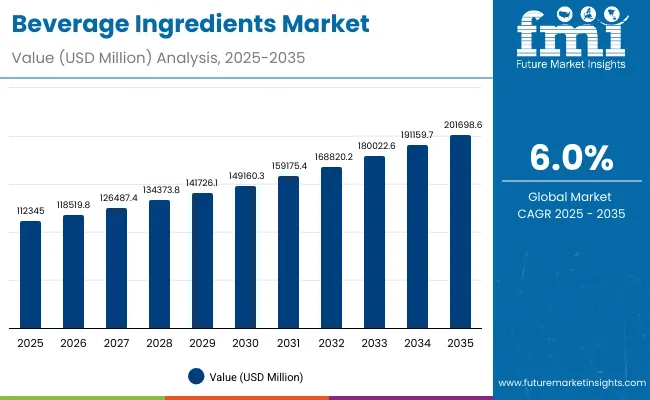

The Beverage Ingredients Market is expected to record a valuation of USD 112,345.0 million in 2025 and USD 201,698.6 million in 2035, with an increase of USD 89,353.6 million, which equals a growth of nearly 1.8X over the decade. The overall expansion represents a CAGR of 6.0% and a strong double-digit increase in incremental revenues across regions.

Beverage Ingredients Market Key Takeaways

| Metric | Value |

|---|---|

| Beverage Ingredients Market Estimated Value in (2025E) | USD 112,345.0 million |

| Beverage Ingredients Market Forecast Value in (2035F) | USD 201,698.6 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 112,345.0 million to USD 149,160.3 million , adding over USD 36,815.3 million , which accounts for around 41% of the total decade growth. This phase records steady adoption in functional beverages, RTD formulations, and dairy & plant-based alternatives, driven by the need for better nutrition, clean label ingredients, and natural formulations. Functional ingredients dominate this period as they cater to over 28% of beverage innovations, especially in energy drinks, nutraceutical shots, and protein-rich dairy alternatives. The rise of plant-based proteins, prebiotic fibers, and adaptogens strengthens the positioning of functional beverages as lifestyle-oriented solutions.

The second half from 2030 to 2035 contributes USD 52,538.3 million , equal to 59% of total growth, as the market jumps from USD 149,160.3 million to USD 201,698.6 million. This acceleration is powered by widespread deployment of fermentation-derived ingredients, probiotics, and nootropics, alongside the scaling of digital health-linked beverages such as personalized hydration solutions and functional water.

Fermentation-derived ingredients and natural extracts together capture a larger share above 22% by the end of the decade. Functional beverages consolidate leadership, while enhanced water and nutraceutical shots witness faster CAGR growth (6.2%-6.8%), adding recurring value streams. The growing consumer shift toward plant-based, sustainable, and gut-health-focused beverages fuels higher investments by global players, increasing R&D intensity and product launches.

From 2020 to 2024, the Beverage Ingredients Market grew steadily on the back of rising demand for sweeteners, acidulants, and preservatives, particularly in the soft drinks and RTD categories. During this period, the competitive landscape was dominated by large flavor and ingredient manufacturers controlling nearly 70% of revenue, with leaders such as Givaudan, Kerry Group, and ADM focusing on flavors, botanicals, and specialty functional ingredients. Competitive differentiation relied heavily on natural sourcing, regulatory compliance, and innovation in flavor modulation, while categories such as probiotics and adaptogens were still in their early adoption phase. Service-linked formulations and co-creation with beverage manufacturers had minimal traction, contributing less than 15% of the total market value.

Demand for beverage ingredients will expand to USD 112,345.0 million in 2025, and the revenue mix will shift as functional ingredients, probiotics, and fermentation-derived inputs grow to over 44% share. Traditional leaders in flavors and sweeteners face rising competition from digital-first and niche players offering AI-driven flavor mapping, clean-label protein formulations, and bio-fermentation-derived actives.

Major multinational vendors are pivoting to sustainability-led models, integrating traceability, natural extraction technologies, and circular economy approaches to retain relevance. Emerging entrants specializing in plant-based proteins, gut health solutions, and nootropic formulations are gaining share. The competitive advantage is moving away from traditional sweeteners and preservatives alone to ecosystem strength, functional science backing, and consumer engagement capabilities.

Advances in functional science and clean-label innovation have improved the nutritional and sensory profile of beverages, allowing for more efficient adoption across diverse categories such as sports nutrition, dairy alternatives, and functional hydration. Functional ingredients including adaptogens, nootropics, and probiotics have gained strong popularity due to their suitability for enhancing mental focus, gut health, and stress relief. The rise of natural sweeteners such as stevia and monk fruit has contributed to reduced sugar positioning and mass consumer adoption. Industries such as energy drinks, nutraceutical shots, and RTD beverages are driving demand for ingredients that align with health-conscious and sustainability-driven lifestyles.

Expansion of fermentation-based ingredients, probiotics, and natural colorants has fueled market growth. Innovations in plant-based proteins, botanical extracts, and prebiotic fibers are expected to open new application areas across dairy alternatives, functional water, and tea-based beverages. Segment growth is expected to be led by functional ingredients (CAGR 6.2%), prebiotics & probiotics (CAGR 6.5%), and plant-based sources (CAGR 6.0%) due to their precision health appeal, adaptability, and alignment with wellness megatrends.

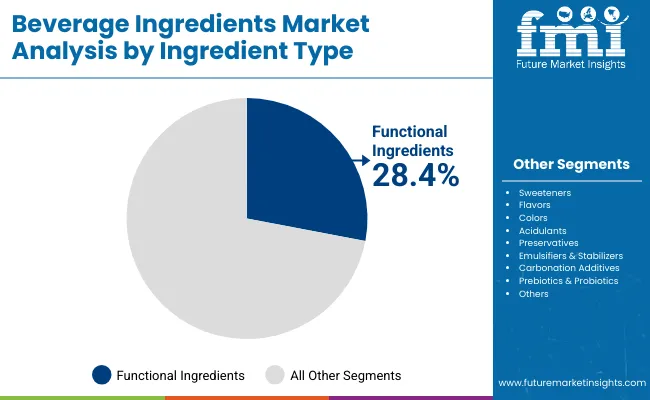

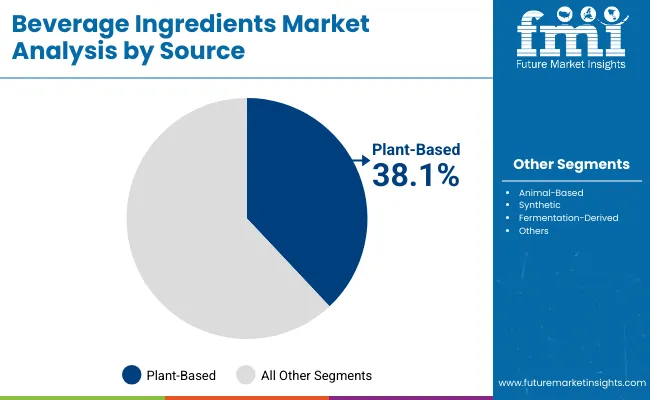

The Beverage Ingredients Market is segmented by ingredient type, source, application, and region. Ingredient types include sweeteners, flavors, colors, acidulants, preservatives, emulsifiers & stabilizers, functional ingredients, carbonation additives, and prebiotics & probiotics, highlighting the core elements driving adoption. Source classification covers plant-based, animal-based, synthetic, and fermentation-derived, catering to different nutritional and functional requirements.

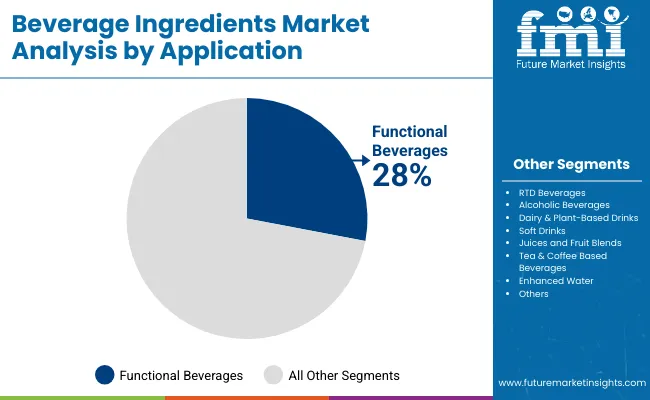

Based on application, the segmentation includes functional beverages, RTD beverages, alcoholic beverages, dairy & plant-based drinks, soft drinks, juices, tea & coffee-based beverages, and enhanced water. In terms of region, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, capturing diverse consumer demand across developed and emerging markets.

| Ingredient Type | Share (%) |

|---|---|

| Functional Ingredients | 28.4% |

| Others | 71.6% |

The functional ingredients segment is projected to contribute the largest share of the Beverage Ingredients Market in 2025, maintaining its lead as the dominant category. This growth is driven by ongoing demand for proteins, probiotics, adaptogens, nootropics, and electrolytes, which address critical consumer needs for energy, immunity, digestive health, and mental performance. Functional ingredients have become the cornerstone of beverage innovation, particularly in sports drinks, nutraceutical shots, energy beverages, and dairy alternatives, where they enable clear product differentiation.

The segment’s expansion is also supported by the development of science-backed formulations that appeal to health-conscious consumers. As beverages increasingly integrate botanicals and bioactive compounds, functional ingredients provide opportunities for cross-category innovation. With their versatility and alignment to wellness, performance, and preventive health, functional ingredients are expected to remain the backbone of beverage formulation strategies through 2035.

| Source Type | Share (%) |

|---|---|

| Plant-Based | 38.1% |

| Others | 61.9% |

The plant-based segment is forecasted to hold the largest share of the Beverage Ingredients Market in 2025, supported by its strong adoption across both mainstream and premium beverage categories. This is driven by consumer preference for natural, vegan, and clean-label products, which has accelerated the use of herbal extracts, botanical flavors, fruit juices, and natural colors.

Plant-based ingredients also play a pivotal role in the global protein transition, with consumers shifting from dairy to pea, soy, oat, and other botanical proteins in both functional and RTD beverages. Furthermore, natural sweeteners such as stevia and monk fruit are enabling sugar reduction without compromising taste, while natural colorants such as carotenoids and anthocyanins are helping brands remove synthetic dyes. As sustainability and traceability become critical to purchasing decisions, plant-based ingredients will continue to dominate, shaping the future of innovation across functional beverages, dairy alternatives, and enhanced waters.

| Application | Share (%) |

|---|---|

| Functional Beverages | 28.4% |

| Others | 71.6% |

The functional beverages segment is projected to hold the leading share of the Beverage Ingredients Market in 2025, establishing itself as the fastest-growing application. Growth is led by sports drinks, energy drinks, and nutraceutical shots, all of which are favored by consumers seeking performance, hydration, immunity, and convenience. Functional beverages are also gaining traction through enhanced waters, protein-rich dairy alternatives, and nootropic-infused drinks, creating new growth opportunities across both developed and emerging markets.

The segment’s expansion is further supported by the blurring of boundaries between nutrition and refreshment, with functional benefits increasingly being embedded into mainstream RTD and soft drink formulations. Innovations in adaptogen-infused drinks, probiotic beverages, and personalized nutrition solutions are reinforcing functional beverages as a premium yet accessible segment. With a CAGR of over 6.3%, functional beverages are expected to remain the driving force of beverage industry growth throughout the forecast period, setting the benchmark for innovation in health and wellness-focused drinks.

Shifting consumer preferences, regulatory pressures, and innovation in functional formulations are reshaping the Beverage Ingredients Market, even as the industry faces challenges around sourcing, formulation complexity, and high production costs. Demand is being fueled by the rise of functional, plant-based, and clean-label beverages, while hurdles persist in ensuring scalability, affordability, and compliance across regions. At the same time, digital tools, sustainability goals, and health-conscious lifestyles are creating new pathways for long-term market expansion.

Health & Wellness-Oriented Consumption

The Beverage Ingredients Market is witnessing strong growth driven by rising consumer demand for functional, clean-label, and health-focused beverages. Functional ingredients such as probiotics, proteins, adaptogens, and nootropics are increasingly being used in sports drinks, nutraceutical shots, and dairy alternatives. Consumers seek beverages that deliver not only refreshment but also tangible health benefits such as improved immunity, gut health, and mental clarity. This shift has encouraged manufacturers to reformulate with natural and plant-based ingredients, boosting innovation across categories from energy drinks to enhanced water.

Plant-Based and Natural Ingredient Expansion

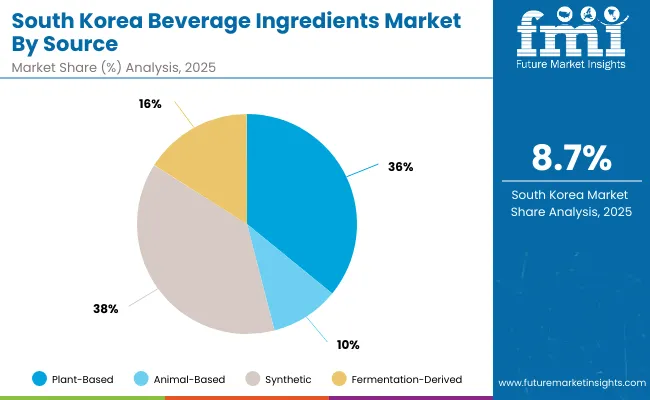

Plant-based beverages are leading growth, with 38% market share in 2025, as demand for natural extracts, botanical flavors, and vegan proteins accelerates. The shift from synthetic to natural colorants, sweeteners, and preservatives is creating new opportunities for ingredient suppliers. Consumers increasingly associate plant-based ingredients with sustainability, transparency, and wellness, making them central to both premium and mainstream beverage launches. This driver is reinforced by regulatory trends encouraging the reduction of artificial additives and added sugars.

High Production Costs and Supply Constraints

The reliance on natural, specialty, and fermentation-derived ingredients comes with higher production costs, impacting beverage manufacturers’ margins. Sourcing challenges for botanicals, natural sweeteners, and probiotics often lead to price volatility and supply instability. Smaller manufacturers face difficulties in scaling production due to the expense of specialized extraction, fermentation, and stabilization processes, which can limit broader adoption despite rising demand.

Regulatory Hurdles and Formulation Complexity

Compliance with stringent food safety, labeling, and health-claims regulations is a major restraint for the market. Functional ingredients such as adaptogens, probiotics, and nootropics often face varying approval standards across regions, slowing global rollouts. Additionally, formulation complexity arises when integrating multiple active ingredients without compromising taste, stability, or shelf life. This creates barriers for both established players and startups looking to commercialize innovative beverages at scale.

Rise of Functional Beverages as Lifestyle Products

Functional beverages are no longer niche they represent 28% of the market in 2025 and are expanding as daily lifestyle products. Beverages infused with probiotics, electrolytes, and nootropics are being positioned as alternatives to supplements, offering on-the-go health benefits in convenient formats. This trend reflects the merging of food, nutrition, and pharmaceuticals, with functional drinks moving into mainstream retail channels alongside traditional soft drinks and juices.

Digital Innovation and Personalization in Beverages

The integration of AI, data analytics, and digital health platforms is shaping the next wave of beverage innovation. Companies are exploring personalized hydration, microbiome-targeted drinks, and subscription-based functional beverages tailored to consumer health profiles. At the same time, digital flavor-mapping tools and smart R&D systems are enabling faster innovation in taste and formulation. This trend is expected to create new ecosystems where beverage ingredients are linked to consumer data and wellness tracking, driving long-term engagement.

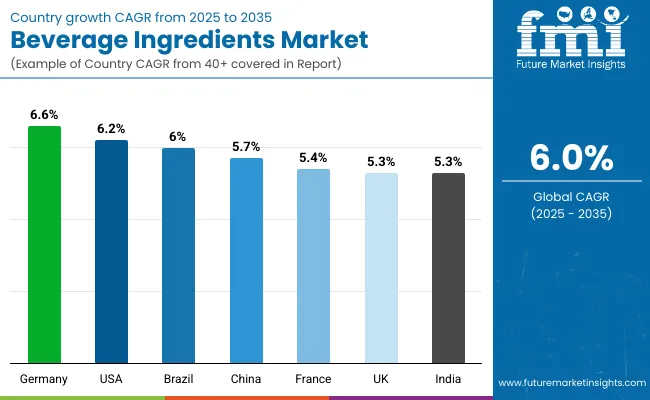

| Countries | CAGR (%) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 6.6% |

| France | 5.4% |

| UK | 5.3% |

| USA | 6.2% |

| Brazil | 6.0% |

The Beverage Ingredients Market demonstrates notable regional disparities in adoption speed, shaped by regulatory policies, consumer health trends, and manufacturing modernization.

Asia-Pacific is the fastest-growing region, anchored by China at 5.7% CAGR and India at 5.3% CAGR. China’s growth is driven by strong functional beverage adoption, sugar-reduction initiatives, and regulatory support for probiotics and plant-based proteins. India is rapidly integrating dairy alternatives, fortified waters, and nutraceutical beverages, supported by tier-2 city consumption and MSME expansion.

Europe maintains a balanced growth outlook, with France (5.4%), Germany (6.6%), and the UK (5.3%) supported by stringent EU food regulations, high penetration of plant-based beverages, and clean-label adoption. Europe continues to be a hub for fermentation-derived ingredients and sustainable sourcing, aligning with consumer preference for natural, organic, and low-sugar beverages.

North America, led by the United States at 6.2% CAGR, shows strong expansion due to innovation in RTD, nutraceutical shots, and functional waters. The USA is advancing in AI-enabled flavor mapping, personalized hydration, and dairy alternative innovations, making it a center for high-value ingredient development.

Latin America, with Brazil at 6.0% CAGR, reflects gradual adoption, led by soft drinks, juices, and energy beverages, but is increasingly integrating functional and fortified formulations into mainstream markets.

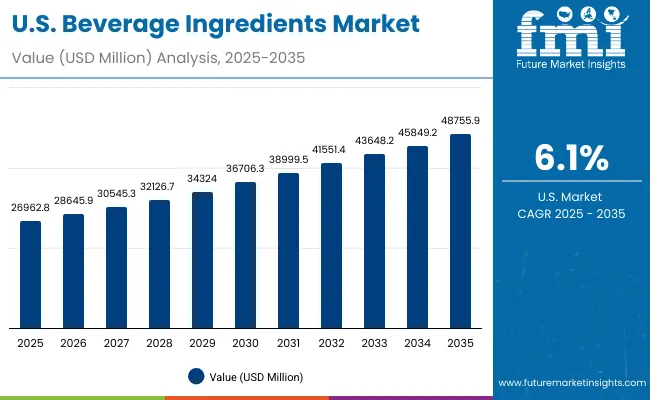

| Year | USA Beverage Ingredients Market (USD Million) |

|---|---|

| 2025 | 26,962.8 |

| 2026 | 28,646.0 |

| 2027 | 30,545.4 |

| 2028 | 32,126.7 |

| 2029 | 34,324.0 |

| 2030 | 36,706.3 |

| 2031 | 38,999.5 |

| 2032 | 41,551.4 |

| 2033 | 43,648.2 |

| 2034 | 45,849.2 |

| 2035 | 48,755.9 |

The Beverage Ingredients Market in the United States is projected to grow at a CAGR of 6.2%, led by increased demand across functional, plant-based, and RTD segments. Nutraceutical shots and functional waters show accelerated growth, while dairy alternatives are gaining mainstream acceptance.

The Beverage Ingredients Market in the United Kingdom is projected to grow at a CAGR of 5.3%, supported by adoption in functional teas, dairy alternatives, and low-sugar RTDs. Regulatory pressure from sugar taxes accelerates the shift toward natural sweeteners and reformulation.

India is expected to grow at a CAGR of 5.3%, supported by increasing adoption of functional beverages, fortified waters, and dairy alternatives across urban and rural markets. Tier-2 and tier-3 cities are becoming growth hubs as cost-effective innovations scale.

The Beverage Ingredients Market in China is expected to grow at a CAGR of 5.7%, supported by demand for plant-based dairy alternatives, fortified juices, and probiotic teas. Government initiatives on sugar reduction and functional health reinforce adoption.

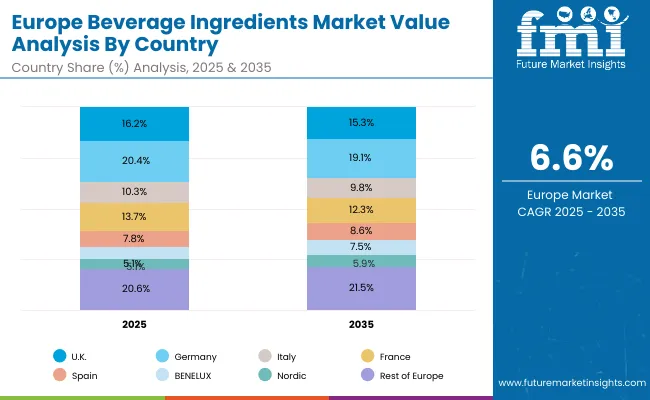

| Countries / Sub-regions | 2025 Share (%) |

|---|---|

| UK | 16.2% |

| Germany | 20.4% |

| Italy | 10.3% |

| France | 13.7% |

| Spain | 7.8% |

| BENELUX | 5.9% |

| Nordic | 5.1% |

| Rest of Europe | 20.6% |

| Total | 100% |

| Countries / Sub-regions | 2035 Share (%) |

|---|---|

| UK | 15.3% |

| Germany | 19.1% |

| Italy | 9.8% |

| France | 12.3% |

| Spain | 8.6% |

| BENELUX | 7.5% |

| Nordic | 5.9% |

| Rest of Europe | 21.5% |

| Total | 100% |

The Beverage Ingredients Market in Germany is projected to grow at a CAGR of 6.6%, anchored by clean-label demand, probiotics, and natural colors. German manufacturers are leaders in sustainability-linked ingredient sourcing.

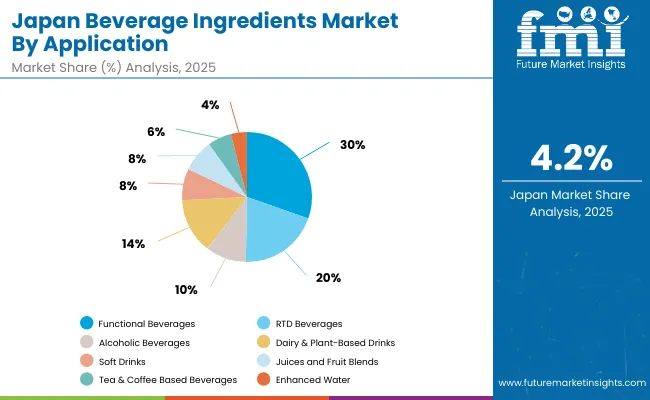

| Application | Share (%) |

|---|---|

| Functional Beverages | 30.4% |

| Others | 69.6% |

The Beverage Ingredients Market in Japan is anchored by functional beverages (30.4%) and RTD beverages (20.0%). Japan emphasizes bio-fermented ingredients, probiotics, and plant-based proteins, with innovation linked to consumer longevity and health trends.

| Source Type | Share (%) |

|---|---|

| Plant-Based | 35.9% |

| Others | 64.1% |

The Beverage Ingredients Market in South Korea is valued at USD 2,426.7 million in 2025 and is projected to reach USD 5,566.9 million by 2035, at a CAGR of 8.7%. Strong demand in energy drinks, RTDs, and functional teas drives consumption.

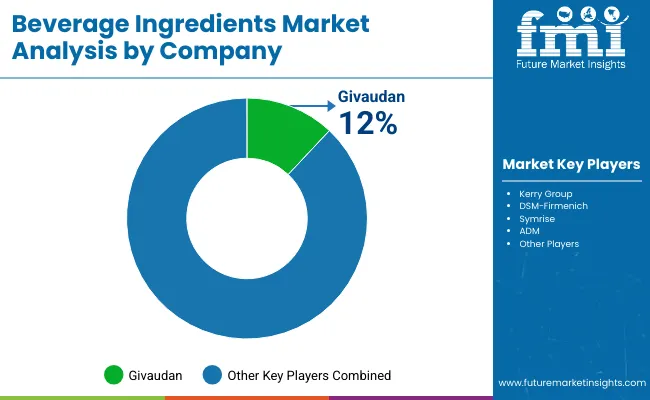

The Beverage Ingredients Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Givaudan holds the dominant share, accounting for nearly 12% of the global market in 2025, supported by its leadership in flavors, botanicals, and nutritional solutions. Its global footprint, extensive flavor portfolio, and integration into functional and clean-label beverage formulations make it the largest player worldwide.

Kerry Group and DSM-Firmenich follow closely, with strong positioning in taste, nutrition, vitamins, and bioactive ingredients, catering to the rising demand for functional beverages and plant-based products. Their strategies emphasize innovation in sugar reduction, protein fortification, and natural flavor systems, ensuring deep penetration across RTDs, dairy alternatives, and nutraceutical drinks.

Symrise and ADM are also prominent, leveraging their expertise in natural ingredients, wild flavors, and specialty nutrition. ADM’s strength lies in its Wild Flavors & Specialty Ingredients division, which plays a central role in natural extracts and flavor systems. Symrise is driving growth through natural ingredients and nutraceuticals, targeting functional teas, enhanced waters, and premium beverages.

Specialized and regional players make up more than half of the market, focusing on botanical extracts, probiotics, fermentation-derived solutions, and plant-based proteins. These companies leverage niche applications, sustainability-linked sourcing, and regional adaptability to remain competitive.

Competitive differentiation is shifting away from commodity sweeteners and preservatives toward functional science-backed ingredients, plant-based innovations, and integrated ecosystems that combine R&D partnerships, clean-label compliance, and consumer wellness platforms. Subscription-based supply models, sustainability certifications, and traceability platforms are becoming critical to securing long-term customer loyalty.

Key Developments in Beverage Ingredients Market

| Item | Value |

|---|---|

| Quantitative Units | USD 112,345.0 million |

| Ingredient Type | Sweeteners, Flavors, Colors, Acidulants, Preservatives, Emulsifiers & Stabilizers, Functional Ingredients, Carbonation Additives, Prebiotics & Probiotics |

| Source | Plant-Based, Animal-Based, Synthetic, Fermentation-Derived |

| Application | Functional Beverages, RTD Beverages, Alcoholic Beverages, Dairy & Plant-Based Drinks, Soft Drinks, Juices and Fruit Blends, Tea & Coffee Based Beverages, Enhanced Water |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Givaudan, Kerry Group, DSM- Firmenich, Symrise, ADM |

| Additional Attributes | Dollar sales by ingredient type and application, adoption trends in functional beverages and dairy alternatives, rising demand for plant-based and clean-label beverages, sector-specific growth in RTD, energy drinks, and nutraceutical shots, source-wise revenue segmentation, integration of probiotics and nootropics, regional trends influenced by sugar-reduction policies, and innovations in plant proteins, natural colors, and fermentation-derived ingredients. |

The Beverage Ingredients Market is estimated to be valued at USD 112,345.0 million in 2025.

The market size for the Beverage Ingredients Market is projected to reach USD 201,698.6 million by 2035.

The Beverage Ingredients Market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key ingredient types in the Beverage Ingredients Market are sweeteners, flavors, colors, acidulants, preservatives, emulsifiers & stabilizers, functional ingredients, carbonation additives, and prebiotics & probiotics.

In terms of ingredient type, the functional ingredients segment is expected to command the largest share of 28.4 % in the Beverage Ingredients Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA