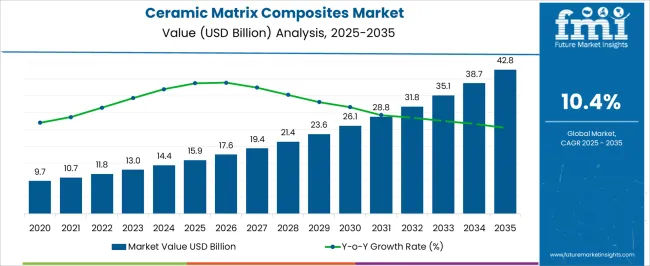

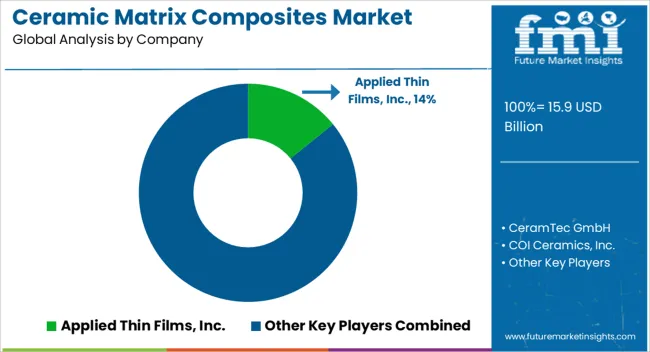

The ceramic matrix composites market is estimated to be valued at USD 15.9 billion in 2025 and is projected to reach USD 42.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period. Raw material procurement, including advanced ceramics and reinforcing fibers, constitutes a significant proportion of production costs due to stringent quality requirements and the limited availability of high-purity feedstocks.

Manufacturing processes such as chemical vapor infiltration, melt infiltration, and polymer impregnation and pyrolysis contribute additional costs owing to specialized equipment, energy-intensive operations, and skilled labor demands. The value chain further extends into precision machining, component integration, and testing for high-performance sectors such as aerospace, defense, and automotive, where reliability standards are rigorous. Each stage, from material synthesis to final component validation, adds incremental cost but enhances product performance, justifying pricing premiums in end-use markets.

Ancillary services, including technical support, maintenance, and aftermarket solutions, also play a role in value-chain economics, contributing to both recurring revenue and overall market valuation. Year-on-year growth from USD 15.9 billion in 2025 to USD 42.8 billion in 2035 indicates steady expansion in production capacity and adoption across high-performance applications.

Economies of scale in material synthesis and process optimization are expected to moderate unit costs over time. The cost-structure and value-chain dynamics emphasize the market’s capital- and technology-intensive nature, where innovation, process efficiency, and material quality directly influence market competitiveness and growth.

| Metric | Value |

|---|---|

| Ceramic Matrix Composites Market Estimated Value in (2025 E) | USD 15.9 billion |

| Ceramic Matrix Composites Market Forecast Value in (2035 F) | USD 42.8 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

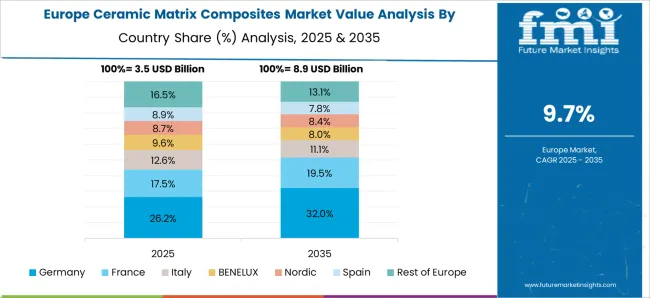

The ceramic matrix composites market represents a specialized segment within the global advanced materials and high-performance composites industry, emphasizing heat resistance, strength, and lightweight performance. Within the broader aerospace and defense materials sector, it accounts for about 5.6%, driven by demand in aircraft engines, thermal protection systems, and high-temperature structural components. In the industrial machinery and automotive applications segment, its share is approximately 4.2%, reflecting adoption in turbine components, brake systems, and wear-resistant parts.

Across the energy and power generation market, it contributes around 3.9%, supporting high-temperature operations in gas turbines and nuclear reactors. Within the materials innovation and high-performance composites category, it represents 4.5%, highlighting integration with additive manufacturing and precision fabrication. In the overall advanced materials ecosystem, the market contributes about 4.8%, emphasizing performance, durability, and efficiency in extreme operating environments.

Recent developments in the ceramic matrix composites market have focused on material innovation, manufacturing efficiency, and application expansion. Groundbreaking trends include the use of fiber-reinforced matrices, advanced sintering techniques, and additive manufacturing integration for complex geometries. Key players are collaborating with aerospace, defense, and industrial equipment manufacturers to develop lightweight, high-temperature-resistant components.

Adoption of oxidation-resistant coatings, hybrid composites, and automated quality inspection is gaining traction to improve performance and reliability. The cost optimization, scaling production for industrial use, and integration into next-generation turbines and aerospace structures are shaping market growth.

The ceramic matrix composites (CMC) market is experiencing strong growth momentum, driven by increasing adoption in high-performance applications requiring superior thermal resistance, low density, and enhanced mechanical strength. Market expansion is supported by rising demand in industries such as aerospace, defense, energy, and automotive, where operational efficiency and durability under extreme conditions are critical. The current landscape reflects growing investments in advanced manufacturing technologies and material innovation to improve cost efficiency and scalability.

Stringent environmental regulations and the need for fuel efficiency in transportation sectors are further accelerating the replacement of conventional alloys with lightweight CMCs. Emerging economies are increasingly adopting CMC-based solutions due to expanding aerospace manufacturing capabilities and defense modernization programs.

Future market prospects remain optimistic, with advancements in fiber architecture, matrix chemistry, and hybrid composites expected to unlock new application areas.

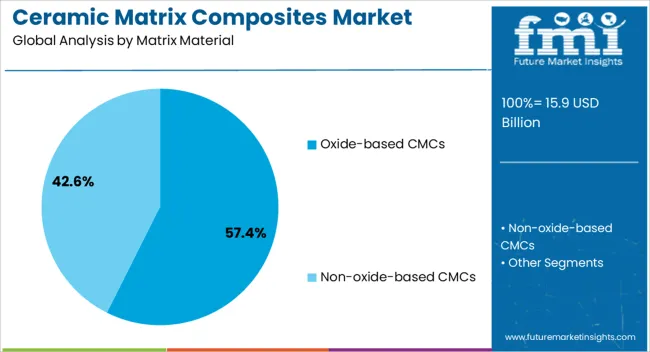

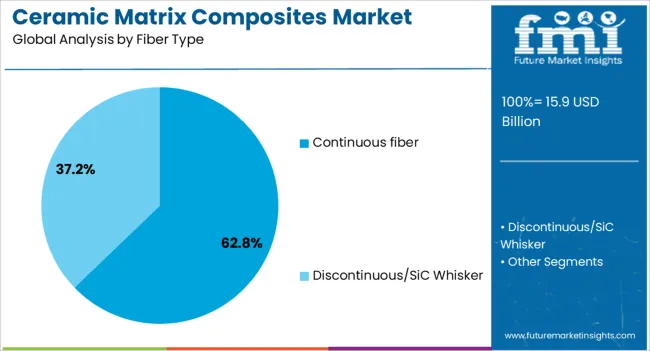

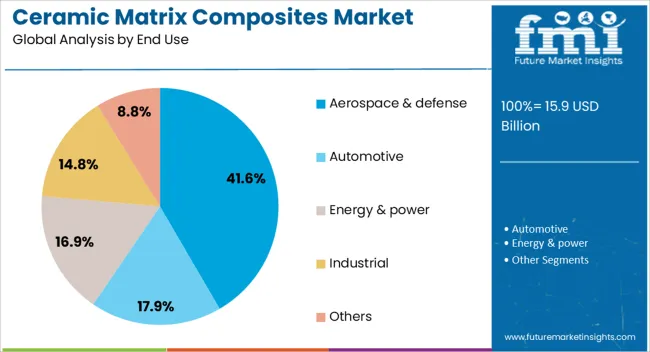

The ceramic matrix composites market is segmented by matrix material, fiber type, end use, and geographic regions. By matrix material, ceramic matrix composites market is divided into Oxide-based CMCs and Non-oxide-based CMCs. In terms of fiber type, ceramic matrix composites market is classified into Continuous fiber and Discontinuous/SiC Whisker. Based on end use, ceramic matrix composites market is segmented into Aerospace & defense, Automotive, Energy & power, Industrial, and Others. Regionally, the ceramic matrix composites industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oxide-based CMCs segment leads the matrix material category, accounting for approximately 57.4% of the overall share. Its dominance is attributed to excellent oxidation resistance, stable high-temperature performance, and cost advantages over non-oxide alternatives in specific applications. The segment’s growth has been supported by its extensive use in industrial gas turbines, aerospace components, and heat-resistant structural parts where environmental stability is crucial.

Oxide-based matrices also offer processing flexibility, enabling compatibility with a range of reinforcement fibers and fabrication techniques. This has facilitated their adoption across both prototyping and mass-production scenarios.

Additionally, lower production complexity and reduced need for protective coatings compared to non-oxide CMCs enhance their commercial appeal. Continued advancements in oxide matrix formulations, coupled with rising demand from the aerospace and energy sectors, are expected to maintain the segment’s leadership position during the forecast period.

The continuous fiber segment holds the largest share within the fiber type category, contributing around 62.8% of the ceramic matrix composites market. This segment’s prominence is underpinned by the superior strength-to-weight ratio, improved crack resistance, and enhanced load-bearing capacity that continuous fibers deliver compared to short or whisker fibers.

Their ability to provide consistent reinforcement across large structures has made them indispensable in applications such as aircraft engine components, brake systems, and turbine blades. The segment benefits from continuous innovation in fiber preform design and infiltration techniques, which enhance performance while reducing manufacturing defects.

Additionally, continuous fiber CMCs enable the production of complex geometries with minimal loss of mechanical properties, aligning with aerospace and defense sector requirements. As demand intensifies for lightweight, high-durability materials in high-temperature environments, the continuous fiber segment is expected to retain its dominant market position.

The aerospace and defense segment leads the end-use category, representing approximately 41.6% of the ceramic matrix composites market. This leadership is driven by the critical need for lightweight, high-strength, and thermally stable materials to enhance fuel efficiency, reduce emissions, and improve operational performance in extreme conditions. CMCs have become increasingly vital in the production of engine components, exhaust systems, and structural elements for both military and commercial aircraft.

Defense applications also leverage CMCs for protective systems and missile structures due to their exceptional durability and resistance to thermal shock. The segment has been bolstered by ongoing aerospace fleet modernization programs and growing investments in hypersonic and space exploration technologies.

Furthermore, the push for sustainable aviation and regulatory compliance on emission standards continues to accelerate adoption. Given the material advantages and expanding application scope, the aerospace and defense segment is anticipated to sustain its leadership throughout the forecast period.

The market has been witnessing considerable growth due to their superior mechanical strength, high-temperature resistance, and lightweight properties compared to conventional metals and ceramics. CMCs are employed across aerospace, defense, automotive, and industrial gas turbine applications to enhance performance and fuel efficiency while reducing overall weight. Increasing adoption of CMCs in turbine blades, exhaust systems, and braking components is driven by the need for durable, heat-resistant materials in high-stress environments. Advances in manufacturing techniques such as chemical vapor infiltration, polymer infiltration and pyrolysis, and slurry infiltration have improved material uniformity and scalability.

The aerospace and defense sectors have been major contributors to the adoption of ceramic matrix composites. High-performance turbine engines, hypersonic vehicles, and thermal protection systems require materials that withstand extreme temperatures while maintaining structural integrity. CMCs provide superior heat resistance and reduced density, improving fuel efficiency and payload capacity. Defense applications, including missile components, armor systems, and aerospace propulsion units, leverage CMCs for enhanced operational reliability under severe conditions. Collaboration between aerospace manufacturers and material suppliers has led to custom-engineered CMCs optimized for specific components. As the aviation industry pursues lighter, more fuel-efficient aircraft, and defense systems prioritize high-performance materials, demand for ceramic matrix composites continues to rise significantly across global markets, supporting research-driven innovation and industrial growth.

Advancements in manufacturing processes have expanded the application scope and quality of ceramic matrix composites. Techniques such as chemical vapor infiltration, polymer infiltration and pyrolysis, and slurry infiltration enable controlled fiber-matrix integration, enhancing fracture toughness, thermal conductivity, and mechanical properties. Additive manufacturing and 3D printing of CMCs are emerging, allowing complex geometries and lightweight structures for aerospace and industrial applications. Process automation and quality monitoring systems reduce production defects and improve reproducibility at scale. Additionally, hybrid CMCs with reinforced fibers or ceramic coatings increase material lifespan and resistance to thermal shock. These innovations have enhanced commercial viability and accelerated adoption across sectors demanding high-performance materials, ensuring that CMCs remain a critical solution for advanced engineering challenges.

Automotive and industrial turbine applications are contributing to increased demand for ceramic matrix composites. High-performance brake systems, exhaust components, and lightweight engine parts in the automotive sector benefit from CMCs’ heat tolerance and weight reduction, improving fuel efficiency and emissions compliance. In industrial turbines, CMCs are used for hot-section components exposed to extreme operating temperatures, increasing turbine efficiency and operational life. Manufacturers are leveraging CMCs to achieve higher thermal performance while reducing maintenance intervals. Collaboration between original equipment manufacturers and material suppliers ensures development of customized composites suited to application-specific thermal and mechanical requirements. Consequently, the convergence of performance demands in automotive and industrial sectors has reinforced the strategic significance of ceramic matrix composites globally.

Sustainability and the push for lightweight design have become key trends shaping the ceramic matrix composites market. Reduced material density contributes to lower fuel consumption and greenhouse gas emissions in aerospace, automotive, and energy sectors. Recyclable and durable composites reduce component replacement frequency, improving lifecycle efficiency. Research into eco-friendly precursor materials and solvent-free manufacturing processes is being conducted to minimize environmental impact. Integration of CMCs in hybrid structures and lightweight assemblies aligns with broader industrial trends toward energy efficiency and operational cost reduction. As industries increasingly prioritize environmentally responsible solutions without compromising performance, ceramic matrix composites are positioned as essential materials that combine sustainability with high-performance characteristics in demanding applications.

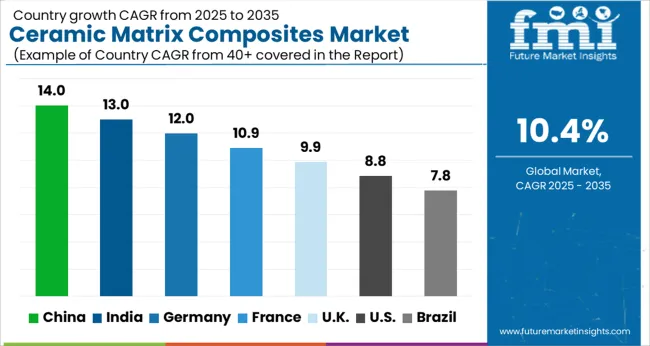

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

The market is projected to grow at a CAGR of 10.4% from 2025 to 2035, fueled by demand in aerospace, automotive, and defense applications. China tops the market with 14.0%, supported by strong industrial infrastructure and investment in high-performance materials. India follows at 13.0%, driven by expanding aerospace and advanced manufacturing sectors. Germany records 12.0%, reflecting its focus on engineering excellence and material innovation. The UK holds 9.9%, benefiting from technological research and industrial adoption. The USA reaches 8.8%, influenced by aerospace and defense sector demand and material development initiatives. Market growth is influenced by the adoption of lightweight, high-strength composites and technological advancements in production methods. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 14.0% CAGR, driven by increasing adoption in aerospace, defense, and high temperature industrial applications. Manufacturers invested in advanced fabrication techniques, lightweight composite materials, and high performance ceramics to meet rising demand for heat resistant and durable components. Research and development focused on improving fracture toughness, thermal stability, and wear resistance. Collaborative projects with global aerospace and industrial players facilitated technology transfer and accelerated commercialization. Competitive strategies emphasized local production, customized solutions, and after sales support for industrial clients. Adoption was highest in aerospace engine components, automotive performance parts, and defense equipment, where high temperature tolerance, reliability, and weight reduction were critical factors influencing procurement decisions.

India demonstrated a 13.0% CAGR, supported by growth in aerospace, automotive, and energy industries. Investments in R&D and collaboration with international technology providers enabled development of lightweight and high strength composites suitable for engine, turbine, and structural applications. Manufacturers emphasized improving thermal shock resistance, oxidation resistance, and fracture toughness for critical components. Competitive strategies included technology licensing, production scalability, and specialized component manufacturing for industrial and defense sectors. Adoption increased in aerospace propulsion systems, power generation turbines, and high performance automotive parts. Government initiatives and strategic defense projects further accelerated demand, positioning Indian manufacturers to leverage both domestic and export opportunities in high performance applications.

Germany advanced at a 12.0% CAGR, influenced by aerospace, automotive, and industrial machinery applications. Manufacturers focused on high temperature resistant, lightweight, and mechanically robust composites to improve engine efficiency and component lifespan. Competitive advantage was achieved through precision manufacturing, certification compliance, and integration with high performance industrial systems. Adoption was strongest in aerospace engine components, gas turbines, and performance automotive parts. Export demand and collaborations with European aerospace and automotive OEMs shaped production and innovation strategies. Advanced machining, quality assurance, and continuous material testing reinforced Germany’s position as a key market for high performance ceramic matrix composites with stringent operational requirements.

The United Kingdom progressed at a 9.9% CAGR, driven by aerospace, defense, and energy sector applications. Adoption of ceramic matrix composites increased in engine components, high temperature industrial machinery, and structural parts. Manufacturers invested in material innovation, machining precision, and thermal stability enhancement. Competitive strategies focused on customization, quality certifications, and collaborative development with aerospace and defense OEMs. Adoption was concentrated in aerospace propulsion systems, power generation turbines, and high performance automotive segments. Government research programs and defense modernization initiatives further supported market growth, enabling domestic manufacturers to enhance production capabilities and leverage export opportunities.

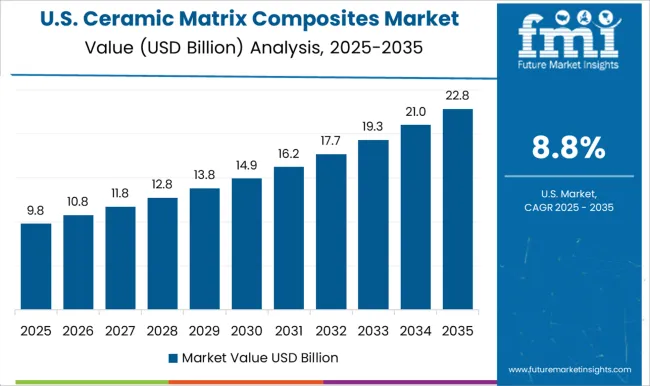

The United States expanded at an 8.8% CAGR, influenced by aerospace, defense, energy, and automotive demand. Manufacturers invested in lightweight, high temperature resistant, and fracture tolerant ceramic matrix composites. Aerospace propulsion systems, military equipment, and industrial turbines were primary applications driving growth. Competitive strategies emphasized advanced material research, collaboration with defense agencies, and rapid prototyping for specialized components. Adoption was highest where weight reduction, thermal stability, and mechanical performance were critical. Export of high performance components and integration with US OEMs reinforced market expansion. Manufacturers prioritized compliance with FAA, DoD, and ASTM standards, while innovation in fabrication and coating techniques enhanced durability, wear resistance, and operational efficiency.

The market has been shaped by advanced material developers and aerospace technology leaders. Applied Thin Films, Inc., CeramTec GmbH, and COI Ceramics, Inc. have focused on high temperature performance, wear resistance, and lightweight structural solutions. Their strategies emphasize precision manufacturing, material purity, and compatibility with extreme operating environments. CoorsTek, Inc. and Morgan Advanced Materials have targeted both industrial and defense applications, providing tailored composites that combine thermal stability with mechanical strength.

Global corporations including General Electric Company, Kyocera Corporation, and Rolls-Royce plc have differentiated through integration with turbine engines, aerospace components, and high performance systems. Product brochures highlight thermal barrier coatings, fiber reinforced matrices, and oxidation resistant formulations. Emphasis is placed on reliability under extreme temperatures, dimensional stability, and long service life. Applied Thin Films and CeramTec emphasize material uniformity, while Rolls-Royce and GE showcase integration into engine systems for performance and efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.9 Billion |

| Matrix Material | Oxide-based CMCs and Non-oxide-based CMCs |

| Fiber Type | Continuous fiber and Discontinuous/SiC Whisker |

| End Use | Aerospace & defense, Automotive, Energy & power, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Applied Thin Films, Inc., CeramTec GmbH, COI Ceramics, Inc., CoorsTek, Inc., General Electric Company, Kyocera Corporation, Lancer Systems, Morgan Advanced Materials, Reinhold Industries, Inc., Renegade Materials Corporation, and Rolls-Royce plc |

| Additional Attributes | Dollar sales by composite type and application, demand dynamics across aerospace, automotive, and industrial sectors, regional trends in high-temperature material adoption, innovation in thermal resistance, lightweight design, and manufacturing processes, environmental impact of production and end-of-life disposal, and emerging use cases in turbine engines, brake systems, and next-generation aerospace structures. |

The global ceramic matrix composites market is estimated to be valued at USD 15.9 billion in 2025.

The market size for the ceramic matrix composites market is projected to reach USD 42.8 billion by 2035.

The ceramic matrix composites market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in ceramic matrix composites market are oxide-based cmcs and non-oxide-based cmcs.

In terms of fiber type, continuous fiber segment to command 62.8% share in the ceramic matrix composites market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Ceramic Additives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA