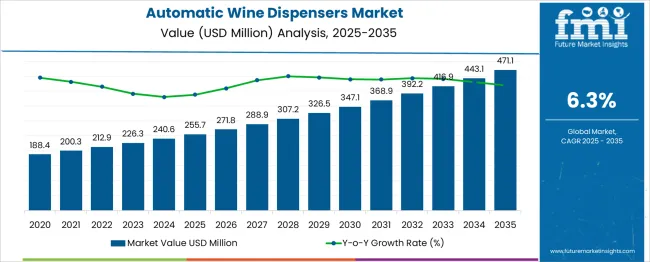

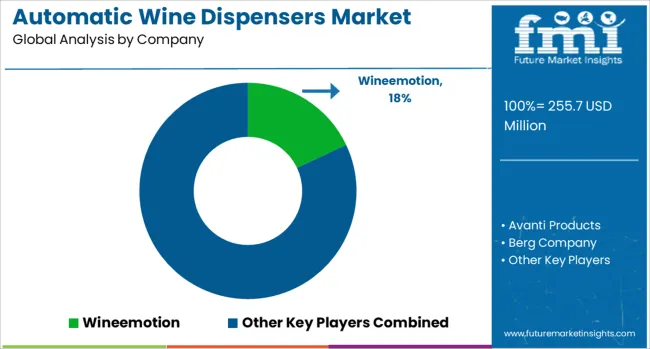

The Automatic Wine Dispensers Market is estimated to be valued at USD 255.7 million in 2025 and is projected to reach USD 471.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. The initial five-year period from 2020 to 2025 witnesses growth from USD 188.4 million to USD 255.7 million, driven by rising demand in the hospitality and retail sectors, where efficient wine dispensing solutions enhance customer experience and reduce wastage. Innovations in dispenser technology, including temperature control and portion management, support adoption. Increasing investments in premium bars, restaurants, and wine retail chains further fuel market expansion. From 2026 to 2030, the market accelerates from USD 271.8 million to USD 347.1 million, supported by expanding use in emerging markets, growing wine consumption trends, and integration of smart dispenser features such as touchless operation and digital interfaces. The latter half of the forecast period, spanning 2031 to 2035, sees the market rise from USD 368.9 million to USD 471.1 million, propelled by continued technological advancements, heightened focus on sustainability through reduced wine spoilage, and broader penetration in hospitality and private use. The automatic wine dispensers market is positioned for consistent growth through 2035, driven by evolving consumer preferences, technology integration, and increasing demand for efficient wine serving solutions.

| Metric | Value |

|---|---|

| Automatic Wine Dispensers Market Estimated Value in (2025 E) | USD 255.7 million |

| Automatic Wine Dispensers Market Forecast Value in (2035 F) | USD 471.1 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The automatic wine dispensers market is expanding steadily due to rising consumer demand for premium wine experiences, wine preservation solutions, and precision-controlled servings. Technological advancements in temperature management, oxygen control, and touchless dispensing have contributed to improved wine quality retention, thereby enhancing their appeal among both hospitality operators and residential users.

Increasing wine consumption across developed and emerging economies, coupled with a growing interest in smart kitchen and bar solutions, has accelerated market penetration. Regulatory emphasis on responsible alcohol service and waste reduction is also influencing adoption across bars, hotels, and tasting rooms. Moreover, rising interest in digital interfaces and automated beverage solutions is aligning with broader smart hospitality trends, further fueling demand for these dispensers.

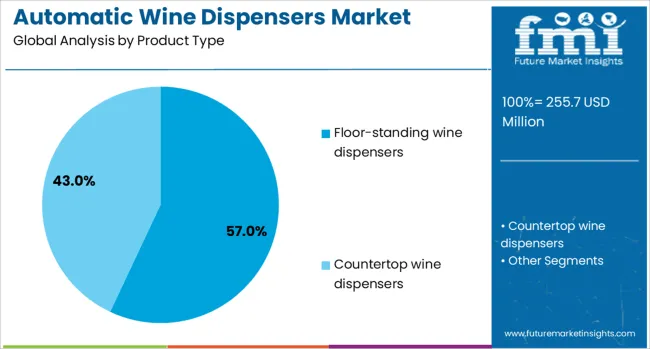

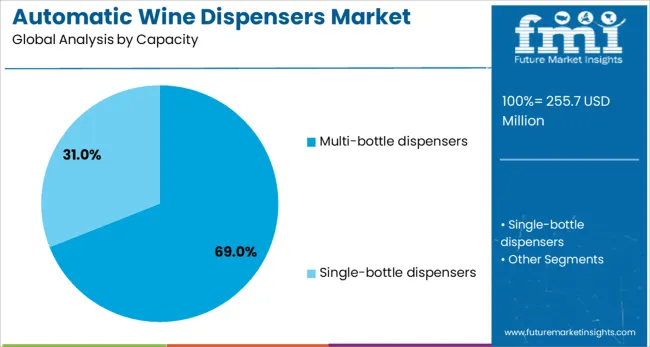

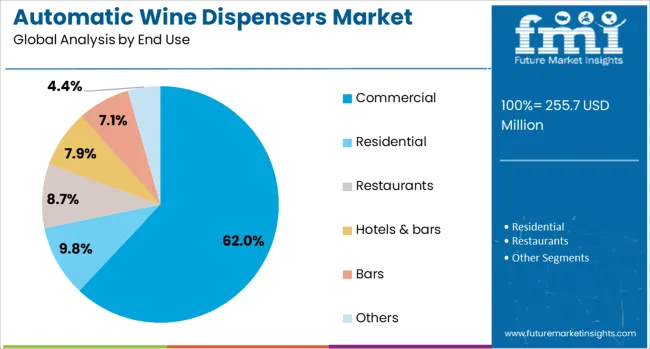

The automatic wine dispensers market is segmented by product type, capacity, end use, pricing, distribution channel, and geographic regions. By product type, the automatic wine dispensers market is divided into Floor-standing wine dispensers and Countertop wine dispensers. In terms of capacity, the automatic wine dispensers market is classified into Multi-bottle dispensers and Single-bottle dispensers. Based on end use, the automatic wine dispensers market is segmented into Commercial, Residential, Restaurants, Hotels & bars, Bars, and others. The price of the automatic wine dispensers market is segmented into High, Low, and Medium. The distribution channel of the automatic wine dispensers market is segmented into offline and online. Regionally, the automatic wine dispensers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Floor-standing wine dispensers are projected to account for 57.0% of the total market revenue by 2025, making them the leading product type. This segment benefits from their higher bottle capacity, advanced cooling and preservation systems, and ergonomic design suited for high-traffic environments.

Floor-standing units are especially popular in restaurants, hotels, and wine tasting venues where display aesthetics, brand visibility, and functionality are essential. Their ability to serve multiple wine types at consistent temperatures while minimizing spillage and oxidation ensures greater product integrity and customer satisfaction.

As establishments prioritize premium service delivery and efficient inventory control, these dispensers offer a compelling combination of technology and user convenience.

Multi-bottle dispensers are expected to dominate the capacity segment with a 69.0% market share in 2025. These systems allow users to offer a wider wine selection simultaneously, enabling personalized tasting experiences and optimized throughput in commercial operations.

Their rising popularity is driven by the hospitality industry’s shift toward curated wine programs, where multiple varietals can be preserved and dispensed without cross-contamination. Multi-bottle models also support smart inventory tracking and programmable pour sizes, enhancing both operational efficiency and cost control.

The combination of scalability and customization makes these units attractive for upscale dining, wine bars, and event venues.

The commercial segment is projected to lead the market with a 62.0% share in 2025, driven by widespread adoption in hotels, restaurants, lounges, and wine cellars. Businesses are investing in automatic wine dispensers to improve service speed, minimize waste, and elevate the wine drinking experience.

With consistent pressure to maintain wine quality over extended periods, commercial operators are turning to dispenser systems that offer vacuum sealing, nitrogen/argon preservation, and controlled dispensing. Additionally, the integration of digital payment options and RFID-enabled tracking has strengthened the appeal of these systems in self-serve and high-volume environments.

As wine tourism and experiential dining continue to grow, commercial end use will remain the primary revenue driver in this market.

Automatic wine dispensers are expanding in hospitality, residential, and tourism sectors, driven by demand for quality preservation, controlled serving, and premium wine experiences. Enhanced features and broad application are strengthening market growth.

Automatic wine dispensers are gaining strong traction in restaurants, hotels, wine bars, and retail stores due to their ability to serve wine by the glass with consistent quality. These systems help operators reduce waste by preserving wine for extended periods, ensuring optimal taste and aroma. They also support revenue growth by offering premium wines in smaller portions, appealing to customers who prefer variety without committing to a full bottle. Integration into self-service wine stations in retail environments has enhanced consumer engagement, while improving operational efficiency for staff. This adoption trend is supported by rising interest in experiential dining and premium beverage experiences.

High-end residential consumers and wine collectors are increasingly investing in automatic wine dispensers for personal use. These systems cater to wine enthusiasts who value precise temperature control, accurate pouring, and preservation capabilities. The convenience of enjoying restaurant-quality wine service at home has driven demand, especially among affluent households and dedicated wine hobbyists. Compact and countertop models are expanding the market by making the technology accessible to smaller spaces. The growing culture of home entertaining, combined with an appreciation for fine wines, has created a niche but profitable segment for manufacturers targeting direct-to-consumer channels.

Modern automatic wine dispensers are incorporating improved preservation methods, such as inert gas systems, to maintain wine quality for weeks after opening. These advancements allow businesses and consumers to expand their wine offerings without risk of spoilage. Features like multiple pour size options, touchscreen controls, and dual-temperature zones cater to diverse varietals and consumer preferences. Payment integration in commercial models enables self-service stations, improving customer autonomy and reducing staff workload. These product enhancements have positioned automatic wine dispensers as essential tools for both hospitality venues and serious wine collectors, reinforcing their market relevance.

Wine tourism destinations and vineyards are increasingly adopting automatic wine dispensers to enhance tasting room operations. These systems enable visitors to sample a wide range of wines efficiently, improving throughput during peak seasons. They also allow wineries to offer rare or premium labels in controlled pours, boosting margins while managing inventory. Interactive displays and guided tasting programs integrated with dispensers create memorable visitor experiences. The equipment supports educational initiatives by providing precise pours for pairing demonstrations or wine appreciation classes. This growing presence in tourism-centric locations is reinforcing the role of dispensers in promoting wine culture globally.

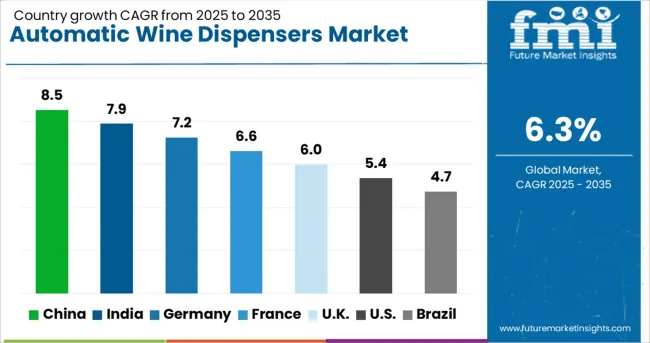

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The automatic wine dispensers market is projected to grow globally at a CAGR of 6.3% between 2025 and 2035, supported by rising demand for premium wine-by-the-glass services, preservation technology adoption, and expansion in hospitality and tourism sectors. China leads with a CAGR of 8.5%, driven by rapid growth in luxury dining, strong wine import volumes, and the emergence of automated self-serve wine bars. India follows at 7.9%, fueled by the expansion of upscale restaurants, increasing wine culture among urban consumers, and the integration of dispensers in premium retail formats. France posts 6.6%, benefiting from the modernization of wine tourism facilities and expansion of premium hospitality venues. The United Kingdom grows at 6.0%, with adoption driven by high-end hotels, event venues, and wine-focused retail outlets, while the United States records 5.4%, reflecting steady demand from luxury dining chains, wine tourism hubs, and affluent residential consumers. The analysis spans over 40 countries, with these six markets serving as benchmarks for capacity expansion, technology integration, and long-term investment opportunities in the global automatic wine dispensers industry.

China is projected to post a CAGR of 8.5% during 2025–2035, up from approximately 7.4% recorded between 2020–2024, indicating a steady acceleration in market momentum. The earlier growth phase was driven by gradual adoption in high-end restaurants, luxury hotels, and select wine tourism destinations, primarily in tier-one cities. The next decade will see expansion fueled by a growing middle-class wine culture, the introduction of automated self-service wine bars, and rising demand for premium wine-by-the-glass experiences. Strategic partnerships between international dispenser manufacturers and Chinese hospitality chains are expected to boost penetration. Additionally, rapid growth in imported premium wine consumption will enhance the need for preservation and dispensing systems.

India is expected to register a CAGR of 7.9% between 2025–2035, higher than the 6.6% achieved during 2020–2024. Early growth was supported by limited installations in upscale hotels, wine lounges, and private clubs. The sharp rise in the coming decade is attributed to the rapid emergence of premium dining destinations, growing awareness of wine preservation benefits, and the rising urban consumer base interested in global wine experiences. The integration of wine dispensers in luxury retail outlets and vineyards is also expected to boost sales. Government efforts to promote wine tourism in select states will further enhance market demand.

France is forecasted to grow at a CAGR of 6.6% during 2025–2035, compared to 5.4% in 2020–2024, reflecting a steady uplift. Early adoption was concentrated in urban wine bars and premium restaurants offering by-the-glass menus. The upcoming decade will benefit from modernization in wine tourism facilities, integration of dispensers in vineyard tasting rooms, and expansion into boutique hotels. The ability to serve rare vintages in measured pours while preserving quality will be a strong driver in heritage wine regions. Partnerships between dispenser manufacturers and wine producers will enable customized solutions tailored to regional varietals and tourist preferences.

The United Kingdom is projected to grow at a CAGR of 6.0% during 2025–2035, up from roughly 4.9% between 2020–2024, marking a moderate but notable increase. Earlier growth was influenced by selective installations in luxury hotels, private clubs, and event venues. The next decade will be driven by expanding adoption in high-end retail wine sections, increased integration in event catering services, and the popularity of experiential wine-tasting venues. The shift toward premium wine culture in metropolitan areas, coupled with a growing base of wine enthusiasts, is expected to accelerate demand. Vendor collaborations with hospitality chains will further enhance market penetration.

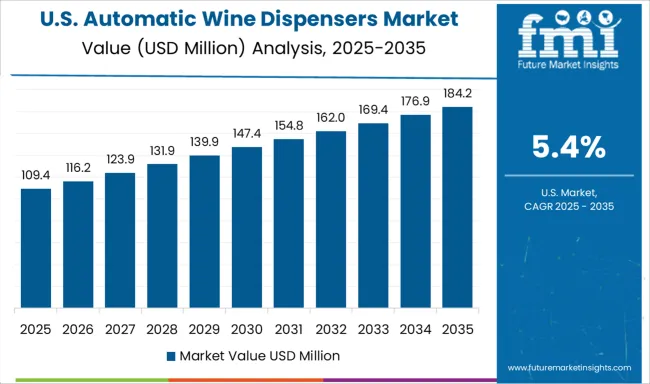

The United States is forecast to achieve a CAGR of 5.4% in 2025–2035, compared to 4.3% in 2020–2024, signaling gradual growth. Earlier adoption was concentrated in wine tourism hubs, luxury resorts, and select fine-dining chains. Growth in the next decade will be supported by rising demand for experiential dining, adoption in upscale grocery wine sections, and consumer interest in premium wine preservation at home. Expansion in wine-producing states like California, Oregon, and Washington will further drive sales, particularly in vineyard tasting rooms. Manufacturers are targeting the residential segment with compact, user-friendly models to capture affluent home users.

The automatic wine dispensers market exhibits a competitive mix of global leaders, specialized innovators, and regional players targeting hospitality, retail, and residential segments. Wineemotion stands out with advanced preservation systems and custom-built solutions for restaurants and wine bars, emphasizing precision and aesthetic appeal. Avanti Products focuses on consumer-friendly models, catering to both residential and small-scale commercial users. Berg Company and By The Glass provide high-end dispensing technologies, with the latter known for its integration of premium design and functional wine-by-the-glass solutions. Cornelius leverages its beverage dispensing expertise to offer versatile, scalable systems adaptable for various service environments.

Dometic Group applies its hospitality market reach to supply compact, stylish wine dispenser units. Edward Don & Company positions itself as a distributor with a broad portfolio for the foodservice industry, including automated wine serving systems. Enomatic is a market pioneer, recognized for patented preservation technology and global reach in premium wine dispensing. EuroCave Professional focuses on luxury-grade dispensers and storage systems for high-end venues. Godrej brings cost-efficient, durable options targeting emerging markets. Lancer Beverage and Napa Technology deliver advanced, sensor-driven solutions, with Napa Technology’s WineStation gaining traction in upscale venues. Rosseto Serving Solutions and Seegir specialize in modular systems for event and retail applications, while Vinotemp offers residential and commercial dispensers blending style with preservation efficiency. Strategic priorities include expanding IoT-enabled features, forging hospitality chain partnerships, and targeting growing wine tourism markets.

For 2024 and 2025, growth in the automatic wine dispensers market will be driven by increasing adoption in premium hospitality venues, integration of digital pour-control and preservation technologies, and rising consumer interest in wine-by-the-glass experiences. Manufacturers are focusing on expanding product portfolios with customizable temperature zones and smart inventory tracking to attract upscale restaurants, wine bars, and event spaces. Strategic partnerships with wineries and distributors are enhancing brand visibility, while targeted marketing in high-income urban areas is boosting awareness. Export expansion to emerging wine tourism destinations further strengthens market potential during the forecast period.

| Item | Value |

|---|---|

| Quantitative Units | USD 255.7 Million |

| Product Type | Floor-standing wine dispensers and Countertop wine dispensers |

| Capacity | Multi-bottle dispensers and Single-bottle dispensers |

| End Use | Commercial, Residential, Restaurants, Hotels & bars, Bars, and Others |

| Price | High, Low, and Medium |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wineemotion, Avanti Products, Berg Company, By The Glass, Cornelius, Dometic Group, Edward Don & Company, Enomatic, EuroCave Professional, Godrej, Lancer Beverage, Napa Technology, Rosseto Serving Solutions, Seegir, and Vinotemp |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive positioning, pricing benchmarks, emerging end-user segments, regulatory impacts, technology adoption rates, and distribution channel performance. |

The global automatic wine dispensers market is estimated to be valued at USD 255.7 million in 2025.

The market size for the automatic wine dispensers market is projected to reach USD 471.1 million by 2035.

The automatic wine dispensers market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in automatic wine dispensers market are floor-standing wine dispensers and countertop wine dispensers.

In terms of capacity, multi-bottle dispensers segment to command 69.0% share in the automatic wine dispensers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA