasing adoption of cutting-edge intelligent building technologies, burgeoning demand from commercial and transportation verticals, and strong governmental emphasis on accessible infrastructure. Japan's aging demographic phenomenon is intensifying the necessity for barrier-free facilities, including self-operating sliding and sensor-based entrances in hospitals, public transit stations, and residential complexes.

The transportation sphere, notably train terminals and airports, represents a major customer of sophisticated, AI-driven automatic doors to optimize passenger flow and security. Additionally, Japan's pioneering robotics and deep integration of AI in smart structures are spurring innovative non-contact and biometric-enabled entrance management systems.

With continuous technological refinement and rising investments in energy-efficient building solutions, the dynamic Japanese automatic door control sector is poised for steady evolution to accommodate diverse accessibility needs through integrated smart technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The South Korean automatic door control industry has witnessed dependable development, fuelled by expanding keen city ventures, developing reception in cutting edge office structures, and developing interest for propelled wellbeing arrangements. The South Korean administration's venture in keen foundation and computerized change is quickening the selection of AI-controlled and IoT-coordinated programmed entryway control frameworks.

The business genuine estate and lodging divisions, including extravagance inns, corporate structures, and shopping centres, are significant shoppers of sensor-based and facial acknowledgment passage frameworks. What's more, the developing reception of vitality proficient and natural agreeable building innovations is driving interest for programmed entryways with keen vitality the board highlights. These frameworks have started to see more prominent penetration as developing urban communities search for keen arrangements.

With ascendant urbanization and solid interest for savvy wellbeing arrangements, the South Korean programmed entryway control part is relied upon to create dependably. Be that as it may, the commercial centre faces difficulties in expanding reception crosswise over provincial regions and smaller scale ventures due to enormous underlying capital necessities and specialized impediments currently being tended to by driving merchants.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

The automatic door control market is witnessing growth owing to a rising demand for contactless entry solutions, energy-efficient building automation, and smart security systems in commercial, residential, healthcare, and transportation sectors.

To address the growing demand, companies are also focused in the development of AI based motion sensor, IoT based access control, and energy efficient automatic door solutions for improved convenience, security and sustainability. Market analysis introduces worldwide building automation, the global automatic sidewalk door, sliding automatic doors, swing automatic doors, revolving automatic door, folding automatic doors, and others.

ASSA ABLOY AB (15-20%)

The automatic door control market with its innovative AI-integrated smart entry solutions, high-efficiency access control, and biometric authentication technologies.

DormaKaba Holding AG (12-16%)

DormaKaba is an access automation company that provides touchless entry methods, smart building automation solutions, and IoT-enabled door access controls.

Stanley Black & Decker, Inc. (10-14%)

Stanley makes rugged automatic door systems for commercial applications, including real time monitoring and security integrations.

GEZE GmbH (8-12%)

AI-driven door automation solutions for energy-efficient designs that align with safety regulations and sustainability strategies.

Horton Automatics (Overhead Door Corporation) (5-9%)

Horton is a supplier of high-performance automatic doors, which feature high-end motion detection and remote access control.

Other Key Players (40-50% Combined)

There are a range of contributors towards next generation automatic door implementations, AI sector authentication systems and other sustainable door control systems in the form of building automation and access control industrialists. These include:

The overall market size for Automatic Door Control Market was USD 16.5 Billion In 2025.

The Automatic Door Control Market expected to reach USD 32.2 Billion In 2035.

The demand for automatic door control systems will be driven by factors such as rising demand for convenience, enhanced security, and energy efficiency in residential, commercial, and industrial spaces. Additionally, increased adoption in healthcare, retail, and transportation sectors, along with technological advancements, will further fuel market growth.

The top 5 countries which drives the development of Automatic Door Control Market are USA, UK, Europe Union, Japan and South Korea.

Automatic Sliding and Automatic Revolving Doors Drive Market Growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA