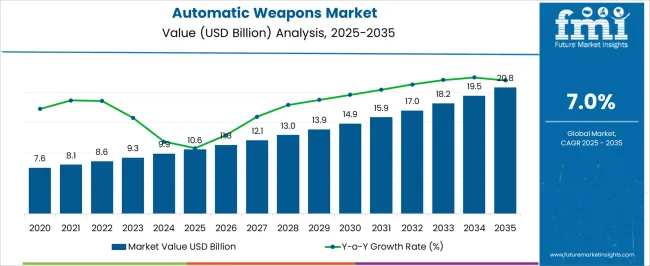

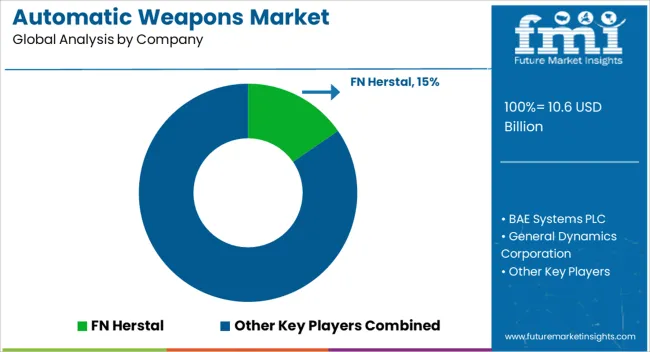

The automatic weapons market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 20.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. This doubling of market value in ten years signifies that the demand for advanced weaponry systems has been reinforced by geopolitical tensions, border disputes, and modernization of defense forces across both developed and developing nations.

Reliance on such weapons has become a necessity rather than a preference, as nations aim to strengthen deterrence and achieve tactical superiority. Pace of growth reflects not just procurement but also the widespread replacement of outdated weapon platforms with automated systems that improve accuracy, firepower, and operational readiness. The trajectory indicates that automation in combat operations is being cemented as a strategic imperative rather than a passing trend. Over the next decade, steady year-on-year expansion is expected as budgets are allocated toward modern firearms, automatic rifles, and vehicle-mounted systems. The increase from USD 10.6 billion to USD 20.8 billion demonstrates that this market is not only resilient but also poised to evolve with changing doctrines of warfare. The 10-year growth comparison shows that the reliance on automatic weaponry is no longer confined to large armies but is gradually being adopted by smaller forces, security agencies, and private defense contractors. By 2035, the adoption curve is likely to confirm that automation has reshaped traditional concepts of firepower, giving stakeholders a profitable yet competitive environment that demands continuous upgrades in weapon design and battlefield adaptability.

| Metric | Value |

|---|---|

| Automatic Weapons Market Estimated Value in (2025 E) | USD 10.6 billion |

| Automatic Weapons Market Forecast Value in (2035 F) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The automatic weapons market represents a significant but specialized segment within the global defense industry, holding an estimated 8-10% share across its parent markets. Within the broader defense equipment and systems market, automatic weapons contribute about 7-8%, primarily through rifles, machine guns, and mounted weapon systems used in infantry and vehicle applications. In the small arms and light weapons market, they account for nearly 20-22% share, reflecting their core role in military-grade firearms compared to semi-automatic and non-automatic arms. In the military modernization and procurement market, their share stands at roughly 6-7%, influenced by large-scale government investments in equipping troops with advanced assault rifles and next-generation machine guns. Within homeland security and law enforcement arms, their share is relatively modest, around 2-3%, as most civilian and police forces rely more on semi-automatic firearms due to regulation and operational requirements. In aerospace and ground combat systems, automatic weapons hold a 4-5% share, largely from integration in armored vehicles, naval platforms, and aircraft-mounted systems. Overall, the automatic weapons market continues to grow due to rising defense budgets, geopolitical conflicts, and the push for modernized infantry weapons with higher accuracy and firepower. Its share across parent markets highlights its critical role in shaping tactical capabilities for modern militaries worldwide.

The automatic weapons market is being shaped by sustained defense modernization initiatives, evolving security threats, and increased procurement from both domestic and international military agencies. Current market conditions are characterized by heightened investment in advanced weapon systems, driven by the need for superior firepower, operational efficiency, and adaptability across varied combat environments.

Governments are prioritizing indigenous manufacturing capabilities and technology transfers to strengthen defense infrastructure, while established manufacturers are leveraging R&D to enhance precision, durability, and modularity in weapon platforms. Rising geopolitical tensions and the modernization of armed forces in emerging economies are supporting steady demand growth.

Export opportunities are expanding, aided by strategic alliances and defense trade agreements. Over the forecast period, the integration of advanced targeting systems, lightweight materials, and improved ergonomics is expected to boost adoption rates, while long-term contracts and lifecycle support services will contribute to market stability and sustained revenue generation.

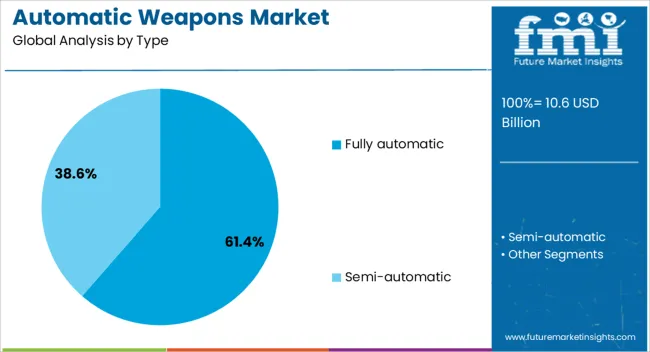

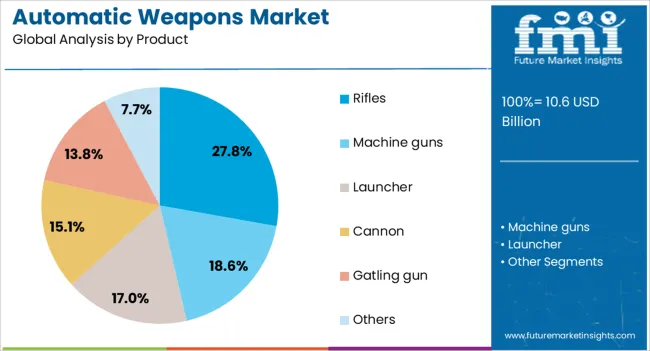

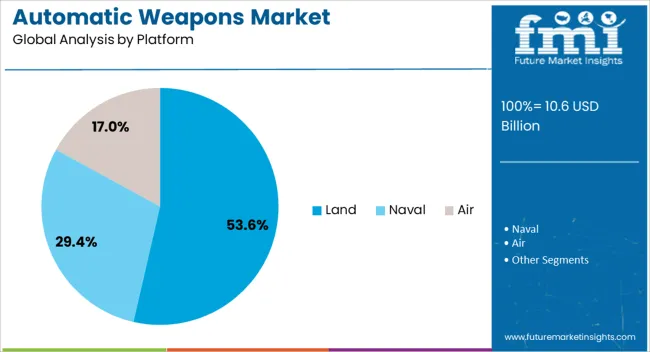

The automatic weapons market is segmented by type, product, platform, application, end user, and geographic regions. By type, the automatic weapons market is divided into fully automatic and Semi-automatic. In terms of product, the automatic weapons market is classified into Rifles, Machine guns, Launchers, Cannons, Gatling guns, and Others. Based on the platform, the automatic weapons market is segmented into Land, Naval, and Air.

By application, the automatic weapons market is segmented into Armored fighting vehicles, Battle tanks, Combat support aircraft, Destroyers, Fighter aircraft, Helicopters, Light protected vehicles, Offshore Patrol Vessels (OPVs), and Others. By end user, the automatic weapons market is segmented into Military, Law enforcement, Civilian, and Others. Regionally, the automatic weapons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fully automatic segment, commanding 61.4% of the type category, has maintained dominance due to its capacity for continuous fire and high rate of engagement in combat scenarios. This segment benefits from broad deployment across multiple branches of armed forces and law enforcement units, providing tactical superiority in high-intensity operations.

Market share has been reinforced by advancements in recoil management, ammunition efficiency, and modular configurations that allow rapid adaptation to mission-specific requirements. The procurement of fully automatic weapons is supported by established defense budgets in developed nations and accelerated acquisition programs in emerging economies.

Standardization initiatives and compatibility with modern ammunition types have enhanced operational interoperability, further strengthening its position. The segment’s leadership is expected to persist as modernization programs prioritize systems offering high reliability, superior lethality, and seamless integration with advanced optics and targeting solutions.

The rifles segment, holding 27.8% of the product category, remains a critical component of infantry armament strategies due to its versatility, portability, and effectiveness in both offensive and defensive operations. Demand has been sustained by a balance of range, accuracy, and firepower, making rifles suitable for varied combat environments from urban engagements to open-field confrontations.

The segment benefits from ongoing upgrades in materials engineering, resulting in lighter yet more durable designs that reduce operator fatigue and improve maneuverability. Rifles are increasingly integrated with modular accessories such as grenade launchers, suppressors, and advanced optics, expanding their tactical utility.

Procurement trends are favoring multi-role configurations capable of accommodating different calibers and ammunition types, ensuring adaptability to diverse mission profiles. Continuous innovation in ballistic performance and precision targeting is anticipated to support the segment’s sustained relevance in both domestic defense and export markets.

The land platform segment, representing 53.6% of the platform category, leads the market due to its central role in ground-based combat operations and its extensive integration with a range of weapon systems. This dominance is supported by large-scale defense procurement programs aimed at strengthening infantry, armored vehicle units, and mechanized divisions.

The segment benefits from established logistics networks and training programs that enable rapid deployment and operational readiness. Technological advancements in land-based platforms, including stabilized weapon mounts, digital fire-control systems, and automated loading mechanisms, have enhanced combat efficiency and survivability.

Demand growth is reinforced by ongoing territorial defense initiatives and urban warfare preparedness strategies, which prioritize adaptable and high-mobility weapon platforms. Over the forecast period, the land segment is expected to retain its leadership, driven by modernization cycles, sustained investment in armored vehicle fleets, and integration with advanced surveillance and targeting technologies.

Opportunities exist in advanced procurement programs and upgrading existing arsenals. Trends are leaning toward modular, lightweight, and smart weapon systems with digital integration. However, stringent global regulations, ethical debates, and high costs pose significant challenges. Despite these, the market is expected to witness steady adoption, supported by defense budgets and evolving military strategies.

The demand for automatic weapons is rising as nations seek to modernize their defense systems and strengthen their armed forces. Increasing cross-border tensions, military modernization programs, and counterterrorism initiatives are key factors driving adoption. Automatic rifles, machine guns, and self-loading firearms are increasingly used in both national defense and law enforcement. Emerging economies are also expanding defense budgets, fueling acquisitions of advanced weapons. This growing demand underlines the role of automatic weapons as essential assets in maintaining national security and battlefield efficiency.

Significant opportunities lie in upgrading existing defense and homeland security infrastructures with next-generation automatic weapons. Governments are allocating higher budgets for the procurement of technologically advanced firearms equipped with modular designs, lightweight materials, and digital targeting systems. Homeland security agencies are also seeking compact and efficient weapons for counterinsurgency and anti-crime operations. Rising geopolitical instability in regions such as the Middle East and Asia-Pacific further enhances procurement opportunities, creating a favorable environment for both established defense contractors and emerging weapon manufacturers.

One of the defining trends in the market is the move toward smart automatic weapons with integrated sensors, advanced optics, and digital targeting solutions. Manufacturers are focusing on modularity, allowing forces to customize weapons for specific missions. Lightweight materials such as polymer composites are being adopted to improve maneuverability without compromising firepower. Another trend is the growing adoption of unmanned ground and aerial platforms equipped with automatic weapons, reflecting the integration of modern warfare technologies with traditional firepower for superior tactical performance.

The market faces challenges stemming from strict regulatory frameworks and ethical debates surrounding the use of automatic weapons. International arms trade restrictions, export control laws, and licensing requirements create barriers for manufacturers and suppliers. Public and political scrutiny regarding civilian safety and misuse of such weapons adds further complications. Moreover, the high costs of advanced automatic weapons limit their affordability for smaller nations with constrained defense budgets. Addressing these challenges requires compliance with global regulations and innovations in cost-effective weapon design.

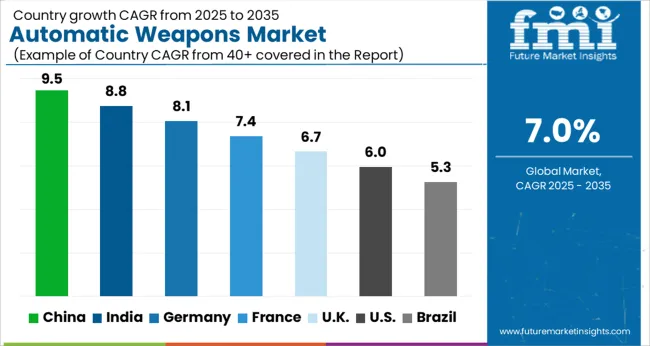

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

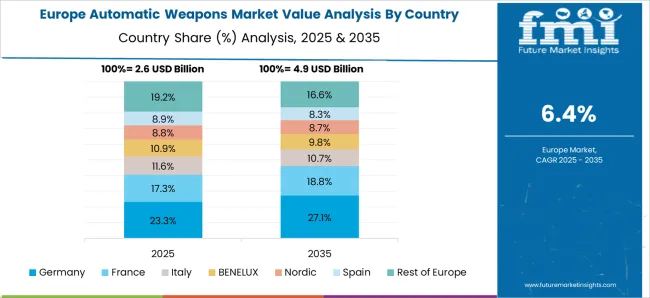

The global automatic weapons market is projected to grow at a CAGR of 7% from 2025 to 2035. China leads with a 9.5% growth rate, followed by India at 8.8% and Germany at 8.1%. The UK is expected to record 6.7%, while the USA stands at 6%. Rising geopolitical tensions, modernization of armed forces, and investment in advanced defense technologies are fueling adoption worldwide.

China and India are expanding their domestic manufacturing and procurement programs, while Germany and the UK are reinforcing NATO-led modernization. The US, with its established defense sector, is focusing on high-precision and automated solutions. Demand for modularity, integration with digital systems, and unmanned platforms is shaping the future growth of the automatic weapons market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automatic weapons market in China is forecast to grow at 9.5% CAGR, the fastest among global players. China’s focus on strengthening its military capabilities is driving demand for automatic rifles, machine guns, and integrated weapons systems. Domestic defense manufacturers are innovating cost-efficient yet technologically advanced weapon platforms that support large-scale deployment across its armed forces. The country is also expanding exports to strengthen ties with developing nations. Government-backed initiatives, combined with modernization programs, make China a key hub for automatic weapons manufacturing and deployment. Its strong industrial base and large defense budget continue to sustain momentum, ensuring China’s role as a dominant market leader in automatic weapon adoption.

The automatic weapons market in India is expected to expand at 8.8% CAGR, driven by government-led defense modernization under initiatives such as “Make in India.” The country is prioritizing the upgrade of its armed forces with advanced automatic rifles, light machine guns, and vehicle-mounted systems. Partnerships with global defense firms and technology transfer agreements are enhancing India’s production capabilities. Domestic players are focusing on cost-effective solutions to serve both national requirements and international customers. Rising border tensions and the need for rapid deployment have also accelerated procurement plans. India’s automatic weapons market reflects a blend of indigenous development and foreign collaboration, positioning it as one of the fastest-growing segments worldwide.

The automatic weapons market in Germany is forecast to grow at 8.1% CAGR, supported by its strong role in NATO’s defense strategies. German defense manufacturers are globally recognized for precision engineering and reliability in small arms and automatic systems. The country is actively supplying weapons to NATO allies while also modernizing its own armed forces. Increased budget allocations toward defense modernization are driving procurement of advanced automatic rifles, machine guns, and vehicle-mounted platforms. Germany’s focus on integrating digital targeting and modular weapon designs is reshaping the automatic weapons sector. Export opportunities in Europe, Asia, and the Middle East further solidify Germany’s role as a major contributor to the global automatic weapons market.

The automatic weapons market in the United Kingdom is projected to register a CAGR of 6.7%, driven by defense modernization efforts and NATO commitments. The UK is investing in upgraded rifles, heavy machine guns, and advanced vehicle-mounted systems for its armed forces. Domestic firms, along with collaborations with international manufacturers, are improving the supply chain for automatic weapon systems. A key focus lies in enhancing interoperability with NATO forces and adopting modular systems that integrate seamlessly with digital targeting technologies. The UK market is also supported by exports to allied countries, ensuring consistent demand. While growth is moderate compared to Asia, strong partnerships and defense priorities continue to sustain its market outlook.

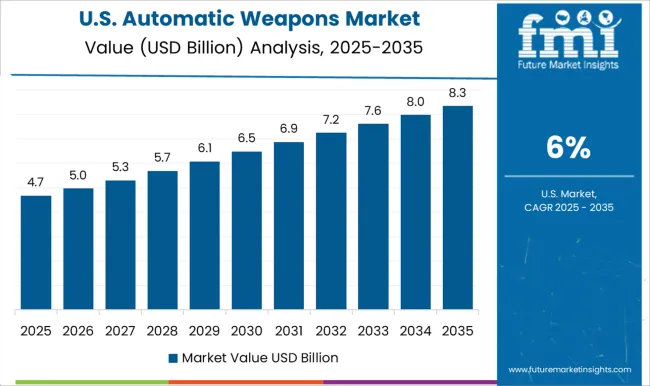

The automatic weapons market in the United States is expected to grow at 6% CAGR, reflecting steady demand from both defense and homeland security agencies. The USA has a mature defense industry with globally recognized manufacturers producing advanced rifles, machine guns, and heavy weapon systems. The market focus is shifting toward precision-based, modular, and automated solutions integrated with AI and digital targeting platforms. Modernization programs by the Department of Defense are encouraging procurement of next-generation systems, while exports remain strong to allied nations. Although its growth rate is lower compared to Asian countries, the USA continues to dominate in terms of technological leadership and large-scale production capacity.

The automatic weapons market is being strongly defined by the strategies of leading defense and arms manufacturers that focus on precision, reliability, and combat readiness. FN Herstal is a key contributor with its portfolio of machine guns and assault rifles widely adopted by military and law enforcement agencies globally. Its emphasis on lightweight designs and high firing efficiency has strengthened its role in modern defense programs. BAE Systems PLC maintains a strong footprint through the production of advanced automatic weapon systems integrated with armored vehicles, naval platforms, and aerial defense units. The company’s focus on system integration and modular adaptability highlights its competitive positioning.

General Dynamics Corporation is also prominent in this market with its Gatling-style cannons and large-caliber automatic weapons that support aircraft, land vehicles, and naval vessels. Their widespread use reflects the company’s expertise in delivering dependable firepower under complex combat scenarios. Alongside them, Israel Weapon Industries Ltd. (IWI) continues to shape the market with its renowned range of assault rifles, submachine guns, and light machine guns, widely adopted across global defense forces for their compactness and battlefield performance. Lockheed Martin Corporation and Northrop Grumman Corporation provide advanced automatic weapon systems integrated into aerial, land, and sea defense solutions, further reinforcing the USA dominance in this market. Rheinmetall AG, headquartered in Germany, offers advanced turret systems and automatic cannons, contributing strongly to Europe’s role in next-generation warfare.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.6 Billion |

| Type | Fully automatic and Semi-automatic |

| Product | Rifles, Machine guns, Launcher, Cannon, Gatling gun, and Others |

| Platform | Land, Naval, and Air |

| Application | Armored fighting vehicles, Battle tanks, Combat support aircraft, Destroyers, Fighter aircraft, Helicopters, Light protected vehicles, Offshore Patrol Vessels (OPVs), and Others |

| End User | Military, Law enforcement, Civilian, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FN Herstal, BAE Systems PLC, General Dynamics Corporation, Israel Weapon Industries Ltd., Lockheed Martin Corporation, Northrop Grumman Corporation, and Rheinmetall AG |

| Additional Attributes | Dollar sales by weapon type (rifles, machine guns, pistols) and end-use (military, law enforcement, civilian) are key metrics. Trends include rising demand for advanced defense equipment, modernization of military arsenals, and increasing cross-border security concerns. Regional adoption, regulatory frameworks, and technological advancements are driving market growth. |

The global automatic weapons market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the automatic weapons market is projected to reach USD 20.8 billion by 2035.

The automatic weapons market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in automatic weapons market are fully automatic and semi-automatic.

In terms of product, rifles segment to command 27.8% share in the automatic weapons market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA