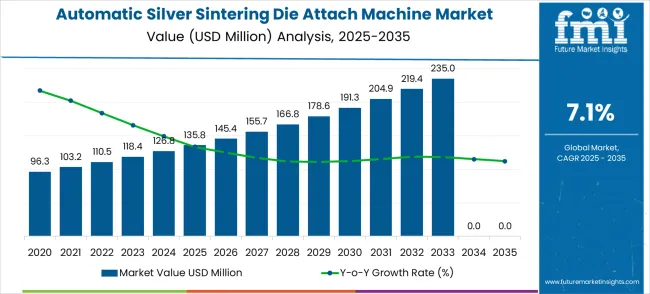

The automatic silver sintering die attach machine market is estimated at USD 135.8 million in 2025 and is forecasted to reach USD 269.6 million by 2035, advancing at a CAGR of 7.1%. The annual growth pattern between 2025 and 2026 indicates a 7.1% increase as the market moves to USD 145.4 million. From 2026 to 2027, growth is expected to maintain its strength at 7.1%, reaching USD 155.7 million, indicating early-phase expansion without major volatility.

This consistency demonstrates that the sector is positioned on a stable upward trajectory as demand strengthens in semiconductor packaging, driven by power electronics and high-performance computing requirements. The global automatic silver sintering die attach machine market is projected to grow from USD 135.8 million in 2025 to approximately USD 269.6 million by 2035, recording an absolute increase of USD 133.8 million over the forecast period. This translates into a total growth of 98.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035. The overall market size is expected to grow by nearly 2.0X during the same period, supported by increasing demand for advanced die attach technologies, growing automation requirements in semiconductor manufacturing industries, and rising adoption of silver sintering solutions across the global power electronics, RF devices, and LED manufacturing sectors.

Examining the full decade, year-over-year growth rates remain remarkably stable, hovering close to the CAGR. For example, the rise from USD 166.8 million in 2028 to USD 178.6 million in 2029 marks a 7.1% increase, while the move from USD 204.9 million in 2031 to USD 219.4 million in 2032 reflects a similar growth pace. This lack of abrupt peaks or troughs signals low volatility, with no single year presenting extreme acceleration or deceleration. Such stability indicates a predictable expansion pattern supported by continuous technological integration, miniaturization trends, and growing demand in industries like automotive powertrain electronics and renewable energy modules. Between 2025 and 2030, the automatic silver sintering die attach machine market is projected to expand from USD 135.8 million to USD 195.2 million, resulting in a value increase of USD 59.4 million, which represents 44.4% of the total forecast growth for the decade.

This phase of development will be shaped by increasing manufacturing automation adoption, rising demand for advanced die attach solutions, and growing utilization in power semiconductor fabrication and LED manufacturing applications. Machine technology manufacturers and automation specialists are expanding their silver sintering capabilities to address the growing preference for ultra-reliable bonding systems in semiconductor assembly processes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 135.8 million |

| Forecast Value in (2035F) | USD 269.6 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

Volatility checks show that growth rates in this market remain aligned within a narrow band of 7.0% to 7.2% annually. Unlike markets affected by external shocks or supply chain disruptions, the silver sintering die attach machine segment demonstrates resilience due to its critical role in improving device reliability and thermal conductivity. No unusually high or low growth years are observed, suggesting steady adoption across industries rather than reliance on cyclical booms. This controlled expansion is further linked to growing adoption of advanced packaging technologies in electric vehicles, aerospace applications, and high-frequency devices, where silver sintering continues to outperform conventional soldering.

The YoY growth over the decade aligns with the 7.1% CAGR, showing the market is expanding at a predictable and sustained pace. The cumulative effect of this annual growth pattern doubles the market size within ten years, from USD 135.8 million in 2025 to USD 269.6 million by 2035. This steady expansion underscores a balanced demand scenario where adoption increases gradually rather than through sudden surges. For manufacturers and stakeholders, the predictable YoY growth translates to lower risk and greater planning reliability, marking this market as structurally robust with long-term opportunities in advanced semiconductor assembly.From 2030 to 2035, the market is forecast to grow from USD 195.2 million to USD 269.6 million, adding another USD 74.4 million, which constitutes 55.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of Industry 4.0 manufacturing technologies, the integration of AI-enhanced bonding systems for premium silver sintering products, and the development of specialized machine formulations for emerging applications. The growing emphasis on quality assurance and reliable semiconductor packaging will drive demand for advanced silver sintering machines with enhanced bonding capabilities and improved process reliability.

Between 2020 and 2024, the automatic silver sintering die attach machine market experienced robust growth, driven by increasing semiconductor packaging quality requirements and growing recognition of silver sintering technology's superior bonding reliability capabilities across power electronics and high-performance LED applications. The market developed as manufacturers recognized the potential for advanced silver sintering machines to enhance production quality while meeting stringent thermal and electrical performance requirements. Technological advancement in bonding methods and process control began emphasizing the critical importance of maintaining bond integrity while extending machine throughput and improving operational efficiency.

Market expansion is being supported by the increasing global demand for advanced die attach technologies and the corresponding shift toward silver sintering solutions that can provide superior bonding reliability while meeting industry requirements for high-temperature operation and thermal cycling resistance. Modern power semiconductor and LED manufacturers are increasingly focused on incorporating automatic silver sintering die attach machines to enhance production quality while satisfying demands for ultra-reliable bonding and thermal management capabilities.

Silver sintering machines' proven ability to deliver superior bonding strength, excellent thermal conductivity, and long-term reliability makes them essential equipment for advanced semiconductor packaging processes and high-performance device applications.

The growing emphasis on automated semiconductor packaging and Industry 4.0 manufacturing is driving demand for high-quality silver sintering machine products that can support distinctive bonding capabilities and premium equipment positioning across power semiconductor devices, RF power devices, and high-performance LED categories. Equipment manufacturer preference for machines that combine bonding excellence with advanced automation compatibility is creating opportunities for innovative silver sintering implementations in both traditional and emerging packaging applications. The rising influence of smart manufacturing technologies and digital process control is also contributing to the increased adoption of premium silver sintering machine products, which can provide authentic high-performance bonding characteristics.

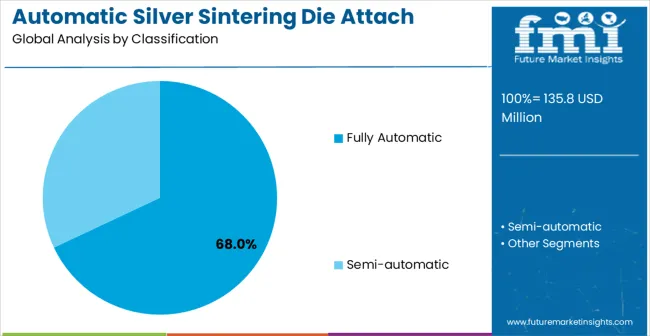

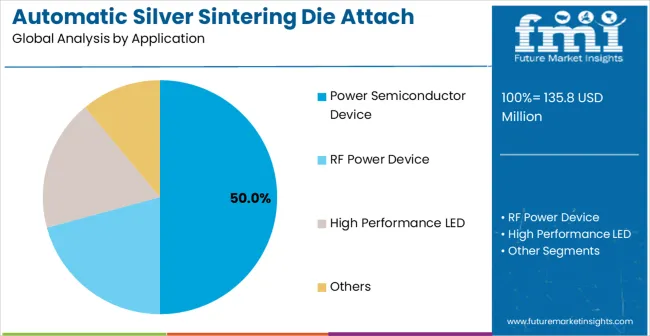

The market is segmented by machine type, application, and region. By machine type, the market is divided into fully automatic and semi-automatic. Based on application, the market is categorized into power semiconductor device, RF power device, high performance LED, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

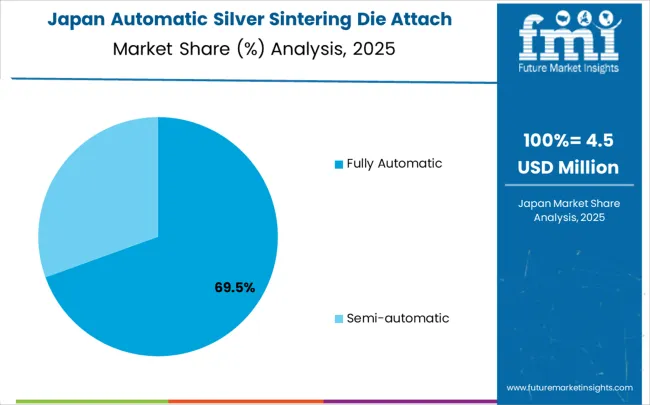

The fully automatic machine segment is projected to hold a dominant 68.0% of the Automatic Silver Sintering Die Attach Machine market in 2025. These machines are critical for high-volume semiconductor manufacturing due to their ability to deliver consistent quality while minimizing human error. Their design incorporates advanced motion control, robotics, and thermal management systems for optimal sintering results. Companies such as Kulicke & Soffa, Hesse Mechatronics, and BESI lead innovation, introducing systems that improve throughput, lower defect rates, and optimize process efficiency. Automated systems integrate with Industry 4.0 frameworks to allow real-time monitoring and adaptive process adjustments, improving yield and reducing downtime. Rising demand for higher reliability in power devices, LEDs, and RF components further boosts adoption. These factors position fully automatic machines as the leading choice for manufacturers seeking scalable, efficient solutions, ensuring continued dominance in this market segment by 2025.

The power semiconductor device application segment is expected to account for about 50.0% of the market in 2025. This growth is fueled by the increasing need for high-performance power electronics in automotive, renewable energy, and industrial automation sectors. Silver sintering technology delivers superior thermal conductivity and mechanical stability, making it ideal for high-power devices such as MOSFETs, IGBTs, and diodes. Companies like Mitsubishi Electric, Infineon Technologies, and Fuji Electric are integrating advanced sintering machines into production lines to ensure higher efficiency and reliability. This integration supports scalability while meeting stringent quality standards. Rising electric vehicle adoption and renewable energy deployment drive demand for power semiconductors, further strengthening this segment. Automated silver sintering machines offer reduced cycle times and improved yield rates, aligning with manufacturing trends toward automation and high precision. As power semiconductor devices increasingly form the backbone of modern electronics, the application segment will continue to dominate, making it a key driver of growth in the Automatic Silver Sintering Die Attach Machine market through 2025.By Machine Type, the Fully Automatic Segment Accounts for the Largest Market Share

The fully automatic segment is projected to account for the largest share of the automatic silver sintering die attach machine market in 2025, reaffirming its position as the leading machine type category. Semiconductor packaging manufacturers and assembly specialists increasingly utilize fully automatic silver sintering machines for their superior process consistency, high throughput capabilities, and ease of integration in automated production lines across diverse packaging applications. Fully automatic machine technology's standardized process configuration and optimized bonding capability directly address the industrial requirements for consistent die attach quality and efficient production in power semiconductor and LED manufacturing operations.

This machine type segment forms the foundation of modern semiconductor packaging applications, as it represents the technology with the greatest automation potential and established compatibility across multiple manufacturing systems. Manufacturer investments in fully automatic machine optimization and process enhancement continue to strengthen adoption among semiconductor equipment producers. With manufacturers prioritizing production efficiency and consistent bonding quality, fully automatic silver sintering machines align with both automation objectives and reliability requirements, making them the central component of comprehensive semiconductor packaging strategies.

Power semiconductor device applications are projected to represent the largest share of automatic silver sintering die attach machine demand in 2025, underscoring their critical role as the primary application for advanced bonding solutions in power electronics packaging and device assembly operations. Equipment manufacturers prefer silver sintering machines for their exceptional bonding reliability, high-temperature operation capabilities, and ability to maintain consistent performance while supporting precise thermal management requirements during power semiconductor manufacturing processes. Positioned as essential equipment for high-performance power electronics packaging operations, silver sintering machines offer both technological advancement and operational reliability advantages.

The segment is supported by continuous growth in power semiconductor manufacturing activities and the growing availability of specialized machine configurations that enable enhanced bonding precision and process optimization at the packaging level. Additionally, power semiconductor manufacturers are investing in advanced die attach technologies to support next-generation device production and thermal performance consistency. As power electronics manufacturing continues to advance and manufacturers seek superior bonding automation solutions, power semiconductor device applications will continue to dominate the application landscape while supporting technology advancement and packaging reliability strategies.

The automatic silver sintering die attach machine market is advancing steadily due to increasing semiconductor packaging automation investments and growing demand for advanced bonding solutions that emphasize superior thermal performance across power electronics and LED manufacturing applications. However T, the market faces challenges, including high machine costs compared to traditional die attach alternatives, technical complexity in process optimization, and competition from alternative bonding technologies. Innovation in bonding process accuracy and application-specific machine development continues to influence market development and expansion patterns.

The growing adoption of silver sintering machines in smart manufacturing and Industry 4.0 applications is enabling equipment manufacturers to develop systems that provide distinctive bonding capabilities while commanding premium positioning and enhanced reliability characteristics. Advanced applications provide superior thermal performance while allowing more sophisticated process control development across various packaging categories and technology segments. Manufacturers are increasingly recognizing the competitive advantages of high-performance bonding positioning for premium equipment development and advanced packaging market penetration.

Modern silver sintering machine suppliers are incorporating artificial intelligence algorithms, machine learning optimization, and predictive process analytics to enhance bonding quality, improve process reliability, and meet semiconductor industry demands for intelligent and adaptive packaging solutions. These programs improve machine performance while enabling new applications, including predictive quality monitoring and automated process optimization systems. Advanced AI integration also allows suppliers to support premium market positioning and technology leadership beyond traditional commodity die attach machines.

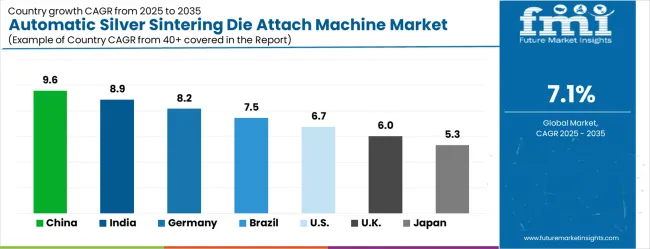

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

| USA | 6.7% |

| UK | 6.0% |

| Japan | 5.3% |

The automatic silver sintering die attach machine market is experiencing robust growth globally, with China leading at a 9.6% CAGR through 2035, driven by the rapidly expanding semiconductor packaging sector, massive investments in power electronics manufacturing facilities, and increasing adoption of advanced die attach technologies. India follows at 8.9%, supported by growing electronics manufacturing, rising automation investments, and expanding semiconductor assembly capabilities. Germany shows growth at 8.2%, emphasizing focusing advanced packaging technology and premium bonding equipment manufacturing. Brazil records 7.5%, focusing on emerging industrial automation applications and semiconductor packaging technology development. The USA demonstrates 6.7% growth, prioritizing advanced power semiconductor manufacturing and bonding process innovation. The UK exhibits 6.0% growth, supported by specialized packaging technology development and advanced manufacturing capabilities. Japan shows 5.3% growth, emphasizing focusing precision manufacturing excellence and high-quality machine production.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from automatic silver sintering die attach machines in China is projected to exhibit exceptional growth with a CAGR of 9.6% through 2035, driven by the rapidly expanding semiconductor packaging sector and massive government investments in power electronics manufacturing capabilities across major technology hubs. The country's growing semiconductor assembly capacity and increasing adoption of advanced die attach technologies are creating substantial demand for high-performance bonding solutions in both established and emerging packaging applications. Major machine technology manufacturers and bonding equipment companies are establishing comprehensive research and production capabilities to serve both domestic consumption and export markets.

Revenue from automatic silver sintering die attach machinesThe market in India is expanding at a CAGR of 8.9%, supported by the growing electronics manufacturing industry, increasing automation investments, and expanding semiconductor assembly applications. The country's developing packaging ecosystem and expanding technology infrastructure are driving demand for quality silver sintering machine products across both electronics assembly and semiconductor packaging applications. International machine companies and domestic packaging technology manufacturers are establishing comprehensive distribution and assembly capabilities to address growing market demand for advanced bonding solutions.

Germany is anticipated to record a CAGR of 8.2%Revenue from automatic silver sintering die attach machines in Germany is projected to grow at a CAGR of 8.2% through 2035, driven by the country's advanced packaging technology sector, premium bonding equipment manufacturing capabilities, and leadership in precision automation solutions. Germany's sophisticated manufacturing culture and willingness to invest in high-performance bonding technologies are creating substantial demand for both standard and specialized silver sintering machine varieties. Leading technology companies and packaging equipment manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

Brazil is likely to achieve a CAGR of 7.5%Revenue from automatic silver sintering die attach machines in Brazil is projected to grow at a CAGR of 7.5% from 2025 to 2035through 2035, supported by the country's expanding industrial automation sector, growing manufacturing applications, and increasing adoption of advanced bonding technologies requiring high-performance die attach solutions. Brazilian manufacturers and international companies consistently seek reliable silver sintering machine products that enhance production quality for both domestic applications and regional markets. The country's position as a regional manufacturing hub continues to drive innovation in bonding technology applications and quality standards.

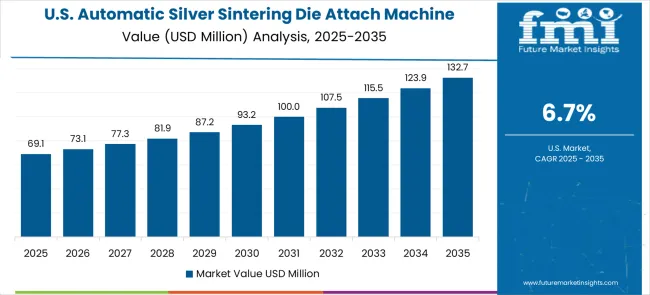

The United States is forecasted to register a CAGR of 6.7% over 2025 to 2035Revenue from automatic silver sintering die attach machines in the United States is projected to grow at a CAGR of 6.7% through 2035, supported by the country's advanced power semiconductor manufacturing sector, bonding technology innovation capabilities, and established leadership in high-performance packaging solutions. American semiconductor companies and equipment manufacturers prioritize reliability, performance, and technical excellence, making silver sintering machines essential equipment for both domestic production and technology-oriented manufacturing. The country's comprehensive research capabilities and technical expertise support continued market development.

The United Kingdom is estimated to grow at a CAGR of 6.0% Revenue from automatic silver sintering die attach machines in the United Kingdom is projected to grow at a CAGR of 6.0% through 2035, supported by the country's specialized packaging technology development sector, advanced manufacturing capabilities, and established expertise in high-performance bonding solutions. British manufacturers' focus on innovation, reliability, and technical excellence creates steady demand for premium silver sintering machine equipment. The country's attention to bonding quality and process optimization drives consistent adoption across both traditional packaging and emerging precision applications.

Japan is predicted to expand at a CAGR of 5.3% between 2025 and 2035Revenue from automatic silver sintering die attach machines in Japan is projected to grow at a CAGR of 5.3% through 2035, supported by the country's precision manufacturing excellence, advanced machine technology expertise, and established reputation for producing superior bonding equipment while working to enhance die attach capabilities and develop next-generation silver sintering technologies. Japan's machine industry continues to benefit from its reputation for delivering high-quality bonding products while focusing on innovation and manufacturing precision.

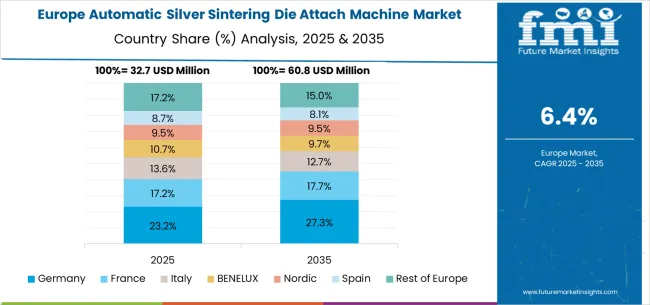

The automatic silver sintering die attach machine market in Europe is projected to grow from USD 34.8 million in 2025 to USD 65.2 million by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to maintain its leadership position with a 38.2% market share in 2025, remaining stable at 38.0% by 2035, supported by its advanced packaging technology sector, precision bonding equipment manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 24.5% share in 2025, projected to reach 24.8% by 2035, driven by specialized packaging technology development programs, advanced manufacturing capabilities, and a growing focus on high-performance bonding solutions for premium applications. France holds a 16.9% share in 2025, expected to maintain 16.7% by 2035, supported by advanced manufacturing demand and bonding technology applications, but facing challenges from market competition and economic considerations. Italy commands an 11.1% share in 2025, projected to reach 11.3% by 2035, while Spain accounts for 5.8% in 2025, expected to reach 6.0% by 2035. The Netherlands maintains a 2.7% share in 2025, growing to 2.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 15.8% in 2025, declining slightly to 15.6% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced manufacturing markets balanced by slower growth in smaller countries implementing bonding technology development programs.

The automatic silver sintering die attach machine market is characterized by competition among established machine technology companies, specialized bonding equipment manufacturers, and integrated packaging solution suppliers. Companies are investing in advanced bonding technologies, process reliability enhancement systems, application-specific machine development, and comprehensive technical support capabilities to deliver consistent, high-performance, and reliable silver sintering products. Innovation in bonding quality optimization, throughput enhancement, and customized application solutions is central to strengthening market position and customer satisfaction.

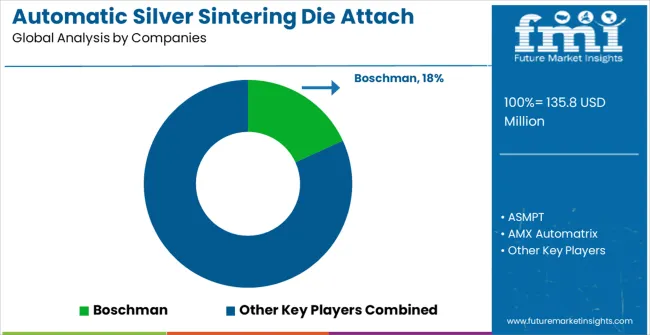

Boschman leads the market with a strong focus on advanced machine technology innovation and comprehensive packaging solutions, offering sophisticated silver sintering machine products with emphasis focus on bonding precision and industrial integration excellence. ASMPT provides specialized assembly and packaging capabilities with a focus on high-volume applications and global manufacturing networks. AMX Automatrix delivers advanced die attach and bonding technology with a focus on innovation and premium machine development. NIKKISO specializes in precision bonding and assembly solutions with emphasis focus on technical expertise and process optimization. PINK GmbH Thermosysteme focuses on thermal processing and bonding technologies. Zhuhai Silicon Cool Technology emphasizes semiconductor packaging expertise with a focus on automation integration and operational reliability.

Automatic silver sintering die attach machines represent advanced bonding technology that enables high-reliability, thermal-efficient die attachment critical for modern power semiconductor and LED manufacturing. With the market projected to grow from USD 135.8 million in 2025 to USD 269.6 million by 2035 at a 7.1% CAGR, these machines address the increasing demands for reliable bonding in power electronics packaging, RF device assembly, and high-performance LED production. The dominance of fully automatic machines and power semiconductor device applications reflects the technology's critical role in enabling advanced packaging processes where traditional die attach methods cannot achieve the required thermal and electrical performance. However, market expansion faces challenges including high machine costs, complex process optimization requirements, and competition from alternative bonding technologies. Maximizing growth potential requires coordinated efforts across machine technology developers and manufacturers, semiconductor packaging industries and assembly specialists, automation system integrators and bonding service providers, research institutions and standards organizations, and technology investment and commercialization partners.

How Machine Technology Developers and Manufacturers Could Drive Innovation Leadership?

Advanced Bonding Technology Development: Invest in next-generation silver sintering technologies, including enhanced heating systems, improved pressure control, and advanced process monitoring that provide superior bonding reliability, extended machine life, and faster cycle times. Develop machine platforms that push the boundaries of bonding performance while maintaining consistency under industrial operating conditions.

Application-Specific Machine Solutions: Create specialized silver sintering machine configurations optimized for specific industries, including power semiconductor packaging, RF device assembly, LED manufacturing, and advanced electronics packaging. Develop machines with application-specific features such as multi-zone heating, cleanroom compatibility, and specialized bonding profiles.

AI-Enhanced Process Capabilities: Integrate artificial intelligence and machine learning algorithms into silver sintering machine systems to enable adaptive process optimization, predictive maintenance, and intelligent quality control. Develop smart machines that can automatically adjust bonding parameters, detect process anomalies, and provide actionable insights for quality optimization.

Cost-Performance Optimization: Focus on manufacturing process improvements and design innovations that reduce machine costs while maintaining bonding quality and reliability. Develop scalable production methods that enable broader market adoption without compromising the performance characteristics that define silver sintering technology.

System Integration and Connectivity: Create silver sintering machines with comprehensive connectivity options, including Industry 4.0 compatibility, cloud integration, and seamless data sharing capabilities. Develop machines that integrate easily with existing packaging lines and provide real-time process data for immediate quality control decisions.

How Semiconductor Packaging Industries Could Optimize Bonding Systems?

Quality Control System Integration: Implement comprehensive quality management systems that leverage silver sintering machine capabilities, including statistical process control, real-time monitoring, and automated decision-making. Develop bonding protocols that maximize the value of high-performance die attach while ensuring consistent product quality and reliability standards.

Process Optimization and Automation: Integrate silver sintering machines into automated packaging lines to enable real-time quality control, bond strength verification, and process adjustment. Develop closed-loop systems that use machine feedback to optimize bonding parameters and maintain consistent packaging quality automatically.

Bonding Data Analytics: Establish comprehensive data analysis capabilities that transform raw process data into actionable packaging insights, including trend analysis, predictive quality modeling, and process improvement recommendations. Use bonding data to optimize packaging processes and prevent quality issues before they occur.

Cross-Industry Knowledge Sharing: Collaborate across different packaging sectors to share best practices for silver sintering machine implementation, bonding techniques, and quality control strategies. Participate in industry forums and technical associations that advance bonding technology adoption and standardization.

Return on Investment Demonstration: Develop comprehensive ROI models that quantify the benefits of automatic silver sintering machines, including reduced rework rates, improved product reliability, enhanced productivity, and competitive differentiation. Document case studies and success stories that demonstrate tangible value from advanced bonding investments.

How Automation System Integrators and Bonding Service Providers Could Enable Market Growth?

Turnkey Bonding Solutions: Provide complete bonding system integration services, including machine selection, system design, software development, installation, and commissioning. Develop standardized integration methodologies that reduce implementation complexity and accelerate deployment of silver sintering solutions.

Process Validation Services: Establish specialized validation laboratories and bonding services that ensure silver sintering process reliability and conformance to industry standards. Provide ongoing process validation, system verification, and bond strength analysis that supports customer quality systems and reliability requirements.

Training and Technical Support: Deliver comprehensive training programs covering silver sintering theory, machine operation, maintenance, and troubleshooting. Develop certification programs for process technicians and provide ongoing technical support that ensures optimal machine performance and bonding reliability.

Application Engineering: Provide specialized application engineering services that help customers optimize silver sintering implementations for specific bonding challenges. Develop custom process solutions, fixture designs, and software configurations that maximize machine performance for unique applications.

Remote Monitoring and Support: Implement advanced remote monitoring capabilities that provide predictive maintenance, performance optimization, and immediate technical support. Develop service platforms that enable proactive machine maintenance and minimize production line downtime.

How Research Institutions and Standards Organizations Could Support Technology Advancement?

Fundamental Research Programs: Conduct advanced research in silver sintering technology, including novel bonding approaches, improved process control, and enhanced machine performance characteristics. Support collaborative research programs between universities and industry that address current technology limitations and enable breakthrough innovations.

Bonding Standards Development: Establish comprehensive bonding standards and test procedures for silver sintering machines, including reliability specifications, process methods, and quality requirements. Develop international standards that ensure bonding consistency and enable global technology adoption.

Technology Transfer and Commercialization: Bridge the gap between research developments and commercial applications by providing technology validation services, prototype testing, and commercialization support. Facilitate partnerships between research institutions and industry to accelerate technology transfer and market adoption.

Educational Programs: Develop specialized education programs in advanced bonding and die attach technology, including university courses, professional training, and technical certification programs. Train the next generation of packaging specialists and support workforce development for semiconductor assembly industries.

International Collaboration: Foster international cooperation in silver sintering research, standards development, and technology advancement. Organize technical conferences, workshops, and collaborative research programs that advance the global state of bonding science and technology.

How Technology Investment and Commercialization Partners Could Unlock Market Value?

Innovation Investment: Fund breakthrough research and development programs in silver sintering technology, including novel bonding approaches, advanced process control, and next-generation machine capabilities. Support startups and established companies developing disruptive bonding technologies that address current market limitations.

Market Development Capital: Finance market development activities, including demonstration projects, application development programs, and technical education initiatives that accelerate silver sintering machine adoption in emerging applications and geographic markets. Support expansion into high-growth markets like China (9.6% CAGR) and India (8.9% CAGR).

Manufacturing Scale-Up Investment: Provide capital for advanced manufacturing facilities, precision bonding equipment, and quality control systems that enable cost-effective production of silver sintering machines at commercial scale. Support the development of manufacturing processes that maintain bonding precision while achieving competitive costs.

Strategic Partnership Facilitation: Support partnerships between machine manufacturers, semiconductor companies, and end-user industries that accelerate technology commercialization and market adoption. Facilitate joint development programs that address specific market needs and create comprehensive bonding solutions.

Global Market Expansion: Fund international business development, including the establishment of regional technical centers, distribution networks, and customer support capabilities. Support market entry strategies that leverage local partnerships and address regional bonding requirements and standards.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 135.8 mMillion |

| Machine Type | Fully Automatic, Semi-automatic |

| Application | Power Semiconductor Device, RF Power Device, High Performance LED, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Boschman, ASMPT, AMX Automatrix, NIKKISO, PINK GmbH Thermosysteme, Zhuhai Silicon Cool Technology, Shenzhen Advanced Joining, Quick Intelligent Equipment, Chenglian Kaida Technology, JH Advanced Semiconductor (Suzhou), and Zhongke Guangzhi (Chongqing) Technology |

| Additional Attributes | Dollar sales by machine type and application, regional demand trends, competitive landscape, technological advancements in bonding technology, die attach process development initiatives, reliability optimization programs, and packaging integration enhancement strategies |

The global automatic silver sintering die attach machine market is estimated to be valued at USD 135.8 million in 2025.

The market size for the automatic silver sintering die attach machine market is projected to reach USD 269.6 million by 2035.

The automatic silver sintering die attach machine market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in automatic silver sintering die attach machine market are fully automatic and semi-automatic.

In terms of application, power semiconductor device segment to command 50.0% share in the automatic silver sintering die attach machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dicing Saw Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Paper Cutter Market Size, Trends, and Forecast 2025 to 2035

Automatic Gearbox Valves Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA