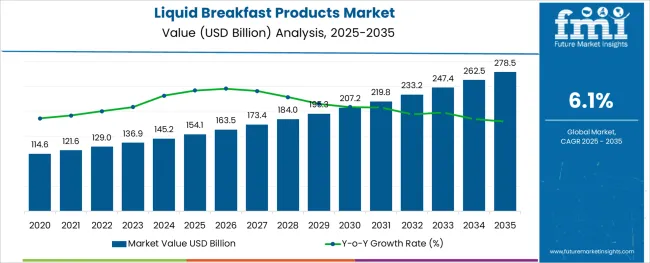

The Liquid Breakfast Products Market is estimated to be valued at USD 154.1 billion in 2025 and is projected to reach USD 278.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The liquid breakfast products market is experiencing steady growth driven by the increasing pace of modern lifestyles, growing awareness of functional nutrition, and the global shift toward on-the-go food consumption. Consumers are increasingly opting for nutrient-dense, ready-to-drink alternatives that align with wellness goals, meal-skipping habits, and dietary personalization. The demand for plant-based proteins, fiber-enriched formulations, and clean-label ingredients is reshaping product development strategies.

Simultaneously, innovations in aseptic processing and cold chain logistics are enhancing shelf-life and quality retention of liquid breakfast offerings.

Regulatory encouragement of health claims and the expansion of premium product lines are also contributing to market expansion. As digital grocery and health-focused retail formats gain traction, the liquid breakfast market is expected to witness sustained adoption across urban and semi-urban consumer segments globally.

The market is segmented by Product Type, Packaging Type, and Distribution Channel and region. By Product Type, the market is divided into Liquid Breakfast and Spoonable Breakfast. In terms of Packaging Type, the market is classified into Carton Packaging, Pouches, Cups & Tubs, Bottles, and Cans.

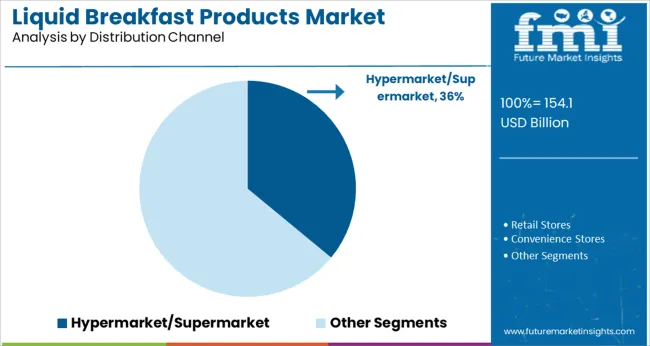

Based on Distribution Channel, the market is segmented into Hypermarket/Supermarket, Retail Stores, Convenience Stores, Online Selling, and Other Retail Formats. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Liquid breakfast products are projected to account for 42.0% of the total revenue in the liquid breakfast products market by 2025, making it the leading product type segment. This position is being driven by the increasing demand for time-saving, nutritious meal solutions that do not compromise on flavor or quality.

Liquid breakfast formats are designed to deliver essential macro- and micronutrients in a convenient, portable form, making them ideal for busy consumers, students, and working professionals. These products are often fortified with proteins, vitamins, and minerals, offering functional benefits such as energy boost, weight management, or digestive health.

The rising popularity of vegan and lactose-free options is also contributing to growth within this segment. With consumers favoring meal replacements that fit into fitness and wellness lifestyles, liquid breakfast offerings are gaining preference across both mainstream and niche nutritional categories.

Carton packaging is projected to hold a 38.0% revenue share in the liquid breakfast products market in 2025, establishing itself as the dominant packaging format. The widespread adoption of carton-based solutions is being driven by their sustainability, ease of branding, and superior barrier properties for preserving taste and nutritional content. Carton packages support aseptic filling and extended shelf life, which are essential for distribution across diverse retail environments.

Their lightweight, recyclable composition makes them attractive to both consumers and manufacturers focused on reducing environmental impact. Additionally, cartons provide a printable surface that enables effective communication of health claims, ingredient transparency, and product benefits key factors influencing consumer decisions.

The rise of eco-conscious purchasing behaviors and regulatory alignment toward circular packaging systems have further reinforced the position of cartons in the liquid breakfast value chain.

Hypermarkets and supermarkets are projected to account for 36.0% of the total revenue in the liquid breakfast products market in 2025, making this channel the leading segment for product distribution. This dominance is being attributed to the broad product visibility, extensive SKU variety, and promotional flexibility that these large-format retail environments offer.

Consumers often rely on supermarkets for regular grocery shopping, where health and convenience products like liquid breakfasts benefit from impulse and cross-merchandising placements. Enhanced shelf space, in-store tastings, and bundling promotions also contribute to consumer trial and repeat purchases.

Moreover, the growing penetration of private-label functional beverages in supermarket chains is reinforcing category presence. As urban retail infrastructure expands and health-focused consumer behavior becomes mainstream, hypermarkets and supermarkets continue to serve as critical access points for high-frequency, high-volume distribution of liquid breakfast products.

The most profitable liquid breakfast products segment is the spoonable breakfast segment, which will represent more than USD 145.2 Billion of the global market in 2024. By the end of 2035, the market will reach USD 103 billion with a 6.1% annual growth rate.

Western Europe was the largest market for liquid breakfast products, likely to reach 26.8% of the global revenue share by 2035.

This segment is estimated to be worth about USD100 Billion by the end of 20252, representing an opportunity of more than USD 2.800 Billion in 2024 alone and an incrementally growing opportunity of more than USD 45 Million between 2024 and 2035. The liquid breakfast segment is expected to be worth about 45% by the end of 2035.

Young people today are oriented increasingly toward the food that they eat. Consumers demand products that satisfy their taste, are healthy, and are natural, pure, and eco-friendly with the non-GMO label as they like choosing foods featuring specific ingredients without side effects. For example, in response to increasing consumer demand for natural and authentic yogurt, dairy ingredients are focusing on the development of ingredients that are assisting yogurt producers to produce lactose-free and clean-label products.

Another factor that is fuelling the demand for spoonable breakfast that includes yogurt among American consumers is the indulgence aspect. Yogurt has become a bite to eat high in both calories and carbohydrate content as a result of its attractively smooth, creamy texture, and continues to be a mainstay as a breakfast dish due to its versatility, convenience, and high nutrition content. The flavor is the key factor responsible for people's craving for yogurt across the globe.

A significant number of Latin Americans are greatly dependent on the consumption of ready-to-eat brekkie food which is also sometimes discovered to be low in fat. Consumers across this region are usually seen buying the top low-fat foodstuffs available as part of their breakfast meals. This will improve sales of packaged liquid breakfast products, such as spoonable and drinkable yogurt, milk, and cereal-based liquid breakfast drinks, as well as other liquid breakfast product categories throughout the region.

Manufacturers of breakfast drinks that are fluid are targeting markets in the Asia Pacific Area in hopes of maximizing profitability. For this reason, they're likewise leveraging demographic patterns due to the increasing general trend of healthier breakfast drinks.

As an example, in 2020, PepsiCo, Inc., a multinational producer of food and beverage products, invested heavily to expand its presence in the Asia-Pacific region by opening a facility in China. It is with this new line of Quaker products that the company plans to develop and market instant oatmeal, quickly-cooked oatmeal, and Quaker's cereal powder drink to match market demand in the region.

Liquid breakfast product sales are predicted to witness robust growth during the upcoming decade, as an increasing number of children have commenced eating solid food. Revenue from the sale of liquid breakfast products in 2012 and 2020 totaled more than USD 80 Billion and more than USD 95 Billion, respectively.

By 2035 end, the global liquid breakfast products market is expected to reach a market value of more than USD 154.1 Million, expanding at a CAGR of 6.1% over the forecast period 2025 to 2035.

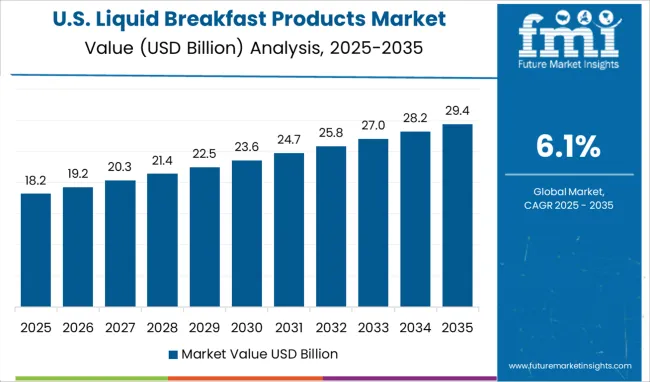

The USA liquid breakfast products market is expected to grow at a CAGR of 5.4% during the forecast period. The market is driven by the health benefits associated with liquid breakfast products, such as improved digestion and weight management. In addition, the growing demand for on-the-go breakfast options is also fueling the growth of the liquid breakfast products market in the United States.

The Indian liquid breakfast products market has seen significant growth in the past few years. With the growing health consciousness among people, there has been an increase in the demand for healthy and nutritious breakfast products. Liquid breakfast products are convenient to consume and easily digestible, which makes them a popular choice among people.

the Chinese market for liquid breakfast products has grown rapidly. This is due to the rising health consciousness among Chinese consumers and their desire for convenient, healthy, and affordable breakfast options. Market players are now targeting China as a key growth market for liquid breakfast products. To tap into this growing market, companies need to understand the preferences of Chinese consumers.

For example, many Chinese prefer breakfast beverages that are high in protein and low in sugar. They also seek out products that are convenient to consume on the go. In addition, price is a key consideration for Chinese consumers when purchasing liquid breakfast products.

In Japan, the liquid breakfast products market is growing at the fastest pace. This can be attributed to the changing lifestyles of the Japanese people. They are now more health conscious and are looking for convenient and healthy breakfast options.

The liquid breakfast products are a perfect solution for them as they are easy to consume and are packed with nutrients. The Japanese people are also increasingly working long hours and do not have time to cook a proper breakfast. The liquid breakfast products provide them with the energy and nutrition they need to start their day.

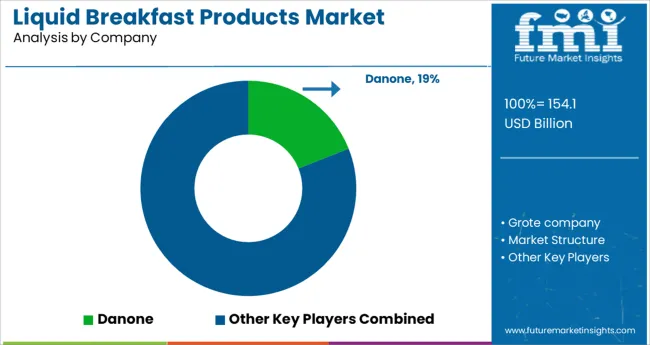

The global market for food trays is incredibly fragmented and competitive due to the existence of several local and regional rivals. Key players employ a range of marketing strategies, such as partnerships, expansions, mergers and acquisitions, and collaborations.

Some of the leading companies operating in the food trays market are Sanitarium Health & Wellbeing, Danone, The Hain Daniels Group Limited, Campbell Soup Company, Tio Gazpacho LLC, Soupologie Limited, Kellogg Co., MOMA Foods, Weetabix Ltd., Nestle S.A., General Mills Inc., Quaker Oats Company, Müller UK & Ireland, Chobani, LLC, The Kraft Heinz Company, The Billington Group.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa |

| Key Countries Covered | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Packaging Type, Distribution Channel, Region |

| Key Companies Profiled | Grote company; Market Structure; Sanitarium Health & Wellbeing; Danone; The Hain Daniels Group Limited; Campbell Soup Company; Tio Gazpacho LLC; Soupologie Limited; Kellogg Co.; MOMA Foods; Weetabix Ltd.; Nestle S.A.; General Mills Inc.; Quaker Oats Company; Müller UK & Ireland; Chobani, LLC; The Kraft Heinz Company; The Billington Group |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global liquid breakfast products market is estimated to be valued at USD 154.1 billion in 2025.

It is projected to reach USD 278.5 billion by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are liquid breakfast, _milk and cereal based breakfast, _drinkable yogurt, _vegetable liquid soup, _chilled soup and spoonable breakfast.

carton packaging segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA