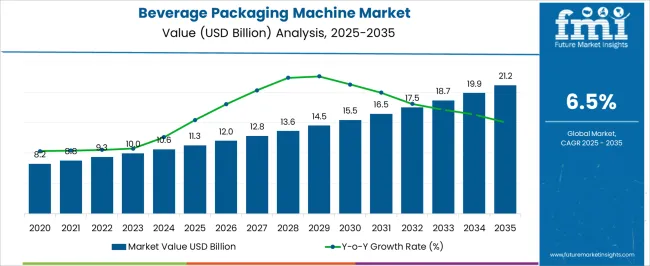

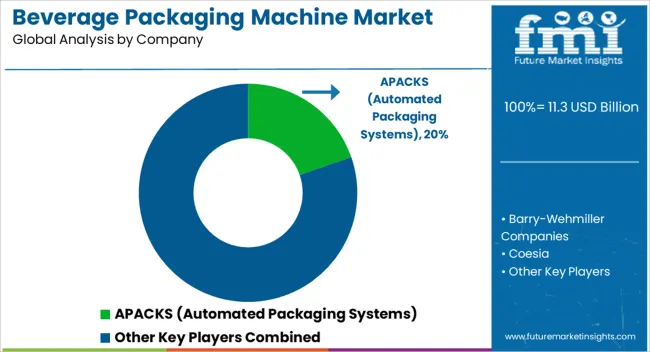

The beverage packaging machine market is estimated to be valued at USD 11.3 billion in 2025 and is projected to reach USD 21.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The global beverage packaging machine market is projected to reach 21.2 USD billion by 2035, up from an estimated 11.3 USD billion in 2025, growing at a CAGR of 6.5%. Market growth is anticipated to be influenced by increasing demand for ready-to-drink beverages, expansion of cold chain logistics, and rising adoption of automated and high-speed packaging solutions across small and large-scale beverage manufacturers. Fluctuations in raw material costs, particularly stainless steel and aluminum, can create peak-to-trough variations in capital expenditure, while seasonal demand spikes in soft drinks, juices, and alcoholic beverages contribute to short-term revenue surges.

Beverage producers are increasingly investing in modular and flexible machines capable of handling multiple container formats, sizes, and packaging types to optimize throughput and reduce downtime. Emerging markets, particularly in Asia-Pacific and Latin America, show strong adoption trends due to rising disposable incomes, urban retail expansion, and growing demand for bottled water, juices, and functional drinks. Technological enhancements in machine efficiency, energy consumption, and sanitation features are expected to further support market growth.

Investment cycles, regulatory approvals, and shifts in consumer preferences toward sustainable and convenient packaging solutions also influence market volatility. The market is poised for steady long-term expansion as beverage companies modernize production lines, integrate automation, and scale operations to meet evolving consumer expectations while navigating cyclical fluctuations in material and labor costs.

| Metric | Value |

|---|---|

| Beverage Packaging Machine Market Estimated Value in (2025 E) | USD 11.3 billion |

| Beverage Packaging Machine Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The beverage packaging machine market is strongly influenced by interconnected parent markets, each contributing distinctly to overall adoption and growth. The bottled water and carbonated soft drink manufacturing market holds the largest share at 35%, as high-speed filling, capping, and labeling machines are essential for mass production, quality control, and operational efficiency in large-scale beverage operations. The juice, tea, and functional drinks market contributes 25%, with manufacturers relying on versatile packaging equipment to handle glass, PET, and carton formats while maintaining hygiene standards and product stability. The alcoholic beverages market accounts for 15%, as breweries, distilleries, and wineries deploy advanced bottling and packaging lines for spirits, beer, and wine, emphasizing precision, speed, and aesthetic presentation.

The dairy and plant-based beverage segment holds a 15% share, driven by milk, yogurt drinks, and alternative beverages requiring specialized filling, sealing, and sterilization systems to ensure shelf life and safety. Finally, the retail and e-commerce distribution market represents 10%, supporting availability, supply chain efficiency, and market penetration for packaged beverages across supermarkets, convenience stores, and online platforms. Collectively, soft drinks, juice, and alcoholic beverage production account for 75% of overall demand, underscoring that large-scale production, packaging efficiency, and product variety remain the primary growth drivers, while dairy, plant-based beverages, and distribution channels provide complementary growth opportunities worldwide.

The beverage packaging machine market is experiencing sustained expansion driven by increasing demand for high efficiency production lines, evolving consumer preferences, and the rapid diversification of beverage product portfolios. Growing emphasis on packaging innovation to enhance product shelf life, maintain quality, and support sustainability objectives has accelerated machine upgrades across manufacturing facilities.

Integration of energy efficient components, improved automation capabilities, and adaptable configurations for varied packaging formats are reshaping operational strategies. Regulatory standards for hygiene, safety, and labeling have further encouraged investments in modernized equipment.

With the beverage industry expanding into functional drinks, craft beverages, and ready to drink categories, packaging machinery is evolving to provide greater flexibility, precision, and speed. The market outlook remains favorable as producers continue to align packaging technologies with brand differentiation, sustainability goals, and cost optimization initiatives.

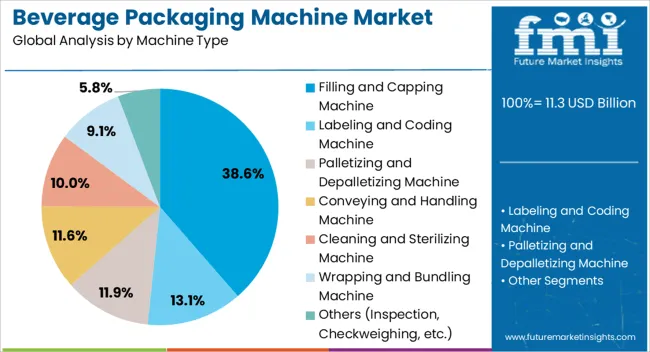

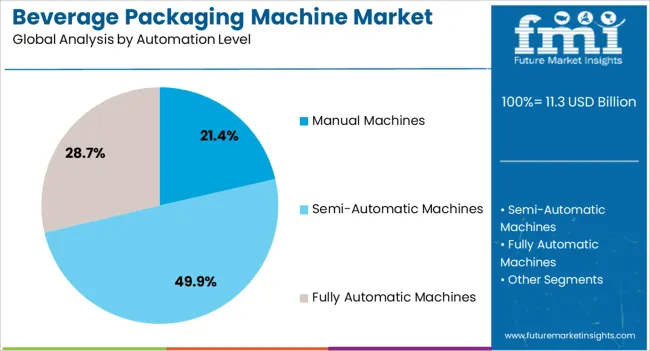

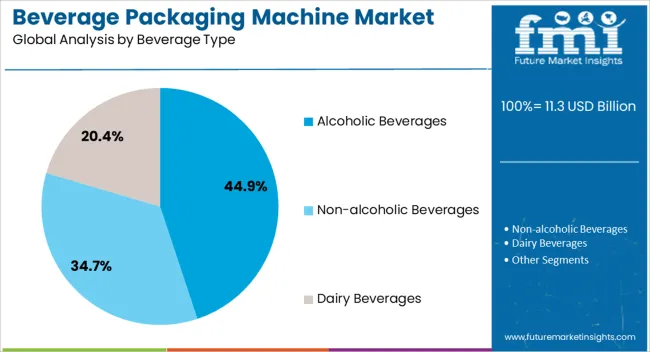

The beverage packaging machine market is segmented by machine type, automation level, beverage type, packaging format, packaging material, distribution channel, and geographic regions. By machine type, beverage packaging machine market is divided into filling and capping machine, labeling and coding machine, palletizing and depalletizing machine, conveying and handling machine, cleaning and sterilizing machine, wrapping and bundling machine, and others (inspection, checkweighing, etc.). In terms of automation level, beverage packaging machine market is classified into manual machines, semi-automatic machines, and fully automatic machines. Based on beverage type, beverage packaging machine market is segmented into alcoholic beverages, non-alcoholic beverages, and dairy beverages. By packaging format, beverage packaging machine market is segmented into bottles, cans, cartons, containers, and others (pouches, etc.). By packaging material, beverage packaging machine market is segmented into glass, metal, paperboard, plastic, and others (biodegradable material, etc.). By distribution channel, beverage packaging machine market is segmented into direct sales and indirect sales. Regionally, the beverage packaging machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The filling and capping machine type segment holds 38.6% of total revenue in 2025 within the machine type category, making it the most significant segment. This leadership is attributed to its ability to deliver high throughput, precise filling volumes, and secure sealing across a range of beverage formats.

Its adaptability to handle both carbonated and non carbonated beverages while maintaining hygiene standards has reinforced its adoption. Reduced downtime through quick changeover features and compatibility with automated inspection systems have further increased its operational value.

As beverage producers aim for speed, accuracy, and product integrity, filling and capping machines remain a preferred choice for large and medium scale production facilities.

The semi-automatic machines segment accounts for 49.9% of total revenue in 2025 within the automation level category, establishing itself as the largest contributor to the market. Its prominence is attributed to the balance it offers between operational efficiency and cost-effectiveness, making it highly attractive to mid-sized beverage producers and expanding enterprises.

Semi-automatic machines are preferred for their ability to deliver higher throughput than manual systems while still allowing operator control for adjustments, ensuring consistency and quality in production.

Their adoption is further supported by the growing demand for moderate-scale production lines, particularly in emerging markets where investment in fully automated systems may be premature. This positions semi-automatic machines as a reliable and scalable solution in the global beverage machinery landscape.

The alcoholic beverages segment represents 44.9% of total revenue in 2025 within the beverage type category, positioning it as the largest segment. This dominance is driven by the rising global consumption of beer, wine, spirits, and craft alcoholic products, coupled with increasing premiumization trends.

The demand for packaging that preserves flavor, ensures safety, and enhances visual appeal has fueled investments in advanced packaging machinery. Growing export volumes and brand competition in the alcoholic sector have further heightened the need for efficient bottling, labeling, and sealing technologies.

With evolving consumer tastes and expanding distribution networks, packaging machines tailored for alcoholic beverages continue to command a leading share in the market.

Beverage packaging machine growth is primarily driven by bottled water, soft drinks, and alcoholic beverage production, with retail expansion and e-commerce further supporting adoption. Modular, flexible, and automated machinery ensures efficiency and market responsiveness globally.

The beverage packaging machine market is witnessing significant growth due to increasing demand for bottled water, flavored water, and functional beverages. Manufacturers are investing in high-speed filling and capping machines to meet production efficiency and hygiene standards. Seasonal peaks in consumption, particularly during summer months, drive short-term demand fluctuations and capital expenditure cycles.

Flexible packaging solutions are being adopted to accommodate different bottle sizes, materials, and designs, enabling brand differentiation. E-commerce and retail expansion further amplify the need for efficient packaging lines to ensure timely delivery. Investment in modular, automated machinery helps producers manage production volumes and reduce operational downtime, supporting both small-scale and large-scale beverage manufacturers worldwide.

Soft drinks, fruit juices, and ready-to-drink teas contribute substantially to beverage packaging machine adoption. Manufacturers prioritize machines capable of handling multiple container formats, including glass, PET, and cartons, while maintaining product integrity. Multi-lane filling lines, automated labeling, and quality inspection systems are increasingly deployed to improve throughput and reduce labor dependency.

Rising health and flavor-conscious consumer trends are encouraging beverage producers to diversify SKUs, prompting frequent line changeovers and machine flexibility. Cold chain integration and sterilization requirements for juice products necessitate specialized filling and sealing equipment. Regional beverage consumption trends, coupled with increased private-label production, drive consistent adoption of advanced packaging machinery across emerging and developed markets.

The alcoholic beverage sector, including beer, wine, and spirits, is a key driver for beverage packaging machines. Breweries and distilleries are investing in automated bottling and packaging lines to meet volume requirements and ensure product quality. Labeling precision, bottle capping, and tamper-evident sealing are critical for branding and regulatory compliance.

Seasonal festivals and premium product launches contribute to short-term revenue peaks, impacting machinery demand. Packaging machines capable of handling diverse container shapes, materials, and sizes support innovation in product presentation. Small craft producers and large-scale manufacturers alike are adopting modular systems to manage production efficiency, optimize labor, and minimize downtime in a competitive alcoholic beverage landscape.

Retail growth, modern trade expansion, and e-commerce penetration are shaping beverage packaging machine demand. Supermarkets, convenience stores, and online platforms require packaged beverages in diverse formats and attractive presentation. Demand for compact, high-speed, and hygienic filling machines has risen to ensure consistent product supply, reduce wastage, and maintain shelf-ready packaging.

OEMs focus on modular and automated solutions to adjust to seasonal demand fluctuations and emerging product variants. Regional beverage consumption patterns, logistics requirements, and export-oriented packaging further drive adoption. Manufacturers are integrating flexible labeling, inspection, and capping systems to comply with international standards and retailer specifications, facilitating faster product rollout and broader market reach.

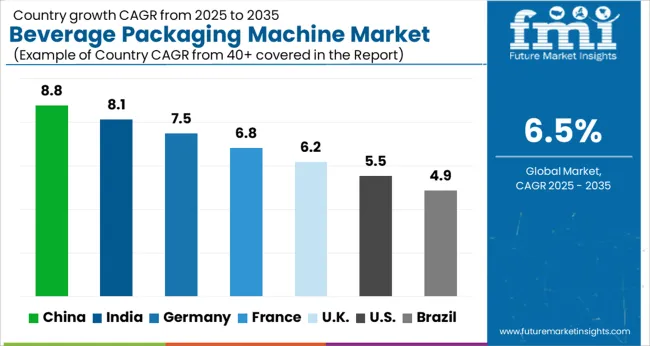

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global beverage packaging machine market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads the market with 8.8%, followed by India at 8.1%, Germany at 7.5%, the UK at 6.2%, and the USA at 5.5%. Growth is driven by rising demand for bottled water, soft drinks, juices, and ready-to-drink beverages, coupled with increasing retail and e-commerce penetration. BRICS nations, particularly China and India, show rapid adoption due to expanding beverage manufacturing, rising disposable incomes, and consumer preference for packaged drinks. OECD countries, including Germany, the UK, and the USA, emphasize high-speed, flexible, and hygienic packaging systems to meet quality, efficiency, and regulatory requirements. The analysis spans over 40+ countries, with the leading markets detailed below.

The beverage packaging machine market in China is projected to expand at a CAGR of 8.8% from 2025 to 2035, driven by the rapid growth of bottled water, juices, soft drinks, and ready-to-drink beverages. Increasing production volumes in both domestic and international beverage companies are encouraging adoption of automated, high-speed, and flexible filling, capping, and labeling machines. E-commerce growth and modern retail formats are boosting demand for packaged beverages, while stringent hygiene and safety regulations compel manufacturers to deploy advanced packaging solutions.

Domestic machine makers are focusing on modular designs, energy efficiency, and integration with digital monitoring systems. Cross-industry collaborations, including beverage OEMs and technology suppliers, enable optimized production lines for cost efficiency, reduced downtime, and consistent quality.

India’s beverage packaging machine market is expected to grow at a CAGR of 8.1% between 2025 and 2035, supported by rising disposable income, rapid expansion of soft drink and packaged juice industries, and growing penetration of bottled water in urban and semi-urban regions. Beverage manufacturers are investing in high-speed filling, labeling, and capping solutions to meet increasing production demands while maintaining hygiene standards.

Local OEMs are providing cost-efficient, versatile, and modular equipment tailored for small and large-scale operations. Growth is further fueled by organized retail chains, convenience stores, and e-commerce platforms improving accessibility of packaged beverages. Demand from hotels, restaurants, and institutional buyers contributes to larger adoption. Government initiatives supporting Make-in-India and food safety compliance enhance overall market expansion.

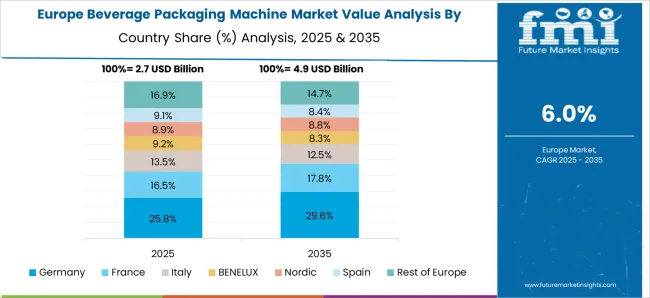

The beverage packaging machine market in Germany is projected to expand at a CAGR of 7.5% from 2025 to 2035, driven by a mature beverage industry emphasizing high-quality beer, soft drinks, and juices. Manufacturers are prioritizing automated, hygienic, and energy-efficient solutions to meet stringent European safety and environmental regulations. Flexible machines capable of handling multiple bottle types, sizes, and formats are gaining adoption in both craft and industrial beverage production.

Domestic and international players focus on smart machine integration, predictive maintenance, and production line optimization to improve efficiency and minimize downtime. E-commerce, specialty beverage stores, and institutional procurement influence adoption trends, while collaborations with suppliers enable customized packaging solutions. Growing consumer preference for sustainable, recyclable packaging further shapes equipment requirements.

The UK beverage packaging machine market is expected to grow at a CAGR of 6.2% from 2025 to 2035, fueled by demand for packaged soft drinks, juices, and bottled water. Beverage manufacturers focus on compact, flexible, and hygienic packaging equipment that aligns with changing production line demands. Integration of digital monitoring, predictive maintenance, and modular designs enables manufacturers to reduce downtime and improve productivity.

Retail expansion, convenience stores, and online beverage delivery platforms are influencing demand for faster and more versatile packaging lines. Domestic and multinational machine suppliers are developing energy-efficient solutions that comply with local safety and environmental standards. Institutional buyers, including cafes, restaurants, and catering services, further drive adoption.

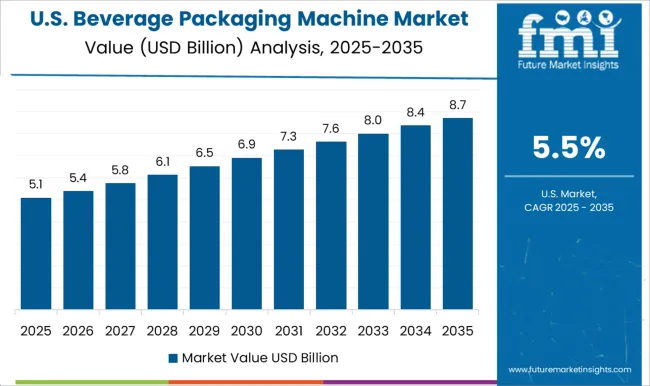

The USA beverage packaging machine market is projected to expand at a CAGR of 5.5% from 2025 to 2035, driven by bottled water, carbonated soft drinks, juices, and energy beverages. Beverage producers emphasize automated, high-capacity, and hygienic machines to ensure production efficiency and compliance with FDA and ISO standards. Flexible equipment that accommodates multiple container types, volumes, and labeling formats is gaining preference.

Growth is supported by modern retail expansion, e-commerce, and direct-to-consumer beverage delivery models. Domestic machine manufacturers and global suppliers focus on energy efficiency, reduced water usage, and predictive maintenance to optimize operations. Institutional demand from hotels, restaurants, and foodservice providers further contributes to market adoption, while collaborations with beverage brands enable customized production solutions.

Competition in the beverage packaging machine market is defined by automation efficiency, versatility, and compliance with hygiene standards. APACKS (Automated Packaging Systems) leads with fully integrated filling, capping, and labeling systems for beverages, emphasizing modular designs, high-speed performance, and ease of maintenance. Barry-Wehmiller Companies focuses on turnkey packaging solutions for bottled water, soft drinks, and juices, highlighting energy-efficient machines and digital process monitoring.

Coesia and Douglas Machine compete through flexible, automated systems optimized for small to large-scale production, ensuring rapid changeovers and minimal downtime. EconoCorp and Jacob White Packaging Ltd. differentiate through cost-effective, scalable solutions tailored for niche beverage segments and regional operations. Global and European players such as GEA Group, KHS Group, Krones AG, Serac Group, Sidel Group, and Tetra Pak International emphasize advanced automation, hygienic design, and regulatory compliance, targeting high-volume production for multinational beverage brands. ProMach and Sealed Air Corporation compete by offering modular and integrated systems for filling, sealing, and labeling, supported by predictive maintenance, energy efficiency, and remote monitoring. Strategies focus on reducing operational costs, improving line efficiency, and supporting multiple container types including PET, glass, and cans.

Product brochures are detailed, highlighting machine capacity, speed, filling accuracy, and cleaning protocols. Specifications include container size compatibility, capping torque, labeling precision, and compliance with FDA, ISO, and EHEDG standards. Energy and water efficiency, integration with conveyor and automation systems, and maintenance schedules are emphasized. Accessories, spare parts, and service agreements are detailed to ensure long-term operational reliability. Marketing emphasizes modularity, hygienic performance, and scalability for beverage producers of all sizes.

Emerging regional and mid-sized players leverage custom solutions, rapid installation, and flexible financing models to penetrate local markets. Collaborative initiatives with beverage brands, co-packers, and technology partners ensure tailored machine configurations, supporting diverse production requirements. The focus on digital integration, smart monitoring, and automation optimization underlines the competitive edge in a market increasingly driven by efficiency, compliance, and scalability.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.3 billion |

| Machine Type | Filling and Capping Machine, Labeling and Coding Machine, Palletizing and Depalletizing Machine, Conveying and Handling Machine, Cleaning and Sterilizing Machine, Wrapping and Bundling Machine, and Others (Inspection, Checkweighing, etc.) |

| Automation Level | Manual Machines, Semi-Automatic Machines, and Fully Automatic Machines |

| Beverage Type | Alcoholic Beverages, Non-alcoholic Beverages, and Dairy Beverages |

| Packaging Format | Bottles, Cans, Cartons, Containers, and Others (Pouches, etc.) |

| Packaging Material | Glass, Metal, Paperboard, Plastic, and Others (Biodegradable material, etc.) |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | APACKS (Automated Packaging Systems), Barry-Wehmiller Companies, Coesia, Douglas Machine, EconoCorp, GEA Group, Industria Macchine Automatiche, Jacob White Packaging Ltd., KHS Group, Krones AG, ProMach, Sealed Air Corporation, Serac Group, Sidel Group, and Tetra Pak International |

| Additional Attributes | Dollar sales, share by region and end-use (water, soft drinks, juices, dairy), adoption of automated and modular systems, demand for high-speed filling/capping, regulatory compliance, and emerging market opportunities. |

The global beverage packaging machine market is estimated to be valued at USD 11.3 billion in 2025.

The market size for the beverage packaging machine market is projected to reach USD 21.2 billion by 2035.

The beverage packaging machine market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in beverage packaging machine market are filling and capping machine, labeling and coding machine, palletizing and depalletizing machine, conveying and handling machine, cleaning and sterilizing machine, wrapping and bundling machine and others (inspection, checkweighing, etc.).

In terms of automation level, manual machines segment to command 21.4% share in the beverage packaging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultra Clean Beverage Packaging Machine Market Analysis Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Beverage Flavoring Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA