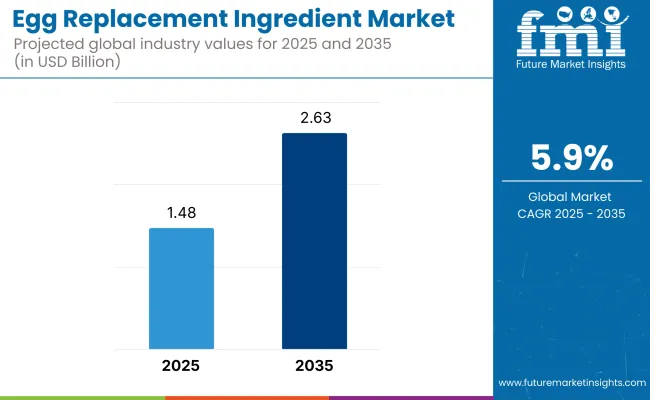

The global egg replacement ingredient market is poised to grow significantly over the next few years, with its market value estimated at USD 1.48 billion in 2025 and expected to reach USD 2.63 billion by 2035. This growth represents a steady CAGR of 5.9% between 2025 and 2035.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 1.48 Billion |

| Projected Industry Value (2035F) | USD 2.63 Billion |

| Value-based CAGR (2025 to 2035) | 5.9% |

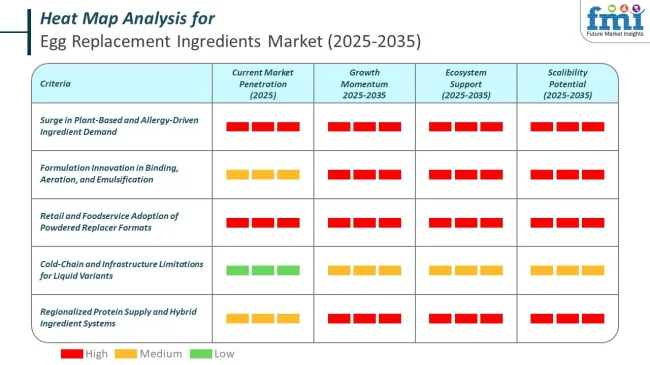

The increasing prevalence of veganism, coupled with rising awareness of egg allergies and dietary restrictions, is contributing substantially to market demand. Additionally, the rising popularity of plant-based diets, especially in North America, Europe, and parts of Asia, has amplified the consumption of egg replacement ingredients, fostering innovations in food formulations and expanding their applications across various food and beverage categories.

The market is undergoing dynamic transformation as food manufacturers increasingly prioritize clean-label and sustainable product offerings. A shift in consumer preference towards non-GMO, allergen-free, and gluten-free food items is compelling manufacturers to explore novel plant-based ingredients. This trend is not only driven by vegan consumers but also by flexitarians who are consciously reducing animal-derived ingredients in their diets.

Furthermore, powdered egg replacements have gained dominance due to their superior shelf-life, ease of transportation, and versatility in different food applications such as bakery products, dressings, and ready-to-eat meals. Ingredient innovations such as algal flours, chia seed gels, and flaxseed gels have attracted considerable interest due to their nutritional profiles and functional benefits, such as binding and emulsification properties that closely mimic traditional eggs.

A significant driving factor for the egg replacement ingredient market is the ongoing advancement in food science and technology, allowing manufacturers to improve the texture, taste, and functionality of plant-based alternatives. Leading players like Cargill Incorporated, Ingredion Incorporated, Kerry Group plc, Bob's Red Mill, Arla Foods, and Ener-G Foods are heavily investing in research and partnerships to develop proprietary protein isolates and functional blends.

These innovations address key challenges such as aeration, heat stability, and emulsification, which are crucial for replicating egg properties in various culinary applications. Additionally, the growing demand from emerging markets such as India, driven by the rapid rise of plant-protein startups and health-conscious consumer bases, is expected to fuel market expansion further in the coming years.

Aquafaba, the cooking liquid from chickpeas, can match or exceed egg white in foam overrun when paired with stabilizers and careful processing. Its performance is sensitive to concentration, pH, and the use of hydrocolloids.

Egg replacement for lift in baked goods relies on chemical leavening systems and approved novel ingredients, but allergen and labeling rules can complicate “egg‑free” claims.

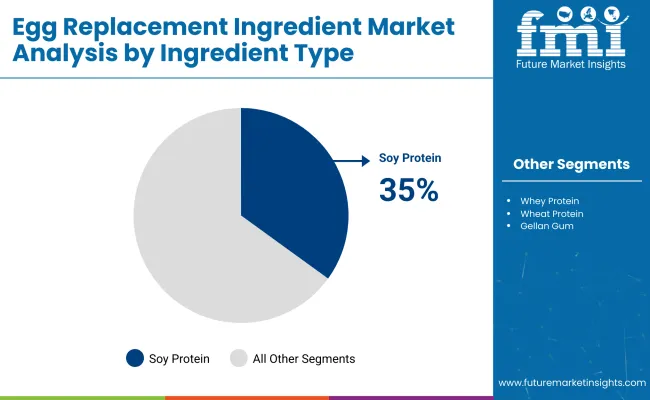

The egg replacement ingredient market is segmented based on ingredient type, form, and region. By ingredient type, the market includes whey proteins, soy proteins, wheat proteins, xanthan gum, guar gum, gellan gum, carrageenan, emulsifiers, chia seed gel, flaxseed gel, and algal flours.

By form, the market is categorized into powder and liquid formats. Regionally, the market analysis covers North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

| Ingredient Type | Share (2025) |

|---|---|

| Soy Protein | 35% |

Soy proteins hold a dominant share in the global egg replacement ingredient market, accounting for nearly 35% of the overall market in 2025. Soy proteins are widely utilized due to their excellent functional properties, such as emulsification, binding, and moisture retention, making them ideal for bakery, confectionery, and ready-to-eat products.

Their affordability and compatibility with existing processing technologies further drive their adoption in both large-scale and artisanal food production. Additionally, soy proteins offer a neutral flavor profile and high protein content, which enhances the nutritional value of final food products, catering to the rising demand for plant-based and clean-label alternatives.

Following soy proteins, whey proteins maintain a stable position in the market, especially in regions with established dairy consumption traditions such as Europe and North America. Although their market share is gradually facing pressure from plant-based proteins, whey proteins remain preferred for their superior foaming, gelling, and texturizing capabilities in specific culinary applications. However, concerns over allergenicity and lactose intolerance are expected to limit their long-term growth potential compared to vegan alternatives.

Emerging ingredient types such as chia seed gel, flaxseed gel, and algal flours are gaining rapid traction due to their natural origin and additional health benefits, such as omega-3 content and dietary fiber. These novel ingredients are particularly favored in premium and functional food products targeting health-conscious and vegan consumers. Among these, algal flours are forecasted to witness the fastest growth rate, driven by their unique nutritional profile and versatility across diverse food and beverage applications.

By form, the liquid segment is projected to grow at the highest CAGR of 6.4% during the forecast period from 2025 to 2035. The demand for liquid egg replacers is expanding due to their suitability in applications requiring quick hydration and better dispersion, such as sauces, dressings, and ready-to-drink formulations.

Liquid formats also cater to foodservice and industrial users who prioritize convenience and faster preparation times. Although the liquid segment currently holds a smaller market share compared to powders, its growth is being propelled by innovations in clean-label, refrigerated plant-based liquid blends that appeal to both commercial kitchens and retail consumers seeking fresher, less-processed alternatives.

On the other hand, Powdered egg replacers are highly preferred due to their long shelf life, ease of storage, and convenient handling during transportation and processing. They offer excellent stability and functionality in a wide range of applications such as bakery, confectionery, and convenience foods. The powder form is favored by manufacturers for its consistent performance in moisture retention, emulsification, and binding properties, making it the default choice across mass production lines.

| Form | CAGR (2025 to 2035) |

|---|---|

| Liquid | 6.4% |

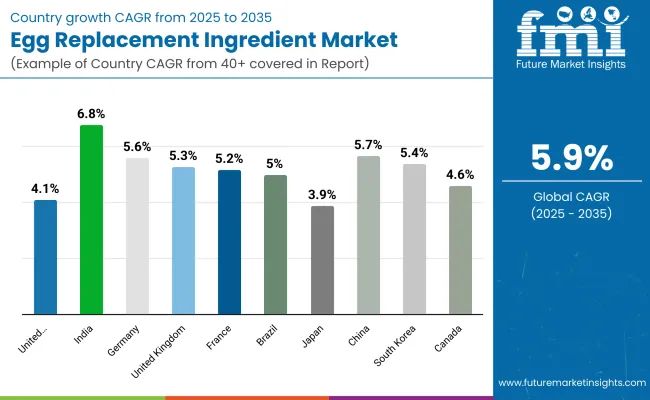

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.10% |

| India | 6.80% |

| Germany | 5.60% |

| United Kingdom | 5.30% |

| France | 5.20% |

| Brazil | 5.00% |

| Japan | 3.90% |

| China | 5.70% |

| South Korea | 5.40% |

| Canada | 4.60% |

Valued at USD 0.61 Billion in 2025, the USA market is expected to reach USD 0.91 Billion by 2035 at a CAGR of 4.1%. This growth is driven by rising consumer awareness of food allergies, cholesterol concerns, and demand for plant-based alternatives. The foodservice industry, especially bakery and confectionery sectors, leads adoption due to the consistent performance and stability of powdered egg replacers.

Private-label expansion, D2C wellness brands, and allergen-free certification trends are further accelerating the shift. As clean-label standards tighten, players that combine functionality with transparency are poised to gain durable market share in a highly competitive landscape.

India’s market stands at USD 0.42 Billion in 2025 and is forecast to surge to USD 0.81 Billion by 2035, clocking a CAGR of 6.8%, the highest among major countries. Rapid urbanization, increased protein intake, and rising lactose and egg allergies among vegetarians have spurred growth in egg substitutes.

Startups and large FMCG players are investing in soy-, mung bean-, and pea-based replacers, while decentralized processing units improve reach and affordability. Ayurvedic formulations and fortified nutritional drinks are also integrating egg-free binders. As consumer health consciousness rises, plant-based egg alternatives are increasingly seen as both a dietary upgrade and a hygienic, shelf-stable solution.

Germany’s egg replacement market, valued at USD 0.17 Billion in 2025, is projected to reach USD 0.29 Billion by 2035, growing at a 5.6% CAGR. The market benefits from EU regulatory frameworks promoting non-GMO and E-number-free ingredients. German consumers strongly favor clean-label, functional food solutions, and this has made whey- and casein-based replacers popular for bakery and patisserie applications.

Recent innovations in membrane filtration and enzymatic modification have increased the appeal of hybrid formulations. Retail chains and industrial food processors are also adopting egg replacers to mitigate supply volatility caused by avian flu and egg price fluctuations.

The UK market, pegged at USD 0.15 Billion in 2025, is forecast to reach USD 0.25 Billion by 2035 at a CAGR of 5.3%. With a mature vegan landscape and regulatory clarity post-Brexit, the country is seeing strong growth in private-label plant-based SKUs across retail and meal-kit services.

Chickpea flour, flaxseed gel, and functional hydrocolloids are widely used in both ready-to-eat meals and baking mixes. UK formulators prioritize taste fidelity and nutritional density, while retailers demand clear sustainability claims. The shift toward fortified, egg-free options for children and elderly nutrition further strengthens category depth and differentiation.

France’s egg substitute market is set to grow from USD 0.14 Billion in 2025 to USD 0.23 Billion in 2035, reflecting a CAGR of 5.2%. Culinary culture plays a unique role here-chefs and boutique brands prefer locally sourced, functional alternatives with a focus on texture and emulsification.

Egg-free mayonnaise, custards, and pâtisserie glazes are increasingly common in gourmet settings. Regulatory scrutiny over egg production and demand for sustainable gastronomy have accelerated innovation in chia gel, emulsifiers, and flaxseed blends. French consumers are also adopting powdered substitutes in meal prep and premium health mixes, especially within flexitarian and lactose-intolerant demographics.

Brazil’s egg replacement ingredient market is projected to grow from USD 0.12 Billion in 2025 to USD 0.20 Billion by 2035, posting a 5.0% CAGR. Growth is fueled by the expansion of mid-tier bakery chains and the foodservice sector’s need for cost-stable, shelf-stable ingredients amid volatile egg prices.

Powdered forms dominate, particularly soy-based and tapioca-starch-enhanced substitutes used in savory baked goods and snacks. Urban consumer interest in flexitarian diets and lactose/egg-free school meals has increased demand. Meanwhile, regional ingredient suppliers are partnering with global food manufacturers to launch allergen-free offerings tailored to Brazilian taste and regulatory preferences.

Valued at USD 0.11 Billion in 2025, Japan’s market is expected to hit USD 0.16 Billion by 2035, growing at a modest 3.9% CAGR. Japanese food processors favor egg replacers that offer consistency, taste neutrality, and clean emulsification-key for delicate bakery goods, confections, and savory snacks.

Algal flours, pea proteins, and modified starches are emerging as premium substitutes in bento-ready meals and school lunch programs. Regulatory emphasis on traceability and food safety is high, prompting companies to invest in certified, local sourcing. Niche growth is also visible in vegan izakaya menus and plant-based beverages that use hydrocolloid stabilizers in place of eggs.

China’s market is projected to grow from USD 0.13 Billion in 2025 to USD 0.23 Billion by 2035, at a 5.7% CAGR. Demand is surging in urban centers for shelf-stable, plant-based protein alternatives. Community group-buying apps, local e-commerce, and convenience chains are expanding access to egg replacers in cooking kits and health snacks.

Pea protein powders, chia-based binders, and gellan gum blends are being used in dumplings, sauces, and bakery fillings. Heightened awareness about food safety and the environmental cost of poultry farming is fueling institutional adoption-particularly in canteens and school meal programs. Imported blends are gaining traction via localized co-packing partnerships.

South Korea’s market, worth USD 0.10 Billion in 2025, is anticipated to grow to USD 0.17 Billion by 2035, posting a 5.4% CAGR. The rapid growth of K-food exports, coupled with domestic demand for allergy-safe and vegan snacks, is driving innovation in egg substitutes. Seaweed-based emulsifiers, mung bean flours, and modified gums are being used in bakery premixes, pancakes, and functional drinks.

Hypermarkets and D2C health brands are launching new SKUs weekly, tapping into Korea’s wellness-focused and trend-sensitive youth. Local players are also capitalizing on the growing demand from convenience stores for RTD beverages and microwavable meals with egg-free claims.

Canada’s market is expected to grow from USD 0.10 Billion in 2025 to USD 0.16 Billion by 2035, with a 4.6% CAGR. The growth is driven by institutional foodservice, smoothie bar chains, and organic bakery brands adopting egg-free ingredients for consistency and allergen-free labeling.

Domestic regulations favor clean-label formulations, and consumer preference is shifting toward chia and flax-based alternatives in high-protein snacks. Canada also imports premium blends from the USA and Europe, which are often customized for local dietary norms. Growth is strongest in health-conscious urban centers like Toronto and Vancouver, where plant-based innovation intersects with multicultural culinary experimentation.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.48 Billion |

| Projected Market Size (2035) | USD 2.63 Billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue (USD Billion), Volume (Kilotons) |

| By Ingredient Type | Whey Proteins, Soy Proteins, Wheat Proteins, Xanthan Gum, Guar Gum, Gellan Gum, Carrageenan, Emulsifiers, Chia Seed Gel, Flaxseed Gel, Algal Flours |

| By Form | Powder, Liquid |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Top Countries Covered | United States, India, Germany, United Kingdom, France, Brazil, Japan, China, South Korea, Canada |

| Key Players | Cargill, Ingredion, Kerry Group, Arla Foods Ingredients, Corbion, Palsgaard, Bob’s Red Mill, Ener-G Foods, Eggcitables, Eat Just, Inc. |

| Additional Attributes | Country-wise CAGR, Segment-wise Forecasts, Company Strategy Profiles, Clean-label & Plant-based Adoption Trends |

By ingredient type, methods industry has been categorized into Whey Proteins, Soy Proteins, Wheat Proteins, Xanthan Gum, Guar Gum, Gellan gum, Carrageenan, Emulsifiers, Chia seed gel, Flaxseed gel and Algal flours

By form, industry has been categorized into powder and liquid

The market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global egg replacement ingredient market is valued at USD 1.48 billion in 2025 and is projected to reach USD 2.63 billion by 2035, expanding at a CAGR of 5.9% over the forecast period.

Powdered plant proteins such as soy and wheat hold the highest share, accounting for around 80% of the market due to their versatility, shelf stability, and functionality in bakery and processed foods.

India is expected to lead with a CAGR of 6.8% from 2025 to 2035, driven by rising demand for vegetarian protein sources, health-conscious diets, and expanding plant-based food innovation.

Key players include Cargill, Ingredion, Kerry Group, and Arla Foods Ingredients, all of whom supply functional proteins, emulsifiers, and plant-based systems used in food and beverage formulations globally.

Egg substitutes are in demand due to rising food allergies, vegan dietary shifts, clean-label preferences, and the need for cost-effective, shelf-stable ingredients in bakery, sauces, and processed meals.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Egg Replacement Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Grading Machines Market Size and Share Forecast Outlook 2025 to 2035

Egg Breaking Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg and Egg Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA