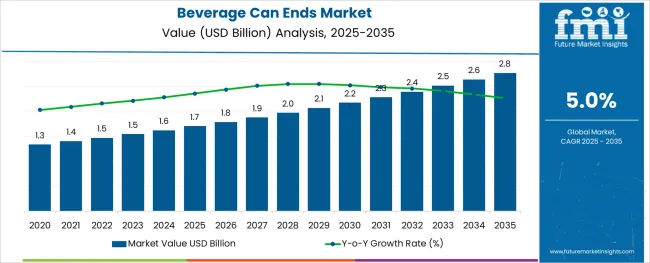

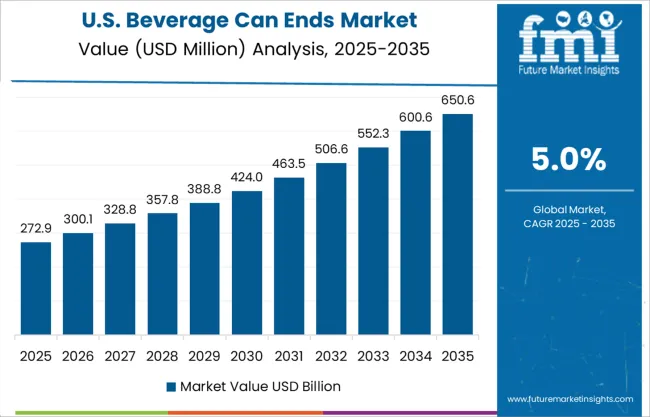

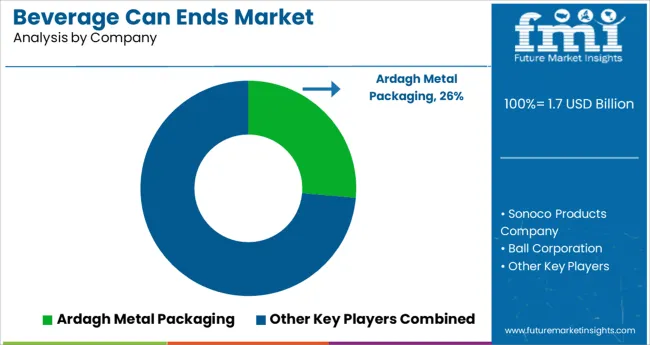

The Beverage Can Ends Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The beverage can ends market is experiencing strong growth driven by increasing consumption of canned beverages, rising demand for recyclable packaging, and a global shift toward lightweight materials. Growing environmental awareness and circular economy initiatives have led manufacturers to prioritize sustainable materials and efficient closure solutions.

Innovations in can end design are enhancing user convenience, product preservation, and branding possibilities. Regulatory mandates for sustainable packaging and rising aluminum recovery rates have contributed to the widespread adoption of metal can ends in both carbonated and non carbonated beverage categories.

The market outlook remains positive as beverage producers emphasize shelf appeal, functionality, and eco responsible packaging formats to meet evolving consumer and industry expectations.

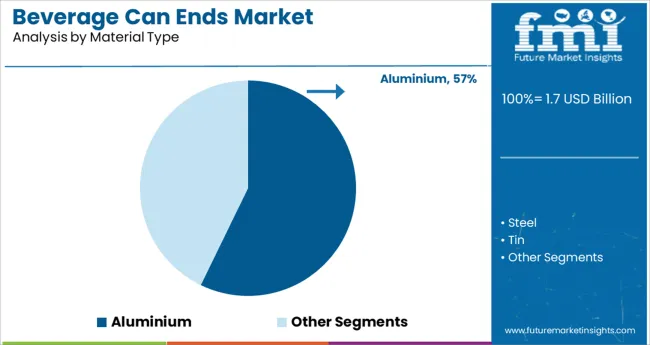

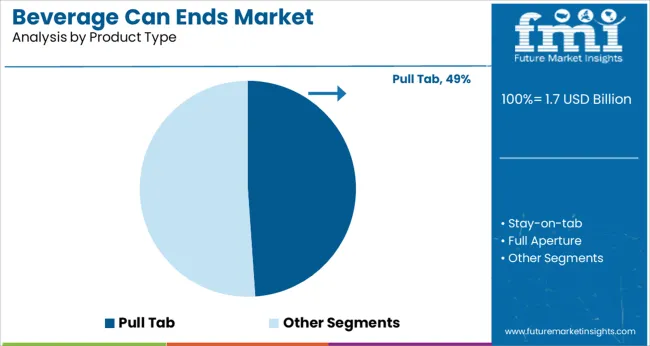

The market is segmented by Material Type, Product Type, and Application and region. By Material Type, the market is divided into Aluminium, Steel, and Tin. In terms of Product Type, the market is classified into Pull Tab, Stay-on-tab, and Full Aperture.

Based on Application, the market is segmented into Alcoholic Beverages and Non-alcoholic Beverages. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aluminium segment is projected to hold 57.20% of total market revenue by 2025 within the material type category, making it the dominant segment. This leadership is attributed to aluminium’s lightweight properties, corrosion resistance, and infinite recyclability.

The material offers strong product protection while supporting sustainability goals, reducing both transportation costs and environmental footprint. As governments and beverage brands commit to low carbon packaging solutions, aluminium has emerged as the preferred choice for can ends.

Its ability to maintain product integrity and extend shelf life while contributing to closed loop recycling systems has further reinforced its market position. This convergence of functional and environmental advantages continues to drive aluminium’s dominance in the beverage can ends market.

The pull tab segment is expected to contribute 48.90% of total revenue by 2025 within the product type category, establishing it as the leading format. This is driven by its widespread use across soda, beer, and energy drink categories, offering a convenient and familiar opening mechanism for consumers.

Pull tabs are favored for their simple operation, tamper resistance, and compatibility with automated canning lines. Their consistent performance in high volume production environments ensures operational efficiency for beverage manufacturers.

Continued improvements in ergonomics and reduced metal usage have also supported their appeal in cost sensitive and eco conscious markets. These factors combined with strong consumer acceptance have maintained pull tabs as the preferred can end product in the beverage packaging landscape.

The global beverage can ends market share witnessed a growth rate of 4.3% during 2020 to 2024 and reached 1.6 Billion in 2024.

Beverage cans are used as the packaging format for non-alcoholic and alcoholic beverages, for instance, juices, soft drinks, beer, and soft drinks. The can ends to give a good barrier property counter to sunlight and oxygen, so holding the quality of the beverage.

There are three types of beverage can ends used in beverage can ends markets pull tab, stay-on-tab, and full aperture. The beverage can ends market is based on the end-user requirement.

Beverage can ends are made up of three types of metals, for instance, aluminium can ends, steel can ends, and tin can ends. The use of metals for manufacturing beverage can ends is more, the reason that all types of metal can ends are infinitely recyclable.

Different types of beverage can ends are appropriate for different beverage can products, it is depending on the product's nature. Beverage can end are available in different sizes to make sure a tight-fit beverage can and also available in different shape and sizes to suit the beverage can.

The surge in demand for a good barrier against sunlight and oxygen thereby, retaining the quality of the beverage in various end-user industries.

Beverage can ends play a major role in beverage product packaging so these are the factors that are increasing for beverage can ends market boosted in near future.

The increasing trade in the food and beverage sector is anticipated to make growth opportunities for the beverage can ends market. Also, the benefits offered by the beverage can ends market increased in popularity in various end-use industries.

The global beverage can ends market is anticipated to boost during the forecast period owing to its various beneficial factors.

The increasing demand for beverages can ends because it gives good barrier properties and retains the quality of the beverage.

In the food & beverages sector for the use of different types of beverage can ends used in beverage can packaging, and this drive the market fast over the forecast period.

These types of beverages can end works as good barrier property counter to sunlight and oxygen.

The manufacturers have introduced new and innovative packaging in beverage can ends. The manufacturers of beverages can end provide an extensive range of beverage can ends such as user-friendly, colored, notched type, etc.

Recently Crown launched Crown's 360 End beverage can ends with a full aperture end. Also, the big manufacturing industries are aiming on preferring better closing of the product on product packaging and it addresses the sustainability goals.

The top key players have started innovations in product design and production capacity and to the demand, for instance.

By product type, the pull tab beverage can segment is expected to hold the major portion of the global beverage can ends market. The pull tab beverage can ends market segment is projected to expand 1.5 times the current market value.

Beverage can ends market increase traction among the end-users due to high production, good quality, reduced time, reduce labor cost, and increased accurateness.

The non-alcoholic segment is projected to grow at CAGR 5.4% during the forecast period.

There is rising demand for healthy beverages which contains natural ingredients. The demand for non-alcoholic drinks are increasing due to changing lifestyle, increasing disposable income are key factors driving the growth of the non-alcoholic beverages market.

Consumption of non-alcoholic drives directly affects the sales of the beverage and can ends the market.

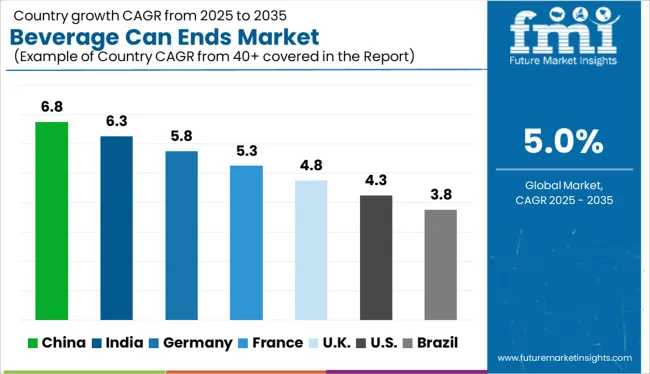

United Kingdom beverage can ends market is anticipated to grow 1.4 times of current market value by the end of 2035. UK has seen sustainable packaging growth in food and beverages due to increased intake in packaged food consumption, awareness, and demand for quality products.

According to a data published by of Government of United Kingdom, Total consumer expenditure on food and drink has increased by 12.3% in 2024. The expenditure on alcoholic drinks has increased by 20%. The beverage industry in UK is likely to create growth opportunities for the beverage can ends market.

The USA beverage can ends market is projected to grow at CAGR 4.2% during the forecast period. The reason behind the same is the rising food and beverage sector, due to increased intake in packaged food consumption, awareness, and demand for quality products.

According to the American Beverage Organisation, the non-alcoholic beverage industry plays an important role in the USA economy and 178 billion impact of these industry.

Thus, the food and beverage sector in USA is likely to create growth opportunities for the beverage can ends market.

The players involved in manufacturing beverage can ends are trying to focus on expanding their presence, product portfolio, capacity, and resources to meet the growing demand for packaging in various regions.

The key players are adopting merger/acquisition and expansion strategies. Some of the latest developments are as follows -

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material Type, Product Type, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Ardagh Metal Packaging; Sonoco Products Company; Ball Corporation; Crown Holdings, Inc.; Silgan Holdings Inc.; Novelis; Helvetia Packaging; Mahmood Inc Ltd; Envases Universales de; Kian Joo Can Factory Berhad; SWAN Industries (Thailand) Company Limited; Toyo Seikan Group Holdings, Ltd.; Can Ends Packaging Limited; Hindustan Tin Works Ltd.; VM Can Industries Pvt. Ltd.; Qingdao Baixi Industry Co., Ltd.; Linyi Earnest Industrial Co.,Ltd. |

| Customization & Pricing | Available upon Request |

The global beverage can ends market is estimated to be valued at USD 1.7 billion in 2025.

It is projected to reach USD 2.8 billion by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are aluminium, steel and tin.

pull tab segment is expected to dominate with a 48.9% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Beverage Can Ends Industry

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Beverage Flavoring Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA