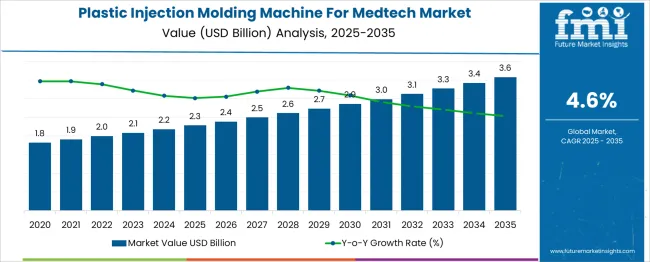

The Plastic Injection Molding Machine For Medtech Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 2.3 billion to USD 2.9 billion, driven by increasing demand for high-precision plastic components in medical devices and equipment.

Year-on-year analysis shows steady growth, with values reaching USD 2.4 billion in 2026 and USD 2.5 billion in 2027, supported by technological advancements in injection molding for enhanced accuracy and quality control. By 2028, the market is forecasted to reach USD 2.6 billion, advancing to USD 2.7 billion in 2029 and USD 2.9 billion by 2030. Growth is expected to be fueled by the rising demand for disposable medical products, diagnostic tools, and advanced healthcare devices. Innovations in multi-material molding and sustainable manufacturing practices will also play a significant role in shaping the market. These dynamics position plastic injection molding machines as a critical enabler in the production of reliable, cost-effective, and scalable medical components for the medtech industry.

Sumitomo (SHI) Demag, Arburg GmbH, Engel Austria GmbH, Milacron Holdings Corp., Nissei Plastic Industrial Co., Husky Injection Molding Systems Ltd.

| Metric | Value |

|---|---|

| Plastic Injection Molding Machine For Medtech Market Estimated Value in (2025 E) | USD 2.3 billion |

| Plastic Injection Molding Machine For Medtech Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The Plastic Injection Molding Machine For Medtech market is exhibiting strong growth, driven by rising demand for high-precision medical components across diagnostic, therapeutic, and surgical applications. The need for mass customization and scalable manufacturing solutions is accelerating the adoption of specialized injection molding machines in the medical device industry. Stringent quality and safety regulations within the healthcare sector have placed a premium on machines that offer consistency, precision, and contamination-free processing.

As medtech companies continue to develop advanced devices using complex polymer materials, equipment with enhanced software controls and precision feedback systems is being favored. Ongoing innovations in tooling, automation, and cleanroom compatibility are enabling faster production cycles while ensuring product compliance.

Increasing investments in the development of minimally invasive devices and disposable instruments are expected to stimulate demand further. With a growing focus on lean manufacturing and supply chain optimization, the market is anticipated to expand steadily across developed and emerging economies..

The plastic injection molding machine for medtech market is segmented by machine type, technology, clamping force, application, and geographic regions. By machine type, the plastic injection molding machine for medtech market is divided into Electric machines. In terms of technology, the plastic injection molding machine for the medtech market is classified into High-precision mold technologies.

Based on clamping force, the plastic injection molding machine for medtech market is segmented into 201-500 ton force. By application, the plastic injection molding machine for the medtech market is segmented into Packaging, Diagnostic, Surgical, and Others. Regionally, the plastic injection molding machine for medtech industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric machines subsegment within the machine type category is projected to account for 42% of the Plastic Injection Molding Machine For Medtech market revenue share in 2025. Growth in this subsegment has been largely attributed to the superior energy efficiency, faster cycle times, and cleaner operation offered by electric injection molding machines. Their ability to deliver precise control over critical molding parameters has made them highly suitable for the production of intricate medical components.

As medtech manufacturers prioritize repeatability and reduced material waste, electric machines are being increasingly adopted in cleanroom environments where contamination control is essential. The absence of hydraulic oil reduces maintenance requirements and aligns with regulatory expectations for sterile production.

Furthermore, the compatibility of electric machines with real-time monitoring systems and digital production lines enhances their utility in data-driven manufacturing environments. These advantages are positioning electric machines as the preferred choice for high-volume, precision-focused medical molding operations across global markets..

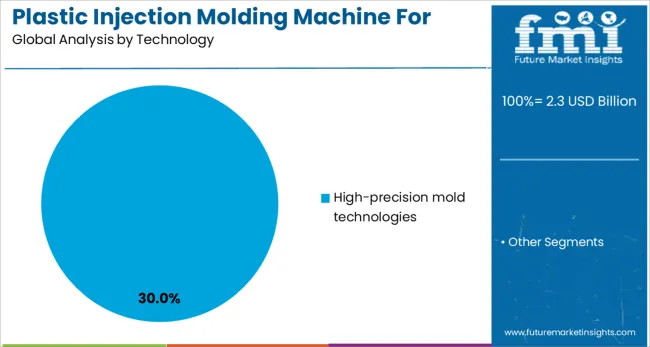

The high precision mold technologies subsegment within the technology category is anticipated to capture 30% of the Plastic Injection Molding Machine for Medtech market revenue share in 2025. This leadership is driven by the critical need for dimensional accuracy, consistency, and the reproduction of complex geometry in medical components. High precision molding technologies enable the manufacture of micro-scale features and tight tolerances, which are essential for devices such as syringes, catheters, and drug delivery systems.

The use of these technologies reduces the risk of defects, ensuring compliance with international medical standards. Manufacturers have increasingly integrated advanced sensor systems, digital controls, and simulation tools into mold development, allowing predictive quality assurance and minimized cycle time.

The capability of these technologies to support multi-cavity and multi-material molding processes is also enhancing production scalability. With the growing trend toward miniaturization and device complexity, high precision mold technologies are expected to remain central to innovation and quality assurance in medtech manufacturing..

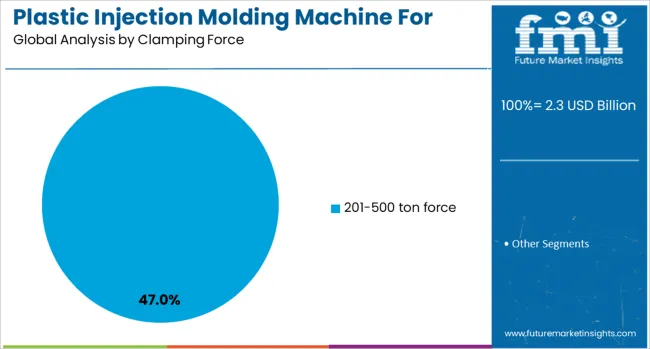

The 201 to 500 ton force subsegment within the clamping force category is expected to represent 47% of the Plastic Injection Molding Machine For Medtech market revenue share in 2025, making it the dominant clamping force range. This preference has been shaped by its ability to balance force requirements with flexibility for a broad range of medical applications.

Machines within this clamping range are well-suited for producing medium to large-sized components, such as housing for diagnostic equipment and surgical instrument casings, while still maintaining precision. The versatility of this segment has enabled manufacturers to achieve optimal part quality without compromising on production throughput or energy consumption.

Furthermore, machines with this clamping force range are frequently configured with modular tooling and automation systems, enhancing their adaptability across varying production needs. As medical product complexity and demand continue to rise, the 201 to 500 ton force machines are expected to remain highly relevant in scaling production with consistency and regulatory compliance..

The plastic injection molding machine for medtech market is driven by the increasing demand for precise, cost-effective medical components. Opportunities in the growing medical device and diagnostics market are propelling demand for advanced molding technologies. Emerging trends towards automation and system integration are reshaping production processes, while challenges such as high initial investments and operational costs may hinder growth. By 2025, addressing these barriers will be key to maintaining the market's expansion and ensuring accessibility for diverse manufacturers.

The plastic injection molding machine for medtech market is expanding due to the increasing demand for high-precision, cost-effective components used in medical devices. As the healthcare industry grows, the need for disposable medical devices, diagnostic equipment, and surgical tools continues to drive demand for efficient molding technologies. By 2025, the focus on producing smaller, more complex devices at lower costs will fuel market growth, with injection molding playing a critical role in meeting these demands.

Opportunities in the plastic injection molding machine market are growing, driven by the expanding medical device and diagnostics market. The need for efficient, scalable production of medical devices such as implants, syringes, and diagnostic components is boosting the demand for precision molding machines. By 2025, increasing investments in healthcare infrastructure and the rising prevalence of chronic diseases will further accelerate demand for injection molding machines designed for medtech applications.

Emerging trends in the market include the growing adoption of automation and system integration in injection molding processes. Automated molding systems, coupled with advanced robotics, are enhancing production efficiency and precision, which is crucial for the production of complex medical components. By 2025, the trend towards fully integrated molding systems will continue, with manufacturers focusing on reducing human intervention, improving consistency, and minimizing production errors in medtech applications.

Despite the market’s growth, challenges related to high initial investment and operational costs persist. The cost of acquiring and maintaining advanced injection molding machines, particularly those designed for medtech applications, can be prohibitive for smaller manufacturers. Additionally, the need for specialized molds and high-precision processes further increases operational expenses. By 2025, overcoming these financial barriers and developing more cost-effective solutions will be essential for ensuring market accessibility, particularly in emerging economies.

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

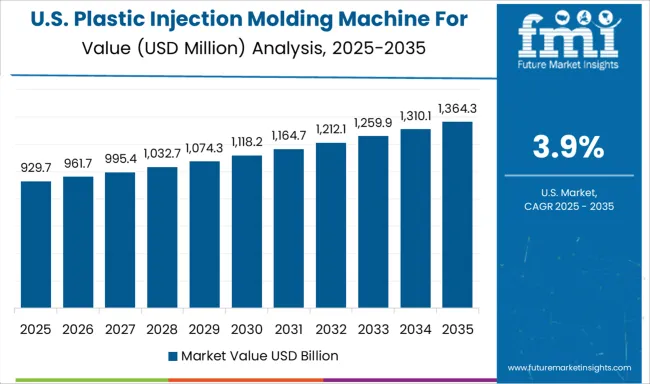

| USA | 3.9% |

| Brazil | 3.5% |

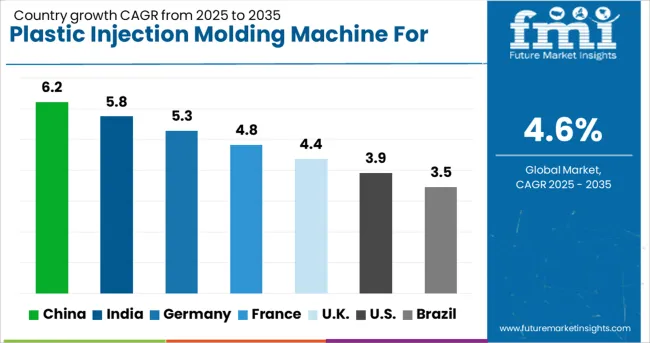

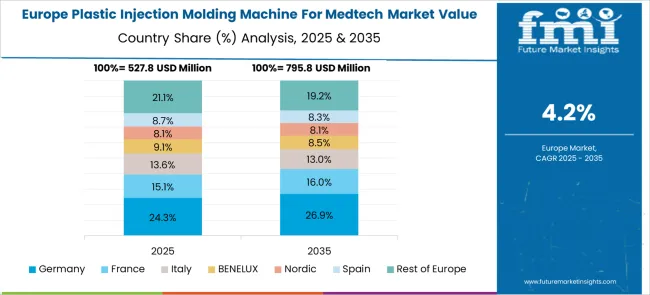

The global plastic injection molding machine for medtech market is projected to grow at a 4.6% CAGR from 2025 to 2035. China leads with a growth rate of 6.2%, followed by India at 5.8%, and France at 4.8%. The United Kingdom records a growth rate of 4.4%, while the United States shows the slowest growth at 3.9%. These varying growth rates are influenced by factors such as increasing demand for medical devices, advancements in manufacturing technologies, and rising production capacities in the medtech sector. Emerging markets like China and India are seeing higher growth due to industrial expansion, increased healthcare demand, and the adoption of advanced manufacturing technologies, while more mature markets like the USA and the UK experience steady growth driven by established medtech industries and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The plastic injection molding machine for medtech market in China is growing at an impressive pace, with a projected CAGR of 6.2%. China’s rapidly expanding healthcare and medical device manufacturing sectors are driving demand for efficient and high-quality plastic injection molding machines. As the country continues to increase its production capacity for medical devices such as syringes, diagnostic equipment, and surgical tools, the need for advanced injection molding technologies rises. Additionally, China’s focus on improving healthcare infrastructure, coupled with government incentives for local medtech production, is fueling the market’s growth.

The plastic injection molding machine for medtech market in India is projected to grow at a CAGR of 5.8%. India’s growing healthcare sector, rising demand for medical devices, and increasing focus on local production are key factors contributing to market growth. The country’s expanding medical device manufacturing industry, along with the increasing adoption of advanced molding technologies, is driving the demand for efficient and cost-effective injection molding machines. Additionally, India’s focus on reducing reliance on imports and promoting domestic production of medical devices is supporting the adoption of advanced plastic injection molding solutions.

The plastic injection molding machine for medtech market in France is projected to grow at a CAGR of 4.8%. France’s well-established medical device manufacturing industry, combined with its focus on innovation and regulatory compliance, supports steady demand for high-quality plastic injection molding machines. The rising need for efficient, sustainable, and high-precision molding solutions in medical device production is contributing to market growth. Additionally, France’s investments in healthcare innovation and the growing trend of outsourcing medical device manufacturing to meet increasing demand for cost-effective solutions further drive the adoption of advanced injection molding technologies.

The plastic injection molding machine for medtech market in the United Kingdom is projected to grow at a CAGR of 4.4%. The UK continues to see steady demand for injection molding machines, driven by its well-established medical device manufacturing industry and increasing focus on medical technology innovations. The growing demand for high-quality medical devices, combined with the UK’s regulatory requirements for precision manufacturing, further contributes to market growth. Additionally, the increasing adoption of automation and digitalization in manufacturing processes, as well as government support for healthcare and medtech innovation, are key drivers of growth in this sector.

The plastic injection molding machine for medtech market in the United States is expected to grow at a CAGR of 3.9%. Despite being a mature market, the USA continues to experience steady demand for plastic injection molding machines, primarily driven by the strong medical device manufacturing industry. The rising need for precision and high-quality medical devices, along with the increasing use of plastic injection molding for complex components in healthcare products, contributes to market stability. Furthermore, ongoing regulatory compliance and technological advancements in injection molding processes ensure that the market remains robust, albeit with slower growth compared to emerging markets.

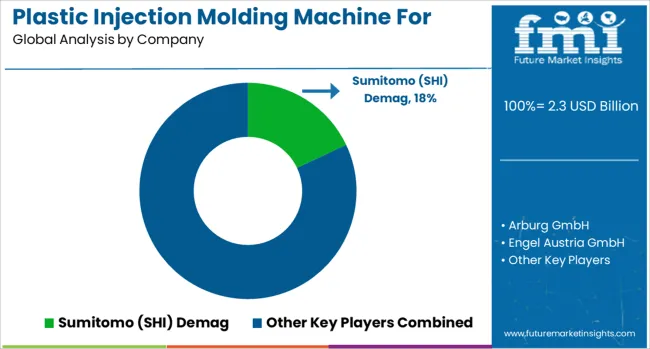

The plastic injection molding machine for medtech market is dominated by Sumitomo (SHI) Demag, which leads with its high-precision, durable injection molding machines tailored specifically for the medical device manufacturing industry. Sumitomo’s dominance is supported by its advanced technology, consistent quality, and focus on meeting the stringent regulatory requirements of the medtech sector. Key players such as Arburg GmbH, Engel Austria GmbH, and Milacron Holdings Corp. maintain significant market shares by offering injection molding solutions that provide high efficiency, repeatability, and high-quality production for medical components, including syringes, IV components, and diagnostic devices. These companies focus on delivering machines with excellent accuracy, low waste, and energy efficiency to meet the specific demands of the medtech market. Emerging players like Nissei Plastic Industrial Co., Husky Injection Molding, and others are expanding their market presence by offering cost-effective, specialized machines designed for smaller-volume, high-precision medical production. Their strategies include enhancing machine flexibility, improving cycle times, and integrating automation for seamless production lines. Market growth is driven by the increasing demand for medical devices, the rise of personalized healthcare, and the ongoing need for highly efficient, high-quality manufacturing processes. Innovations in multi-material molding, micro-injection technologies, and sustainable production practices are expected to shape competitive dynamics and foster further growth in the global plastic injection molding machine for medtech market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Machine Type | Electric machines |

| Technology | High-precision mold technologies |

| Clamping Force | 201-500 ton force |

| Application | Packaging, Diagnostic, Surgical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sumitomo (SHI) Demag, Arburg GmbH, Engel Austria GmbH, Milacron Holdings Corp., Nissei Plastic Industrial Co., and Husky Injection Molding |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across medical device manufacturing, pharmaceutical packaging, and diagnostics sectors, regional trends in injection molding machine adoption, innovation in precision molding and automation technologies, impact of regulatory standards on quality and safety, and emerging use cases in personalized medicine and sustainable medical packaging solutions. |

The global plastic injection molding machine for medtech market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the plastic injection molding machine for medtech market is projected to reach USD 3.6 billion by 2035.

The plastic injection molding machine for medtech market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in plastic injection molding machine for medtech market are electric machines, _hydraulic machines, _hybrid machines and _micro machines.

In terms of technology, high-precision mold technologies segment to command 30.0% share in the plastic injection molding machine for medtech market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Plastic Transistors Market Size and Share Forecast Outlook 2025 to 2035

Plastic Liner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Calendering Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA