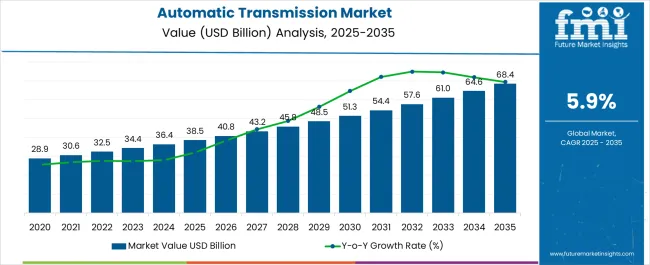

The Automatic Transmission Market is estimated to be valued at USD 38.5 billion in 2025 and is projected to reach USD 68.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Automatic Transmission Market Estimated Value in (2025 E) | USD 38.5 billion |

| Automatic Transmission Market Forecast Value in (2035 F) | USD 68.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The automatic transmission market is experiencing robust growth, driven by rising consumer demand for enhanced driving comfort, convenience, and fuel efficiency. Increasing urbanization and higher vehicle usage are encouraging adoption of vehicles with automatic transmissions due to their smooth gear-shifting capabilities and reduced driver fatigue. Advances in transmission technology, including the development of continuously variable transmissions, dual-clutch systems, and electronically controlled gearboxes, are further boosting adoption across passenger and commercial vehicle segments.

Regulatory emphasis on fuel efficiency and emissions reduction has accelerated innovation in lightweight transmission components and intelligent systems, making them more cost-efficient and environmentally compliant. Additionally, growing penetration of advanced driver assistance systems and electrification in the automotive industry has created strong demand for transmission systems compatible with hybrid and electric vehicles.

Rising disposable incomes in emerging economies, combined with consumer preference for premium and technologically advanced vehicles, is reinforcing market expansion As automotive manufacturers increasingly focus on efficiency, performance, and safety, the automatic transmission market is expected to remain on a steady growth trajectory, supported by innovation and broader accessibility.

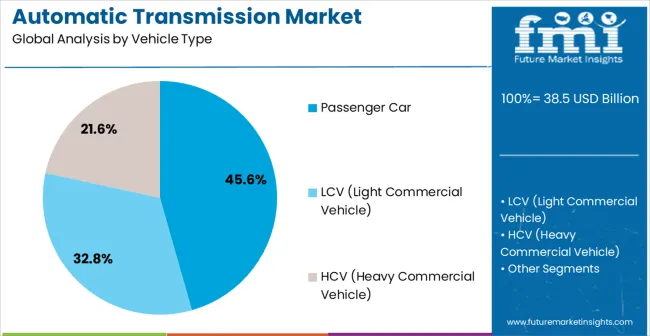

The automatic transmission market is segmented by vehicle type, fuel type, and geographic regions. By vehicle type, automatic transmission market is divided into Passenger Car, LCV (Light Commercial Vehicle), and HCV (Heavy Commercial Vehicle). In terms of fuel type, automatic transmission market is classified into Diesel, Gasoline, Hybrid, and Others (Electric Vehicle, PHEV, etc.). Regionally, the automatic transmission industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger car segment is projected to hold 45.6% of the automatic transmission market revenue in 2025, making it the leading vehicle type. This dominance is being fueled by rising global demand for passenger vehicles equipped with advanced comfort and convenience features. Automatic transmissions in passenger cars provide smoother acceleration, improved fuel efficiency, and reduced driver fatigue, which appeal to consumers in urban and high-traffic regions.

Increasing disposable income levels and consumer preference for premium and mid-range vehicles equipped with modern features have accelerated adoption in both developed and emerging markets. Advancements in compact and lightweight transmission systems are making automatic options more accessible even in small car categories, broadening the consumer base. Additionally, integration of automatic transmissions with hybrid and electric powertrains is reinforcing demand as governments and manufacturers emphasize sustainable mobility solutions.

Enhanced driving experiences, coupled with regulatory pressures for cleaner and more efficient vehicles, are further supporting the segment’s market share Passenger cars are expected to maintain leadership due to strong consumer appeal, expanding model availability, and continued technological innovation.

The diesel fuel type segment is anticipated to account for 40.2% of the automatic transmission market revenue in 2025, positioning it as the leading fuel category. Growth is being driven by strong demand for diesel-powered vehicles in commercial and passenger segments, where high torque output and fuel economy are critical advantages. Automatic transmissions enhance diesel vehicle performance by optimizing power delivery and reducing gear-shifting delays, making them highly suitable for long-haul transportation and urban usage.

In regions where diesel vehicles remain dominant due to favorable fuel pricing and established infrastructure, automatic transmissions are gaining traction as consumers and fleet operators seek greater efficiency and lower maintenance. Integration of electronic control systems with diesel engines is improving overall performance while ensuring compliance with emissions regulations.

Additionally, the popularity of sport utility vehicles and light commercial vehicles powered by diesel engines has further supported adoption Despite global electrification trends, the diesel segment continues to hold strong relevance in several markets, with automatic transmissions offering enhanced operational efficiency, performance, and driving comfort.

Transmission system provides required torque delivery from the engine to the driven vehicle. Transmission system uses set of pulleys or gears to ensure the required speed and alternating torque from engine to the wheel of the vehicle. Automatic transmission has several advantages such as transferring power from engine to wheel, easy to handle, etc.

Automatic transmission shifts the gear ratios automatically and hence make the task easy for the driver. Process of automatic transmission involves the transmission of engine torque so that upshift and downshift are managed automatically without any assistance of driver. Automatic transmission system are gaining demand in the developing economies as it is easy to handle and maintain as compared to manual automatic system.

Automatic transmission make it easy to drive in heavy traffic by adjusting the gear automatically. Consumers’ main preference is to focus on the fuel efficient system without compromising with the efficiency of the vehicle. Automatic transmission is preferred over the manual one because of its prominent features of higher fuel efficiency, better comfort and increased power.

Automatic transmission enhances driving experience due to improved acceleration and auto gear shifting. Rising fuel prices has shifted the focus of the consumer towards more efficient fuel systems. Technological advancement has led to the launch of 9-speed automatic transmission, continuous variable transmission and dual shaft gearboxes.

Convenience and comfort offered by automatic transmission system is one of the most prominent driver to accelerate the growth of automatic transmission global market. The main reasons for opting for this technology are fuel efficiency, augmented power requirements, growing demand for vehicle performance and growing comfort levels. However, higher preliminary cost and low implementation rates in high volume markets have restrained the development of new technologies.

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| Brazil | 6.2% |

| USA | 5.6% |

| UK | 5.0% |

| Japan | 4.4% |

The Automatic Transmission Market is expected to register a CAGR of 5.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.0%, followed by India at 7.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Automatic Transmission Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.8%. The USA Automatic Transmission Market is estimated to be valued at USD 14.1 billion in 2025 and is anticipated to reach a valuation of USD 14.1 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.1 billion and USD 1.1 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.5 Billion |

| Vehicle Type | Passenger Car, LCV (Light Commercial Vehicle), and HCV (Heavy Commercial Vehicle) |

| Fuel Type | Diesel, Gasoline, Hybrid, and Others (Electric Vehicle, PHEV, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

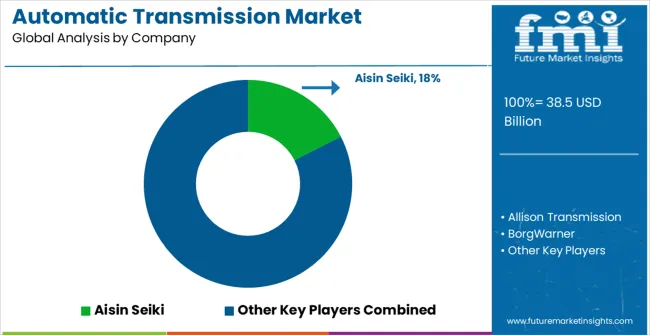

| Key Companies Profiled | Aisin Seiki, Allison Transmission, BorgWarner, Eaton, Hyundai Transys, Jatco, Magna International, Schaeffler, Voith, and ZF Friedrichshafen |

The global automatic transmission market is estimated to be valued at USD 38.5 billion in 2025.

The market size for the automatic transmission market is projected to reach USD 68.4 billion by 2035.

The automatic transmission market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in automatic transmission market are passenger car, lcv (light commercial vehicle) and hcv (heavy commercial vehicle).

In terms of fuel type, diesel segment to command 40.2% share in the automatic transmission market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA