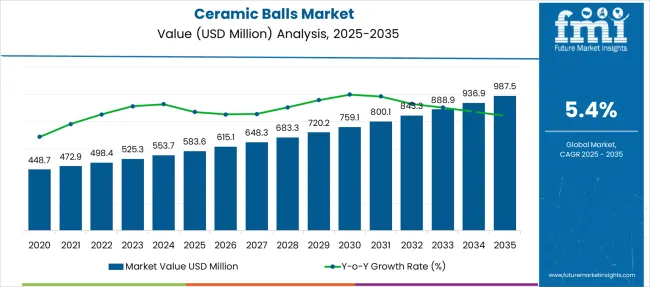

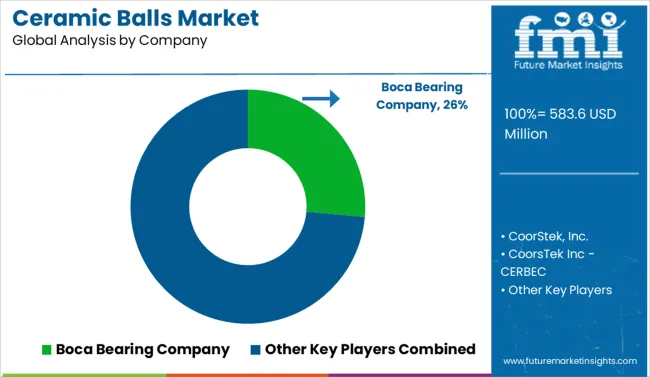

The Ceramic Balls Market is estimated to be valued at USD 583.6 million in 2025 and is projected to reach USD 987.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Ceramic Balls Market Estimated Value in (2025 E) | USD 583.6 million |

| Ceramic Balls Market Forecast Value in (2035 F) | USD 987.5 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The ceramic balls market is witnessing consistent growth driven by their superior thermal resistance, mechanical strength, and chemical stability across high performance industrial applications. Rising demand from end use sectors such as aerospace, automotive, and chemical processing is contributing to sustained adoption.

The ability of ceramic balls to withstand extreme temperatures, corrosive environments, and high wear conditions positions them as a critical component in precision systems. Ongoing advancements in material science and manufacturing processes are further enhancing product durability and consistency.

Strategic shifts toward lightweight and low maintenance components in aerospace and defense sectors are also accelerating usage. The global market outlook remains positive as manufacturers focus on enhancing load capacity, operational efficiency, and sustainability through innovative ceramic formulations.

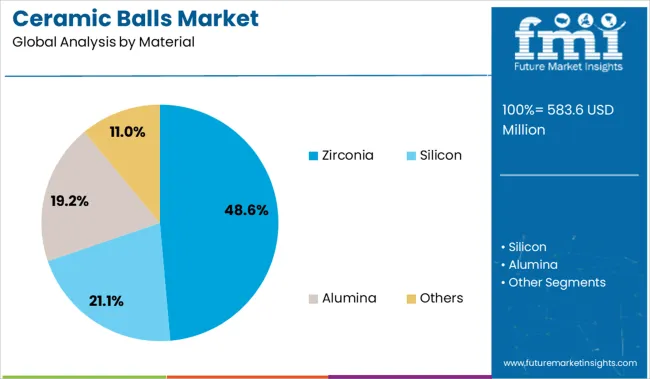

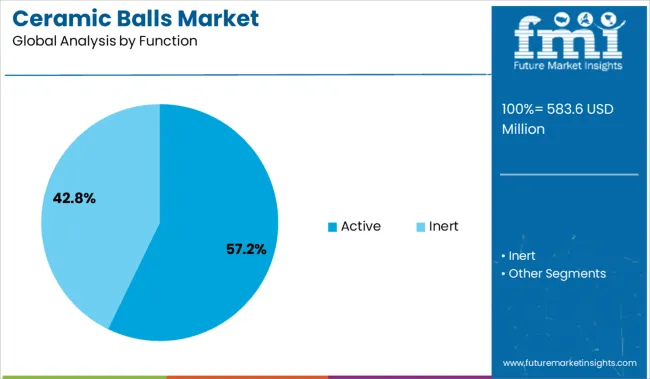

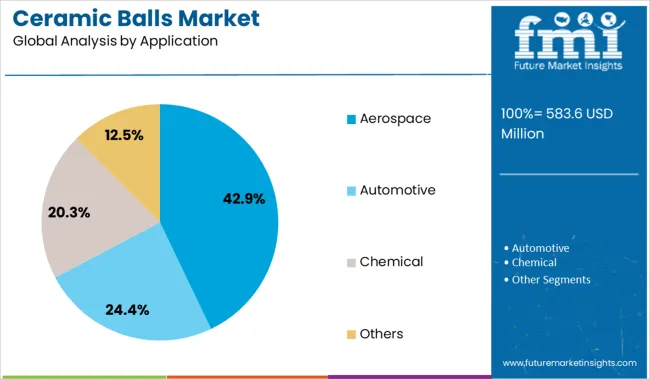

The ceramic balls market is segmented by material, function, and application and geographic regions. By material of the ceramic balls market is divided into Zirconia, Silicon, Alumina, and Others. In terms of function of the ceramic balls market is classified into Active and Inert. Based on application of the ceramic balls market is segmented into Aerospace, Automotive, Chemical, and Others. Regionally, the ceramic balls industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zirconia material segment is projected to represent 48.60 percent of total revenue by 2025 within the material category, establishing it as the leading segment. This growth is primarily due to zirconia’s high fracture toughness, wear resistance, and excellent thermal insulation properties, making it well suited for critical applications.

Its electrical insulation capability and resistance to corrosion have made it a preferred material in industries requiring high precision and operational stability. Additionally, zirconia ceramic balls offer high dimensional accuracy and prolonged lifespan, minimizing system downtime and enhancing performance in demanding environments.

The continued focus on quality assurance and extended service intervals has solidified zirconia’s dominance within the material category.

The active function segment is anticipated to account for 57.20 percent of overall market revenue by 2025, emerging as the most prominent function type. This dominance is driven by the strategic role ceramic balls play in mechanical systems where they directly engage in load bearing, rotational, or filtering activities.

Active ceramic balls contribute to operational efficiency by reducing friction, distributing stress, and improving flow dynamics in pumps, valves, and bearings. Their use in high temperature and pressure conditions makes them indispensable in systems that require durability and reliability.

The growing demand for high performing industrial components with longer lifespans and low maintenance requirements continues to reinforce the active segment’s leadership in the market.

The aerospace application segment is expected to capture 42.90 percent of total market revenue by 2025, making it the leading application area. This is attributed to the sector’s demand for lightweight, high strength materials that can endure extreme thermal and mechanical stress.

Ceramic balls are extensively used in aerospace engines, gyroscopes, and control systems due to their ability to maintain dimensional integrity under high load and temperature fluctuations. The increasing focus on fuel efficiency, weight reduction, and long term reliability in aircraft design is supporting the expanded use of ceramic components.

Additionally, the emphasis on safety and regulatory compliance in aerospace manufacturing is accelerating the adoption of high performance ceramic balls, positioning this segment as a key driver of overall market growth.

Demand for ceramic balls is growing in high-temperature, corrosion-resistant applications across automotive, chemical, and energy sectors. Sales of silicon nitride and zirconia-based ceramic balls are gaining momentum due to rising reliability needs in EV drivetrains, mechanical seals, and oilfield equipment.

Demand for ceramic balls in automotive applications rose 21% in 2025, driven by their increasing integration into electric vehicle drivetrains and turbochargers. Silicon nitride balls replaced steel variants in high-speed bearings, delivering 40% lower friction and 22% longer service life. Japanese EV OEMs adopted ceramic bearings in dual motor systems to boost power density, while EU suppliers certified hybrid ball sets for regenerative braking systems. In India, two-wheeler manufacturers began testing lightweight zirconia variants to enhance mileage performance. Suppliers optimized sintering processes to cut per-unit costs by 14%, enabling broader adoption in mid-range vehicles. Automotive-grade ceramic ball demand now accounts for nearly 38% of total volume.

Sales of ceramic balls in industrial processes grew 18% in 2025, especially in oil & gas and chemical processing facilities. Alumina and silicon carbide balls were increasingly used in pump valves, catalyst beds, and flow regulators due to superior chemical resistance. Middle East-based refineries adopted these grades in sour gas and brine systems, reducing component replacement intervals by 31%. European chemical plants utilized inert ceramic media for heat transfer beds and reactor linings, stabilizing thermal cycles. Chinese coal-to-chemicals firms reported a 27% drop in downtime using ceramic valve components. This industrial shift is anchoring long-term contracts for high-specification ceramic ball grades.

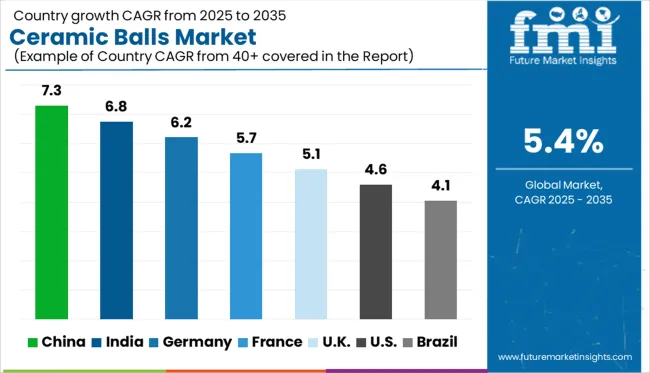

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global ceramic balls market is forecast to grow at a CAGR of 5.4% from 2025 to 2035. China (BRICS) leads with a CAGR of 7.3%, exceeding the global average by 1.9 percentage points, supported by expanding applications in chemical processing, electronics, and renewable energy. India (BRICS) follows at 6.8% (+1.4 pp), driven by government-backed infrastructure projects and increasing demand in high-temperature bearing assemblies. Germany (OECD) posts a CAGR of 6.2% (+0.8 pp), aided by precision manufacturing in aerospace and medical device sectors.

The UK sees slower growth at 5.1% (–0.3 pp), as adoption is limited to specialized industrial applications. The United States trails at 4.6% (–0.8 pp), reflecting a matured industrial market and slower replacement cycles. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s ceramic balls market is expected to witness a CAGR of 7.3% from 2025 to 2035, driven by its growing role in high-performance bearings, filtration, and electronics. From 2020 to 2024, industrial applications led demand, especially in automotive and chemical sectors. Future growth will benefit from domestic push for lightweight and thermally resistant materials in EVs and semiconductors.

India is projected to grow at a CAGR of 6.8% through 2035, supported by rising usage in precision machinery, renewables, and the pharma industry. Between 2020 and 2024, demand remained steady across lubricated environments. In the upcoming phase, emphasis on energy-efficient mechanical systems will enhance adoption of ceramic alternatives.

Germany’s ceramic balls market is forecast to grow at 6.2% CAGR between 2025 and 2035, anchored by the country’s engineering-intensive sectors. The 2020–2024 period saw modest gains from automation and tooling upgrades. The next decade will mark a strategic shift toward ceramic integration in aerospace, robotics, and medical device manufacturing.

The UK market is projected to rise at a CAGR of 5.1% during the 2025–2035 window, shaped by developments in biotechnology and green energy infrastructure. From 2020 to 2024, ceramic balls gained acceptance in oil & gas processing. Moving forward, usage will broaden to include lab equipment, semiconductors, and hydrogen fuel systems.

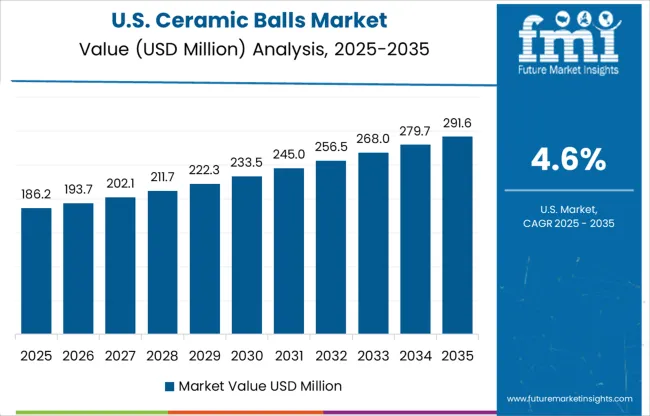

The USA ceramic balls market is anticipated to grow at 4.6% CAGR from 2025 to 2035, led by developments in defense, automotive, and semiconductor manufacturing. During 2020–2024, consumption was centered in traditional mechanical applications. The future outlook is defined by demand for longer-lasting and heat-tolerant components in harsh-use environments.

Demand for ceramic balls is rising in 2025 due to their expanding application in aerospace, automotive, petrochemical, and medical sectors. Boca Bearing Company holds the largest market share, benefiting from its diversified product line and growing OEM partnerships. CoorStek Inc., including its CERBEC division, is scaling advanced ceramics for high-speed, high-temperature environments. Saint-Gobain and Toshiba Materials are investing in ultra-pure ceramic technologies for semiconductor and clean energy sectors. Honeywell is leveraging ceramic bearings in extreme industrial and aerospace operations. Indian suppliers like Devson Catalyst and Topack Ceramics are gaining traction in catalysts and filtration. Ortech and MetalBall focus on high-durability components for valves and pumps. The market is seeing a shift toward hybrid bearings and precision-engineered ceramic media across industries.

In October 2024, Honeywell revealed plans to spin off its Advanced Materials business, which includes ceramic technologies, into a standalone public company by the end of 2025 or early 2026, aiming to sharpen focus and accelerate innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 583.6 Million |

| Material | Zirconia, Silicon, Alumina, and Others |

| Function | Active and Inert |

| Application | Aerospace, Automotive, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boca Bearing Company, CoorStek, Inc., CoorsTek Inc - CERBEC, Devson Catalyst Pvt. Ltd., Fineway Inc., Global Precision Ball & Roller, Honeywell International, Industrial Tectonics Bearings Limited, Industrial Tectonics Inc., MetalBall, Ortech Advanced Ceramics, Saint-Gobain, Topack Ceramics Pvt. Ltd., and Toshiba Materials Co. Ltd. |

| Additional Attributes | Dollar sales by material type (alumina, silicon, zirconia, others) and application (bearings, grinding, valves), demand dynamics across automotive, aerospace, chemical, and industrial sectors, regional adoption trends in Asia‑Pacific versus North America/Europe, innovation in high‑density ceramics and inert/active functionality, environmental impact of manufacturing waste and health‑hazard regulations, and emerging uses in precision instruments and renewable energy systems. |

The global ceramic balls market is estimated to be valued at USD 583.6 million in 2025.

The market size for the ceramic balls market is projected to reach USD 987.5 million by 2035.

The ceramic balls market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in ceramic balls market are zirconia, silicon, alumina and others.

In terms of function, active segment to command 57.2% share in the ceramic balls market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Ceramic Additives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA