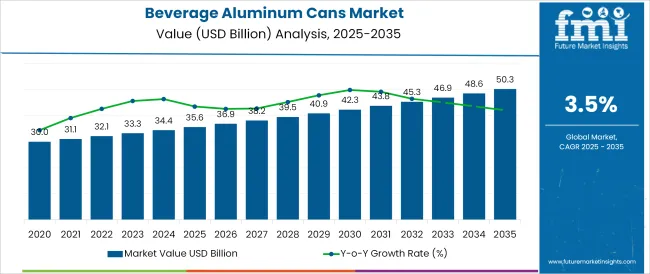

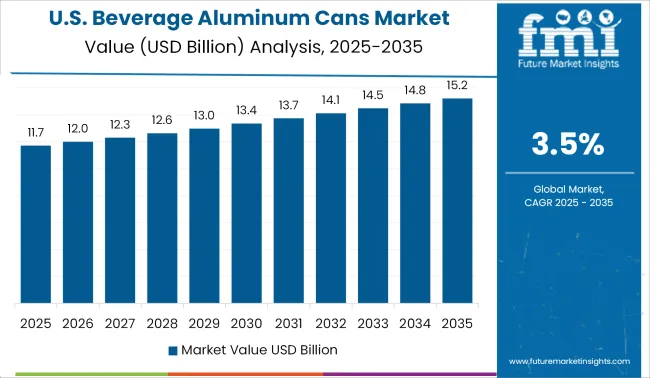

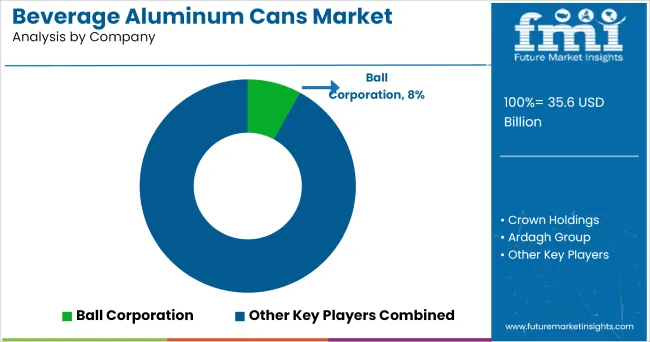

The Beverage Aluminum Cans Market is estimated to be valued at USD 35.6 billion in 2025 and is projected to reach USD 50.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The beverage aluminum cans market is witnessing steady growth as sustainability imperatives, consumer convenience, and brand differentiation drive widespread adoption. Rising awareness about recyclability and the circular economy has positioned aluminum as a preferred material over plastics and glass in beverage packaging.

Brands are increasingly leveraging cans not only for their lower carbon footprint but also for their ability to preserve product quality and extend shelf life. Technological advancements in design, coating, and lightweighting have improved the appeal and cost efficiency of aluminum cans, making them viable across mass and premium segments.

Future growth is anticipated to be fueled by expanding beverage categories such as energy drinks, craft beverages, and flavored waters, which are adopting cans as a core packaging format. Strengthened recycling infrastructures and rising regulatory pressures to eliminate single use plastics are paving the path for further penetration and innovation in the market.

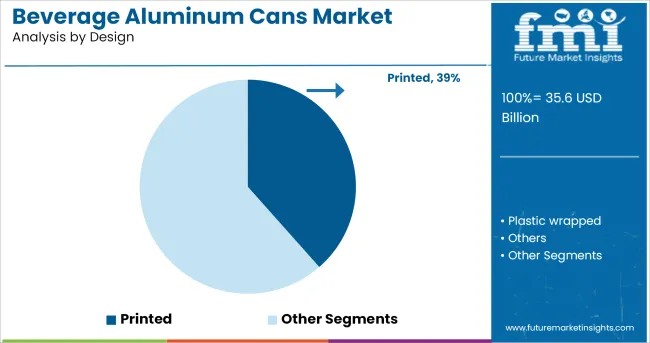

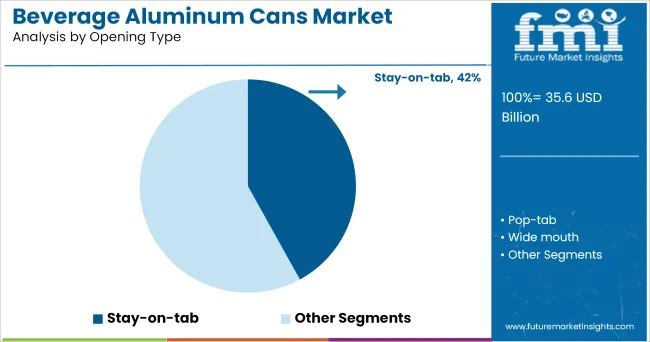

The market is segmented by Design, Opening Type, Capacity, and End-use and region. By Design, the market is divided into Printed, Plastic wrapped, and Others. In terms of Opening Type, the market is classified into Stay-on-tab, Pop-tab, Wide mouth, Press button can, Full aperture end, Reseal able lid, and Others.

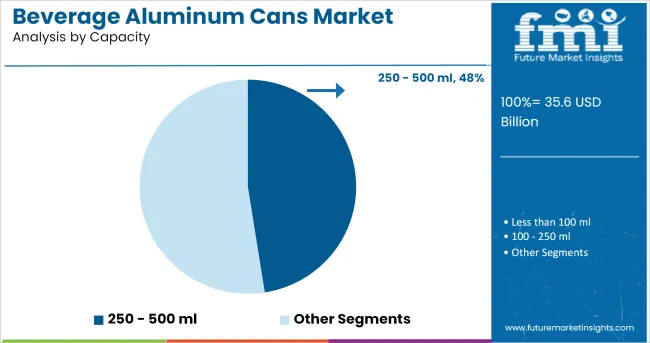

Based on Capacity, the market is segmented into 250 - 500 ml, Less than 100 ml, 100 - 250 ml, 500 - 750 ml, 750 - 1000 ml, and More than 1000 ml. By End-use, the market is divided into Non-alcoholic, Water, Soft Drinks, Juice & Juice Drinks, Others, Alcoholic, Beer, Cider, Wine, Spirits, Others, Café/Brew Drinks, Coffee, Hot Chocolate, Tea, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by design, the printed subsegment is projected to hold 38.5% of the beverage aluminum cans market revenue in 2025, establishing itself as the leading design choice. This leadership has been supported by the ability of printed designs to offer superior brand visibility and communicate product attributes effectively at the point of sale.

The use of vibrant graphics and tactile finishes has enabled brands to stand out on crowded shelves, enhancing consumer engagement and perceived value. Printed designs have also allowed for greater flexibility in promotional campaigns and seasonal packaging, supporting marketing strategies without incurring significant tooling changes.

This combination of branding impact, consumer appeal, and operational flexibility has reinforced the printed design’s dominance in the market.

Segmented by opening type, the stay-on-tab subsegment is expected to account for 42.0% of the market revenue in 2025, maintaining its position as the most preferred opening mechanism. This prominence has been attributed to its superior convenience, safety, and environmental benefits compared to alternative mechanisms.

The stay-on-tab design prevents the tab from detaching, reducing litter and minimizing the risk of accidental ingestion, which has aligned well with both regulatory expectations and consumer preferences.

Its user-friendly operation and compatibility with high-speed filling and sealing processes have further contributed to its widespread adoption. The sustained focus on minimizing environmental impact and enhancing consumer experience has ensured that the stay-on-tab remains the standard in beverage can openings.

When segmented by capacity, the 250-500 ml range is forecast to capture 47.5% of the market revenue in 2025, securing its leadership among capacity options. This dominance has been driven by its alignment with consumer consumption patterns, offering a balance between portability and adequate serving size.

The 250-500 ml range has proven to be versatile across multiple beverage categories including soft drinks, energy drinks, and alcoholic beverages, making it a favored choice among manufacturers.

The manageable portion size appeals to health conscious consumers while meeting regulatory requirements in certain markets for controlled serving sizes. Additionally, its compatibility with existing production lines and secondary packaging formats has further solidified its position as the most widely adopted capacity in the beverage aluminum cans market.

There always existed a fight for sustainable packaging for food & beverages. As the bio-based packaging materials are from long way to overtake the conventional plastic packaging, metal based containers have witnessed to gain the advantage owing to the recyclability character that they exhibit. Aluminum cans are most lucrative opportunity for various food & beverage packaging and are widely used across the globe.

Confining to aluminum cans, these are the mostly preferred material type for beverage packaging as it offers excellent malleability, which is the most desirable characteristic for metal packaging manufacturer to draw reliable packaging material.

Sales of aluminum cans is set to witness huge upward curve throughout the forecast period and beyond as the market is nowhere to possess threat from potential alternative for filling and delivering of beverages.

The consistent demand for aluminum cans from soft drinks remained a push across the globe and actors trying to enhance the performance of the same is further set to bolster the sales.

Ever since the entrance of brewery products to be filled and shipped in aluminum cans, the market has started to expand and is on its cusp with actors investing substantial funds in developing 100% protection against oxygen, light, moisture and other contaminants parallel with innovative can and opening types is projected to drop positive insight for market growth in beverage aluminum cans market share.

The United States is among the biggest markets for packaging metal cans. During the time period of 2025 to 2035, USA beverage aluminum cans sales is anticipated to initiate huge push. The need for recyclable packaging materials is on highly positive note and making the market to result tremendous growth in years to come.

Canada is also among the countries across the world to showcase heavy spending on innovative aluminum packaging methods to adhere to sustainability along with reliable filling and delivery system for beverages. The inclination of huge end-use industries towards aluminum cans for beverage packaging is to facilitate positive growth factor.

All in all, these factors leave North America as a region with highly favourable sources and most dominating globally.

However, the region has Greenfield and brownfield investments for sustainable packaging systems for food & beverages. The region has showcased a huge positive nature for adaptation of metal beverage cans with extra interests for aluminum.

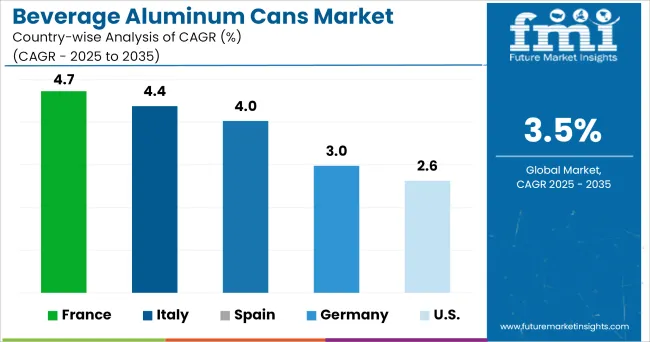

As far as beverage aluminum cans market is considered, countries like Germany, France, Italy, Spain, UK Russia and many others have approval for adaptation as they offer numerous positive characteristics for recyclability. The players in the region spend huge funds on making the interior coating for aluminum cans as less chemicals involved as possible to gain advantage against the retarding claims being risen by few committees.

Major actors present in the business of beverage aluminum cans include

The most of the industry leaders in the beverage aluminum cans business have a diverse product line and provide high-quality packaging. To reach a clientele and obtain a competitive edge over competitors, manufacturers opt to play with organic market strategy by creating new production methods and other hybrid techniques. Manufacturers have also been seen expanding their product lines across regions to strengthen their position

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global beverage aluminum cans market is estimated to be valued at USD 35.6 billion in 2025.

The market size for the beverage aluminum cans market is projected to reach USD 50.3 billion by 2035.

The beverage aluminum cans market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in beverage aluminum cans market are printed, plastic wrapped and others.

In terms of opening type, stay-on-tab segment to command 42.0% share in the beverage aluminum cans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Positioning & Share in Beverage Aluminum Cans Production

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA