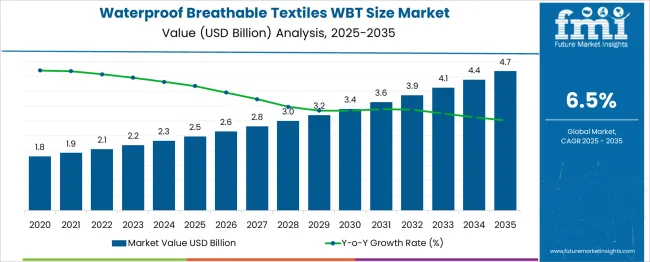

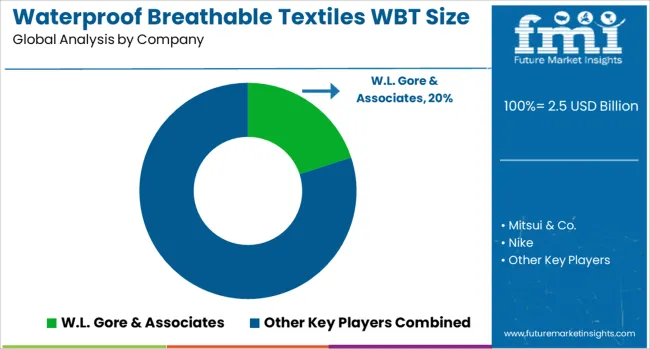

The Waterproof Breathable Textiles WBT Size Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Waterproof Breathable Textiles WBT Size Market Estimated Value in (2025E) | USD 2.5 billion |

| Waterproof Breathable Textiles WBT Size Market Forecast Value in (2035F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The waterproof breathable textiles market is expanding steadily, supported by growing consumer demand for performance fabrics that offer comfort and protection. Increasing participation in outdoor activities and sports has elevated the need for textiles that combine waterproofing with breathability.

Technological innovations in membrane development have improved fabric durability and moisture management, making these textiles highly suitable for activewear. Additionally, rising awareness about the benefits of functional clothing in various weather conditions has driven adoption among athletes and fitness enthusiasts.

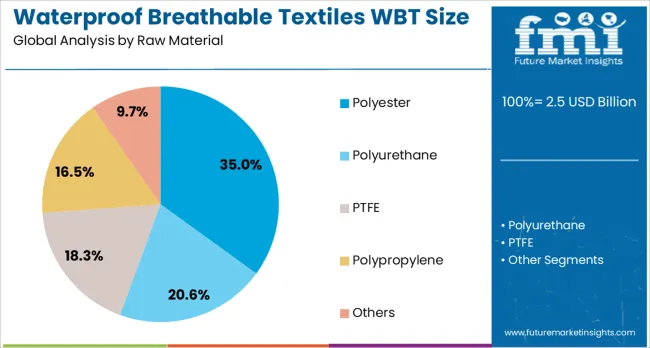

The shift towards sustainable and high-performance raw materials has also influenced market dynamics. Growth is expected to be fueled by continuous product innovation and expanding applications across sportswear and activewear segments. Segment expansion is anticipated to be led by polyester as the preferred raw material, membranes as the dominant textile technology, and sportswear and activewear as the primary product application.

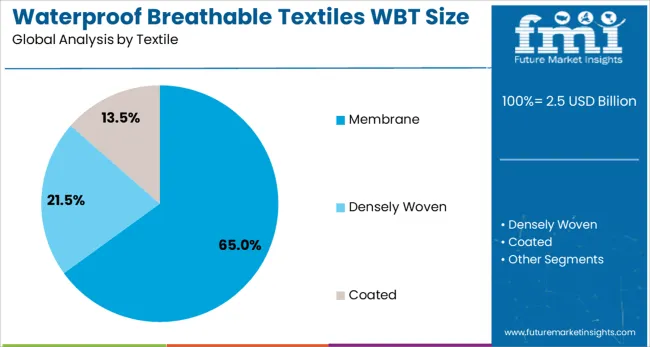

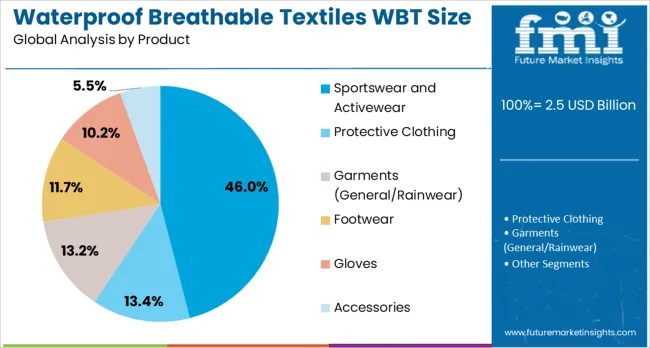

The waterproof breathable textiles wbt size market is segmented by raw material, textile, and product and geographic regions. By raw material of the waterproof breathable textiles wbt size market is divided into Polyester, Polyurethane, PTFE, Polypropylene, and Others. In terms of textile of the waterproof breathable textiles wbt size market is classified into Membrane, Densely Woven, and Coated. Based on product of the waterproof breathable textiles wbt size market is segmented into Sportswear and Activewear, Protective Clothing, Garments (General/Rainwear), Footwear, Gloves, and Accessories. Regionally, the waterproof breathable textiles wbt size industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyester raw material segment is projected to account for 35.0% of the waterproof breathable textiles market revenue in 2025, maintaining its leadership position. Polyester’s strength, durability, and moisture-wicking properties have made it a favored choice in performance textiles. Its cost-effectiveness and ease of processing have supported widespread adoption in textile manufacturing.

Additionally, polyester fibers can be engineered to enhance breathability and water resistance, meeting the dual demands of comfort and protection. The material’s compatibility with advanced membrane technologies has reinforced its dominance.

As demand for versatile, high-performance fabrics grows, the polyester segment is expected to continue driving the market forward.

The membrane textile segment is projected to contribute 65.0% of the market revenue in 2025, establishing itself as the dominant technology. Membranes provide a critical function by allowing moisture vapor to escape while preventing liquid water penetration, thus enhancing wearer comfort in varied conditions.

Advances in membrane materials have increased durability and flexibility, broadening their application across different fabric types. Manufacturers have focused on improving membrane integration techniques to maintain fabric breathability without compromising waterproofing.

Growing consumer preference for lightweight and functional clothing has further supported membrane adoption. The membrane textile segment is expected to sustain its leading market share as innovation continues.

The sportswear and activewear segment is expected to hold 46.0% of the waterproof breathable textiles market revenue in 2025, reflecting its importance as the largest product application category. The demand in this segment has been driven by the rising trend of athleisure and outdoor sports participation globally.

Consumers increasingly seek apparel that offers protection from environmental elements while maintaining comfort during physical activity. Waterproof breathable fabrics have become essential in sportswear for their ability to regulate temperature and manage sweat effectively.

Product designers have prioritized functionality combined with style to appeal to active consumers. As health and fitness lifestyles continue to grow, the sportswear and activewear segment is projected to maintain a strong presence in the market.

Demand for waterproof breathable textiles is rising as outdoor gear, performance wear, and industrial-safety apparel prioritize weather protection and comfort. Sales of membrane-laminated fabrics and sustainable WBT options are expanding rapidly. Adoption is strongest in sportswear, military gear, and protective clothing markets across Europe, North America, and Asia-Pacific.

Demand for advanced waterproof breathable textiles surged by 29% in 2024, driven by manufacturers targeting high-performance outdoor wear and protective uniforms. Membrane technologies like ePTFE and PU-laminated fabrics became standard, achieving water penetration resistance above 10,000 mm H₂O while maintaining air permeability rates of 15 L/m²·s. Apparel equipped with these textiles reduced moisture accumulation and heat stress by over 30% compared to conventional coatings. Demand is driven by consumer expectations for breathability in extreme weather conditions and regulatory needs for safety clothing in offshore, mining, and industrial cleaning sectors.

Sales of sustainable waterproof breathable textiles rose 34% year-over-year in 2024, led by demand for recycled PET-based membranes and fluorine-free waterproof finishes. Brands adopting bluesign-certified or recycled-content fabrics reduced lifecycle environmental impact by over 25%. In performance sportswear and eco-conscious outdoor gear, recycled-based WBTs now represent over 18% of new product launches. Sales tie-in with microfiber reduction initiatives also boosted adoption in high-stretch and lightweight product lines. Vendors offering digital traceability of recycled content and chemical-free waterproof coating systems gained competitive traction across sustainable apparel brands.

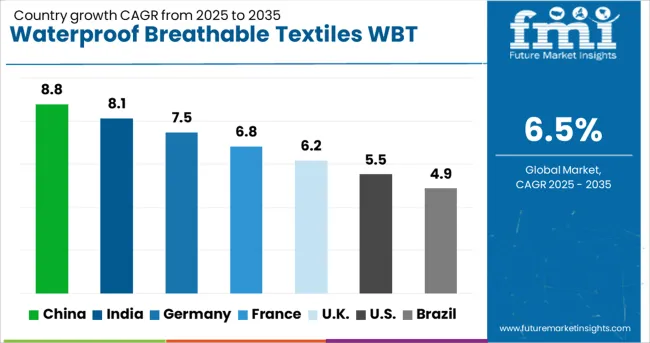

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global WBT market is forecast to grow at a CAGR of 6.5% from 2025 to 2035, propelled by increasing demand for technical apparel, rising outdoor recreational activity, and growth in performance wear and defense textiles. China leads the expansion with an 8.8% CAGR, driven by large-scale manufacturing, government incentives for eco-friendly fabric production, and strong demand for athleisure. India follows at 8.1%, where demand is rising from adventure sports gear, smart uniforms, and consumer preference for moisture-regulating fabrics in hot climates. Germany is growing at 7.5%, supported by R&D in membrane technology and demand for sustainable outdoor apparel. The UK, at 6.2%, is focused on performance textiles for sports, defense, and medical wearables. The US sees a 5.5% CAGR, influenced by innovations in breathable nanomaterials and consumer awareness of moisture-wicking apparel. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is expected to grow at an 8.8% CAGR, driven by its dominance in large-scale textile manufacturing and rising demand for high-performance fabrics in outdoor and athleisure wear. Government incentives for advanced fabric production encourage the adoption of membrane-based technologies for waterproof and moisture-regulating apparel. The sportswear segment is expanding as local and global brands introduce functional garments for fitness and hiking. Manufacturers are integrating nanotechnology and multi-layer laminates to improve fabric breathability and durability. Partnerships with global outdoor apparel brands enable domestic producers to enhance quality standards and diversify export capabilities for technical textiles.

India is forecast to grow at an 8.1% CAGR, supported by increased use of waterproof breathable fabrics in outdoor gear, industrial uniforms, and consumer apparel for hot climates. Adventure sports and trekking activities are fueling demand for lightweight, breathable jackets and footwear. Military procurement programs are introducing high-performance fabrics for combat uniforms, designed for comfort and protection in varying weather conditions. Domestic brands are adopting membrane and coating technologies to compete with premium imports. Rising preference for functional apparel in semi-urban regions is further boosting sales across e-commerce channels, creating new market opportunities for value-added textiles.

Germany is projected to expand at a 7.5% CAGR, driven by R&D advancements in waterproof membranes and technical laminates. Domestic apparel brands are investing in high-precision coating systems to enhance moisture management and durability for outdoor wear. Demand is rising in mountaineering, skiing, and cycling apparel segments, as consumers prefer weather-resistant yet breathable textiles. Industrial players are also exploring applications in workwear and protective clothing. German research centers are collaborating with textile manufacturers to integrate micro-porous membranes into eco-certified fabrics for global exports. Growth is further supported by partnerships between apparel brands and technology providers specializing in nanocoating processes.

The United Kingdom is anticipated to grow at a 6.2% CAGR, supported by rising demand for high-performance apparel in professional sports and defense applications. Waterproof breathable fabrics are increasingly used in medical wearables, emphasizing comfort and hygiene. Brands are focusing on developing functional outerwear for premium retail and e-commerce channels. Lightweight, durable laminates are gaining popularity in cycling and running apparel. Government contracts for advanced uniforms are creating opportunities for domestic textile innovators. Integration of digital printing with breathable laminates is enabling customization in performance apparel, strengthening market presence for UK-based manufacturers.

The United States is expected to grow at a 5.5% CAGR, fueled by innovations in nanomaterials and smart coatings that enhance water resistance without sacrificing breathability. Outdoor apparel and athleisure segments remain key growth drivers, with leading brands introducing advanced waterproof jackets and footwear for all-weather use. High adoption in snow sports and hiking gear underlines demand for functional fabrics with superior comfort. Manufacturers are exploring recyclable membranes and lightweight laminates for performance apparel. Strategic collaborations between textile firms and technology companies are accelerating development of fabrics with improved thermal regulation for extreme weather conditions.

W.L. Gore & Associates leads the market, supported by its GORE-TEX technology used in outdoor apparel and performance gear. Mitsui & Co. and Nike are expanding their textile innovation to include sustainable and high-performance fabrics for sports and lifestyle wear. Toray Industries continues to invest in R&D for advanced membranes and coatings, strengthening its global partnerships. Covestro contributes through high-tech polyurethane materials, while Clariant AG focuses on functional textile treatments that enhance water repellency and breathability. The market is growing as brands demand lightweight, eco-friendly, and weather-resistant textiles across both activewear and technical clothing segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Raw Material | Polyester, Polyurethane, PTFE, Polypropylene, and Others |

| Textile | Membrane, Densely Woven, and Coated |

| Product | Sportswear and Activewear, Protective Clothing, Garments (General/Rainwear), Footwear, Gloves, and Accessories |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | W.L. Gore & Associates, Mitsui & Co., Nike, Toray Industries, Covestro, and Clariant AG |

| Additional Attributes | Dollar sales by raw material (ePTFE, polyurethane, polyester) and application (garments, footwear, accessories), demand dynamics across outdoor apparel and protective wear, regional leadership in Asia‑Pacific with strong North American growth, innovation in membrane coatings and sustainable DWR alternatives, and environmental impact related to PFAS regulations and recyclability. |

The global waterproof breathable textiles wbt size market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the waterproof breathable textiles wbt size market is projected to reach USD 4.7 billion by 2035.

The waterproof breathable textiles wbt size market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in waterproof breathable textiles wbt size market are polyester, polyurethane, ptfe, polypropylene and others.

In terms of textile, membrane segment to command 65.0% share in the waterproof breathable textiles wbt size market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Makeup Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Sneakers Market Analysis - Growth & Forecast 2025 to 2035

Waterproof Socks Market Analysis by Product Type, Application, Consumer Orientation, Sales Channel, and Region Through 2035

Waterproof Boots Market Trends - Growth & Forecast to 2035

Waterproof Shoe Covers Market Analysis - Trends, Growth & Forecast 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Waterproof Speaker Market Analysis - Trends, Growth & Forecast 2025 to 2035

Industry Share Analysis for Waterproof Label Companies

Waterproof Label Market Analysis by Polyethylene & Polypropylene Through 2034

Waterproof Orthotics Market

Waterproof Cases Market

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Breathable Bag Perforators Market Forecast Outlook 2025 to 2035

Breathable Membrane Market Size and Share Forecast Outlook 2025 to 2035

Breathable Tape Market Size and Share Forecast Outlook 2025 to 2035

Breathable Films Market Growth, Trends, Forecast 2025 to 2035

Breathable Lidding Film Packaging Market by Material Type from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA