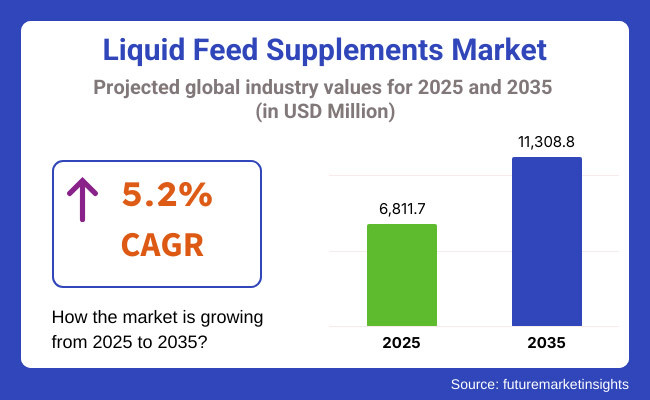

The global liquid feed supplements market is projected to reach a valuation of USD 6,811.7 million in 2025 and is anticipated to expand to USD 11,308.8 million by 2035, registering a CAGR of 5.2% over the forecast period.

The sector is mainly influenced by the continuous change in buyer's choice for livestock nutrition with the liquid diets that are high in nutrients, and additives such as functional prebiotics, probiotics, and enzymes all of which are cost-effective other than enhancing digestive health, and feed efficiency. The rise in the popularity of protein-rich products of animal origin has brought a corresponding demand for premium feed ingredients, which has led the companies to increase capacities and experiment with natural ingredient formulations.

The most prominent enterprises, namely Archer Daniels Midland Company, Cargill, Land O’Lakes, and BASF SE, are the most active ones in pouring out funds for the construction of newer production sites and the development of R&D facilities with the sole aim of forming the basis for their operation. Businesses have started dealing with the production of sustainable and organic formulations by using molasses, fish oils, and plant-based extracts in comparison with the previously used synthetic ingredients in response to the growing interest from consumers in natural feed ingredients.

Market consolidation has been a key topic, and companies have been riding on acquisitions and collaborative strategies to further this process. Crossing the line for BASF SE was the cooperation with feed additive experts to raise the nutritional value of liquid feed supplements. Likewise, Land O’Lakes is addressing the challenges by developing tailored feed solutions and integrating AI-based precision feeding methods to guarantee the herd is healthy.

The sector is experiencing a very strong trend that also points to the sustainability drive. With the growing concerns over the overuse of antibiotics and the synthetic additives in the food chain, consumers, along with the regulatory authorities, are coaxing the producers to utilize organic and clean-label formulations. West way Feed Products and Ridley Inc., which are the companies designed on this principle, stepped into the market of enzyme-enhanced and probiotic-infused liquid feeds to pursue the consumer demand for natural, residue-free feed solutions.

The table given below shows a comparison of the expected changes in CAGR from the base year (2024) and current year (2025) for the global liquid feed supplements industry. This assessment gives insight into the critical performance transformations of the company and gives guidance as far as the stakeholder's revenue realization is concerned. By this, they get a better idea of the growth path over the year. The first half of the year, or H1, is from January to June, whereas the second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.2% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 5.3% |

| H2 (2025 to 2035) | 5.6% |

In the first half (H1) of the decade from 2024 to 2034, the market is projected to grow at a CAGR of 5.2%, followed by a slight increase to 5.6% in the second half (H2). In the next period from 2025 to 2035, the CAGR is expected to further increase to 5.3% in the first half and maintain 5.6% steady growth in the second half. The sector in H1 has experienced a 10 BPS increase while in H2 the stability has ceased any significant fluctuations.

Precision-Formulated Livestock Nutrition

Shift: The main reason is livestock performance and disease resistance issues that are the problems in farm animals; the increase in demand for precision-formulated liquid feed supplements has gone up considerably. Farmers are looking for specific nutrient blends that can be tailored to the species, breed, and growth stages to ensure optimal performance while minimizing feed waste. The demand is particularly pronounced in North America and Europe, where animal nutrition strategies are put on priority to improve meat, dairy, and egg quality.

Strategic Response: Thus, the manufacturers are creating species-specific formulas. Taking full advantage of AI data collection, the companies will be provided with an accurate feed analysis that will assist in the making of exact supplement blends, and thus, the feed will become more effective since animals will absorb it better and lose fewer nutrients.

Industry players are incorporating chelated minerals, amino acid-enriched solutions, and probiotic-infused liquid feeds, all for species-specific formulations. Among other projects, Cargill and ADM are the ones who have built upon offering liquid feed supplement ranges that are high in trace minerals as a way of promoting immune function and better feed conversion in dairy and poultry farming.

Molasses-Reduced Formulations Due to Sugar Price Volatility

Shift: The fluctuation of global sugar prices has resulted in a continuous elevation of the costs of molasses-based liquid feed supplements, which, in turn, led to the search for binding and energy ingredients. Manufacturers have been pursuing the strategy of changing the trend to diversify the sources that provide molasses and to substitute the glucose rate with the sorghum extract, glycerol, and corn syrup. Configuration.

Strategic Response: The process here will be the efforts made by companies to work with less sugar without compromising on the flavor of liquid feed supplements. The base is made from agricultural waste products, and the company is investing in a process of enzymatic hydrolysis to convert waste into a fermentable sugar.

Moreover, BASF and Ridley have put their low-molasses products on the market, featuring energy sources derived from fermentation. Running along these lines, local feed manufacturers have long-term agreements with alternative carbohydrate providers to lessen the vulnerability of their production costs to sugar price fluctuations.

High-Performance Feeds for Heat-Stressed Livestock

Shift: As a result of global warming, livestock animals are under pressure from heat; therefore, their feed intake and performance are affected. This situation has led to the creation of liquid feed supplements that contain cooling agents, electrolytes, and stress-reducing additives in demand. The strong influence on this trend can be felt in the regions of South Asia, Latin America, and the southern USA, where the most extreme weather conditions are experienced, and dairy and poultry are being heavily impacted.

Strategic Response: The manufacturers, on the other hand, are including heat-stress inhibitors in liquid feeds like cooling age, i.e., betaine, menthol, and some regulatory agents to improve hydration and overall stress resistance. Throw Nutrition and Land O' Lakes are two of the manufacturers who are working on electrolyte-fortified liquid feeds aimed at reducing the risks of dehydration.

Furthermore, farmers are involved in targeted marketing, which teaches them to be well-equipped with the tools to fight heat-stress through the use of precision feeding, thus ensuring the adoption in the areas where severe climate is the biggest concern.

Functional Gut Health Enhancements in Liquid Feeds

Shift: There is an increasing awareness of the role of gut health in animal productivity, and that's why the demand for prebiotic and probiotic-enhanced liquid feed supplements has increased. Consumers and regulatory bodies are becoming more and more determinative about the issue of raising livestock without antibiotics, and this creates demand for the functional gut health solutions that are the natural way to enrich the animal's immunity and digestion.

Strategic Response: The use of synbiotics blends - prebiotics and probiotics together in one product - is being built into liquid feed supplements to optimize gut flora. Among the introductions of Novus International and Biomin were yeast-derived beta-glucans and organic-acid infusions that made nutrient absorption easier for the animals.

The addition of enzyme-treated fiber is becoming popular, which will benefit bowel movement. As the regulatory framework becomes stricter, the industry players offer the gut solutions as alternatives for antibiotics, therefore positioning them strongly in the premium and organic livestock feed sector.

The global liquid feed supplements market is a mixture of multinationals (MNCs), regional players, and new emerging companies from China. MNCs are the major players in the market, taking advantage of powerful distribution networks, technical innovation, and well-known brand names.

These companies are engaged in product innovation that is based on R&D, and they provide high-performance liquid feed solutions that are supplemented with amino acids, probiotics, and trace minerals, aimed at increasing livestock productivity. Their dominance is particularly evident in North America, Europe, and parts of Asia, where the demand for precision-formulated nutrition is high.

Regional players target local demands, usually creating mixes that are especially made for local species, weather conditions, and raw materials. They are key players in the markets of Latin America, Southeast Asia, and Africa, where their focus on affordability and flexibility is the driving factor of consumers' choice. So, for instance, some of these companies proceed with cost savings measures by the use of food-grade by-products as alternatives to molasses and high-cost ingredients.

They have close connections with local farmers in the dairy, poultry, and beef sectors, where they assure them continued demand for their products, which they make available under both their direct delivery program and through farmers' cooperatives.

Chinese manufacturers are now incoming disruptors in the market with their large-scale production and competitive prices. Their pace of market penetration is dramatic in areas where bulk purchasing is paramount and where price can change the procurement strategy.

China's domestic livestock sector is on the rise, which in turn creates an ever-growing need for the liquid feed supplements that are produced locally. Manufacturers are thus moving towards implementing the enzyme-enhanced and herbal extract-infused formulations that comply with the new legislation supporting the use of antibiotic-free livestock nutrition.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | Market Volume (USD Million) |

|---|---|

| United States | 2,462.0 |

| China | 1,230.5 |

| India | 615.5 |

| Brazil | 492.4 |

| Germany | 369.3 |

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.0% |

| China | 5.4% |

| India | 4.5% |

| Brazil | 4.8% |

| Germany | 4.6% |

The expected figure for 2025 is that the United States will be at the foremost position in the global liquid feed supplements market, with a value of around USD 2,462.0 million. The vibrant livestock sector of the country, especially in the beef and dairy sectors, is the main driver of the increase in the demand for premium feed additives.

The producers are more and more frequently using liquid feed in a bid to achieve better feed efficiency and health of animals. Another factor boosting the market is the shift toward ecologically sustainable and organic farming systems that consumers are advocating for. The companies are reacting to this trend by innovating with high-nutrient formulas that are specific to the needs of different animals, thereby ensuring optimal growth and productivity.

The liquid feed supplements market in China is predicted to be valued at about USD 1,230.5 million in 2025 and will likely expand at a CAGR of 5.4% from 2025 to 2035. The reason behind that is the increased meat consumption and a growing middle class.

As a result, we are seeing more livestock being raised and more feed being used, including liquid feed supplements, to improve the efficiency and health of the animals. Government programs that focus on adopting new agricultural technologies and food safety are also the foundation of market growth. Some of the companies are focusing on R&D as a way to find cost-effective solutions and are developing locally made, high-quality feed solutions.

The liquid feed supplements market in India is expected to reach USD 615.5 million by 2025, up from a current value of USD 474.2 million, corresponding to a CAGR of 4.5%. The main factor that makes the country the top market supply is the massive number of livestock, including cattle and goat milk producers.

Old feeding techniques that are used traditionally are being modernized through the use of liquid feed solutions to promote health and milk yield. The main driving force in dairy production is the government, which not only subsidizes farmers but also trains them to use advanced technologies by bringing in feed. Manufacturers are using low-cost ingredients from the local area, thereby ensuring the tailoring of their products to the needs of farmers.

| Segment | Value Share (2025) |

|---|---|

| Protein Liquid (By Product Type) | 42.5% |

Proteins are the most popular feed supplements consumed in the product type section, and their share in the fluid feed supplement market is 42.5%. The need for high-performance livestock nutrition, which increases the growth, milk production, and muscle development of animals, is the major driving force in the market. The consumer's ever-growing preference for animal-based products, especially dairy and meat, is the superior factor that supports the utilization of these supplements by livestock farmers.

The increase in the consumption of these supplements in the livestock farmers' sector is further driven by the knowledge of the importance of protein in feed conversion efficiency and animal health. Feed Suppliers are more focused on the use of feed ingredients like soybean meal, fish protein hydrolysates, and amino acids to develop protein-rich liquid supplements that can raise animal productivity.

| Segment | Value Share (2025) |

|---|---|

| Ruminants Liquid (By Livestock) | 48.3% |

Ruminants Liquid Feed Supplements control the livestock market with the highest share of 48.3%, which represents the global share of all the livestock industries' needs. About half of the ruminant population is accounted for by the dairy and beef cattle, therefore the preponderance of the supplemental liquid feed market in the ruminant sector. These ruminants are preferred by farmers due to the added benefits of improved digestion, effective fiber utilization, and enhanced nutrient absorption.

The market expansion is driven mainly by the demand for milk and meat products in areas that have the highest concentration of livestock. The upgrading of the line of feed producers to include high-energy molasses and protein formulations is the driving force for the segment.

The global liquid feed supplements market is expected to show strong growth starting in the year 2024, with the increasing demand for enhanced livestock nutrition and productivity as the main driving force. Market shareholders are concentrated on innovative product designs, as well as entering into strategically important partnerships and expanding these products in the local markets to consolidate their positions.

The competitive terrain becomes a battleground between the multinational giants, regional firms, and new companies, all aiming at meeting the changing requirements of the livestock space.

The market is segmented into protein liquid feed supplements, minerals liquid feed supplements, vitamins liquid feed supplements, and other liquid feed supplements.

The market is segmented into liquid feed supplements by molasses, corns, urea, and others.

The market is categorized into ruminants, poultry, swine, aquaculture, and others.

The regional segmentation covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global liquid feed supplements market is expected to grow at a CAGR of 5.2% during the forecast period from 2025 to 2035.

The market is projected to reach a value of approximately USD 11,308.8 million by 2035.

The protein liquid feed supplements segment is expected to witness the fastest growth, driven by increasing demand for high-performance livestock nutrition.

Key factors include rising demand for nutrient-rich animal diets, increasing meat and dairy consumption, and advancements in feed supplement formulations.

Dominant players include Archer Daniels Midland Company, Cargill Incorporated, BASF SE, Land O'Lakes Inc., Nutreco N.V., and Alltech Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Source, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Source, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Source, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Source, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Livestock, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Source, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Livestock, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Livestock, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by Livestock, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Livestock, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Livestock, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Livestock, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Livestock, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Livestock, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Livestock, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Livestock, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Livestock, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Livestock, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Livestock, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Liquid Smoke Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA