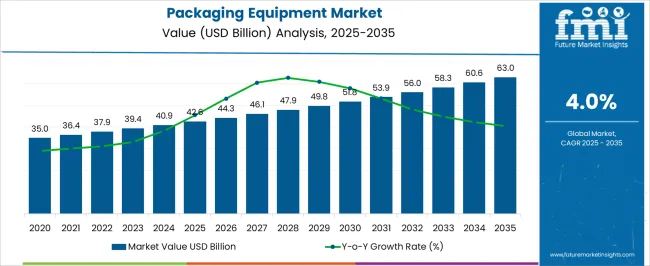

The Packaging Equipment Market is estimated to be valued at USD 42.6 billion in 2025 and is projected to reach USD 63.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. A Year-on-Year (YoY) growth analysis reveals steady expansion with slight fluctuations over the forecast period. Between 2025 and 2026, the market grows by USD 1.7 billion, moving from USD 42.6 billion to USD 44.3 billion, reflecting a YoY growth of 4.0%. This early-stage growth is driven by rising demand for automated and efficient packaging solutions across industries like food, pharmaceuticals, and consumer goods.

The growth rate then stabilizes over the next few years, with USD 1.8 billion added between 2026 and 2027, reaching USD 46.1 billion. As the market matures, the YoY growth rate slightly moderates. From 2027 to 2030, the market expands more gradually, increasing by USD 3.6 billion from USD 46.1 billion to USD 49.8 billion. Between 2030 and 2035, the market continues its steady upward trend, adding USD 14.1 billion to reach USD 63.0 billion. The final years show a stable YoY growth rate of around 3.5–4.0%, as the packaging equipment market becomes increasingly reliant on innovations such as sustainable packaging and smarter automation systems, meeting the growing global demand for packaging efficiency.

| Metric | Value |

|---|---|

| Packaging Equipment Market Estimated Value in (2025 E) | USD 42.6 billion |

| Packaging Equipment Market Forecast Value in (2035 F) | USD 63.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The packaging equipment market is undergoing steady expansion driven by automation trends, evolving consumer demands, and regulatory emphasis on hygiene and sustainability. Manufacturers across industries are prioritizing flexible, high-speed, and energy-efficient machinery to meet diversified product portfolios and increased throughput requirements.

Advancements in robotics, sensor technology, and digital twin integration are enabling predictive maintenance, minimizing downtime, and enhancing operational visibility. At the same time, regulatory pressures on packaging standards and traceability are compelling end-users to adopt more intelligent and modular systems.

The demand for tamper-evident, recyclable, and lightweight packaging is also accelerating technological upgrades in both primary and secondary packaging machinery. Over the forecast period, increased capital expenditure in emerging economies and the rise of Industry 4.0-enabled factories are expected to support further market penetration across sectors including food, healthcare, personal care, and logistics.

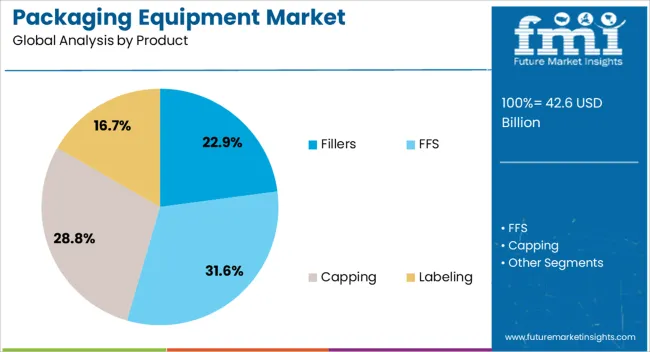

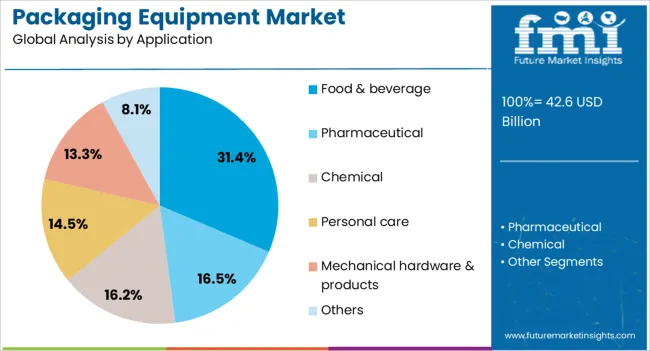

The packaging equipment market is segmented by product, application, and geographic regions. By product, the packaging equipment market is divided into Fillers, FFS, Capping, Labeling, Coding, Palletizing, and Others. The packaging equipment market is classified into Food & beverage, Pharmaceutical, Chemical, Personal care, Mechanical hardware & products, and Others. Regionally, the packaging equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fillers are projected to hold 22.90% of the total revenue share in the packaging equipment market in 2025, positioning them as the leading product segment. This leadership is being attributed to the critical role fillers play in ensuring accuracy, hygiene, and speed across high-volume production lines.

The segment has gained momentum due to its ability to handle a wide range of viscosities and formulations, from liquids to semi-solids, with minimal product wastage. Growth has also been reinforced by the rising preference for automated volumetric and gravimetric filling technologies, especially in industries where portion control and consistency are operational priorities.

The integration of servo-driven systems and real-time monitoring capabilities has further enhanced their performance, enabling compliance with stringent food safety and pharmaceutical packaging regulations. As companies continue to prioritize line efficiency and waste reduction, fillers remain central to packaging system investments.

The food & beverage sector is anticipated to account for 31.40% of the total packaging equipment market revenue in 2025, making it the most dominant application segment. This growth is being supported by rising consumption of packaged and ready-to-eat foods, along with increasing demand for sustainable and tamper-proof packaging formats.

The sector’s dynamic SKUs and sensitivity to hygiene regulations necessitate rapid changeovers and contamination-resistant equipment, which has accelerated adoption of specialized machinery. Furthermore, the shift toward smaller packaging formats for on-the-go consumption has driven demand for highly adaptable packaging lines.

The integration of automated inspection systems, clean-in-place (CIP) features, and smart sensors in food-grade equipment has improved compliance and operational efficiency. As global food safety standards become more rigorous and consumer preferences evolve, the food & beverage industry is expected to continue investing heavily in next-generation packaging systems.

Packaging equipment is essential in sectors like food and beverage, pharmaceuticals, cosmetics, and consumer goods, providing machinery to efficiently package products. These systems help improve speed, reduce labor costs, and ensure product safety. The growing need for automation, customized packaging, and improved efficiency is driving the market. Manufacturers offering flexible, high-speed equipment that handles a variety of packaging types are gaining popularity. Features that prioritize easy operation, high output, and diverse material handling continue to influence purchasing decisions across both residential and industrial environments.

The packaging equipment market is experiencing rapid growth as industries strive to automate and improve packaging efficiency. Consumer demand for faster, more reliable packaging solutions has pushed manufacturers to prioritize automation in their production processes. The rise of e-commerce has further fueled the need for efficient packaging systems capable of handling a wide range of product sizes and ensuring safe, timely delivery. Automated systems reduce the need for labor, streamline operations, and improve overall production speed. Additionally, advancements in robotics, artificial intelligence (AI), and machine learning are playing a significant role in enhancing the capabilities of packaging lines. These technologies help reduce costs, optimize workflows, and improve accuracy. The integration of these technologies not only increases output but also supports businesses in meeting high consumer expectations while improving operational efficiency and reducing waste.

Despite significant growth, the packaging equipment market faces considerable challenges, mainly due to high installation and maintenance costs. Automated packaging systems require significant upfront capital investment, especially for industries with complex or specialized packaging needs. The cost of upgrading existing systems to accommodate new technologies, such as those required to support the growing e-commerce sector, adds to the overall financial burden. Regular maintenance, especially when systems need to be updated to handle new materials or formats, increases operational costs. Additionally, supply chain disruptions, particularly for raw materials and components used in packaging machinery, have led to price fluctuations, further complicating the market dynamics. These factors make it difficult for businesses, particularly in developing regions, to adopt advanced packaging equipment. High upfront and ongoing costs can limit widespread adoption and slow market expansion in price-sensitive sectors.

The packaging equipment market is witnessing numerous opportunities, particularly in the areas of customization and innovation. As consumer demand for personalized products and packaging continues to rise, manufacturers are increasingly focusing on developing equipment that accommodates a wide variety of designs and branding needs. The growth of e-commerce has created a strong demand for packaging systems that can handle smaller, more varied packages, ensuring product integrity and security during transit. Innovations such as IoT-enabled packaging systems provide tracking, monitoring, and predictive maintenance capabilities that enhance efficiency and reduce downtime. These technological advancements offer businesses the opportunity to respond quickly to evolving consumer preferences and faster production cycles. Furthermore, developments in packaging material handling, such as equipment designed for sustainable materials, present an opportunity for manufacturers to expand their product offerings and address the growing demand for eco-friendly solutions in packaging.

The packaging equipment market is driven by several key trends, with automation, smart packaging, and technological advancements at the forefront. Automation is revolutionizing production lines, significantly enhancing speed, improving productivity, and reducing labor costs. The integration of IoT and AI technologies is enabling real-time monitoring, predictive maintenance, and data-driven insights that optimize packaging processes and reduce operational disruptions. Smart packaging, which allows for better product traceability, enhanced security, and reduced human error, is becoming a standard feature in modern packaging equipment. As consumer demand for customized packaging solutions rises, manufacturers are innovating to provide flexible and scalable systems that can handle a wider range of product types and sizes. These advancements are shaping the future of the packaging equipment market, ensuring that businesses can meet the growing demand for faster, more efficient, and customized packaging solutions.

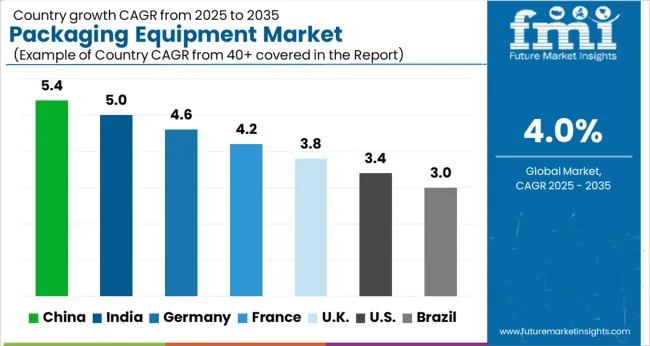

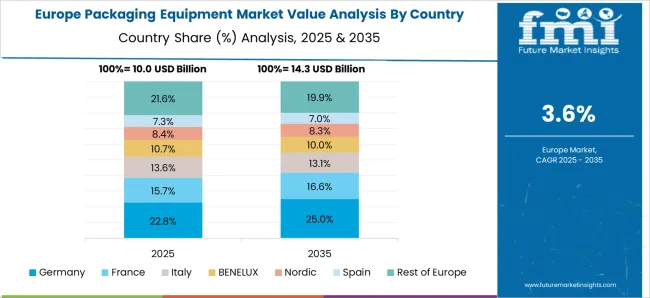

The packaging equipment market is projected to grow at a CAGR of 4.0% from 2025 to 2035. China, India, and Germany lead with growth rates of 5% each. The United Kingdom records 4%, while the United States stands at 3%. The rise in demand for packaged goods, along with increasing automation in manufacturing processes, is boosting the demand for packaging equipment. Emerging markets like China and India benefit from growing industrialization and consumer demand, while Germany, the UK, and the USA continue to invest in advanced packaging technologies to meet rising consumer expectations. The analysis includes over 40 countries, with the top market detailed below.

China is projected to grow at a CAGR of 5% through 2035, primarily driven by the rapid expansion of its manufacturing and consumer goods sectors. The country is a major producer and consumer of packaged products, with packaging equipment demand rising across multiple industries, including food and beverage, electronics, and personal care. With the rise in automation and Industry 4.0 adoption, Chinese manufacturers are increasingly investing in advanced packaging solutions to increase productivity and meet consumer demand. Furthermore, the growing middle class, urbanization, and rising disposable incomes contribute to an increased demand for packaged goods, further fueling the market.

India is expected to grow at a CAGR of 5% through 2035, driven by a rapid increase in demand for packaged goods and significant industrial growth. The rise of modern retail formats, e-commerce, and a growing middle class in India has fueled the demand for packaging solutions across various sectors, including food and beverage, pharmaceuticals, and consumer goods. The country’s increasing focus on automation and advanced packaging technologies in industries like food processing and personal care is also driving market growth. Government initiatives to improve manufacturing and supply chain infrastructure further support the packaging equipment market in India.

Germany is projected to grow at a CAGR of 5% through 2035, with its advanced manufacturing capabilities and significant industrial base driving the demand for packaging equipment. The country’s strong automotive, food, and beverage, and pharmaceutical sectors rely on packaging technologies to ensure high-quality products and efficient production processes. The rise of smart packaging solutions and increasing focus on automation and digitalization in packaging lines further supports the market growth. Germany’s established position as a global leader in engineering and manufacturing also ensures its competitiveness in the packaging equipment market.

The United Kingdom is expected to grow at a CAGR of 4% through 2035, driven by increased demand for packaging in food and beverage and pharmaceuticals. The UK packaging equipment market is expanding as industries look for more efficient and innovative ways to package products. With increasing consumer demand for convenience, especially in ready-to-eat meals and packaged foods, the demand for automated and high-quality packaging solutions continues to rise. The country’s focus on sustainability, as well as its investment in manufacturing technology, is pushing the adoption of advanced, environmentally-friendly packaging solutions.

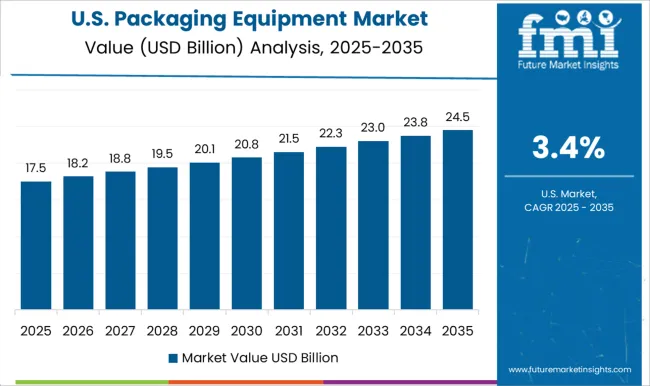

The United States is projected to grow at a CAGR of 3% through 2035, supported by the increasing demand for packaging solutions across various industries. The USA is a key player in the food and beverage, pharmaceuticals, and personal care sectors, all of which require efficient and advanced packaging systems. The demand for packaging equipment is being driven by the need for better functionality, cost-efficiency, and automation in production lines. Additionally, with a growing preference for eco-friendly packaging solutions, USA companies are increasingly adopting advanced technologies to meet evolving consumer expectations.

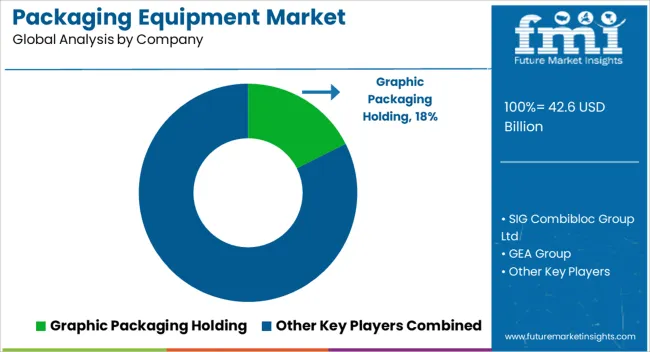

The packaging equipment market is driven by leading manufacturers offering advanced machinery for a wide range of applications in food and beverage, pharmaceuticals, consumer goods, and industrial products. Graphic Packaging Holding is a market leader, providing a comprehensive portfolio of packaging equipment solutions, including carton packaging, paperboard forming, and filling equipment, with a focus on sustainability and efficiency. SIG Combibloc Group Ltd is a key player in the market, specializing in carton packaging systems and aseptic filling technologies, supporting industries such as beverages and liquid foods. GEA Group and I.M.A Group are significant competitors, offering advanced packaging solutions for the food, pharmaceutical, and cosmetic industries, focusing on automation and customization to improve operational efficiency.

Salzgitter AG and OPTIMA Packaging Group GmbH provide innovative packaging systems, catering to both large-scale manufacturers and niche markets, with a strong emphasis on quality, speed, and precision in packaging processes. SACMI Imola SC and FUJI MACHINERY Co., Ltd offer high-performance packaging machines designed for high-speed operations, specializing in bottling, capping, and labeling solutions. CKD Corporation and Langley Holdings Plc offer integrated packaging equipment with a focus on high-end automation and packaging flexibility. Douglas Machine Inc and Marchesini Group focus on providing specialized packaging systems for the pharmaceutical and healthcare industries, ensuring regulatory compliance and product integrity.

Syntegon Technology GmbH and Barry-Wehmiller Group Inc. provide packaging solutions with a focus on efficiency, automation, and cost reduction for food and beverage, personal care, and pharmaceutical packaging. Competitive differentiation is driven by machine efficiency, automation capabilities, material compatibility, and the ability to offer customizable solutions for different industries.

Barriers to entry include high capital investment, technical expertise, and strict regulatory standards. Strategic priorities include developing smart packaging equipment with IoT connectivity, enhancing sustainability in packaging materials, and increasing automation to improve production efficiency.

Companies are leveraging additive manufacturing to create custom molds, packaging prototypes, and samples in a more cost-effective and time-efficient manner. This technology is also being used for the development of customized packaging tools and spare parts for existing packaging lines.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.6 Billion |

| Product | Fillers, FFS, Capping, Labeling, Coding, Palletizing, and Others |

| Application | Food & beverage, Pharmaceutical, Chemical, Personal care, Mechanical hardware & products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Graphic Packaging Holding, SIG Combibloc Group Ltd, GEA Group, I.M.A Group, Salzgitter AG, OPTIMA Packaging Group GmbH, SACMI Imola SC, FUJI MACHINERY Co., Ltd, CKD Corporation, Langley Holdings Plc, Douglas Machine Inc, Marchesini Group, Syntegon Technology GmbH, and Barry-Wehmiller Group Inc. |

| Additional Attributes | Dollar sales by equipment type (filling machines, labeling machines, cartoning machines, wrapping machines) and end-use segments (food and beverage, pharmaceuticals, consumer goods, industrial). Demand dynamics are driven by the rising adoption of automation in packaging processes, the growth of e-commerce and online retailing, and increasing demand for sustainable packaging solutions. Regional trends show North America and Europe leading the adoption of advanced packaging equipment, with strong growth in Asia-Pacific driven by rapid industrialization and the demand for efficient packaging systems in emerging markets. |

The global packaging equipment market is estimated to be valued at USD 42.6 billion in 2025.

The market size for the packaging equipment market is projected to reach USD 63.0 billion by 2035.

The packaging equipment market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in packaging equipment market are fillers, _liquid type, _powder & granulated filling, _bottle filling, ffs, _vertical, _horizontal, capping, _screw capping, _vial coating, _ropp cappers, _others, labeling, _wet glue, _self-adhesives, _rotary sticker, coding, _wet ink system, _inkjet system, _laser system, _hot stamp, _thermal transfer, palletizing and others.

In terms of application, food & beverage segment to command 31.4% share in the packaging equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Food Packaging Equipment Market

Skin Packaging Equipment Market

Aseptic Packaging Equipment Market Trends - Growth & Forecast 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Packaging Equipment Market Growth - Forecast 2025 to 2035

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Equipment Market Size, Share & Forecast 2025 to 2035

Modified Atmosphere Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Personal Protective Equipment Packaging Market

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA