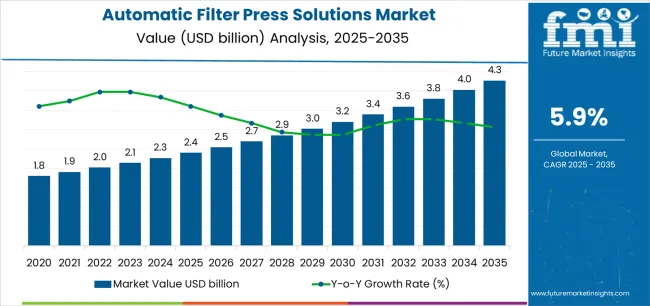

The global automatic filter press solutions market is projected to grow from USD 2.4 billion in 2025 to approximately USD 4.2 billion by 2035, recording an absolute increase of USD 1.8 billion over the forecast period. This translates into a total growth of 77.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.9% between 2025 and 2035. The overall market size is expected to grow by approximately 1.8X during the same period, supported by escalating global demand for efficient solid-liquid separation solutions across wastewater treatment, mining, chemical processing, and food production sectors, stringent environmental regulations mandating advanced dewatering technologies reducing disposal volumes and associated costs, and increasing adoption of automated filtration systems minimizing manual intervention while improving operational consistency and worker safety.

The expansion is further reinforced by rapid industrialization in emerging economies driving wastewater generation and treatment requirements, growing emphasis on resource recovery and circular economy principles necessitating effective solid separation for material reclamation, and substantial investments in mining operations requiring sophisticated tailings management and process water clarification systems. Industrial facility operators, municipal utilities, and mining companies are increasingly recognizing automatic filter press solutions as critical infrastructure components enabling efficient dewatering of sludges, slurries, and industrial process streams while reducing labor costs, improving cake dryness, and minimizing environmental footprint through reduced disposal volumes and enhanced filtrate quality.

The market benefits from continuous technological advances including fully automated operation sequences, real-time pressure monitoring and control systems, and integrated cake discharge mechanisms that eliminate manual intervention requirements while optimizing cycle times and filtration performance. Rising operational cost pressures, increasing labor costs in developed economies, and growing safety consciousness are compelling operators to transition from manual or semi-automatic filter presses to fully automated systems that deliver consistent performance, reduce workplace hazards, and enable remote monitoring and control capabilities supporting modern industrial operational paradigms and digital transformation initiatives across diverse processing industries.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.4 billion |

| Market Forecast Value (2035) | USD 4.2 billion |

| Forecast CAGR (2025-2035) | 5.9% |

| INDUSTRIAL & REGULATORY DRIVERS | OPERATIONAL EFFICIENCY DEMANDS | TECHNOLOGY & SUSTAINABILITY TRENDS |

|---|---|---|

| Environmental Compliance Pressure Increasingly stringent regulations governing wastewater discharge, solid waste disposal, and environmental protection mandating advanced dewatering technologies reducing disposal volumes and improving effluent quality across industrial and municipal sectors. Industrial Production Expansion Continuous growth in mining operations, chemical manufacturing, food processing, and other industrial activities generating substantial volumes of sludges and slurries requiring efficient solid-liquid separation for process optimization and waste management. Infrastructure Investment Growth Substantial global investments in wastewater treatment infrastructure, industrial facility construction, and mining project development creating sustained demand for filtration equipment across diverse geographic regions and application sectors. |

Labor Cost Reduction Escalating labor costs particularly in developed economies driving adoption of fully automated filter press systems eliminating manual operation requirements and reducing workforce needs while improving operational consistency and safety. Operational Consistency Requirements Growing emphasis on process reliability and product quality consistency necessitating automated filtration systems delivering repeatable performance without operator variability affecting cycle times and cake characteristics. Throughput Optimization Continuous pressure to maximize processing capacity and minimize downtime driving adoption of automated systems with optimized cycle sequences, predictive maintenance capabilities, and remote monitoring supporting operational efficiency objectives. |

Advanced Automation Integration Development of fully automated filter press systems with programmable control sequences, real-time pressure monitoring, and integrated cake discharge mechanisms eliminating manual intervention and enabling lights-out operation capabilities. Resource Recovery Focus Growing emphasis on circular economy principles and material recovery driving adoption of efficient dewatering systems maximizing solid capture for reuse or sale while producing high-quality filtrate for process water recycling. Digital Connectivity Integration of filter press systems with industrial IoT platforms, SCADA networks, and cloud-based monitoring enabling predictive maintenance, performance optimization, and remote troubleshooting supporting modern operational paradigms. Membrane Technology Advancement Continuous improvement in membrane squeeze technology enabling higher cake dryness and reduced cycle times creating compelling performance advantages over traditional chamber filter presses in applications valuing maximum dewatering. |

| Category | Segments Covered |

|---|---|

| By Offering (Solution Type) | Membrane Filter Press Machines, Filter Press Plates and Filter Cloths, Service |

| By Application | Wastewater Treatment, Chemical Industry, Mining and Metallurgical Industry, Food and Beverage, Other Applications |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

.webp)

| Segment | 2025 to 2035 Outlook |

|---|---|

| Membrane Filter Press Machines | Leader in 2025 with 52.7% market share, maintaining dominance through 2035. Membrane filter presses incorporating flexible membrane technology enabling squeeze phase after conventional filtration, achieving significantly higher cake dryness compared to chamber-only designs. Automated membrane systems offering superior performance in applications where maximum dewatering is critical including mining tailings, industrial sludges, and process residues where disposal costs correlate directly with moisture content. Momentum: strong growth driven by expanding mining operations requiring efficient tailings management, industrial waste minimization initiatives valuing disposal cost reduction, and replacement of aging chamber filter presses with advanced membrane systems delivering superior performance. Membrane technology enabling 10-15% higher cake dryness translating to substantial disposal cost savings and supporting rapid payback periods justifying premium equipment investments. Growing availability of automated membrane systems with fully integrated control and discharge systems eliminating historical operational complexity concerns. Watchouts: higher capital investment compared to chamber filter presses potentially limiting adoption in price-sensitive applications, membrane replacement costs affecting total cost of ownership calculations, operational complexity requiring trained personnel for maintenance activities, competitive pressure from alternative dewatering technologies in specific application niches. |

| Filter Press Plates and Filter Cloths | Significant presence with 31.6% share in 2025, showing steady demand through 2035. Consumable components including filter plates, membrane elements, and filter cloths representing essential ongoing purchases for installed filter press base. Replacement parts market characterized by both original equipment manufacturer supplies and aftermarket alternatives creating competitive dynamics balancing quality and cost considerations. Momentum: stable growth driven by expanding installed equipment base requiring regular filter cloth replacement and periodic plate renewal, growing recognition of filter cloth quality impact on performance driving premium product adoption, and increasing availability of specialized cloth materials optimized for specific applications. Aftermarket suppliers offering competitive alternatives to OEM parts creating price competition while potentially reducing replacement costs for operators. Technological advances in cloth materials improving abrasion resistance and cake release characteristics extending service life. Watchouts: aftermarket competition creating margin pressure for equipment manufacturers, varying quality standards among cloth suppliers potentially affecting performance consistency, operator cost sensitivity driving purchasing decisions toward lowest-price alternatives, potential technology shifts toward alternative filtration media reducing traditional cloth demand. |

| Service | Growing segment holding 15.7% share in 2025 with expanding trajectory through 2035. Encompasses installation services, preventive maintenance programs, emergency repair support, performance optimization consulting, and comprehensive service contracts. Service offerings becoming increasingly important differentiator as equipment complexity increases and operators seek to maximize uptime and performance while minimizing internal maintenance resource requirements. Momentum: solid growth driven by expanding installed equipment base requiring ongoing maintenance support, increasing equipment sophistication creating demand for specialized technical expertise, and growing operator preference for service contracts transferring maintenance responsibility and risk to equipment suppliers. Preventive maintenance programs supporting equipment longevity and minimizing unplanned downtime creating value propositions justifying recurring service revenues. Remote monitoring capabilities enabling predictive maintenance and proactive service interventions. Watchouts: competitive pressure from independent service providers offering lower-cost maintenance alternatives, customer internal maintenance capabilities potentially limiting service penetration, economic downturns affecting discretionary service spending, geographic dispersion of installations creating service delivery challenges and cost burdens. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Wastewater Treatment | Dominant segment with 38.4% market share in 2025, expected to maintain leadership through 2035. Encompasses municipal wastewater treatment plants, industrial effluent treatment facilities, and decentralized treatment systems using automatic filter presses for biosolids dewatering, primary sludge thickening, and industrial waste conditioning. Largest volume contributor driven by global wastewater treatment capacity expansion, regulatory requirements for biosolids handling, and disposal cost pressures driving maximum dewatering objectives. Momentum: steady growth supported by urbanization driving municipal treatment capacity expansion, increasingly stringent biosolids quality and disposal regulations, and growing industrial water treatment requirements for environmental compliance. Membrane filter press adoption accelerating in biosolids applications where transportation and disposal costs justify premium equipment investments through moisture reduction benefits. Emerging nutrient recovery initiatives and biosolids-to-energy projects creating additional dewatering requirements supporting equipment demand. Watchouts: municipal budget constraints affecting capital equipment procurement particularly in smaller facilities, long procurement cycles and competitive bidding environments creating pricing pressure, alternative dewatering technologies including belt presses and centrifuges competing in specific application niches, operational cost sensitivity affecting upgrade and replacement timing decisions. |

| Mining and Metallurgical Industry | Fast-growing segment holding 24.7% share in 2025 with accelerating adoption trajectory through 2035. Covers tailings dewatering, concentrate filtration, process water clarification, and mineral recovery applications across base metals, precious metals, coal, and industrial minerals operations. Mining applications demanding robust filtration systems handling abrasive slurries and operating in challenging environmental conditions while delivering maximum dewatering performance minimizing tailings storage requirements. Momentum: strong growth driven by expanding global mining production particularly in emerging markets, increasing regulatory pressure on tailings management driving dry stacking adoption, and water scarcity concerns compelling operations to maximize process water recovery. Membrane filter press technology particularly suited to mining applications where achieving maximum cake dryness reduces tailings storage facility requirements and associated environmental risks. Growing adoption in lithium, rare earth, and battery materials processing supporting clean energy transition. Watchouts: mining commodity price volatility affecting capital investment timing, remote location installation challenges increasing equipment and service costs, harsh operating conditions accelerating wear and maintenance requirements, competitive intensity among equipment suppliers in cost-sensitive commodity operations. |

| Chemical Industry | Significant segment with 18.3% share in 2025 showing steady expansion through 2035. Includes chemical manufacturing facilities, pharmaceutical production operations, and specialty chemical plants using automatic filter presses for catalyst recovery, pigment washing, active pharmaceutical ingredient isolation, and waste treatment applications. Chemical industry applications often requiring specialized materials of construction and certifications addressing corrosive environments and hazardous area classifications. Momentum: moderate growth driven by expanding chemical production capacity particularly in Asia, pharmaceutical manufacturing growth supporting active ingredient recovery requirements, and environmental compliance driving waste minimization through efficient solid-liquid separation. Specialty chemical and fine chemical applications valuing precise control and product quality consistency supporting adoption of automated systems with advanced monitoring capabilities. Growing emphasis on solvent recovery and material reuse supporting equipment investments. Watchouts: chemical industry consolidation affecting capital investment patterns, regulatory compliance costs and validation requirements increasing project complexity particularly in pharmaceutical applications, alternative separation technologies competing in specific chemical processing applications, cyclical production patterns affecting equipment utilization and investment justification. |

| Food and Beverage | Growing segment holding 11.2% share in 2025 with variable growth trajectory through 2035. Encompasses food processing facilities, beverage production operations, and agricultural processing using automatic filter presses for spent yeast recovery, juice clarification, starch dewatering, and waste treatment applications. Food industry applications requiring sanitary design standards, washdown capabilities, and materials meeting food contact regulations. Momentum: selective growth in specific food processing applications including brewing and winemaking where spent grain and lees dewatering creates disposal cost savings, starch and protein processing where product recovery justifies equipment investments, and waste treatment where regulatory compliance drives adoption. Growing emphasis on food waste valorization and byproduct recovery supporting filtration equipment demand. Automation benefits particularly valuable in food processing addressing labor availability challenges. Watchouts: intense cost competition in commodity food processing limiting capital equipment budgets, seasonal production patterns affecting equipment utilization economics, sanitary design requirements increasing equipment costs compared to industrial applications, alternative separation technologies including decanter centrifuges competing in specific food processing applications. |

| Other Applications | Diverse segment with 7.4% share in 2025 encompassing pulp and paper, oil and gas, ceramics, and various specialty applications. Category includes niche applications where automatic filter presses address specific solid-liquid separation requirements across diverse industrial sectors with varying technical specifications and performance objectives. Momentum: selective growth in specialized applications including kaolin and clay processing where product quality requirements drive filtration technology selection, oil and gas drilling mud and produced water treatment supporting environmental compliance, and pulp and paper mill applications where process optimization justifies equipment investments. Emerging applications in renewable energy sectors including biodiesel production and algae processing. Watchouts: fragmented market characteristics with diverse requirements limiting focused product development, small volume applications potentially receiving limited commercial attention from major equipment suppliers, application-specific technologies potentially offering superior performance in niche markets, economic sensitivity in commodity industries affecting capital investment priorities. |

| Region | Status & Outlook 2025-2035 |

|---|---|

| Asia Pacific | Dominant region commanding approximately 43.8% market share in 2025, driven by massive industrial expansion across China, India, Southeast Asia, and other developing economies with rapid urbanization and manufacturing growth generating substantial solid-liquid separation requirements. Region experiencing fastest infrastructure development with governments prioritizing environmental protection and industrial capacity expansion creating sustained equipment demand across diverse applications. Momentum: robust growth trajectory supported by continued industrialization with expanding chemical production, mining operations, and manufacturing activities, wastewater treatment infrastructure development addressing environmental compliance requirements, and growing domestic equipment manufacturing capabilities supporting competitive pricing. China leading regional growth with comprehensive industrial production and environmental protection initiatives driving equipment adoption. India and Southeast Asian nations implementing mining projects and industrial expansion creating substantial opportunities. Watchouts: intense price competition from local equipment manufacturers creating margin pressure for international suppliers, varying quality standards and regulatory enforcement across countries, project financing challenges in some markets affecting procurement timelines, preference for lower-cost solutions potentially limiting adoption of premium automated systems in price-sensitive applications. |

| Europe | Established market holding approximately 28.4% share in 2025, characterized by mature industrial base, stringent environmental regulations, and emphasis on operational efficiency and automation. Region featuring sophisticated manufacturing industries, advanced mining operations, and comprehensive wastewater treatment infrastructure requiring high-performance filtration solutions meeting demanding specifications. Momentum: steady growth driven by equipment replacement cycles in aging industrial facilities, environmental compliance requirements driving upgrades to advanced dewatering systems, and growing emphasis on resource recovery and circular economy principles. Eastern European industrial development and Western European facility modernization creating balanced demand patterns. Automation adoption accelerating as labor costs increase and operators seek operational efficiency improvements. Watchouts: mature industrial base limiting greenfield project opportunities, economic uncertainties affecting capital investment budgets particularly in energy-intensive industries, stringent technical specifications and certification requirements potentially limiting supplier participation, competitive landscape dominated by established European manufacturers with strong local presence. |

| North America | Critical market with approximately 19.6% share in 2025, featuring advanced industrial operations, sophisticated mining sector, and comprehensive environmental regulations driving adoption of high-performance dewatering technologies. United States representing majority of regional market with substantial industrial base and growing emphasis on automation and operational efficiency. Momentum: moderate growth supported by mining sector expansion particularly in precious metals and industrial minerals, industrial wastewater treatment requirements driven by regulatory compliance, and equipment replacement cycles in aging facilities. Infrastructure investment initiatives and industrial reshoring trends potentially supporting domestic manufacturing growth and associated filtration equipment demand. Growing automation adoption driven by labor availability challenges and operational cost optimization objectives. Watchouts: mature industrial infrastructure limiting overall growth potential, competitive intensity among equipment suppliers creating pricing pressure, long equipment replacement cycles in established facilities, potential economic sensitivities in commodity industries affecting capital investment timing and project execution. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Environmental Regulation Expansion Increasingly stringent environmental regulations governing wastewater discharge, solid waste disposal, and tailings management mandating advanced dewatering technologies reducing environmental impact and supporting compliance objectives across industrial and municipal sectors. Labor Cost Pressures Rising labor costs particularly in developed economies and growing workforce availability challenges driving adoption of fully automated filter press systems eliminating manual operation requirements and reducing ongoing labor expenses. Mining Sector Growth Expanding global mining production addressing metal demand for electrification and industrial applications creating substantial requirements for tailings dewatering, concentrate filtration, and process water management equipment across diverse mineral operations. |

High Capital Investment Substantial equipment costs particularly for advanced membrane filter press systems creating financial barriers for smaller operations and potentially limiting adoption in applications with marginal economic justification for premium solutions. Alternative Technology Competition Competitive pressure from alternative dewatering technologies including belt filter presses, centrifuges, and screw presses offering different performance characteristics and cost structures potentially limiting filter press adoption in specific applications. Economic Cyclicality Sensitivity to economic cycles particularly in mining and industrial sectors where commodity price volatility affects capital investment budgets and project execution timing creating demand uncertainty and potential market fluctuations. |

Full Automation Integration Growing adoption of fully automated filter press systems with programmable sequences, automated cake discharge, and remote monitoring eliminating manual intervention requirements and enabling optimized operation supporting modern industrial practices. Membrane Technology Advancement Continuous improvement in membrane squeeze technology achieving higher cake dryness percentages, faster cycle times, and improved reliability creating compelling performance advantages justifying premium equipment investments across applications. Digital Connectivity Integration of filter presses with industrial IoT platforms, cloud-based monitoring, and predictive maintenance systems enabling remote performance optimization, proactive service interventions, and data-driven operational improvements. Sustainability Focus Growing emphasis on resource recovery, circular economy principles, and waste minimization driving adoption of efficient dewatering systems maximizing solid recovery for reuse while producing high-quality filtrate supporting water recycling objectives. |

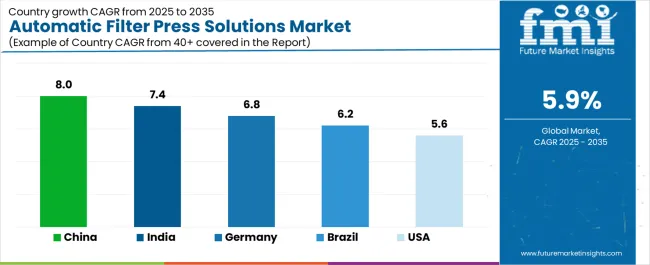

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| Brazil | 6.2% |

| USA | 5.6% |

Revenue from automatic filter press solutions in China is projected to exhibit exceptional growth with an 8% CAGR, driven by unprecedented industrial production scale with comprehensive manufacturing base spanning chemicals, mining, food processing, and diverse industrial sectors generating massive solid-liquid separation requirements. The country's environmental protection priorities with government implementing stringent regulations on wastewater discharge and solid waste disposal compelling industrial facilities to invest in advanced dewatering technologies. Major Chinese equipment manufacturers and international companies establishing local operations developing comprehensive filter press product portfolios serving domestic and export markets.

Revenue from automatic filter press solutions in India is expanding at a 7.4% CAGR, supported by rapidly growing industrial sector with expanding chemical manufacturing, mining operations, and food processing creating substantial filtration equipment requirements. The country's infrastructure development programs and environmental regulation implementation driving wastewater treatment capacity expansion and industrial compliance investments. Major international equipment suppliers and domestic manufacturers establishing operations serving growing market opportunities.

Demand for automatic filter press solutions in Germany is projected to grow at 6.8% CAGR, supported by the country's leadership in industrial equipment manufacturing with sophisticated engineering capabilities and comprehensive industrial base including chemical production, mining operations, and advanced manufacturing requiring high-performance filtration solutions. German market characterized by emphasis on quality, automation sophistication, and long-term operational performance over initial cost considerations. Advanced environmental standards and operational excellence culture supporting premium equipment adoption.

Revenue from automatic filter press solutions in Brazil is growing at 6.2% CAGR, driven by the country's position as major mining producer with substantial iron ore, gold, and industrial minerals operations requiring sophisticated tailings management and process water treatment systems. Brazilian industrial sector including chemical manufacturing and food processing creating additional filtration equipment demand. Market characterized by growing environmental compliance requirements and operational efficiency emphasis.

Demand for automatic filter press solutions in the USA is projected grow at 5.6% CAGR, driven by advanced industrial operations across mining, chemical manufacturing, and municipal wastewater treatment with emphasis on automation, operational efficiency, and environmental compliance. American market characterized by sophisticated equipment specifications, comprehensive regulatory requirements, and growing focus on labor cost reduction through automation adoption.

Demand for automatic filter press solutions in the UK is projected to reach USD 637.4 million by 2035, supported by sophisticated industrial base including chemical manufacturing, mining operations, and comprehensive wastewater treatment infrastructure requiring high-performance filtration solutions. British market characterized by emphasis on operational reliability, automation capabilities, and environmental compliance meeting stringent regulatory standards.

Demand for automatic filter press solutions in Japan is projected to reach USD 557.6 million by 2035, driven by sophisticated industrial operations across chemical manufacturing, electronics production, and food processing with stringent quality standards and emphasis on operational reliability. Japanese market characterized by mature industrial base requiring equipment replacement, advanced automation adoption, and comprehensive environmental compliance supporting premium equipment demand.

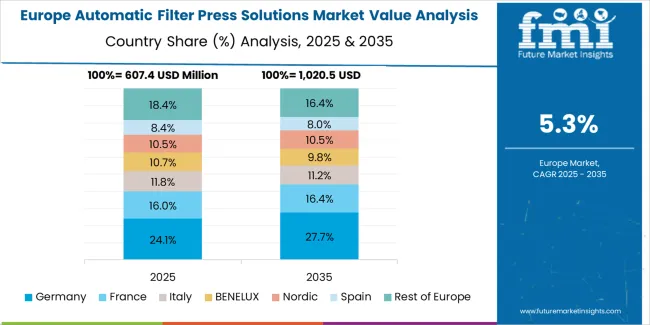

The automatic filter press solutions market in Europe is projected to grow from USD 669.2 million in 2025 to USD 1.2 billion by 2035, registering a CAGR of 5.9% over the forecast period. Germany is expected to maintain its leadership position with a 27.6% market share in 2025, reaching 28.2% by 2035, supported by its dominant industrial manufacturing base, leadership in equipment engineering and production, and comprehensive chemical and mining sectors requiring sophisticated filtration solutions.

France follows with a 17.3% share in 2025, projected to reach 17.8% by 2035, driven by diversified industrial base including chemical manufacturing, mining operations, and food processing sectors alongside comprehensive wastewater treatment infrastructure requiring advanced dewatering equipment. The United Kingdom holds a 15.9% share in 2025, expected to reach 16.3% by 2035, supported by sophisticated chemical industry, water utility operations, and growing emphasis on automation and operational efficiency. Italy commands a 13.4% share, while Spain accounts for 11.6% in 2025, both benefiting from industrial operations, mining activities, and wastewater treatment requirements driving filtration equipment demand. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 14.2% to 14.7% by 2035, attributed to industrial development in Eastern European countries including Poland, Czech Republic, and Romania where manufacturing expansion, mining operations, and environmental compliance requirements are driving filtration equipment adoption across diverse application sectors.

.webp)

Japanese automatic filter press solution operations reflect the country's exacting quality standards and sophisticated industrial manufacturing culture. Major industrial companies and municipal utilities maintain rigorous equipment procurement processes emphasizing long-term reliability, comprehensive documentation, and proven performance track records that can require extensive reference validation, factory acceptance testing, and pilot demonstrations extending procurement timelines to 24-36 months. This creates substantial barriers for new equipment suppliers but ensures consistent quality supporting Japan's reputation for industrial excellence and operational reliability across manufacturing sectors.

The Japanese market demonstrates unique technical requirements, with significant emphasis on earthquake-resistant design incorporating comprehensive seismic engineering, compact equipment configurations accommodating space constraints in densely developed industrial areas, and detailed maintenance documentation supporting preventive maintenance programs. Facilities require specific equipment specifications including low-noise operation reflecting urban installation contexts, advanced safety interlocks exceeding international standards, and integration capabilities with existing DCS and SCADA systems that differ from Western applications, driving demand for customized engineering and extensive local technical support throughout equipment lifecycle.

Regulatory oversight through Ministry of Economy, Trade and Industry for industrial applications and Ministry of the Environment for waste treatment facilities emphasizes comprehensive safety standards, environmental protection requirements, and energy efficiency considerations. Equipment procurement processes require extensive technical documentation, quality certifications including JIS and other Japanese standards compliance, and demonstrated track records in Japanese operating environments creating advantages for established suppliers with local manufacturing presence, comprehensive service networks, and proven installation bases supporting reference requirements.

Supply chain management in Japanese industrial sector focuses on long-term partnership relationships rather than purely transactional procurement approaches. Major industrial companies and utilities typically maintain multi-decade supplier relationships, with annual performance reviews emphasizing equipment reliability, responsive technical support, rapid spare parts availability, and continuous improvement through collaborative problem-solving and technology development initiatives. This stability supports investment in localized manufacturing or assembly operations, dedicated service capabilities with trained personnel, and customized equipment variants optimized for Japanese requirements including control system interfaces and operational practices, while creating challenges for new market entrants seeking to establish customer relationships in this quality-focused market demanding demonstrated long-term commitment and comprehensive local support infrastructure including service technicians and spare parts inventory.

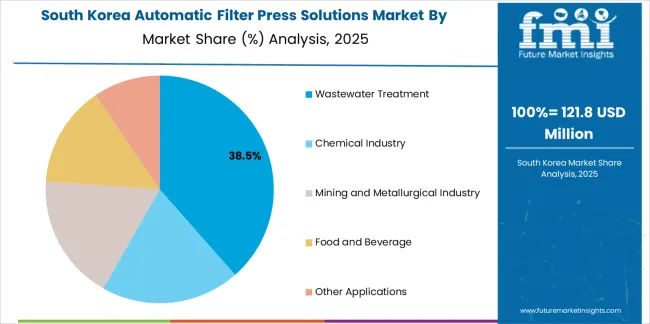

South Korean automatic filter press solution operations reflect the country's advanced industrial base and emphasis on technological sophistication and operational efficiency. Major industrial companies including chemical manufacturers, steel producers, and electronics companies alongside municipal utilities drive equipment procurement strategies emphasizing automation sophistication, monitoring integration, and operational optimization supporting productivity objectives. Korean industrial sector benefiting from government support for environmental compliance and technology modernization supporting equipment investments.

The Korean market demonstrates particular strength in rapid technology adoption and digital integration capabilities, with industrial facilities implementing smart manufacturing systems and advanced process control architectures. This creates opportunities for equipment suppliers offering automatic filter presses with comprehensive automation packages, real-time monitoring capabilities, data connectivity supporting optimization initiatives, and remote access features enabling centralized management across multiple facility locations. Korean operators increasingly focused on operational efficiency, energy consumption reduction, and labor cost optimization reflecting competitive pressures in global markets.

Regulatory frameworks through Ministry of Environment and industry-specific regulations maintain comprehensive environmental standards and treatment requirements following international best practices while incorporating specific Korean conditions. Equipment procurement processes emphasize technical performance verification through pilot testing, energy efficiency certifications supporting operational cost projections, and comprehensive warranty provisions protecting capital investments. Korean regulatory environment particularly favors suppliers demonstrating proven technology with extensive installation references, technical support capabilities including local service presence with Korean-speaking personnel, and commitment to long-term market presence supporting ongoing parts availability and service support throughout extended equipment lifecycles.

Supply chain efficiency remains important given Korea's concentrated industrial production and export-oriented manufacturing requiring reliable waste treatment and process optimization supporting production continuity. Industrial facilities and utilities increasingly pursuing equipment standardization across sites and strategic supplier relationships supporting operational efficiency, spare parts consolidation, and maintenance optimization through platform approaches. Domestic equipment manufacturing capabilities developing with Korean companies establishing filter press production serving local markets with competitive pricing while international suppliers maintain presence serving premium market segments and specialized applications requiring advanced capabilities, proven international technology platforms, and comprehensive technical support throughout equipment lifecycle from specification development through commissioning and ongoing operational support.

The automatic filter press solutions market exhibits moderately consolidated characteristics with established global equipment manufacturers maintaining significant positions alongside regional specialists and emerging Asian producers offering competitive alternatives. Market dynamics favor suppliers with proven technology track records, comprehensive product portfolios spanning multiple capacity ranges and configurations, established service networks supporting global operations, and application expertise across diverse industries enabling effective solution specification and optimization. Several distinct competitive archetypes define market structure: global industrial equipment conglomerates offering filter presses as part of comprehensive separation and process equipment portfolios with extensive resources and worldwide presence; specialized filtration equipment manufacturers focusing exclusively on filter press technologies with deep technical expertise and application knowledge; regional manufacturers serving local markets with cost-competitive solutions and responsive service; and emerging Asian producers leveraging manufacturing cost advantages to compete globally particularly in price-sensitive market segments.

Competitive differentiation increasingly centers on automation sophistication including fully automated operation sequences with minimal manual intervention, membrane technology performance achieving maximum cake dryness, equipment reliability and longevity minimizing downtime and maintenance costs, and comprehensive service capabilities ensuring responsive support throughout equipment lifecycle. Application-specific expertise including process optimization, chemical conditioning, and operational troubleshooting represents critical differentiator as customers seek partners capable of supporting complete solution implementation beyond equipment supply. Project execution capabilities including engineering, installation supervision, commissioning, and operator training increasingly influence purchasing decisions particularly for complex installations and greenfield projects requiring comprehensive support.

Strategic imperatives include developing advanced automation technologies with integrated monitoring and control supporting Industry 4.0 initiatives, expanding service networks ensuring responsive technical support and parts availability across key markets, and building comprehensive application expertise supporting diverse customer requirements across industrial sectors. Geographic expansion focuses on high-growth emerging markets particularly Asia and Latin America where industrial expansion and infrastructure development create substantial opportunities, while established markets emphasize equipment replacement, technology upgrades, and service revenue growth from installed base. Technology development priorities include membrane performance enhancement achieving higher cake dryness and faster cycles, energy efficiency improvements reducing operational costs, and digital integration supporting remote monitoring, predictive maintenance, and performance optimization throughout equipment lifecycle.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.4 billion |

| Offering (Solution Type) | Membrane Filter Press Machines, Filter Press Plates and Filter Cloths, Service |

| Application | Wastewater Treatment, Chemical Industry, Mining and Metallurgical Industry, Food and Beverage, Other Applications |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, and other 35+ countries |

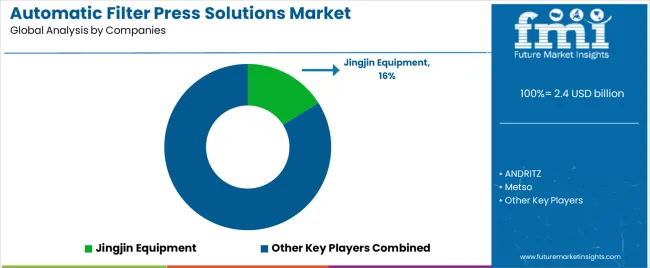

| Key Companies Profiled | Jingjin Equipment, ANDRITZ, Metso, ISHIGAKI, Zhongda Bright Filter Press, Hengshui Haijiang, ALFA LAVAL, Shanghai Dazhang, Aqseptence Group, Evoqua Water Technologies (Xylem), Xingyuan Environment, JL-Filterpresso, FLSmidth, Tianli Machinery, Kurita Machinery Mfg. Co. Ltd., Matec, Kanadevia (Hitachi Zosen), Zhejiang Longyuan, Micronics, NMP, TEFSA, Shanghai CEO Environmental, Jiangsu Sudong, Latham International |

| Additional Attributes | Dollar sales by offering and application, regional demand (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), competitive landscape, automation capabilities, membrane technology achievements, and advanced engineering supporting operational efficiency, dewatering optimization, and environmental compliance |

The global automatic filter press solutions market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the automatic filter press solutions market is projected to reach USD 4.3 billion by 2035.

The automatic filter press solutions market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in automatic filter press solutions market are membrane filter press machines, filter press plates and filter cloths and service.

In terms of application, wastewater treatment segment to command 38.4% share in the automatic filter press solutions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA