The Plastic-free Packaging Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. The chart indicates steady expansion with a gradual upward trajectory in annual market values. From USD 9.2 billion in 2026, the sector steadily rises to USD 10.8 billion in 2030 and USD 12.1 billion in 2033, before reaching USD 13.1 billion in 2035.

Year-over-year growth rates show a declining trend from 2025 onward, stabilizing around lower single digits, suggesting that while demand continues to expand, the pace of growth moderates as the market matures. This trend highlights a shift from rapid adoption toward consistent mainstream acceptance of plastic-free packaging solutions across industries. Market progression is influenced by regulatory pressure to reduce single-use plastics, retailer commitments to eco-friendly alternatives, and growing consumer inclination toward biodegradable, compostable, and recyclable materials. By 2035, the market is expected to achieve notable scale, with rising investments in fiber-based formats, plant-derived polymers, and reusable systems driving competitive differentiation.

| Metric | Value |

|---|---|

| Plastic-free Packaging Market Estimated Value in (2025 E) | USD 8.9 billion |

| Plastic-free Packaging Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The plastic-free packaging market is gaining strong traction globally as governments, corporations, and consumers collectively push for eco-friendly alternatives to conventional plastic. This shift has been catalyzed by escalating environmental concerns, tightening regulations on plastic waste, and evolving sustainability mandates across value chains. Innovations in biodegradable, compostable, and recyclable materials have expanded the application scope of plastic-free packaging, particularly in fast-moving consumer goods, retail, and e-commerce sectors.

Large-scale retailers and brand owners are increasingly aligning with circular economy models, which emphasize plastic reduction, reuse, and material recovery. Additionally, the rise of ESG investing has prompted stakeholders to prioritize sustainable packaging transitions as a critical component of long-term value creation.

Technological advancements in barrier coatings, fiber-based rigid solutions, and water-based inks have further elevated the performance of plastic-free materials, enabling their use across diverse product categories Looking forward, the market is expected to witness accelerated growth, driven by a confluence of policy support, cost parity improvements, and shifting consumer preferences toward zero-waste lifestyles.

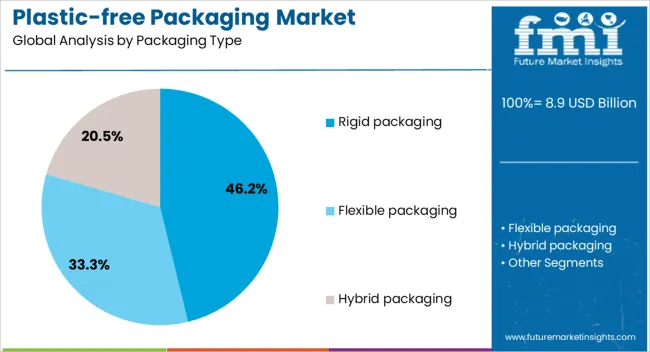

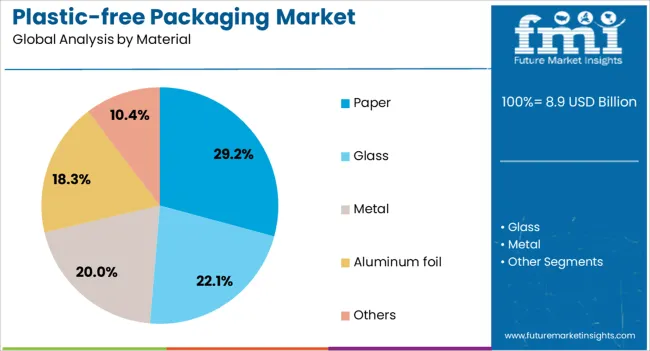

The plastic-free packaging market is segmented by packaging type, material, end-use industry, and geographic regions. By packaging type, plastic-free packaging market is divided into Rigid packaging, Flexible packaging, and Hybrid packaging. In terms of material, plastic-free packaging market is classified into Paper, Glass, Metal, Aluminum foil, and Others.

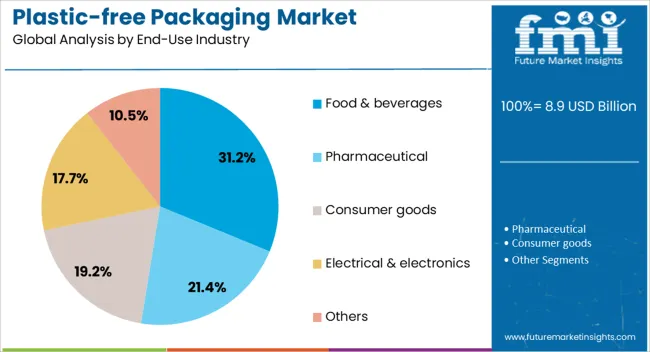

Based on end-use industry, plastic-free packaging market is segmented into Food & beverages, Pharmaceutical, Consumer goods, Electrical & electronics, and Others. Regionally, the plastic-free packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rigid packaging is projected to account for 46.2% of the plastic-free packaging market revenue in 2025, emerging as the most dominant packaging type. This leading position is being supported by its structural integrity, product protection capabilities, and enhanced shelf appeal across various retail formats. Paperboard-based containers, molded fiber packaging, and other rigid solutions have been widely adopted due to their ability to substitute conventional plastic formats without compromising durability or visual presentation.

Advancements are further influencing the segment's growth in compression-molding and pulp-formed packaging technologies, which allow for high-volume production while maintaining sustainability standards. The ability to integrate tamper-evident features, embossing, and high-resolution printing has made rigid plastic-free formats particularly attractive for brand-conscious applications.

Regulatory support for phasing out polystyrene and hard plastics in consumer packaging has also contributed to the segment’s expansion. As retail brands and foodservice operators intensify their focus on eliminating hard plastics from supply chains, rigid packaging is expected to remain the backbone of sustainable packaging strategies.

The paper segment is estimated to hold 29.2% of the overall material share in the plastic-free packaging market by 2025, reflecting its rising demand as a renewable, biodegradable, and easily recyclable packaging alternative. Paper has become a preferred choice for brands aiming to reduce their plastic footprint while maintaining functional performance and branding aesthetics. Its compatibility with sustainable coatings, laminates, and printing techniques has enabled its use across various industries, including foodservice, cosmetics, apparel, and electronics.

Government regulations promoting recyclable and compostable materials have further driven the substitution of plastic with fiber-based alternatives in both primary and secondary packaging formats. Additionally, the growth of e-commerce and takeaway food services has bolstered the demand for paper-based cartons, mailers, and wraps.

Technological progress in water and grease-resistant barrier formulations has expanded paper's applicability in moisture-sensitive products. As more companies commit to zero-waste and plastic-neutral initiatives, the paper segment is expected to witness continued acceleration in market share and innovation.

The food and beverages sector is anticipated to contribute 31.2% of the total revenue share in the plastic-free packaging market in 2025, making it the most significant end-use industry. This segment’s dominance is being driven by mounting pressure from regulators and consumers to eliminate plastic contamination in food systems. Major food brands and quick service restaurants are transitioning to compostable, recyclable, and reusable packaging formats in alignment with sustainability goals and global plastic pledges.

The integration of plastic-free alternatives such as molded fiber trays, paper-based pouches, and biodegradable films has been facilitated by innovations in heat-sealing, barrier protection, and extended shelf-life technologies. In addition, labeling requirements for “plastic-free” and “eco-friendly” packaging have influenced consumer purchasing decisions, prompting brands to redesign their packaging lines accordingly.

Investments in localized supply chains and renewable material sourcing have also supported the scalability of plastic-free solutions in the food sector. As food safety, waste reduction, and circular packaging remain high priorities, this segment is expected to continue leading adoption across the industry.

The plastic-free packaging sector is being reshaped by regulations, consumer preference, and supply chain recalibration. Competitive intensity and innovation are accelerating adoption, with fiber-based and compostable formats gaining significant traction.

Government regulations and policy restrictions on single-use plastics have pushed companies toward adopting plastic-free alternatives. Bans and levies on plastic bags, straws, and containers have created a strong compliance-driven environment. Regulators across Europe, North America, and parts of Asia are setting strict targets for reduction of plastic waste, compelling industries to adapt packaging formats. Retailers are responding by offering paper-based bags, molded fiber containers, and cellulose films. In several countries, extended producer responsibility frameworks have been established, placing accountability on brands to manage packaging end-of-life. Such measures have not only accelerated the transition away from plastics but have also encouraged investments in scalable fiber, plant-based, and biodegradable packaging solutions across food, beverage, and consumer goods industries.

Consumer sentiment has played a critical role in the adoption of plastic-free packaging. Growing awareness of plastic waste and ocean pollution has reshaped purchasing decisions. Many consumers, particularly younger demographics, actively seek out brands that commit to eco-friendly packaging alternatives. Food and beverage companies are experiencing rising acceptance of carton bottles, compostable wraps, and paper-based trays in supermarkets and quick-service outlets. Cosmetics brands are increasingly highlighting their use of glass, tin, or refillable fiber packaging as a differentiation strategy. Online retail customers are demanding fiber-based mailers instead of bubble wraps. The overall trend shows that consumer loyalty is tilting toward companies that demonstrate credible action by replacing plastic formats with verifiable and effective alternatives.

Manufacturers are reconfiguring their supply chains to integrate plastic-free packaging at scale. The demand for recyclable and compostable inputs has influenced raw material sourcing and procurement contracts. Packaging suppliers are investing in pulp molding technologies, plant fiber composites, and barrier coatings derived from natural extracts. Foodservice chains are rapidly shifting toward molded fiber containers, replacing plastic clamshells and trays, while beverage companies are experimenting with carton bottles and paper straws. E-commerce and logistics players are adopting corrugated and cellulose-based solutions for shipping purposes. These changes are not only a response to regulations but also reflect internal corporate strategies aimed at waste reduction. Large enterprises are partnering with packaging startups to pilot scalable, high-volume alternatives.

Competition in the plastic-free packaging sector is intensifying as global and regional players enter the space with diversified product portfolios. Traditional packaging giants are expanding their offerings to include fiber-based and compostable alternatives, while emerging companies are focusing exclusively on plastic substitution technologies. Strategic collaborations, licensing agreements, and joint ventures are being witnessed, especially in food and beverage packaging. Investments are directed toward developing coatings with enhanced barrier performance to compete with plastic in moisture and oxygen protection. Pricing remains a key differentiator, as cost competitiveness against plastic is still a challenge. Companies adopting innovative formats such as seaweed films, edible wraps, and mycelium-based containers are gaining attention in niche and premium product categories.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

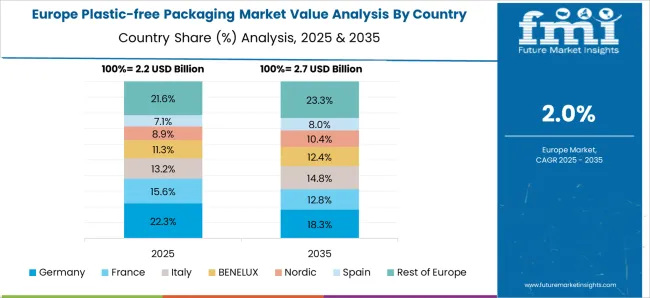

The plastic-free packaging market is projected to grow globally at a CAGR of 4.0% from 2025 to 2035, supported by regulatory restrictions, rising consumer awareness, and strong retail adoption of eco-friendly alternatives. China leads with a CAGR of 5.4%, driven by government-led bans on single-use plastics and investments in molded fiber and paper-based solutions. India follows at 5.0%, with packaging suppliers expanding bio-based and fiber packaging due to rising demand from food, beverage, and e-commerce sectors. France posts a CAGR of 4.2%, driven by demand for compostable wraps and cellulose coatings. The United Kingdom achieves 3.8% growth, influenced by large retailer initiatives to eliminate single-use plastics, while the United States shows steady growth at 3.4%, supported by brand-level commitments and steady replacement demand in foodservice packaging. This outlook highlights Asia-Pacific as the fastest-growing hub for plastic-free packaging adoption, while Europe and North America advance at steady rates due to strong compliance frameworks and brand-driven initiatives.

The CAGR for the plastic-free packaging market in the United Kingdom was around 3.1% during 2020–2024 and improved to 3.8% for 2025–2035. The earlier phase remained restricted by limited retail participation and slower adoption of biodegradable formats in mainstream consumer goods, which curbed substitution of plastics. A stronger trajectory has been projected for 2025–2035 as large supermarkets, foodservice operators, and e-commerce platforms expand fiber-based trays, corrugated boxes, and cellulose coatings. Extended producer responsibility obligations are also expected to enforce broader adoption. Demand from quick-service restaurants and premium grocery chains has created momentum for cellulose wraps and molded fiber solutions, reinforcing future prospects. This market is anticipated to remain stable as cost competitiveness improves and compliance-driven demand expands.

China’s plastic-free packaging market entered from a position of strength, with a 4.6% CAGR recorded during 2020–2024 that increased to 5.4% for 2025–2035. The earlier phase benefited from partial bans on single-use plastics, though the persistence of low-cost plastic formats slowed overall momentum. The next stage reflects a stronger trajectory as the government enforces stricter restrictions and expands investment in pulp and fiber production. Leading e-commerce players are deploying molded fiber mailers, while beverage and FMCG companies integrate paper bottles and compostable trays at scale. Safety and health considerations are also influencing household preferences for eco-friendly formats. Local supply chain expansion has reduced cost disadvantages, ensuring that adoption accelerates across consumer and industrial applications.

India’s plastic-free packaging market registered a 4.3% CAGR during 2020–2024 and is expected to advance to 5.0% for 2025–2035. The earlier period was shaped by limited processing capacity and slower acceptance of biodegradable films in rural markets, although awareness campaigns created a base for expansion. A higher trajectory for 2025–2035 is anticipated with government bans on plastics, urban e-commerce growth, and brand-led initiatives in FMCG packaging. Food delivery services have become significant adopters of molded pulp and paper bowls, which is reshaping the packaging landscape in major cities. Premium personal care and beverage sectors are also expected to adopt cellulose films and plant-based coatings. The shift is creating broader opportunities for suppliers and retailers alike.

France’s plastic-free packaging market recorded a 3.6% CAGR during 2020–2024, which strengthened to 4.2% for 2025–2035. The earlier stage was marked by gradual restrictions on plastic cutlery, bags, and straws, with limited substitution in FMCG packaging slowing wider adoption. Growth in the upcoming period is supported by compliance with EU Green Deal directives and consumer preference for recyclable and compostable formats. French supermarkets are transitioning bakery and fresh produce packaging to paper and cellulose films, while confectionery brands experiment with compostable wraps. Consumer responsiveness to eco-labels has created favorable demand. Subsidies and regulatory incentives are also driving investment in packaging innovation, further enhancing long-term growth opportunities.

The CAGR for the plastic-free packaging market in the United States was around 2.9% during 2020–2024 and has been projected to improve to 3.4% during 2025–2035. Earlier growth was modest due to entrenched reliance on plastics and limited willingness to pay for premium alternatives. The stronger trajectory for the future period is tied to brand-level sustainability goals, e-commerce adoption of fiber-based mailers, and state-level plastic bans. Retail chains are scaling biodegradable packaging across private labels, and quick-service restaurants are steadily moving toward molded fiber trays. Subscription-based delivery services have also created demand for recyclable mailers and compostable wraps. This market outlook remains positive as consumer sentiment shifts and retail compliance accelerates adoption.

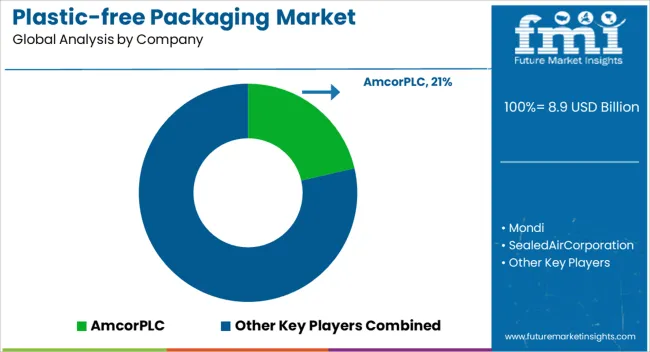

Amcor PLC emphasizes recyclable and compostable packaging solutions across food and beverage sectors, strengthening its presence with R&D investments in next-generation bio-based formats. Mondi focuses on fiber-based packaging, developing barrier-coated paper solutions and collaborating with FMCG brands to replace traditional plastics. Sealed Air Corporation is leveraging its strength in protective packaging by expanding compostable mailers and paper-based cushioning formats, catering to e-commerce and logistics demand. WestRock Company dominates in corrugated packaging and fiberboard solutions, driving growth in consumer goods and e-commerce. Huhtamaki OYJ has prioritized molded fiber technologies and paper-based containers, gaining momentum in quick-service restaurants and premium food packaging. Smurfit Kappa maintains a strong position with corrugated and paper-based packaging, introducing customizable fiber solutions for global retailers. Tetra Pak International S.A. combines carton-based beverage packaging with renewable material integration, aligning with global beverage companies to scale paper-centric formats.

Key competitive strategies include strategic collaborations with foodservice and FMCG brands, expansion of regional fiber processing capacity, and R&D in advanced barrier coatings to extend shelf life without plastics. Players are differentiating through scalability, cost competitiveness, and performance reliability, while partnerships with retailers and e-commerce platforms remain critical in driving adoption. Investment in molded fiber, cellulose-based coatings, and circular collection models continues to define competition, ensuring compliance with regulations and meeting shifting consumer preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Packaging Type | Rigid packaging, Flexible packaging, and Hybrid packaging |

| Material | Paper, Glass, Metal, Aluminum foil, and Others |

| End-Use Industry | Food & beverages, Pharmaceutical, Consumer goods, Electrical & electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmcorPLC, Mondi, SealedAirCorporation, WestRockCompany, HuhtamakiOYJ, SmurfitKappa, and TetraPakInternationalS.A. |

| Additional Attributes | Dollar sales, share, regional adoption trends, competitive moves, raw material availability, regulatory drivers, pricing dynamics, consumer preference shifts, and growth opportunities across food, beverage, and e-commerce channels. |

The global plastic-free packaging market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the plastic-free packaging market is projected to reach USD 13.1 billion by 2035.

The plastic-free packaging market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in plastic-free packaging market are rigid packaging, flexible packaging and hybrid packaging.

In terms of material, paper segment to command 29.2% share in the plastic-free packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Services Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA