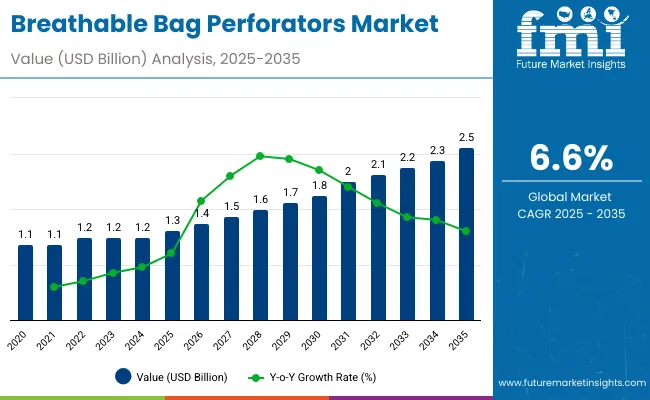

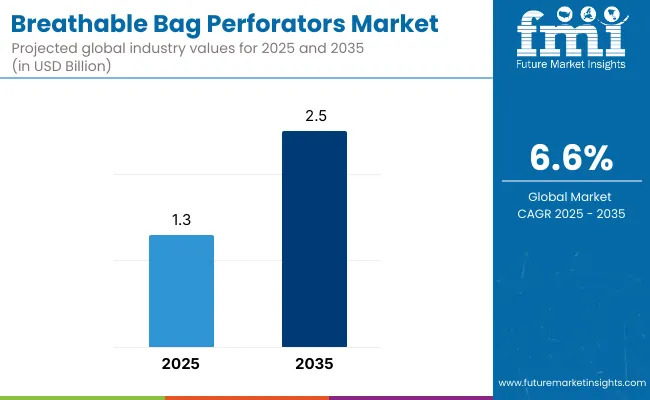

The global Breathable Bag Perforators Market will rise from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, growing at a CAGR of 6.6 %. Growth is fueled by expanding food retail and e-commerce packaging sectors that demand breathable and recyclable materials. Laser perforators enable high-precision ventilation while maintaining film integrity, improving shelf life for fresh produce and bakery items. Between 2025 and 2030, integration of automation and smart sensor systems will enhance operational accuracy and energy efficiency. Asia-Pacific will lead production due to large-scale adoption of perforated film technologies across the food packaging industry.

Between 2020 and 2024, rapid development of ventilated flexible packaging for perishables accelerated the adoption of precision perforation equipment. Laser and micro-perforation systems emerged as preferred technologies for high-speed, low-waste production. By 2035, the market will reach USD 2.5 billion, supported by digital control integration and eco-compatible materials. Asia-Pacific will remain the manufacturing hub, while North America and Europe will emphasize high-performance systems and sustainable packaging compliance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.4 billion |

| Forecast Value in (2035F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Market growth is driven by increasing global demand for breathable packaging that maintains freshness, reduces spoilage, and supports sustainable waste management. The rise in ready-to-eat food packaging and agricultural exports necessitates high-speed, automated perforation lines capable of handling recyclable films with minimal energy consumption.

The market is segmented by machine type, perforation type, material compatibility, application, end-use industry, and region. Machine types include laser, mechanical, needle roller, and hot pin perforators. Perforation types cover micro, macro, and customized pattern perforation. Materials include polyethylene (PE), polypropylene (PP), paper-based laminates, and biodegradable films. Applications encompass fresh produce, bakery and confectionery, meat and poultry, and industrial packaging. End-use sectors include food & beverages, agriculture, industrial, and retail & e-commerce.

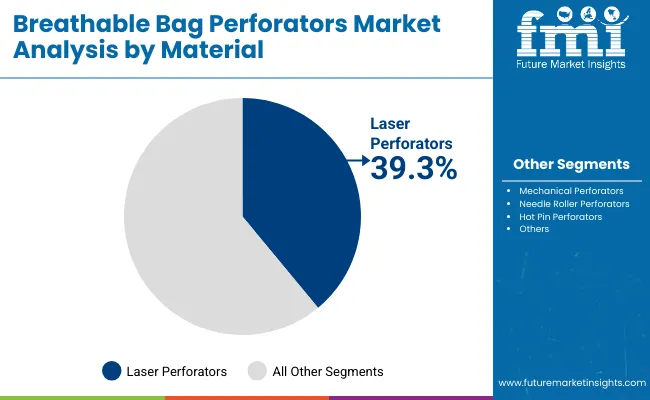

Laser perforators are expected to account for 39.3% of the market in 2025, favored for their precision, versatility, and low material waste. They enable controlled perforation patterns that regulate gas exchange, enhancing the shelf life of packaged food products. Advanced laser systems offer superior repeatability and minimal mechanical wear during continuous operation.

Their integration with automated winding and film inspection technologies improves productivity and film uniformity. Adjustable perforation density allows customization for product-specific ventilation needs. As sustainability standards and automation adoption rise, laser perforators continue to dominate machine installations in modern packaging lines.

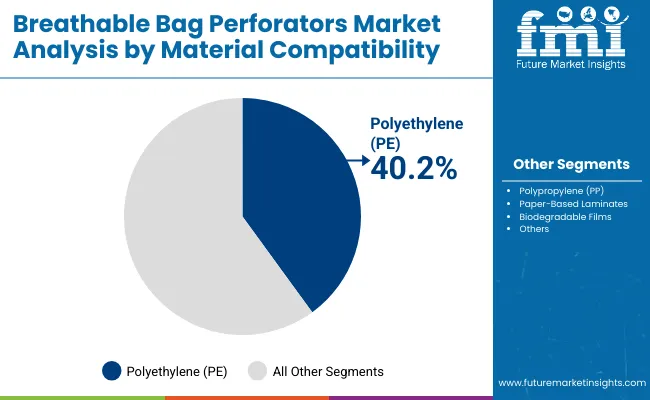

Polyethylene films are projected to represent 40.2% of the market in 2025, driven by their high flexibility, tensile strength, and barrier performance. Their compatibility with both laser and hot pin perforation methods ensures wide application across fresh produce and bakery packaging.

Clarity, sealability, and recyclability make PE films ideal for breathable packaging in high-volume food production. Ongoing innovations in mono-material films support circular economy goals. As global regulations promote sustainable packaging, polyethylene remains the material of choice for perforated film solutions.

Fresh produce packaging is forecast to capture 35.9% of the market in 2025, supported by growing exports of fruits and vegetables worldwide. Micro-perforated films maintain moisture balance and prevent condensation, preserving freshness and reducing spoilage during long-haul distribution.

These films enhance visibility and consumer appeal while extending product life on retail shelves. Packaging manufacturers are incorporating adaptive laser perforation systems tailored to different produce respiration rates. As global cold-chain infrastructure strengthens, fresh produce applications will sustain leading market demand.

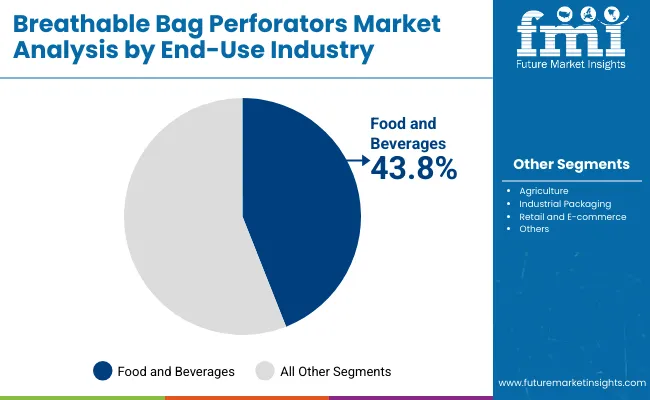

The food and beverage sector is anticipated to command 43.8% of the market in 2025, underpinned by demand for ventilated and durable packaging solutions. Perforated PE films are increasingly used in bakery, meat, dairy, and produce segments to preserve product texture and safety.

Automation and hygiene standards in film manufacturing improve operational efficiency and traceability. Brands continue to adopt laser-perforated, recyclable films to meet eco-labelling requirements and reduce plastic waste. As the industry embraces precision packaging, food and beverages remain the core end-use segment.

The market is driven by increasing consumption of packaged fresh foods and regulatory emphasis on sustainable packaging practices promoting eco-conscious production. However, the high initial investment for laser-based systems and limited heat resistance of biodegradable films restrains widespread use. Opportunities emerge in bio-perforated films and digital airflow customization. Key trends include AI-driven and sensor-based perforation monitoring, automated film adjustment, and hybrid mechanical-laser technologies improving precision and efficiency.

The global breathable bag perforators market is expanding rapidly as automation, sustainability, and food preservation technologies converge. Asia-Pacific dominates global production, driven by rising packaged-food exports and large-scale adoption of automated perforation systems. North America focuses on high-speed laser perforation for industrial packaging applications, while Europe emphasizes biodegradable and recyclable film innovation to meet environmental regulations. Growth in fresh produce, bakery, and frozen food sectors continues to fuel demand for advanced, energy-efficient perforation machinery worldwide.

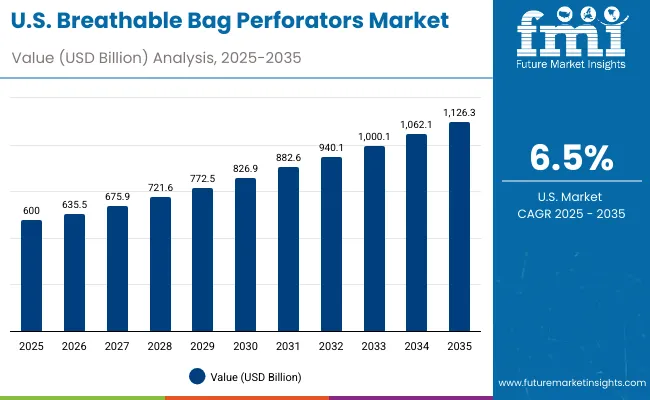

The USA will grow at 6.5% CAGR, driven by robust demand for automated perforation systems in fresh produce and bakery packaging. Increasing adoption of IoT-enabled laser machinery enhances precision and production visibility. Retrofits of high-speed laser systems across existing packaging lines support operational efficiency and sustainability goals.

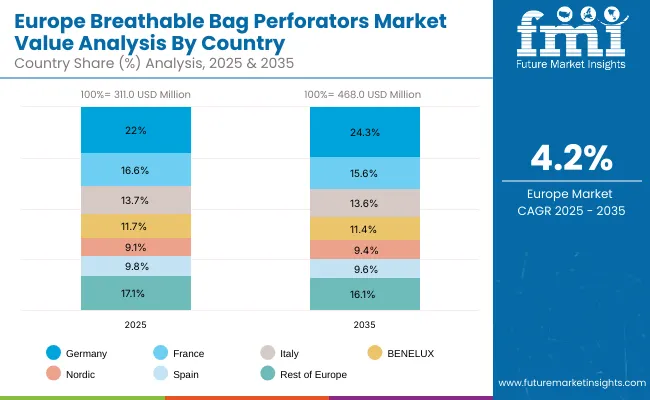

Germany will expand at 6.3% CAGR, focusing on sustainable micro-perforation and biodegradable film technologies. The country’s expertise in precision engineering supports innovation in high-speed, laser-controlled packaging systems. R&D initiatives targeting recyclable and compostable packaging align with EU sustainability mandates.

The UK will grow at 6.4% CAGR, with rising use of recyclable perforated films in retail and e-commerce packaging. Investment in hybrid hot-laser machinery enhances flexibility for small and medium packaging enterprises. Exports of breathable food packaging films continue to strengthen the country’s position in sustainable packaging markets.

China will grow at 6.6% CAGR, supported by large-scale polyethylene perforated film production. Domestic manufacturers are developing high-precision automated perforation units for both food and industrial applications. Exports of affordable, high-performance perforation machinery continue to increase as the nation consolidates its role in global packaging automation.

India will grow at 6.5% CAGR, driven by rapid growth in the fresh produce and frozen food packaging sectors. Expansion of cost-effective local perforation unit manufacturing improves accessibility for regional processors. Government-backed programs promoting packaging technology development are further accelerating adoption.

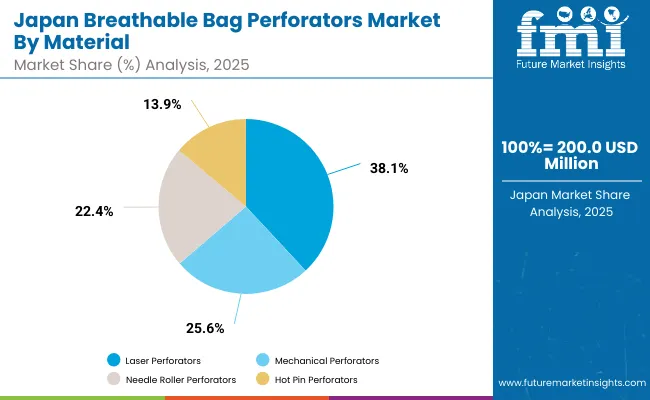

Japan will grow at 7.0% CAGR, maintaining leadership in compact and high-speed perforation systems. Technological advancements in precision airflow control enhance freshness and quality in ready-to-eat packaging. Integration of automated inspection and cleaning modules elevates operational efficiency and product safety.

South Korea will lead with 7.2% CAGR, propelled by continuous R&D in energy-efficient perforation technologies. The country’s strong food export sector is driving widespread automation adoption. Development of eco-perforation systems tailored for retail packaging supports national sustainability targets and export growth.

Japan’s breathable bag perforators market, valued at USD 200.0 million in 2025, is dominated by laser perforators, holding a 37.6% share for their precision and adaptability in packaging films. Mechanical perforators support high-speed processing, while needle roller systems cater to uniform hole distribution. Hot pin perforators are gaining adoption in flexible food packaging applications demanding enhanced airflow and moisture control.

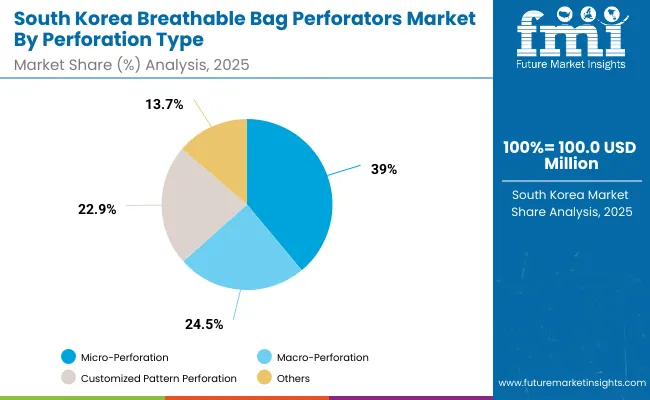

South Korea’s breathable bag perforators market, worth USD 100.0 million in 2025, is led by micro-perforation technology, accounting for 38.4% share due to its use in fresh produce and bakery packaging. Macro-perforation serves industrial sacks and agricultural applications, while customized pattern perforation finds use in premium packaging. The country’s strong automation integration drives efficiency in local converting operations.

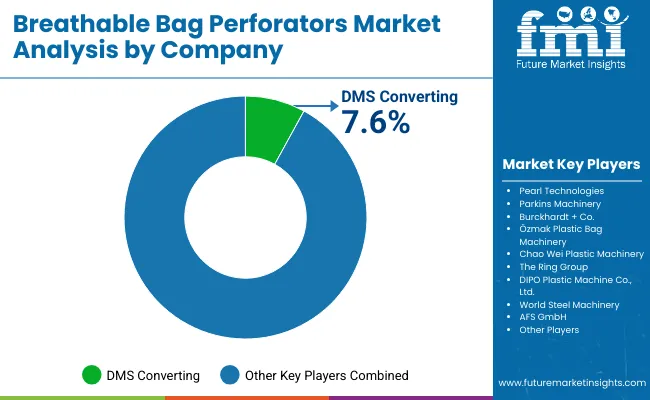

The market is moderately fragmented, with key players such as DMS Converting, Pearl Technologies, Parkins Machinery, Burckhardt + Co., Özmak Plastic Bag Machinery, Chao Wei Plastic Machinery, The Ring Group, DIPO Plastic Machine Co., Ltd., World Steel Machinery, and AFS GmbH. Companies are investing in automation, digital control modules, and recyclable material processing systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Machine Type | Laser, Mechanical, Needle Roller, Hot Pin |

| By Perforation Type | Micro, Macro, Customized Pattern |

| By Material | Polyethylene (PE), Polypropylene (PP), Paper-Based Laminates, Biodegradable Films |

| By Application | Fresh Produce, Bakery, Meat & Poultry, Industrial |

| By End-Use Industry | Food & Beverages, Agriculture, Industrial, Retail & E-commerce |

| Key Companies Profiled | DMS Converting, Pearl Technologies, Parkins Machinery, Burckhardt + Co., AFS GmbH |

| Additional Attributes | Market driven by sustainable packaging automation and high-precision ventilation systems |

The Breathable Bag Perforators Market is valued at USD 1.3 billion in 2025.

The Breathable Bag Perforators Market will reach USD 2.5 billion by 2035.

The market is projected to expand at a CAGR of 6.6 % through the forecast period.

Laser Perforators dominate with a 39.3 % share, offering high precision and operational flexibility.

The Food and Beverage industry leads with a 43.8 % share, driven by shelf-life optimization and eco-compliant packaging.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breathable Membrane Market Size and Share Forecast Outlook 2025 to 2035

Breathable Tape Market Size and Share Forecast Outlook 2025 to 2035

Breathable Films Market Growth, Trends, Forecast 2025 to 2035

Breathable Lidding Film Packaging Market by Material Type from 2025 to 2035

Market Positioning & Share in the Breathable Films Industry

Competitive Overview of Breathable Lidding Film Packaging Companies

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA