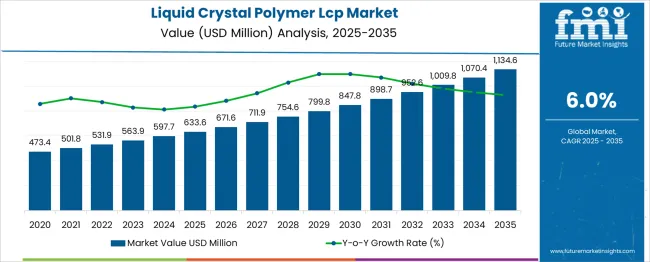

The Liquid Crystal Polymer (LCP) Market is estimated to be valued at USD 633.6 million in 2025 and is projected to reach USD 1134.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The liquid crystal polymer (LCP) market is projected to create an absolute gain of USD 501 million and achieve a growth multiplier of 1.79x over the forecast period. Supported by a steady CAGR of 6%, this growth is driven by expanding demand for high-performance materials in automotive electronics, 5G infrastructure, and consumer electronics. In the first five years (2025–2030), the market will rise from USD 633.6 million to USD 847.8 million, adding USD 214.2 million, which accounts for 42.7% of the total incremental gain, with a 5-year multiplier of 1.34x.

The second phase (2030–2035) contributes USD 286.8 million, representing 57.3% of incremental growth, reflecting accelerating adoption in electric vehicle components, lightweight connectors, and high-frequency communication devices. Annual increments increase from USD 38 million in early years to over USD 64 million by 2035, highlighting sustained momentum in miniaturized and thermally stable components. Manufacturers focusing on cost-efficient processing, bio-based LCP variants, and global supply chain expansion will be positioned to capture the largest share of this USD 501 million opportunity, as demand for advanced polymers continues to rise across technology-driven industries.

| Metric | Value |

|---|---|

| Liquid Crystal Polymer (LCP) Market Estimated Value in (2025 E) | USD 633.6 million |

| Liquid Crystal Polymer (LCP) Market Forecast Value in (2035 F) | USD 1134.6 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The liquid crystal polymer (LCP) market is experiencing strong momentum, supported by the increasing demand for high-performance materials in precision engineering and electronic applications.

Current dynamics are being shaped by rapid advancements in miniaturized components, rising adoption of 5G infrastructure, and the integration of LCP in semiconductor packaging due to its thermal stability, chemical resistance, and dielectric properties.

Demand growth is further reinforced by expanding automotive electronics, where lightweight and heat-resistant materials are essential for next-generation vehicles. Manufacturers are investing in process optimization and scaling up production capacities to ensure consistent supply while addressing stringent regulatory and performance requirements. The future outlook is defined by the material’s expanding role in advanced circuit boards, connectors, and flexible devices, combined with growth in consumer electronics and communication technologies. The underlying growth rationale is its unmatched material profile, which aligns with evolving industrial needs for durability, efficiency, and precision, ensuring sustained revenue expansion and broader adoption across critical technology-driven sectors.

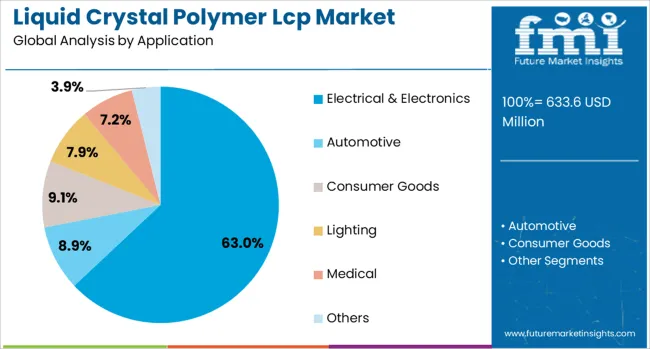

The liquid crystal polymer (LCP) market is segmented by application and geographic regions. By application, the liquid crystal polymer (LCP) market is divided into Electrical & Electronics, Automotive, Consumer Goods, Lighting, Medical, and others. Regionally, the liquid crystal polymer (LCP) industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electrical and electronics segment, holding 63.0% of the application category, has maintained dominance due to the widespread utilization of LCP in high-frequency connectors, printed circuit boards, and semiconductor components.

Its share has been reinforced by the material’s superior dielectric strength, dimensional stability, and resistance to extreme environmental conditions, making it highly suitable for miniaturized and high-speed electronic devices.

Growth has been sustained by the rising penetration of 5G networks, wearable technology, and automotive electronics, where signal integrity and thermal management are critical. Manufacturers have expanded adoption by developing tailored LCP grades that meet evolving industry standards, enhancing both performance and cost-efficiency. Supply security and quality assurance are being prioritized through advanced compounding processes and partnerships with leading electronics producers. Looking forward, the segment’s dominance is expected to remain intact as demand from next-generation communication systems, semiconductor innovations, and precision consumer devices continues to accelerate, further consolidating the electrical and electronics category as the primary growth engine of the LCP market.

The liquid crystal polymer market is expanding due to its superior electrical and thermal properties, which make it indispensable in electronics and automotive sectors. Growth in 2024 and 2025 was driven by rising demand for high-frequency connectors, miniaturized components, and thermal management solutions in 5G infrastructure. Opportunities are emerging in medical devices and EV components where heat resistance and dimensional stability are crucial. Key trends include the development of eco-compliant LCP grades and integration with metal replacement applications. However, high production costs and limited recyclability remain significant constraints for widespread adoption globally.

The primary growth driver is the increasing adoption of LCP in electronics due to miniaturization and performance requirements. In 2024 and 2025, manufacturers widely used LCP in high-frequency connectors, 5G antennas, and semiconductor packaging for its low dielectric constant and thermal stability. Automotive electronics also contributed to demand, particularly in radar sensors and control modules. The material’s capacity to maintain dimensional stability under heat and chemical exposure positioned it as a preferred choice in precision engineering. These developments indicate that the need for compact, high-performance components will continue to shape LCP demand globally.

Significant opportunities exist in electric vehicle components and medical device manufacturing. In 2025, EV platforms increasingly incorporated LCP for battery connectors and inverter housings, where lightweight properties and heat resistance are critical. The medical sector embraced LCP for precision surgical instruments and diagnostic equipment requiring biocompatibility and sterilization resistance. Additional potential emerged in renewable energy systems and wearable electronics. These factors suggest that suppliers focusing on niche applications demanding high mechanical strength and chemical resilience are well positioned to secure long-term growth in this specialty polymer segment.

Emerging trends include the development of eco-compliant formulations and high-performance blends to improve versatility. In 2024, leading manufacturers introduced LCP variants compatible with metal replacement applications in aerospace and automotive components. Bio-based LCP options gained early traction among OEMs responding to environmental compliance mandates. Integration with additive manufacturing processes was explored to support rapid prototyping and lightweight structures. These innovations highlight a growing preference for multifunctional materials capable of meeting stringent performance and compliance standards, reinforcing LCP’s role in advanced engineering and high-frequency electronic applications.

Market restraints are shaped by high raw material costs, energy-intensive production processes, and limited recycling options. In 2024 and 2025, cost-sensitive markets delayed adoption due to the premium pricing of LCP compared to conventional engineering plastics. Processing complexities requiring specialized equipment further raised operational expenses for manufacturers. Recycling limitations associated with the polymer’s unique molecular structure created additional compliance and cost challenges in regulated markets. These constraints emphasize the necessity for cost-optimized production, improved material recovery technologies, and broader supply chain integration to enable competitive scalability for LCP products.

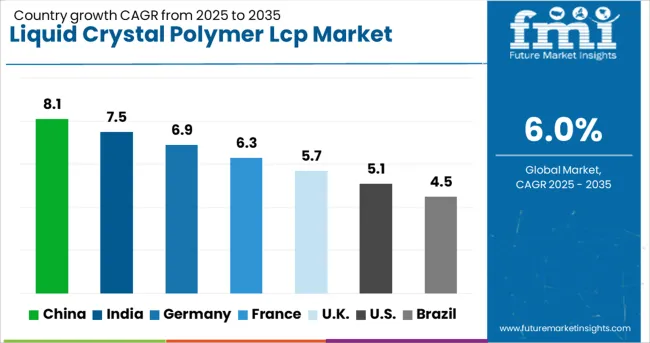

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

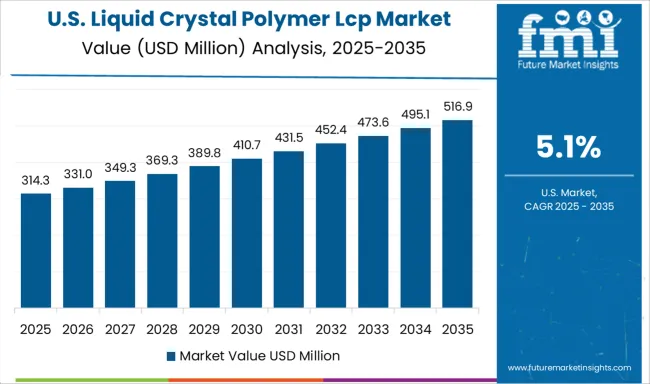

| USA | 5.1% |

| Brazil | 4.5% |

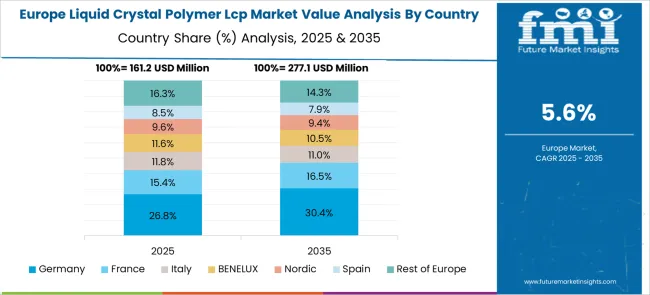

The global liquid crystal polymer (LCP) market is projected to grow at 6.0% CAGR during 2025–2035. China leads at 8.1% CAGR, driven by rapid electronics manufacturing expansion and adoption in automotive components. India follows at 7.5%, supported by increasing demand for lightweight materials in electrical and telecom sectors. Germany posts 6.9% CAGR, emphasizing high-performance engineering plastics for automotive and industrial applications. The United Kingdom grows at 5.7%, while the United States records 5.1%, reflecting steady growth in mature markets prioritizing advanced materials for 5G, aerospace, and medical devices. Asia-Pacific dominates due to large-scale electronics production, while Western markets focus on sustainability, miniaturization, and high-precision molding.

The liquid crystal polymer (LCP) market in China is forecasted to grow at 8.1% CAGR, supported by its leadership in electronics, automotive, and 5G infrastructure manufacturing. High demand for miniaturized connectors, flexible circuits, and high-frequency components strengthens LCP consumption. Domestic producers expand manufacturing capacity to meet global export requirements for electronics. Global players introduce specialty LCP grades for automotive under-the-hood components, ensuring heat and chemical resistance. Integration of LCP in high-speed data cables and antenna systems accelerates adoption in 5G base stations.

The liquid crystal polymer (LCP) market in India is expected to grow at 7.5% CAGR, driven by rapid digitalization, rising 5G investments, and increased production of automotive electronics. Demand for lightweight engineering plastics in electric vehicles (EVs) boosts LCP integration in battery components and thermal barriers. Domestic manufacturers collaborate with global suppliers to develop cost-effective LCP grades for telecom and consumer electronics. Growth in wearable devices and high-performance medical equipment strengthens market penetration across specialized applications.

The liquid crystal polymer (LCP) market in Germany is forecasted to grow at 6.9% CAGR, supported by demand for high-precision molding in automotive, medical, and industrial equipment sectors. EU sustainability regulations promote the use of recyclable, high-performance plastics, influencing LCP product innovation. Automotive OEMs adopt LCP for lightweight components to enhance fuel efficiency and meet emission targets. Manufacturers develop eco-compliant LCP formulations to align with circular economy initiatives, while industrial automation and robotics applications further drive material adoption.

The liquid crystal polymer (LCP) market in the United Kingdom is projected to grow at 5.7% CAGR, driven by demand in medical devices, electronics, and aerospace applications. LCP’s biocompatibility supports adoption in surgical instruments and implantable devices. Growth in advanced telecommunications and data transmission systems accelerates the use of LCP-based connectors and high-frequency components. Manufacturers focus on developing specialty grades for high-temperature performance and enhanced durability. Increased R&D spending fosters innovation in recyclable LCP materials for sustainable product lines.

The liquid crystal polymer (LCP) market in the United States is forecasted to grow at 5.1% CAGR, reflecting mature yet steady adoption in critical sectors. LCP usage rises in aerospace components requiring high strength-to-weight ratios and resistance to extreme conditions. Automotive applications increase as OEMs adopt advanced polymers for electric and hybrid vehicles. Electronics and semiconductor manufacturers prioritize LCP for miniaturized connectors and advanced circuit components in 5G and IoT devices. Focus on clean manufacturing and compliance with environmental regulations drives innovation in eco-friendly LCP materials.

The liquid crystal polymer market is dominated by Celanese, which secures its leadership through a comprehensive portfolio of high-performance LCP materials designed for electronics, automotive, and industrial components requiring superior thermal and chemical resistance.

Celanese strengthens its dominant position by leveraging global manufacturing capabilities, strong technical support, and continuous investment in material innovation for miniaturized electronic components. Key players such as Solvay, Sumitomo, Polyplastics Co., and Toray International hold significant shares by delivering LCP grades optimized for high-frequency connectors, precision parts, and lightweight structural applications. These companies emphasize dimensional stability, high flow characteristics, and compliance with demanding industry standards, making them preferred suppliers for critical end-use sectors. Emerging players including Kuraray and RTP Co. are expanding their footprint by offering customized LCP formulations and targeting niche applications such as automotive sensors, 5G components, and medical devices. Their strategies include enhancing processing efficiency, improving mechanical properties, and addressing specialized customer requirements through tailored solutions. Market growth is driven by increasing demand for miniaturized electronics, high-performance connectors, and components capable of withstanding extreme operating conditions in automotive and consumer electronics. Ongoing advancements in LCP processing technology and the integration of recycled and eco-friendly variants are expected to shape future competitive dynamics globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 633.6 Million |

| Application | Electrical & Electronics, Automotive, Consumer Goods, Lighting, Medical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Celenese, Solvay, Sumitomo, Polyplastics Co., Toray International, Kuraray, and RTP Co. |

| Additional Attributes | Dollar sales by grade (high-flow, puncture-resistant, flame-retardant) and application (electronics, automotive, medical). Segmentation by format (pellets, films, molded parts) and channel (resin suppliers, OEMs). Asia-Pacific dominates demand, driven by 5G and miniaturized connectors. Innovations include filler-reinforced LCPs, recyclable blends, and flexible electronics for next-gen consumer and industrial applications. |

The global liquid crystal polymer (LCP) market is estimated to be valued at USD 633.6 million in 2025.

The market size for the liquid crystal polymer (LCP) market is projected to reach USD 1,134.6 million by 2035.

The liquid crystal polymer (LCP) market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in liquid crystal polymer (LCP) market are electrical & electronics, automotive, consumer goods, lighting, medical and others.

In terms of , segment to command 0.0% share in the liquid crystal polymer (LCP) market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Breakfast Products Market Size and Share Forecast Outlook 2025 to 2035

Liquid Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Waste Container Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA