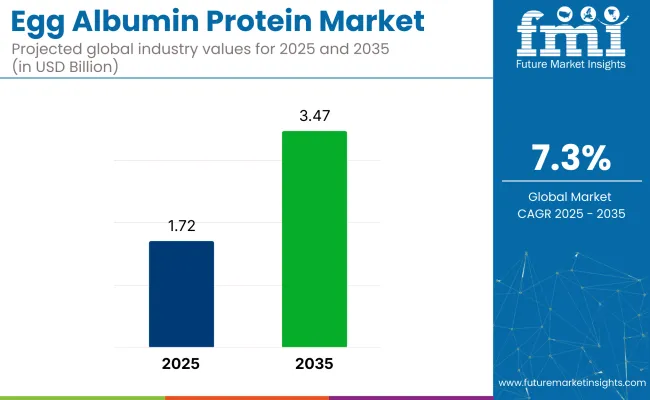

The global egg albumin protein market is estimated to be valued at USD 1.72 billion in 2025 and USD 3.47 billion by 2035. This represents a CAGR of 7.3% throughout the forecast period. Between 2020 and 2024, demand for egg albumin protein surged due to a spike in home baking, increased use in meal kits, and the rebound of sports nutrition post-COVID lockdowns.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.72 billion |

| Industry Value (2035F) | USD 3.47 billion |

| CAGR (2025 to 2035) | 7.3% |

Global shipments grew by 10.6%, with Asia-Pacific leading the volume increase. Avian influenza outbreaks across the USA and Europe disrupted shell-egg availability, driving manufacturers to shift toward powdered albumin as a price-stable alternative. US processors imported egg derivatives to offset the domestic shortfall, lifting global processed egg trade. Regulatory changes also streamlined product approvals, enabling clean-label, unflavoured albumin variants to gain wider shelf presence.

From 2025 to 2035, market growth will be driven by expansion into medical nutrition, elderly care, and protein-fortified baked goods. Asia Pacific, led by India’s 10.6% CAGR, will dominate growth through rising middle-class health adoption and clinical use.

Input costs are expected to stabilize as egg supply chains recover from past shocks, reducing price volatility and enabling consistent use across functional food applications. While early growth was reactive and supply-constrained, the next decade will rely on product reformulation, precision targeting in health-focused segments, and expanded retail penetration in nutraceutical blends and personalized nutrition formats.

The industry accounts for a relatively small yet growing share within these broader markets. In the plant-based protein market, egg albumin protein, being an animal-based protein, accounts for a modest share, likely under 5%, as the sector is dominated by plant-based alternatives. Within the legume market, the market’s share is negligible, as legumes like soy, peas, and beans are the primary sources of plant protein.

In the functional foods market, egg albumin plays a more significant role, likely capturing around 2-3% due to its nutritional benefits in health-focused products. Within the food and beverage ingredients market, egg albumin’s share is also small, under 10%, while in the agricultural market, its contribution is limited, as egg albumin is primarily a byproduct rather than a core agricultural commodity.

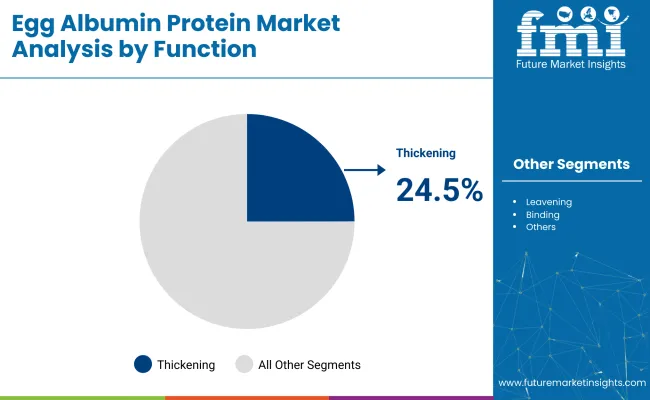

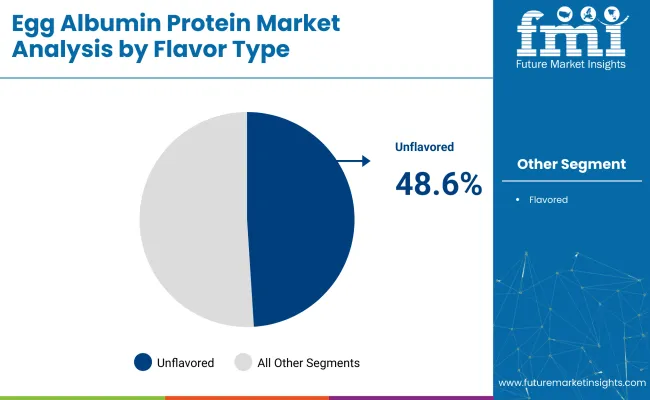

In 2025, the bakery & confectionery segment will lead the market with a 21.5% share, driven by its role in providing structure, volume, and texture in baked goods. The thickening segment follows closely with a 24.5% share, fueled by the demand for clean-label, natural thickening agents. The regular/unflavored segment is expected to hold 48.6% of the market, favored for its versatility, purity, and appeal among athletes and health-conscious consumers seeking high-quality, neutral-tasting protein.

Bakery & confectionery are projected to dominate the egg albumin protein market in 2025, accounting for 21.5% of the market share. The bakery & confectionery segment dominates the egg albumin protein market due to the critical role egg whites play in baking and confectionery products.

Thickening is projected to account for 24.5% of the egg albumin protein market share in 2025, due to the unique functional properties of egg albumin that make it an ideal natural thickening agent. .

The regular/unflavored is expected to hold a 48.6% share of the market in 2025, due to its versatility and appeal, particularly among athletes, fitness enthusiasts, and health-conscious consumers.

The egg albumin protein market is being reshaped by less visible but strategically important shifts in sourcing strategies, regulatory alignment, and industrial applications-beyond health and fitness trends. These forces are widening the addressable market across geographies and verticals.

Veterinary-grade usage broadens protein lifecycle value

An underappreciated dynamic has emerged through the growing use of egg albumin in veterinary and animal diagnostics. Its stability under variable conditions has made it a favored reagent in diagnostic kits and vaccine stabilizers. This has led to incremental demand from biopharma suppliers, who repurpose edible-grade albumin in diagnostics and non-human vaccines.

Cross-border labeling compliance is shaping global supply routes

Regulatory harmonization between key food trade blocs-especially ASEAN, EU, and GCC-has accelerated cross-border demand for albumin products with standardized certifications (e.g., ISO 22000, halal, kosher). These protocols are driving supplier preference toward centralized, audit-compliant facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| Germany | 6.4% |

| Japan | 7.3% |

| China | 9.3% |

| India | 10.6% |

The egg albumin protein market shows diverse growth trends across various countries. The United States (5.8% CAGR) and Germany (6.4% CAGR), both part of the OECD group, benefit from a mature wellness industry and strong demand for clean-label, high-protein products. Japan (7.3% CAGR), also in the OECD, is driven by its aging population seeking functional foods for healthy aging, with egg albumin’s digestibility and amino acid profile making it a natural choice.

In China (9.3% CAGR) and India (10.6% CAGR), both part of the BRICS group, rapid urbanization, rising health awareness, and growing middle classes are fueling demand for egg albumin, driven by the adoption of Western fitness trends and increasing interest in protein-based foods. The BRICS countries are experiencing faster growth, while OECD markets focus on premium, allergen-free ingredients.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for egg albumin protein in the United States is projected to grow at a 5.8% CAGR from 2025 to 2035. This growth is driven by the strong health and fitness culture in the USA, along with a significant rise in health-conscious consumers who are increasingly adopting high-protein diets.

The demand for clean-label, natural ingredients is fueling the preference for egg albumin as a premium protein source. The expansion of protein-based products in retail and e-commerce platforms is also contributing to the rapid growth of the product in the country, particularly within the protein supplements, sports nutrition, and functional foods markets.

Sales of egg albumin protein in Germany is anticipated to grow at a 6.4% CAGR between 2025 and 2035. German consumers are increasingly focusing on health and wellness, particularly with a preference for sustainable, allergen-free, and clean-label ingredients.

Egg albumin is emerging as a preferred natural protein source, aligning with the country's eco-consciousness and transparency in food sourcing. The demand for plant-based and alternative protein sources is accelerating, with egg albumin complementing plant-based diets as an ideal protein source. These factors are set to drive the German market’s growth significantly over the next decade.

The egg albumin protein market in Japan is expected to grow at a 7.3% CAGR from 2025 to 2035. The aging population in Japan is a major driver of this market growth, as consumers increasingly seek protein-rich foods and supplements to support healthy aging. Egg albumin is a popular choice due to its complete amino acid profile and digestibility. The market is further boosted by Japan’s cultural affinity for eggs, which naturally integrates egg albumin into both traditional and modern culinary practices, including sports nutrition products.

The egg albumin protein market in China is projected to grow at a 9.3% CAGR during the forecast period. The rapid expansion of China's middle class and growing awareness about the importance of health and wellness are key drivers of the market. Increasing health concerns and the rise in Western-style fitness trends have led to an increased demand for protein-rich foods, and egg albumin fits well as a high-quality, low-fat protein source. The growth of the fitness culture and the expanding dietary supplement market further enhances the demand for egg albumin.

India's egg albumin protein market is expected to grow at a 10.6% CAGR from 2025 to 2035. With a large, young population increasingly prioritizing fitness and health, the demand for high-quality, affordable protein sources is growing. Egg albumin is an attractive option due to its digestibility, affordability, and versatility in various dietary regimens. The rise of fitness trends, particularly in urban areas, is further driving demand. The surge in vegetarianism is contributing to the popularity of egg albumin as a valuable protein source for plant-based diets.

The industry is supported by a blend of well-established companies and emerging innovators focusing on high-quality protein products, clean-label ingredients, and sustainable sourcing. Leading players such as Merck KGaA, Kewpie Corporation, and Now Health Group drive with a focus on natural, allergen-free protein alternatives.

Companies like Rembrandt Foods and Taiyo Kagaku Co. Ltd. are recognized for their expertise in food-grade egg albumin production, while firms like Rose Acre Farms and Ovostar provide significant market reach with large-scale production and distribution. Newer entrants such as JW Nutritional LLC, IGRECA, and Caneggs are responding to increasing consumer demand for protein supplements and functional foods.

European innovators like Dutch Egg Powder Solutions BV and Redspoon Company are driving the shift toward clean-label egg albumin products, with Avangardco and Aqua Lab Technologies providing solutions that cater to both the retail and sports nutrition sectors.

Recent Egg Albumin Protein Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.72 billion |

| Projected Market Size (2035) | USD 3.47 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Flavor Type Analyzed (Segment 1) | Regular/Unflavored and Flavored. |

| End User Application Analyzed (Segment 2) | Bakery & Confectionery, Protein & Nutritional Bars, Breakfast Cereals, Functional Beverages, Dietary Supplements, Sports Nutrition, Infant Nutrition, Prepared Foods, Meat Analogs, Dressings, Sauces & Spreads, Pharmaceutical Products, Personal Care Products, Dairy & Desserts, and Others. |

| Function Analyzed (Segment 3) | Thickening, Leavening, Binding, Preservatives/Antimicrobial, Emulsifying, Crystallization, and Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Merck KGaA, HiMedia Laboratories Pvt. Ltd, Kewpie Corporation, Now Health Group, Rembrandt Foods, Sanaovo, Taiyo Kagaku Co. Ltd, JW Nutritional LLC, Rose Acre Farms, Ovostar, IGRECA, Dutch Egg Powder Solutions BV, Caneggs, Redspoon Company, Avangardco, Aqua Lab Technologies, and Sainsbury's. |

| Additional Attributes | Dollar sales, market share, growth trends, key consumer segments, competitive landscape, pricing strategies, demand for clean-label products, and forecasted growth rates by region. |

The industry is segmented into regular/unflavored and flavored.

The key end users include bakery & confectionery, protein & nutritional bars, breakfast cereals, functional beverages, dietary supplements, sports nutrition, infant nutrition, prepared foods, meat analogs, dressings, sauces & spreads, pharmaceutical products, personal care products, dairy & desserts, and others.

The industry finds functions in thickening, leavening, binding, preservatives/antimicrobial, emulsifying, crystallization, and others.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 1.72 billion in 2025.

It is forecasted to reach USD 3.47 billion by 2035.

The industry is anticipated to grow at a CAGR of 7.3% during this period.

Regular/unflavored are projected to lead the market with a 48.6% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 10.6%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Albumin Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA