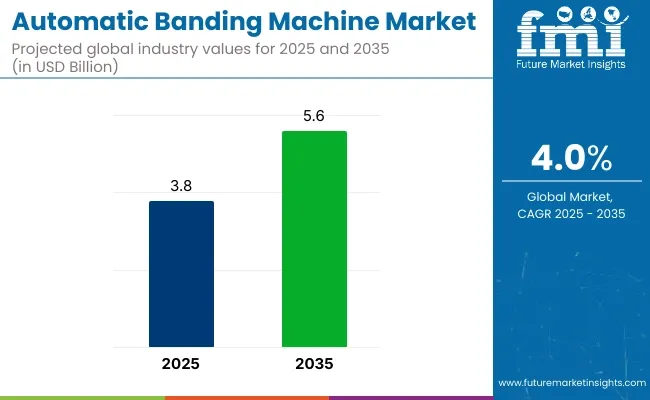

The global automatic banding machine market is poised for steady expansion, projected to grow from USD 3.8 billion in 2025 to approximately USD 5.6 billion by 2035, reflecting a CAGR of around 4.0% during this period. In 2024, sales reached USD 3.6 billion, underpinned by rising adoption of automation, sustainability, and smart packaging solutions across logistics, food & beverage, pharmaceuticals, and printing sectors. Automated banding systems are being incorporated to reduce material use, ensure secure bundling, and align with eco-friendly packaging strategies.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 3.8 Billion |

| Market Value (2035F) | USD 5.6 Billion |

| CAGR (2025 to 2035) | 4.0% |

Key innovations are steering market direction. Programmable logic controllers (PLCs) and touchscreen interfaces are being integrated to enhance line efficiency and minimize changeover times. Furthermore, energy-efficient motors, low-noise operation, and heat-free sealing technologies have started to gain traction in 2025, highlighting a commitment to operational excellence and worker safety.

A notable shift has been seen toward paper banding systems. These compostable solutions are being implemented to eliminate adhesives and shrink films. Manufacturers are adopting them in response to tightening regulations and growing corporate sustainability commitments. In Europe, several major producers have begun pilot programs using paper bands for shipment bundles and pallet stabilization.

The trend towards digital integration is also evident. Smart controls and IoT-enabled monitoring are being used to enable predictive maintenance and real-time diagnostics. These features are reducing downtime and extending machine lifespan. As packaging lines become increasingly digitized, banding machines are now being designed to integrate seamlessly with MES (Manufacturing Execution Systems) and WMS (Warehouse Management Systems).

The market is expected to generate an incremental opportunity of USD 1.8 billion by 2035. Companies that invest in customization, sustainability, and digital integration are expected to benefit most. Regulatory pressure to reduce plastic use and enhance automation in logistics are reinforcing the long-term outlook for automatic banding systems. Capital intensity remains a challenge for small to mid-size enterprises. Additionally, tech integration complexity and regional regulatory fragmentation persist.

However, manufacturers such as PackTech, Apex Packaging, and Fachin are strategically focusing on eco-friendly materials, modular designs, and smart features to drive next-gen automation. The automatic banding machine market is being reshaped by sustainability mandates, digital transformation, and demand for operational efficiency. Through 2035, companies that balance eco-friendly materials with automation and intelligent controls are expected to lead this evolving sector.

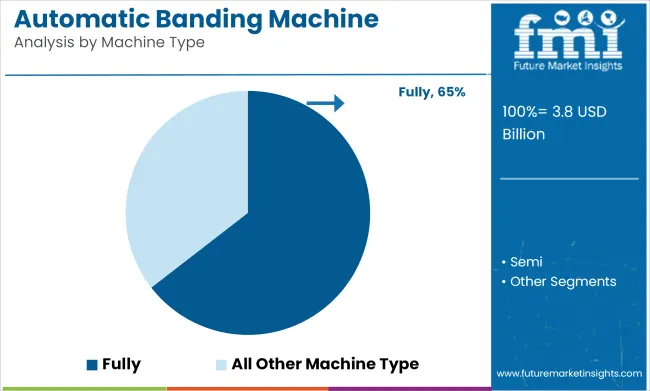

Fully automatic banding machines are expected to dominate the machine type segment with an estimated 64.5% market share by 2025, fueled by increasing demand for automation, speed, and minimal human intervention across manufacturing and packaging industries.

These machines integrate seamlessly into high-throughput production lines, automatically detecting, aligning, and banding items without operator assistance, significantly reducing labor costs and errors. Fully automatic machines are widely used in sectors such as food and beverage, pharmaceuticals, printing, logistics, and consumer electronics, where precise bundling, labeling, and tamper-evidence are critical. Equipped with programmable logic controllers (PLCs), user-friendly HMIs, and integration capabilities with smart factory systems, these machines support Industry 4.0 initiatives and real-time data monitoring.

Additionally, they offer flexibility in banding materials ranging from paper to poly film making them suitable for both branding and protective purposes. As labor shortages and cost pressures persist globally, businesses are increasingly adopting fully automatic banding machines to boost throughput, ensure product consistency, and enhance packaging aesthetics. Their ability to reduce downtime, improve precision, and streamline logistics ensures their leadership in the banding equipment market well into 2025 and beyond.

The food and beverages industry is projected to hold the largest share of the automatic banding machine market by 2025, with an estimated 24.8% share, owing to its high-volume packaging requirements, stringent hygiene protocols, and increasing focus on sustainable bundling methods.

Banding machines have been utilized for unitizing multipacks, closing trays, and bundling primary packages for secondary logistics while minimizing the use of shrink wrap and excess packaging. Automatic banding equipment has enabled brands to meet food-grade compliance through the use of heat-free, adhesive-free paper or film bands that provide secure sealing without damaging sensitive surfaces or labeling. Banding has also been used for tamper-evidence, allergen labeling, and traceability marking, which are increasingly regulated in global food distribution channels.

Ready-to-eat meals, bottled drinks, meat trays, and produce packaging have benefited from machine-based banding, which provides not only product integrity but also shelf-ready appearance. Integration into high-speed food lines has further enhanced operational efficiency and throughput in packaging facilities.

As food manufacturers invest in automation to meet growing demand while cutting down on packaging waste, the adoption of automatic banding machines is expected to accelerate, keeping this sector at the forefront of end-use applications in the market.

High Initial Costs and Maintenance Requirements

Automatic banding machines necessitate significant capital investment, which can be a barrier for small and mid-sized firms. When it comes to such advanced machines with high-speed capabilities, in addition to IoT-enabled features, high upfront costs can make it difficult for businesses on a budget to make the investment. The total cost of ownership is also higher due to the need for ongoing maintenance and technical expertise to operate automated systems. In response to these challenges, producers are concentrating on producing affordable, modular banding solutions with decreased operational costs easily integrated into existing production lines.

Integration of Smart Automation and Sustainable Banding Solutions

Market growth opportunities are present due to the growing demand for smart packaging automation in addition to increasing need sustainable banding materials. Furthermore, the incorporation of AI-driven tracking, near real-time data analysis, and predictive maintenance within banding machines is enhancing productivity while minimizing downtime.

Moreover, the move towards biodegradable banding materials like paper bands and biodegradable adhesives is in line with global sustainability objectives. Manufacturers that adopt intelligent, energy-efficient banding technologies with integrated smart automation are likely to find themselves at a competitive advantage in this changing landscape.

Automatic banding machines and the United States is the primary market, growing with the level of automation in the packaging and logistics industry. Increasing demand for efficient, secure, and sustainable bundling solutions in various industries including food & beverage, pharmaceuticals, and e-commerce is driving the growth of bundling materials market.

The requirement for precise banding with little waste also appeals with the country’s sustainability programs, and boosting adoption. To improve operational efficiency for meeting stringent packaging regulations, manufacturers are emphasizing smart sensors, IoT and AI embedded advanced banding machine in their production processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The market in the United Kingdom is expected to grow at a significant rate owing to the growth of retail, logistics and pharmaceuticals. As the pressure increases to address plastic packaging waste, companies are seeking paper-based and biodegradable banding solutions. Technological advancements such as the growth in e-commerce as well as the increasing inclination of end users towards automated warehouse operations are also expected to boost the demand for high-speed banding machines. In addition, the increasing implementation of Industry 4.0 technologies such as smart automation and remote supervision is also hastening the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

Increased demand is aiding the expansion of the automatic banding machines market in Europe, as well, with Germany, France, and Italy being the top three countries that are adopting automatic banding machines. Robust regulatory framework in the region that promotes sustainable packaging practices is fuelling investments by the industries for eco-friendly banding solutions. Growing pharmaceutical and food processing industries and continuous automation in manufacturing are fuelling the demand for high precision banding systems. Moreover, increasing usage of automated banding solutions for enhanced product safety and optimized supply chain processes by logistics and warehousing facilities is expected to drive the demand for the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

Japan is the fastest-growing banding machine market in Asia because of the country’s high standards of packaging quality and attention to industrial automation. Trends Observed in the Industry Robotics, AI-driven quality control, smart packaging solutions are among the major trends shaping the industry. The food packaging industry, specifically, is leveraging sophisticated banding machines that adhere to regulations and meet market demands for less and eco-friendly packaging. Also, Japan has an extremely sophisticated logistics industry that uses automatic banding machines to improve efficiency of supply chain management.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Increase in demand for packaging services in sectors like electronics, cosmetics, and food, among others, has theorem to the increasing use of machinery automatic banding machine in South Korea. There are some strong advanced technologies by the country in category of smart packaging systems and automated production lines fuelling the growth of the market. Moreover, the growing requirement for secure bundling solutions across export-oriented sectors is propelling the investments in high-efficiency banding machines. Additionally, the rapid development of e-commerce and last-mile logistics services is driving the proliferation of automated banding systems in packaging and distribution centres.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

As industries look for sustainable, economical, and high-speed packaging solutions, the automatic banding machine market flourishes. Tension control integrated with AI, smart automation, energy-efficient banding technologies are innovative solutions introduced by companies to improve accuracy and operational efficiency. Banding solutions: Paper, plastic and biodegradable banding solutions that optimize logistics, retail, food packaging, and pharmaceutical applications.

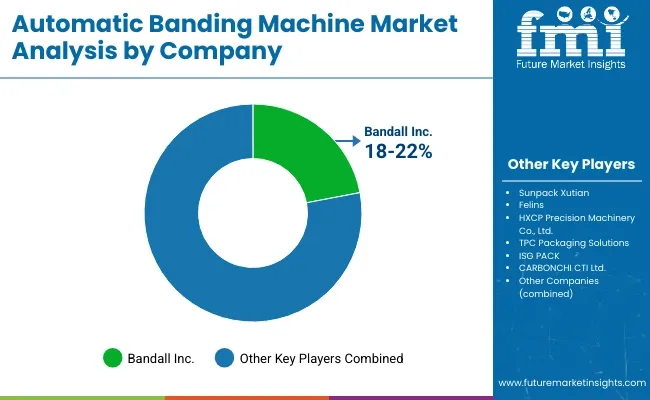

Bandall Inc. (18-22%)

Bandall Inc. leads the market with eco-friendly, precision banding solutions, integrating biodegradable banding materials and smart automation.

Sunpack Xutian (12-16%)

Sunpack Xutian develops customizable high-speed banding systems, optimizing banding efficiency for industrial packaging.

Felins (10-14%)

Felins specializes in sustainable, heat-sealed banding machines, offering smart automation for retail and food packaging.

HXCP Precision Machinery Co., Ltd. (8-12%)

HXCP enhances sensor-based banding technology, ensuring secure tension control and automated band feed.

TPC Packaging Solutions (7-11%)

TPC integrates AI-driven banding automation, improving packaging efficiency for large-scale industries.

ISG PACK (6-10%)

ISG PACK produces compact banding machines, ideal for pharmaceutical and food processing applications.

CARBONCHI CTI Ltd. (5-9%)

CARBONCHI innovates IoT-powered banding machines, enhancing automated tension monitoring and precision control.

Bandpak (4-8%)

Bandpak provides portable and modular banding solutions, catering to e-commerce, logistics, and bulk packaging sectors.

EAM-MOSCA CORPORATION (3-7%)

EAM-MOSCA delivers automated plastic and paper banding systems, integrating smart material tracking.

StraPack, Corp. (3-6%)

StraPack enhances heavy-duty automatic banding machines, optimizing high-speed industrial packaging.

Other Key Players (30-40% Combined)

Emerging companies introduce AI-integrated banding, biodegradable material innovations, and energy-efficient automation. Notable players include:

The overall market size for the Automatic Banding Machine Market was USD 3.8 Billion in 2025.

The Automatic Banding Machine Market is expected to reach USD 5.6 Billion in 2035.

The demand is driven by increasing automation in packaging, rising e-commerce activities, growing demand for efficient product bundling, and stringent regulations on sustainable packaging solutions.

The top 5 countries driving market growth are USA, UK, Europe, Japan, and South Korea.

Automatic Banding Machines is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weapons Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Goat Waterer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Automatic Content Recognition Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dicing Saw Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Paper Cutter Market Size, Trends, and Forecast 2025 to 2035

Automatic Gearbox Valves Market Growth - Trends & Forecast 2025 to 2035

Automatic Door Control Market Analysis - Size, Share & Forecast 2025 to 2035

Automatic Tire Inflation System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA