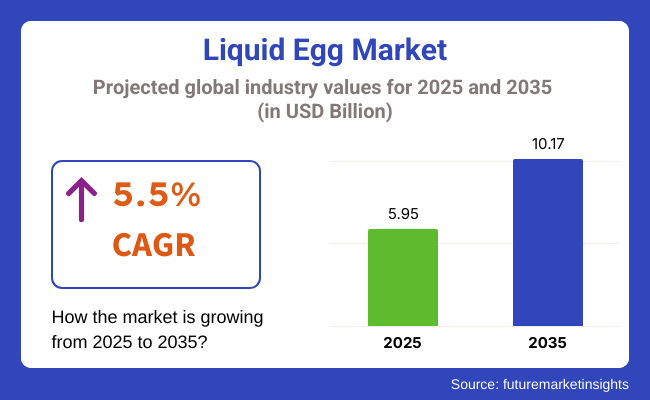

The global liquid egg market is anticipated to demonstrate steady growth, with its valuation projected to rise from approximately USD 5.95 billion in 2025 to about USD 10.17 billion by 2035. This corresponds to a CAGR of 5.5% during the forecast period.

The increasing consumer awareness surrounding the nutritional benefits of eggs and the rising demand for protein-enriched diets serve as the primary drivers fueling market expansion. Eggs are widely recognized for their rich protein content, vitamins, and minerals, making liquid egg products an attractive choice among health-conscious consumers and food manufacturers alike.

Innovations in packaging solutions have played a significant role in enhancing the shelf life and convenience of liquid egg products. Manufacturers continue to invest in improved aseptic packaging and portion-controlled formats, which facilitate ease of use in both retail and foodservice sectors.

These advancements support the growing preference for ready-to-use protein ingredients in various applications, including bakery products, confectionery, and processed foods. The versatility of liquid egg products further broadens their usage across multiple end-use segments, driving demand consistently.

Segmentation within the liquid egg market reflects varying preferences for whole egg, egg white, and egg yolk-based products. The whole liquid egg segment holds a substantial market share due to its balanced composition of nutrients and wide applicability. Egg white products are increasingly favored in fitness and dietary markets due to their low-fat and cholesterol-free characteristics. Conversely, liquid egg yolks find usage in premium culinary preparations, adding richness and texture to food products.

In September 2024, Cal-Maine Foods, the largest USA egg producer, formed a joint venture with Crepini LLC to establish Crepini Foods LLC. This strategic move aimed to expand Cal-Maine's presence in the value-added egg products sector, including egg wraps, protein pancakes, and crepes. Cal-Maine invested approximately USD 6.75 million to acquire a 51% stake in the new entity, headquartered in Hopewell Junction, New York. Crepini LLC contributed its existing assets and business in exchange for a 49% interest.

Sustainability initiatives are gaining importance within the market, with companies exploring eco-friendly packaging options and sustainable sourcing practices. Consumer preference for natural and clean-label products influences manufacturers to prioritize transparency and environmental responsibility. Additionally, regulatory frameworks regarding food safety and quality standards continue to evolve, ensuring product integrity and consumer protection.

Overall, the liquid egg market is expected to maintain its upward trajectory through 2035. Its growth will be shaped by increasing nutritional awareness, product innovation, and expanding applications across food sectors. Despite challenges related to perishability and supply chain complexities, ongoing advancements in packaging technology and process optimization are anticipated to support market resilience and long-term development.

The whole egg segment is projected to hold approximately 52% market share in 2025, making it the dominant product type in the liquid egg market. Its popularity is driven by the convenience of pre-cracked, ready-to-use liquid whole egg and the nutritional benefits associated with fresh whole eggs.

Widely used in bakeries, confectionery, dairy products, and foodservice sectors, whole liquid eggs facilitate bulk food preparation without the hassle of handling shells. Manufacturers are innovating with pasteurized, protein-rich formulations to meet growing demand for high-quality egg ingredients in commercial kitchens. The segment’s versatility across various food applications, including baked goods and processed foods, sustains its leading position.

The shelf life and ease of storage add to its appeal, especially among food processors seeking efficiency and consistent quality. Ongoing consumer trends favoring natural and nutritious ingredients further support growth. As liquid egg adoption expands globally, the whole egg segment is expected to maintain a significant share throughout the forecast period.

The egg white segment is estimated to capture around 28% market share in 2025, driven by growing consumer focus on protein-rich, low-fat, and cholesterol-free foods. Egg whites are widely used in fitness nutrition, protein shakes, and dietary supplements because they provide high-quality protein without fat or cholesterol.

This makes them a favored ingredient among health-conscious consumers, athletes, and those managing weight or following clean-label diets. Food manufacturers leverage liquid egg whites for their convenience, consistent quality, and ease of incorporation into various products. Advances in pasteurization and formulation techniques have improved safety and shelf life, enabling broader applications across nutrition bars, meal replacements, and functional foods.

The rising prevalence of lifestyle diseases and increased awareness of healthy eating habits further bolster demand. Additionally, egg white products align well with trends favoring natural, minimally processed ingredients. As consumers increasingly seek specialized nutrition solutions, the egg white segment is expected to expand steadily, capturing new markets and innovating with value-added products. This growth complements the overall liquid egg market, underscoring egg whites’ rising importance in health and wellness-focused food sectors.

The North America liquid egg product market continues to display its strength and resilience as a key market owing to a highly aware consumer base, extensive application in foodservice and bakery sectors, and a rising demand for convenience and high-protein food choices. The steady growth of food processing particularly in Canada and United States contribute as leading share as they have a well-developed processed food industry.

Europe based on high food quality and safety standards, strong demand from the bakery and confectionery sectors, and the growing trend toward convenience foods, Europe is another key market. Liquid eggs are also being adopted increasingly by countries such as Germany, the United Kingdom, and France for both retail and industrial applications.

Liquid egg demand in the Asia-Pacific region is growing at the fastest rate, spurred by increasing disposable incomes, urbanization and growing food processing industries. Liquid egg demand has been increasing in countries like, China, Japan and India owing to the growing bakery segment, increasing popularity of Western style diets and focus on protein-rich diets. As a result, the region’s robust economic development and continued investment in food production facilities are seen as an essential catalyst for expanding the global market.

Challenges

Regulatory Compliance, Short Shelf Life, and Supply Chain Instability

Food Safety regulations set forth by FDA (USA), EFSA (Europe), and FSSAI (India) about pasteurization, microbial controls, and contamination prevention is one of the factors that can challenge the liquid egg market. These regulations necessitate strict quality control practices as well as regular testing and specialized equipment for processing, thus raising operating costs.

Also, short shelf life is the other big challenge liquid egg being a perishable product that needs to be kept in a refrigerated environment in order to be fresh and food safe, increases the transportation and storage cost. And production efficiency and cost predictability are also affected by instability in the supply chain, such as the price of eggs, avian influenza outbreaks, and raw materials shortage.

Opportunities

Growth in Ready-to-Eat Foods, AI-Optimized Production, and Sustainable Packaging

AI-backed production monitoring and predictive analytics, along with automated pasteurization systems, are further driving process improvements in product consistency, food safety, and yield optimization. A move toward sustainable packaging including using biodegradable cartons, recyclable plastic pouches and reduced-waste design is also creating new opportunities in environmentally aware food markets.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with pasteurization standards, contamination prevention, and food safety labeling laws. |

| Consumer Trends | Demand for protein-rich convenience foods, high-quality bakery ingredients, and pre-cooked liquid eggs. |

| Industry Adoption | High use in food service, commercial bakeries, and processed food manufacturing. |

| Supply Chain and Sourcing | Dependence on commercial poultry farms, bulk egg producers, and cold-chain logistics. |

| Market Competition | Dominated by egg processing companies, foodservice suppliers, and bakery ingredient manufacturers. |

| Market Growth Drivers | Growth fueled by demand for functional foods, foodservice expansion, and high-protein diet trends. |

| Sustainability and Environmental Impact | Moderate adoption of recyclable packaging, water-efficient processing, and organic egg certification. |

| Integration of Smart Technologies | Early adoption of AI-powered microbial detection, automated pasteurization, and smart temperature monitoring. |

| Advancements in Liquid Egg Processing | Development of high-yield pasteurization techniques, extended-shelf-life formulations, and allergen-free egg substitutes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-powered quality tracking, block chain-based traceability, and global sustainability mandates. |

| Consumer Trends | Growth in AI-optimized personalized nutrition, fortified liquid eggs (omega-3, vitamins), and plant-egg hybrid blends. |

| Industry Adoption | Expansion into smart packaging innovations, AI-assisted freshness tracking, and lab-grown egg protein alternatives. |

| Supply Chain and Sourcing | Shift toward cage-free and organic egg sourcing, AI-powered farm management, and carbon-neutral egg production. |

| Market Competition | Entry of AI-driven food safety startups, plant-based egg alternatives, and sustainable egg protein innovators. |

| Market Growth Drivers | Accelerated by AI-enhanced production automation, next-gen food packaging solutions, and zero-waste egg production technologies. |

| Sustainability and Environmental Impact | Large-scale shift toward net-zero egg production, AI-driven food waste reduction, and fully biodegradable liquid egg containers. |

| Integration of Smart Technologies | Expansion into block chain-enabled egg sourcing transparency, AI-driven shelf-life extension, and robotic quality control. |

| Advancements in Liquid Egg Processing | Development of AI-powered inline quality inspection, enzyme-assisted nutrient enhancement, nanotechnology-based preservation methods, and precision-formulated functional egg blends. |

The USA liquid egg market is projected to expand over the next few years, fueled on account of the growing demand for convenient and ready to use egg and egg products, rising usage in foodservice and bakery industries, and increasing consumer inclination for high protein diets. The growing usage of liquid eggs in processed foods, sports nutrition, and meal replacements is spurring market growth. Moreover, the growing investment in pasteurized and cage-free liquid egg products is acting as further growth catalysts for the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The United Kingdom liquid egg market is growing due to the rising demand for egg-based protein solutions, higher consumption in hotels, restaurants, and cafés (HoReCa), and increasing adoption of free-range and organic liquid egg. The growing consumer shift towards healthy & sustainable food choices, along with increasingly stringent regulations around food safety, is contributing to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

The liquid egg market in European Union is witnessing stable growth owing to growing consumption of egg-based convenience foods, surging preferences for pasteurized and fortified liquid eggs, and increasing use in bakery and confectionery applications. Moreover, EU policies which are supporting animal welfare and sustainable farming standards are also buoying growth in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

Japan’s liquid egg market is growing on moderate rate, purely on the rising demand for high-protein & low-fat egg products, increasing adoption of liquid eggs in food manufacturing and growing interest in cholesterol-free egg alternatives. Demand is increasing for high-quality liquid eggs for use in both convenience foods and traditional Japanese dishes. Moreover, the market is being propelled by the development of egg processing technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The South Korea liquid egg market is growing attributing to the increasing demand for protein-rich diet food, increasing application of liquid eggs in the bakery and campaign food industries and growing preferences towards pre-cooked and pasteurized egg products. Market growth is driven by the increasing popularity of functional and fortified egg-based beverages and the growing consumption of ready-to-cook liquid eggs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Rising requirements for ready-to-use egg products from food processing, hospitality, and retail sectors are leading to an expand in the liquid egg market. The growth is driven by the rising preference for protein-rich diets, technological advancements in AI-based egg processing, and increasing adoption of pasteurized liquid eggs in commercial kitchens. Businesses aiming for AI-based quality assurance, sustainability in egg procurement, and superior packing alternatives for better storage and safety in food processes.

Market Share Analysis by Key Players & Liquid Egg Producers

| Company Name | Estimated Market Share (%) |

|---|---|

| Cal-Maine Foods, Inc. | 18-22% |

| Michael Foods, Inc. | 12-16% |

| Rose Acre Farms, Inc. | 10-14% |

| Rembrandt Foods | 8-12% |

| Cargill, Incorporated | 5-9% |

| Other Liquid Egg Producers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cal-Maine Foods, Inc. | Develops AI-powered egg quality assurance, cage-free liquid eggs, and sustainable egg production. |

| Michael Foods, Inc. | Specializes in pasteurized liquid eggs, AI-assisted egg processing, and high-protein egg blends. |

| Rose Acre Farms, Inc. | Provides organic and conventional liquid eggs, AI-driven production efficiency, and extended-shelf-life solutions. |

| Rembrandt Foods | Focuses on low-cholesterol liquid egg formulations, AI-enhanced egg pasteurization, and foodservice applications. |

| Cargill, Incorporated | Offers high-performance liquid egg products, AI-powered food safety measures, and sustainable egg supply chain management. |

Key Market Insights

Cal-Maine Foods, Inc. (18-22%)

Cal-Maine leads the liquid egg market, offering AI-driven egg quality control, cage-free liquid eggs, and large-scale production for retail and foodservice.

Michael Foods, Inc. (12-16%)

Michael Foods specializes in high-protein pasteurized liquid eggs, ensuring AI-enhanced safety, extended shelf life, and bulk packaging solutions.

Rose Acre Farms, Inc. (10-14%)

Rose Acre Farms provides organic and conventionally processed liquid eggs, optimizing AI-powered production efficiency and food safety.

Rembrandt Foods (8-12%)

Rembrandt focuses on cholesterol-reduced liquid egg products, integrating AI-assisted egg pasteurization and packaging innovation.

Cargill, Incorporated (5-9%)

Cargill develops sustainable liquid egg solutions, ensuring AI-powered traceability and next-generation egg-based food formulations.

Other Key Players (30-40% Combined)

Several egg processing companies, specialty food manufacturers, and sustainable egg producers contribute to next-generation liquid egg innovations, AI-powered production advancements, and extended-shelf-life solutions. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.95 billion |

| Projected Market Size (2035) | USD 10.17 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Whole Egg, Egg White, Egg Yolk, Scrambled Mix |

| Forms Analyzed (Segment 2) | Frozen, Refrigerated |

| End-Use Applications Covered (Segment 3) | Food Industry, Biotechnology, Cosmetics, Pharmaceuticals, Animal Nutrition, Others |

| Sales Channels Covered (Segment 4) | B2B, Ho-Re-Ca, B2C |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, United Kingdom, European Union, Japan, South Korea, India, China |

| Key Players Influencing the Market | Cal-Maine Foods, Michael Foods, Rose Acre Farms, Rembrandt Foods, Cargill, Nest Fresh Eggs, Nature’s Yoke, Eggland’s Best, Vital Farms, Global Food Group |

| Additional Attributes | Dollar sales by product and form, AI-powered production advances, pasteurization technologies, sustainability trends, e-commerce growth |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the liquid egg market was USD 5.95 billion in 2025.

The liquid egg market is expected to reach USD 10.17 billion in 2035.

Growth is driven by the rising demand for convenient and ready-to-use egg products, increasing application in the foodservice and bakery industries, growing preference for protein-rich diets, and advancements in pasteurization techniques for extended shelf life.

The top 5 countries driving the development of the liquid egg market are the USA, China, Germany, India, and France.

Whole Egg and Refrigerated Liquid Egg are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-use Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by End-use Application, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by End-use Application, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 42: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by End-use Application, 2018 to 2033

Table 46: Europe Market Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: Asia Pacific Market Volume (MT) Forecast by Product, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 56: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by End-use Application, 2018 to 2033

Table 58: Asia Pacific Market Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Product, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 68: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by End-use Application, 2018 to 2033

Table 70: MEA Market Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-use Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by End-use Application, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product, 2023 to 2033

Figure 32: Global Market Attractiveness by Form, 2023 to 2033

Figure 33: Global Market Attractiveness by Source, 2023 to 2033

Figure 34: Global Market Attractiveness by End-use Application, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by End-use Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by End-use Application, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product, 2023 to 2033

Figure 68: North America Market Attractiveness by Form, 2023 to 2033

Figure 69: North America Market Attractiveness by Source, 2023 to 2033

Figure 70: North America Market Attractiveness by End-use Application, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by End-use Application, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by End-use Application, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 106: Latin America Market Attractiveness by End-use Application, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by End-use Application, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 124: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by End-use Application, 2018 to 2033

Figure 132: Europe Market Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product, 2023 to 2033

Figure 140: Europe Market Attractiveness by Form, 2023 to 2033

Figure 141: Europe Market Attractiveness by Source, 2023 to 2033

Figure 142: Europe Market Attractiveness by End-use Application, 2023 to 2033

Figure 143: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by End-use Application, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 156: Asia Pacific Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 164: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by End-use Application, 2018 to 2033

Figure 168: Asia Pacific Market Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by End-use Application, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by End-use Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 192: MEA Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 196: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 200: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by End-use Application, 2018 to 2033

Figure 204: MEA Market Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product, 2023 to 2033

Figure 212: MEA Market Attractiveness by Form, 2023 to 2033

Figure 213: MEA Market Attractiveness by Source, 2023 to 2033

Figure 214: MEA Market Attractiveness by End-use Application, 2023 to 2033

Figure 215: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA