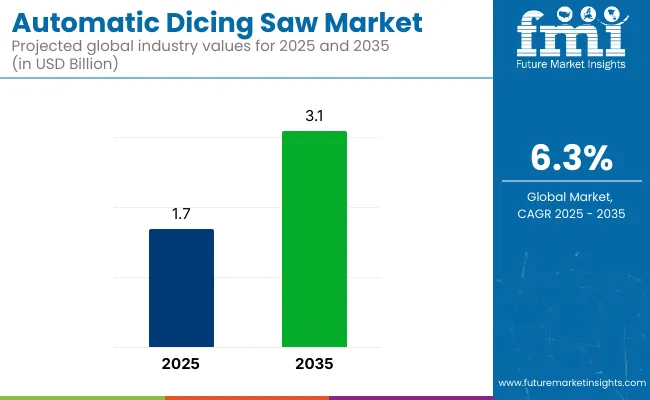

The global automatic dicing saw market is valued at USD 1.7 billion in 2025 and is slated to be worth USD 3.1 billion by 2035, representing a CAGR of 6.3%. This expansion is being supported by the increasing adoption of high-precision wafer dicing solutions, particularly in semiconductor manufacturing for 5G networks, AI chips, and compact electronic devices.

Moreover, significant advancements in automation and predictive maintenance technologies have been accelerating the deployment of full-automatic dicing saws, especially across high-volume fabrication facilities.

Innovations in the global market focus on enhancing precision, speed, and automation. Advanced robotic integration and AI-driven algorithms have improved cutting accuracy and efficiency, reducing material waste. New laser-based dicing technologies offer finer cuts and increased throughput.

Additionally, the development of multi-blade saws has allowed for simultaneous cutting of multiple wafers, significantly boosting productivity. Automation and real-time monitoring systems are also being integrated to enhance operational control, reduce human error, and improve overall process optimization. These innovations are driving growth in the market.

Government regulations ensure safety, precision, and environmental compliance in manufacturing processes. In the USA, OSHA mandates worker safety during dicing saw operations, including protective equipment and ventilation. The EPA regulates the disposal of hazardous materials like cutting fluids.

In Europe, the EU enforces machinery safety standards and waste management protocols, requiring compliance with CE marking for product safety and sustainability. These regulations maintain high safety standards and promote eco-friendly practices in the automatic dicing saw industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.7 billion |

| Forecast Value (2035) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

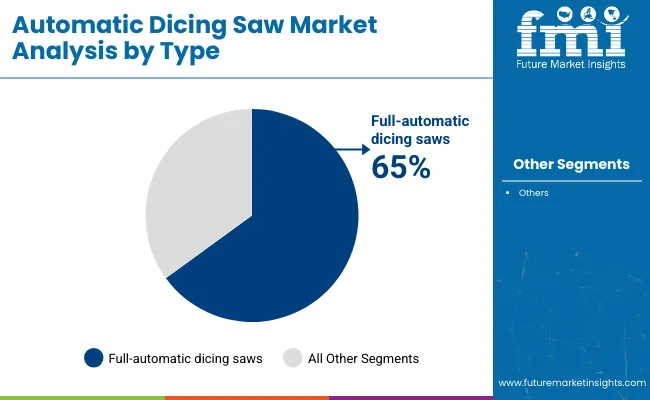

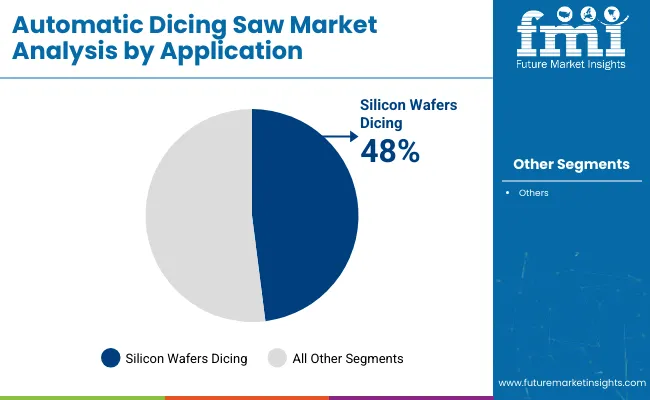

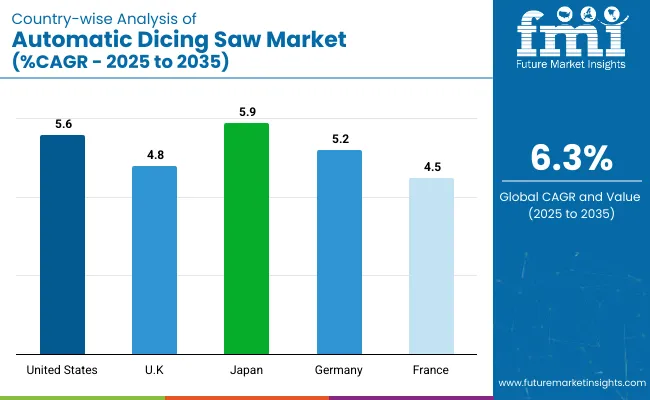

The USA is projected to be the fastest-growing market for automatic dicing saws, with a CAGR of 5.6%. Full-automatic dicing saws will lead the product type segment with a 65% market share in 2025. Silicon wafer dicing will dominate the application segment, capturing 48% of the market. Japan is expected to grow at the highest rate, with a CAGR of 5.9%, followed by Germany at 5.2%. The electronics and semiconductor industry will lead the end-use segment, holding 60% of the market share in 2025.

The automatic dicing saw market is segmented by type, application, dicing blade, end use industry, and region. By type, the market is bifurcated into semi-automatic and full-automatic systems. In terms of application, the market is segmented into silicon wafer dicing, semiconductor dicing, glass sheets dicing, ceramic dicing, and others (sapphire substrates, led wafers, lithium niobate, and photonic devices).

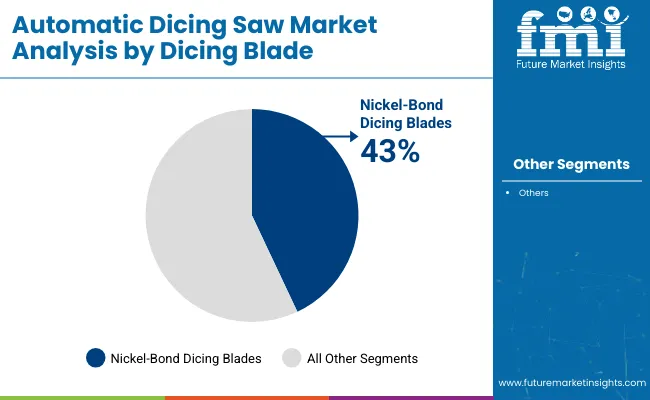

Based on dicing blade, the market is categorized into nickel-bond dicing blades, resin-bond dicing blade, and metal sintered dicing blades. By end use industry, the market is segmented into electronics & semiconductor, military & aerospace, telecommunications, universities, and passive component manufacturing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Full-automatic dicing saws are projected to dominate the type segment, accounting for 65% of the global market share by 2025.

Among the application segmentation, silicon wafers dicing has been identified as the most lucrative segment, accounting for approximately 48% of the global market share by 2025.

Nickel-bond dicing blades are expected to be the most lucrative, holding around 43% of the global market share in 2025.

Electronics and semiconductor sectors are expected to be the most lucrative, capturing around 60% of the global market share by 2025.

The automatic dicing saw market is experiencing steady growth, driven by increasing semiconductor demand, miniaturization of electronic components, and advancements in precision automation technologies.

Recent Trends in the Automatic Dicing Saw Market

Challenges in the Automatic Dicing Saw Market

The USA automatic dicing saw market is projected to expand a CAGR of 5.6% from 2025 to 2035. Growth has been underpinned by high investments in semiconductor foundries, increasing demand for AI and HPC chips, and government-led reshoring initiatives aimed at domestic chip fabrication expansion.

The UK automatic dicing saw market is anticipated to grow at a CAGR of 4.8% between 2025 and 2035. Growth has been led by rising R&D investments in photonics, MEMS devices, and university-led semiconductor fabrication programs.

Germany’s automatic dicing saw market is projected to grow at a CAGR of 5.2% during the forecast period. The market has been driven by strong automotive electronics demand, industrial automation, and increasing wafer dicing for high-performance power electronics.

French automatic dicing saw market to grow at a CAGR of 4.5% from 2025 to 2035. Innovation in aerospace electronics and miniaturized defense components has driven steady adoption of dicing technologies across specialized fabrication facilities.

Japan’s automatic dicing saw market is expected to grow at a CAGR of 5.9% through 2035. Japan has remained a global leader in dicing equipment production, led by DISCO Corporation and Tokyo Seimitsu, and has also exhibited strong domestic adoption of next-generation AI-driven dicing systems.

The competitive landscape of the automatic dicing saw market is moderately consolidated, with key global players such as DISCO Corporation, ASM Pacific Technology (ASMPT), and Tokyo Seimitsu leading through innovation, scale, and extensive distribution networks. Simultaneously, specialized firms and regional players contribute to a fragmented ecosystem that encourages niche innovations and localized service.

Tier-two companies like Micro Automation GmbH, Loadpoint Ltd., Suzhou Delphi Laser, Dynatex International, and ALSI have sustained operations through regional service models, customized integration with university and research institutions, and specialized blade technologies for applications such as power electronics, optical devices, and ultra-miniature dies.

Recent Automatic Dicing Saw Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions / Volume in units |

| By Type Analyzed | Semi-Automatic and Full-Automatic |

| By Application Analyzed | Silicon Wafer Dicing, Semiconductor Dicing, Glass Sheets Dicing, Ceramic Dicing, and Others (Sapphire Substrates, Led Wafers, Lithium Niobate, and Photonic Devices) |

| By Dicing Blade Analyzed | Nickel-Bond Dicing Blades, Resin-Bond Dicing Blades, and Metal Sintered Dicing Blades |

| By End Use Industry Analyzed | Electronics & Semiconductor, Military & Aerospace, Telecommunications, Universities, and Passive Component Manufacturing |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Loadpoint Ltd., Dynatex International, Suzhou Delphi Laser, ALSI, HAN'S Laser Technology Group, Synova SA, Micro Automation GmbH, ASM Pacific Technology Ltd., NPMT, Accretech Laser Systems, and Others |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

In terms of Type, the industry is divided into Semi - Automatic, Full - Automatic

In terms of Application, the industry is divided into Silicon wafers Dicing, Semiconductors Dicing, Glass sheets Dicing, Ceramic Dicing, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The market is projected to reach USD 3.1 billion by 2035.

Full-automatic dicing saws are expected to lead with a projected 65% market share in 2025.

Silicon wafer dicing is expected to hold the largest share, with 48% in 2025.

A CAGR of 6.3% is projected from 2025 to 2035.

Japan is forecast to grow at the highest CAGR of 5.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA