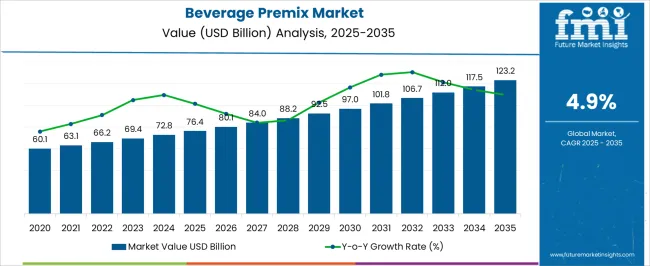

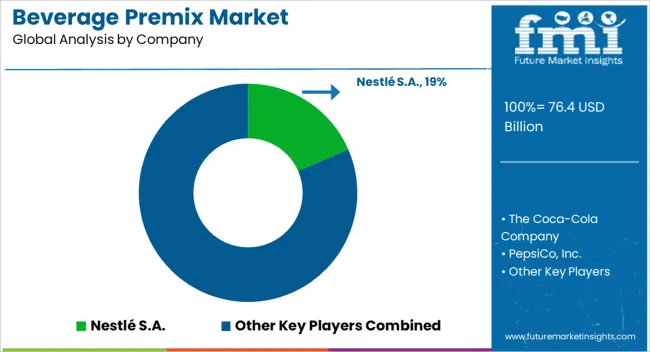

The beverage premix market is estimated to be valued at USD 76.4 billion in 2025 and is projected to reach USD 123.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

Between 2025 and 2030, the market grows from USD 76.4 billion to USD 97.0 billion, contributing USD 20.6 billion in growth, with a CAGR of 5.1%. This phase reflects increased demand for convenience beverages, driven by busy lifestyles, rising health awareness, and the growing popularity of ready-to-drink (RTD) products. Consumers are increasingly opting for premixed beverages that offer convenience, variety, and nutritional benefits, particularly in coffee, tea, and health-focused drinks.

From 2030 to 2035, the market continues to grow from USD 97.0 billion to USD 123.2 billion, contributing USD 26.2 billion in growth, with a slightly lower CAGR of 4.6%. This deceleration is indicative of the market maturing as the demand stabilizes, but growth remains strong due to innovations in product offerings, such as organic and functional beverage premixes. The increasing adoption of beverage premixes in emerging markets further drives expansion. The 5-year growth block analysis highlights a strong early-phase surge, followed by stable growth, as the beverage premix market continues to evolve with changing consumer preferences.

| Metric | Value |

|---|---|

| Beverage Premix Market Estimated Value in (2025 E) | USD 76.4 billion |

| Beverage Premix Market Forecast Value in (2035 F) | USD 123.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The beverage premix market is witnessing strong growth, driven by increasing consumer demand for convenience, consistency, and on-the-go beverage solutions. The current landscape is shaped by a rising preference for instant beverages, influenced by busy lifestyles and a growing focus on premium taste experiences. Technological advancements in processing and packaging have improved the shelf life and quality of premix products, further strengthening their market presence.

Consumer awareness of health, nutrition, and functional ingredients is encouraging manufacturers to innovate within the category while maintaining ease of use and flavor integrity. Press releases and investor communications have highlighted significant investments in ready-to-consume beverage lines by food and beverage giants, indicating long-term confidence in this space.

Furthermore, commercial sectors such as offices, airlines, and hospitality chains are driving institutional demand for premixes, contributing to overall volume growth These evolving dynamics, alongside global urbanization and rising disposable income levels, are paving the way for continued expansion of the Beverage Premix market.

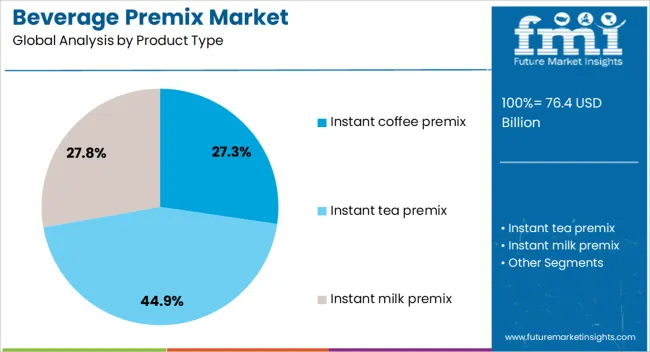

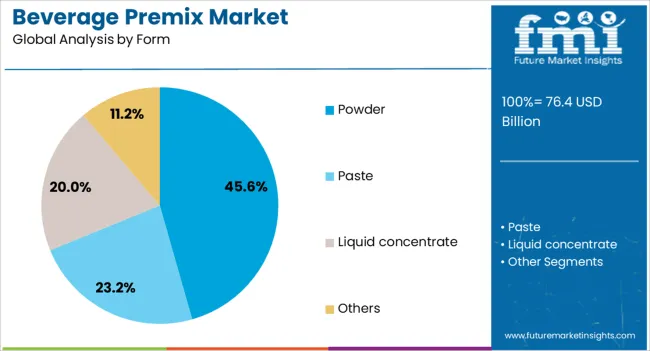

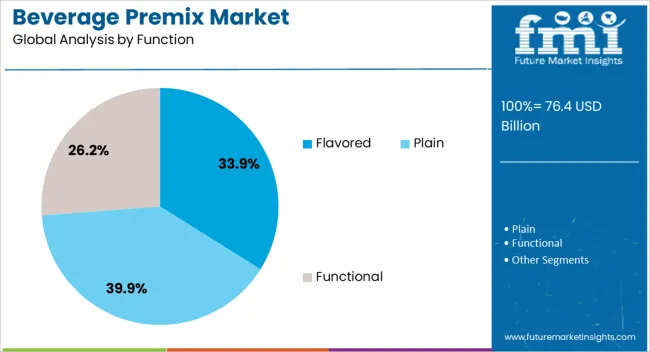

The beverage premix market is segmented by product type, form, functiondistribution channel, and geographic regions. By product type, the market is divided into instant coffee premix, instant tea premix, instant milk premix, health drink premix, alcoholic beverage premix, soft drink premix, and others. In terms of form, the market is classified into powder, paste, liquid concentrate, and others. Based on function, the market is segmented into flavored, plain, functional, and fortified. By distribution channel, the market is segmented into business-to-business and business-to-consumer b2c. Regionally, the beverage premix industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The instant coffee premix segment is projected to hold 27.3% of the market revenue share in 2025, positioning it as the leading product type. This segment’s dominance has been supported by the increasing consumer inclination toward convenient coffee solutions without compromising on taste. Preference for instant coffee formats has grown across working professionals, students, and travelers, primarily due to minimal preparation time and consistent quality.

The availability of diverse blends and flavors, often modeled after café-style experiences, has also contributed to its rising popularity. Additionally, the expansion of vending machine installations in corporate and institutional settings has boosted the demand for instant coffee premix.

Industry announcements and product development news confirm that manufacturers are investing in enhanced aroma retention, improved granulation techniques, and sustainable sourcing, all of which have further solidified the position of this segment These combined factors have played a critical role in the segment’s expected leadership within the overall product type category.

The powder form segment is anticipated to lead the market with a 45.6% revenue share in 2025. This form’s preference has been attributed to its long shelf life, ease of storage, and efficient packaging, making it suitable for both personal and institutional consumption. Manufacturers have increasingly leaned into powdered formulations due to their compatibility with a wide range of beverage types, including coffee, tea, nutritional drinks, and flavored water.

The simplicity of mixing and consistent solubility in various liquid bases have made this form highly acceptable across different consumer demographics. Market expansion has also been driven by the scalability of powdered premix production, as it aligns with bulk distribution needs and supports cost-efficient supply chains.

Announcements from food and beverage firms suggest a strong focus on portion-controlled sachets, eco-friendly packs, and improved ingredient stability These attributes have helped powder formulations maintain their dominant position in the Beverage Premix market in 2025.

The flavored function segment is expected to hold 33.9% of the market revenue share in 2025, reflecting its position as the leading function-based subsegment. This growth has been supported by shifting consumer preferences toward taste-forward wellness and indulgence options. Beverage manufacturers have focused on enhancing flavor profiles using natural extracts, botanical infusions, and fruit blends to cater to diverse palates while ensuring functionality.

The demand for flavored premixes has grown substantially in urban regions where consumers seek premium and customizable beverage experiences at home and on-the-go. The segment’s expansion has also been influenced by its relevance across categories including iced teas, flavored coffees, energy drinks, and fruit-based premixes.

Product innovations showcased in brand press communications highlight sustained investments in flavor differentiation and clean label claims These strategic initiatives have made flavored beverage premixes a preferred choice, ensuring this segment’s leading role in the overall market by 2025.

The beverage premix market is growing as consumers increasingly seek convenient and ready-to-use solutions for drinks across the foodservice, retail, and home consumption sectors. Premixes, which include powders, concentrates, and liquid form products, are used in a wide variety of beverages, including coffee, tea, energy drinks, and nutritional shakes. The demand is rising due to the busy lifestyles of consumers who prefer time-saving, high-quality, and customizable drink options. Innovations in flavor profiles and packaging are contributing to market growth. Challenges like maintaining taste consistency and addressing packaging concerns persist in the sector.

The growth of the beverage premix market is primarily driven by the rising demand for convenience and customization in consumer food and drink consumption. With busy lifestyles, many consumers seek quick and easy solutions that provide high-quality, ready-to-drink beverages without the need for complex preparation. Premixes allow for consistency in taste and convenience, which is a key factor in the market’s growth. Additionally, as more people are shifting towards personalized and specialty drinks such as gourmet coffee, fitness shakes, and energy drinks, beverage premixes offer a quick and affordable way to cater to these preferences. Moreover, the expansion of foodservice outlets and retail channels offering ready-to-make beverages is further propelling market demand.

A significant challenge for the beverage premix market is maintaining taste consistency across batches. As the market grows, ensuring that the flavor profile and quality remain consistent in every product becomes increasingly complex, particularly for mass-produced premixes. This can be difficult when dealing with natural ingredients, which may have variability in flavor or texture. Furthermore, packaging costs are rising due to the need for moisture-resistant, airtight, and durable packaging that ensures the product’s shelf life and quality. Developing cost-effective, yet high-quality packaging solutions that can maintain product integrity without increasing overall costs is a challenge for manufacturers in the beverage premix market. These factors can impact profitability and scalability, especially for smaller brands.

The beverage premix market presents significant opportunities for product diversification and expansion into emerging markets. Manufacturers can innovate by offering a broader range of flavors, functional beverages (such as energy-boosting, detox, or vitamin-enriched drinks), and options for dietary preferences such as gluten-free, sugar-free, or organic premixes. This diversification caters to the growing demand for healthy and specialty drinks. Furthermore, emerging markets in Asia-Pacific, Latin America, and Africa represent untapped opportunities. With rising disposable incomes and increasing interest in Western beverage trends, these regions provide substantial growth potential for beverage premix manufacturers. The increasing number of urban consumers in these markets looking for convenient, affordable, and high-quality drink options opens new avenues for market penetration.

A significant trend in the beverage premix market is the growth of ready-to-drink (RTD) beverages and the shift towards e-commerce sales. With the increasing preference for on-the-go convenience, RTD beverages have gained popularity, especially in categories such as iced coffee, tea, and energy drinks. Beverage premixes are often the backbone of RTD drinks, allowing for quick production and consistent quality. The rise of e-commerce platforms is also revolutionizing the market, providing consumers with easy access to a wide variety of premixes delivered directly to their doorstep. The growing role of digital marketing and direct-to-consumer sales channels is creating more opportunities for beverage premix manufacturers to reach global consumers and cater to niche beverage trends. These trends are shaping the future of the beverage premix market, promoting product innovation and convenience.

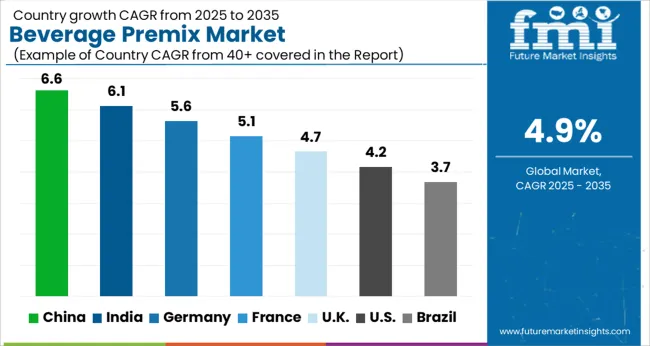

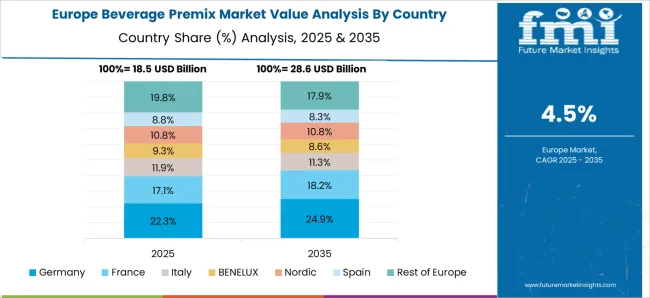

The beverage premix market is projected to grow at a global CAGR of 4.9% from 2025 to 2035. China leads the market with a growth rate of 6.6%, followed by India at 6.1%, and France at 5.1%. The United Kingdom is expected to grow at 4.7%, while the United States shows a growth rate of 4.2%. The demand for beverage premixes is increasing, driven by the rising consumption of ready-to-drink beverages in both emerging and developed markets. Growth in the food service industry and the increasing demand for convenient, easy-to-make beverages are the key factors driving this market. Advancements in product formulations and a growing focus on product convenience continue to propel market growth. The market's expansion is further supported by increasing consumer preference for diverse beverage options, including functional and flavored beverages. The analysis spans over 40 countries, with the leading markets shown below.

China is expected to grow at a 6.6% CAGR through 2035, driven by the booming beverage industry. The increasing demand for ready-to-drink beverages, particularly in urban areas, is a key factor contributing to the rise in beverage premix consumption. With a growing middle-class population and changing consumer preferences towards more convenient beverage options, China is witnessing a significant shift toward beverage premixes. The rapid growth of the foodservice industry in China is boosting the demand for beverage premixes in cafes, restaurants, and hotels. Local manufacturers are innovating with new flavors and formulations, further accelerating the market's growth.

India is projected to grow at a 6.1% CAGR through 2035, with the increasing popularity of ready-to-drink beverages. Beverage premixes are becoming more popular due to their convenience, especially in urban areas. The rising number of working professionals, along with busy lifestyles, has led to an increased demand for instant beverage options. The expansion of organized retail channels and growing café culture further drives the adoption of beverage premixes. The Indian food service industry is rapidly growing, contributing to the increased consumption of ready-to-drink beverages in various outlets. The growing trend toward functional beverages is also expected to fuel demand.

France is expected to grow at a 5.1% CAGR through 2035, driven by the rising demand for convenient and on-the-go beverage solutions. The popularity of coffee, tea, and flavored drinks is driving the growth of beverage premixes in both retail and foodservice channels. The changing consumer preference for premium, functional, and ready-to-consume beverages is accelerating market demand. The French market is seeing an increasing shift toward plant-based and organic beverage premixes. Innovations in flavors and formulations are also contributing to the expansion of the beverage premix market.

The United Kingdom is projected to grow at a 4.7% CAGR through 2035, with increasing consumer demand for convenient beverage options. Ready-to-drink coffee and tea beverages are becoming more popular in the UK, driving the demand for beverage premixes. The UK’s growing trend toward health-conscious and functional beverages also supports the market, as consumers look for easy-to-make options with added nutritional benefits. The growth of the coffee culture, particularly in cafés and restaurants, further contributes to the expansion of beverage premixes in the foodservice industry.

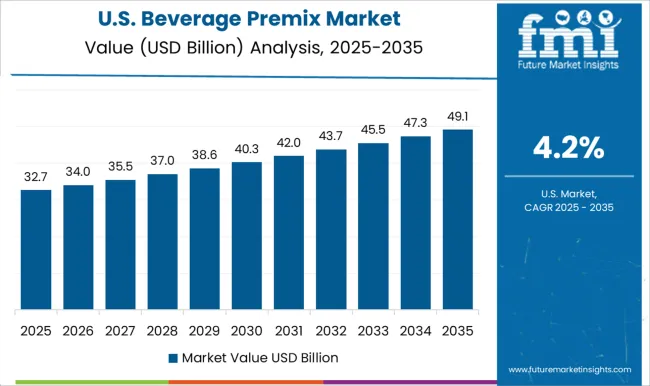

The United States is projected to grow at a 4.2% CAGR through 2035, with strong demand for beverage premixes across various sectors. Convenience and portability are key factors driving the demand for ready-to-drink beverages, including coffee, tea, and health-focused drinks. As consumers seek quick, on-the-go solutions, the USA market continues to see growth in beverage premixes. The USA foodservice sector is expanding, contributing to the increasing demand for instant beverage solutions in cafés, restaurants, and hotels. The trend toward functional beverages further propels the market’s expansion.

The beverage premix market is driven by major players offering ready-to-mix solutions for a variety of beverages, including tea, coffee, fruit juices, and energy drinks, catering to the growing demand for convenience and customization in the food and beverage sector. Nestlé S.A. leads the market with its wide range of beverage premix products, including popular offerings such as Nescafé and Nesquik, catering to both retail and foodservice channels. The Coca-Cola Company and PepsiCo, Inc. dominate the market with their ready-to-mix beverage solutions, particularly in the flavored drink and energy drink segments, with an emphasis on global distribution and consumer loyalty. Starbucks Corporation and Keurig Dr Pepper Inc. focus on premium coffee premixes and single-serve coffee machines, targeting consumers looking for high-quality beverages at home or in the office.

Unilever PLC offers a diverse range of beverage premixes, including tea and coffee solutions, under well-known brands like Lipton and PG Tips, with a focus on natural ingredients and sustainability. Ajinomoto Co., Inc. and Monster Beverage Corporation provide beverage premix solutions for both health-conscious consumers and energy drink enthusiasts, offering products with added nutrients, vitamins, and functional ingredients. Suntory Holdings Limited and Tata Consumer Products Limited offer ready-to-mix beverages, including fruit juices and health-oriented drinks, targeting the growing demand for functional and convenience products. Kraft Heinz Company and Mondelēz International, Inc. provide ready-to-drink beverage mixes, focusing on flavor and nutritional content. Danone S.A., Associated British Foods plc, and Kerry Group plc offer a range of healthy beverage premixes, including yogurt-based drinks and functional beverage powders. In addition, Ito En, Ltd., Diageo plc, and Bacardi Limited offer alcoholic and non-alcoholic beverage premixes, catering to the demand for convenience in alcoholic beverages. Pernod Ricard and Red Bull GmbH provide energy drink premixes and mixers, offering solutions for both consumers and bars/restaurants.

DSM-Firmenich AG, Givaudan SA, and International Flavors & Fragrances Inc. supply flavor ingredients for beverage premixes, working closely with beverage manufacturers to develop new and innovative flavor profiles. Symrise AG, Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, and Tate & Lyle PLC provide essential ingredients such as sweeteners, stabilizers, and emulsifiers, contributing to the functionality and taste of beverage premixes. Nitin's Premixes and Veebha Beverages Private Limited are regional players offering competitive beverage premix products tailored to local tastes and preferences, focusing on niche markets and customized solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 76.4 Billion |

| Product Type | Instant coffee premix, Instant tea premix, Instant milk premix, Health drink premix, Alcoholic beverage premix, Soft drink premix, and Others |

| Form | Powder, Paste, Liquid concentrate, and Others |

| Function | Flavored, Plain, Functional, and Fortified |

| Distribution Channel | Business-to-business and Business-to-consumer b2c |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., The Coca-Cola Company, PepsiCo, Inc., Starbucks Corporation, Keurig Dr Pepper Inc., Unilever PLC, Ajinomoto Co., Inc., Monster Beverage Corporation, Suntory Holdings Limited, Tata Consumer Products Limited, Kraft Heinz Company, Mondelēz International, Inc., Danone S.A., Associated British Foods plc, Kerry Group plc, Ito En, Ltd., Diageo plc, Bacardi Limited, Pernod Ricard, Red Bull GmbH, DSM-Firmenich AG, Givaudan SA, International Flavors & Fragrances Inc., Symrise AG, Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Nitin's Premixes, and Veebha Beverages Private Limited |

| Additional Attributes | Dollar sales by product type (coffee premixes, tea premixes, energy drink premixes, juice premixes, health drinks, alcoholic drink premixes) and end-use segments (retail, foodservice, hospitality). Demand dynamics are influenced by the increasing demand for convenient and ready-to-mix beverages, the rise in health-conscious consumers seeking functional beverages, and the growing preference for premium and sustainable products. Regional trends show strong growth in North America and Europe due to high demand for premium coffee and tea solutions, while Asia-Pacific is expanding rapidly due to rising disposable incomes and growing interest in health-focused drinks. |

The global beverage premix market is estimated to be valued at USD 76.4 billion in 2025.

The market size for the beverage premix market is projected to reach USD 123.2 billion by 2035.

The beverage premix market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in beverage premix market are instant coffee premix, _regular coffee, _flavored coffee, _specialty coffee, _others, instant tea premix, _black tea, _green tea, _herbal tea, _flavored tea, _others, instant milk premix, _plain milk, _flavored milk, _dairy alternatives, _others, health drink premix, _protein drinks, _energy drinks, _functional beverages, _nutritional supplements, _others, alcoholic beverage premix, _cocktail mixes, _wine mixes, _spirit-based mixes, _others, soft drink premix, _carbonated drink mixes, _fruit-based drink mixes, _sports and energy drink mixes, _others and others.

In terms of form, powder segment to command 45.6% share in the beverage premix market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA