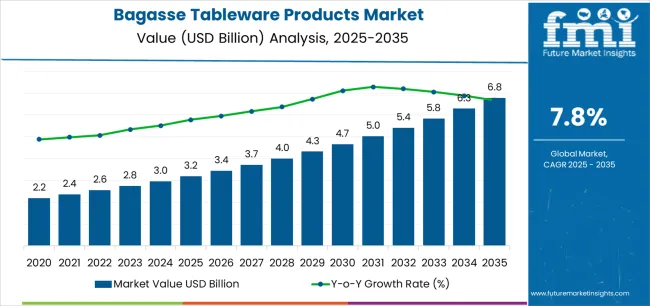

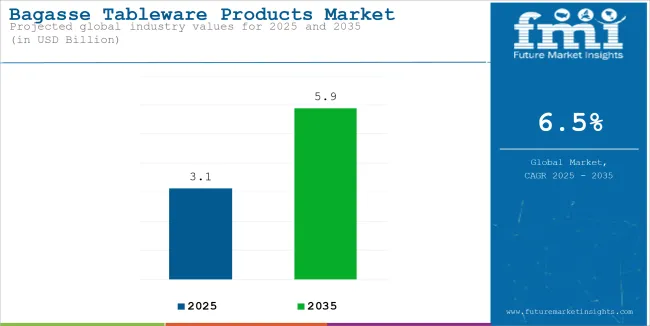

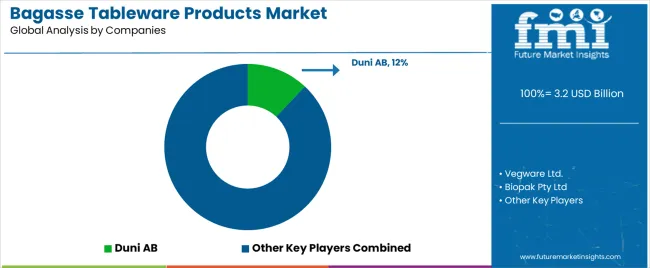

The bagasse tableware products market stands at the threshold of a decade-long expansion trajectory that promises to reshape disposable foodservice packaging and eco-conscious dining solutions. The market's journey from USD 3.2 billion in 2025 to USD 6.8 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of plant-based packaging technology and premium compostable solutions across quick-service restaurants, institutional catering operations, and commercial foodservice sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 3.2 billion to approximately USD 4.5 billion, adding USD 1.3 billion in value, which constitutes 38% of the total forecast growth period. As per Future Market Insights, recognized by ESOMAR for upholding global analytics standards, this phase will be characterized by the rapid adoption of premium bagasse products, driven by increasing environmental awareness and the growing need for plastic-free packaging solutions worldwide. Enhanced structural integrity capabilities and moisture resistance systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 4.5 billion to USD 6.8 billion, representing an addition of USD 2.3 billion or 62% of the decade's expansion. This period will be defined by mass market penetration of specialized molded fiber technologies, integration with comprehensive foodservice platforms, and seamless compatibility with existing commercial kitchen infrastructure. The market trajectory signals fundamental shifts in how food establishments approach disposable tableware quality and waste management, with participants positioned to benefit from growing demand across multiple product categories and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Plates & bowls (standard) | 38% | Quick-service restaurants, institutional catering |

| Clamshell containers | 26% | Takeout packaging, food delivery | |

| Cups & lids | 19% | Beverage service, hot drinks | |

| Cutlery sets | 11% | Complete meal solutions | |

| Trays & platters | 6% | Catering events, bulk serving | |

| Future (3-5 yrs) | Compartmented plates & bowls | 28-34% | Multi-item meals, portion control |

| Premium clamshells with secure closures | 24-29% | Food delivery growth, leak prevention | |

| Insulated cup systems | 16-21% | Hot beverage optimization, temperature retention | |

| Heavy-duty cutlery kits | 13-17% | Premium dining experience, durability focus | |

| Specialized serving ware | 8-13% | Event catering, presentation quality |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.2 billion |

| Market Forecast (2035) | USD 6.8 billion |

| Growth Rate | 7.8% CAGR |

| Leading Technology | Plates & Bowls |

| Primary Application | Quick-Service Restaurant Segment |

The market demonstrates strong fundamentals with plates and bowls capturing a dominant share through advanced molded fiber capabilities and food containment optimization. Quick-service restaurant applications drive primary demand, supported by increasing environmental regulations and compostable tableware adoption requirements. Geographic expansion remains concentrated in developed markets with established waste management infrastructure, while emerging economies show accelerating adoption rates driven by regulatory mandates and rising environmental awareness.

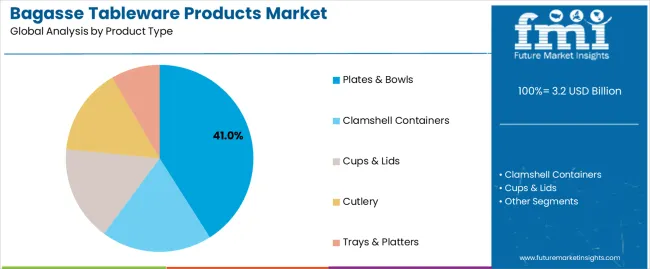

Primary Classification: The market segments by product type into plates & bowls, clamshell containers, cups & lids, cutlery, and trays & platters, representing the evolution from basic disposable items to sophisticated foodservice solutions for comprehensive meal presentation optimization.

Secondary Classification: Size segmentation divides the market into small items (up to 6 inches), medium items (6-10 inches), and large items (above 10 inches), reflecting distinct requirements for portion sizes, food types, and serving capacity standards.

Tertiary Classification: Application segmentation covers quick-service restaurants, full-service restaurants, institutional catering, food delivery services, and event catering operations, while end-use spans commercial foodservice, retail foodservice, and institutional sectors.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by regulatory compliance programs.

The segmentation structure reveals technology progression from standard disposable tableware toward sophisticated compostable systems with enhanced durability and heat resistance capabilities, while application diversity spans from quick-service operations to institutional catering establishments requiring precise foodservice solutions.

Market Position: Plates & Bowls systems command the leading position in the bagasse tableware products market with 41% market share through advanced molded fiber features, including superior food containment, load-bearing capacity, and meal presentation optimization that enable food establishments to achieve optimal serving standards across diverse dining and takeout environments.

Value Drivers: The segment benefits from foodservice preference for reliable tableware systems that provide consistent structural performance, enhanced food presentation, and quality optimization without compromising product integrity or affecting food temperature characteristics. Advanced fiber molding enables diverse size options, aesthetic appeal, and integration with existing serving systems, where structural performance and presentation consistency represent critical operational requirements.

Competitive Advantages: Plates & Bowls systems differentiate through proven structural reliability, consistent food containment characteristics, and integration with automated dispensing systems that enhance operational efficiency while maintaining optimal food safety standards suitable for diverse quick-service and institutional applications.

Key market characteristics:

Clamshell Container systems maintain a 28% market position in the bagasse tableware products market due to their secure closure convenience and leak-resistant advantages. These systems appeal to establishments requiring effective food containment with competitive pricing for diverse takeout packaging applications. Market growth is driven by operator preference, emphasizing food protection and versatile packaging through optimized container design.

Cups & Lids systems capture 18% market share through hot beverage requirements in coffee shops, quick-service restaurants, and institutional cafeterias. These establishments demand heat-resistant container systems capable of maintaining beverage temperature while providing exceptional customer experience and leak prevention.

Market Context: Medium size products (6-10 inches) demonstrate the highest growth rate in the bagasse tableware products market with 8.4% CAGR due to widespread adoption of standard meal portions and increasing focus on versatile serving options, portion control, and foodservice optimization that maximizes product utility while maintaining structural standards.

Appeal Factors: Medium size operators prioritize serving versatility, structural integrity, and integration with diverse food types that enables optimized foodservice operations across multiple meal formats. The segment benefits from substantial restaurant investment and food delivery programs that emphasize the acquisition of medium-sized tableware for meal optimization and customer satisfaction applications.

Growth Drivers: Food delivery expansion programs incorporate medium-sized products as standard packaging for individual meals, while restaurant growth increases demand for versatile size capabilities that comply with safety standards and minimize inventory complexity.

Market Challenges: Varying food types and serving requirements may limit product standardization across different restaurants or catering scenarios.

Application dynamics include:

Small size product applications capture market share through appetizer serving requirements in restaurants, dessert packaging, and side dish presentations. These applications demand compact tableware systems capable of operating with specialty food equipment while providing effective presentation and operational simplicity capabilities.

Large size product applications account for market share, including catering operations, family-style serving, and event hosting requiring substantial serving capabilities for operational optimization and presentation efficiency.

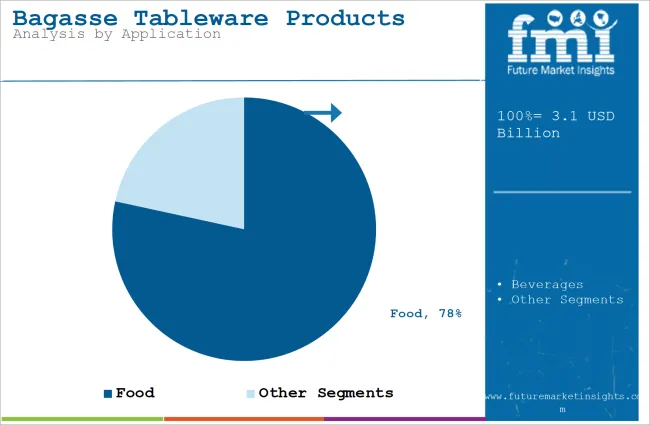

Market Position: Quick-Service Restaurant applications command 65% market share through growing fast food consumption trends and takeout service adoption for rapid meal delivery.

Value Drivers: This application segment provides the ideal combination of speed and convenience, meeting requirements for fast service, disposable tableware, and operational efficiency without reliance on traditional dishware.

Growth Characteristics: The segment benefits from broad applicability across restaurant chains, automated dispensing adoption, and established takeout programs that support widespread product usage and operational convenience.

Market Context: Commercial Foodservice dominates the market with 8.6% CAGR, reflecting the primary demand source for bagasse tableware products in restaurant operations and foodservice platforms.

Business Model Advantages: Commercial foodservice provides direct market demand for compostable tableware materials, driving quality standards and waste management innovation while maintaining food safety and customer satisfaction requirements.

Operational Benefits: Commercial applications include meal presentation, convenience optimization, and customer experience enhancement that drive consistent demand for bagasse products while providing access to latest molded fiber technologies.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Plastic ban regulations & single-use plastic restrictions (government mandates, environmental legislation) | ★★★★★ | Regulatory pressure eliminating plastic alternatives; bagasse products become compliant option for environmental legislation and waste reduction goals. |

| Driver | Environmental consciousness & consumer preference for plant-based products | ★★★★★ | Growing consumer awareness demanding eco-friendly alternatives; restaurants adopting compostable tableware for brand reputation and customer alignment. |

| Driver | Quick-service restaurant expansion & food delivery growth | ★★★★★ | Rapid proliferation of QSR chains and delivery platforms; disposable tableware requirements across multiple locations drive bulk procurement and consistent demand. |

| Restraint | Higher cost compared to plastic & foam alternatives | ★★★★☆ | Price sensitivity in cost-conscious markets; bagasse products command 20-40% premium over conventional disposables, limiting adoption in budget segments. |

| Restraint | Limited temperature tolerance & structural limitations for certain applications | ★★★☆☆ | Performance constraints with extreme temperatures and liquid-heavy foods; moisture absorption issues affect usability for specific food types. |

| Trend | Compartmented designs & specialized product formats (multi-section plates, secure-lid containers) | ★★★★★ | Functional innovation enhancing meal presentation; restaurants leveraging advanced designs for portion control and food separation requirements. |

| Trend | Coating technology improvements & moisture-barrier innovations (plant-based coatings, enhanced water resistance) | ★★★★☆ | Technical advancements addressing performance gaps; bio-based barrier solutions improving functionality while maintaining compostability standards. |

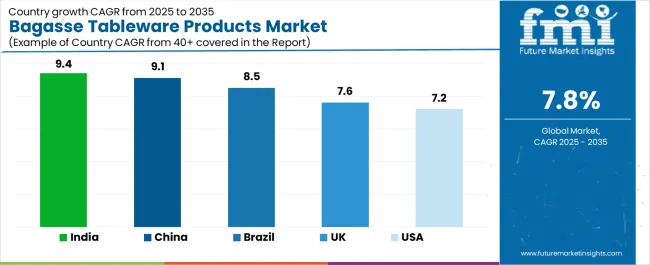

The bagasse tableware products market demonstrates varied regional dynamics with Growth Leaders including China (9.1% growth rate) and India (9.4% growth rate) driving expansion through regulatory enforcement and foodservice proliferation initiatives. Steady Performers encompass United States (7.2% growth rate), United Kingdom (7.6% growth rate), and developed regions, benefiting from established environmental policies and compostable product adoption. Emerging Markets feature Brazil (8.5% growth rate) and developing regions, where plastic ban implementation and foodservice modernization support consistent growth patterns.

Regional synthesis reveals North American markets leading value generation through premium product adoption and regulatory compliance culture, while Asian markets demonstrate highest volume growth supported by manufacturing capacity and rising environmental awareness. European markets show strong growth driven by stringent waste management requirements and compostable certification integration.

| Region/Country | 2025 to 2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 9.1% | Manufacturing scale; cost-effective production | Quality standardization; export competition |

| India | 9.4% | Regulatory compliance; local partnerships | Infrastructure gaps; price sensitivity |

| United States | 7.2% | Premium positioning; certified products | Raw material costs; competitive pressure |

| United Kingdom | 7.6% | Compliance solutions; compostable standards | Supply chain complexity; Brexit impacts |

| Brazil | 8.5% | Regional leadership; foodservice growth | Economic volatility; logistics challenges |

China establishes manufacturing leadership through extensive sugarcane processing infrastructure and comprehensive bagasse supply chain, integrating advanced molded fiber technology as standard production capability in commercial and export facilities. The country's 9.1% growth rate reflects substantial bagasse availability and domestic environmental policy adoption that mandates the development of plant-based packaging systems in foodservice and manufacturing facilities. Growth concentrates in major production centers, including Guangdong, Fujian, and Zhejiang provinces, where bagasse processing facilities showcase integrated manufacturing systems that appeal to domestic and international buyers seeking cost-effective compostable solutions.

Chinese manufacturers are developing domestically-produced bagasse products that combine production efficiency advantages with functional performance features, including enhanced moisture resistance and structural integrity capabilities. Distribution channels through foodservice supply chains and export partnerships expand market access, while cost competitiveness supports adoption across diverse commercial and institutional segments.

Strategic Market Indicators:

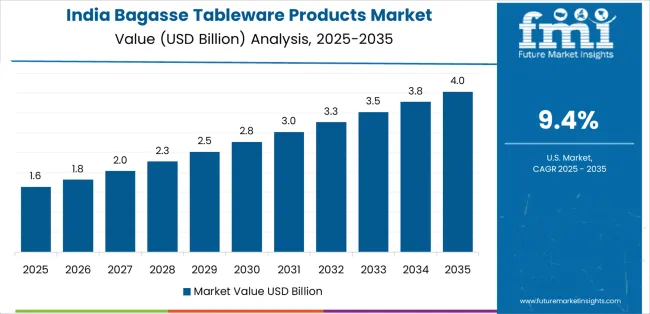

In Mumbai, Delhi, and Bangalore, restaurants and institutional catering services are implementing bagasse tableware products as standard disposable solutions for regulatory compliance and environmental positioning applications, driven by increasing plastic ban enforcement and foodservice programs that emphasize the importance of compostable alternatives. The market holds a 9.4% growth rate, supported by quick-service restaurant expansion and urbanization programs that promote plant-based tableware systems for commercial and institutional applications. Indian operators are adopting bagasse solutions that provide consistent performance and compostable features, particularly appealing in urban regions where environmental regulations and waste management represent critical operational requirements.

Market expansion benefits from growing sugarcane production capacity and bagasse availability that enable widespread adoption of locally-manufactured tableware systems for foodservice and catering applications. Technology adoption follows patterns established in agricultural waste utilization, where resource efficiency and regulatory compliance drive procurement decisions and operational deployment.

Market Intelligence Brief:

United States establishes premium market leadership through comprehensive environmental programs and advanced compostable certification infrastructure, integrating bagasse tableware products across restaurant and institutional applications. The country's 7.2% growth rate reflects established environmental consciousness and mature waste management adoption that supports widespread use of certified compostable systems in foodservice and catering facilities. Growth concentrates in major metropolitan areas and environmentally-progressive states, including California, New York, and Washington, where plastic ban legislation showcases mature bagasse deployment that appeals to foodservice operators seeking proven compostable capabilities and regulatory compliance applications.

American foodservice establishments leverage established distribution networks and comprehensive product availability, including premium compartmented plates and insulated cup systems that create differentiation and operational advantages. The market benefits from mature composting infrastructure and consumer willingness to invest in certified compostable materials that enhance environmental credentials and waste management optimization.

Market Intelligence Brief:

United Kingdom's advanced environmental regulation market demonstrates sophisticated bagasse tableware deployment with documented compliance effectiveness in quick-service applications and institutional facilities through integration with existing waste management systems and regulatory infrastructure. The country leverages plastic ban legislation and compostable standards to maintain a 7.6% growth rate. Urban centers, including London, Manchester, and Edinburgh, showcase premium installations where bagasse products integrate with comprehensive foodservice platforms and compliance systems to optimize environmental operations and regulatory effectiveness.

UK operators prioritize compostable certification and environmental credentials in tableware procurement, creating demand for certified products with advanced features, including enhanced durability and moisture resistance. The market benefits from established environmental consciousness and a willingness to invest in premium compostable materials that provide superior compliance benefits and adherence to waste management standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse sugarcane production capacity, including bagasse availability in São Paulo and Paraná regions, agricultural waste utilization growth, and rising environmental consciousness that increasingly incorporate bagasse tableware solutions for foodservice packaging applications. The country maintains an 8.5% growth rate, driven by urbanization and increasing recognition of compostable product benefits, including improved waste management and enhanced environmental positioning.

Market dynamics focus on locally-sourced bagasse solutions that balance product performance with cost considerations important to Brazilian foodservice operators. Growing quick-service restaurant proliferation creates continued demand for compostable tableware systems in new establishment infrastructure and foodservice modernization projects.

Strategic Market Considerations:

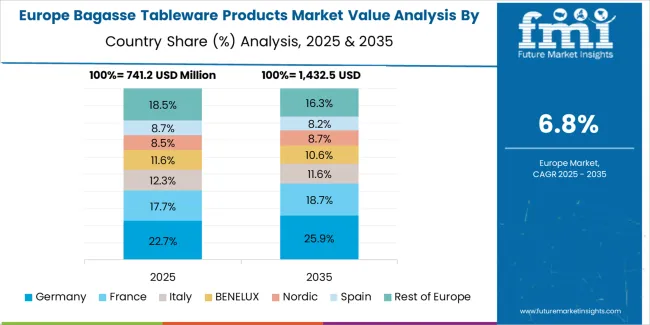

The European bagasse tableware products market is projected to grow from USD 1.1 billion in 2025 to USD 2.0 billion by 2035, registering a CAGR of 6.2% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, supported by its strong environmental regulations and comprehensive waste management infrastructure.

United Kingdom follows with a 24.8% share in 2025, driven by plastic ban enforcement and compostable certification adoption. France holds a 19.6% share through traditional foodservice culture and institutional catering applications. Italy commands a 13.7% share, while Spain accounts for 10.7% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.8% to 6.5% by 2035, attributed to increasing environmental awareness in Nordic countries and emerging compostable product implementation in institutional foodservice facilities.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global manufacturers | Production capacity, bagasse sourcing, distribution networks | Scale efficiency, consistent quality, international reach | Local customization; emerging market penetration |

| Specialty converters | Custom molding; coating technology; premium designs | Technical expertise; foodservice partnerships; certification management | Mass market scaling; price competition |

| Regional producers | Local bagasse supply, manufacturing facilities, competitive pricing | Market proximity; raw material access; cost advantage | Technology gaps; quality consistency |

| Private label suppliers | Retailer partnerships, value positioning, volume production | Price competitiveness; retail distribution; volume scale | Brand recognition; premium segment access |

| Technology innovators | Coating solutions, barrier technology, fiber engineering | Patent portfolio; performance optimization; R&D investment | Market scalability; distribution limitations |

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 billion |

| Product Type | Plates & Bowls, Clamshell Containers, Cups & Lids, Cutlery, Trays & Platters |

| Size | Small (up to 6 inches), Medium (6-10 inches), Large (above 10 inches) |

| Application | Quick-Service Restaurants, Full-Service Restaurants, Institutional Catering, Food Delivery Services, Event Catering |

| End-Use | Commercial Foodservice, Retail Foodservice, Institutional Sectors |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Brazil, Canada, Japan, France, Australia, and 30+ additional countries |

| Key Companies Profiled | Duni AB, Vegware Ltd., Biopak Pty Ltd, Eco-Products Inc., Sabert Corporation, World Centric, Natural Tableware |

| Additional Attributes | Dollar sales by product type and size categories, regional adoption trends across North America, Western Europe, and East Asia, competitive landscape with molded fiber manufacturers and foodservice suppliers, consumer preferences for compostable products and environmental compliance, integration with waste management systems and composting facilities, innovations in moisture-barrier technology and structural enhancement, and development of specialized bagasse solutions with enhanced performance and foodservice optimization capabilities. |

The global bagasse tableware products market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the bagasse tableware products market is projected to reach USD 6.8 billion by 2035.

The bagasse tableware products market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in bagasse tableware products market are plates & bowls, clamshell containers, cups & lids, cutlery and trays & platters.

In terms of application, quick-service restaurants segment to command 65.0% share in the bagasse tableware products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Bagasse Tableware Product Providers

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Japan Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

ASEAN Bagasse Tableware Products Market Insights – Growth, Demand & Forecast 2025-2035

Germany Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Bagasse Disposable Cutlery

Market Share Insights for Bagasse Bowls Providers

Understanding Market Share Trends in Bagasse Packaging

Demand and Trend Analysis of Bagasse Tableware Product in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Bagasse Tableware Product in Korea Size and Share Forecast Outlook 2025 to 2035

Western Europe Bagasse Tableware Market Analysis – Growth & Forecast 2023-2033

Tableware Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Tableware Providers

Glass Tableware Market Trends - Size, Demand & Forecast to 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Fiber Tableware and Kitchenware Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA