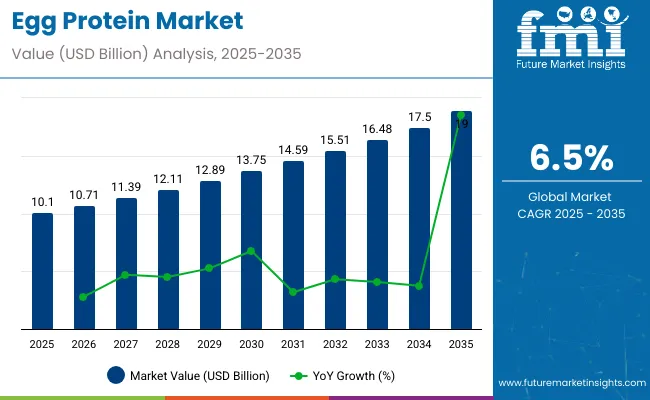

The global egg protein market is expected to expand from USD 10.1 billion in 2025 to around USD 19.0 billion by 2035, marking a total growth of USD 8.9 billion over the forecast period. This translates into a total growth of 88.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.88X during the same period, supported by the rising demand for high-protein, clean-label ingredients in bakery and confectionery applications and expanding adoption across sports nutrition and dietary supplements.

Egg Protein Market Key Takeaways

| Metric | Value |

|---|---|

| Egg Protein Market Value (2025) | USD 10.1 billion |

| Market Forecast Value (2035) | USD 19.0 billion |

| Market Forecast CAGR | 6.5% |

Between 2025 and 2030, the Egg Protein market is projected to expand from USD 10.1 billion to USD 14.1 billion, resulting in a value increase of USD 4.0 billion, which represents 44.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer demand for high-protein ingredients, increasing adoption of clean-label formulations, and expanding applications across sports nutrition and functional food segments. Food manufacturers are enhancing extraction technologies and developing specialized protein concentrates to meet diverse functional requirements across multiple end-use categories.

From 2030 to 2035, the market is forecast to grow from USD 14.1 billion to USD 19.0 billion, adding another USD 4.9 billion, which constitutes 55.1% of the overall ten-year expansion. This period is expected to be characterized by technological innovations in enzymatic hydrolysis and microfiltration processes, development of specialized pharmaceutical applications, and increasing penetration in emerging markets. The growing emphasis on cage-free sourcing and blockchain-based traceability will drive demand for premium egg protein formulations and specialized manufacturing expertise.

Between 2020 and 2025, the Egg Protein market experienced steady expansion, driven by increasing health consciousness and growing demand for functional food ingredients. The market developed as food manufacturers recognized the superior binding, emulsification, and texture enhancement properties of egg proteins. Rising adoption in bakery applications and expanding sports nutrition segments contributed significantly to market development during this foundational period.

Market expansion is being supported by the increasing consumer demand for high-protein, clean-label ingredients that offer superior functional properties including binding, emulsification, and texture enhancement across diverse food applications. Egg protein provides exceptional amino acid profiles and bioavailability that make it highly valued in sports nutrition, infant formula, and medical nutrition products. Modern extraction techniques including microfiltration and enzymatic processing are improving protein purity and solubility while enabling entry into novel application areas.

The growing emphasis on clean-label formulations is driving food manufacturers to replace synthetic stabilizers and emulsifiers with natural egg protein alternatives. Ongoing refinements in processing technologies are enhancing functional performance while meeting consumer preferences for recognizable, natural ingredients. The expanding sports nutrition and functional food markets create additional demand as consumers seek high-quality protein sources that support muscle building, recovery, and overall wellness goals.

The market is segmented by end use, function, and region. By end use, the market is divided into bakery & confectionery, protein & nutritional bars, breakfast cereals, functional beverages, dietary supplements, sports nutrition, infant nutrition, prepared foods, meat analogs, dressings, sauces & spreads, pharmaceutical products, and personal care products. Based on function, the market is categorized into thickening, leavening, binding, preservatives/antimicrobial, emulsifying, and crystallization. Regionally, the market is divided into key countries including United States, Japan, United Kingdom, Germany, and France.

Bakery & Confectionery is projected to account for 24% of the egg protein market in 2025. This leading share is supported by egg protein's multifunctional benefits including improved dough elasticity, natural aeration, and enhanced moisture retention that are prized by product developers. Clean-label formulation requirements have further propelled adoption, with over 60% of artisanal and industrial bakeries adopting egg protein to replace synthetic emulsifiers and stabilizers. The segment benefits from established applications in premium baked goods and continuous formulation refinements to meet evolving consumer preferences.

The dominance of Bakery & Confectionery reflects egg protein's essential role in creating superior texture and shelf life characteristics in baked products. Egg protein-fortified doughs demonstrate increased loaf volume and crumb stability, enabling softer textures and longer shelf life that meet commercial bakery requirements. Major ingredient suppliers including Cargill, Kewpie, and Rose Acre Farms offer enzyme-modified egg protein concentrates specifically tailored for bakery applications. Gluten-free and low-carb bakery formats utilize egg protein-based dough enhancers to improve handling and final product quality. Innovative pre-hydrated and spray-dried egg protein systems are being introduced to simplify processing and reduce production steps, making egg protein more accessible to diverse bakery operations seeking clean-label solutions.

Thickening function is expected to represent 22% of egg protein functional demand in 2025. This dominant share reflects egg protein's capacity to increase fluid viscosity naturally, enabling manufacturers to replace synthetic thickeners with clean-label alternatives. More than 65% of prepared food producers have adopted egg protein to replace modified starches and gums, driven by clean-label mandates and consumer preferences for natural ingredients. The segment benefits from egg protein's ability to provide consistent viscosity across wide pH ranges while reducing formulation complexity.

The thickening function's market leadership demonstrates egg protein's versatility as a natural viscosity modifier that enhances both texture and nutritional content of food products. Membrane-filtration techniques are being used to concentrate functional fractions, improving thickening efficiency while maintaining protein quality. Clean-label dressings and sauces increasingly formulate with egg protein to deliver protein content and desired mouthfeel characteristics. Pre-hydrated egg protein systems have been introduced to enable rapid dispersion and reduce processing time in commercial food production. The segment's continued growth is supported by food manufacturers' need for natural thickening agents that provide functional benefits while meeting clean-label requirements and consumer expectations for recognizable ingredients.

The Egg Protein market is advancing steadily due to increasing demand for high-protein ingredients and superior functional properties in food applications. However, the market faces challenges including allergen concerns as egg proteins remain among the top eight recognized food allergens, price volatility due to seasonal fluctuations in egg production and feed costs, and competition from plant-based protein alternatives. Processing innovations in enzymatic hydrolysis and membrane filtration continue to influence product development and market expansion patterns.

Expansion of Sports Nutrition and Functional Food Applications

The growing adoption of egg protein in sports nutrition and functional food segments is enabling manufacturers to leverage its superior amino acid profile and bioavailability for muscle building and recovery applications. Enzymatically hydrolyzed egg protein is being explored for controlled-release applications, while precision-formulated protein blends are being developed for meal-replacement products. These applications are particularly valuable for consumers seeking high-quality protein sources that provide complete amino acid profiles and optimal absorption characteristics.

Innovation in Processing Technologies and Clean-Label Solutions

Modern egg protein manufacturers are incorporating advanced extraction technologies including enzymatic hydrolysis and microfiltration that improve protein purity, solubility, and functional performance. Development of blockchain-based traceability systems ensures egg-source transparency and meets clean-label requirements. Advanced processing technologies also support development of cage-free and organic certified products that command premium pricing while addressing consumer preferences for ethical and sustainable ingredient sourcing.

Europe Market Split by Segments

In Europe, the Bakery & Confectionery segment dominates with approximately 26% market share, supported by the region's rich baking traditions and premium product positioning. The thickening function accounts for the largest functional segment at 24%, driven by clean-label mandates and replacement of synthetic ingredients. Protein & Nutritional Bars represent a growing segment at 18%, reflecting European consumer interest in healthy snacking options, while Sports Nutrition applications contribute 15% to the regional market, supported by increasing fitness awareness and active lifestyle trends.

| Countries | CAGR (%) |

|---|---|

| United States | 6.7 |

| Japan | 6. 6 |

| United Kingdom | 6. 5 |

| China | 6. 4 |

| Germany | 6.3 |

| France | 6.2 |

| South Korea | 5.6 |

The global egg protein market shows robust but regionally varied growth. The United States leads with the strongest projected CAGR of 6.7% through 2035, driven by sports nutrition, clean-label bakery demand, and advanced extraction technologies. Japan follows at 6.6%, reflecting strong interest in protein-enriched beverages and elderly care nutrition supported by strict quality standards. The United Kingdom ranks close with 6.5%, benefiting from its clean-label focus, allergen management regulations, and investment in enzyme-assisted protein hydrolysates. China also records 6.4% CAGR, leveraging its vast egg production capacity and growing domestic consumption alongside export opportunities. Germany demonstrates 6.3% CAGR, supported by industrial baking and pharmaceutical applications, while France shows slightly lower but steady growth at 6.2%, driven by its artisanal bakery tradition and fortified infant nutrition. South Korea grows at 5.6%, reflecting advanced food technology integration and rising sports nutrition demand.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand of egg protein in the United States is projected to exhibit the strongest growth at 6.7% CAGR through 2035, driven by robust demand in sports nutrition applications and widespread adoption of cage-free certification standards. American consumers demonstrate strong preference for high-protein diets and clean-label bakery products, creating significant demand for functional egg protein ingredients. The country's advanced extraction technologies and investment in enzyme-modified egg proteins support market leadership across multiple application segments including nutritional bars and medical nutrition products.

The United States' emphasis on protein-enriched food products and collaboration between ingredient suppliers and quick-service restaurant chains enable comprehensive market development. The expanding online retail channels for functional ingredients and increasing use in infant formula applications create additional growth opportunities across diverse consumer segments.

Revenue from egg protein in Japan is expanding at 6.6% CAGR, supported by consumer interest in protein-enriched beverages and health-focused nutritional products for aging populations. Japanese consumers demonstrate sophisticated understanding of functional ingredients and growing demand for high-purity protein formulations that support elderly care nutrition and medical applications. The country's regulatory support for advanced protein ingredients and precision-formulation technologies create opportunities for premium egg protein products.

Japan's emphasis on quality control and traceability systems aligns with egg protein's positioning as a premium functional ingredient. The integration of egg protein in medical nutrition products and collaboration with precision-formulation startups support specialized market development across health-focused consumer segments.

Revenue from egg protein in the United Kingdom is projected to grow at 6.5% CAGR, driven by heightened focus on ingredient transparency and stringent allergen management requirements. UK consumers demonstrate strong preference for clean-label positioning and premium bakery products that utilize natural functional ingredients. The country's advanced regulatory framework and emphasis on ingredient traceability support market development through quality-focused product formulations and consumer confidence building.

The United Kingdom's investment in enzyme-assisted protein hydrolysates and partnerships between foodservice operators create opportunities for innovative egg protein applications. The pilot programs for high-protein breakfast cereals and uptick in premium bakery launches support market expansion across traditional and emerging application segments.

Revenue from egg protein in Germany is expanding at 6.3% CAGR, supported by strong industrial baking volumes and dietary supplement innovation across health-focused consumer segments. German food manufacturers demonstrate consistent demand for egg protein binding agents and functional ingredients that enhance product quality while meeting clean-label requirements. The country's advanced food processing infrastructure and research initiatives support development of pharmaceutical excipient applications and specialized protein formulations.

Germany's emphasis on microfiltration technology and functional purity improvements enable production of high-quality egg protein ingredients that serve diverse industrial applications. The growth in online direct-to-consumer ingredient sales and expansion of sports nutrition bars create additional market opportunities for specialized egg protein products.

Revenue from egg protein in France is projected to grow at 6.2% CAGR, supported by the country's artisanal bakery heritage and growing penetration of functional food applications. French consumers demonstrate appreciation for traditional baking methods enhanced with natural functional ingredients, creating demand for egg protein that supports natural leavening and texture enhancement. The country's government support for fortified infant nutrition formulations and development of specialized protein concentrates support market growth across premium food segments.

France's emphasis on artisanal quality and co-development projects between ingredient firms and patisserie brands enable innovative egg protein applications. The introduction of protein-fortified viennoiserie products and development of pre-hydrated egg protein concentrates support market expansion through traditional and modern food applications.

Demand for egg protein in South Korea is expected at a CAGR of 5.6% expanding steadily, supported by the country's advanced food processing capabilities and growing consumer interest in functional nutrition products. South Korean consumers demonstrate increasing awareness of protein supplementation and health-focused food ingredients that support active lifestyles. The country's sophisticated food manufacturing infrastructure and emphasis on quality control enable development of specialized egg protein applications across diverse food categories.

South Korea's position in the East Asian market and technological expertise in food processing create opportunities for innovative egg protein formulations. The country's growing sports nutrition market and emphasis on convenient, high-protein food products support market development across health-conscious consumer segments.

Revenue from egg proteinin China is expected at a CAGR of 6.4% demonstrates significant growth potential, supported by the country's position as a major egg producer and expanding food processing industry. Chinese manufacturers benefit from abundant raw material availability and growing domestic demand for protein-enriched food products. The country's large population and increasing disposable income create substantial market opportunities for egg protein applications across multiple food categories.

China's expanding food processing capabilities and growing export potential enable market development through both domestic consumption and international trade opportunities. The country's emphasis on food safety regulations and quality improvements support development of higher-value egg protein products that meet international standards.

The European egg protein market is set for steady expansion, increasing from USD 3.2 billion in 2025 to USD 5.7 billion by 2035, reflecting a CAGR of 6.1%. Germany is projected to remain the largest national market, holding a 23.0% share in 2025, softening slightly to 22.4% by 2035, driven by strong demand from industrial bakeries and the integration of egg protein in pharmaceutical formulations. The United Kingdom follows with 18.5% in 2025, rising to 19.1% by 2035, supported by premium bakery innovation, stringent allergen labeling, and functional beverage launches. France accounts for 16.5% in 2025, easing to 16.0% by 2035, influenced by the shift toward plant-based proteins, yet sustained by its artisanal bakery tradition and fortified viennoiserie. Italy holds 11.5% in 2025, remaining close to 11.3% by 2035, reflecting consistent use in bakery and confectionery. Spain captures 9.5% in 2025, climbing to 10.0% by 2035 amid growing applications in beverages and sports nutrition. The BENELUX countries contribute 6.0% in 2025, slightly easing to 5.7% by 2035, while the remainder of Europe (Eastern Europe, Nordic, and others) collectively declines from 15.0% in 2025 to 15.0% by 2035, shaped by uneven adoption rates across mature and emerging protein markets.

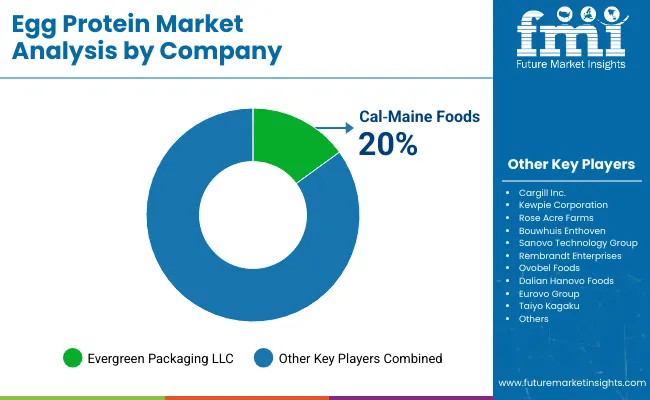

The egg protein market is characterized by competition among global integrators and specialized suppliers focused on advanced extraction technologies and traceability systems. Leading companies are investing in enzyme-assisted hydrolysis techniques, strategic partnerships with biotech startups, and targeted acquisitions of protein-refining assets to broaden functional ingredient portfolios. Cargill Inc., Kewpie Corporation, Rose Acre Farms, BouwhuisEnthoven, and Sanovo Technology Group represent Tier 1 players leveraging scale advantages and advanced processing capabilities. Tier 2 players including Rembrandt Enterprises, Ovobel Foods, Dalian Hanovo Foods, and Eurovo Group differentiate through agility in co-development projects and regional distribution networks, focusing on flexible production runs and customized blends for local markets.

Egg protein is a high-quality, bioavailable protein with strong functional and nutritional properties - used across sports nutrition, clinical nutrition, bakery, meat analogs, and specialty food formulations. Its advantages (complete amino-acid profile, emulsification, foaming, heat-stability variations between whites and yolks) make it valuable where performance and functionality matter. Growing interest in clean-label, minimally processed proteins and demand for sustainable protein supply chains means the egg-protein sector must scale responsibly while protecting animal welfare and managing biosecurity risks.

Key Players in the Egg Protein Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 10.1 Billion |

| End Use Segments | Bakery & Confectionery, Protein & Nutritional Bars, Breakfast Cereals, Functional Beverages, Dietary Supplements, Sports Nutrition, Infant Nutrition, Prepared Foods, Meat Analogs, Dressings, Sauces & Spreads, Pharmaceutical Products, Personal Care Products |

| Function | Thickening, Leavening, Binding, Preservatives/Antimicrobial, Emulsifying, Crystallization |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countr ies Covered | United States, United Kingdom, France, Germany, Japan, South Korea, China, and 40+ countries |

| Key Companies Profiled | Cargill Inc., Rose Acre Farms, Bouwhuis Enthoven, IGRECA, SANOVO TECHNOLOGY GROUP, Interovo Egg Group BV, Dalian Hanovo Foods Co. Ltd, Kewpie Corporation, Rembrandt Enterprises, Wulro BV |

| Additional Attributes | Dollar sales by end use/function, clean-label certification, cage-free sourcing, blockchain traceability, enzymatic and membrane innovations, regional demand (key markets), supplier competition, consumer protein preferences, and advanced processing for purity/functionality |

The egg protein market size in 2025 was USD 10.1 billion.

A CAGR of 6.5% is expected from 2025 to 2035

The Bakery & Confectionery segment leads with a 24% share in 2025.

Leading players include Cargill Inc., Kewpie Corporation, Rose Acre Farms, Bouwhuis Enthoven, and Sanovo Technology Group.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Grading Machines Market Size and Share Forecast Outlook 2025 to 2035

Egg Breaking Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg and Egg Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Egg Packaging Market by Packaging Type & Material from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA