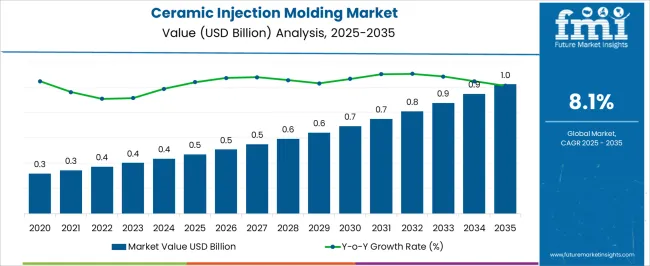

The Ceramic Injection Molding Market is estimated to be valued at USD 0.5 billion in 2025 and is projected to reach USD 1.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. A review of the progression shows that the market maintained its initial value of USD 0.3 billion through 2021, before rising to USD 0.4 billion in 2022 and remaining at the same level in 2023, signaling a steady adoption pace. By 2024, it reached USD 0.5 billion, which also marked the starting point for a stronger upward trajectory.

The market value is projected to hit USD 0.6 billion in 2028 and USD 0.7 billion by 2030, underpinned by heightened demand for precision-engineered ceramic components across sectors such as medical devices, aerospace, and automotive. By 2033, it is expected to advance to USD 0.9 billion before achieving the USD 1.0 billion mark in 2035, reflecting a growth multiplier of approximately 3.3 times from the 2020 level. The first half of the period, from 2020 to 2027, contributes USD 0.2 billion to overall expansion, while the latter half accounts for USD 0.5 billion, indicating back-loaded growth momentum. This trend is fueled by advancements in ceramic feedstock materials, increasing miniaturization in high-performance applications, and cost efficiency improvements in injection molding processes, encouraging wider adoption across diverse industrial applications.

| Metric | Value |

|---|---|

| Ceramic Injection Molding Market Estimated Value in (2025 E) | USD 0.5 billion |

| Ceramic Injection Molding Market Forecast Value in (2035 F) | USD 1.0 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The ceramic injection molding market is expanding steadily, driven by increasing demand for precision components with complex geometries in various industries. The superior properties of ceramic materials, such as high hardness, wear resistance, and thermal stability, have made them attractive alternatives to metals in applications requiring durability and performance.

Technological advances in molding processes have improved production efficiency and design flexibility, allowing manufacturers to produce intricate shapes with tight tolerances. Growth in sectors like industrial machinery, electronics, and automotive has fueled the need for ceramic components capable of withstanding harsh operating conditions.

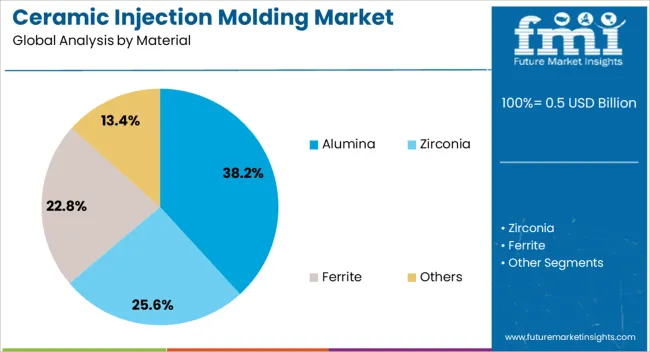

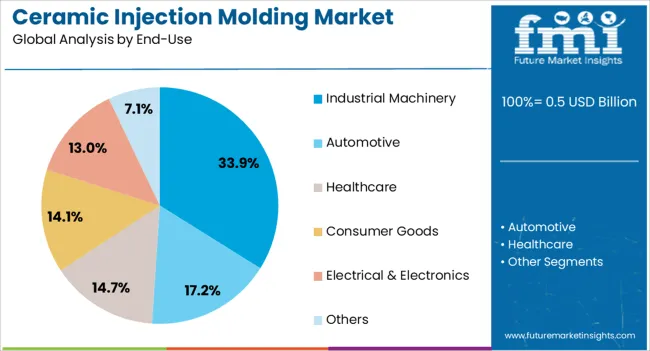

Moreover, environmental regulations promoting sustainable manufacturing practices have encouraged the adoption of ceramic materials due to their longevity and recyclability. Looking ahead, the market is expected to grow as new material formulations and hybrid composites enhance product functionality. Segmental growth is anticipated to be led by Alumina as the preferred material and Industrial Machinery as the primary end-use sector.

The ceramic injection molding market is segmented by material, end-use, and geographic regions. By material, the ceramic injection molding market is divided into Alumina, Zirconia, Ferrite, and Others. In terms of end-use, the ceramic injection molding market is classified into Industrial Machinery, Automotive, Healthcare, Consumer Goods, Electrical & Electronics, and Others. Regionally, the ceramic injection molding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Alumina segment is projected to hold 38.2% of the ceramic injection molding market revenue in 2025, establishing itself as the leading material choice. Alumina is favored for its excellent mechanical strength, electrical insulation properties, and chemical stability, making it suitable for a wide range of industrial applications.

Manufacturers prefer alumina due to its availability, cost-effectiveness, and proven performance in high-temperature and wear-intensive environments. The material’s compatibility with precision molding techniques has allowed the production of complex and reliable components used in demanding machinery parts.

Additionally, alumina’s biocompatibility has opened opportunities in medical devices, further boosting its market share. With ongoing research focused on improving alumina powder quality and sintering processes, this segment is expected to maintain its dominant position.

The Industrial Machinery segment is anticipated to contribute 33.9% of the ceramic injection molding market revenue in 2025, remaining the largest end-use sector. Growth in this segment is driven by the need for components that offer high durability, wear resistance, and thermal stability under strenuous operating conditions.

Ceramic injection molded parts are increasingly being used in pumps, valves, bearings, and cutting tools within industrial machinery, where metal components often fall short. The push toward automation and precision engineering has further heightened demand for ceramic parts capable of maintaining performance over extended operational cycles.

Investments in infrastructure development and manufacturing modernization globally have supported the expansion of ceramic component usage in machinery. As industrial processes become more sophisticated, the Industrial Machinery segment is expected to sustain its leadership in the ceramic injection molding market.

The ceramic injection molding market is influenced by precision manufacturing demands, advances in feedstock and processing methods, and expansion into high-performance industries. Increasing adoption in medical, electronics, and aerospace sectors is driving future growth potential.

The ability of ceramic injection molding to produce highly complex shapes with tight dimensional tolerances is a major factor behind its adoption. Industries such as aerospace, automotive, and electronics require components that combine lightweight structure with exceptional wear, heat, and corrosion resistance. This process enables mass production without compromising on accuracy or surface finish, which is essential in applications like dental implants, fuel cell plates, and high-frequency electronic parts. The capacity to integrate multiple design features into a single molded piece also reduces secondary processing steps, lowering production times and costs. These advantages are prompting more manufacturers to replace traditional ceramic forming methods with injection molding in precision-demanding projects.

Refinement of ceramic powder feedstock and binder formulations is improving the consistency and quality of molded components. Controlled particle size distribution ensures better mold filling, while improved binder systems simplify debinding and sintering stages. These enhancements minimize defects such as warping or cracking, resulting in stronger and more reliable end products. The development of specialty feedstocks tailored for high-purity alumina, zirconia, and silicon nitride ceramics has opened opportunities in sectors where extreme performance is required. Such material improvements also enable more efficient production of thin-walled, intricate components that were previously challenging to manufacture. These feedstock innovations are expanding the design scope and performance capabilities of ceramic injection molding applications.

Ceramic injection molding is seeing increased deployment in sectors such as medical devices, semiconductor manufacturing, and aerospace, where materials must withstand extreme operational conditions. Its suitability for creating custom, miniature, and geometrically complex parts has driven its use in dental crowns, orthopedic implants, semiconductor wafer guides, and aerospace fuel nozzles. As industries demand lighter yet more durable components, this process offers a competitive edge. The ability to mass-produce consistent parts also appeals to large-scale production lines. Coupled with the growing shift toward precision-engineered components in high-value applications, the technology is establishing a stronger foothold in industries where reliability and quality are non-negotiable.

The adoption of ceramic injection molding is increasing as manufacturers seek compatibility with automated production lines. This process supports repeatable quality, enabling integration into high-volume manufacturing systems without extensive manual oversight. Automated handling of molding, debinding, and sintering stages reduces labor costs and increases throughput. Robotics and inline quality control systems further enhance efficiency, ensuring each part meets stringent specifications. For large-scale producers in electronics, automotive, and healthcare sectors, this level of process control is critical to maintaining competitive delivery schedules. The compatibility of ceramic injection molding with modern production automation is making it a preferred choice for companies aiming to optimize both precision and scalability.

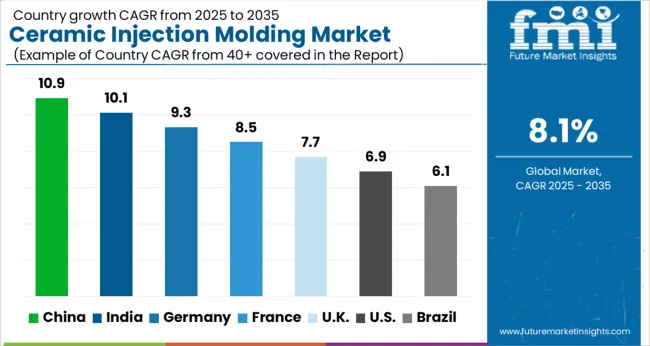

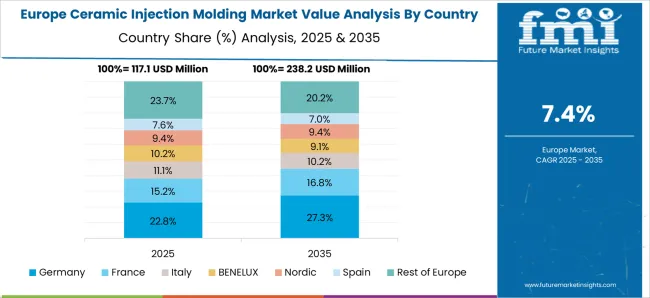

The ceramic injection molding market is projected to grow globally at a CAGR of 8.1% between 2025 and 2035, supported by increasing demand for precision-engineered ceramic components in medical, electronics, and aerospace sectors. China leads with a CAGR of 10.9%, driven by rapid industrial expansion, advanced manufacturing investments, and a growing domestic electronics base. India follows at 10.1%, fueled by rising adoption in dental applications, industrial wear parts, and defense components. France records 8.5%, supported by growth in medical implants, aerospace assemblies, and energy sector applications. The United Kingdom stands at 7.7%, driven by defense manufacturing, electronics miniaturization, and industrial automation projects, while the United States records 6.9%, reflecting steady adoption in high-value electronics, aerospace, and healthcare applications. The analysis covers more than 40 countries, with these six serving as primary benchmarks for capacity planning, export potential assessment, and strategic investment decisions in the global ceramic injection molding industry.

China is projected to achieve a CAGR of 10.9% for 2025–2035, up from about 8.2% during 2020–2024, outpacing the global average of 8.1%. The earlier growth phase was fueled by steady demand from domestic electronics and industrial ceramics manufacturing. The higher rate ahead is driven by expanded applications in medical devices, precision aerospace parts, and high-frequency electronic components. Strategic investments in advanced molding facilities and feedstock refinement are also accelerating adoption. Export growth to Europe and North America, coupled with government incentives for advanced manufacturing, is strengthening China's role as a global supply hub.

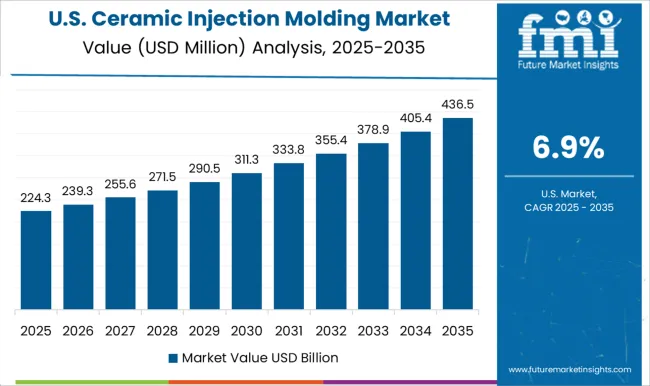

The United States is expected to grow at a CAGR of 6.9% for 2025–2035, up from about 5.6% during 2020–2024, signaling steady but moderate acceleration. Earlier growth was supported by defense, electronics, and specialized industrial applications. The increase is linked to expanding aerospace programs, the rise in minimally invasive surgical device production, and high-performance automotive part demand. Investment in domestic feedstock production and the adoption of automated molding systems are improving efficiency and cost competitiveness. R&D initiatives with universities are also driving innovation in complex part design, enhancing market appeal.

India is expected to post a CAGR of 10.1% for 2025–2035, compared to approximately 7.8% in 2020–2024, showing notable upward momentum. Earlier growth was supported by adoption in dental restorations, industrial wear parts, and defense-related components. The acceleration is due to increasing domestic manufacturing of precision ceramics, rising medical implant production, and demand for lightweight, durable aerospace parts. Partnerships between Indian manufacturers and international technology providers are improving process quality and scalability. Government-backed industrial corridor projects are providing infrastructure to expand production capacity, positioning India as a competitive player in the high-value ceramics supply chain.

France is forecast to grow at a CAGR of 8.5% for 2025–2035, rising from about 6.9% during 2020–2024, indicating solid growth momentum. The earlier period’s expansion was supported by use in dental applications, niche aerospace parts, and electronic insulators. The faster growth ahead will be fueled by increased adoption in defense manufacturing, renewable energy equipment, and high-performance automotive components. Investments in precision manufacturing hubs and localized supply of high-purity ceramics are reducing lead times and costs. Export opportunities within the EU are also rising as France aligns production capabilities with European high-tech industry needs.

The United Kingdom is projected to record a CAGR of 7.7% for 2025–2035, up from roughly 6.0% in 2020–2024, reflecting a measurable increase in pace. The earlier period saw adoption mainly in niche electronics, small aerospace components, and research-focused prototypes. The stronger future growth will be driven by greater adoption in industrial automation, medical device manufacturing, and defense-grade components. The expansion of precision machining facilities and integration of ceramic molding with additive manufacturing are enabling complex, high-value part production. Strategic partnerships with European buyers are also expanding the UK’s export footprint in advanced ceramics.

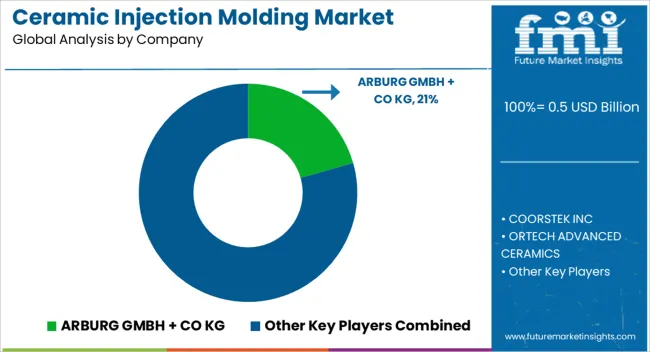

The ceramic injection molding market features prominent global and regional players such as ARBURG GmbH + Co KG, CoorsTek Inc, Ortech Advanced Ceramics, Oechsler AG, Morgan Advanced Materials PLC, INDO-MIM Pvt. Ltd, Micro Kläger Spritzguss GmbH & Co. KG, Nishimura Advanced Ceramics, and Paul Rauschert GmbH & Co. KG, each competing through material expertise, production precision, and application-specific innovation. ARBURG GmbH + Co KG is a leading injection molding machinery supplier, providing advanced systems tailored for high-precision ceramic molding operations. CoorsTek Inc leverages its extensive ceramics portfolio to serve demanding sectors like aerospace, electronics, and healthcare. Ortech Advanced Ceramics specializes in customized high-performance ceramic parts, meeting stringent client specifications. Oechsler AG integrates ceramic molding with automation solutions for complex, high-volume production. Morgan Advanced Materials PLC offers a wide range of engineered ceramics for critical environments, focusing on durability and performance. INDO-MIM Pvt. Ltd combines metal and ceramic injection molding expertise to cater to global industrial, medical, and aerospace clients. Micro Kläger Spritzguss GmbH & Co. KG focuses on precision small-part molding for niche markets. Nishimura Advanced Ceramics provides high-purity, specialty ceramics for electronics and semiconductor industries, while Paul Rauschert GmbH & Co. KG offers technical ceramic solutions for energy, process engineering, and industrial equipment. Competition in the sector is shaped by the need for ultra-precise components, consistent material quality, and scalable production capabilities. Key strategies include investment in automated molding technology, partnerships with OEMs in aerospace and medical sectors, and expansion into hybrid-material product lines. Manufacturers are also enhancing R&D capabilities for advanced feedstocks, adopting environmentally conscious production methods, and building global distribution networks to meet rising demand across diversified high-value industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.5 Billion |

| Material | Alumina, Zirconia, Ferrite, and Others |

| End-Use | Industrial Machinery, Automotive, Healthcare, Consumer Goods, Electrical & Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ARBURG GMBH + CO KG, COORSTEK INC, ORTECH ADVANCED CERAMICS, OECHSLER AG, MORGAN ADVANCED MATERIALS PLC, INDO-MIM PVT. LTD, MICRO KLÄGER SPRITZGUSS GMBH & CO. KG, NISHIMURA ADVANCED CERAMICS, and PAUL RAUSCHERT GMBH & CO. KG |

| Additional Attributes | Dollar sales, share, regional demand trends, application growth areas, competitor positioning, material innovations, production cost benchmarks, regulatory impacts, and emerging end-use sectors. |

The global ceramic injection molding market is estimated to be valued at USD 0.5 billion in 2025.

The market size for the ceramic injection molding market is projected to reach USD 1.0 billion by 2035.

The ceramic injection molding market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in ceramic injection molding market are alumina, zirconia, ferrite and others.

In terms of end-use, industrial machinery segment to command 33.9% share in the ceramic injection molding market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Demand for Powder Injection Molding in Japan Size and Share Forecast Outlook 2025 to 2035

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Molding Starch Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA