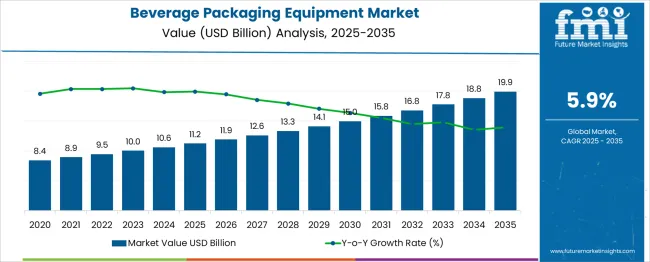

The global beverage packaging equipment market is projected to grow from USD 11.23 billion in 2025 to approximately USD 19.92 billion by 2035, recording an absolute increase of USD 8.69 billion over the forecast period. This translates into a total growth of 77.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.9% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing demand for automated packaging solutions, rising consumption of packaged beverages, and growing focus on sustainable packaging technologies.

Between 2025 and 2030, the beverage packaging equipment market is projected to expand from USD 11.23 billion to USD 15.1 billion, resulting in a value increase of USD 3.87 billion, which represents 44.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising automation adoption in packaging processes, increasing demand for flexible packaging solutions, and growing penetration of advanced equipment in emerging markets. Beverage manufacturers are expanding their equipment portfolios to address the growing demand for high-speed, efficient packaging solutions.

| Metric | Value |

| Estimated Value in (2025E) | USD 11.2 billion |

| Forecast Value in (2035F) | USD 19.9 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

From 2030 to 2035, the market is forecast to grow from USD 15.1 billion to USD 19.92 billion, adding another USD 4.82 billion, which constitutes 55.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of smart packaging technologies, integration of IoT and digital solutions in equipment, and development of sustainable packaging innovations. The growing adoption of Industry 4.0 principles and demand for energy-efficient equipment will drive demand for advanced beverage packaging solutions with enhanced performance and reduced environmental impact.

Between 2020 and 2025, the beverage packaging equipment market experienced steady expansion, driven by increasing consumption of packaged beverages and growing demand for automated production lines. The market developed as beverage manufacturers recognized the need for efficient packaging solutions to meet rising consumer demand and improve operational efficiency. Technological advancements in automation and digitalization began emphasizing the importance of modern packaging equipment in maintaining product quality and production scalability.

Market expansion is being supported by the increasing global consumption of packaged beverages and the corresponding demand for efficient, high-speed packaging solutions. Modern beverage manufacturers are increasingly focused on automation and production optimization to meet growing consumer demand while maintaining consistent product quality and reducing operational costs. Advanced packaging equipment's proven ability to enhance production efficiency, reduce material waste, and ensure product safety makes it a preferred investment for beverage production facilities.

The growing emphasis on sustainable packaging and environmentally friendly production processes is driving demand for energy-efficient equipment and innovative packaging technologies. Consumer preference for convenient, portable beverage formats is creating opportunities for specialized packaging equipment that can handle diverse container types and sizes. The rising influence of e-commerce growth and direct-to-consumer distribution models is also contributing to increased demand for flexible packaging solutions across different beverage categories and market segments.

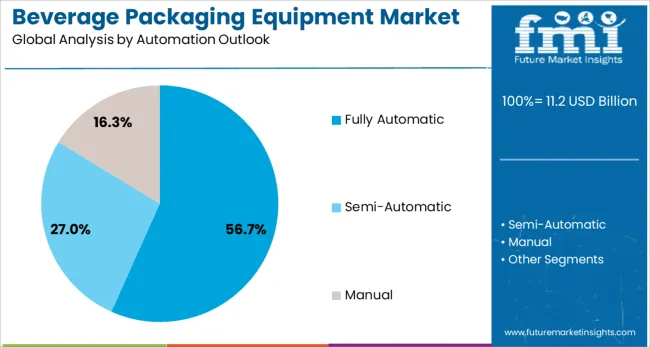

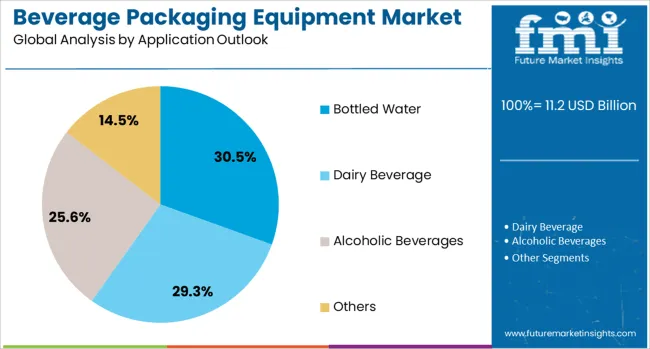

The market is segmented by type, automation, application, and region. By type, the market is divided into filling and capping machines, labelling and coding machines, palletizing and depalletizing machines, conveying and handling machines, cleaning and sterilizing machines, wrapping and bundling machines, and cartoning machines. Based on automation, the market is categorized into fully automatic, semi-automatic, and manual. In terms of application, the market is segmented into bottled water, dairy beverages, alcoholic beverages, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The filling and capping machines segment is projected to account for 36.1% of the beverage packaging equipment market in 2025, reaffirming its position as the category's core equipment type. Beverage manufacturers increasingly understand the critical importance of accurate filling and secure capping in maintaining product quality, ensuring consumer safety, and minimizing production waste. Advanced filling and capping systems directly address these concerns by providing precise volume control, contamination prevention, and consistent sealing performance.

This equipment type forms the foundation of most beverage production lines, as it represents the most essential and productivity-critical component in packaging operations. Industry endorsements and ongoing technological validation continue to strengthen confidence in advanced filling and capping systems. With beverage production requiring higher speeds and greater accuracy, filling and capping machines align with both efficiency and quality objectives. Their universal necessity across all beverage categories ensures sustained dominance, making them the central investment priority for beverage packaging operations.

Fully automatic equipment is projected to represent 56.7% of beverage packaging equipment demand in 2025, underscoring manufacturers' preference for high-speed, labor-efficient production solutions. Beverage producers gravitate toward fully automatic systems for their superior throughput, consistent performance, and ability to operate with minimal human intervention, maximizing operational efficiency and product quality. Positioned as productivity enhancers, fully automatic equipment offers both cost benefits through labor reduction and quality benefits through precise, repeatable operations.

The segment is supported by the rising complexity of beverage production requirements, where fully automatic systems play a central role in meeting high-volume demands. Additionally, manufacturers are increasingly integrating fully automatic equipment with digital monitoring systems, IoT connectivity, and predictive maintenance capabilities, enhancing operational control and justifying premium investments. As beverage companies prioritize efficiency and scalability, fully automatic packaging equipment will continue to dominate market demand, reinforcing its position as the preferred automation level for modern beverage packaging operations.

The bottled water application is forecasted to contribute 30.5% of the beverage packaging equipment market in 2025, reflecting the sustained global demand for packaged water products and the specialized equipment requirements for water bottling operations. Consumers continue to drive demand for convenient, portable water packaging, requiring dedicated filling, capping, and labeling equipment optimized for water production environments. This application benefits from consistent year-round demand and the need for high-speed, high-volume production capabilities.

The bottled water segment also represents significant equipment standardization opportunities, as water bottling operations often require similar packaging processes across different markets and regions. The growing focus on sustainable water packaging and advanced purification technologies drives demand for specialized equipment that can handle various bottle materials and sizes while maintaining strict hygiene standards. With continued global population growth and increasing health consciousness, bottled water applications serve as a stable foundation for beverage packaging equipment demand, making them a critical driver of market expansion and equipment innovation.

The beverage packaging equipment market is advancing rapidly due to increasing beverage consumption globally and growing demand for automated production solutions. However, the market faces challenges including high initial capital investment requirements, complex maintenance needs, and rapid technological changes requiring frequent upgrades. Innovation in smart packaging technologies and sustainable equipment design continue to influence product development and market expansion patterns.

The growing adoption of Industry 4.0 principles is enabling beverage manufacturers to implement fully integrated, digitally connected packaging systems. Smart equipment offers real-time monitoring, predictive maintenance capabilities, and production optimization features that improve efficiency and reduce downtime. IoT connectivity and data analytics are driving equipment selection decisions, particularly among large-scale beverage producers who prioritize operational excellence and continuous improvement.

Modern beverage packaging equipment manufacturers are incorporating energy-efficient technologies and sustainable design principles to reduce environmental impact and operating costs. These innovations improve resource utilization while meeting growing regulatory requirements and corporate sustainability goals. Advanced equipment designs also enable the use of recyclable materials and reduced packaging waste, providing better environmental performance throughout the production process.

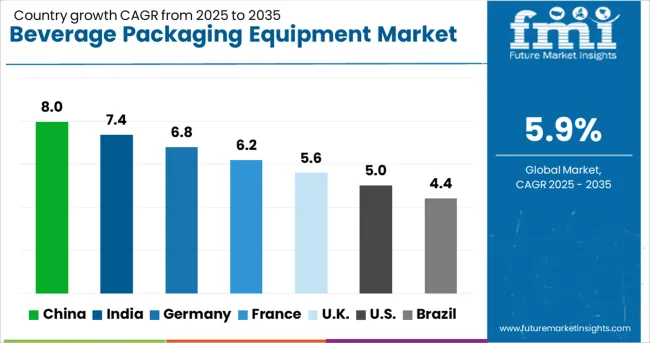

| Country | CAGR (2025-2035) |

| China | 8% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5% |

| Brazil | 4.4% |

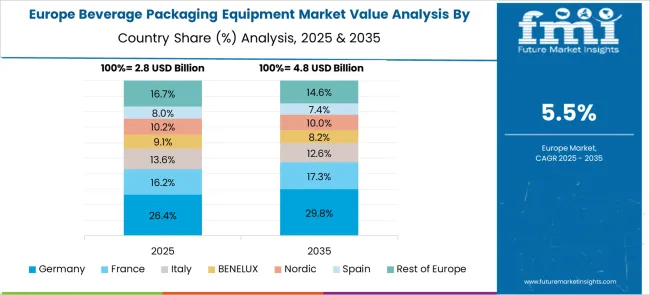

The beverage packaging equipment market is experiencing robust growth globally, with China leading at an 8% CAGR through 2035, driven by expanding beverage production capacity, increasing automation adoption, and growing domestic consumption. India follows closely at 7.4%, supported by rising beverage manufacturing investments, growing packaged beverage demand, and increasing focus on production efficiency. Germany shows steady growth at 6.8%, emphasizing precision engineering and advanced automation technologies. France records 6.2%, focusing on specialized packaging solutions and premium equipment development. The UK shows 5.6% growth, prioritizing innovative packaging technologies and flexible production systems.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from beverage packaging equipment in China is projected to exhibit strong growth with a CAGR of 8% through 2035, driven by rapid expansion of beverage manufacturing facilities and increasing adoption of automated packaging solutions. The country's growing beverage consumption and expanding middle class are creating significant demand for efficient packaging equipment across bottled water, soft drinks, and dairy beverage segments. Major international and domestic equipment manufacturers are establishing comprehensive service networks to support the growing population of beverage producers across tier-1 and tier-2 cities.

Revenue from beverage packaging equipment in India is expanding at a CAGR of 7.4%, supported by increasing beverage production capacity, growing domestic consumption, and rising investments in manufacturing infrastructure. The country's young demographic profile and increasing urbanization are driving demand for packaged beverages, creating opportunities for packaging equipment suppliers. International equipment manufacturers and domestic suppliers are establishing service capabilities to serve the growing demand for reliable packaging solutions.

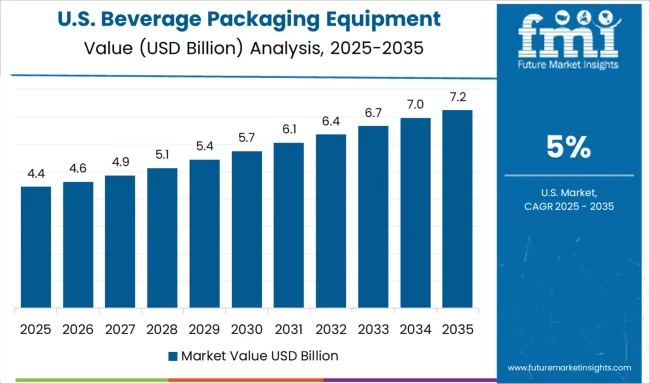

Demand for beverage packaging equipment in the USA is projected to grow at a CAGR of 5%, supported by continued emphasis on production efficiency, automation adoption, and sustainable packaging technologies. American beverage manufacturers are increasingly focused on equipment reliability, energy efficiency, and integration capabilities with existing production systems. The market is characterized by strong demand for premium equipment that combines advanced features with proven performance and comprehensive service support.

Revenue from beverage packaging equipment in Germany is projected to grow at a CAGR of 6.8% through 2035, driven by the country's strong focus on precision engineering, equipment reliability, and manufacturing innovation. German beverage manufacturers consistently demand high-quality, durable equipment that delivers consistent performance while maintaining strict quality standards and operational efficiency.

Revenue from beverage packaging equipment in the UK is projected to grow at a CAGR of 5.6% through 2035, supported by rising investment in flexible packaging solutions and advanced manufacturing technologies. British beverage manufacturers value equipment versatility, reliability, and ability to handle diverse product formats, positioning advanced packaging equipment as essential for competitive production operations.

Revenue from beverage packaging equipment in France is projected to grow at a CAGR of 6.2% through 2035, supported by the country's diverse beverage industry and emphasis on premium packaging solutions. French beverage manufacturers prioritize equipment quality, innovation, and ability to maintain product integrity, making advanced packaging equipment a trusted component in premium beverage production operations.

The beverage packaging equipment market is characterized by competition among established equipment manufacturers, specialized packaging technology companies, and emerging automation solution providers. Companies are investing in advanced automation technologies, sustainable equipment design, comprehensive service networks, and digital integration capabilities to deliver efficient, reliable, and adaptable packaging solutions. Technology innovation, service excellence, and global presence are central to strengthening product portfolios and market position.

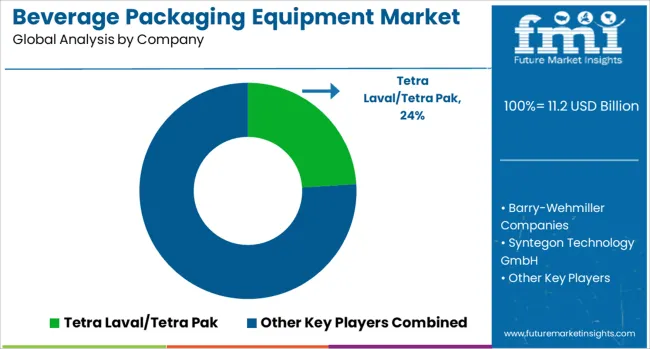

Tetra Laval/Tetra Pak leads the market with 24.0% global value share, offering comprehensive packaging solutions with focus on aseptic packaging technology and sustainable packaging innovations. Barry-Wehmiller Companies provides diverse packaging equipment portfolio with emphasis on automation and production efficiency. Syntegon Technology GmbH delivers advanced packaging systems with focus on pharmaceutical and food-grade applications. Bradman Lake Group Ltd. specializes in secondary packaging solutions with emphasis on flexibility and reliability.

Coesia S.p.A. and Clearpack focus on innovative packaging technologies across multiple beverage categories and container types. EconoCorp Inc. emphasizes cost-effective packaging solutions with focus on operational simplicity and maintenance efficiency. GEA Group provides comprehensive process and packaging solutions with focus on dairy and beverage applications. Jacob White Packaging Ltd., KHS Group, and Mpac Group plc offer specialized equipment with focus on specific beverage segments and automation requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 11.2 billion |

| Type | Filling and Capping Machines, Labelling and Coding Machines, Palletizing and Depalletizing Machines, Conveying and Handling Machines, Cleaning and Sterilizing Machines, Wrapping and Bundling Machines, Cartoning Machines |

| Automation | Fully Automatic, Semi-Automatic, Manual |

| Application | Bottled Water, Dairy Beverage, Alcoholic Beverages, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, United States, Germany, France, United Kingdom, Japan, Brazil, South Korea, Australia and 40+ countries |

| Key Companies Profiled | Tetra Laval/Tetra Pak, Barry-Wehmiller Companies, Syntegon Technology GmbH, Bradman Lake Group Ltd., Coesia S.p.A., Clearpack, EconoCorp Inc., GEA Group, Jacob White Packaging Ltd., KHS Group, Mpac Group plc |

| Additional Attributes | Equipment sales by automation level and application type, regional demand trends, competitive landscape, buyer preferences for automation versus manual systems, integration with Industry 4.0 and IoT connectivity, innovations in sustainable packaging design, energy efficiency optimization, and predictive maintenance capabilities |

Asia Pacific

The global beverage packaging equipment market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the beverage packaging equipment market is projected to reach USD 19.9 billion by 2035.

The beverage packaging equipment market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in beverage packaging equipment market are filling and capping machines, labelling and coding machines, palletizing and depalletizing machines, conveying and handling machines, cleaning and sterilizing machines, wrapping and bundling machines, cartoning machines and others.

In terms of automation outlook, fully automatic segment to command 56.7% share in the beverage packaging equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Beverage Flavoring Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA