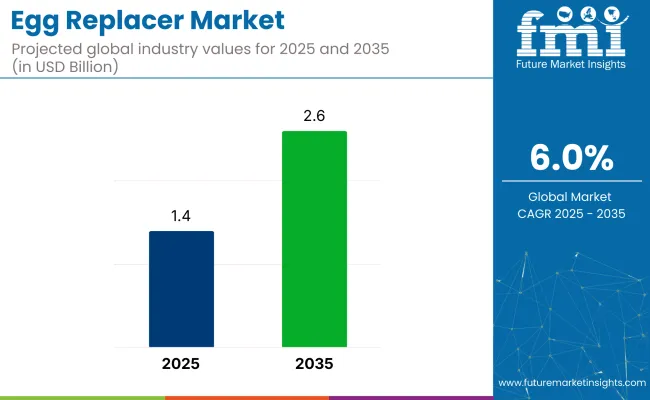

The global egg replacer market is valued at USD 1.4 billion in 2025 and is expected to reach USD 2.6 billion by 2035, reflecting a CAGR of 6.0%. Factors driving this growth include rising consumer demand for plant-based diets, increased incidence of egg allergies, and evolving food preferences.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 1.4 billion |

| Projected value (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 6.0% |

Health-conscious consumers and flexitarian lifestyles are promoting the shift toward cholesterol-free, allergen-free alternatives, particularly in bakery, confectionery, and processed food applications. Additionally, the growing popularity of vegan baking and fortified food products has accelerated the need for functional egg substitutes in both commercial and household kitchens.

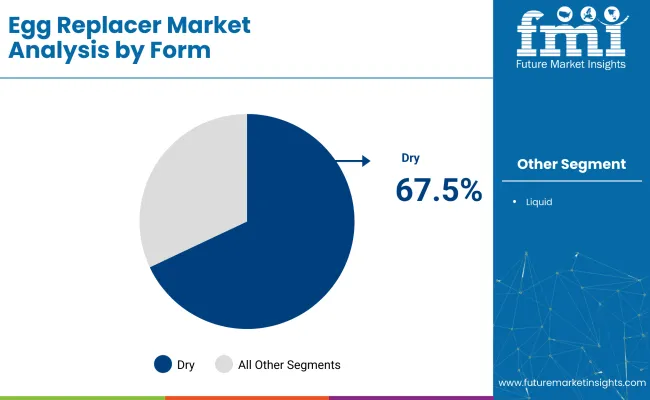

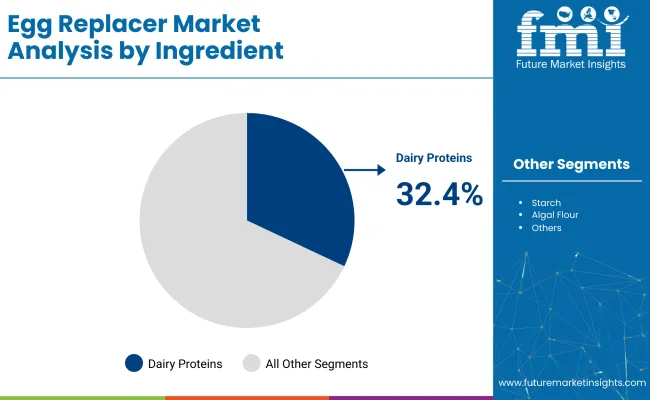

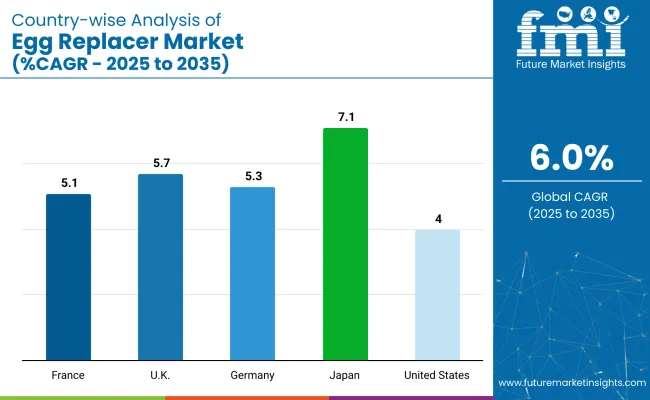

By 2025, dry egg replacers are expected to dominate the global market due to their practicality, long shelf life, and cost-effectiveness. Japan is anticipated to grow at a significant CAGR of 7.1%.Meanwhile, the UK and Germany closely follow this rapid growth with CAGRs of 5.7% and 5.3% respectively. Dairy proteins by ingredient type account for 32.4% of the market share, while dry egg replacer form holds a prominent share of 67.5% in 2025.

The market holds a relatively small percentage within the broader markets it belongs to, though its share is growing steadily. Within the plant-based food market, it has approximately 5-7% as egg replacers are a key component in plant-based diets. In the vegan food market, its share is around 8-10%, driven by the increasing preference for vegan baking and cooking.

In the food and beverage ingredients market, the share of egg replacers is estimated at 2-3%. The functional foods market and dairy alternatives market have smaller shares, around 1-2%, as egg replacers complement these larger categories.

The market is segmented into form, ingredient, application, and region. By form, the market is divided into dry and liquid variants. In terms of ingredients, the segmentation includes dairy proteins, starch, algal flour, and soy-based products.

The application spectrum covers a wide array of food products, including biscuits, chocolates, cakes, mayonnaise, pasta, noodles, and bread. Regionally, the market is evaluated across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Dry egg replacers are projected to remain the most dominant form through 2035, owing to their extended shelf life, cost-efficiency, and ease of transport. In 2025, dry variants are estimated to account for 67.5% of the global market share.

Dairy proteins are expected to lead the ingredient segment due to their close nutritional profile to eggs and superior binding properties. In 2025, dairy proteins are projected to hold a 32.4% market share.

Within applications, cakes are set to dominate the market owing to the rapid global shift toward egg-free baking. In 2025, cakes are forecast to hold a 27.2% share of the application segment. Vital for structure and aeration in eggless cakes

Recent Trends in the Egg Replacer Market

Key Challenges in the Egg Replacer Market

The growth rates of the egg replacer market in the top five countries show notable variation. The USA is projected to grow at a CAGR of 4.0% from 2025 to 2035, driven by increasing plant-based and allergen-free consumption. The UK follows closely with a CAGR of 5.7%, fueled by the rise in veganism and stricter food labeling regulations.

Germany is expected to see a 5.3% CAGR, supported by the demand for clean-label, organic ingredients. France is projected to grow at 5.1%, with a focus on flexitarian preferences and premium products. Japan is the fastest-growing market at 7.1% CAGR, driven by health concerns and an aging population.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The egg replacer revenue in the USA is projected to expand at a CAGR of 4.0% from 2025 to 2035, supported by heightened consumer interest in plant-based and allergen-free diets. With approximately 39% of Americans incorporating plant-based alternatives into their meals, the demand for functional egg substitutes in baking and processed foods has surged.

The sales of the egg replacersin the UK are expected to grow at a CAGR of 5.7% from 2025 to 2035, driven by increasing demand for vegan alternatives and stricter food safety norms. British consumers are becoming more label-conscious and are actively seeking alternatives to common allergens such as eggs.

With veganism on the rise and supermarkets expanding their free-from food aisles, egg replacers are gaining popularity in baked goods and ready-to-eat meals. Additionally, the country’s sustainability efforts have influenced the food industry to reformulate with eco-friendly, plant-based ingredients.

The revenue from egg replacersin Germany is anticipated to rise at a CAGR of 5.3% from 2025 to 2035, supported by the country’s deep-rooted organic food culture and demand for sustainable consumption. German consumers prefer high-protein, clean-label alternatives, making dairy protein-based egg replacers particularly attractive.

The egg replacer market in France is estimated to flourish at a CAGR of 5.1% from 2025 to 2035, influenced by the dual trends of culinary innovation and health consciousness. French food manufacturers are increasingly investing in reformulated products to reduce allergen exposure and accommodate plant-based preferences.

Thesales of egg replacers in Japan are forecasted to register a CAGR of 7.1% from 2025 to 2035, making it one of the fastest-growing markets globally. Rising food safety concerns, coupled with an aging population seeking low-cholesterol diets, are propelling demand.

The market is moderately consolidated, with a mix of global leaders and regional players shaping the competitive landscape. Prominent companies such as Corbion NV, Tate & Lyle Plc., Glanbia plc., Ingredion Incorporated, and BASF SE are at the forefront, leveraging their extensive R&D capabilities, robust distribution networks, and strategic partnerships to maintain and enhance their market positions.

Leading companies in the egg replacer market are strategically focusing on innovation and sustainability to align with evolving consumer preferences. Investments are being made in product development to enhance taste, texture, and nutritional value, particularly for vegan and allergen-free formulations. Strategic collaborations with food manufacturers and research institutions are enabling the creation of customized solutions and faster market penetration.

Recent Egg Replacer Industry News

In July 2025, BASF finalized the purchase of DOMO Chemicals’ 49% share in the Alsachimie joint venture, making BASF the sole owner of a key production entity for polyamide 6.6 precursors in France. This move strengthens BASF’s operational footprint and supply reliability in Europe, supporting its broader strategy in specialty ingredients and food solutions.

In April 2024, Glanbia completed the acquisition of Flavor Producers for USD 300 million to bolster its flavor portfolio.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Form | Dry, Liquid |

| By Ingredient | Dairy Proteins, Starch, Algal Flour, Soy-based Products |

| By Application | Biscuits, Chocolates, Cakes, Mayonnaise, Pasta, Noodles, Breads |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | BASF SE, Corbion NV, Tate & Lyle Plc., Glanbia plc, Ingredion Incorporated, MGP Ingredients, Enter-G Foods Inc., Dupont De Nemours and Company, Fiberstar, Puratos, and Danone Nutricia |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per form the industry has been categorized into Dry, Liquid

This segment is further categorized into Dairy Proteins, Starch, Algal Flour and Soy-based Products

Application further Includes Biscuits, Chocolates, Cakes, Mayonnaise, Pasta, Noodles and Breads Swine

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East & Africa

The egg replacer market is valued at USD 1.4 billion in 2025.

The market is expected to reach USD 2.6 billion by 2035, with a CAGR of 6.0%.

Dry egg replacers are anticipated to lead the market with a 67.5% share in 2025.

Dairy proteins are expected to hold a 32.4% share in 2025.

Japan is projected to be the fastest-growing market with a CAGR of 7.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Grading Machines Market Size and Share Forecast Outlook 2025 to 2035

Egg Breaking Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg and Egg Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Egg Packaging Market by Packaging Type & Material from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA