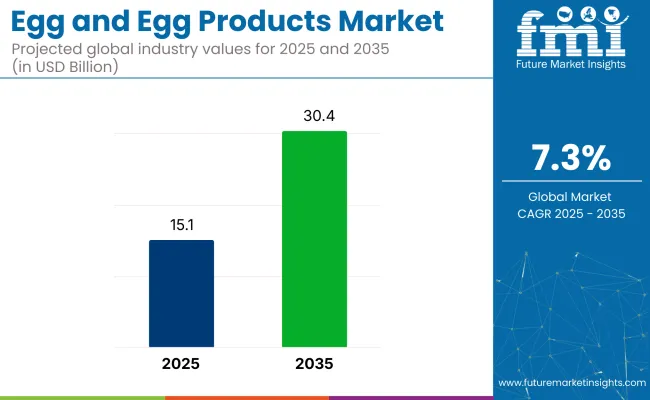

The global egg and egg products market is anticipated to reach a market value of USD 15.1 billion in 2025, with expectations to expand further to USD 30.4 billion by 2035. This growth trajectory indicates a CAGR of 7.3% from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 15.1 billion |

| Industry Value (2035F) | USD 30.4 billion |

| CAGR (2025 to 2035) | 7.3% |

The egg and egg products market reached an inflection point between 2020 and 2024, shaped by supply reconfiguration and rapid adoption of processed formats across industrial applications. Between 2020 and 2024, global demand was buoyed by the pandemic-driven acceleration of shelf-stable and value-added protein ingredients.

Shelf-ready products such as pasteurized liquid eggs and powdered albumin gained commercial momentum, especially in North America and parts of East Asia, where baking, confectionery, and institutional catering underwent cost and labor rationalization.

USA egg exports rose from 231 million dozen in 2020 to 293 million dozen in 2023, with Japan, South Korea, and Mexico leading import growth. In Europe, the egg-processing sector saw a 19% rise in demand for powdered yolk in bakery and ready-meal categories over this same period, aided by long ambient shelf life and streamlined HACCP compliance.

By contrast, the 2025 to 2035 phase is shaped more by efficiency, vertical integration, and differentiated nutrition. Automation and robotics adoption in grading, packing, and pasteurization has reduced production cost per dozen by 12- 14% in the USA and EU since 2021, improving the feasibility of diversified SKUs for institutional buyers.

Growth from 2025 onward is less reactive and more structurally optimized: centralized processing, renewable energy-driven hatcheries, and precision-fed layer hens are becoming dominant themes. These shifts mark the movement from pandemic-induced substitution to strategic protein integration- where shelf life, consistency, and functionality are prioritized across ready-to-eat, sports nutrition, and medical nutrition categories.

The industry accounts for a smaller share compared to parent markets such as the global pulses, legumes, and plant-based protein markets. In the broader agricultural and protein sectors, eggs represent a niche segment. The egg market, while substantial, accounts for only about 2-3% of the total global protein market.

In comparison, pulses and legumes, with their diverse applications and higher global consumption, dominate with a share of approximately 10-12%. Within the plant-based protein market, eggs, particularly in the form of substitutes or processed products, make up around 4-5%, still a significant but smaller portion. In relation to the organic food and African agricultural markets, eggs capture a modest share, influenced by regional consumer trends towards health.

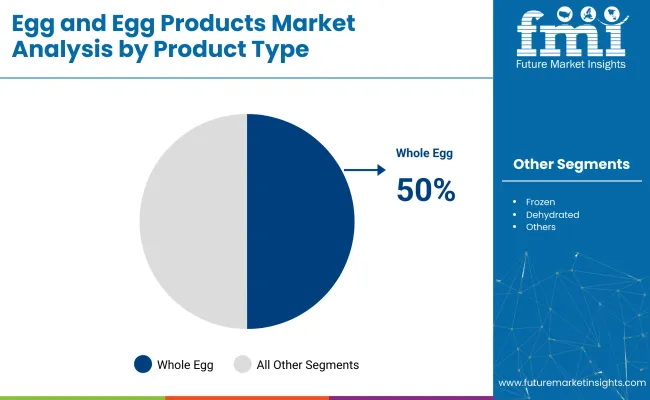

The market is primarily driven by the dominance of whole eggs, brown eggs, and medium-sized eggs, each holding substantial shares due to their versatility, affordability, and consumer preferences for health. The food and beverage industry remains the largest end-user, with liquid eggs leading in form due to their convenience in large-scale food production.

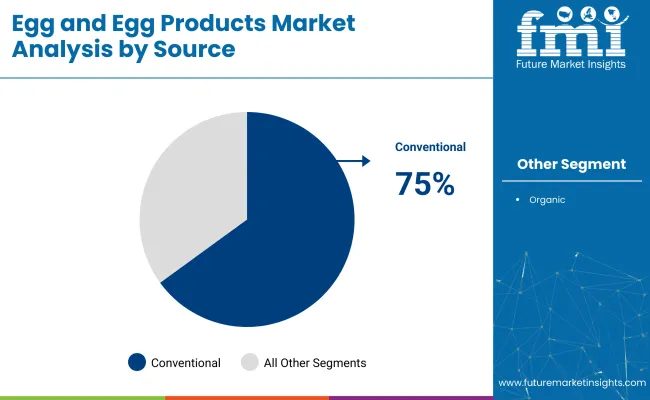

Conventional eggs dominate the market, while indirect sales channels continue to hold the majority share, ensuring widespread accessibility and distribution across both retail and foodservice sectors.

The whole egg segment is expected to dominate the market, holding the largest share. This segment is projected to capture 50% of the total market in 2025.

Brown eggs are projected to account for nearly 58.3% industry share by 2025, primarily due to their perceived health benefits.

Medium size are projected to account for over 36.4% of the share in 2025, making them the largest size category. The medium size egg segment is leading due to its versatility and suitability for a wide range of culinary applications.

The food and beverage segment is expected to dominate the market in 2025, capturing the largest share. This segment is projected to hold around 45% of the total market due to the widespread use of eggs in various food applications, particularly in processed foods, ready-to-eat meals, and beverages.

The liquid egg segment is expected to lead the market in 2025, capturing the largest share of 55% in 2025. This dominance is driven by the growing demand for convenience in food preparation, particularly in commercial kitchens, food processing, and the bakery industry.

The conventional egg segment is expected to lead the market in 2025, capturing the largest share of 75% in 2025. This dominance is due to conventional eggs being more widely available and cost-effective compared to organic eggs.

The indirect sales segment is expected to lead the market in 2025, holding a significant share of around 60%. This dominance is primarily driven by the extensive distribution network that reaches a broad consumer base through intermediaries like wholesalers, distributors, and retailers.

Egg and egg product demand is accelerating due to supply-side recalibration and downstream functional diversification. Demand drivers extend beyond fitness trends and into contract manufacturing, foodservice digitization, and ingredient precision.

Shelf-Stable Proteins Restructuring Institutional Menus

Across hospital catering, QSR chains, and export-ready baked goods, egg derivatives such as albumin powder and pasteurized yolk are replacing fresh eggs due to their thermal stability, pathogen control, and transport efficiency. Liquid eggs now account for over 24% of institutional procurement in North America, while UHT-treated formats in Japan have reduced last-mile cold chain dependency by 17% in school meal programs. High-protein ready meals incorporating pasteurized egg blends have expanded in Southeast Asia, where workforce-led urban expansion drives meal-prep simplification.

Hybrid Sourcing Models Redefining Convenience Economics

Manufacturers are now favoring hybrid sourcing: centralized procurement of cage-free whole eggs paired with regional spray-drying operations to localize powdered supply. These models are helping brands balance ethical sourcing claims with operational resilience.

In France and South Korea, private-label producers increased their egg protein use in breakfast kits and bakery mixes by 14% and 18% YoY, respectively, enabled by localized drying and blending hubs. The rise in plant-animal hybrid meal kits is also prompting reclassification of egg inputs under functional protein indexes rather than commodity SKUs.

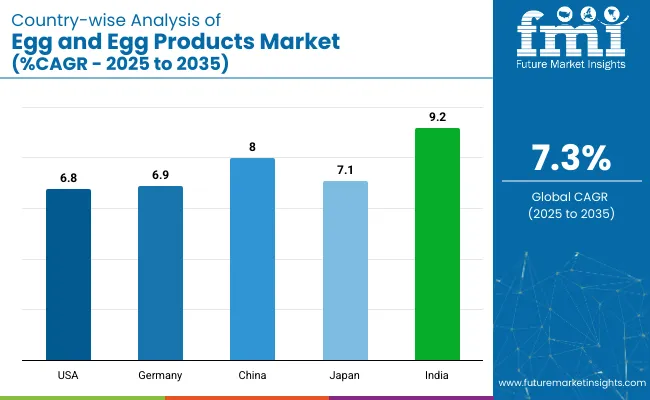

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

| Germany | 6.9% |

| Japan | 7.1% |

| China | 8.0% |

| India | 9.2% |

The global egg and egg products market is projected to grow at a CAGR of 7.3% from 2025 to 2035. Among the five profiled countries, India leads with a CAGR of 9.2%, followed by China at 8.0%, and Japan at 7.1%, while Germany posts 6.9%, and the United States records 6.8%. These rates result in a growth premium of +34% for India, +17% for China, and +10% for Japan compared to the baseline, whereas Germany and the United States trail by -1% each.

Divergence reflects country-specific drivers: India’s rising demand for affordable protein amid population growth, China’s expanding foodservice sector, Japan’s blend of traditional and premium egg consumption trends, Germany’s preference for organic and free-range eggs, and the USA’s focus on health-conscious consumers and convenience-driven egg products.

The egg and egg products market in the United States is estimated to grow at a CAGR of 6.8% during the forecast period. This growth is driven by the increasing consumer demand for affordable, high-protein food options and the rise of health-conscious diets. Eggs are widely recognized for their nutritional benefits, offering a cost-effective source of protein, vitamins, and minerals, which has contributed to their increased consumption across various demographics.

The popularity of ready-to-eat meals, meal kits, and processed foods, where eggs are used as a key ingredient, is fueling the market. As the USA continues to focus on convenience, liquid eggs and pre-cooked egg products are seeing higher adoption in both households and the foodservice industry. The growing trend of plant-based diets has encouraged in egg alternatives, with some consumers increasingly seeking sustainable and ethical farming practices for egg production, further driving demand.

The egg and egg products market in Germany is expected to grow at a CAGR of 6.9% from 2025 to 2035. Germany’s growing demand for eggs is influenced by the country’s strong focus on health, and organic products. Consumers are increasingly shifting towards organic and free-range eggs, viewing them as healthier and more environmentally friendly options. The increasing popularity of vegan and plant-based diets has sparked a rising interest in egg alternatives, but eggs remain a staple in German cuisine, used in a variety of foods, including baked goods, pastries, and sauces.

The growing demand for convenience in cooking and food preparation also supports the growth of liquid and pre-cooked egg products, particularly among busy urban consumers. As German consumers place a premium on food traceability and ethical production, eggs produced under strict welfare and standards are expected to see continued demand growth.

The egg and egg products market in China is projected to grow at a CAGR of 8.0% between 2025 and 2035. China is one of the largest producers and consumers of eggs in the world, and this market is expanding due to increasing a middle class with rising disposable income. As Chinese consumers shift toward more balanced and health-conscious diets, eggs, known for their high protein content and nutritional value, are becoming a staple food item.

The demand for processed egg products, including liquid and powdered eggs, is growing due to the expanding foodservice and bakery sectors. The Chinese government’s focus on food safety and quality control is further driving demand for more standardized and traceable egg products. The shift towards more convenient, ready-to-eat, and high-quality egg options is transforming consumer preferences, supporting continued market growth.

Sales of egg and egg products in Japan is anticipated to grow at a CAGR of 7.1% during the forecast period. Japan’s egg consumption is increasing due to its integral role in the country’s traditional diet, including dishes like tamago (egg omelet) and tamagoyaki (Japanese rolled omelet). The rising health awareness among Japanese consumers is driving demand for eggs, as they are considered an excellent source of protein and essential nutrients.

Japan also has a strong preference for premium and ethically produced eggs, including organic and cage-free varieties, as consumers become more conscious about animal welfare and environmental. Japan's growing food processing and convenience food industries are fueling demand for egg-based ingredients, such as liquid eggs and egg powder, due to their ease of use in mass production and longer shelf life. The market is also supported by Japan’s aging population, where eggs are seen as a convenient and nutritious food choice.

Demand for egg and egg products in India is valued at a CAGR of 9.2% during the forecast period. India is experiencing rapid growth in egg consumption due to the rising population, and increased awareness of the nutritional benefits of eggs, especially for protein. Eggs are a vital part of the Indian diet, providing a cost-effective and easily accessible protein source, particularly in rural areas.

The growing popularity of convenience foods, such as ready-to-eat meals and meal kits, is also driving demand for processed egg products like liquid and powdered eggs. As India’s middle class expands, there is increasing demand for higher-quality, premium egg products, including organic and cage-free options. This shift toward more sustainable and ethical egg production practices is in line with global trends, with consumers becoming more concerned about food origins and the ethical treatment of animals.

The egg and egg products market is moderately consolidated, with leading players such as Centrum Valley Farms, Opal Foods LLC, Kreider Farms, Wabash Valley Produce, Inc., Center Fresh Group, Cal-Maine Foods Inc., Rose Acre Farms Inc., Michael Foods Inc., Hillandale Farms, Trillium Farm Holdings L.LC., Rembrandt Enterprises, Hickman’s Egg Ranch, Midwest Poultry Services L.P., Sparboe Farms, Herbruck’s Poultry Ranch, Weaver Brothers, Daybreak Foods Inc., The Compass Group, and ISE America Inc. These companies dominate the market by offering a variety of egg products, including fresh, liquid, and processed eggs, as well as specialty egg-based offerings tailored to various industries such as food service, retail, and animal feed.

For example, Cal-Maine Foods Inc. is the largest producer of eggs in the USA, focusing on both shell eggs and processed egg products. Rose Acre Farms Inc. is known for its wide range of egg products and sustainable farming practices, while Michael Foods Inc. offers processed egg products that cater to both retail and food service sectors. Sparboe Farms specializes in providing cage-free and organic eggs, which aligns with the growing demand for ethically produced and sustainable food products.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 15.1 billion |

| Projected Market Size (2035) | USD 30.4 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Type Analyzed (Segment 1) | Whole Egg, Frozen, Chilled, Pre-Cooked, Dehydrated, and Specialty Products. |

| Color Analyzed (Segment 2) | Brown and White. |

| Size Analyzed (Segment 3) | Small, Medium, Large, and Jumbo Size. |

| End Use Analyzed (Segment 4) | Food And Beverage (Bakery, Confectionary, Dressings, Pasta & Noodles, Fish & Meat Products, And Others), Animal Feed, Pharmaceutical, Cosmetics & Personal Care, Household, And HORECA. |

| Form Analyzed (Segment 5) | Liquid, Crystal, And Powder. |

| Source Analyzed (Segment 6) | Organic And Conventional. |

| Sales Channel Analyzed (Segment 7) | Direct Sales And Indirect Sales (Modern Trade Formats, Convenience Store, Online Retail, Grocery Stores, And Other Retail Formats) |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Centrum Valley Farms, Opal Foods LLC, Kreider Farms, Wabash Valley Produce, Inc., Center Fresh Group, Cal-Maine Foods Inc., Rose Acre Farms Inc., Michael Foods Inc., Hillandale Farms, Trillium Farm Holdings L.L.C., Rembrandt Enterprises, Hickman's Egg Ranch, Midwest Poultry Services L.P., Sparboe Farms, Herbruck's Poultry Ranch, Weaver Brothers, Daybreak Foods Inc., The Compass Group, ISE America Inc. |

| Additional Attributes | Dollar sales, market share, growth rate (CAGR), consumer preferences, trends in product types (whole, liquid, specialty), regional demand, competitive landscape, and pricing strategies. |

The industry is segmented into whole egg, frozen, chilled, pre-cooked, dehydrated, and specialty products.

The key colors are brown and white.

The industry finds small, medium, large, and jumbo size.

The industry is segmented into food and beverage (bakery, confectionary, dressings, pasta & noodles, fish & meat products, and others), animal feed, pharmaceutical, cosmetics & personal care, household, and HORECA.

The industry is segmented into liquid, crystal, and powder.

The industry covers organic and conventional.

The industry is divided into direct sales and indirect sales (modern trade formats, convenience store, online retail, grocery stores, and other retail formats).

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 15.1 billion in 2025.

It is forecasted to reach USD 30.4 billion by 2035.

The industry is anticipated to grow at a CAGR of 7.3% during this period.

Conventional egg is projected to lead the market with a 65% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 9.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Grading Machines Market Size and Share Forecast Outlook 2025 to 2035

Egg Breaking Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Egg Packaging Market by Packaging Type & Material from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA