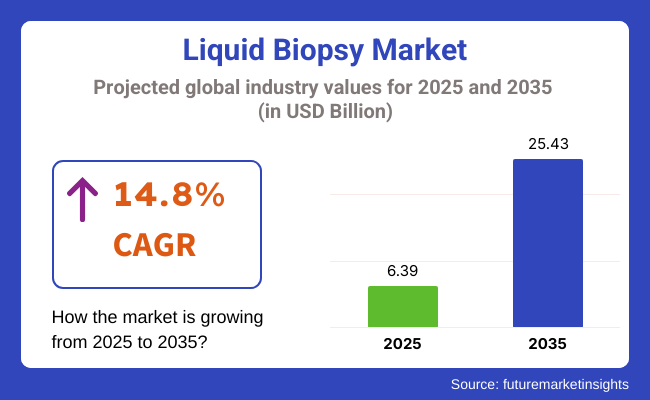

The global liquid biopsy market is estimated to be valued at USD 6.39 billion in 2025 and is projected to reach USD 25.43 billion by 2035 at a CAGR of 14.8% over the forecast period. Key factors contributing to this growth include the rising prevalence of cancer, advancements in next-generation sequencing (NGS) technologies, and the growing emphasis on personalized medicine.

Liquid biopsies offer real-time monitoring of tumor dynamics, enabling early detection and treatment adjustments, which enhances patient outcomes and reduces healthcare costs. The integration of artificial intelligence (AI) in analyzing circulating tumor DNA (ctDNA) and other biomarkers further augments the diagnostic accuracy and utility of liquid biopsies.

A significant technological advancement in this period is the integration of AI with CRISPR genome editing in liquid biopsy applications. AI tools have accelerated the discovery of gene-editing proteins and predicted heat-tolerant RNA molecules, enhancing therapy delivery and biomanufacturing processes.

Prominent players in the liquid biopsy market include Guardant Health, Natera, Exact Sciences, Illumina, and Roche. These companies are actively engaged in expanding their product portfolios and enhancing technological capabilities to meet the growing demand. Manufacturers have been actively launching novel tests and next-generation platforms to expand clinical utility and improve detection sensitivity.

Labcorp® in 2025 launches Plasma Detect™ for clinical use to detect the risk of risk of recurrence in stage III colon cancer patients. As stated by Shakti Ramkissoon, Vice President, Oncology at Labcorp. Similarly, Natera, Inc. announced its launch of Ultra-Sensitive Signatera™ Genome MRD Test in 2025 for clinical research use and uses ctDNA to detect and quantify cancer left in the body, identify recurrence earlier than standard of care tools.

These innovations are focused on broadening indications beyond oncology to prenatal and transplant diagnostics, thus driving adoption. Manufacturers are also integrating AI and automation to improve scalability and reduce turnaround time. As regulatory approvals increase and reimbursement frameworks evolve, these activities are expected to significantly expand market penetration across both high-income and emerging economies.

North America continues to dominate the demand for liquid biopsy. The region's growth is propelled by a well-established healthcare infrastructure, high adoption rates of advanced diagnostic technologies, and supportive regulatory frameworks. The increasing prevalence of cancer and the emphasis on early detection and personalized medicine further drive market expansion. Europe also holds a substantial share of the liquid biopsy market, with growth driven by rising cancer incidence rates and the implementation of innovative diagnostic solutions.

The integration of liquid biopsies into national healthcare systems, such as the NHS in the UK, exemplifies the region's commitment to adopting cutting-edge technologies. In January 2025, the NHS expanded its National Genomic Test Directory to include ESR1 circulating tumor DNA (ctDNA) testing for breast cancer patients. This milestone enables oncologists to detect ESR1 mutations through a simple blood test, guiding personalized treatment strategies for patients with estrogen receptor (ER)-positive, HER2-negative locally advanced or metastatic breast cancer.

Circulating tumor cells (CTCs) are set to lead the demand for liquid biopsy with over 70% revenue share in 2025 due to their utility in early detection and treatment monitoring. Blood samples remain the preferred sample type, capturing 87.4% share, driven by their accessibility, high biomarker yield, and compatibility with advanced diagnostics.

In 2025, circulating tumor cells (CTCs) are projected to account for over 70.0% of global liquid biopsy market revenue by biomarker type. Their widespread clinical adoption is attributed to their non-invasive nature and their ability to provide real-time insights into tumor dynamics. Present in peripheral blood, CTCs allow continuous molecular profiling, eliminating the need for invasive tissue biopsies during cancer treatment and follow-up.

The segment's growth is strongly supported by technological progress in CTC enrichment and detection. Innovations in microfluidics, immunomagnetic separation, and single-cell analysis have significantly improved detection rates, especially for early-stage cancers. Regulatory approvals for CTC-based assays have expanded their acceptance in clinical workflows.

Collaboration between academic research institutes and diagnostic technology providers is accelerating innovation. With rising global focus on precision oncology, CTCs are increasingly being integrated into personalized medicine protocols. Their proven relevance across multiple cancer types-such as breast, prostate, and lung-reinforces their market leadership through 2035.

Blood samples are expected to dominate the liquid biopsy market in 2025, holding an estimated 87.4% revenue share by sample type. This is primarily due to their ease of collection, minimal invasiveness, and high compatibility with next-generation sequencing (NGS) and digital PCR platforms. Blood has consistently provided a rich source of ctDNA, CTCs, and exosomes, enabling multi-biomarker analysis from a single sample.

The increased accuracy of blood-based diagnostics has supported their widespread use in early cancer detection, longitudinal monitoring, and therapy selection. Regulatory milestones-such as FDA approval of blood-based liquid biopsy panels for early-stage lung and colorectal cancers-have further enhanced credibility and market growth.

Leading diagnostic companies are prioritizing multiplex assay development and expanding access through improved insurance reimbursement frameworks. Clinicians are increasingly choosing blood-based approaches for repeat sampling, particularly when monitoring treatment response or resistance. As non-invasive diagnostics gain traction in clinical oncology, blood samples will continue to anchor the liquid biopsy ecosystem across both developed and emerging healthcare markets.

The liquid biopsy market is advancing rapidly due to the growing demand for non-invasive cancer diagnostics, rising adoption of personalized medicine, and strong regulatory support. However, high test costs and limited clinical validation across cancer types continue to challenge broader adoption and long-term cost-effectiveness in real-world settings.

Rising Demand for Non-Invasive Cancer Diagnostics Accelerates Liquid Biopsy Adoption

Liquid biopsy has emerged as a game-changing technology in oncology, offering real-time, non-invasive access to tumor dynamics through blood and other biofluids. Patients benefit from reduced procedural risk, while clinicians gain actionable molecular insights for disease monitoring and therapy guidance. By 2025, blood-based liquid biopsy is projected to account for 87.4% of total market revenue, driven by its ease of collection and patient compliance.

With early detection being crucial for successful outcomes, circulating tumor cells (CTCs) and ctDNA assays are increasingly integrated into diagnostic workflows. A 2024 statement from Guardant Health's CEO highlighted that liquid biopsy brings us closer to precision oncology that’s accessible, timely, and repeatable, without waiting for surgical biopsies. As the pipeline of FDA-approved blood-based assays expands, adoption in both hospital settings and outpatient clinics is expected to grow significantly.

Personalized Medicine and Targeted Therapies Fuel Clinical Demand for Liquid Biopsy

The shift toward individualized treatment regimens has increased reliance on biomarker-driven diagnostics. Liquid biopsy enables longitudinal tumor profiling, allowing oncologists to detect mutations, monitor resistance, and adapt therapies accordingly. This is especially valuable in non-small cell lung cancer, colorectal cancer, and breast cancer, where genomic targets evolve over treatment cycles.

Pharma companies are also integrating liquid biopsy into clinical trials to screen patients faster and track response in real time. Regulatory bodies have shown supportive momentum-FDA and EMA approvals for liquid biopsy-based companion diagnostics have grown since 2021, validating their role in precision care. As value-based care models mature, real-time diagnostics that enhance outcomes and reduce costs are gaining traction across healthcare systems.

High Costs and Variable Sensitivity Pose Adoption Barriers

Despite its promise, liquid biopsy adoption is constrained by high testing costs, variability in sensitivity, and limited validation across early-stage cancers. Reimbursement remains uneven across markets, particularly for multi-cancer early detection (MCED) tests, which are still undergoing large-scale validation.

Many liquid biopsy tests currently supplement-not replace-tissue biopsies, which reduces cost-efficiency. Concerns over false negatives and overdiagnosis persist, particularly in cancers with low biomarker shedding. Smaller diagnostic labs also face high infrastructure costs due to the need for NGS platforms and data analytics pipelines.

In a 2024 white paper, industry analysts emphasized that until liquid biopsy demonstrates consistent utility in broad screening with regulatory and payor backing, uptake will remain limited to specific use cases. Balancing clinical utility, scalability, and cost-effectiveness remains the market’s most pressing challenge.

The global liquid biopsy market is expanding across diverse regions, supported by rising cancer incidence, policy-backed diagnostics, and advancements in genomic technologies. The United States and Germany are leveraging innovation and healthcare infrastructure, while India, China, and Brazil are experiencing high-growth trajectories driven by public health programs, affordability, and growing awareness.

The United States liquid biopsy market is projected to expand at a CAGR of 4.4% from 2025 to 2035. Growth is being driven by a combination of high cancer incidence, increased adoption of next-generation sequencing (NGS) technologies, and favorable regulatory support. Substantial investments by NIH and BARDA in oncology diagnostics are encouraging the commercialization of novel blood-based biomarker platforms. Integration of artificial intelligence in data interpretation is further enhancing diagnostic accuracy and clinical relevance.

Patient preference for non-invasive, real-time monitoring tools is also contributing to market momentum. Clinical trials and FDA-approved assays, including Guardant360 and FoundationOne Liquid, are reinforcing adoption in both community and academic settings.

In a 2024 stakeholder roundtable, an executive at Illumina emphasized that liquid biopsy has transitioned from an experimental option to an essential tool in cancer diagnostics, particularly for precision medicine pathways. With ongoing digital health integration and robust payer engagement, the USA market is positioned for sustained growth.

Demand for liquid biopsy in India is forecast to grow at a CAGR of 8.1% between 2025 and 2035. Rising cancer incidence, especially in urban centers, and a growing emphasis on early detection are driving demand for accessible diagnostic tools. Low-cost test development by domestic players has enhanced affordability, making diagnostics more inclusive across economic strata.

Public healthcare initiatives such as Ayushman Bharat and national cancer screening programs are increasing uptake. The rise of telemedicine platforms and digital diagnostics is also improving access in rural and semi-urban areas, supported by mobile blood collection and lab partnerships.

According to a 2025 report by the Indian Council of Medical Research, the demand for liquid biopsy solutions in breast and lung cancer screening is growing rapidly, particularly in tier-2 cities. With expanding infrastructure and digital health innovation, India remains one of the highest-potential markets for liquid biopsy adoption.

Demand for liquid biopsy in China is projected to grow at a CAGR of 7.5% through 2035. Market expansion is being fueled by a large patient population, increased government spending on oncology diagnostics, and rapid deployment of low-cost, high-throughput NGS platforms. National initiatives aimed at cancer prevention and early detection are significantly enhancing accessibility. Leading hospitals and biotech firms are collaborating to bring AI-powered biomarker panels into routine care.

Investments in medical infrastructure and genomic research centers, especially in provinces like Guangdong and Zhejiang, are strengthening the diagnostic landscape. A 2024 policy framework from the National Health Commission emphasized support for multi-cancer early detection (MCED) technologies, validating the role of liquid biopsy in national cancer control strategies. China’s dual focus on affordability and innovation is enabling rapid market penetration across both urban and regional health systems.

The market in Germany is expected to grow at a CAGR of 5.6% from 2025 to 2035. Backed by strong healthcare infrastructure, R&D funding, and precision medicine programs, Germany remains one of the most innovation-driven markets in Europe. The integration of liquid biopsy into oncology diagnostics is being accelerated by collaborations between university hospitals, biotech startups, and academic research centers.

Applications are expanding beyond oncology to include monitoring for recurrence, treatment resistance, and minimal residual disease (MRD). Regulatory clarity and fast-track approvals by BfArM have supported the launch of companion diagnostics for targeted therapies.

In 2024, the Fraunhofer Institute initiated a national study using liquid biopsy for colorectal cancer surveillance, reinforcing clinical adoption. With reimbursement systems in place and rising emphasis on non-invasive monitoring tools, Germany’s market is poised for stable growth and technological leadership.

The liquid biopsy market in Brazil is forecast to grow at a CAGR of 5.9% during 2025 to 2035. Growth is being supported by the government’s efforts to expand oncology services, integrate advanced diagnostics in the public healthcare system, and improve awareness around early detection. Investments in healthcare infrastructure are enabling the rollout of hospital-based diagnostic labs, particularly in metropolitan regions. Partnerships between Brazilian research institutions and global diagnostics firms are also increasing access to validated assays.

However, regional inequality in access remains a challenge. The private sector is leading adoption through premium cancer centers and medical tourism hubs, particularly in São Paulo and Rio de Janeiro. In 2024, a collaboration between Fleury Group and Roche Diagnostics was launched to expand liquid biopsy availability for lung cancer patients. The combination of healthcare expansion, rising disposable income, and public-private initiatives positions Brazil as a growing contributor to the global liquid biopsy landscape.

The liquid biopsy market is characterized by rapid innovation, high clinical value, and evolving competition across diagnostic, biotechnology, and precision oncology domains. The market remains moderately consolidated, with Tier 1 companies leveraging molecular diagnostics portfolios, regulatory expertise, and clinical partnerships to dominate. Market entry is limited by high R&D costs, biomarker validation hurdles, and stringent regulatory pathways, including compliance with CLIA, FDA, and CE-IVD standards.

Tier 1 players such as Guardant Health, Exact Sciences, and Foundation Medicine (Roche) lead the global market with expansive platforms for circulating tumor DNA (ctDNA) detection, companion diagnostics, and early-stage cancer screening. These firms focus on NGS-based multi-cancer detection, AI-assisted interpretation, and payer-backed commercialization models. According to Future Market Insights, Guardant’s expansion of Guardant360 and Guardant Reveal demonstrates strategic scale in minimal residual disease and treatment response monitoring.

Tier 2 companies include Biocept, Freenome, and Lucence Diagnostics, which offer targeted or regional platforms for single-cancer liquid biopsy and emerging detection technologies like methylation and fragmentomics. These companies often partner with academic institutions to refine biomarker panels and enhance clinical utility. Tier 3 firms, including Personal Genome Diagnostics, Chronix Biomedical, and Inivata, address niche markets such as brain tumors, sarcomas, or liquid biopsy for rare cancers, with an emphasis on research-grade solutions and B2B service models.

Key strategic themes across tiers include multi-cancer early detection (MCED), AI-powered variant classification, integration with electronic health records (EHRs), and decentralized laboratory infrastructure. Partnerships with hospital networks, biopharma sponsors, and digital health platforms are increasingly shaping commercialization and scalability. According to Future Market Insights, clinical validation and reimbursement approvals remain critical milestones that define the long-term market leadership hierarchy.

Recent Liquid Biopsy Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6.39 billion |

| Projected Market Size (2035) | USD 25.43 billion |

| CAGR (2025 to 2035) | 14.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Segments Analyzed (Segment 1) | By Biomarker Type: Circulating Tumor Cells (CTCs), Circulating Tumor Nucleic Acids, Exosomes |

| Segments Analyzed (Segment 2) | By Sample Type: Blood, Urine, Others |

| Segments Analyzed (Segment 3) | By End User: Hospitals, Cancer Institutes, Academic Institutes, Diagnostic Centers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Companies Profiled | Guardant Health, Illumina, Inc., Bio-Rad Laboratories, Roche Diagnostics, Natera , Inc., Exact Sciences Corporation, Foundation Medicine, Thermo Fisher Scientific, NeoGenomics Laboratories, Freenome Holdings |

| Additional Attributes | Market share analysis by biomarker and sample type, technological innovation trends, regulatory and reimbursement landscape, emerging MCED test adoption, region-wise opportunity mapping, pricing intelligence, pipeline analysis, and competitive benchmarking |

Circulating Tumor Cells - 70% Market Share in 2025, Circulating Tumor Nucleic Acids, Exosomes

Blood - 87.4% Market Share in 2025, Urine, Others

Hospitals, Cancer Institutes, Academic Institutes and Diagnostic Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global liquid biopsy industry is projected to witness CAGR of 14.8% between 2025 and 2035.

The global Liquid Biopsy industry stood at USD 3,358.8 million in 2024.

The global Liquid Biopsy industry is anticipated to reach USD 25.43 billion by 2035 end.

India is expected to show a CAGR of 8.1% in the assessment period.

The key players operating in the global Liquid Biopsy industry are Guardant Health, Illumina, Inc., Bio-Rad Laboratories, Roche Diagnostics, Natera, Inc., Exact Sciences Corporation, Foundation Medicine, Thermo Fisher Scientific, NeoGenomics Laboratories, Freenome Holdings and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2023

Table 2: Global Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 3: Global Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 4: Global Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 6: North America Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 7: North America Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 8: North America Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 10: Latin America Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 11: Latin America Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 12: Latin America Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 14: Western Europe Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 15: Western Europe Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 16: Western Europe Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 26: East Asia Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 27: East Asia Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 28: East Asia Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2023

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Marker Type, 2018 to 2023

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Sample Type, 2018 to 2023

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Application Type , 2018 to 2023

Figure 1: Global Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2023

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 9: Global Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 12: Global Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 15: Global Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 17: Global Market Attractiveness by Marker Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Sample Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Application Type , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 29: North America Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 32: North America Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 35: North America Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 37: North America Market Attractiveness by Marker Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Sample Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Application Type , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Marker Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Sample Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application Type , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Marker Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Sample Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Application Type , 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Marker Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Sample Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Application Type , 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Marker Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Sample Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Application Type , 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 137: East Asia Market Attractiveness by Marker Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Sample Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Application Type , 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Marker Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Application Type , 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2023

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Marker Type, 2018 to 2023

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Marker Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Marker Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Sample Type, 2018 to 2023

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Application Type , 2018 to 2023

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Application Type , 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application Type , 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Marker Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Sample Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Application Type , 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA