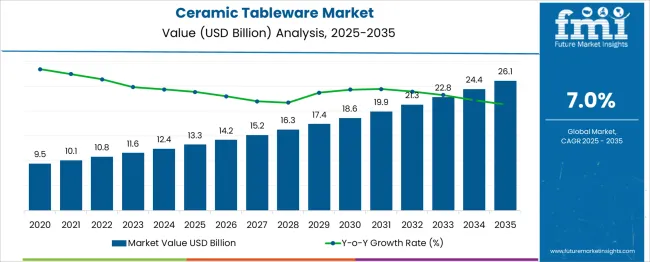

The Ceramic Tableware Market is estimated to be valued at USD 13.3 billion in 2025 and is projected to reach USD 26.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. This steady rise is driven by sustained consumer interest in durable and attractive tableware options worldwide. The market’s value is set to grow significantly, presenting substantial opportunities for manufacturers, distributors, and retailers to meet evolving consumer demands and capitalize on increasing purchasing power, especially in emerging economies. Between 2020 and 2025, the market is expected to grow from USD 9.5 billion to USD 13.3 billion, marking a strong start supported by product innovation and expanding customer bases. The subsequent decade, from 2025 to 2035, offers even greater potential, with the market nearly doubling in size to USD 26.1 billion. This continued expansion reflects growing adoption of premium ceramic tableware and widening market reach, creating a favorable environment for business growth and investment in the sector.

| Metric | Value |

|---|---|

| Ceramic Tableware Market Estimated Value in (2025 E) | USD 13.3 billion |

| Ceramic Tableware Market Forecast Value in (2035 F) | USD 26.1 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The Ceramic Tableware market is experiencing sustained expansion due to rising consumer interest in premium dining experiences and increasing demand for aesthetically appealing and durable tableware products. Shifting lifestyles and the growing trend of home dining, particularly in urban regions, have contributed significantly to market development. Manufacturers are focusing on design innovation, sustainable materials, and high-quality glazing techniques to cater to the evolving preferences of both residential and commercial consumers.

Additionally, the hospitality industry's recovery and the expansion of the food service sector are reinforcing demand for versatile and long-lasting ceramic solutions. E-commerce penetration and online customization tools are also enhancing consumer accessibility to a wider range of products.

As environmental consciousness grows, demand for reusable and recyclable ceramic materials is expected to support the long-term outlook. The market is anticipated to benefit from ongoing investments in production technology, material engineering, and global distribution networks, ensuring continued growth in both emerging and mature regions..

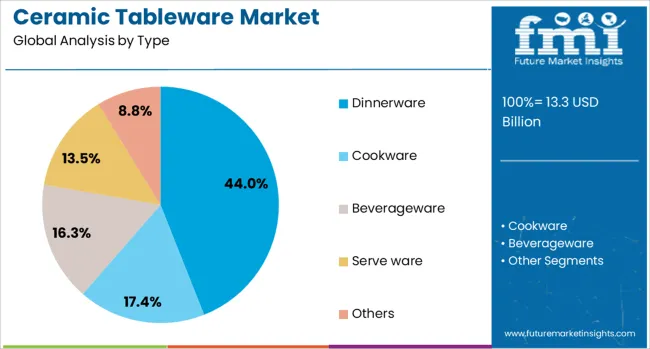

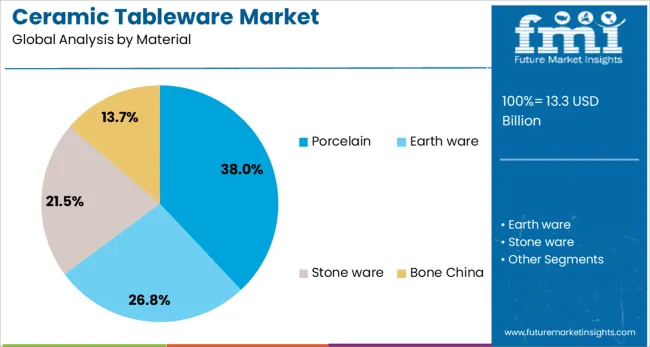

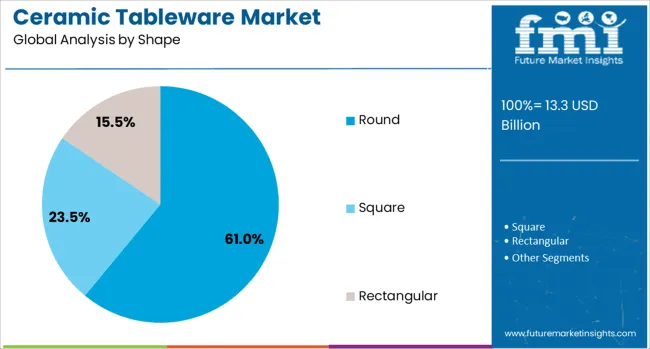

The ceramic tableware market is segmented by type, material, shape, price range, end use, and geographic regions. The ceramic tableware market is divided into Dinnerware, Cookware, beverage ware, serving ware, and Others. In terms of material, the ceramic tableware market is classified into Porcelain, Earthenware, Stoneware, and Bone China. The shape of the ceramic tableware market is segmented into Round, Square, and Rectangular. The price range of the ceramic tableware market is segmented into Medium, Low, and High. The end use of the ceramic tableware market is segmented into Residential and Commercial. Regionally, the ceramic tableware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dinnerware segment is projected to hold 44% of the Ceramic Tableware market revenue share in 2025, positioning it as the leading type category. This growth has been supported by the increasing preference for complete dining sets that offer coordinated aesthetics and enhanced dining experiences. Consumer demand for durable and visually appealing products has favored dinnerware items such as plates, bowls, and serving platters that are suited for both everyday use and formal settings.

The segment has also benefited from the rising trend of themed dining and seasonal table arrangements, encouraging repeated purchases. Product developments that incorporate microwave safety, scratch resistance, and dishwasher compatibility have contributed to wider adoption across households and restaurants.

Manufacturers have responded with expanded product lines and varied design offerings, ensuring that dinnerware continues to capture a significant portion of the overall ceramic tableware demand. The consistent demand from both individual and institutional buyers has further strengthened the segment’s leadership in the market..

The porcelain segment is expected to account for 38% of the Ceramic Tableware market revenue share in 2025, making it the most prominent material type. Growth in this segment has been driven by the material’s refined appearance, high durability, and resistance to thermal shock. Porcelain’s non-porous surface allows for superior hygiene, making it a preferred choice in both domestic and hospitality applications.

The demand for elegant yet functional tableware has led to greater adoption of porcelain-based products in premium dining environments. In addition, advancements in manufacturing processes have enabled the production of thinner yet stronger porcelain, increasing its appeal among design-conscious consumers.

The material's ability to retain color and withstand repeated washing has further enhanced its long-term usability. As consumers and food service providers prioritize longevity and visual appeal, porcelain is expected to remain the dominant material choice in the ceramic tableware industry..

The round shape segment is estimated to represent 61% of the Ceramic Tableware market revenue share in 2025, establishing it as the dominant shape category. This segment’s growth has been supported by the timeless and versatile appeal of round tableware, which complements both traditional and contemporary dining settings. Consumers have consistently favored round plates and bowls for their balanced proportions and ergonomic functionality.

The ease of stacking and storage, combined with compatibility across various table layouts, has reinforced the practical advantages of round-shaped products. Manufacturers have also maintained strong design variation within the round category, introducing textured rims, subtle patterns, and minimalist aesthetics to cater to diverse tastes.

The commercial food service industry has preferred round tableware due to uniform portion presentation and serving efficiency. As the market continues to focus on usability, aesthetic balance, and production efficiency, the round shape is expected to retain its leadership in the ceramic tableware segment..

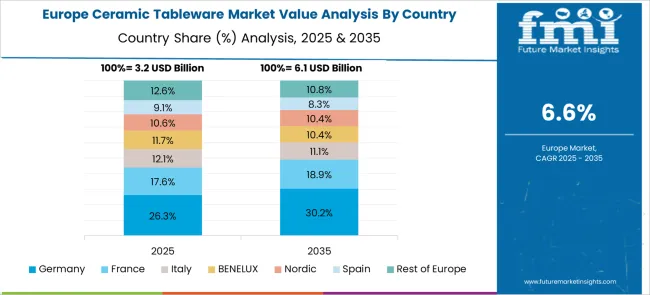

The ceramic tableware market is experiencing steady growth driven by consumer demand for durable, aesthetically pleasing, and eco-friendly dining products. Ceramic items, including plates, bowls, cups, and serving dishes, are favored for their heat retention, non-reactive surfaces, and design versatility. Expansion in the hospitality sector, growing interest in home dining experiences, and rising disposable incomes in emerging economies support market growth. Asia-Pacific leads production, while North America and Europe remain key consumption regions with focus on premium and artisanal collections.

Ceramic tableware varies based on clay types, glazing methods, and firing temperatures, impacting product durability, finish, and resistance to chipping or staining. Porcelain, stoneware, and earthenware each offer distinct characteristics suitable for different price points and consumer preferences. Traditional handcrafting methods compete with mass production, affecting texture and uniqueness. Quality control challenges arise from maintaining consistent color and glaze integrity across batches. Manufacturers investing in improved kiln technologies and raw material sourcing achieve better product reliability and customer satisfaction. Variations in production scale and craftsmanship contribute to wide market segmentation from everyday use to luxury tableware.

Market offerings increasingly include innovative designs, patterns, and personalized tableware options to meet consumer desire for unique dining aesthetics. Collaborations with designers and artists produce limited editions and thematic collections appealing to niche segments. Use of digital printing and advanced glazing techniques allows intricate decoration with vibrant colors and textures. Customization services enable consumers and hospitality clients to create branded or bespoke sets. Functional enhancements like microwave and dishwasher safety add convenience. These developments enhance consumer engagement and support premium pricing strategies while encouraging repeat purchases and gifting occasions.

The hospitality industry, including hotels, restaurants, and catering services, drives demand for robust, easy-to-maintain ceramic tableware suited to high-frequency use. Increasing focus on dining ambiance and presentation fuels adoption of decorative yet durable products. Retail channels benefit from e-commerce growth, allowing direct consumer access to a broader product range, including artisanal and international brands. Specialty stores and department outlets continue to attract customers seeking premium options. Regional preferences influence product types and styles, with markets such as Europe favoring classic designs and Asia-Pacific embracing vibrant colors. Channel diversification expands market reach and supports product innovation aligned with consumer trends.

Ceramic tableware must meet safety regulations concerning lead and cadmium content in glazes to ensure food safety and comply with import/export rules. Stricter quality standards in developed markets increase production scrutiny and certification needs. Raw material price fluctuations, especially in high-quality clays and pigments, affect manufacturing costs and pricing strategies. Balancing affordability with premium features remains a challenge for producers targeting mass markets. Additionally, transportation fragility requires careful packaging and logistics management to minimize damage and returns. Companies that optimize production efficiency and maintain compliance while offering competitive pricing are better positioned to capture diverse customer segments globally.

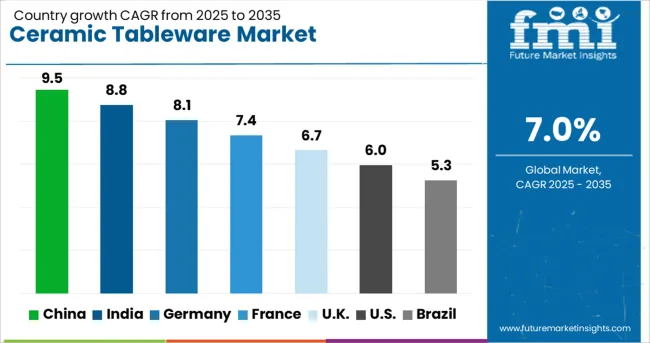

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global ceramic tableware market is growing at a 7.0% CAGR, driven by rising demand in both household and hospitality sectors. Among BRICS nations, China leads with 9.5% growth, supported by large-scale production and export capacity. India follows at 8.8%, fueled by growing domestic consumption and artisanal manufacturing. In the OECD region, Germany records 8.1% growth, reflecting quality standards and design preferences. The United Kingdom grows at 6.7%, driven by consumer demand for durable and aesthetic tableware. The United States, a mature market, shows 6.0% growth, shaped by evolving lifestyle trends and retail expansion. These countries collectively influence market dynamics through manufacturing capabilities, regulatory standards, and consumer demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the ceramic tableware market with a robust growth rate of 9.5%, driven by increasing demand for aesthetically pleasing and durable dining products. Rising middle-class income and evolving lifestyle preferences contribute to the popularity of ceramic tableware in both urban and rural areas. Compared to India, China has a more established manufacturing base, enabling large-scale production and export. Domestic brands focus on innovation in design and materials to attract consumers, while e-commerce platforms broaden market reach. Additionally, growth in the hospitality sector and increased interest in premium tableware further fuel demand. China’s competitive pricing and quality improvements help maintain its leadership in the ceramic tableware industry.

India experiences significant growth in the ceramic tableware market at 8.8%, supported by rising disposable incomes and expanding urban households. The market benefits from a rich tradition of ceramic craftsmanship combined with modern designs catering to younger consumers. Compared to Germany, India’s market is expanding faster but faces challenges in consistent quality and raw material availability. Local artisans and manufacturers are collaborating to create both affordable and luxury products. Increasing awareness about health-safe and eco-friendly materials also plays a role. Growing foodservice businesses and a shift towards more formal dining at home contribute to the demand surge in India’s ceramic tableware segment.

Germany maintains steady growth in the ceramic tableware market with an 8.1% expansion rate, supported by strong consumer preference for high-quality and sustainable products. Compared to the UK, Germany’s market favors durable and classic designs reflecting European tastes. The presence of established brands with a focus on environmental standards and innovative glazing techniques attracts discerning buyers. Retailers emphasize product longevity and safety certifications to gain consumer trust. Germany’s hospitality industry demands premium ceramic tableware for upscale dining experiences, further propelling market growth. Limited raw material sourcing and higher production costs present challenges but also encourage premium pricing strategies.

The United Kingdom ceramic tableware market grows steadily at 6.7%, influenced by rising interest in home dining and stylish kitchenware. Compared to the USA, the UK market places higher value on design innovation and brand heritage. Increasing popularity of casual dining and hosting culture supports demand for varied ceramic tableware collections. Retailers and online platforms offer diverse product ranges to cater to different consumer segments. Consumer preference shifts towards durable yet elegant options, emphasizing ease of cleaning and microwave safety. Collaborations between designers and manufacturers boost unique product lines, enhancing market vibrancy in the United Kingdom.

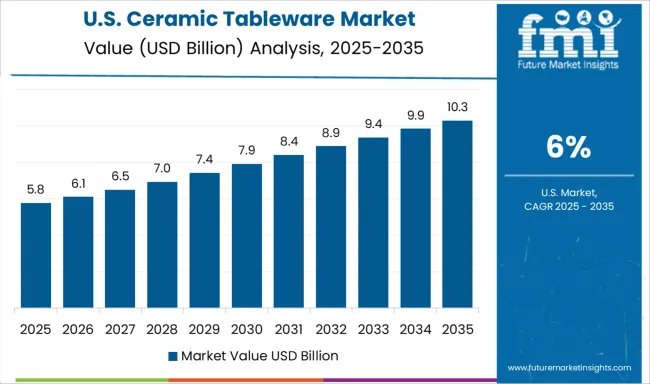

The United States ceramic tableware market grows at a moderate 6.0%, supported by steady consumer demand for functional and stylish dining products. Compared to China, the USA market is more fragmented, with a mix of domestic brands and imports competing for attention. Consumers prefer microwave-safe and dishwasher-friendly ceramic tableware suitable for busy lifestyles. The rise of online retail and subscription box services enhances product accessibility. Health and safety certifications are critical purchasing factors in the USA market. Additionally, growing interest in artisanal and handmade ceramics creates niche opportunities. The steady growth reflects a balance between affordability and premium product offerings in the American ceramic tableware segment.

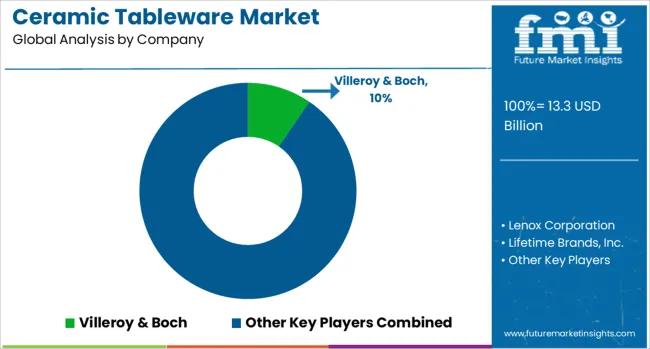

The ceramic tableware market is shaped by well-established brands known for combining craftsmanship with innovative design to cater to both luxury and mass-market segments. Villeroy & Boch stands out as a premium player with a rich heritage, offering high-quality, artistically crafted ceramic tableware that appeals to upscale consumers globally. Lenox Corporation leverages its strong presence in North America with a diverse portfolio of elegant and durable ceramic products designed for everyday use and special occasions.

Lifetime Brands, Inc. focuses on providing a broad range of affordable and stylish ceramic tableware, targeting value-conscious consumers through multiple retail channels. Noritake Co., Ltd. is recognized for its precision in porcelain manufacturing, blending traditional techniques with modern aesthetics, making it a preferred choice in both domestic and international markets. Rosenthal GmbH emphasizes artistic collaborations and innovative design, creating distinctive collections that merge functionality with high-end artistry. Competition among these suppliers revolves around quality, design innovation, brand heritage, and expanding product lines to meet evolving consumer preferences. Sustainability and durability are increasingly central, with many companies integrating eco-friendly materials and manufacturing processes to appeal to environmentally conscious buyers.

On March 21, 2025, Iittala launched its "Solare" collection globally in all Iittala stores, online, and at selected retailers. This collection, the third designed under the creative direction of Janni Vepsäläinen, explores the concept of Nordic light and its influence on emotions and physical behaviors. The collection includes tableware, glass art, textiles, and accessories, all embodying a harmonious blend of light, form, and craftsmanship.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.3 Billion |

| Type | Dinnerware, Cookware, Beverageware, Serve ware, and Others |

| Material | Porcelain, Earth ware, Stone ware, and Bone China |

| Shape | Round, Square, and Rectangular |

| Price Range | Medium, Low, and High |

| End Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Villeroy & Boch, Lenox Corporation, Lifetime Brands, Inc., Noritake Co., Ltd., and Rosenthal GmbH |

| Additional Attributes | Dollar sales in the Ceramic Tableware Market vary by product type (dinner sets, cups & saucers, serving dishes), material (porcelain, stoneware, earthenware), distribution channel (online, retail, hospitality), and region (North America, Europe, Asia-Pacific). Growth is driven by rising home dining trends, hospitality sector expansion, and demand for durable, stylish tableware. |

The global ceramic tableware market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the ceramic tableware market is projected to reach USD 26.1 billion by 2035.

The ceramic tableware market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in ceramic tableware market are dinnerware, cookware, beverageware, serve ware and others.

In terms of material, porcelain segment to command 38.0% share in the ceramic tableware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Heat-Resistant Ceramic Tableware Market Analysis – Growth & Trends 2025 to 2035

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA