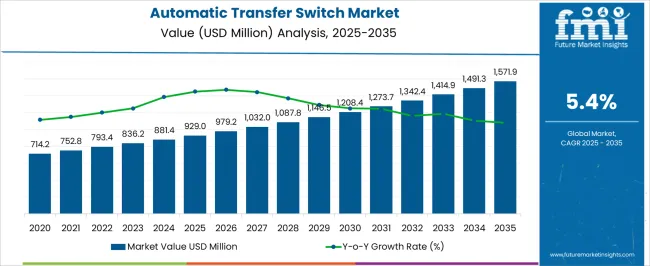

The automatic transfer switch (ATS) market is expected to grow from USD 929.0 million in 2025 to USD 1,571.9 million by 2035, registering a 5.4% CAGR and generating an absolute dollar opportunity of USD 642.9 million. Growth is supported by increasing demand for reliable power backup solutions across commercial, industrial, and utility applications. ATS devices ensure uninterrupted power supply by automatically switching between primary and backup power sources, making them critical for hospitals, data centers, manufacturing plants, and other mission-critical facilities.

Early versus late growth curve comparison highlights shifts in market adoption and momentum over the forecast period. In the early phase from 2025 to 2028, growth is steady but moderate, primarily driven by North America and Europe, where established infrastructure, regulatory compliance, and replacement of aging power systems support incremental adoption. During this phase, revenue growth is largely influenced by retrofitting projects and the replacement of conventional manual switching systems. In the late phase from 2029 to 2035, growth accelerates as Asia Pacific, Latin America, and the Middle East expand industrial and commercial infrastructure, increasing demand for automated power management solutions.

Additionally, technological improvements such as smart ATS systems and IoT-enabled monitoring enhance adoption in later years. Overall, the USD 642.9 million opportunity reflects gradual early-stage uptake followed by stronger late-stage growth, demonstrating a steady upward trajectory for automatic transfer switches globally between 2025 and 2035.

| Metric | Value |

|---|---|

| Automatic Transfer Switch Market Estimated Value in (2025 E) | USD 929.0 million |

| Automatic Transfer Switch Market Forecast Value in (2035 F) | USD 1571.9 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The automatic transfer switch (ATS) market is primarily driven by the commercial and industrial power sector, which accounts for around 44% of the market share, as facilities require uninterrupted electricity for critical operations. Data centers and IT infrastructure contribute about 25%, leveraging ATS systems to ensure continuous power supply and prevent downtime. The residential segment represents close to 15%, where ATS units are used with backup generators for home safety and convenience. Utilities and microgrid projects account for roughly 10%, integrating ATS for grid reliability and load management. The remaining 6% comes from healthcare, hospitality, and public infrastructure projects, which rely on automated switching to maintain continuous electricity for essential services.

The automatic transfer switch market is evolving with advancements in smart monitoring, IoT integration, and modular design. Intelligent ATS systems now allow remote monitoring, predictive maintenance, and real-time performance tracking. Compact and modular designs improve installation flexibility for both small and large-scale power systems. Integration with renewable energy sources, such as solar and wind, is increasing to enable hybrid power solutions.

Manufacturers are focusing on improved switching speed, enhanced durability, and compliance with stricter safety and reliability standards. Strategic partnerships with generator suppliers, energy service providers, and facility operators are expanding market reach. Growing demand for uninterrupted power in commercial, industrial, and critical infrastructure applications continues to drive adoption globally.

The automatic transfer switch market is demonstrating steady growth driven by the increasing demand for uninterrupted power supply and enhanced electrical system reliability across residential, commercial, and industrial sectors. Rising investments in critical infrastructure, data centers, and telecommunication networks are fueling the adoption of automatic transfer switches, which ensure seamless transition between power sources during outages or disturbances.

Technological advancements focusing on improved switching speed, durability, and smart monitoring capabilities are enhancing product performance and reliability. Additionally, the growing trend towards smart grids and renewable energy integration is creating new opportunities for advanced transfer switch solutions capable of managing complex power flows.

Regulatory requirements for power continuity in healthcare, financial services, and manufacturing industries are further encouraging market expansion The increasing focus on minimizing downtime and protecting sensitive equipment supports the ongoing demand, positioning the market for sustainable growth over the coming years.

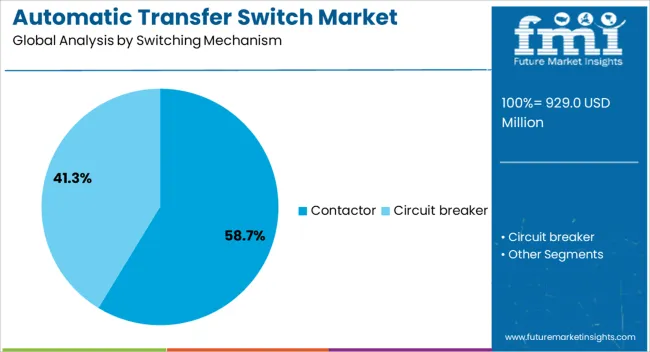

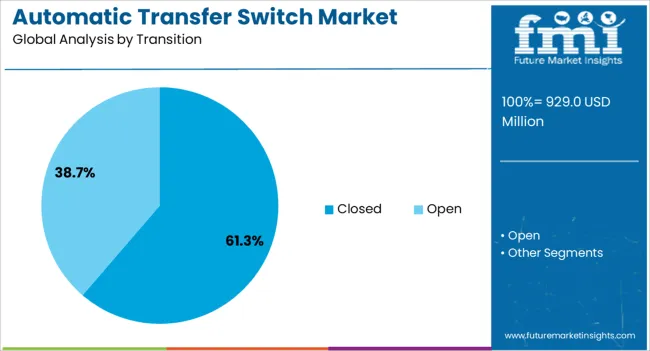

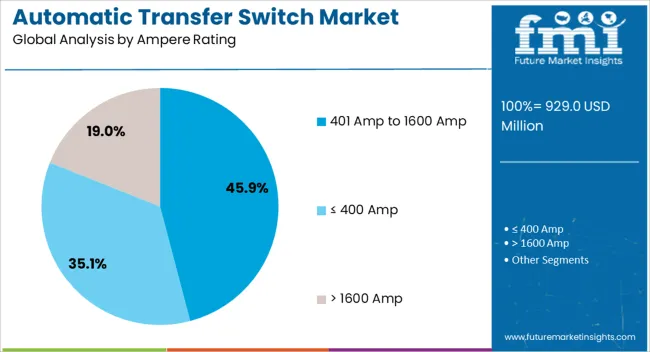

The automatic transfer switch market is segmented by switching mechanism, transition, ampere rating, application, and geographic regions. By switching mechanism, automatic transfer switch market is divided into contactor and circuit breaker. In terms of transition, automatic transfer switch market is classified into closed and open. Based on ampere rating, automatic transfer switch market is segmented into 401 Amp to 1600 Amp, ≤ 400 Amp, and > 1600 Amp. By application, automatic transfer switch market is segmented into emergency systems, legally required systems, critical operations power systems, and optional standby systems. Regionally, the automatic transfer switch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The contactor switching mechanism segment is expected to hold 58.7% of the automatic transfer switch market revenue share in 2025, making it the leading switching mechanism type. Its prominence is driven by its reliable operation in rapidly switching power sources, offering high durability and low maintenance requirements. Contactor-based switches provide fast transition speeds and superior electrical isolation, making them suitable for critical applications demanding minimal power interruption.

The modular design facilitates easy integration with control systems and allows for scalability in complex electrical networks. The segment benefits from increasing deployment in industrial and commercial facilities where power quality and continuity are vital. Contactor mechanisms offer enhanced protection features, supporting compliance with evolving safety standards.

The closed transition segment is projected to represent 61.3% of the automatic transfer switch market revenue share in 2025, positioning it as the leading transition type. This dominance is attributed to its ability to maintain a continuous power supply by briefly paralleling power sources during transfer, thereby eliminating power interruption. The closed transition mechanism is preferred in applications where power quality and sensitive equipment protection are critical, such as hospitals, data centers, and manufacturing plants.

Its design reduces the risk of equipment damage and operational downtime, supporting high reliability and system stability. Growing adoption is also linked to stringent regulatory frameworks requiring seamless power transfer in essential services.

The segment benefits from advancements that improve switching precision and fault detection, enhancing overall system performance and user confidence.

The 401 Amp to 1600 Amp ampere rating segment is anticipated to account for 45.9% of the automatic transfer switch market revenue share in 2025, making it the leading capacity category. This segment’s growth is supported by the widespread need for medium to high-capacity transfer switches in commercial buildings, industrial facilities, and large residential complexes. It offers an optimal balance between power handling capability and compact design, enabling efficient integration into electrical distribution systems.

The segment benefits from the increasing scale and complexity of electrical infrastructure that requires robust power management solutions. Additionally, it caters to applications demanding reliable switching under heavy load conditions, including backup power systems and emergency power supplies.

Advances in thermal management and switching technology have enhanced the performance and durability of transfer switches within this rating range. As energy demand and infrastructure complexity grow, the preference for this ampere rating segment is expected to remain strong, driving market leadership.

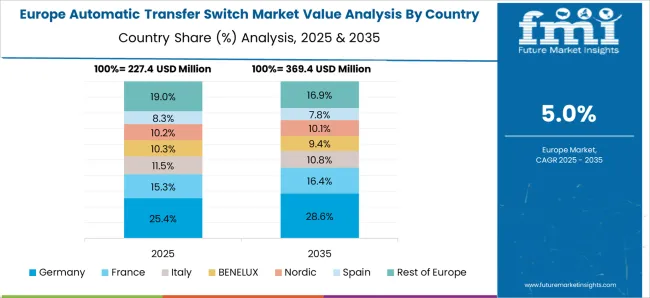

The automatic transfer switch market is expanding due to increasing demand for reliable power backup, rising industrialization, and growth in commercial and critical infrastructure. Global revenue reached USD 4.3 billion in 2024. Asia Pacific leads with 40% share, driven by China (USD 1.2 billion), India (USD 0.7 billion), and Japan (USD 0.5 billion). Europe contributes 30% (USD 1.3 billion), led by Germany, France, and UK, while North America accounts for 25% (USD 1.1 billion), primarily the USA Advancements in smart switching, load management, and integration with backup generators support widespread adoption globally.

Automatic transfer switches are widely used in industrial facilities, commercial buildings, and data centers, together accounting for over 70% of market demand. Industrial applications represent 35%, providing uninterrupted power to manufacturing units, refineries, and processing plants. Commercial buildings contribute 25%, including hospitals, office complexes, and shopping centers. Data centers represent 10%, ensuring reliability and continuous operation for critical IT infrastructure. Asia Pacific leads with 40% market share, deploying over 12,000 units in 2024. Europe contributes 30%, while North America holds 25%, driven by USA adoption in commercial and industrial sectors. Growing demand for continuous power drives global ATS deployment.

Technological innovations in ATS include digital controllers, IoT-enabled monitoring, and predictive maintenance capabilities. Advanced digital controls enable seamless switching between primary and backup power within milliseconds. IoT integration allows remote monitoring, diagnostics, and alerts for load and fault management. Predictive maintenance reduces downtime by 10–15% and improves system reliability. Asia Pacific emphasizes cost-effective, high-capacity switches for industrial applications. Europe invests in smart ATS for commercial buildings and renewable-integrated power systems. North America focuses on modular designs for rapid deployment and critical infrastructure support. These advancements enhance operational efficiency and ensure uninterrupted power supply across sectors.

ATS systems are increasingly deployed in hospitals, telecommunication networks, and government buildings. Healthcare facilities account for 30% of adoption, providing critical power for medical equipment and emergency systems. Telecommunication infrastructure represents 25%, supporting cellular towers, data centers, and communication hubs. Government and municipal buildings contribute 15%, ensuring continuous operations for administrative services and public safety. Asia Pacific leads with 40% market share, deploying over 12,000 units in 2024. Europe contributes 30%, while North America holds 25%, primarily in the USA Expanding use in essential services supports market growth and strengthens infrastructure resilience globally.

The automatic transfer switch market faces challenges from high initial investment, installation complexity, and compliance requirements. Industrial-grade ATS units can cost USD 5,000–25,000 depending on capacity and features. Installation requires skilled technicians, configuration, and integration with generators or power grids. Regulatory standards in Europe and North America mandate safety certification, load testing, and environmental compliance, increasing project complexity. Asia Pacific mitigates costs through large-scale procurement and local manufacturing. Europe emphasizes certified, high-capacity switches, while North America integrates advanced monitoring and energy optimization. Despite the benefits in power continuity, high costs and regulatory compliance remain barriers to adoption.

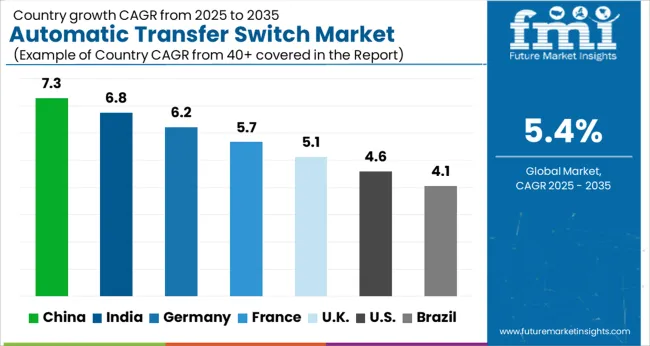

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The automatic transfer switch market is projected to grow at a global CAGR of 5.4% through 2035, driven by increasing demand for reliable power backup, industrial electrification, and commercial infrastructure. China leads at 7.3%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion in industrial facilities, commercial buildings, and power backup installations. India follows at 6.8%, a 1.26× multiple of the global rate, reflecting growing demand in manufacturing units, commercial establishments, and urban infrastructure projects. Germany records 6.2%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in high-performance transfer switches, industrial automation, and energy management systems. The United Kingdom posts 5.1%, 0.94× the global rate, with selective uptake in commercial and industrial facilities, retrofitting projects, and infrastructure upgrades. The United States stands at 4.6%, 0.85× the benchmark, with steady adoption in utility, industrial, and commercial power backup applications. BRICS economies drive most of the market volume, OECD countries emphasize efficiency and advanced technology, while ASEAN nations contribute through expanding industrial and commercial power infrastructure.

The automatic transfer switch (ATS) market in China is projected to grow at a CAGR of 7.3%, driven by expansion of industrial, commercial, and data center infrastructure requiring reliable power backup solutions. Domestic manufacturers such as CHINT Group and Delixi Electric supply ATS units for low, medium, and high-voltage applications. Demand is supported by increased adoption in power generation plants, critical infrastructure, and large commercial facilities. Technological improvements focus on intelligent monitoring, fast switching, and integration with renewable energy systems. Industrial automation and smart grid projects further enhance deployment across urban and semi-urban regions.

The automatic transfer switch market in India is expected to grow at a CAGR of 6.8%, supported by industrial electrification, growth in commercial facilities, and rising demand for uninterrupted power supply. Companies such as L&T Electrical and Crompton Greaves supply low and medium-voltage ATS for manufacturing, IT, and commercial sectors. Technological innovation focuses on fast switching, remote monitoring, and compatibility with diesel generators and renewable energy sources. Expansion is fueled by urban infrastructure development and adoption in hospitals, IT parks, and telecom facilities.

Germany’s automatic transfer switch market is projected to grow at a CAGR of 6.2%, influenced by modernization of industrial and commercial power infrastructure, renewable integration, and regulatory standards for power reliability. Suppliers such as Siemens and ABB provide ATS for low, medium, and high-voltage applications with advanced monitoring and safety features. Demand is driven by industrial facilities, hospitals, and commercial buildings requiring uninterrupted power supply. Technological improvements include fast switching, predictive maintenance, and integration with smart grid and renewable power sources. Export opportunities to neighboring European countries supplement domestic growth.

The automatic transfer switch market in the United Kingdom is expected to grow at a CAGR of 5.1%, supported by the need for reliable power in hospitals, commercial centers, and industrial facilities. Suppliers focus on low and medium-voltage ATS with intelligent monitoring, fast switching, and generator compatibility. Demand is influenced by smart grid integration, data center growth, and urban infrastructure projects. Technological innovation emphasizes predictive monitoring, ease of installation, and energy-efficient designs. Retrofit projects and modernization of existing power systems also drive demand.

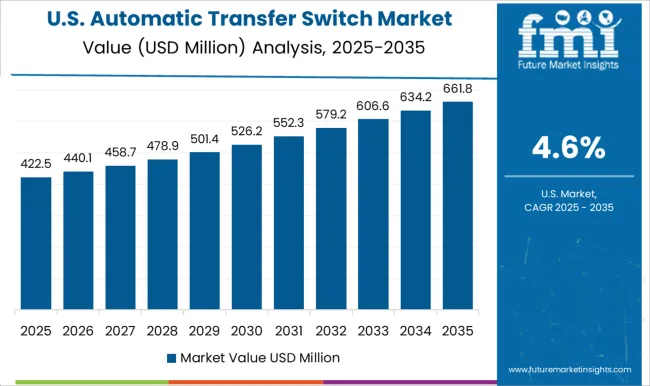

The automatic transfer switch market in the United States is projected to grow at a CAGR of 4.6%, driven by demand for uninterrupted power supply in industrial, commercial, and healthcare sectors. Major suppliers such as Eaton and Generac provide ATS units for low, medium, and high-voltage applications. Technological improvements include fast switching, remote monitoring, and integration with renewable and backup power systems. Retrofits and new installations in critical facilities, data centers, and commercial buildings support steady growth. Demand is also influenced by government regulations and reliability standards.

The automatic transfer switch (ATS) market is highly competitive, driven by the growing demand for uninterrupted power supply in commercial, industrial, and residential applications. Market competition is shaped by switch type (open transition, closed transition, or delayed transition), rated voltage, current capacity, reliability, integration with generators or renewable energy systems, and pricing. Companies differentiate through advanced control systems, remote monitoring, smart connectivity, and rapid response times that ensure seamless power switching and operational safety.

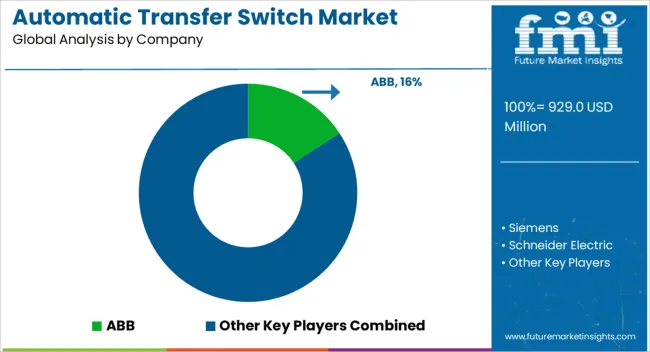

Key players such as ABB, Schneider Electric, Eaton Corporation, Siemens Energy, General Electric (GE), Legrand, Emerson Electric, Socomec, Cummins, and ASCO Power Technologies dominate the market by offering reliable, high-performance, and technologically advanced automatic transfer switches. Strategic partnerships with utilities, industrial facilities, and distributors are leveraged to expand market reach. Regional and emerging manufacturers compete by providing cost-effective, compact, and customizable ATS solutions. The market is moderately consolidated, with leading companies focusing on innovation, regulatory compliance, long-term service support, and integration with smart grid systems to strengthen market share and meet growing demand for reliable power backup solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 929.0 million |

| Switching Mechanism | Contactor and Circuit breaker |

| Transition | Closed and Open |

| Ampere Rating | 401 Amp to 1600 Amp, ≤ 400 Amp, and > 1600 Amp |

| Application | Emergency systems, Legally required systems, Critical operations power systems, and Optional standby systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, Schneider Electric, Eaton, Generac Power Systems, Cummins, Caterpillar, AEG Power Solutions, Kohler, Vertiv Group, Briggs & Stratton, General Electric, Global Power Supply, and One Two Three Electric |

| Additional Attributes | Dollar sales by switch type and end use, demand dynamics across residential, commercial, and industrial power systems, regional trends in backup power adoption, innovation in reliability, load management, and remote monitoring, environmental impact of material use and disposal, and emerging use cases in microgrids and renewable integration. |

The global automatic transfer switch market is estimated to be valued at USD 929.0 million in 2025.

The market size for the automatic transfer switch market is projected to reach USD 1,571.9 million by 2035.

The automatic transfer switch market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in automatic transfer switch market are contactor and circuit breaker.

In terms of transition, closed segment to command 61.3% share in the automatic transfer switch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA