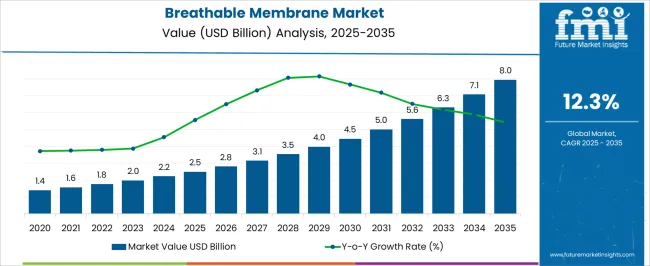

The Breathable Membrane Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

| Metric | Value |

|---|---|

| Breathable Membrane Market Estimated Value in (2025 E) | USD 2.5 billion |

| Breathable Membrane Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 12.3% |

The Breathable Membrane market is experiencing robust growth, driven by the increasing demand for construction materials that provide weather protection while allowing moisture vapor to escape. These membranes are being widely adopted in residential, commercial, and industrial construction projects due to their ability to enhance building durability, prevent condensation, and improve energy efficiency. Rising investments in infrastructure development, coupled with growing awareness of sustainable and high-performance construction practices, are further accelerating adoption.

Advancements in membrane technology, including enhanced permeability, UV resistance, and mechanical strength, are improving performance and reliability. The integration of membranes in roofing and wall systems supports building safety, occupant comfort, and long-term maintenance cost reduction.

Regulatory standards promoting energy-efficient and environmentally friendly construction are also driving market expansion As demand for high-performance building materials continues to rise, the Breathable Membrane market is expected to experience sustained growth, with opportunities emerging from both new construction projects and retrofitting applications aimed at improving building efficiency and durability.

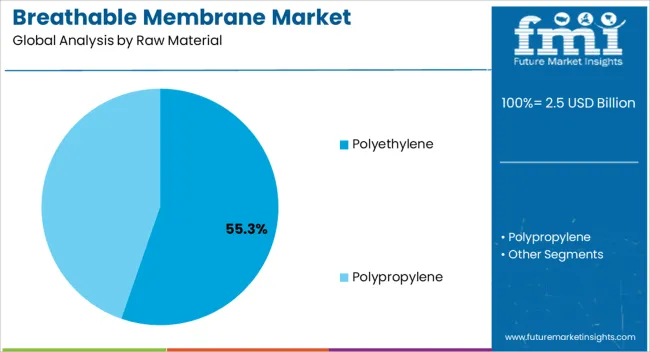

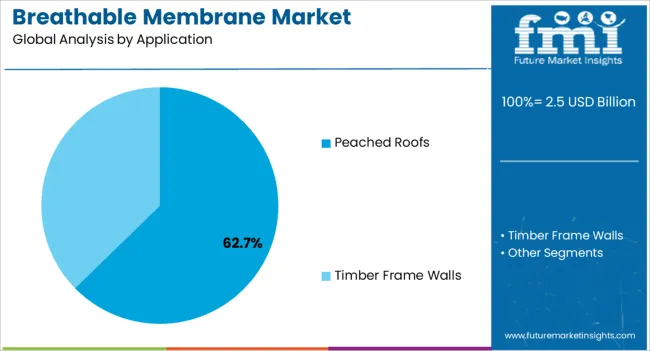

The breathable membrane market is segmented by raw material, application, and geographic regions. By raw material, breathable membrane market is divided into Polyethylene and Polypropylene. In terms of application, breathable membrane market is classified into Peached Roofs and Timber Frame Walls. Regionally, the breathable membrane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene raw material segment is projected to hold 55.3% of the market revenue in 2025, establishing it as the leading raw material type. Its dominance is being driven by the combination of flexibility, durability, and cost-effectiveness that polyethylene provides, making it suitable for a wide range of construction applications. Polyethylene-based membranes exhibit high water resistance while allowing moisture vapor to escape, preventing condensation and mold formation within building structures.

The lightweight nature and ease of installation further enhance its adoption among contractors and builders. Continuous improvements in polymer formulation and processing technologies have improved tensile strength, UV resistance, and lifespan, strengthening the material’s market position.

Growing awareness of energy efficiency, building safety, and sustainable construction practices is reinforcing demand for polyethylene membranes As the construction industry increasingly prioritizes materials that balance performance, durability, and cost, polyethylene is expected to maintain its leading position in the market, supported by technological innovation and widespread applicability across roofing and wall systems.

The peached roofs application segment is expected to account for 62.7% of the market revenue in 2025, making it the leading application area. Growth in this segment is being driven by the need for durable, weather-resistant, and breathable roofing solutions in residential and commercial construction. Breathable membranes in peached roof systems prevent water ingress while allowing moisture vapor to escape, improving structural integrity and extending roof life.

Enhanced permeability and UV resistance of modern membranes have increased their adoption in both new construction and renovation projects. The lightweight and flexible characteristics of these membranes facilitate faster installation and reduce labor costs, providing additional value to builders and contractors.

Rising awareness of energy-efficient and sustainable building practices has reinforced demand, as breathable membranes improve thermal performance and indoor comfort With increasing infrastructure development and renovation activities globally, peached roofs are expected to remain the primary driver of market growth, supported by the superior performance and adaptability of breathable membrane solutions in modern construction applications.

The global breathable membrane market is projected to reach a value of USD 2219.6 million in 2025. The industry is expected to grow at a CAGR of 12.3% during the forecast period 2025 to 2035. The sector, at this growth rate, is estimated to reach USD 7080.6 million by 2035.

The breathable membrane market is witnessing significant growth propelled by increasing awareness about energy efficiency, sustainability concerns, and advancements in construction technology. These membranes, designed to allow moisture vapor to escape while preventing liquid water ingress, are revolutionizing building practices globally.

| Attributes | Description |

|---|---|

| Estimated Global Breathable Membrane Market Size (2025E) | USD 2219.6 million |

| Projected Global Breathable Membrane Market Value (2035F) | USD 7080.6 million |

| Value-based CAGR (2025 to 2035) | 12.3% |

One of the primary drivers of this market is the growing demand for energy-efficient construction solutions. With a focus on reducing carbon emissions and conserving energy, breathable membranes play a crucial role in enhancing the thermal performance of buildings. By facilitating the escape of moisture vapor, these membranes contribute to improved insulation and reduced energy consumption for heating and cooling, thus aligning with sustainability goals and regulatory requirements.

Moreover, there's a noticeable shift towards sustainable and eco-friendly building materials, driving the adoption of breathable membranes made from recyclable and biodegradable materials. Manufacturers are investing in research and development to create membranes with minimal environmental impact, catering to the preferences of environmentally conscious consumers and industries.

Technological advancements are also driving innovation in breathable membrane manufacturing processes, resulting in membranes with enhanced properties such as higher breathability, improved waterproofing, and increased durability. These advancements offer architects and builders more options for creating structures that meet stringent performance standards while prioritizing occupant comfort and health.

The construction industry's rapid growth, particularly in urbanizing regions, is fueling the demand for breathable membranes across various applications such as roofing, walls, and floors. As the importance of indoor air quality and occupant comfort gains prominence, breathable membranes are increasingly recognized for their ability to create healthier indoor environments by preventing the buildup of mold and mildew.

Despite the market's growth prospects, several challenges exist, including high initial costs, limited awareness, resistance to change, and competition from alternative solutions. Overcoming these challenges requires collaborative efforts from manufacturers, industry stakeholders, and policymakers to drive innovation, raise awareness, and improve affordability, thus unlocking the full potential of the market in the construction industry.

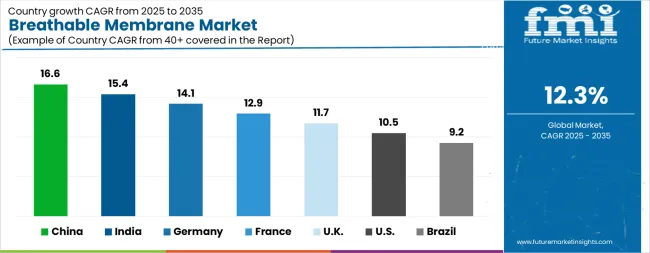

| Country | CAGR |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.1% |

| France | 12.9% |

| UK | 11.7% |

| USA | 10.5% |

| Brazil | 9.2% |

The Breathable Membrane Market is expected to register a CAGR of 12.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.6%, followed by India at 15.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.2%, yet still underscores a broadly positive trajectory for the global Breathable Membrane Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.1%. The USA Breathable Membrane Market is estimated to be valued at USD 883.9 million in 2025 and is anticipated to reach a valuation of USD 2.4 billion by 2035. Sales are projected to rise at a CAGR of 10.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 134.2 million and USD 81.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Raw Material | Polyethylene and Polypropylene |

| Application | Peached Roofs and Timber Frame Walls |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

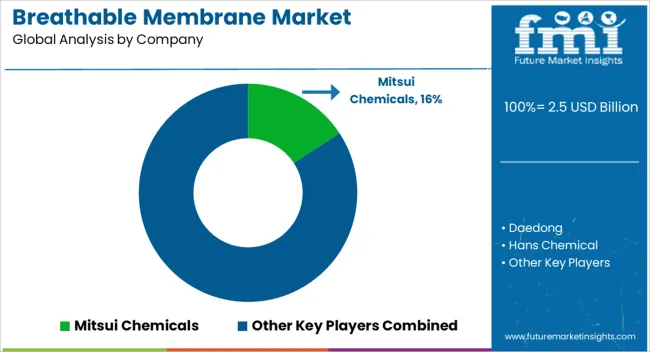

| Key Companies Profiled | Mitsui Chemicals, Daedong, Hans Chemical, Hanjin P&C, Swanson Plastics, FSPG Huahan, Liansu Wanjia, Shandong HaiWei, AvoTeck, Shanghai Zihua, Arkema, Clopay Plastic Products, and NITTO DENKO |

The global breathable membrane market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the breathable membrane market is projected to reach USD 8.0 billion by 2035.

The breathable membrane market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in breathable membrane market are polyethylene and polypropylene.

In terms of application, peached roofs segment to command 62.7% share in the breathable membrane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breathable Bag Perforators Market Forecast Outlook 2025 to 2035

Breathable Tape Market Size and Share Forecast Outlook 2025 to 2035

Breathable Films Market Growth, Trends, Forecast 2025 to 2035

Breathable Lidding Film Packaging Market by Material Type from 2025 to 2035

Competitive Overview of Breathable Lidding Film Packaging Companies

Market Positioning & Share in the Breathable Films Industry

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Membrane Switch Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in Membrane Boxes Manufacturing

Geomembrane Market Strategic Growth 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA