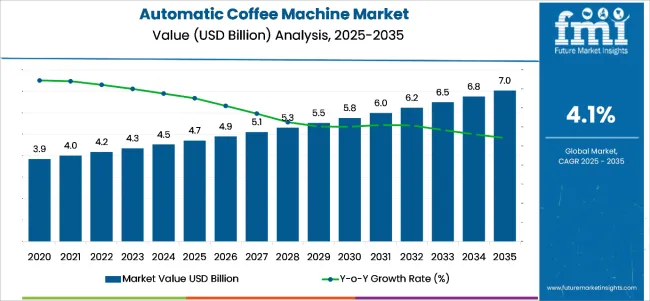

The global automatic coffee machine market is worth USD 4.7 billion in 2025 and is projected to reach USD 7 billion by 2035, growing steadily at a CAGR of 4.1% during the forecast period. This market growth reflects the rising penetration of automatic coffee machines in both commercial and residential spaces worldwide.

Increasing preference for premium coffee experiences at home and in office setups is contributing significantly to the demand for these machines. Alongside this, the global shift toward convenience-driven lifestyles has pushed consumers to opt for machines that can deliver café-quality coffee with minimal manual intervention.

The market is primarily driven by technological advancements such as touchscreen displays, smartphone integration, and the compatibility of these machines with Internet of Things (IoT) systems. Smart automatic coffee machines are reshaping user experience by allowing customization of various parameters such as temperature, brew strength, and milk texture, which cater to the evolving taste preferences of consumers.

Furthermore, the rising trend of smart homes and connected kitchen appliances is fueling the adoption of automatic coffee machines across urban households. Innovations aimed at reducing energy consumption and improving machine efficiency are also proving attractive to environmentally conscious buyers, thereby broadening the market base.

The increasing culture of premium coffee consumption, especially in developing regions such as India, China, and Southeast Asia, has created new avenues for market expansion. A growing working population, busy lifestyles, and higher disposable incomes are factors that continue to boost sales in the residential segment. In the commercial domain, coffee chains, restaurants, and office spaces are investing in high-end automatic machines to meet the demand for consistent and high-quality coffee service.

Prominent companies remain focused on expanding their smart product portfolios to strengthen their market presence globally. Increasing disposable income is significantly fueling the growth of the automatic coffee machine market. As consumers experience higher disposable incomes, they are more inclined to invest in premium kitchen appliances, including automatic coffee machines, which offer convenience and quality.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.7 billion |

| Industry Value (2035F) | USD 7 billion |

| CAGR (2025 to 2035) | 4.10% |

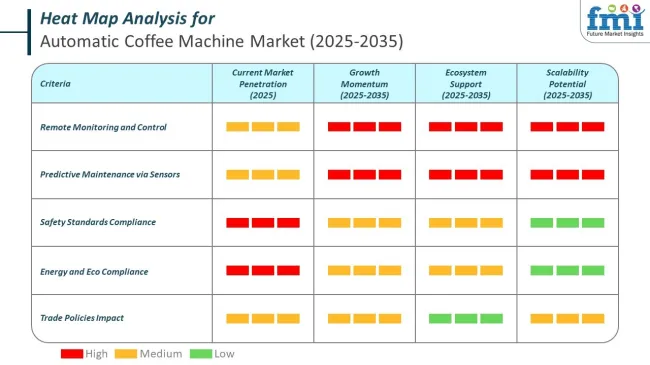

The automatic coffee machine market is experiencing rapid transformation through IoT connectivity and sensor-based automation. These technologies are enabling seamless control, operational visibility, and predictive capabilities, creating a smarter brewing experience for both home and commercial users. IoT integration allows machines to connect with smartphones and cloud platforms, providing real-time data access and remote operation. Sensors, on the other hand, ensure precision in brewing parameters and monitor machine health for uninterrupted performance.

Government regulations strongly influence how automatic coffee machines are designed, manufactured, and distributed. Compliance with safety, energy, and environmental standards is essential for market entry and customer trust. Regulatory frameworks often mandate specific certifications for electrical safety, food-grade materials, and product durability to protect consumers. Manufacturers must also adhere to energy efficiency guidelines, which drive innovation in heating and brewing technologies. These policies not only ensure safe and sustainable products but also impact pricing, production cycles, and supply chains globally.

Below table presents the expected CAGR for the global automatic coffee machine market over several semi-annual periods spanning from 2025 to 2035. First half (H1) from 2024 to 2034, the sector is seen to have a growth of CAGR 3.9%, followed by a growth of 4.2% in the second half (H2) of the same period.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.9% |

| H2 (2024 to 2034) | 4.2% |

| H1 (2025 to 2035) | 4% |

| H2 (2025 to 2035) | 4.3% |

Moving forward to the subsequent period from H1 2024 to H2 2035, the CAGR is foreseen to surge from 4% in the first half to 4.3% in the second half.

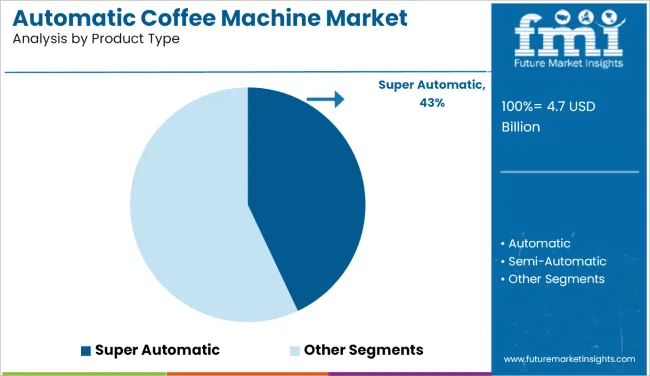

The automatic coffee machine market is segmented based on product type, end use, price range, and region. By product type, the market is segmented into automatic, super automatic, and semi-automatic machines.

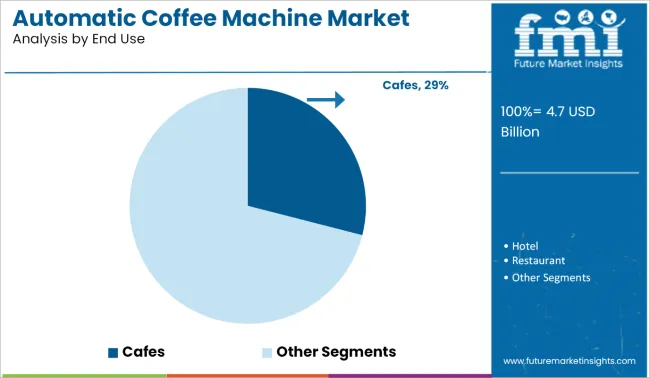

By end use, the market is categorized into hotel, restaurant, café, institutional, and residential sectors. Based on price range, the market is segmented into low, medium, and high. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Super automatic coffee machines dominate the market with a significant 43% value share in 2025, maintaining their leadership through the forecast period. These machines are widely preferred due to their convenience, as they combine grinding, brewing, and milk frothing functions into a single unit. The increasing consumer inclination toward high-quality, hassle-free coffee experiences in both residential and commercial settings, such as offices and cafes, has accelerated the demand for super automatic models. These machines cater to busy consumers who seek quick yet premium coffee preparation without manual effort.

Automatic coffee machines, on the other hand, also hold a substantial market position due to their cost-effectiveness and simplicity in operation. They appeal to households and small offices where the need for customizable brewing options exists, but the budget for high-end super automatic machines may be limited.

Their growing popularity among middle-income consumers is likely to support consistent market demand, especially in emerging economies. Semi-automatic coffee machines are valued for providing users more control over the brewing process, allowing enthusiasts and baristas to fine-tune coffee preparation to their taste.

These machines find high acceptance in specialty cafes and boutique coffee shops, where manual adjustment and craftsmanship are essential to delivering unique coffee experiences. However, their share remains lower compared to super automatic variants due to the higher skill requirement and time involved in operation.

| Product Type | Share (2025) |

|---|---|

| Super Automatic | 43% |

The café segment dominates the market, accounting for a significant share of 29% in 2025. This leadership is attributed to the proliferation of specialty coffee shops and rising customer visits to cafés globally. Operators prefer automatic coffee machines for their ability to consistently deliver high-quality beverages while ensuring operational efficiency and menu diversity, minimizing manual intervention.

The residential segment is driven by the rising preference for premium, customizable coffee experiences at home, supported by the work-from-home trend and growing urbanization. Consumers are increasingly investing in smart, easy-to-use automatic coffee machines that offer café-like quality in domestic settings, fuelling demand in this segment.

The hotel segment is expanding steadily as hospitality businesses invest in enhancing customer experiences. Hotels are increasingly equipping guest rooms, lounges, and dining areas with automatic coffee machines to offer convenient, high-quality coffee services, contributing to higher guest satisfaction and brand differentiation in competitive markets.

In the restaurant sector, the deployment of automatic coffee machines is rising as restaurants seek to diversify their beverage offerings and cater to customers demanding specialty and gourmet coffee options alongside meals. These machines improve efficiency and allow restaurants to serve barista-quality coffee without the need for highly trained staff.

The institutional segment, which includes offices, educational institutions, and corporate spaces, is also growing consistently. Automatic coffee machines are becoming essential in such settings to provide convenient access to fresh coffee, enhancing employee satisfaction, productivity, and workplace amenities, which in turn supports the sustained demand for these machines.

| End Use | Share (2025) |

|---|---|

| Cafes | 29% |

The high-priced segment is anticipated to witness the fastest growth, registering a CAGR of 5.7% from 2025 to 2035. This rise is primarily driven by the increasing demand for premium and technologically advanced automatic coffee machines that offer features like touch screen interfaces, smartphone connectivity, customizable brewing options, and integration with smart home systems. Consumers, especially in urban areas and developed markets, are willing to invest in high-end models for superior quality, durability, and a café-like coffee experience at home or in commercial spaces.

The medium-priced segment continues to dominate the market owing to its balanced offering of affordability and advanced features. These machines attract middle-income consumers who seek reliable performance without the premium cost, making this segment popular among residential users and small businesses. The low-priced segment maintains steady demand, particularly in emerging markets, where cost-sensitive consumers prioritize basic functionality over high-end features.

These machines are widely adopted by budget-conscious households and small institutional setups, ensuring accessibility to automatic coffee solutions at affordable prices. However, the growth in this segment is comparatively slower due to limited technological advancements and rising consumer preference for smarter and more versatile models.

| Price Range | CAGR (2025 to 2035) |

|---|---|

| High | 5.7% |

Growth factors influencing the automatic coffee machine market are workplace trends, technological advancements, a variety of options, and no intervention with quick service features. Demand for automatic coffee machines market has also seen a proliferation of coffee culture fueled by the popularity of specialty coffee beverages.

Artisanal brewing methods have led to a surge in demand for high-quality coffee makers that can replicate café-quality. Growth of the automatic coffee machine industry has also seen to have a huge uptrend with rising IT parks and cafes. People have a huge urge for coffee while working as it aids in warding off sleep.

Coffee makers with health-enhancing features like water filtration systems, BPA-free materials, and easy-to-clean designs appeal to health-conscious consumers. Thus, products prioritizing safety, hygiene, and ease of maintenance gain traction. Also health benefits offered draw attention to improving adoption and sales of automatic coffee machine industry.

Product safety standards, energy efficiency regulations, and environmental sustainability requirements influence entry barriers for coffee maker manufacturers. Effective marketing and branding strategies play a critical role in driving consumer awareness and brand loyalty.

Consumer seek coffee makers that allow customization and personalization of their coffee beverages. Adjustable brew strength, cup size option, amount and volume, and ability to create specialty drinks like cappuccinos all attract a big customer pool. Versatility in brewing capabilities aids in high demand and curating the country-wide presence of advanced coffee makers.

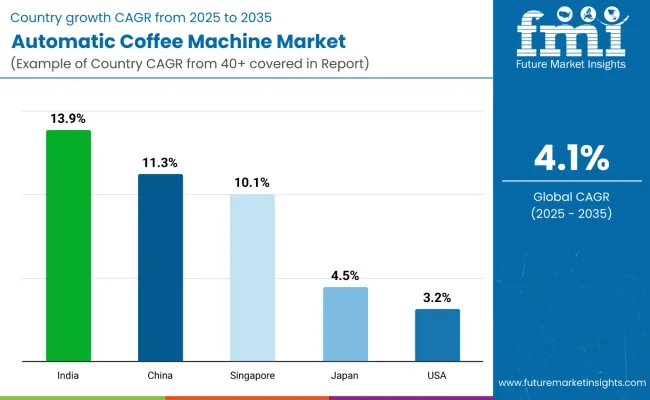

The USA automatic coffee machine market is estimated to grow at a CAGR of 3.2% from 2025 to 2035. Growth is driven by a mature coffee culture, rising demand for premium home brewing systems, and widespread adoption of smart kitchen appliances integrated with IoT.

The preference for customized coffee options at home and in office environments has elevated the need for technologically advanced machines. Major brands such as Keurig Green Mountain and De'Longhi lead innovation in this market by offering machines that meet evolving American consumer demands for convenience and performance. Additionally, the continuous expansion of specialty coffee chains and the trend towards single-serve brewing options are sustaining market demand in both residential and commercial sectors across the United States.

The India automatic coffee machine market is forecast to register a CAGR of 13.9% from 2025 to 2035, making it the fastest-growing country market globally. The surge in demand is attributed to rapid urbanization, the growing middle-class population, and a shift in consumer preference towards premium coffee experiences.

India’s increasing exposure to global coffee culture, coupled with the expansion of café chains like Starbucks and Café Coffee Day, fuels market adoption. Rising office installations of automatic machines and the penetration of smart home appliances are accelerating sales in urban households. The demand is also supported by millennial consumers seeking personalized brewing options and the overall growth of the organized retail and e-commerce sectors that simplify product availability nationwide.

The China automatic coffee machine market is projected to expand at a CAGR of 11.3% between 2025 and 2035, spurred by Western-style coffee adoption among urban youth and the booming specialty café culture in cities like Shanghai and Beijing. Chinese consumers are embracing premium, feature-rich machines for home use, replicating high-quality café experiences domestically.

The office segment is also expanding as corporations install automatic machines to improve workplace amenities. Rising disposable incomes and a focus on lifestyle enhancement drive consumer willingness to invest in technologically advanced appliances. Additionally, increased tourism and hospitality infrastructure development are supporting demand for automatic machines in hotels, restaurants, and institutional settings across China's tier 1 and tier 2 cities.

The Singapore automatic coffee machine market is anticipated to witness a CAGR of 10.1% from 2025 to 2035, backed by rising disposable income, modern lifestyle trends, and growing demand for smart kitchen appliances.

The island nation’s strong coffee-drinking culture, coupled with the expansion of specialty cafés and artisanal coffee shops, has contributed to the uptake of advanced automatic machines in both residential and commercial settings. Space-efficient and intuitive models are particularly appealing to Singaporeans living in compact urban apartments.

Additionally, the thriving hospitality and corporate sectors are investing in these machines to improve customer and employee satisfaction. High consumer awareness regarding technology-driven home appliances further accelerates adoption in Singapore’s dynamic and tech-savvy market.

The Japan automatic coffee machine market is set to grow at a CAGR of 4.5% during 2025 to 2035, supported by evolving beverage preferences where coffee consumption is steadily replacing traditional tea habits among younger consumers. Japanese buyers favor precision-based, compact, and user-friendly machines that deliver high-quality brewing performance suited to limited living spaces.

Super-automatic and fully automatic machines are popular choices, meeting demand for convenience and advanced features. The café and restaurant industries in Japan are also contributing to market growth by upgrading to energy-efficient, smart machines to enhance customer service. Increasing disposable incomes and technological innovation in domestic appliance design continue to encourage automatic coffee machine purchases in both the residential and commercial sectors.

Tier 1 companies are among the commanding leaders who cover a huge share of the automatic coffee machine market with revenue of USD 2,426.6 million. This captures around 55% of the share of the global industries. Companies like Jura, Miele, De'Longhi, Breville, and Saeco are positioned in this section with their exceptional build quality, advanced technology, and precision engineering.

Major companies here produce, for high-end use, professional-grade espresso machines that cater to coffee enthusiasts and connoisseurs. Also, they are focused on innovation, superior performance, and durability, solidifying their position as leaders in the industry. Customers appealing for a premium coffee experience are willing to invest here in prioritizing quality.

Tier 2 companies include Gaggia, Nespresso, Krups, Siemens, and Melitta. They hold a strong position due to their combination of quality and affordability. Tier 2 companies cover around 30% of value share of global industries. With a valuation of USD 1,323.4 million, these companies offer a range of espresso machines, appealing broad customer base.

They provide semi-automatic machines to convenient capsule systems. They are known for striking a balance between performance and price. Thus, making machines more accessible to a wider audience maintains a level of quality and functionality.

Tier 3 includes companies having revenue of USD 661.8 million. They cover around 15% of the share of the industry sector worldwide. Companies in this section are providers of entry-level and mainstream coffee equipment. Their products are designed to be cost-effective, easy to use, and widely available.

These features cater to consumers seeking convenient and budget-friendly options for making coffee at home. They may not compete with tier 1 holders in sophistication and precision but come as to-go brands for simple everyday coffee solutions at cheap prices. Prominent companies in Tier 3 include Mr. Coffee, Cuisinart, Hamilton Beach, Black+Decker, and Keurig.

Manufacturers are tapping into these growing industries by offering affordable and accessible coffee maker options tailored to local preferences. Producers are also developing new products with marketing strategies according to consumer behavior in the industry. Many new entrants with a taste in artisanal brewing methods are replicating café-quality drinking at home with advanced features coffee makers.

Industry Update

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 4.7 billion |

| Projected Market Size (2035) | USD 7 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/volume in metric tons |

| By Product Type | Automatic, Super Automatic, Semi-Automatic |

| By End Use | Hotel, Restaurant, Cafe, Institutional, Residential |

| By Price Range | Low, Medium, High |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Koninklijke Philips N.V, Keurig Green Mountain, Inc., De'Longhi Appliances s.r.l, Nestlé Nespresso S.A, Melitta Group, JURA Elektroapparate AG, BUNN-O-Matic Corporation, BSH Hausgeräte GmbH, Bravilor Bonamat B.V, Animo B.V |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

Fully-automatic, super-automatic, and semi-automatic product types are categorized in the automatic coffee machine industry.

Hotel, restaurant, café, institutional, and residential are categories of the automatic coffee machine industry.

The segment is distributed to low, medium, and high prices.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

Industry is set to reach USD 4.7 billion in 2025.

The valuation is expected to reach USD 7 billion by 2035.

Industry is set to register a CAGR of 4.1% from 2025 to 2035.

Super-automatic, with a share of 43% in 2025.

India is expected to progress at a CAGR of 13.9% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filling Machine Market Analysis - Size, Growth, and Forecast 2025 to 2035

Automatic Capping Machine Market - Size, Share, and Forecast 2025 to 2035

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Automatic Ducting Machine Market Growth - Trends & Forecast 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Automatic Grilling Machine Market

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Capsule Coffee Machines Market

Automatic Case Erecting Machine Market Size, Trend & Forecast 2024-2034

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Built-in Coffee Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Powder Filling Machines Market

Automatic Liquid Filling Machines Market

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Clay Brick Making Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA