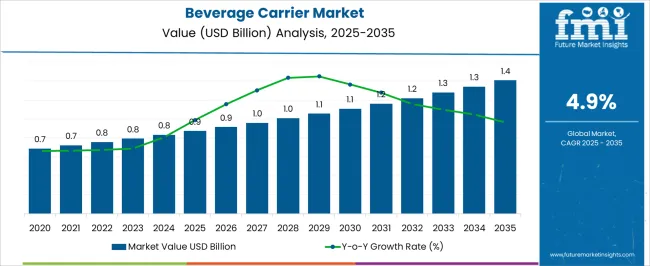

The Beverage Carrier Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Beverage Carrier Market Estimated Value in (2025 E) | USD 0.9 billion |

| Beverage Carrier Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The beverage carrier market is expanding steadily, driven by the growing demand for convenient and portable packaging solutions in both alcoholic and non-alcoholic beverage segments. Industry publications and packaging company reports have highlighted increased adoption of carriers that enhance functionality, durability, and sustainability. Rising consumer preference for multipack formats has been particularly influential, encouraging manufacturers to invest in innovative carrier designs that balance strength with reduced material use.

Regulations targeting single-use plastics have prompted research into recyclable and biodegradable alternatives, reshaping material choices within the market. In addition, e-commerce growth and on-the-go consumption trends have amplified the need for packaging solutions that provide both protection and ease of handling.

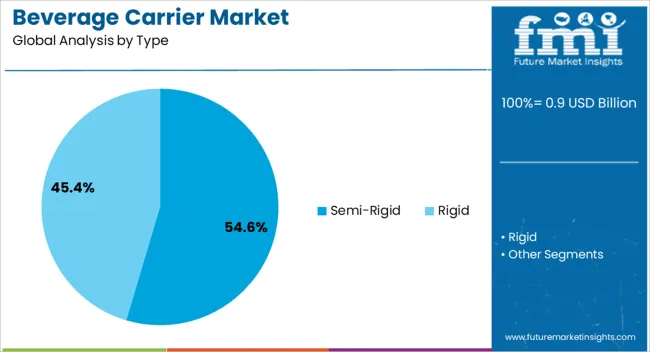

Future growth prospects are expected to be shaped by continued investment in material innovations, partnerships between beverage brands and packaging manufacturers, and consumer-driven demand for sustainable yet cost-effective carriers. Segmental leadership is currently observed in semi-rigid types, beverage carrier rings, and plastic materials due to their widespread usage and practical performance in large-scale beverage distribution.

The Semi-Rigid segment is projected to account for 54.6% of the beverage carrier market revenue in 2025, maintaining its dominance as the preferred type. This segment’s leadership has been reinforced by its balance of flexibility and structural integrity, making it suitable for a wide variety of packaging configurations. Beverage producers have favored semi-rigid carriers for their ability to secure multiple units while withstanding handling, transport, and storage conditions.

Advancements in semi-rigid designs have reduced material use without compromising strength, addressing both cost and sustainability concerns. Industry insights have indicated that semi-rigid carriers offer versatility across product categories, from carbonated drinks to bottled water, thereby supporting their widespread adoption.

As beverage companies continue to seek lightweight, durable, and adaptable solutions, the Semi-Rigid segment is expected to sustain its leading market share.

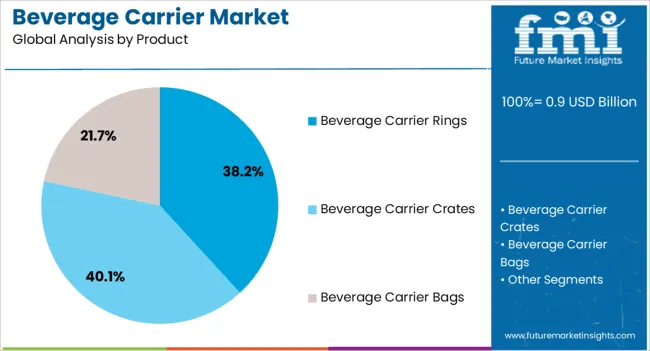

The Beverage Carrier Rings segment is projected to contribute 38.2% of the beverage carrier market revenue in 2025, emerging as the leading product category. This growth has been supported by the widespread use of carrier rings in multipack beverage packaging, particularly for cans. Their popularity has been attributed to their lightweight design, ease of application, and cost-effectiveness in high-volume packaging operations.

Packaging companies have continuously refined carrier rings to improve durability and reduce environmental impact, including the development of recyclable and biodegradable versions. Regulatory pressures on traditional plastic rings have spurred innovation, leading to eco-friendly alternatives that preserve convenience while addressing sustainability targets.

With strong adoption across global beverage industries, Beverage Carrier Rings are expected to retain their leadership position, supported by ongoing product development and regulatory compliance.

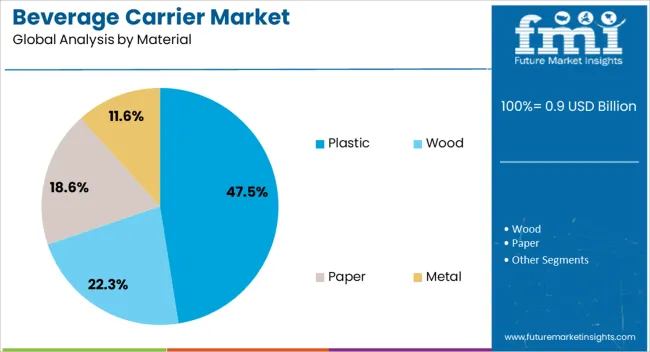

The Plastic segment is projected to hold 47.5% of the beverage carrier market revenue in 2025, maintaining its dominance as the primary material used. This segment’s strength has been driven by plastic’s durability, lightweight nature, and cost efficiency, which have made it indispensable for mass-market beverage packaging. Manufacturers have benefited from well-established plastic processing technologies and large-scale production capacity, ensuring reliable supply and consistent quality.

Additionally, plastics have been engineered for greater recyclability, with increasing adoption of post-consumer recycled content in carrier production. While sustainability pressures have encouraged exploration of paper, cardboard, and bio-based materials, plastics continue to dominate due to their performance advantages and affordability.

Ongoing research into biodegradable plastics and closed-loop recycling systems is expected to further reinforce the segment’s position in the evolving market landscape.

Environmentally friendly packaging solutions are actively sought by brands.

Brands stand out from the competition with innovative packaging designs, limited edition releases, and marketing campaigns.

A trend towards simplicity and elegance has led to the rise of sleek and minimalist drink carriers.

The trend towards on-the-go consumption and convenience

QR codes, NFC tags, and even temperature-sensitive indicators may be incorporated into packaging solutions.

Reusable or multi-purpose beverage carriers attract consumers, which include collapsible designs, components that can be detached, and containers that can be reused.

The influence of social media and influencer marketing on beverage carrier trends.

The beverage carrier is becoming a canvas on which brands can convey their stories and express their brands.

Government initiatives promoting sustainability and reducing plastic waste

The beverage industry may also benefit from blockchain technology and data intelligence for better strategic decision-making. Data-driven research enables companies to learn how emerging technologies will impact their industries. From 2020 to 2025, the beverage carrier market recorded a CAGR of 6.6%.

Smart beverage carriers with integrated modern technology have the potential to improve both consumer experience and efficiency. Route optimization software facilitates the distribution of beverages by identifying the safest and quickest routes to delivery sites.

Delivery teams may now design routes more readily thanks to technology, which means beverage delivery businesses can save time and money by using smart route optimization.

The role of automation and technology in beverage carrier manufacturing will create opportunities in future years. Beverage companies are utilizing digital tools and automation to increase efficiency and provide memorable customer experiences.

Automating coffee machines and utilizing digital tools to modernize manufacturing and distribution processes demonstrate the industry's willingness to embrace modern technology. According to the projections, the CAGR is projected to reach 4.9% between 2025 and 2035.

| Historical CAGR from 2020 to 2025 | 6.6% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.9% |

As environmental consciousness and consumer desire for eco-friendly packaging options increase, recyclable and biodegradable beverage carriers are becoming more and more popular.

A busy lifestyle necessitates a useful, creative, and portable beverage carrier that meets consumers' needs for convenience.

Health consciousness among consumers is leading to a desire for better beverage options, like organic drinks, smoothies, and natural juices.

Health-oriented beverage carriers that accept these goods are becoming more popular.

The rise of personalized and customizable beverage carriers, which are now being incorporated into products by some brands in order to attract customers.

Personalized messaging, adjustable features, or carriers that represent company identity attract consumers' attention.

With the growth of e-commerce platforms and on-demand delivery services, the demand for reliable and safe beverage packaging solutions has increased.

As technology advances, beverage carriers have become more affordable, long-lasting, lightweight, and reliable while delivering improved performance, driving industry growth.

Regulatory compliance and food safety standards impact market dynamics, which prompt manufacturers to invest in compliant and food-safe beverage carriers.

Due to fierce competition, leading beverage carriers are facing logistical and transportation issues due to limited supply chains.

Beverage freight is seasonal and peaks in the summer, when trucking supplies are limited.

Due to the seasonal nature of beverages, beverage companies might not be the most appropriate candidates for traditional annual bidding processes.

Traditionally, beverage carrier rings face a challenge in the future due to a lack of recycling infrastructure in many parts of the world.

Economic downturn and reduced consumer spending on non-essential items

Due to current supply chain conditions, beverage development projects face multiple constraints, including cost, quality, and time constraints.

South Korea, Japan, China, the United Kingdom, and the United States are experiencing growth as consumers continue to seek out easy ways to consume beverages.

The beverage carrier market can vary significantly across different geographic locations due to cultural preferences, factors related to the economy, environmental concerns, and regulatory requirements. Trade policies and import/export tariffs on beverage carriers from different countries will impact the market.

South Korea has also made significant contributions to the development of new materials, as well as being a global leader in both technology and innovation. Drink consumption in South Korea has shown several noteworthy trends, a reflection of changing demographics and consumer preferences.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 5.2% |

| United Kingdom | 6% |

| China | 5.6% |

| Japan | 6.6% |

| South Korea | 7.1% |

Beverage carriers are undergoing significant changes and advancements that will determine their future direction. Based on forecasts, the market will advance by 5.2% CAGR over the next ten years.

As part of its research, the USA Navy is discovering innovative methods for generating fuel from seawater that could also benefit beverage carriers. Using catalysts, researchers hope to convert seawater into fuel efficiently, offering carriers and other vessels an environmentally sustainable alternative to fossil fuels.

Increasing environmental awareness has prompted consumers to search for products with the lowest carbon footprint actively. Challenges and opportunities in beverage carrier recycling and waste reduction are expected to emerge on the market.

Recycled or decomposable beverage containers are consequently becoming increasingly popular. Due to consumer preferences and sustainability objectives, manufacturers are developing and introducing eco-friendly beverage carriers, such as those made of recycled paperboard or PLA.

United Kingdom beverage carriers have seen notable advancements, and several factors are influencing their future. Travelers are increasingly seeking convenience and consumption when traveling. Increasing demand for convenience and on-the-go consumption of beverages to propel the market.

In order to be able to carry a variety of drinks on the go while juggling their hectic schedules and preferences for convenience, consumers seek out beverage carriers that provide them with this convenience. People who commute or engage in outdoor activities tend to exhibit such behaviors more frequently in urban settings.

Increasingly, consumers are looking for compact and lightweight beverage carriers, especially those designed for single-serve bottles or cans. A CAGR of 6% is predicted for the industry over the forecast period.

Alternatives to dairy-based and plant-based products are growing in popularity in mainstream beverage categories, particularly coffee and tea. Health and wellness have driven the demand for substitutes that mimic non-dairy or plant-based counterparts in recent years. A CAGR of 5.6% is predicted between 2025 and 2035.

As consumers' preferences shift, functional mainstream beverages are becoming more popular in the country. China's growing popularity of online grocery shopping is one of the main driving forces behind the beverage carrier market. The role of e-commerce and online beverage sales in the beverage carrier value chain to drive the market.

As online shopping grows, China's beverage carrier market will grow. Drink carriers ensure the safe and efficient transportation of beverages from warehouses to clients' houses. In response, reliable and durable beverage carriers are needed to retain beverage quality during transportation while maintaining durability.

Japan's beverage carrier business is undergoing several significant developments. In the past few years, convenience stores and vending machines have become the best places to purchase beverages. The CAGR for Japan is forecast to reach 6.6% between 2025 and 2035.

The packaging designs of Japan are renowned for their innovations. The ergonomic handles and unique folding techniques found on Japan’s drink carriers make them particularly popular. The innovative designs of beverage carriers enhance consumer satisfaction and contribute to their popularity.

Sustainability is a major concern in Japan. As plastic waste concerns grow, eco-friendly drink carriers made from recycled materials are becoming more popular. As a result, companies are offering sustainable packaging options.

BBQs, picnics, and hiking have become increasingly popular outdoor activities and social gatherings. Health and wellness are also important factors driving the beverage carrier industry in South Korea.

In response to growing health consciousness among consumers, beverages with vitamins, antioxidants, and natural compounds are becoming increasingly popular.

Healthy consumers who wish to maintain the freshness and nutritional value of their beverages while on the go seek beverage carriers with insulation and temperature control features.

Drink carriers in South Korea are expected to continue to innovate and grow as long as consumers put health and wellness at the forefront. South Korean beverage carriers are predicted to rise at a CAGR of 7.1% over the next few years.

Here are the leading characteristics of a market segment. Transporting canned drinks in a tailored and practical manner is accomplished by using plastic, fiber, and cardboard carrier rings. Based on product type, the beverage carrier rings segment is projected to exhibit a CAGR of 4.7% from 2025 to 2035.

Regulations on food safety and hygiene standards for beverage containers and carriers to drive the market. Shipping alcohol requires adherence to all FDA guidelines and TTB (Alcohol and Tobacco Tax and Trade Bureau) regulations, in addition to obtaining the necessary permits and licenses from the shipping company.

The alcoholic segment is expected to increase at a CAGR of 4.5% between 2025 and 2035.

| Category | CAGR From 2025 to 2035 |

|---|---|

| Beverage Carrier Rings | 4.7% |

| Alcoholic | 4.5% |

The demand for beverage carrier rings made from fiber and cardboard will rise at a rapid pace in the near future. In 2025, beverage carrier rings accounted for 46% of market revenue.

A lifestyle centered on convenience and portability drives beverage carrier demand. In the beverage industry, beverage carrier rings are used to repackage loose cans, which is an efficient and environmentally friendly method of repackaging drinks.

Repackaging beer and soda bottles is also possible with lightweight, easy-to-grip plastic handles. Premium craft brews are also packaged in these repackaging cases.

As alcohol consumption rises, packaging choices are becoming more important. As specialty spirits and craft beers become more popular, upscale beverage containers are in high demand. The alcoholic market was forecast to have a share of 58% by 2025.

As social events and outdoor activities grow, portable drink transportation solutions become more important. The package design of beverages has been modified to provide a choice of branding and marketing options, as well as innovation in design.

Boxes designed to hold beverages are incredibly durable and designed to keep liquids from spilling. For in-house breweries or beverage products, different designs, finishes, sizes, and surface finishes can be customized.

Strategies for new entrants to differentiate themselves in the beverage carrier market. For startups and small companies, innovation is key to building a competitive edge.

New materials, designs, and features can be introduced to create a competitive edge. Strategic partnership with a distributor or retailer to expand market reach. The uniqueness and effectiveness of their product will determine their success in addition to their production capacity and secure distribution channels.

Key Market Developments

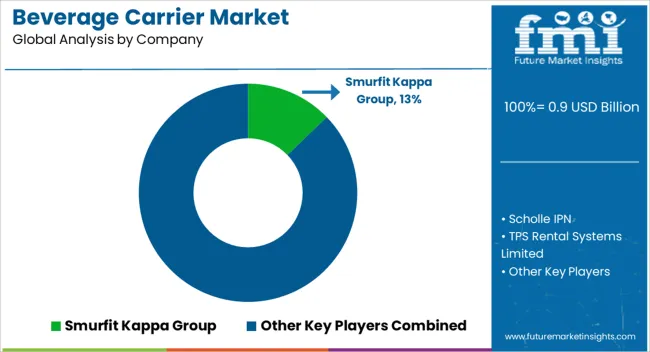

In January 2025, Smurfit Kappa opened a new corrugated packaging factory in Morocco to better serve local customers. North Africa marks the first venture for Smurfit Kappa in the corrugated industry. Investments in long-term growth and customer support have totaled USD 5.1 billion (€4.7 billion) over the last five years.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 0.9 billion |

| Projected Market Valuation in 2035 | USD 1.4 billion |

| Value-based CAGR 2025 to 2035 | 4.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; East Asia; Western Europe; Eastern Europe; South Asia and Pacific; The Middle East and Africa |

| Key Market Segments Covered | Type, Product, Material, Capacity, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Smurfit Kappa Group; Scholle IPN; TPS Rental Systems Limited; Optopack Limited; CDF Corporation; Zumbiel Packaging; Valco Melton; Keystone Paper and Box Company; RTS Packaging; NEPA Carton & Carriers Company |

The global beverage carrier market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the beverage carrier market is projected to reach USD 1.4 billion by 2035.

The beverage carrier market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in beverage carrier market are semi-rigid and rigid.

In terms of product, beverage carrier rings segment to command 38.2% share in the beverage carrier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Food and Beverage Carriers Market

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA