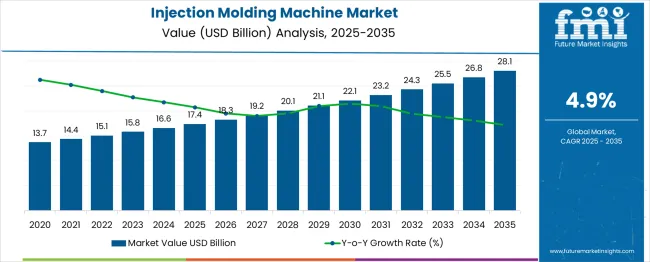

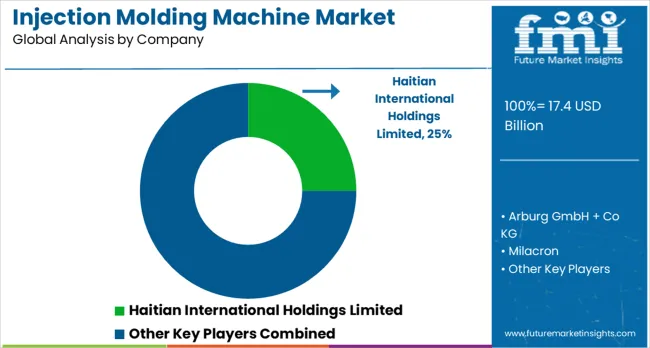

The global injection molding machine market is projected to grow from USD 17.4 billion in 2025 to USD 28 billion by 2035, reflecting a 4.9% CAGR and generating an absolute dollar opportunity of USD 10.68 billion. Expansion is driven by increasing demand from automotive, packaging, consumer goods, and electronics industries, where precision, efficiency, and high-volume production are critical. Technological advancements such as electric and hybrid injection molding machines, along with automation integration, further enhance operational performance and adoption across manufacturing sectors globally.

Analyzing elasticity of growth against macroeconomic indicators highlights the market’s responsiveness to broader economic conditions. In periods of industrial expansion and rising manufacturing output, the market experiences accelerated adoption as companies invest in new machines to meet growing production needs. Conversely, during economic slowdowns or reduced industrial spending, growth shows resilience due to the replacement demand for older machines, energy-efficient upgrades, and process optimization initiatives. Regional infrastructure development, government manufacturing incentives, and trade policies also influence growth elasticity, particularly in emerging economies. Over the forecast period, the market demonstrates moderate sensitivity to GDP fluctuations, with long-term expansion driven more by technological adoption, industrial modernization, and demand for high-efficiency manufacturing processes than short-term economic variations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 17.4 billion |

| Forecast Value in (2035F) | USD 28 billion |

| Forecast CAGR (2025 to 2035) | 4.9 % |

The injection molding machine market is driven by five primary parent markets with specific shares. Automotive leads with 41%, using injection molding for interior, exterior, and engine components. Consumer goods contribute 24%, producing household items, electronics casings, and packaging solutions. Packaging accounts for 14%, supporting containers, caps, and closures for food, beverages, and pharmaceuticals. Medical devices represent 13%, employing high-precision molding for syringes, diagnostic kits, and implants. Industrial and electrical equipment hold 8%, producing components for machinery, appliances, and electronics.

Recent developments in the injection molding machine market focus on automation, efficiency, and sustainability. Manufacturers are introducing electric and hybrid machines to reduce energy consumption and increase precision. Advanced control systems, IoT integration, and real-time monitoring are enhancing production efficiency, predictive maintenance, and quality control. Multi-material and micro-injection technologies are expanding applications across automotive, medical, and consumer sectors. Growing demand for lightweight, complex, and high-performance plastic components, coupled with rapid industrialization and smart manufacturing initiatives, is driving adoption.

Market expansion is being supported by the increasing demand for lightweight and durable components across automotive, packaging, and consumer goods industries, driving the corresponding need for advanced injection molding capabilities. Modern manufacturers are increasingly focused on production efficiency measures that can reduce cycle times, minimize material waste, and improve part quality. Advanced injection molding machine technologies offer proven capabilities in processing various materials while supporting sustainable manufacturing practices.

The growing prioritize on automation and smart manufacturing is driving demand for injection molding machines equipped with advanced control systems, real-time monitoring, and predictive maintenance capabilities. Manufacturer preference for energy-efficient solutions that combine high-speed processing with reduced power consumption is creating opportunities for innovative machine designs. The rising influence of Industry 4.0 principles and digital manufacturing integration is also contributing to increased adoption of intelligent injection molding systems across different industrial sectors.

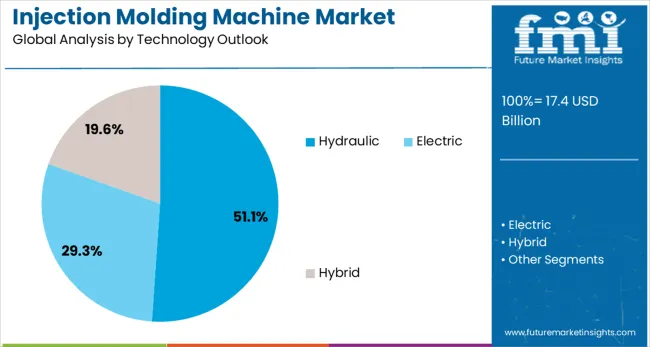

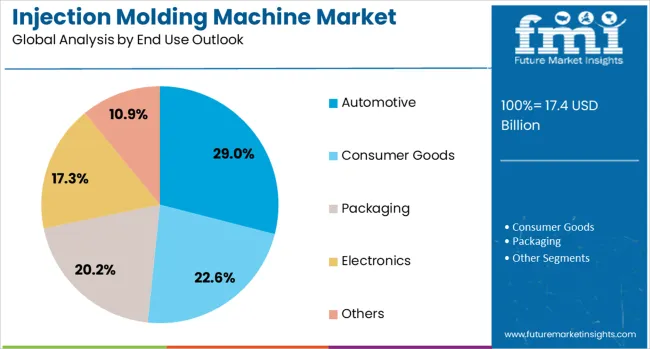

The market is segmented by material outlook, technology outlook, end use outlook, and region. By material outlook, the market is divided into plastics, metals, and others. Based on technology outlook, the market is categorized into hydraulic, electric, and hybrid systems. In terms of end use outlook, the market is segmented into automotive, consumer goods, packaging, electronics, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The plastics material segment is projected to account for 77% of the injection molding machine market in 2025, reaffirming its position as the dominant material category. The widespread adoption of plastic components across automotive, packaging, consumer goods, and electronics industries drives consistent demand for specialized injection molding equipment. Plastics offer versatility in design, cost-effectiveness, and the ability to produce complex geometries with tight tolerances.

This segment forms the foundation of most injection molding applications, as it represents the most established and diverse material processing category. Technological advancements in plastic formulations and processing techniques continue to expand application possibilities across industries. With growing emphasis on lightweight materials and sustainable plastic solutions, the plastics segment maintains its central role in driving injection molding machine demand across global markets.

Hydraulic technology is projected to represent 51% of injection molding machine demand in 2025, demonstrating its continued relevance in manufacturing operations requiring high clamping force and robust performance. Manufacturers value hydraulic systems for their proven reliability, cost-effectiveness, and ability to handle large-scale production requirements across various material types. Hydraulic machines offer superior force delivery for processing thick-walled parts and handling challenging molding applications.

The segment benefits from established maintenance expertise, widespread service availability, and lower initial investment requirements compared to alternative technologies. While electric and hybrid systems gain market share through energy efficiency advantages, hydraulic technology maintains strong demand in applications prioritizing raw processing power and operational durability. Continuous improvements in hydraulic system efficiency and control precision support sustained market leadership in the injection molding machinery sector.

The automotive end use segment is forecasted to contribute 29% of the injection molding machine market in 2025, reflecting the industry's significant reliance on precision-molded components for vehicle manufacturing. The automotive sector demands high-performance injection molding solutions capable of producing lightweight, durable, and complex-geometry parts that meet stringent quality and safety requirements.

Electric vehicle development and lightweighting initiatives drive demand for advanced injection molding capabilities that can process specialized materials and achieve precise dimensional tolerances. The segment benefits from ongoing innovation in automotive design, where injection-molded components replace traditional materials to improve fuel efficiency and performance. With the continued expansion of automotive production globally and increasing component complexity, the automotive segment serves as a primary growth driver for sophisticated injection molding machine technologies.

The injection molding machine market is advancing steadily due to increasing demand for precision manufacturing and growing adoption of automated production systems, the market faces challenges including high capital investment requirements, maintenance complexity, and competition from alternative manufacturing technologies. Innovation in servo-driven systems and smart manufacturing integration continue to influence product development and market expansion patterns.

The growing adoption of connected manufacturing systems is enabling injection molding machines to provide real-time production monitoring, predictive maintenance capabilities, and automated quality control. Smart machine integration offers improved production efficiency, reduced downtime, and enhanced process optimization through data analytics and machine learning algorithms. Digital connectivity enables remote monitoring and control capabilities that improve operational flexibility and maintenance planning.

Modern injection molding machine manufacturers are incorporating energy-efficient drive systems, optimized heating and cooling cycles, and reduced material waste technologies to meet sustainability requirements. Advanced servo-driven systems and hybrid technologies improve energy consumption while maintaining high-performance processing capabilities. Sustainable manufacturing practices also enable the integration of recycled materials and circular economy principles in injection molding operations.

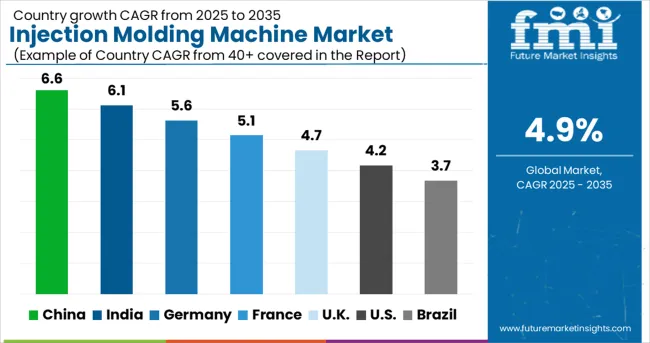

| Countries | CAGR (2025-2035) |

|---|---|

| India | 6.6% |

| China | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

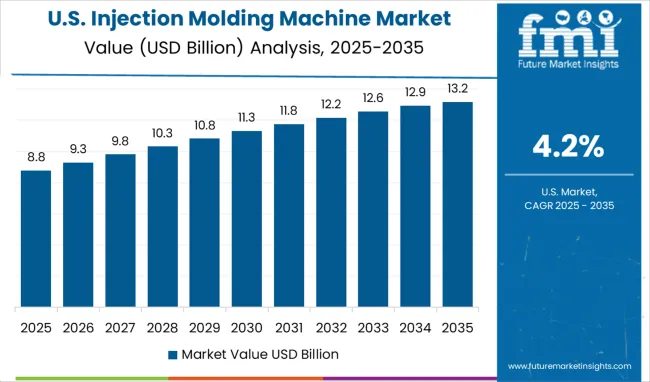

| USA | 4.2% |

| Brazil | 3.7% |

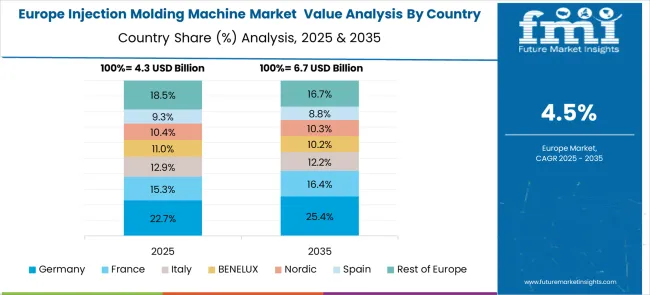

The global injection molding machine market is projected to expand from USD 17.4 billion in 2025 to USD 28 billion by 2035, registering a CAGR of 5%. India, a key BRICS economy, leads with 6.6%, supported by growing manufacturing hubs, rising domestic production, and the adoption of advanced industrial technologies. China follows at 6.1%, driven by plastic high-volume output, government incentives for machinery upgrades, and export-oriented manufacturing.

Germany, representing OECD markets, posts 5.6% growth, fueled by precision engineering, automation, and smart factory integration. France's growth rate is 5.1%, driven by the modernization of molding facilities and stable industrial demand. The United Kingdom reaches 4.7%, shaped by selective automotive and consumer product applications. The United States, at 4.2%, reflects steady growth from automation adoption and specialized industrial usage.

This report includes insights on 40+ countries; the top markets are shown here for reference.

India is expected to grow at a CAGR of 6.6%, driven by increasing demand from the automotive, packaging, and consumer goods sectors. Manufacturers are adopting advanced injection molding machines with higher precision, energy efficiency, and automation capabilities. Local and international players are expanding production facilities and collaborating with Indian companies to offer custom solutions for small- and medium-scale manufacturing. Analysts note that rising industrial automation, coupled with growing adoption of advanced polymers, is supporting market expansion. Government initiatives to support manufacturing infrastructure and “Make in India” programs are further enhancing adoption. Tier 1 and Tier 2 cities are seeing significant uptake of high-performance injection molding machines, while smaller urban centers are gradually integrating modern equipment.

China is growing at a CAGR of 6.1%, supported by high demand in the automotive, electronics, and medical device industries. Manufacturers are upgrading conventional equipment to servo-driven, high-precision, and multi-material injection molding machines. Analysts anticipate strong growth due to the country’s leading polymer production capabilities and the expansion of manufacturing hubs in coastal regions. Domestic manufacturers collaborate with international technology providers to improve machine performance, energy efficiency, and automation. Increasing industrial robotics integration allows faster production cycles and enhanced product consistency. Urban centers lead adoption, while secondary cities are increasingly integrating mid-range, automated machines. Government incentives for advanced manufacturing and energy-efficient production further accelerate market growth.

Germany is expanding at a CAGR of 5.6%, driven by advanced manufacturing requirements in automotive, packaging, and precision engineering sectors. Operators are increasingly deploying electric and hybrid injection molding machines for high-precision components. Analysts note that R&D investment and collaboration with European technology providers are improving machine capabilities and operational efficiency. Adoption is concentrated in industrial clusters with a focus on sustainable energy use and high throughput. Specialty machines for medical and electronics applications are seeing significant uptake.

France is growing at a CAGR of 5.1%, supported by investments in automotive, packaging, and consumer goods production. Operators focus on energy-efficient and precision-driven machines to reduce production costs and improve throughput. Analysts expect adoption to rise due to the country’s strong industrial ecosystem and collaborations with European equipment providers. Specialty sectors such as medical device manufacturing and electronics are driving demand for high-performance injection molding solutions. Small and medium enterprises are gradually investing in automated and multi-material machines, enhancing competitiveness.

The UK is growing at a CAGR of 4.7%, driven by automotive, packaging, and electronics industries. Manufacturers are deploying servo-driven and hybrid injection molding machines for high-efficiency production. Analysts note that increasing demand for lightweight components and complex designs supports market growth. Urban manufacturing hubs lead adoption, with rural centers gradually integrating automated machines. Collaborations with European and international equipment providers enhance technological capabilities, while energy efficiency and reduced operational costs remain key adoption factors.

The US is expanding at a CAGR of 4.2%, supported by demand from automotive, medical device, and packaging sectors. Manufacturers are upgrading to electric and hybrid injection molding machines for enhanced precision, energy savings, and operational efficiency. Analysts anticipate steady growth due to automation adoption and integration of high-speed multi-cavity machines. Specialty machines for medical and electronics applications are experiencing increasing adoption. Urban and industrial manufacturing hubs are leading implementation, while smaller regions gradually adopt modern equipment. Continuous collaboration with domestic and international technology providers drives improvements in production throughput and cost efficiency.

Haitian International Holdings Limited, China-based, specializes in high-performance injection molding machines for plastics processing, offering energy-efficient solutions and extensive global support. Arburg GmbH + Co KG, Germany, provides precision injection molding technologies with advanced automation, digital connectivity, and modular systems for diverse industrial applications. Milacron Holdings Corp., USA, delivers a wide range of injection molding machines integrated with smart manufacturing technologies and global service capabilities. Nissei Plastic Industrial Co., Ltd., Japan, focuses on high-speed, high-precision injection molding solutions for automotive, packaging, and electronics sectors.

Engel Austria GmbH, Austria, focus fully electric and hybrid injection molding systems with integrated automation, digital process monitoring, and energy-saving features. Sumitomo (SHI) Demag Plastics Machinery GmbH, Germany, delivers precision injection molding machines tailored for automotive, medical, and consumer goods applications, with advanced process reliability. Chen Hsong Holdings Limited, Hong Kong, offers high-capacity, efficient molding machines for industrial and packaging segments.

Toyo Machinery & Metal Co., Ltd., Japan, provides specialized injection molding solutions with high-speed, large-tonnage, and energy-efficient systems. Husky Injection Molding Systems Ltd., Canada, delivers turnkey solutions including hot runners, automation, and mold technologies for packaging and medical industries. Japan Steel Works Ltd., Japan, offers large-tonnage, high-precision machines for engineering and automotive applications. KraussMaffei Group GmbH, Germany, integrates digital manufacturing solutions with injection molding expertise for diverse industrial sectors. UBE Machinery Corporation, Ltd., Japan, delivers high-performance machines with energy efficiency and advanced process control. Shibaura Machine Co., Ltd., Japan, and Wittmann Battenfeld, Austria, provide modular, automated, and energy-efficient injection molding technologies for global industrial markets.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 17.4 billion |

| Projected Market Size (2035) | USD 28 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and number of machines for volume |

| Material Types Analyzed (Segment 1) | Plastics, Metals, Others |

| Technology Types Analyzed (Segment 2) | Hydraulic, Electric, Hybrid |

| End-Use Segments Analyzed (Segment 3) | Automotive, Consumer Goods, Packaging, Electronics, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, France, Italy, United Kingdom, India, China, Japan, South Korea, UAE, South Africa |

| Key Players Influencing the Market | Haitian International Holdings Limited, Arburg GmbH + Co KG, Milacron, Nissei Plastic Industrial Co., Limited, Engel Austria GmbH, Sumitomo (SHI) Demag Plastics Machinery GmbH, Chen Hsong Holdings Limited, Toyo Machinery & Metal Co., Ltd, Husky Injection Molding Systems Ltd, Japan Steel Works Limited, KraussMaffei Group, UBE Machinery, Shibaura Machine Co. Ltd, Wittmann Battenfeld |

| Additional Attributes | Dollar sales by machine type and end use, demand dynamics across automotive, packaging, electronics, and consumer goods, regional trends in plastic manufacturing and automation, innovation in precision, cycle time, and energy efficiency, environmental impact of material use and waste, and emerging use cases in bioplastics, medical devices, and miniaturized components. |

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

The global injection molding machine market is estimated to be valued at USD 17.4 billion in 2025.

The market size for the injection molding machine market is projected to reach USD 28.1 billion by 2035.

The injection molding machine market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in injection molding machine market are plastics, metals and others.

In terms of technology outlook, hydraulic segment to command 51.1% share in the injection molding machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Injection Moulding Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Injection Pen Market Insights - Growth, Demand & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Injection Moulding Cosmetic Packaging Manufacturers

Injection Molded Plastic Market Trends – Growth & Forecast 2024-2034

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Micro Injection Molded Plastic Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA