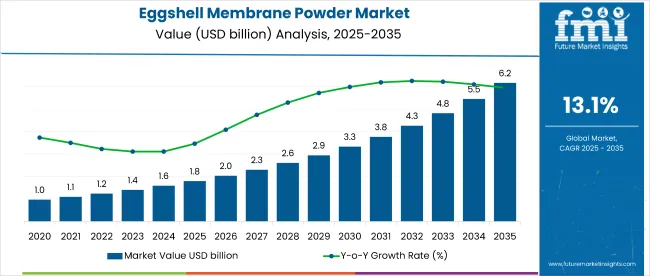

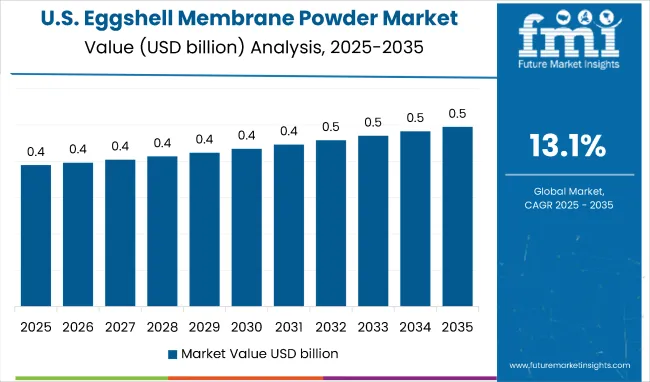

The global eggshell membrane powder market is projected to grow from USD 1.8 billion in 2025 to USD 6.2 billion by 2035, registering a CAGR of 13.1%. The market expansion is being driven by increasing demand for natural and bioactive ingredients in dietary supplements, cosmetics, and functional foods.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.8 billion |

| Industry Value (2035F) | USD 6.2 billion |

| CAGR (2025 to 2035) | 13.1% |

Rising consumer awareness about joint, bone, and skin health is encouraging the use of eggshell membrane powder in nutraceutical and personal care formulations. Products enriched with collagen, elastin, and glycosaminoglycans derived from eggshell membranes are gaining traction across wellness, beauty, and anti-aging segments.

The market holds an estimated 11% share of the global collagen supplement market, driven by its rich content of collagen and elastin. Within the nutraceutical ingredients market, it accounts for 3.5%, reflecting its growing use in joint and bone health supplements. It contributes around 2.8% to the functional food ingredients market due to its application in bars, shakes, and wellness products.

In the personal care ingredients market, it holds a 1.2% share, supported by its inclusion in anti-aging and skin-nourishing products. Its presence in the broader animal-based protein and dietary supplements markets remains below 1%.

Government regulations impacting the market focus on food safety, nutraceutical labeling, and permissible claims in cosmetics and supplements. In the United States, the FDA’s Dietary Supplement Health and Education Act (DSHEA) governs the marketing of eggshell membrane-based supplements.

In the European Union, EFSA regulations ensure scientific substantiation for health claims made on food products. Similarly, in Japan, eggshell membrane products are regulated under the Food with Health Claims (FHC) framework. These regulatory frameworks drive the development of standardized, high-purity formulations that meet safety and efficacy requirements, supporting the expansion of the market.

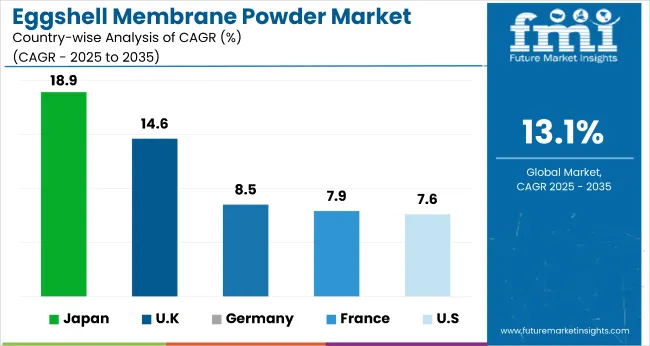

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 18.9% from 2025 to 2035. Nutraceuticals will lead the application segment with a 46% share, while powdered eggshell membrane will dominate the type segment with a 52% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 7.6% and 8.5%, respectively. The UK will expand at a strong CAGR of 14.6%, while France is projected to grow at 7.9% during the same period.

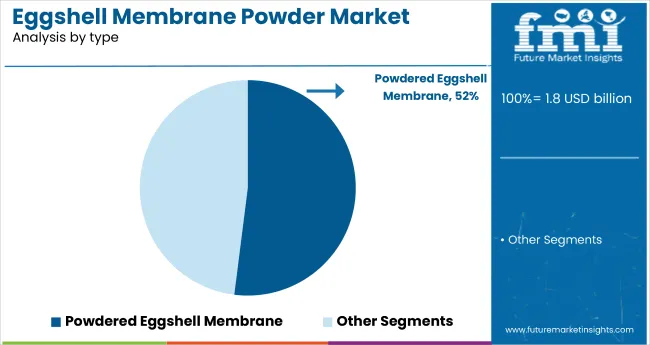

The global market is segmented by type, application, and region. By type, the market includes powdered eggshell membrane, concentrated eggshell membrane, and other eggshell membranes (hydrolyzed eggshell membrane, fermented eggshell membrane, enzymatically processed membranes, and membrane-derived peptides).

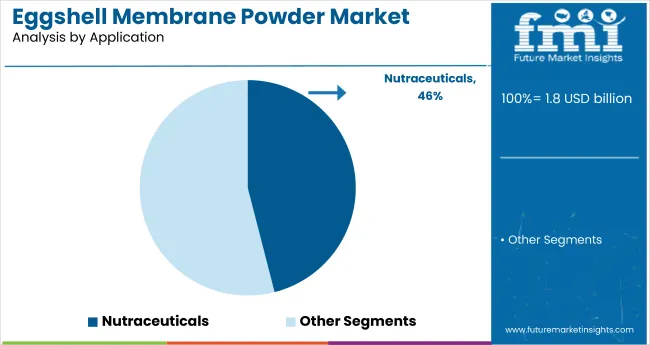

Based on application, the market is divided into nutraceuticals, food & beverages, pet food industry, cosmetic & personal care, and other applications (pharmaceuticals, biotechnology, sports nutrition, and animal supplements). Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Powdered eggshell membrane is projected to lead the type segment, capturing 52% of the market share by 2025. This form is widely preferred due to its ease of formulation in dietary supplements and food applications. Additionally, its superior bioavailability and compatibility with various delivery systems enhance its effectiveness, making it ideal for joint health and skin care products. The powder form also offers longer shelf life and consistent quality, driving strong demand across nutraceutical and functional food industries globally.

Nutraceutical is projected to lead the application segment, accounting for 46% of the global market in 2025. This growth is driven by rising demand for natural supplements supporting joint, bone, and skin health among health-conscious consumers. Increasing awareness of preventive healthcare and the benefits of collagen-rich ingredients like eggshell membrane further fuels market expansion.

The global eggshell membrane powder market is experiencing rapid growth, fueled by increasing consumer preference for natural, functional ingredients in dietary supplements, cosmetics, and functional foods. Eggshell membrane powder plays a critical role in supporting joint, bone, and skin health due to its rich composition of collagen, elastin, and glycosaminoglycans.

Recent Trends in the Eggshell Membrane Powder Market

Challenges in the Eggshell Membrane Powder Market

Japan’s growth is propelled by nutraceutical innovation, collagen-based beauty products, and strong consumer acceptance of functional food ingredients. Germany and France sustain steady demand through strict supplement labeling laws and clean-label food movements. Developed economies such as the United States (7.6% CAGR), United Kingdom (14.6% CAGR), and Japan (18.9% CAGR) are projected to grow at 0.58 to 1.44 times the global rate.

Japan leads market growth, fueled by demand for functional foods and collagen-based supplements. The United Kingdom follows closely, supported by innovation in clean-label cosmeceuticals and sports nutrition products. Germany maintains steady growth, driven by consumer trust in pharmaceutical-grade supplements and robust regulatory standards.

France experiences moderate expansion, driven by rising demand for nutricosmetics and traceable ingredient sourcing. The United States shows the slowest growth among these countries, with gains concentrated in mobility and beauty-from-within segments, supported by strong retail infrastructure and wellness-focused demographics across capsules, powders, and drink blends.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan eggshell membrane powder market is growing at a CAGR of 18.9% from 2025 to 2035. Growth is driven by aging demographics, demand for natural collagen sources, and the popularity of functional foods. Japan’s food and beauty sectors integrate eggshell membrane powder into skin-supporting drinks, powders, and beauty supplements. A technological focus on high bioavailability and safety certifications differentiates Japan from other markets.

Sales of eggshell membrane powder in Germany are expected to expand at a CAGR of 8.5% during the forecast period, below the global average but supported by strong regulatory frameworks and consumer health interest. EU nutrition labeling rules, preference for verified health claims, and the integration of eggshell membrane in orthomolecular therapy and cosmetics fuel demand.

The French eggshell membrane powder market is projected to grow at a 7.9% CAGR during the forecast period. Demand is supported by national wellness campaigns, rising cosmetic supplement adoption, and growing penetration of collagen-based functional beverages. France’s preference for traceable, organic-sourced ingredients aligns with the clean-label trend.

The USA eggshell membrane powder market is projected to grow at a CAGR of 7.6% from 2025 to 2035, or 0.58 times the global rate. Unlike emerging economies focused on new product launches, USA growth stems from the popularity of joint, bone, and beauty supplements among aging and wellness-focused demographics. Demand is strongest in capsules, drink powders, and sports recovery blends.

The UK eggshell membrane powder market is projected to grow at a CAGR of 14.6% from 2025 to 2035, the highest among OECD nations at 1.11 times the global average. Growth is driven by surging demand for natural ingredients in sports nutrition, cosmeceuticals, and functional foods. UK brands are launching marine- and egg-derived collagen products with strong wellness positioning.

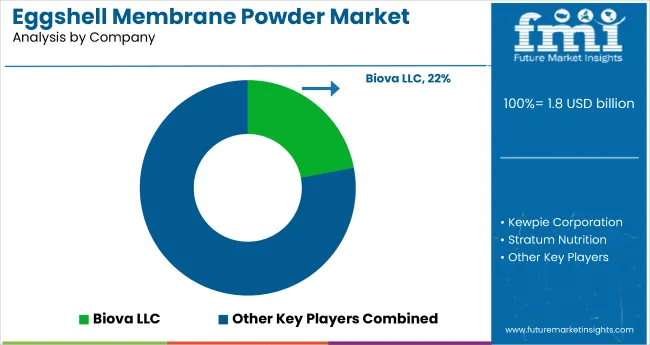

The global market is moderately consolidated, with key players such as Biova LLC, Microcore Research Laboratories, Ecovatec Solutions, Eggbrane, and Stratum Nutrition shaping the industry landscape. These companies focus on innovation, bioavailability, and clean-label formulations for dietary supplements, cosmetics, and nutraceuticals. Biova LLC is recognized for its BiovaFlex and BiovaDerm ingredients catering to joint and skin health. Microcore Research Laboratories and Ecovatec Solutions emphasize high-purity production and sustainability.

Eggbrane and Stratum Nutrition deliver pharmaceutical-grade and bioactive-rich formulations. Other notable players like Certified Nutraceutical Inc, Bolise Co. Ltd., Mitushi Biopharma, Kewpie Corporation, and Eggnovo SL contribute with specialized offerings across global markets, supporting functional food, personal care, and wellness applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 6.2 billion |

| CAGR (2025 to 2035) | 13.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Type Analyzed | Powdered Eggshell Membrane, Concentrated Eggshell Membrane, Other Eggshell Membranes (Hydrolyzed Eggshell Membrane, Fermented Eggshell Membrane, Enzymatically Processed Membranes, Membrane-Derived Peptides) |

| Application Analyzed | Nutraceuticals, Food & Beverages, Pet Food Industry, Cosmetic & Personal Care, Other Applications (Pharmaceuticals, Biotechnology, Sports Nutrition, Animal Supplements) |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Biova LLC, Microcore Research Laboratories, Ecovatec Solutions, Eggbrane, Stratum Nutrition, Certified Nutraceutical Inc, Bolise Co. Ltd., Mitushi Biopharma, Kewpie Corporation, Eggnovo SL |

| Additional Attributes | Share by type, application trends, regional demand outlook, clean-label certifications, functional ingredient penetration, pricing benchmarks |

The global eggshell membrane powder market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the eggshell membrane powder market is projected to reach USD 6.2 billion by 2035.

The eggshell membrane powder market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in eggshell membrane powder market are organic and conventional.

In terms of application, nutraceutical segment to command 42.6% share in the eggshell membrane powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Membrane Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Membrane Switch Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in Membrane Boxes Manufacturing

Geomembrane Market Strategic Growth 2024-2034

Egg Membrane Powder Market

PTFE Membrane Market

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Mucous Membrane Pemphigoid Treatment Market

Medical Membrane Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Amniotic Membrane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA