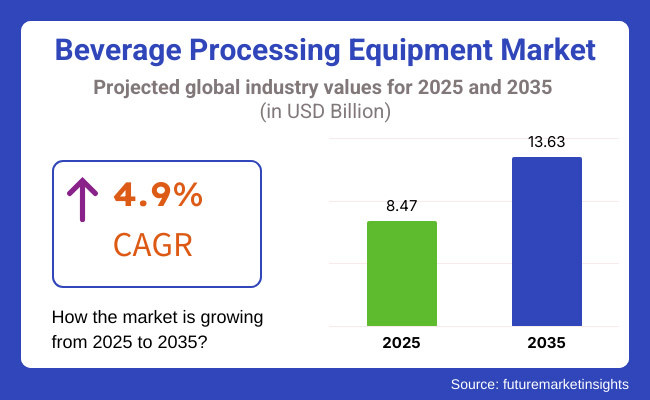

Beverage processing equipment market revenue is valued at USD 8.47 billion in 2025 and is expected to reach USD 13.63 billion by 2035, expanding at a 4.9 % CAGR during the forecast period.

The United States remains the most lucrative national market in 2025, buoyed by rapid SKU diversification, strict FDA hygiene mandates, and sustained premium-craft activity. Conversely, India and Southeast Asia are forecast to log the fastest growth through 2035, propelled by urbanisation, rising middle-class disposable income, and surging demand for ready-to-drink teas, coffees, and fortified juices.

Momentum is fuelled by three converging drivers including the shift toward plant-based milks, kombucha, and probiotic waters that require gentle agitation, aseptic filling, and advanced filtration; regulatory pressure for energy-efficient, low-waste operations, pushing upgrades to high-shear mixers, plate heat-exchangers, and CIP-ready homogenisers; and the march toward Industry 4.0, where vision-guided robotics, IoT sensors, and AI-optimised utility loads slash downtime and cut operating costs by up to 15 %. Restraints include heavy cap-ex outlays for fully automatic lines and the skills gap in emerging regions.

Looking ahead, suppliers will embed digital twins and edge-AI analytics into core modules, enabling predictive maintenance windows and line-wide OEE dashboards. Carbon-neutral brewhouses and next-gen pulse electric-field pasteurisers are slated to hit mainstream adoption by 2030, trimming thermal energy use by 25 % versus legacy tunnel pasteurisers.

As consumer palates favour clean-label, low-sugar, and functional formulations, modular skid systems that pivot swiftly between small-batch plant-based lattes and electrolyte waters will capture share. Collectively, these trends guarantee durable, single-digit growth and cement beverage processing equipment as a strategic linchpin for global food-and-drink producers.

Mixers and blenders underpin roughly 22 % of 2025 sales, indispensable for emulsifying dairy alternatives, dispersing functional powders, and guaranteeing batch-to-batch homogeneity in high-viscosity fruit purées. Tumbler blenders and high-shear inline mixers are being retrofitted with servo-controlled agitators and real-time density probes that cut blend times by 18 %.

Shell-and-tube heat-exchangers follow as utilities-hungry bottlenecks, yet demand is shifting toward compact plate heat-exchangers with corrugated plates that raise thermal efficiency above 92 %. The standout growth pocket, however, is fermentation and maturation equipment, forecast to post the market-leading 6.2 % CAGR through 2035.

Craft breweries, kombucha start-ups, and hard-seltzer producers alike are investing in cylindro-conical fermenters with CIP spray-balls, automated CO₂ blow-off valves, and PTFE jackets that cut chill-loss. Suppliers bundling skid-mounted brew-houses with cloud SCADA and yeast-propagation modules are carving out premium price points, particularly in Southeast Asia and Latin America where brewpub culture is exploding. Meanwhile, centrifugal clarifiers and membrane micro-filters are progressing from stainless to duplex alloys, extending service life in acidic juice lines.

| Product Sub-segment | CAGR (2025 to 2035) |

|---|---|

| Fermentation & Maturation Systems | 6.2% |

Alcoholic beverages (beer, spirits, hard seltzers) still account for 38 % of equipment demand in 2025, anchored by continual investments in hygienic mash tuns, carbonation stones, and returnable-glass fillers. Yet the fastest expansion stems from functional and plant-based beverages, projected at a 6.5 % CAGR.

Oat-milk, RTD protein shakes, and adaptogenic teas demand low-shear mixing, ultra-high-pressure homogenisation, and aseptic bag-in-box fillers to safeguard viscosity and probiotic viability. Carbonated soft-drink lines remain steady but pivot toward nitrogen-dosing and stevia blending to align with sugar-tax regimes. Non-carbonated still drinks-cold-brewed coffees, vitamin waters, premium juices-see robust adoption of pulsed-light pasteurisers that preserve colour and polyphenols.

In dairy beverages, high-pressure pasteurisation and dual-stage homogenisers enable shelf-stable, lactose-free offerings. Collectively, this diversity compels OEMs to deliver quick-changeover valves, clean-label additive dosing skids, and dry-lubrication conveyors that cut water use by up to 80 %.

| Beverage Category | CAGR (2025 to 2035) |

|---|---|

| Functional & Plant-based Drinks | 6.5% |

In 2025, semi-automatic lines still populate many mid-tier bottling halls, representing 57 % of installed base, but the momentum is decisively shifting. Fully automatic systems-featuring closed-loop PLC control, digital twin simulation, and AI-driven vision inspection-are set to expand at a 7.1 % CAGR through 2035.

The economics are compelling: predictive maintenance cuts unplanned downtime by 25 % and trims labour cost per hectolitre below USD 0.11. Early adopters retrofit legacy fillers with servo cappers and robotic case packers, achieving 30 % throughput uplift without enlarging floor-space.

Start-ups, meanwhile, opt straight into turn-key, skid-mounted nano-breweries and juice micro-plants, financed via equipment-as-a-service models. Manual and semi-automatic solutions won’t vanish-artisan cideries and niche cold-press operators value tactile control-but their growth moderates to 3.2 %, limited by hygiene risks and tracer ability gaps. Over the decade, OPC-UA interoperability, 5G edge gateways, and cyber-secure SCADA will become table stakes, ensuring seamless data flow from valve actuator to enterprise MES.

| Automation Grade | CAGR (2025 to 2035) |

|---|---|

| Fully Automatic Systems | 7.1% |

Future Market Insights (FMI) held an extensive survey of stakeholders through different segments of the beverage processing equipment industry. The survey aimed to gain knowledge regarding prevailing market trends, technological innovation, and future development opportunities.

The survey indicated a strong trend towards automation and energy-efficient technology in beverage processing. Stakeholders pointed out that the incorporation of automated systems improves production efficiency, lowers operational costs, and maintains consistent product quality. Rising emphasis on the use of energy-efficient equipment for sustainable goals and meeting stringent environmental regulations.

The survey also identified increased demand for dedicated equipment addressing health and functional beverage categories. As consumers increasingly seek healthier products, manufacturers invest more in beverage technologies that allow them to meet their evolving nutritional needs. This trend is motivating equipment suppliers to innovate and offer products that address these industry requirements.

Geographically, stakeholders have been witnessing strong growth prospects in the emerging markets, including Asia Pacific. These industries are driving the demand for advanced beverage processing technology on account of urbanization, increasing middle-class population and changing lifestyles of consumers. This trend provides manufacturers with a high potential to expand and meet the needs of these evolving industry.

| Countries/Region | Regulations Impacting the Beverage Processing Equipment Market |

|---|---|

| United States | Food safety, labeling, and the beverage manufacturing process are regulated by the Food and Drug Administration (FDA) (e.g., FDA Food Safety Modernization Act). The USA Environmental Protection Agency (EPA) calls for regulations regarding the use of water and the disposal of waste during beverage manufacturing. |

| European Union | The EU General Food Law Regulation provides food safety and hygienic compliance in every phase of beverage production. - The EU Eco-Design Directive has energy efficiency specifications for equipment involved in beverage processing. - REACH Regulation asks manufacturers of beverage production equipment to handle chemical substances involved in production. |

| China | China's Food Safety Law and State Administration for Industry Regulation (SAMR) prescribe standards for the safety of beverages and labelling Roadmap - Environmental regulations (publications of Ministry of Ecology and Environment (MEE)) - beverage manufacturing waste admissions reduction focus |

| India | The Food Safety and Standards Authority of India (FSSAI) oversees food safety regulations, such as hygiene regulations for the processing of drinks. |

The drinks industry experienced numerous significant shifts during 2020 and 2024. The COVID-19 pandemic caused upheaval across the board - manufacturing, supply chain, and consumption habits. It resulted in a surge in online deliveries and an uptick in demand for packaged drinks.

The expansion of industry has raised the demand for health-conscious consumptions involving low-sugar, organic beverages and functional drinks. Moreover, several businesses have been opting for sustainability and have been adopting eco-friendly and sustainable packaging. Further, the demand for premium and craft alcohol has also boosted at a substantial pace, with digital platforms emerging as prominent platforms for sales.

During the upcoming period, the beverage processing equipment industry is poised to make sustainable growth with fewer industry disruptions and a stable industry. Online purchases and direct-to-consumer models will thrive. The shift towards plant-based and functional beverages will increase, and sustainability will be emphasised with stricter regulations.

Production will be more efficient, owing to full-scale automation and intelligent manufacturing from technological progress. Blockchain technology will provide traceability, and energy efficiency will be the priority to minimize the environmental footprint. Additionally, driving growth in developing economies like Asia, Africa and Latin America as incomes increase and consumer tastes change.

The United States is among the world's largest beverage industries, with a diverse and fast-changing environment. The industry for healthier, low-sugar, organic, and functional drinks has grown in recent years, especially in the categories of plant-based beverages and fortified drinks.

The trend toward plant-based milks (almond, oat, etc.) and probiotic beverages has revolutionized beverage manufacturing technologies. Tremendous consumer demand and regulatory pressure have both contributed to this interest in sustainability, triggering innovations in packaging and green manufacturing. The country’s industry is expected to grow at a CAGR of over 5% throughout the analysis period.

Automation and AI-driven solutions are smarter; they improve the productivity of the manufacturing process and help companies scale up to meet the consumer offerings of personalization. E-commerce is increasingly becoming a factor in a direct-to-consumer world.

With growing demand from consumers for healthy products, including functional and plant-based drinks, the UK drinks processing industry is closely following trends and exploring product innovation opportunities. Products with organic or reduced sugar are a growing trend, as are functional beverages, which may contain added probiotics or adaptogens.

Alcoholic drinks, especially premium spirits and craft beer, are significant segments, but there is also a strong increase in the consumption of low- or non-alcoholic beverages. It's a key consideration, with the UK manufacturers heavily investing in the use of biodegradable and recyclable packages. The British industry is further enhanced by powerful regulatory environments, which foster the development of the product portfolio, as well as manufacturing processes.

Beverage processing in France remains heavily driven by its wine as well as the sparkling wine, which forms the backbone of its culture as well as economy. While wine is still dominant, demand for healthier and functional non-alcoholic drinks, like juices and vegetable-based alternatives, is on the rise. Demand for organic products is also rising.

Efforts at sustainability are becoming more important, with many French producers attempting to cut down on their carbon footprint using energy-saving production and sustainable packaging. France's rich heritage of high-quality beverage manufacturing, such as wine and specialty beer, means that quality is a prime motivator in both the home and export industries.

Germany has a varied beverage industry, from beer and soft drinks to fruit juice and bottled water. Beer is culturally important and remains one of Germany's biggest beverage exports. There is a move, though, toward healthier beverages, including functional drinks, sparkling water, and juices with vitamins or minerals added.

Sustainability is also a top concern, as in other European countries, with German producers heavily investing in energy-efficient technology and recycling. Premium beverages, especially craft beers and specialty beverages, are changing the German beverage industry. Further, automation and digitalization of the processing of beverages will be contributing to efficiencies as well as lowered production costs.

The Italian beverage processing industry has a strong tradition of wine and coffee, both of which are foundational to the country's economy as well as its culture. Still, the growing demand for healthy choices, such as organic fruit juices, plant-based milk alternatives, and functional beverages, is affecting trends in production.

Italy is also witnessing a boom in non-alcoholic drinks like sparkling water, tea, and low-calorie cola. Sustainability is key, with companies increasingly using green manufacturing processes. Demand for premium products, especially in the wine, coffee, and juice categories, keeps rising. The country's robust export industry also makes it a significant player in the European drinks industry.

South Korea's beverage processing industry is being driven by the increased trend of health-based consumption, with consumers increasingly gravitating toward functional and probiotic drinks. There is a surge in the popularity of plant-based milks and low-sugar products, which is transforming the industry, and technological innovations in beverage processing are assisting companies in catering to these new needs.

Also, the beverage sector of South Korea is increasing its emphasis on sustainability, especially plastic waste reduction and enhancing packaging recycling. With a very advanced technology infrastructure, South Korea has also accepted automation and AI technology in beverage production, which enables it to produce more efficiently with greater product consistency. The export industry for Korean drinks, especially in Asia, is also growing.

Japan's beverage processing industry is characterized by both novelty and high demand for traditional and functional drinks. For a long time, Japanese people preferred green tea, soft drinks, and alcoholic drinks like sake, but over the past few years, there has been a growing trend towards health-focused drinks like functional drinks (e.g., drinks that are beneficial to the digestion or the immune system) and plant-based drinks.

The industry is also seeing increased demand for low-sugar and organic products. Japan is highly focused on packaging innovation and sustainability and has a strong focus on minimizing plastic and maximizing the recyclability of packaging. Japanese beverage producers are tending increasingly towards smart manufacturing techniques to enhance efficiency and address improving consumer expectations.

China's food and beverage processing industry is among the world's largest and most rapidly expanding. The nation has experienced strong growth in demand for alcoholic and non-alcoholic drinks. Soft drinks, tea, and bottled water are the top categories, but there has also been a quick increase in functional and plant-based drinks.

With the Chinese middle class still growing, consumer tastes are moving toward lower-sugar, healthier beverages. The government also plays a significant role in the beverage industry through regulations that drive sustainability, with manufacturers increasingly adopting environmentally friendly practices.

The increased use of automation and AI-based manufacturing processes is enhancing production efficiency, while the rising trend of online purchases is influencing new channels of distribution. China's position as both a consumer and exporter of beverages makes it a key player globally.

Australia's beverage processing industry is witnessing robust growth, fueled by consumer trends that prioritize health, such as increased demand for plant-based beverages, low-sugar carbonated soft drinks, and functional drinks.

Australia is also witnessing a premiumization trend in beverages, especially in the craft beer, wine, and cold-pressed juice industries. Sustainability is also a top priority, with Australian beverage producers looking to minimize their carbon footprint, enhance energy efficiency, and use recyclable packaging.

Moreover, there is a growing demand for health-promoting beverages such as probiotic drinks and functional waters. The industry is underpinned by an advanced supply chain and export framework, with Australian drinks becoming popular in overseas industries, especially in Asia.

The international beverage processing industry has witnessed high growth over the last ten years, influenced by changing consumer attitudes, technology improvements, and a growing need for healthier and sustainable beverages.

The industry experienced a short-term disruption between 2020 and 2024 when the COVID-19 pandemic necessitated that producer respond quickly by switching to e-commerce channels and investing in digital and automation technologies to provide supply chain resilience. Sustainable and health-focused trends fueled demand for organic, low-sugar, and green drinks, as firms innovated to satisfy such consumer demands.

Looking forward to 2025 to 2035, the industry will continue its rise, driven by a growing demand for plant-based and functional drinks and the continuous drive towards sustainability in all production processes. Advances in technology in the areas of automation, AI, and smart manufacturing will transform beverage processing with enhanced efficiency and lower costs.

In addition, growth in emerging industries, especially in Asia-Pacific, Africa, and Latin America, will provide new opportunities as increasing disposable incomes and lifestyle changes fuel demand for various types of beverage products.

The industry for beverage processing has immense growth potential, given the increasing demand from consumers for healthy beverages, sustainability, and newness. To leverage these trends, companies need to invest in improving automation and embracing Industry 4.0 technologies to gain higher production efficiency and lower the cost of operations.

Supporting investments in AI and IoT-based systems for real-time tracking and predictive maintenance will bring in consistency and less waste. The movement towards plant-based, functional, and low-sugar drinks offers an expanding niche, and thus, companies are creating specialized production lines and making investments in novel processing technologies for these segments.

Sustainability would continue to be a priority area, with advancements in environmentally friendly packaging and energy-efficient processes becoming more crucial. Entering the emerging industries, especially in the Asia-Pacific and Africa, where increasing disposable incomes are fueling beverage consumption, will also provide substantial growth prospects. Last but not least, e-commerce channel strengthening will help brands directly interact with consumers, boosting sales as well as brand loyalty.

The industry for beverage processing is very fragmented, and major players in the industry are Tetra Pak, Krones AG, Alfa Laval, GEA Group, Sidel, Ziemann Holvrieka, and SPX FLOW. These companies lead with a wide range of processing technologies and equipment to meet large-scale and niche beverage manufacturers.

In 2024, Tetra Pak solidified its sustainability stance through energy-efficient solutions and circular packaging solutions. Krones AG highlighted automation with AI-based production systems for enhanced efficiency, and Alfa Laval upgraded heat exchanger technologies for enhanced energy savings. These advancements reflect the growing demand for efficiency and sustainability in beverage processing.

Mergers and Acquisitions

JBT Corporation carried out a strategic merger with Danish company SiccaDania, broadening its evaporation and drying technology base. In the meantime, Tetra Pak finalized its takeover of Miteco, a Swiss expert in beverage mixing, and Japanese conglomerate Sumitomo Heavy Industries joined the fray with its acquisition of an Austro-controlling interest in BrauKon GmbH, an Austrian brew equipment manufacturer, for about USD 180 million.

Strategic Partnerships

Tetra Pak teamed up with sustainable packaging technology pioneer Pulpex to bring paper bottle technology into their processing lines. SPX Flow partnered with Dutch startup Fooditive to develop plant-based ingredient processing abilities. Alfa Laval signed a technology-sharing deal with Israeli water treatment expert IDE Technologies, while JBT Corporation formed a joint venture with Brazilian sugar processor Copersucar to create specialized equipment for sugarcane-based drinks.

Demand for healthier, sustainable beverages and advancements in automation and AI.

Tetra Pak, Krones AG, Alfa Laval, GEA Group, SPX FLOW.

Eco-friendly packaging, energy-efficient processes, and sustainable methods.

Plant-based drinks, functional beverages, automation, and sustainability.

Automation, AI, and IoT boost efficiency, reduce waste, and improve quality.

Table 1: Global Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 4: Global Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 6: Global Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 7: Global Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 8: Global Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 9: North America Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 10: North America Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 12: North America Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 14: North America Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 15: North America Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 16: North America Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 17: Latin America Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 22: Latin America Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 23: Latin America Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 24: Latin America Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 25: Europe Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 26: Europe Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 28: Europe Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 30: Europe Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 31: Europe Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 32: Europe Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 33: East Asia Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 34: East Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 38: East Asia Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 39: East Asia Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 40: East Asia Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 41: South Asia Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 42: South Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 46: South Asia Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 47: South Asia Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 48: South Asia Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 49: Oceania Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 50: Oceania Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 54: Oceania Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 55: Oceania Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 56: Oceania Volume (MT) Forecast by Automation Grade, 2018 to 2033

Table 57: MEA Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 58: MEA Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 60: MEA Volume (MT) Forecast by Product Type, 2018 to 2033

Table 61: MEA Value (US$ Billion) Forecast by Beverage Type, 2018 to 2033

Table 62: MEA Volume (MT) Forecast by Beverage Type, 2018 to 2033

Table 63: MEA Value (US$ Billion) Forecast by Automation Grade, 2018 to 2033

Table 64: MEA Volume (MT) Forecast by Automation Grade, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 17: Global Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Beverage Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Automation Grade, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 27: North America Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 28: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 41: North America Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Beverage Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Automation Grade, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 52: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Beverage Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Automation Grade, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 76: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Beverage Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by Automation Grade, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 99: East Asia Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 100: East Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 113: East Asia Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Beverage Type, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Automation Grade, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 124: South Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 137: South Asia Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Beverage Type, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Automation Grade, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 147: Oceania Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 148: Oceania Market Value (US$ Billion) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 161: Oceania Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Beverage Type, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Automation Grade, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Billion) by Beverage Type, 2023 to 2033

Figure 171: MEA Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 172: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Billion) Analysis by Beverage Type, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Beverage Type, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Beverage Type, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Beverage Type, 2023 to 2033

Figure 185: MEA Market Value (US$ Billion) Analysis by Automation Grade, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Automation Grade, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Beverage Type, 2023 to 2033

Figure 191: MEA Market Attractiveness by Automation Grade, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA