The liquid carton packaging market is experiencing steady growth driven by the rising demand for sustainable, convenient, and lightweight packaging solutions across the beverage and food industries. Increasing consumer awareness regarding environmental protection and recyclability is pushing manufacturers to invest in eco-friendly designs and renewable material sourcing.

Current market dynamics reflect a growing preference for aseptic and shelf-stable packaging formats that enhance product safety and extend shelf life. Technological advancements in barrier coatings, sealing techniques, and digital printing have improved both the functional and aesthetic aspects of liquid cartons.

The future outlook is supported by strong demand from the dairy and non-alcoholic beverage sectors, coupled with ongoing innovation in material combinations that reduce carbon footprint Growth rationale is founded on the consistent shift toward renewable packaging substrates, enhanced filling line efficiency, and evolving consumer expectations for sustainable product presentation, positioning the market for continued expansion across developed and emerging economies.

| Metric | Value |

|---|---|

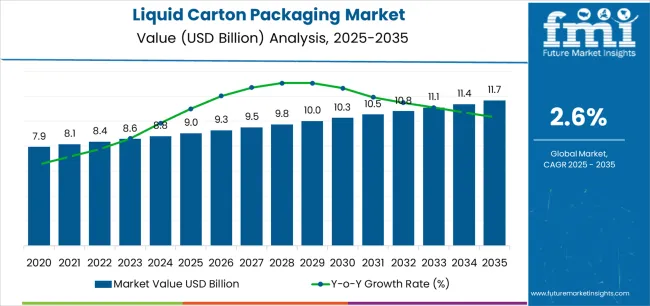

| Liquid Carton Packaging Market Estimated Value in (2025 E) | USD 9.0 billion |

| Liquid Carton Packaging Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

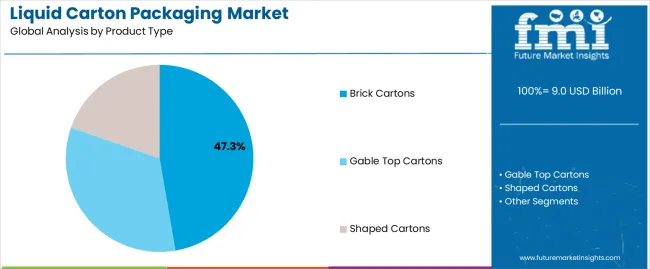

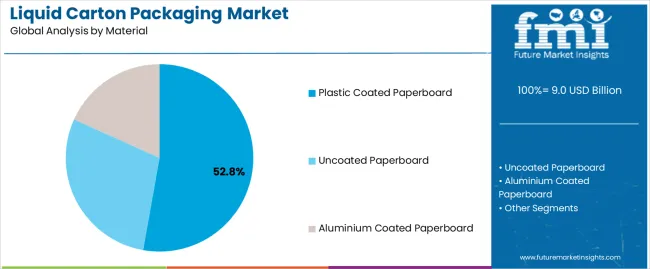

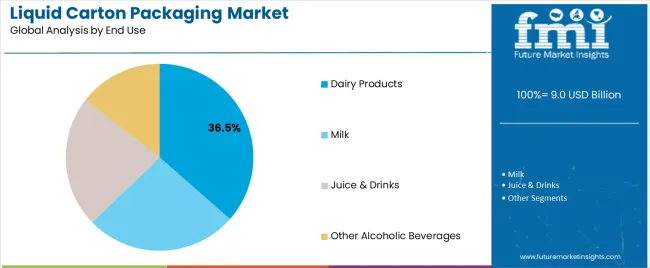

The market is segmented by Product Type, Material, and End Use and region. By Product Type, the market is divided into Brick Cartons, Gable Top Cartons, and Shaped Cartons. In terms of Material, the market is classified into Plastic Coated Paperboard, Uncoated Paperboard, and Aluminium Coated Paperboard. Based on End Use, the market is segmented into Dairy Products, Milk, Juice & Drinks, and Other Alcoholic Beverages. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The brick cartons segment, accounting for 47.30% of the product type category, is leading the market due to its high structural integrity, cost efficiency, and widespread use in packaging milk, juices, and other liquid foods. Its dominance is reinforced by compatibility with automated filling systems and suitability for high-volume production lines.

The segment benefits from its ability to maintain product freshness while offering efficient space utilization during transport and storage. Technological improvements in sealing and printing have enhanced product shelf appeal and brand differentiation.

The growing popularity of aseptic packaging formats within brick carton designs is further strengthening adoption in global markets Continued advancements in recyclability and lightweighting are expected to sustain the segment’s leadership and ensure consistent revenue contribution throughout the forecast period.

The plastic coated paperboard segment, representing 52.80% of the material category, holds a leading position due to its superior moisture and oxygen barrier properties that ensure product preservation and safety. The material’s adaptability in forming multi-layered structures provides enhanced durability and printability, supporting both product protection and visual branding.

Its market dominance is driven by increased use in recyclable and renewable packaging formats that meet sustainability standards. Ongoing innovation in bio-based coatings and advanced lamination processes has improved the recyclability profile of plastic coated paperboard, aligning with global sustainability goals.

The segment’s continued growth is supported by regulatory encouragement toward eco-efficient materials and by brand owners’ efforts to replace traditional plastic packaging with renewable, fiber-based alternatives.

The dairy products segment, holding 36.50% of the end use category, remains the primary driver of market demand owing to the consistent consumption of milk, flavored dairy beverages, and yogurt-based drinks. Its prominence is sustained by the hygienic and protective qualities of liquid cartons, which ensure extended shelf life and safe distribution under varying temperature conditions.

Increasing demand for portion-controlled and single-serve dairy packaging formats has accelerated carton adoption among producers. The segment’s performance is further supported by the growth of organized retail and e-commerce distribution, facilitating wider accessibility of packaged dairy items.

Continued innovation in aseptic packaging technology, coupled with sustainability-focused design trends, is expected to reinforce the dominance of the dairy products segment within the liquid carton packaging market.

Brick cartons are firm in their position at the top of the product type segment. Dairy products are the predominant products encased in liquid carton packaging.

For 2025, brick cartons are expected to account for 53.4% of the market share by product type. Some of the key drivers for the increasing use of brick cartons are:

| Attributes | Details |

|---|---|

| Top Product Type | Brick Cartons |

| Market Share (2025) | 53.4% |

Dairy product use of liquid carton packaging is anticipated to account for 61.4% of the market share in 2025. Some of the key drivers for the progress of liquid carton packaging in the dairy industry include:

| Attributes | Details |

|---|---|

| Top End Use | Dairy Products |

| Market Share (2025) | 61.4% |

The mammoth nature of the food and beverage industry helps the market’s prospects in the Asia Pacific. The encouragement given to the packaging industry in the region is also helping the market’s cause in the Asia Pacific.

European tendency to consume packaged food and beverages is conducive to the growth of the market. The rising disposable income of the region is also infesting the market with positivity.

| Countries | CAGR |

|---|---|

| India | 4.8% |

| Thailand | 3.1% |

| China | 4.0% |

| South Korea | 2.4% |

| Spain | 2.2% |

The market is set to register a CAGR of 4.8% in India for the forecast period. The key drivers for growth are:

The CAGR for liquid carton packaging in Thailand is tipped to be 3.1% over the forecast period. Some of the key factors driving the growth are:

The CAGR for liquid carton packaging in China is tipped to be 4.0% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 2.4% in South Korea for the forecast period. Some of the key trends include:

The market is expected to register a CAGR of 2.2% in Spain over the forecast period. Some of the key trends include:

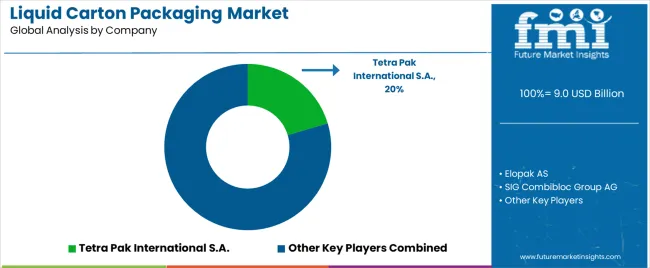

The liquid carton packaging market is highly fragmented. Both established companies and newer players are looking to make a name for themselves in the competitive landscape of liquid carton packaging.

Collaborations and mergers are common in the market. Acquisitions and facility expansions are common sights in the country.

Recent Developments in the Liquid Carton Packaging Market

The global liquid carton packaging market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the liquid carton packaging market is projected to reach USD 11.7 billion by 2035.

The liquid carton packaging market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in liquid carton packaging market are brick cartons, gable top cartons and shaped cartons.

In terms of material, plastic coated paperboard segment to command 52.8% share in the liquid carton packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Liquid Carton Packaging

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA