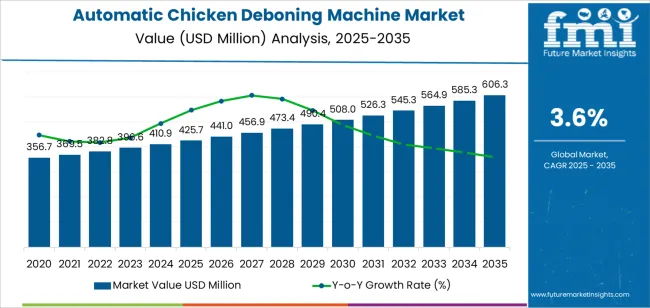

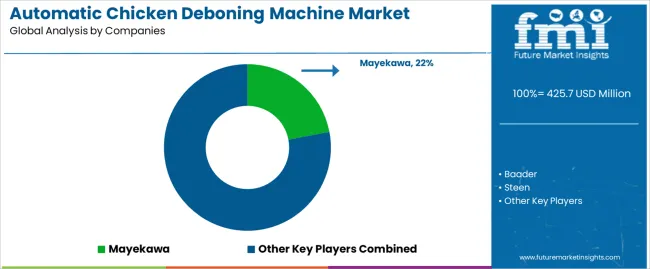

The global automatic chicken deboning machine market is valued at USD 425.7 million in 2025. It is slated to reach USD 606.4 million by 2035, recording an absolute increase of USD 180.7 million over the forecast period. This translates into a total growth of 42.4%, with the market forecast to expand at a CAGR of 3.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.42X during the same period, supported by increasing global poultry consumption and protein demand, growing adoption of automated food processing technologies, and rising emphasis on production efficiency and labor cost reduction across diverse poultry processing facilities, meat processing plants, and food manufacturing operations.

Between 2025 and 2030, the automatic chicken deboning machine market is projected to expand from USD 425.7 million to USD 508.1 million, resulting in a value increase of USD 82.4 million, which represents 45.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing labor shortages in food processing industries requiring automation solutions, rising adoption of mechanized deboning systems in emerging poultry markets, and growing demand for consistent meat quality and yield optimization. Poultry processors and food manufacturers are expanding their automated deboning capabilities to address the growing demand for efficient meat separation solutions that ensure product quality and operational productivity.

From 2030 to 2035, the market is forecast to grow from USD 508.1 million to USD 606.4 million, adding another USD 98.3 million, which constitutes 54.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence-driven quality inspection and defect detection systems, the development of robotic deboning technologies with advanced vision systems, and the growth of specialized applications for value-added poultry products and ready-to-eat meal production. The growing adoption of Industry 4.0 technologies and smart factory concepts will drive demand for connected automatic deboning machines with enhanced functionality and real-time performance monitoring features.

Between 2020 and 2025, the automatic chicken deboning machine market experienced steady growth, driven by increasing poultry processing volumes and growing recognition of automated deboning as essential technology for improving operational efficiency and maintaining consistent meat quality in diverse food processing and meat production applications. The market developed as poultry processors and production managers recognized the potential for automated deboning technology to reduce manual labor dependency, improve meat yield, and support food safety objectives while meeting production capacity requirements. Technological advancement in mechanical deboning mechanisms and control systems began emphasizing the critical importance of maintaining gentle meat handling and bone separation precision in high-speed processing environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 425.7 million |

| Forecast Value in (2035F) | USD 606.4 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

Market expansion is being supported by the increasing global poultry consumption driven by population growth and dietary protein preferences, alongside the corresponding need for efficient meat processing technologies that can maximize meat yield, reduce labor costs, and maintain consistent product quality across various poultry processing operations, food manufacturing facilities, and meat production applications. Modern poultry processors and food industry operators are increasingly focused on implementing automatic deboning solutions that can increase processing capacity, minimize product waste, and provide reliable meat separation in high-volume production conditions.

The growing emphasis on food safety and traceability is driving demand for automatic chicken deboning machines that can support hygienic meat processing, enable controlled production environments, and ensure comprehensive quality standards. Poultry industry operators' preference for automated systems that combine processing efficiency with food safety compliance and yield optimization is creating opportunities for innovative deboning machine implementations. The rising influence of labor shortages and increasing wage costs is also contributing to increased adoption of automatic deboning machines that can provide consistent processing performance without compromising production output or meat quality.

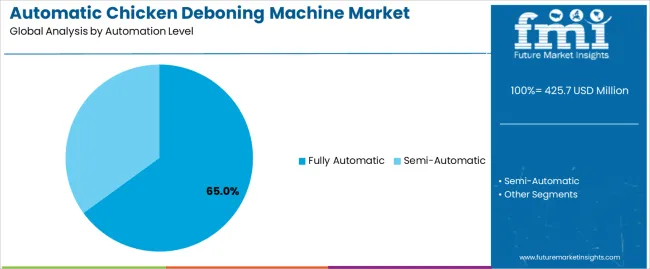

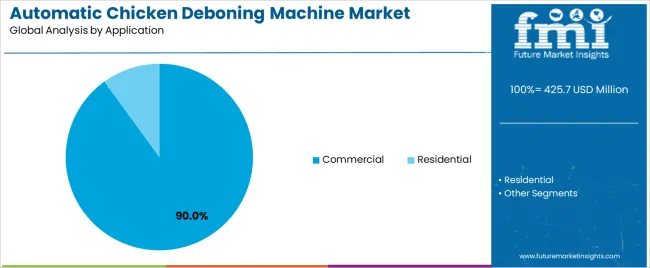

The market is segmented by automation level, application, and region. By automation level, the market is divided into fully automatic and semi-automatic. Based on application, the market is categorized into residential and commercial. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

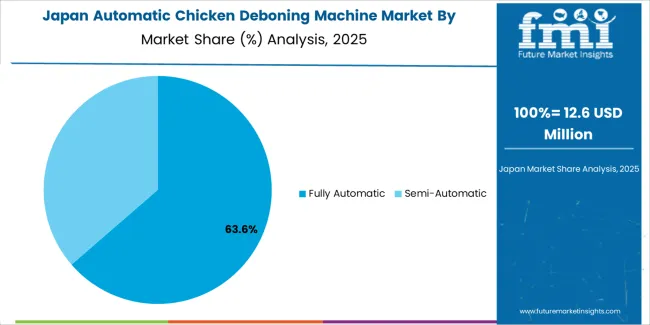

The fully automatic automation level segment is projected to maintain its leading position in the automatic chicken deboning machine market in 2025, accounting for 65% of the market share. This reaffirms its role as the preferred technology category for high-capacity poultry processing and industrial meat production operations. Poultry processors and food manufacturers increasingly utilize fully automatic deboning machines for their superior throughput capabilities, proven consistency in meat separation, and ability to operate with minimal manual intervention while maintaining product quality and operational efficiency. Fully automatic deboning technology's proven effectiveness and production capacity directly address the industry requirements for large-scale poultry processing and comprehensive automation across diverse production volumes and facility configurations.

This automation level segment forms the foundation of modern industrial poultry processing, as it represents the technology with the greatest contribution to production efficiency and established performance record across multiple processing applications and meat product types. Food industry investments in automation infrastructure continue to strengthen adoption among large-scale processors and integrated poultry companies. With labor availability challenges requiring reduced workforce dependency and improved productivity outcomes, fully automatic deboning machines align with both operational efficiency objectives and quality consistency requirements, making them the central component of comprehensive poultry processing automation strategies.

The commercial application segment is projected to represent the largest share of automatic chicken deboning machine demand in 2025, holding 90% of the market share, underscoring its critical role as the primary driver for equipment adoption across large-scale poultry processing plants, meat processing facilities, and food manufacturing operations. Commercial food processors prefer automatic deboning machines for production applications due to their essential contribution to processing capacity, meat yield optimization, and ability to maintain consistent product specifications while supporting high-volume production requirements and food safety standards. Positioned as essential equipment for modern commercial poultry processing, automatic deboning machines offer both productivity advantages and quality assurance benefits.

The segment is supported by continuous innovation in processing technology and the growing availability of advanced deboning systems that enable flexible production with enhanced meat recovery and reduced operational costs. Commercial poultry processors are investing in comprehensive automation programs to support increasingly demanding production schedules and consumer demand for convenient poultry products and value-added meat items. As global poultry consumption increases and processing efficiency requirements intensify, the commercial application will continue to dominate the market while supporting advanced automation adoption and production optimization strategies.

The automatic chicken deboning machine market is advancing steadily due to increasing global poultry consumption driven by population growth and protein demand and growing adoption of processing automation that provides efficient meat separation and labor cost reduction benefits across diverse poultry processing, food manufacturing, and meat production applications. However, the market faces challenges, including high initial capital investment and equipment costs, technical complexity requiring specialized maintenance and operational expertise, and product quality considerations related to meat texture and bone fragment control. Innovation in robotic technologies and artificial intelligence integration continues to influence product development and market expansion patterns.

The growing worldwide demand for poultry meat is driving expansion of processing facilities and modernization programs that address increasing production requirements including higher throughput capabilities, improved meat yield efficiency, and enhanced processing automation. Commercial poultry processing requires advanced deboning equipment that delivers consistent meat separation across diverse chicken sizes while supporting rapid processing speeds and minimal product damage. Food processors are increasingly recognizing the economic advantages of automated deboning systems for meeting growing market demand and maintaining competitive production costs, creating opportunities for high-capacity deboning machines specifically designed for large-scale operations and integrated poultry production facilities.

Modern automatic chicken deboning machine manufacturers are incorporating artificial intelligence algorithms and computer vision systems to enhance meat quality assessment, detect bone fragments, and support comprehensive process control through real-time defect detection, automated adjustment capabilities, and predictive maintenance monitoring. Leading companies are developing machines with integrated imaging systems, machine learning algorithms, and automated feedback control that allow processors to optimize deboning parameters and ensure consistent product quality throughout production runs. These technologies improve processing outcomes while enabling new operational approaches, including adaptive processing for varying raw material quality, automated yield optimization, and data-driven performance analysis. Advanced technology integration also allows manufacturers to differentiate equipment offerings and address food safety requirements beyond traditional mechanical deboning functionality.

The expansion of collaborative robotics and increasing availability of sophisticated manipulation technologies is driving development of robotic chicken deboning systems with three-dimensional vision guidance and flexible processing capabilities. These advanced applications require intelligent motion control and sensory feedback that enable precise bone removal adapted to individual chicken anatomy, creating premium market segments with differentiated value propositions. Manufacturers are investing in robotic arm technologies and advanced gripper designs to serve processors requiring flexible production capabilities and premium meat quality while supporting innovation in customized cutting patterns and waste minimization strategies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

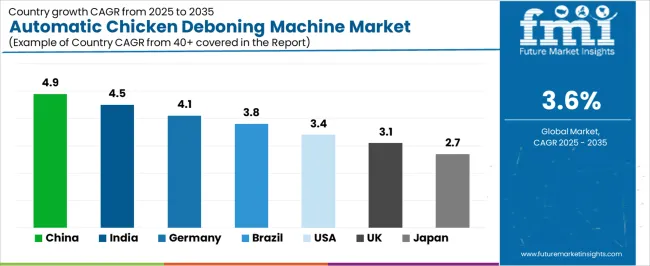

The automatic chicken deboning machine market is experiencing solid growth globally, with China leading at 4.9% CAGR through 2035, driven by massive poultry production expansion, growing domestic meat consumption, and increasing processing automation adoption. India follows at 4.5%, supported by rapidly growing poultry industry, rising protein consumption, and modernizing food processing infrastructure. Germany shows growth at 4.1%, emphasizing advanced food processing technology, comprehensive food safety standards, and export-oriented poultry production. Brazil demonstrates 3.8% growth, supported by position as major poultry exporter, expanding processing capacity, and increasing automation investment. The United States records 3.4%, focusing on labor efficiency improvement, processing modernization, and value-added product development. The United Kingdom exhibits 3.1% growth, emphasizing food safety compliance and processing efficiency enhancement. Japan shows 2.7% growth, supported by automated food processing adoption and quality-focused meat production.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

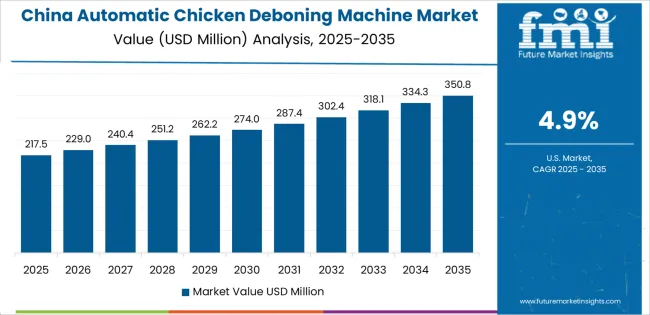

Revenue from automatic chicken deboning machines in China is projected to exhibit exceptional growth with a CAGR of 4.9% through 2035, driven by expanding poultry production capacity and rapidly growing domestic meat consumption supported by urbanization trends and middle-class dietary shifts toward protein-rich foods. The country's massive poultry processing industry and increasing investment in food processing automation are creating substantial demand for automatic deboning solutions. Major food processing equipment manufacturers and international suppliers are establishing comprehensive sales and service capabilities to serve both domestic markets and export-oriented processors.

Demand for automatic chicken deboning machines in India is expanding at a CAGR of 4.5%, supported by the country's rapidly growing poultry sector, increasing per capita chicken consumption, and modernizing food processing infrastructure driven by organized retail expansion and food safety awareness. The country's developing poultry processing capabilities and improving technology adoption are driving sophisticated deboning automation throughout commercial processing facilities. Leading equipment suppliers are establishing distribution networks and technical support services to address growing demand.

Revenue from automatic chicken deboning machines in Germany is growing at a CAGR of 4.1%, supported by the country's advanced food processing technology sector, comprehensive food safety standards, and strong export-oriented poultry production capabilities. The nation's engineering excellence and food industry sophistication are driving sophisticated deboning automation throughout commercial processing operations. Leading equipment manufacturers are investing extensively in technology innovation and product development for European market requirements.

Demand for automatic chicken deboning machines in Brazil is anticipated to expand at a CAGR of 3.8%, supported by the country's position as leading global poultry exporter, expanding domestic processing capacity, and increasing automation investment driven by labor efficiency requirements and international quality standards. Brazil's integrated poultry production system and export focus are driving demand for advanced processing equipment. International equipment suppliers are establishing partnerships with Brazilian processors to support capacity expansion and technology upgrading.

Revenue from automatic chicken deboning machines in the United States is projected to grow at a CAGR of 3.4%, supported by the country's large-scale poultry processing industry, persistent labor availability challenges, and growing emphasis on value-added products requiring automated processing capabilities. The nation's established poultry sector and technology adoption are driving demand for advanced deboning solutions. Equipment manufacturers are investing in automation technologies and service capabilities to support processor efficiency and product innovation requirements.

Demand for automatic chicken deboning machines in the United Kingdom is expanding at a CAGR of 3.1%, supported by the country's comprehensive food safety regulations, established poultry processing sector, and increasing emphasis on production efficiency and traceability. The UK's food safety culture and quality standards are driving structured adoption of automated processing technologies. Equipment suppliers are establishing service capabilities and technical support to address British processor requirements.

Revenue from automatic chicken deboning machines in Japan is growing at a CAGR of 2.7%, supported by the country's quality-focused food culture, established automated food processing infrastructure, and comprehensive hygiene standards. Japan's food industry sophistication and automation expertise are driving demand for precise and hygienic deboning equipment. Leading food processors are investing in advanced automation for maintaining quality standards and addressing labor constraints.

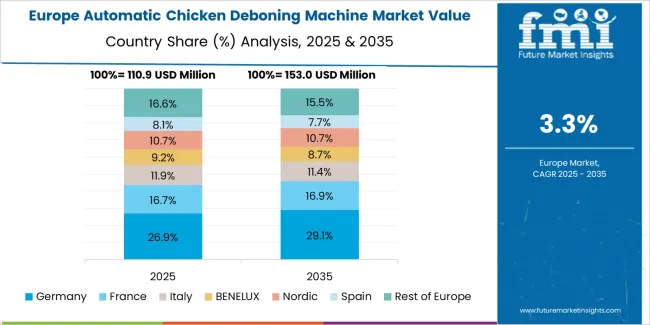

The automatic chicken deboning machine market in Europe is projected to grow from USD 127.7 million in 2025 to USD 181.9 million by 2035, registering a CAGR of 3.6% over the forecast period. Germany is expected to maintain leadership with a 26.3% market share in 2025, moderating to 26.0% by 2035, supported by advanced food processing equipment manufacturing, comprehensive food safety infrastructure, and strong poultry processing capabilities.

France follows with 19.8% in 2025, projected at 20.1% by 2035, driven by established poultry production, food processing industry development, and export-oriented operations. The United Kingdom holds 16.4% in 2025, reaching 16.1% by 2035 on the back of integrated poultry processing and food safety standard compliance. Italy commands 13.9% in 2025, rising slightly to 14.1% by 2035, while Spain accounts for 11.2% in 2025, reaching 11.4% by 2035 aided by poultry production growth and processing modernization. The Netherlands maintains 5.7% in 2025, up to 5.8% by 2035 due to intensive poultry production and advanced automation adoption. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 6.7% in 2025 and 6.5% by 2035, reflecting steady development in poultry processing modernization and automation infrastructure expansion.

The automatic chicken deboning machine market is characterized by competition among established food processing equipment manufacturers, specialized poultry processing machinery suppliers, and comprehensive production line integrators. Companies are investing in automation technology advancement, mechanical design optimization, after-sales service enhancement, and application development to deliver efficient, reliable, and hygienic automatic chicken deboning solutions. Innovation in robotic manipulation, artificial intelligence-based quality control, and modular system design is central to strengthening market position and competitive advantage.

Mayekawa leads the market with comprehensive food processing and refrigeration solutions, offering automatic chicken deboning systems with focus on processing efficiency, meat quality preservation, and hygienic design across commercial poultry processing applications. Baader provides advanced food processing equipment with emphasis on yield optimization and automated production line integration. Steen delivers specialized poultry processing machinery with focus on flexible deboning solutions and compact system designs.

Foodmate offers comprehensive poultry processing equipment with emphasis on automation and production efficiency. Meyn specializes in integrated poultry processing systems with advanced deboning technologies. Prince Industries focuses on poultry processing equipment for North American markets with emphasis on robust construction and reliable operation.

Drobtech provides specialized deboning and food processing machinery for European markets. Qingdao Ruizhi Intelligent Equipment Technology specializes in automated food processing equipment manufacturing for Asian markets with focus on cost-effective solutions and local technical support.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 425.7 million |

| Automation Level | Fully Automatic, Semi-Automatic |

| Application | Residential, Commercial |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Mayekawa, Baader, Steen, Foodmate, Meyn, Prince Industries |

| Additional Attributes | Dollar sales by automation level and application category, regional demand trends, competitive landscape, technological advancements in mechanical deboning, robotic integration development, artificial intelligence-based quality control, and meat yield optimization |

The global automatic chicken deboning machine market is estimated to be valued at USD 425.7 million in 2025.

The market size for the automatic chicken deboning machine market is projected to reach USD 606.3 million by 2035.

The automatic chicken deboning machine market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in automatic chicken deboning machine market are fully automatic and semi-automatic.

In terms of application, commercial segment to command 90.0% share in the automatic chicken deboning machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dicing Saw Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Paper Cutter Market Size, Trends, and Forecast 2025 to 2035

Automatic Gearbox Valves Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA